Complete text - 2016–17 Departmental Performance Report - Treasury Board of Canada Secretariat

Table of Contents

- President's message

- Results at a glance

- Raison d'être and mandate: who we are and what we do

- Operating context and key risks

- Results: what we achieved

- Programs

- Strategic Outcome: Good governance and sound stewardship to enable efficient and effective service to Canadians.

- Program 1.1: Decision-Making Support and Oversight

- Program 1.2: Management Policies Development and Monitoring

- Program 1.3: Government-Wide Program Design and Delivery

- Program 1.4: Government-Wide Funds and Public Service Employer Payments

- Internal Services

- Programs

- Analysis of trends in spending and human resources

- Supplementary information

- Appendix: definitions

© Her Majesty the Queen in Right of Canada, represented by the President of the Treasury Board, 2017,

ISSN: 2561-3561

President’s message

Scott Brison

I am pleased to present the 2016–17 Departmental Results Report for the Treasury Board of Canada Secretariat. Canadians expect and deserve a government that represents their interests, delivers the services they need, and achieves meaningful results. We promised Canadians a government that would bring real change and that would be clear about how we define success. To that end, the Prime Minister gave me an ambitious set of priorities in my mandate letter.

In 2016–17, we began to deliver on these priorities. We strengthened the oversight of taxpayers’ dollars by changing the timing of the Estimates to better align with the Budget, and by introducing a new Policy on Results. We made government more open and transparent by getting rid of all access to information fees except for the initial $5 filing fee, and by modernizing the Policy on Communications and Federal Identity. We continued to rebuild a culture of respect in the public service by moving to repeal unfair labour laws and reaching tentative collective agreements covering more than 85% of employees.

I am encouraged by our progress so far. Going forward, I know that I can count on a fully engaged, dedicated and professional public service. Together, we will make the Government of Canada the best it can be.

I invite all Canadians to read this report to find out more about our efforts at the Treasury Board of Canada Secretariat to create the effective, responsible government Canadians deserve.

The Honourable Scott Brison

President of the Treasury Board

Results at a glance

In 2016-17,Results at a Glance Footnote 1 the Treasury Board of Canada Secretariat (the Secretariat) supported the President of the Treasury Board in delivering on key elements of his mandate through initiatives under the Secretariat’s 4 programs. The following are highlights of the Secretariat’s achievements in each of these programs.

Program 1.1: Decision-Making Support and Oversight

- Released the Policy on Results

- Facilitated rapid implementation of the federal Budget 2016

- Released the Experimentation Direction for Deputy Heads

- Expanded, as a 5-year pilot project, the existing transfer payment toolkit to enable innovative funding approaches

Program 1.2: Management Policies Development and Monitoring

- Modernized communications by releasing a new Policy on Communications and Federal Identity

- Released the Interim Directive on the Administration of the Access to Information Act

- Developed the Government of Canada Service Strategy and published the Guideline on Service Management

- Supported the Treasury Board in adopting the new Policy on Financial Management and Policy on Internal Audit

- Launched the Federal Public Service Workplace Mental Health Strategy

- Created a joint union/management Task Force on Diversity and Inclusion in the Public Service

- Launched the Indigenous Youth Summer Employment Opportunity

Program 1.3: Government-Wide Program Design and Delivery

- Spearheaded work that resulted in Canada’s being ranked second in the world on the Web Foundation’s Open Data Barometer and being elected to the Open Government Partnership Steering Committee

- Established a Centre for Greening Government

- Reached 16 tentative settlements on collective agreements covering 85% of represented employees

Program 1.4: Government-Wide Funds and Public Service Employer Payments

- Made 100% of the expected allocations and payments it manages

Actual spending: $3,064,208,634

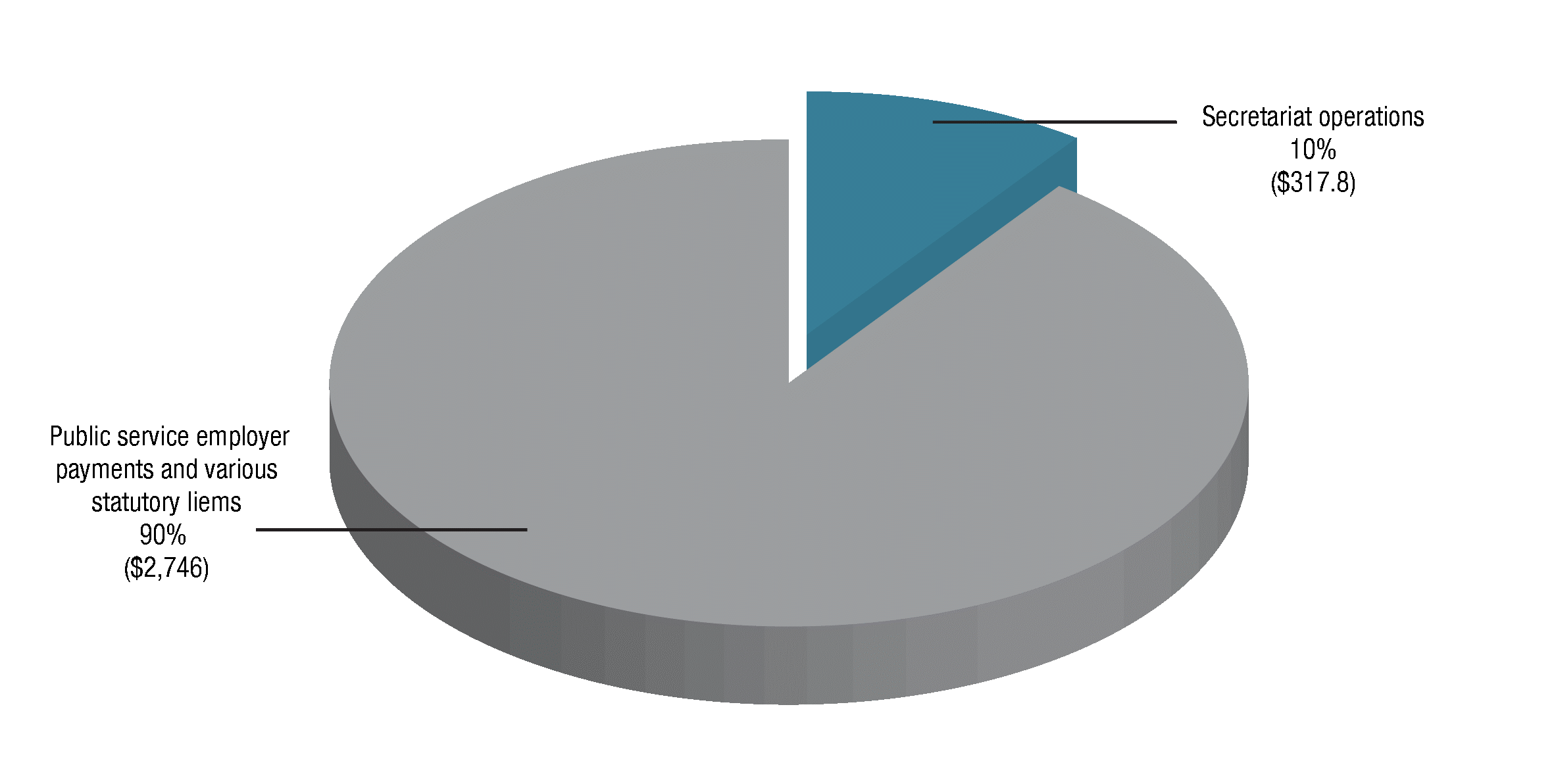

$317.8 million (or 10%) was spent by the Secretariat to deliver results, $2.4 billion (or 79%) was spent to fund the employer’s share of insurance premium payments for public servants and public service pensioners, and $339.7 million (or 11%) was spent to pay the employer’s share of contributions to the Public Service Pension Plan.

Actual full-time equivalents: 1,922

For information on the Secretariat’s plans, priorities and results achieved, see the “ Results: what we achieved” section of this report.Raison d’être and mandate

Raison d’être

The Treasury Board of Canada Secretariat (Secretariat) is the administrative arm of the Treasury Board, and the President of the Treasury Board is the Minister responsible for the Secretariat. The Secretariat supports the Treasury Board by making recommendations and providing advice on program spending, regulations and management policies and directives, while respecting the primary responsibility of deputy heads in managing their organizations, and their roles as accounting officers before Parliament. In this way, the Secretariat helps to strengthen government performance, results and reporting and supports good governance and sound stewardship to enable efficient and effective service to Canadians.

Mandate

As the administrative arm of the Treasury Board, the Secretariat has a dual mandate: to support the Treasury Board as a committee of ministers and to fulfill the statutory responsibilities of a central government agency. The Treasury Board’s mandate is derived from the Financial Administration Act, R.S.C., 1985, c. F-11.

For more general information about the Secretariat, see the “Supplementary information” section of this report.

For more information on the Secretariat’s organizational mandate letter commitments, see the President of the Treasury Board’s mandate letter.

Operating context and key risks

Operating context

The Government of Canada operates in a global environment characterized by economic fluctuations, rapid technological developments, changing demographics, and geopolitical instability.

The Secretariat must always be prepared to respond to how this environment affects the overall management of government. It therefore works with departments and agencies to help them:

- acquire new skill sets

- invest in information technology (IT) and innovation

- take government-wide approaches to solving cross-cutting management challenges

Key risks

In its 2016–17 Report on Plans and Priorities, the Secretariat identified 4 risk areas relating to its ability to deliver results for Canadians: Operating context and key risks Footnote 1

- fiscal flexibility

- cyber-security

- ability to attract and align talent with needs

- pace of implementation

Over the course of the year, the Secretariat broadened the cyber-security risk area into a more general security vulnerabilities risk area.

The Secretariat also identified 2 more risk areas:

- capacity for delivery of government-wide projects

- IT capacity

Throughout the year, the Secretariat made significant efforts to respond to these risks.

Risk area |

Mitigating strategy and effectiveness |

Link to the department’s Programs |

Link to mandate letter commitments or to government-wide and departmental priorities |

|---|---|---|---|

Fiscal flexibility There is a risk that a global economic slowdown could impact the Canadian economy and require the Secretariat to significantly redirect resources in order to be able to deliver on its priority initiatives. |

To mitigate this risk, the Secretariat:

Budget 2017 announced that the President of the Treasury Board and the Minister of Finance will lead 3 new initiatives to review departmental spending. |

1.1 Decision-Making Support and Oversight |

All mandate-letter commitments |

Security vulnerabilities An increased reliance on digital technology, coupled with constantly evolving cyber- and insider threats, could compromise sensitive Government of Canada information and disrupt the delivery of Government of Canada programs and services. |

To mitigate security vulnerabilities, which include cyber-, physical and personnel threats, the Secretariat:

|

1.2 Management Policies Development and Monitoring 1.3 Government-Wide Program Design and Delivery |

All mandate-letter commitments |

Ability to attract and align talent with needs As technological and social changes create new ways of working, government departments may find that the rigidities in the system make it increasingly difficult to attract and mobilize highly talented individuals. |

To address this risk, the Secretariat:

|

1.2 Management Policies Development and Monitoring |

Workforce of the Future |

Pace of implementation The Secretariat may not achieve the desired results or may be delayed in delivering results. |

To manage this risk, the Secretariat:

As of the end of 2016–17, the Secretariat fulfilled 3 mandate-letter commitments by developing:

It is making progress on the remaining commitments. |

1.1 Decision-Making Support and Oversight 1.2 Management Policies Development and Monitoring 1.3 Government-Wide Program Design and Delivery |

All mandate-letter commitments |

Capacity for delivery of government-wide projects There is a risk that the Secretariat may not have sufficient capacity to support government-wide projects. |

To mitigate this risk, the Secretariat:

|

1.3 Government- Wide Program Design and Delivery |

|

IT capacity Without enhancements to the Secretariat’s IT infrastructure, the Secretariat may not be able to deliver on some key priorities. |

To mitigate this risk, the Secretariat:

The IT capacity risk remains constant. The Secretariat will work with Shared Services Canada to continue to address it. |

1.1 Decision- Making Support and Oversight 1.2 Management Policies Development and Monitoring 1.3 Government- Wide Program Design and Delivery |

All mandate-letter commitments |

Results: what we achieved

Programs

Strategic Outcome: Good governance and sound stewardship to enable efficient and effective service to Canadians

Strategic outcome |

Performance indicator |

Target |

Actual result |

|---|---|---|---|

Good governance and sound stewardship to enable efficient and effective service to Canadians |

Canada's ranking in the World Bank's Worldwide Governance Indicators for the third indicator, Government Effectiveness |

Top 10 among Organisation for Economic Co-operation and Development (OECD) member countries |

Canada ranks eighth among the 35 OECD member countries for Government Effectiveness (as of 2016) |

The World Bank's Government Effectiveness indicator is an index that captures perceptions about the quality of public services, the quality of the civil service, and the degree of its independence from political pressure. This indicator also measures the quality of policy formulation and implementation, and the credibility of the government's commitment to these policies. In 2016, Canada's performance against this indicator improved, and the country moved up from ninth place to eighth place.

2016–17 Main Estimates |

2016–17 Planned Spending |

2016–17 Total authorities available for use |

2016–17 Actual spending (authorities used) |

2016–17 Difference (actual minus planned) |

|---|---|---|---|---|

6,570,806,029 |

6,570,806,029 |

5,330,876,320 |

3,064,208,634 |

-3,506,597,395 |

2016–17 Planned |

2016–17 Actual |

2016–17 Difference (actual minus planned) |

|---|---|---|

1,802 |

1,922 |

120 |

Program 1.1: Decision-Making Support and Oversight

Description

Through the Decision-Making Support and Oversight program, the Treasury Board of Canada Secretariat supports the Treasury Board in its roles as management board of the Government of Canada and as expenditure manager in the government-wide expenditure cycle. The objective is to support the government in promoting value for money and results for Canadians in programs and operations.

The Secretariat achieves program results by providing independent strategic advice, analysis, guidance and oversight of programs, operations, and expenditures. It reviews departmental submissions, provides recommendations to the Treasury Board, and coordinates and reports on the allocation of expenditures across government organizations and programs.

Results

Highlights

- Released the Policy on Results

- Facilitated rapid implementation of the federal Budget 2016

- Released the Experimentation Direction for Deputy Heads

- Expanded, as a 5-year pilot project, the existing transfer payment toolkit to enable innovative funding approaches

In 2016–17, the Secretariat reviewed approximately:

- 330 Treasury Board submissions

- 500 memoranda to Cabinet and other Cabinet presentations

- 520 Governor in Council submissions

The Secretariat improved the quality of costing estimates in government decision-making by reviewing nearly 100 high-value or high-risk Cabinet documents that covered projects valued at a total of about $47 billion.

The Secretariat performed enhanced due diligence reviews on 86 Treasury Board submissions and 11 memoranda to Cabinet. These reviews resulted in more transparent cost estimates, the rationalization of contingencies and, in some instances, changes in the amounts submitted.

The Secretariat improved the quality of Governor in Council regulatory submissions by:

- reviewing 173 final regulatory submissions that included regulations that would result in $16.6 billion in benefits to Canadians

- ensuring that these submissions complied with the requirements of the Cabinet Directive on Regulatory Management (for example, included input from stakeholder consultations, included a cost-benefit analysis, and were coordinated and aligned with existing regulations)

The Secretariat provided an effective challenge function and even exceeded its target for this indicator, with 91% of deputy heads agreeing that the Secretariat fulfills this role effectively (up from 88% in 2015–16). According to feedback from deputy heads, Secretariat analysts are supportive and accessible, and provide useful advice. Deputy heads suggested, however, that the challenge function could be streamlined.

In 2016–17, the Government of Canada released the Policy on Results, which replaced the Policy on Management, Resources and Results Structures and the Policy on Evaluation. The new policy promotes simpler and more flexible planning and reporting structures; better alignment of resources, priorities, and results; and clearer, more transparent reporting. It also introduces a requirement to provide more information on the expected results of spending proposals. This requirement is aimed at improving the quality of Treasury Board submissions.

The Secretariat provided guidance to the 6 departments that were the first to use the reporting framework set out in the new Policy on Results. The Secretariat also helped organizations build their capacity for evidence-based decision making by, for example, helping them identify effective performance measures.

Steps have been made to improve spending oversight and reporting to Parliament. In 2016–17, 95% of Budget 2016 funding was included in Estimates documents, with 66% of funding included in the first available Estimates document. Parliamentarians will continue to be consulted on options to make the planning, spending and tracking of tax dollars more timely and transparent.

The Secretariat updated the TBS InfoBase to reflect the new departmental planning and reporting structures required under the Policy on Results. Canadians and Parliamentarians can now view graphics that show how resources relate to results. In 2016–17, TBS InfoBase was visited over 35,000 times.

In December 2016, after consulting with experts and practitioners in experimental design both within and outside the federal government, the Secretariat and the Privy Council Office released the Experimentation Direction for Deputy Heads. The direction provides context and guidance for all deputy heads to begin reporting publicly on their current or planned efforts to experiment with new approaches. It also includes a requirement to earmark a percentage of program funds for experimentation.

Since it released the direction, the Secretariat has created tools for experimenting with new approaches, provided guidance to departments and partnered with them on workshops and community-building to strengthen experimentation capacity in the federal government.

The Secretariat also expanded, as a 5-year pilot project, the transfer payment toolkit to enable innovative program delivery, giving government departments new instruments for distributing grants and contributions.

Expected results |

Performance indicators |

Target |

Date to achieve target |

2016–17 Actual results |

2015–16 Actual results |

2014–15 Actual results |

|---|---|---|---|---|---|---|

The Secretariat promotes value for money and results for Canadians in programs and operations |

Federal organizations agree that the Secretariat provides an effective challenge function |

70% |

March 2017 |

91% |

88% |

97% |

2016–17 Main Estimates |

2016–17 Planned spending |

2016–17 Total authorities available for use |

2016–17 Actual spending (authorities used) |

2016–17 Difference (actual minus planned) |

|---|---|---|---|---|

49,543,385 |

50,579,535 |

47,860,798 |

46,426,488 |

-4,153,047 |

2016–17 Planned |

2016–17 Actual |

2016–17 Difference (actual minus planned) |

|---|---|---|

343 |

337 |

-6 |

Information on the Secretariat's lower-level programs is available in the TBS InfoBase.

Program 1.2: Management Policies Development and Monitoring

Description

Through the Management Policies Development and Monitoring Program, the Secretariat supports the Treasury Board in its role of establishing principles for sound governance and management by setting government-wide policy direction in targeted areas. The objective is to have a sound management policy framework for the Government of Canada.

The Secretariat achieves program results by communicating clear management expectations to deputy heads and by adopting principles-based and risk-informed approaches to monitoring policy compliance. The Secretariat provides reviews, leads implementation, and supports and monitors policies and departmental performance under several of areas of management. The Secretariat also engages with functional communities and undertakes outreach and monitoring to promote policy compliance and build the capacity of functional communities.

This program is underpinned by legislation such as the Financial Administration Act and the Public Service Employment Act.

Results

Highlights

- Modernized communications by releasing a new Policy on Communications and Federal Identity

- Released the Interim Directive on the Administration of the Access to Information Act

- Developed the Government of Canada Service Strategy and published the Guideline on Service Management

- Supported the Treasury Board in adopting the new Policy on Financial Management and Policy on Internal Audit

- Launched the Federal Public Service Workplace Mental Health Strategy

- Created a joint union/management Task Force on Diversity and Inclusion in the Public Service

- Launched the Indigenous Youth Summer Employment Opportunity

The Secretariat supports departments and agencies on implementing more than 200 policy instruments.

In 2016–17, the Secretariat continued to review these policy instruments through the Policy Suite Reset initiative, which aims at developing clearer, more coherent requirements and accountabilities. More time is needed to complete this initiative, but it is having the intended impact. 82% of deputy heads say that policy instruments reviewed so far under the initiative are easier to understand and apply. Deputy heads also say, however, that they would like to receive guidance and communications before they have to implement reset policy instruments.

As part of making government more open and transparent, the Secretariat supported the Treasury Board in implementing the new Policy on Communications and Federal Identity. The policy aims to bring Government of Canada communication practices into line with the digital environment. The Secretariat also implemented a new interim process under which Advertising Standards Canada must review all federal government advertising campaigns that have budgets over $500,000.

The Secretariat also released the Interim Directive on the Administration of the Access to Information Act. This directive eliminated all access to information fees except for the initial $5 application fee. It also confirmed that all Government of Canada information should be available to the public, except in specific situations when it must be protected because of privacy, confidentiality and security.

To improve oversight of public resources and to modernize comptrollership, the Secretariat supported the Treasury Board in implementing:

- the new Policy on Financial Management

- This policy, through which the Government of Canada seeks to have financial resources that are well managed in the delivery of programs to Canadians and that are safeguarded through balanced controls that enable flexibility and manage risk, consolidates requirements set out in a number of different policy instruments.

- the updated Policy on Internal Audit

- The objective of this policy is to ensure that the oversight of public resources in the federal public administration is informed by a professional and objective internal audit function that is independent of departmental management.

In 2016–17, the Secretariat and Public Services and Procurement Canada developed a joint procurement modernization work plan. Under the work plan, the 2 organizations aligned their procurement-related activities and created a dashboard to track and report on progress on initiatives. The Secretariat and Public Services and Procurement Canada's Procurement Modernization Integration team began developing a government-wide framework for social procurement. Social procurement involves using federal procurement processes and purchasing power to generate positive social outcomes in addition to delivering goods and services.

As part of improving services for Canadians, the Secretariat launched the Government of Canada Service Strategy in collaboration with several service-oriented departments and agencies. The Strategy has 3 broad goals:

- Client-driven design and delivery, to make sure that services are designed and delivered in ways that meet client needs and preferences across all channels

- Easy online services, to make the digital channel the medium of choice

- Seamless delivery, to connect services through a single window

To support government organizations in their efforts to provide quality, consistent services to Canadians, the Secretariat published a Guideline on Service Management. The guideline supports the requirements of the Policy on Service by outlining key components of good service management.

The Secretariat continued to lead efforts to build the public service workforce of the future, by promoting a healthy, respectful and supportive work environment. These efforts included:

- introducing an online pledge on GCintranet to support mental health in the workplace

- encouraging all federal public service employees to take the online pledge

- posting the list of the deputy ministers who signed the pledge

- creating a Centre of Expertise on Mental Health in the Workplace

The Secretariat also launched the Proudly Serving Canadians web page to celebrate the strength and diversity of Canada's public service. The page promotes public service culture, innovation and employment and is a key recruitment and retention tool for the Government of Canada. In 2016–17, the website received over 26,000 visits.

The Secretariat also committed to working with Employment and Social Development Canada to introduce, by late 2018, legislative reforms for proactive (in other words, employer-initiated) pay equity in the federal public service and in the federally regulated private sector.

In 2016–17, the Secretariat formed the Joint Union/Management Task Force on Diversity and Inclusion in the Public Service. The task force brings together representatives from across the public service and from the public sector bargaining agents. Their aim is to find ways to strengthen diversity and inclusion in the federal government. They are focusing on 4 key areas:

- accountability

- people management

- education and awareness

- diversity lens, an integrated approach

Through a partnership with the Assembly of First Nations, 30 Indigenous post-secondary students were brought to the National Capital Region from across the country in 2016 to work in a variety of departments and agencies under the Indigenous Youth Summer Employment Opportunity pilot. The Secretariat:

- developed the initiative

- provided support to departments and students

- organized learning events and activities

- matched students with mentors

- evaluated the performance of the initiative

The pilot has since expanded to a program that supported 100 students in 27 departments in 2017.

In addition, the Government of Canada announced consultations to review its Official Languages Regulations to better reflect the realities of minority language communities and allow the government to serve Canadians better in the language of their choice.

Expected results |

Performance indicators |

Target |

Date to achieve target |

2016–17 Actual results |

2015–16 Actual results |

2014–15 Actual results |

|---|---|---|---|---|---|---|

A streamlined policy suite that supports modern management |

Percentage of policy instruments that have been streamlined |

90% |

March 2017 |

33% |

N/A | N/A |

Percentage of departments that have implemented renewed policies within expected timelines |

90% |

March 2018 |

Not yet available |

N/A | N/A | |

Percentage of organizations that agree that the new policy suite is streamlined |

75% |

March 2017 |

82% |

N/A | N/A |

2016–17 Main Estimates |

2016–17 Planned spending |

2016–17 Total authorities available for use |

2016–17 Actual spending (authorities used) |

2016–17 Difference (actual minus planned) |

|---|---|---|---|---|

67,614,269 |

68,090,606 |

73,070,813 |

70,832,094 |

2,741,488 |

2016–17 Planned |

2016–17 Actual |

2016–17 Difference (actual minus planned) |

|---|---|---|

498 |

506 |

8 |

Information on the Secretariat's lower-level programs is available in the TBS InfoBase.

Program 1.3: Government-Wide Program Design and Delivery

Description

Through the Government-Wide Program Design and Delivery program, the Secretariat designs and delivers activities, systems, services and operations with, for, or on behalf of other organizations in the Government of Canada. It also establishes a platform for transformational initiatives. The objective is to provide consistent and cost-controlled operations across the Government of Canada.

The Secretariat achieves program results by developing and delivering solutions where whole-of-government leadership is required, or where transformation and standardization can be achieved to improve quality and value for money.

Results

Highlights

- Spearheaded work that resulted in Canada's being ranked second in the world on the Web Foundation's Open Data Barometer and being elected to the Open Government Partnership Steering Committee

- Established a Centre for Greening Government

- Reached 16 tentative settlements on collective agreements covering 85% of represented employees

The Secretariat continued to lead the Government-Wide Enabling Functions Transformation Initiative.Results Footnote 1 This initiative involves modernizing human resources management and information management and focuses on standardizing and consolidating IT platforms and increasing system functionality. As a result of this initiative, 41 departments have modernized their human resources systems, and 23 departments have modernized their IT systems.

According to deputy heads, the Secretariat needs to:

- strengthen the governance of enterprise-wide systems and operations to better meet clients' needs

- align and coordinate initiatives

The Secretariat will take steps to improve the governance of enterprise-wide systems and operations. It will also build on consultations it has had with user communities to improve how initiatives are designed and implemented.

In 2016–17, the Secretariat led advancements in the area of open government. It released its first set of inventories that were completed under the Directive on Open Government and published on Open.Canada.ca. Canadians can now see both unreleased and released datasets. Over 1,500 new datasets have been identified as eligible for release. In addition to being able to search the inventories on Open.Canada.ca, Canadians can now vote for datasets they would like to access. The Secretariat improved Open.Canada.ca's search features by adding an integrated search that has more filters and more metadata. Canadians now have better access to data and information that is proactively disclosed by departments and agencies. As a result of the Government of Canada's efforts, Canada was ranked second globally in the Web Foundation's Open Data Barometer and was elected to the Open Government Partnership Steering Committee.

The Secretariat established the Centre for Greening Government. The Centre leads the Government of Canada's emissions reduction program and other initiatives to green government. It drives results to make sure the government meets its objectives by:

- tracking and reporting the federal government's emissions centrally

- coordinating efforts across government

In 2016–17, the Centre organized 2 round tables with environmental leaders and published the Government of Canada's Greenhouse Gas Inventory on open data for the first time.

The Secretariat also supported the workforce of the future by negotiating in good faith to reach collective agreements that are fair and reasonable for employees and for Canadians. As of March 31, 2017, 16 tentative settlements were reached in this round of bargaining, covering 85% of the represented employees in the core public administration.

The Secretariat continued the initiative it launched in 2013 to renew the government's classification system to better reflect the current working environment and business requirements. The goal was to update 12 job evaluation standards and 6 qualification standards over the course of the 6-year project.

As of the end of 2016–17, those target were surpassed. The Secretariat has:

- updated 14 job evaluation standards

- reviewed and amended 3 qualification standards

- developed 6 new qualification standards

The Secretariat also modernized the classification and organizational design training curriculum. It updated 3 classroom courses, expanded 1 online learning module and introduced 1 online learning module for managers and human resources advisors in the core public administration.

The Secretariat launched an oversight framework in 2016–17 to monitor the health of the classification program and to ensure the effective management of compensation costs.

The Secretariat also worked on legislation to establish a new labour relations regime for the Royal Canadian Mounted Police.

Throughout 2016–17, the public service continued to be affected by challenges resulting from the implementation of the new Phoenix pay system. In February 2017, the Secretariat created the Human Resources Management Transformation Sector to help address, in collaboration with Public Services and Procurement Canada (PSPC) and other departments and agencies, the difficulties associated with human resources and pay transactions. The Secretariat further supported PSPC by establishing an executive-level union-management consultation committee structure to address pay issues collaboratively. It also established a new claims process. Under this process, a dedicated claims office at the Secretariat is working with departments and agencies to process employees' claims for out-of-pocket expenses resulting from Phoenix pay system issues.

Expected results |

Performance indicators |

Target |

Date to achieve target |

2016–17 Actual results |

2015–16 Actual results |

2014–15 Actual results |

|---|---|---|---|---|---|---|

The Secretariat promotes consistency in systems and operations across the Government of Canada |

Employees agree that they have the necessary tools to do their jobs |

Improvement over 2014 PSES results |

March 2018 |

2017 Public Service Employee Annual Survey did not include this question |

No Public Service Employee Survey undertaken 2015–16 |

N/A |

Percentage of organizations that agree that the Secretariat provides effective guidance with respect to enterprise-wide systems and operations |

To be determined |

March 2017 |

38% |

64% |

N/A |

Information on the Secretariat's lower-level programs is available in the TBS InfoBase.

2016–17 Main Estimates |

2016–17 Planned spending |

2016–17 Total authorities available for use |

2016–17 Actual spending (authorities used) |

2016–17 Difference (actual minus planned) |

|---|---|---|---|---|

53,732,931 |

53,256,595 |

192,795,583 |

127,193,033 |

73,936,438 |

2016–17 Planned |

2016–17 Actual |

2016–17 Difference (actual minus planned) |

|---|---|---|

383 |

498 |

115 |

Program 1.4: Government-Wide Funds and Public Service Employer Payments

Description

The Government-Wide Funds and Public Service Employer Payments program accounts for funds that are held centrally to supplement other appropriations, from which allocations are made to, or payments and receipts are made on behalf of, other federal organizations. These funds supplement the standard appropriations process and meet certain responsibilities of the Treasury Board as the employer of the core public administration, including employer obligations under the public service pension and benefits plans.

The administration of these funds falls under the Expenditure Analysis and Allocation Management sub-program and the People Management Policy sub-program, but their financial resources are shown separately in the Secretariat's Program Alignment Architecture for visibility and reporting purposes.

Results

Highlights

- Made 100% of the expected allocations and payments it manages

In 2016–17, planned spending included about $3.6 billion for government-wide funds. Information on how these funds are allocated over the course of the fiscal year is reported in the annex tables of the Supplementary Estimates and in Section 11, Volume III, of the 2016–17 Public Accounts.

In 2016–17, the Secretariat planned to spend $2.8 billion to meet the Treasury Board's responsibilities as employer. Details on actual spending in this area are provided in the Analysis of trends in spending and human resources section of this report.

Expected results |

Performance indicators |

Target |

Date to achieve target |

2016–17 Actual results |

2015–16 Actual results |

2014–15 Actual results |

|---|---|---|---|---|---|---|

Allocations and payments managed by the Secretariat are made as required |

Percentage of allocations and payments made |

100% |

March 2017 |

100% |

100% |

100% |

2016–17 Main Estimates |

2016–17 Planned spending |

2016–17 Total authorities available for use |

2016–17 Actual spending (authorities used) |

2016–17 Difference (actual minus planned) |

|---|---|---|---|---|

6,333,254,397 |

6,333,254,397 |

4,936,924,721 |

2,746,401,897 |

-3,586,852,500 |

The variance between planned and actual spending in this program is mainly attributable to the way that government-wide funds are transferred between the Secretariat and other government organizations. Every year, the Secretariat includes funding in its reference level to be transferred to other government organizations once specific criteria as approved by Treasury Board are met. If these funds are needed, they are transferred to the appropriate department. If they are not needed, the unused balance is returned to the fiscal framework at the end of the fiscal year and is reported as a Secretariat lapse. No actual spending is incurred by the Secretariat under government-wide funds.

2016–17 Planned |

2016–17 Actual |

2016–17 Difference (actual minus planned) |

|---|---|---|

| N/A | N/A | N/A |

Information on the breakdown of spending on government-wide funds and public service employer payments is available on the Secretariat's website.

Internal Services

Description

Internal Services are those groups of related activities and resources that the federal government considers to be services in support of programs and/or required to meet corporate obligations of an organization. Internal Services refers to the activities and resources of the 10 distinct service categories that support Program delivery in the organization, regardless of the Internal Services delivery model in a department. The 10 service categories are: Management and Oversight Services; Communications Services; Legal Services; Human Resources Management Services; Financial Management Services; Information Management Services; Information Technology Services; Real Property Services; Materiel Services; and Acquisition Services.

Results

Highlights

- A workplace of choice: in 2017, the Secretariat was named one of the top 100 employers in Canada and one of the National Capital Region's top employers

In 2016–17, the Secretariat undertook a number of initiatives relating to Internal Services to support the implementation of the Government of Canada's agenda.

The Secretariat continued to implement a results and delivery approach to ensure consistent reporting on the achievement of the President of the Treasury Board's priorities. The Secretariat's Chief Results and Delivery Officer led the implementation efforts, supported by the Results and Delivery Unit. The Secretariat also led by example by being one of the departments to use the new Departmental Results Framework. Also in line with this approach, the Secretariat developed a data strategy to better manage information, to improve internal processes, to support evidence-based policy decision making, and to report internally and externally on performance.

To support an agile workplace and a high-performing workforce, the Secretariat invested in 2 learning and development strategies for its employees:

- the Analyst Learning and Development Strategy Learning Calendar for analysts

- the Administrative Professionals Learning and Development Strategy for administrative and clerical employees

The Secretariat also implemented the New Direction in Staffing.

The Secretariat's EX community continued to strive to keep its "Every Day" commitment to employees in order to support a respectful, fulfilling and productive work environment.

The Secretariat also drafted a Departmental Wellness Action Plan to define what wellness means at the Secretariat and to raise awareness about mental health. The plan includes actions that grew out of a gap analysis, as well as indicators of progress on the action plan. Mechanisms for measuring progress include employee surveys.

The Secretariat continued to empower employees to work more collaboratively by strengthening and promoting digital tools and the Secretariat's open office environment at its primary location. Employees have access to the latest videoconferencing and collaboration technologies, Wi-Fi, a dedicated meeting and training area, and open collaboration areas. The meeting and training facilities opened in October 2015, and usage of them increased from 44.7% in 2015–16 to 46.3% in 2016–17.

Work is continuing on the design and renovation of the Secretariat's second location, 219 Laurier. The goal is to make all Secretariat workplaces open, agile and collaborative.

2016–17 Main Estimates |

2016–17 Planned spending |

2016–17 Total authorities available for use |

2016–17 Actual spending (authorities used) |

2016–17 Difference (actual minus planned) |

|---|---|---|---|---|

66,661,047 |

65,624,896 |

80,224,405 |

73,355,122 |

7,730,226 |

Actual spending was higher than planned, mainly due to increased charges relating to Shared Services Canada and the rollout of several new IT projects for the Secretariat's analysts. These increased charges were offset by the "reprofiling," or shifting, of $3.3 million from 2016–17 to 2017–18 for phase II of the Workspace Renewal project due to construction delays in fitting up 219 Laurier for the Secretariat's use.

2016–17 Planned |

2016–17 Actual |

2016–17 Difference (actual minus planned) |

|---|---|---|

578 |

581 |

3 |

Actual FTEs aligned with planned FTEs.

Analysis of trends in spending and human resources

Actual expenditures

Departmental spending breakdown

The Secretariat spent a total of $3.1 billion toward achieving its Strategic Outcome. Approximately 10% of its total spending was directly related to operating expenditures.

The balance is primarily related to the Secretariat’s role in supporting the Treasury Board as employer of the core public administration (see Figure 1).

Figure 1 - Text version

This pie chart shows the breakdown of the Treasury Board of Canada Secretariat’s actual spending for 2016–17 in two categories: public service employer payments and various statutory items, which accounted for 90 per cent of actual spending, or $2,746 million; and Secretariat operations, which accounted for 10 per cent of actual spending, or $317.8 million).

Figure 2 - Text version

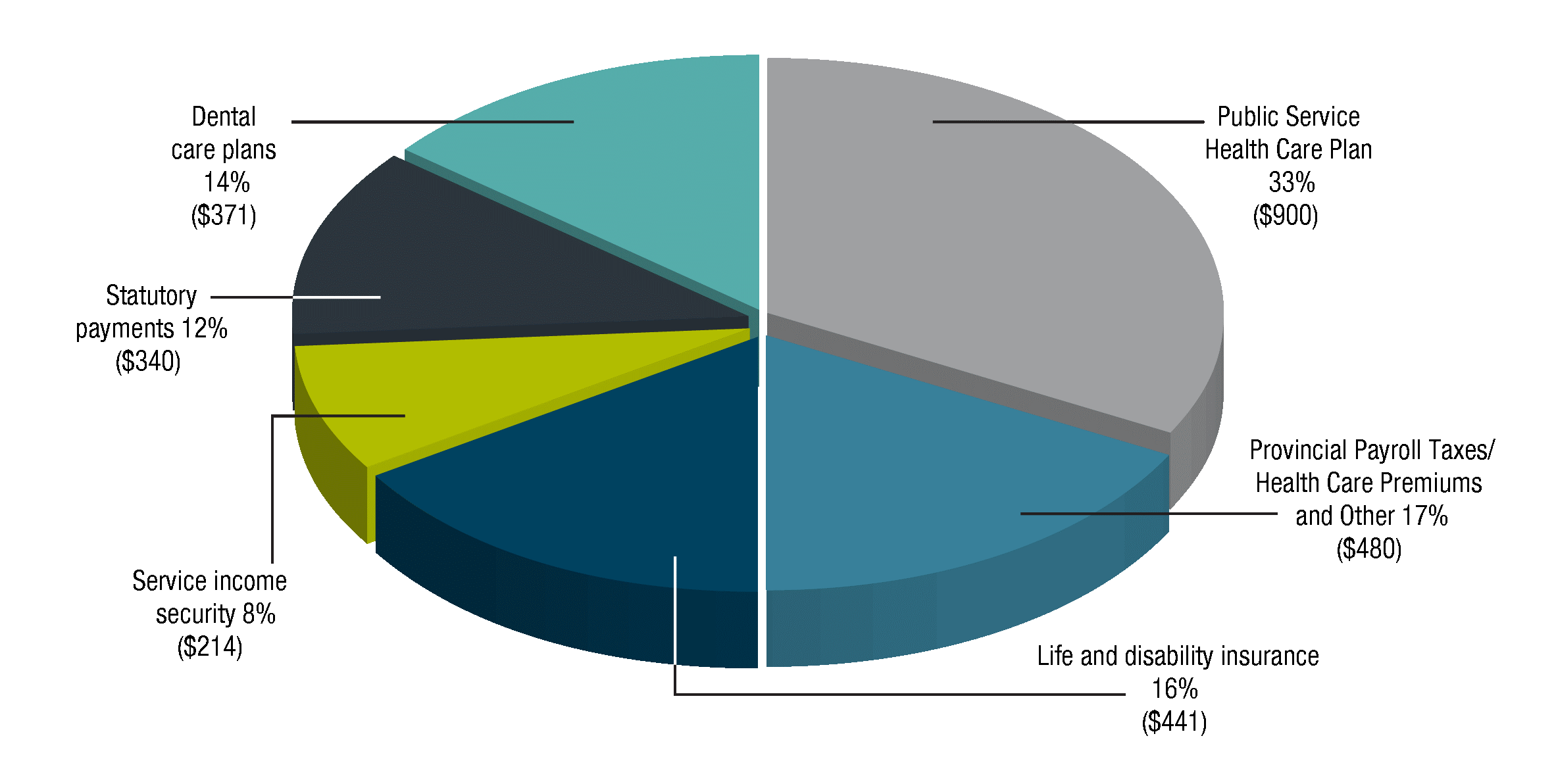

This pie chart shows the breakdown of the Treasury Board of Canada Secretariat’s actual spending on public service employer payments and various statutory items for 2016–17. The pie chart is divided into six spending categories, broken down as follows:

Category |

Amount |

Percentage of total |

|---|---|---|

Public Service Health Care Plan |

$900 million |

33% |

Provincial Payroll Taxes / Health Care Premiums and Other |

$480 million |

17% |

Life and disability insurance |

$441 million |

16% |

Dental care plans |

$371 million |

14% |

Statutory payments |

$340 million |

12% |

Service income security |

$214 million |

8% |

Total spending for Public Service Employer Payments was $2.7 billion in 2016–17. The amount includes payments made under public service benefit plans, legislated amounts payable to provinces and associated administrative expenditures. In addition, statutory payments, which relate to the employer contributions made under the Public Service Superannuation Act and other retirement acts and the Employer Insurance Act totalled $340 million (see Figure 2).

Figure 3 - Text version

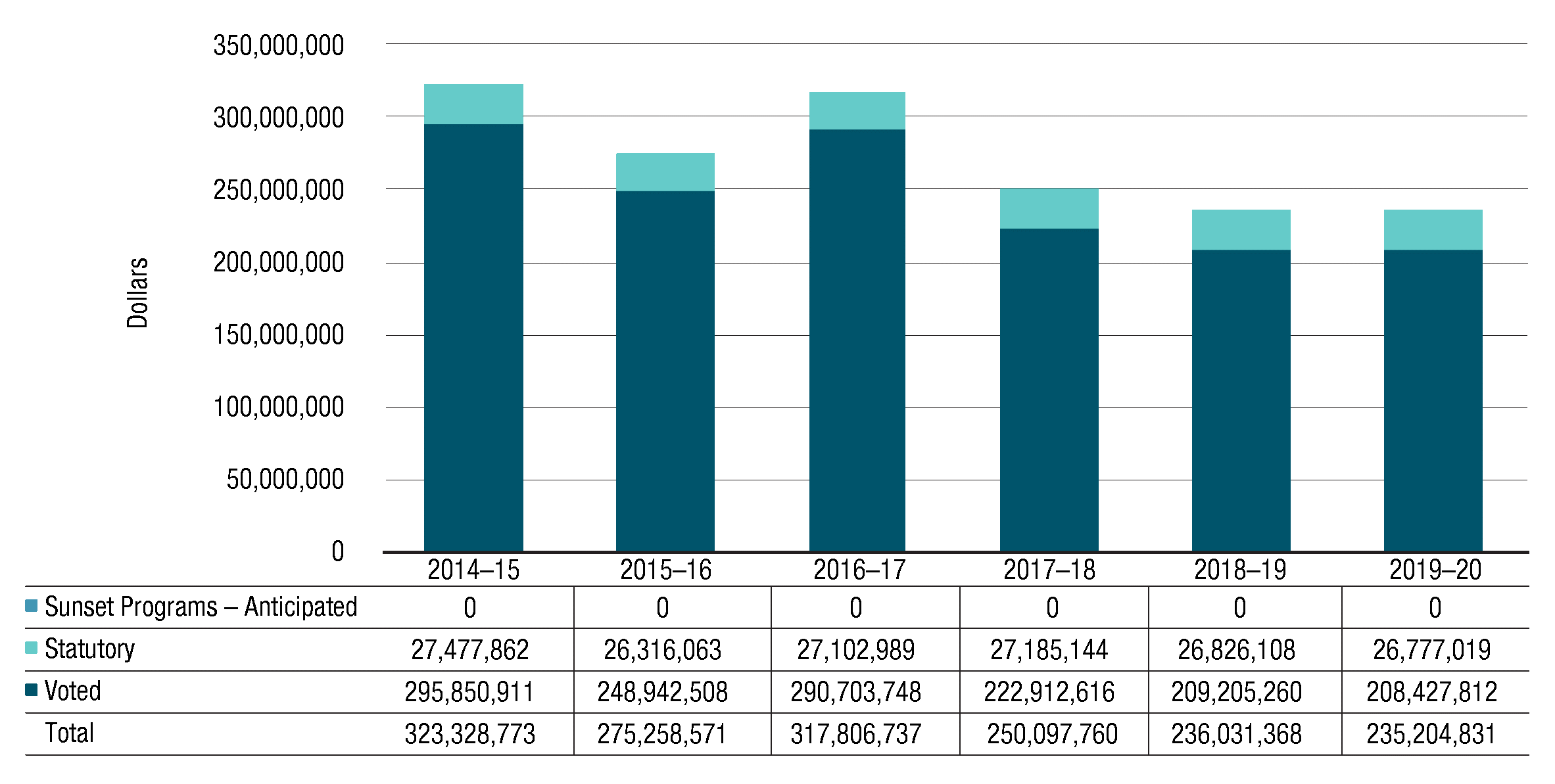

This bar graph illustrates the Secretariat’s actual spending (Vote 1) for fiscal years 2014-15, 2015-16 and 2016-17 and planned spending for fiscal years 2017-18, 2018-19 and 2019-20. Financial figures are presented in dollars along the y axis, increasing by $50 million and ending at $350 million. These are graphed against fiscal years 2014-15 to 2019-20 on the x axis

For each fiscal year, amounts for the Secretariat’s program expenditures (Vote 1), statutory vote (largely comprised of contributions to employee benefit plans), and anticipated sunset programs are identified.

No amount is reported in 2014-15 to 2019-20 as sunset programs - anticipated.

In 2014-15, actual spending was $27,477,862 for statutory items, $295,850,911 for program expenditures for a total of $323,328,773.

In 2015-16, actual spending was $26,316,063 for statutory items and $248,942,508 for program expenditures for a total of $275,258,571.

In 2016-17, actual spending was $27,102,989 for statutory items and $290,703,748 for program expenditures for a total of $317,806,737.

Planned spending for statutory items goes from $27,185,144 in 2017-18, to $26,826,108 in 2018-19 and to $26,777,019 in 2019-20.

Planned spending for program expenditures goes from $222,912,616 in 2017-18, to $209,205,260 in 2018-19, and to $208,427,812 in 2019-20.

Total planned spending goes from $250,097,760 in 2017-18, to $236,061,368 in 2018-19, and to $235,204,831 in 2019-20.

Budgetary performance summary for Programs and Internal Services (dollars)

The Secretariat’s operating expenditures include salaries, non-salary costs to deliver programs and statutory items related to the employer’s contributions to the Secretariat’s employee benefit plans.

The decrease of $48 million between 2014–15 and 2015–16 actual spending resulted mostly from reduced expenditures in 2015–16 related to the settlement in the White class action lawsuit and a decrease in spending related to the Workspace Renewal Initiative (phase I). Those decreases were partially offset by expenditures incurred to support the Secretariat-led government-wide Enabling Functions Transformation.

The increase of $42.5 million between 2015–16 and 2016–17 is mostly attributed to implementing the Secretariat’s Government of Canada’s Budget 2016 initiatives to make progress on government-wide Enabling Functions Transformation, the plan to enhance access to information, and to develop a client-first service strategy and expand open data across the Government of Canada.

A decrease of $67.7 million between 2016–17 and 2017–18 is mostly attributed to one-time funding received to accelerate the Enabling Functions Transformation, as announced in Budget 2016.

Program expenditures are anticipated to further decrease by $14.9 million from 2017–18 to 2019–20, as phase II of the Workspace Renewal Initiative is expected to be completed with more than 800 Secretariat employees expected to move into their new workspace at 219 Laurier by winter 2018.

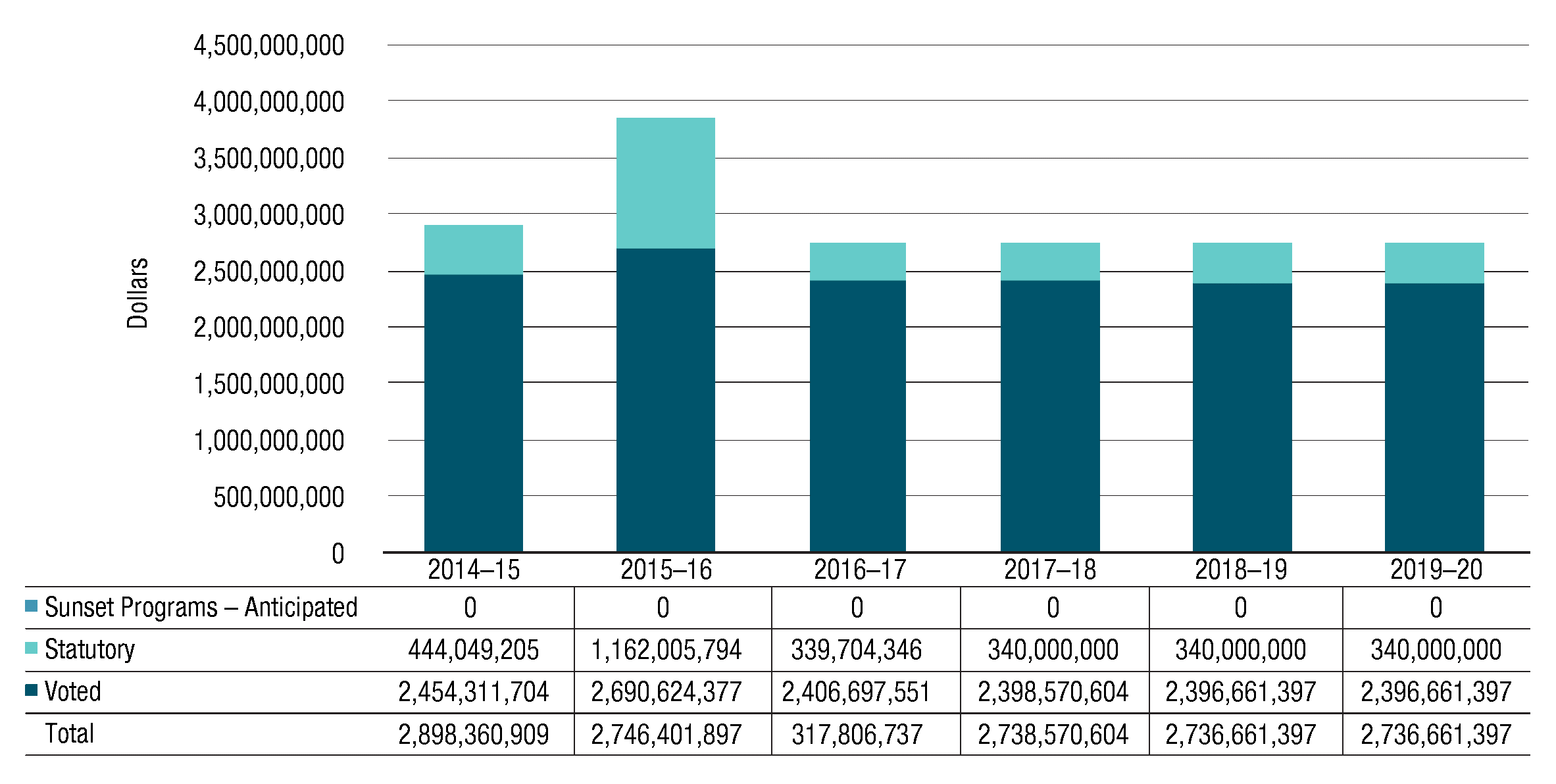

Figure 4 - Text version

This bar graph illustrates the Secretariat’s actual spending for the public service employer payments (Vote 20) and various statutory items for fiscal years 2014-15, 2015-16 and 2016-17 and planned spending for fiscal years 2017-18, 2018-19 and 2019-20. Financial figures are presented in dollars along the y axis, increasing by $500 million and ending at $4.5 billion. These are graphed against fiscal years 2014-15 to 2019-20 on the x axis.

For each fiscal year, amounts for the Secretariat’s public service employer payments (Vote 20), statutory items (largely comprised of payments under the Public Service Pension Adjustment Act), and anticipated sunset programs are identified.

No amount is reported in 2014-15 to 2019-20 as sunset programs - anticipated.

In 2014-15, actual spending was $444,049,205 for statutory items and $2,454,311,704 for public service employer payments for a total of $2,898,360,909.

In 2015-16, actual spending was $1,162,005,794 for statutory items and $2,690,624,377 for public service employer payments for a total of $3,852,630,171.

In 2016-17, actual spending was $339,704,346 for statutory items and $2,406,697,551 for public service employer payments for a total of $2,746,401,897.

Planned spending for statutory items will remain the same for fiscal years 2017-18 to 2019-20 in the amount of $340,000,000.

Planned spending for public service employer payments goes from $2,398,570,604 in 2017-18, to $2,396,661,397 in 2018-19, and will remain the same for fiscal years 2019-20.

Total planned spending for public service employer payments goes from $2,738,570,604 in 2017-18, to $2,736,661,397 in 2018-19, and will remain the same for fiscal years 2019-20.

Expenditures for public service employer payments and statutory items represent the employer’s share of contributions required by the insurance plans sponsored by the Government of Canada. These amounts also include statutory items for payments under the Public Service Pension Adjustment Act and employer contributions made under the Public Service Superannuation Act, the Employment Insurance Act and related acts.

The increase of $954 million from 2014–15 to 2015–16 is attributed to statutory items of $718 million, which is largely due to an actuarial adjustment made in relation to the Public Service Superannuation Act, and an increase of $236 million related to public service employer payments to incrementally restore the financial health of the Service Income Security Insurance Plan.

The decrease of $1,106 million from 2015–16 to 2016–17 is largely attributed to the one-time payments made last fiscal year for the actuarial adjustment and the Service Income Security Insurance Plan noted above. These were offset by an increase mainly due to a one-time payment to the Royal Canadian Mounted Police Disability Insurance Plan to eliminate the current deficit and to restore the plan to sound financial health.

Planned spending for fiscal years 2017–18 to 2019–20 is expected to remain mostly unchanged.

Programs and Internal Services |

2016–17 Main Estimates |

2016–17 Planned spending |

2017–18 Planned spending |

2018–19 Planned spending |

2016–17 Total authorities available for use |

2016–17 Actual spending (authorities used) |

2015–16 Actual spending (authorities used) |

2014–15 Actual spending (authorities used) |

|---|---|---|---|---|---|---|---|---|

Decision-Making Support and Oversight |

49,543,385 |

50,579,535 |

45,643,416 |

45,580,561 |

47,860,798 |

46,426,488 |

41,781,563 |

45,973,078 |

Management Policies Development and Monitoring |

67,614,269 |

68,090,606 |

68,980,686 |

67,203,962 |

73,070,813 |

70,832,094 |

65,041,366 |

71,248,693 |

Government-Wide Program Design and Delivery |

53,732,931 |

53,256,595 |

57,333,552 |

55,931,994 |

192,795,583 |

127,193,033 |

90,757,746 |

128,464,156 |

Government-wide Funds and Public Service Employer Payments |

6,333,254,397 |

6,333,254,397 |

6,291,763,604 |

6,289,854,398 |

4,936,924,721 |

2,746,401,897 |

3,852,630,170 |

2,898,360,909 |

Internal Services |

66,661,047 |

65,624,896 |

78,140,106 |

67,314,850 |

80,224,405 |

73,355,122 |

77,677,897 |

77,642,846 |

Total |

6,570,806,029 |

6,570,806,029 |

6,541,861,364 |

6,525,885,765 |

5,330,876,320 |

3,064,208,634 |

4,127,888,742 |

3,221,689,682 |

In 2017–18, the Secretariat has transitioned from its Strategic Outcome and Program Alignment Architecture, which was required under the previous Policy on Management Resources and Results Structures, to a Departmental Results Framework, which is required under the new Policy on Results. The planned spending for 2017–18 and 2018–19 were prepared as per the Departmental Results Framework and restated to the Program Alignment Architecture for illustration purposes only.

The budgetary performance summary table above provides the following:

- Main Estimates for 2016–17

- Planned spending for 2016–17, as reported in the Secretariat’s 2016–17 Report on Plans and Priorities

- Planned spending for 2017–18 and 2018–19, as reported in the Secretariat’s 2017–18 Departmental Plan (restated as noted above)

- Total Authorities Available for use in 2016–17 which reflects the authorities received to date, including in-year contributions from other government departments (OGDs) for the Enabling Functions Transformation

- Actual spending for 2016–17, 2015–16 and 2014–15 as reported in the Public Accounts

For additional details on planned spending, see the section “Supporting information on lower-level programs” in Supplementary Information.

The Government-Wide Funds and Public Service Employer Payments program is the largest portion of the Secretariat’s planned spending. On average, the Treasury Board approves transfers of approximately 56% of this program’s funding to other federal organizations for items such as government contingencies, government-wide initiatives, compensation requirements, operating and capital budget carry forward, and paylist expenditures (Central Votes 5, 10, 15, 25, 30 and 33). The Secretariat’s total funding available for use is reduced accordingly. The remaining 44% of this program pertains to statutory payments, used to pay the employer’s share of contributions to employee pension plan, and to public service employer payments, used to pay the employer’s share of contributions to employee insurance and benefits plans.

Overall, planned spending is expected to decrease by $45 million by 2018–19, mainly due to the actuarial adjustment referenced above and offset by additional ongoing funding related to the premium rate increase for the Service Income Security Insurance Plan. The decrease is also due to the sunsetting of the Workspace Renewal Initiative (phase II), and the one-time funding received to accelerate the Enabling Functions Transformation, as announced in Budget 2016.

Actual spending decreased by $1,064 million in 2016–17, primarily because of the one-time payments no longer required for the actuarial adjustment and the Service Income Security Insurance Plan. These decreases were offset by an increase in the Secretariat’s operating expenditures used for:

- Budget 2016 initiatives to accelerate the Enabling Functions Transformation, to enhance access to information, to develop a client-first service strategy, and to expand open data

- establishing a Centre for Greening Government at the Secretariat

- the additional claims related to the White class action lawsuit

- the third-party Shared Services Canada resource alignment review

- the transfer of the Regulatory Cooperation Council Secretariat from the Privy Council Office to the Secretariat

As reported in the Secretariat’s 2015–16 Departmental Performance Report, actual spending increased by $906 million from 2014–15 to 2015–16. Most of that increase, $718 million can be attributed to statutory items, largely due to the actuarial adjustment made in relation to the Public Service Superannuation Act discussed above. The rest of the increase, $236 million, related to public service employer payments to incrementally restore the financial health of the Service Income Security Insurance Plan. This plan is providing benefits to an increased number of medically released Canadian Armed Forces members who served in the Afghanistan mission. These increases were offset by a $48-million decrease in the Secretariat’s operating expenditures, mostly related to the sunset of funding received in 2014–15 for the payout of an out-of-court settlement under the White class action lawsuit launched against the Crown in 2014.

Actual human resources

Programs and Internal Services |

2014–15 Actual |

2015–16 Actual |

2016–17 Planned |

2016–17 Actual |

2017–18 Planned |

2018–19 Planned |

|---|---|---|---|---|---|---|

Decision-Making Support and Oversight |

346 |

332 |

343 |

337 |

338 |

337 |

Management Policies Development and Monitoring |

486 |

466 |

498 |

506 |

504 |

490 |

Government-Wide Program Design and Delivery |

413 |

428 |

383 |

498 |

452 |

443 |

Government-Wide Funds and Public Service Employer Payments |

N/A | N/A | N/A | N/A | N/A | N/A |

Internal Services |

590 |

581 |

578 |

581 |

581 |

579 |

Total |

1,835 |

1,807 |

1,802 |

1,922 |

1,875 |

1,849 |

The decrease of 28 full-time equivalents between 2014–15 and 2015–16 relates mostly to the return of funding to the Fiscal Framework for the National Managers’ Community and the Regional Federal Councils and to the transfer of administration of the National Managers’ Community to the Canada School of Public Service, and the full time equivalents related to the funding transferred from the Secretariat to Public Services and Procurement Canada for the consolidation of pay services in Miramichi, New Brunswick.

The increase of 115 full-time equivalents between 2015–16 and 2016–17 relates primarily to the new staff hired to implement Budget 2016 initiatives to accomplish the Enabling Functions Transformation, enhance access to information, develop a client-first service strategy and expand open data. Full-time equivalents also increased because employees who worked in the Regulatory Cooperation Council Secretariat at the Privy Council Office and in the Centre for Greening Government at Public Services and Procurement Canada were transferred to the Secretariat in 2016.

Planned full-time equivalents are expected to decrease by 73 between 2016–17 and 2018–19. This decrease is mostly attributable to the full-time equivalents related to the reduction in funding to:

- implement the Secretariat’s Workspace Renewal Initiative (phase II) as employees will have already moved to their new workspace at 219 Laurier by winter 2018

- advance the Enabling Functions Transformation (as announced in Budget 2016)

Expenditures by vote

For information on the Secretariat’s organizational voted and statutory expenditures, consult the Public Accounts of Canada 2017.

Alignment of spending with the whole-of-government framework

Program |

Spending area |

Government of Canada activity |

2016–17 Actual spending |

|---|---|---|---|

Decision-Making Support and Oversight |

Government Affairs |

Well-managed and efficient government operations |

46,426,488 |

Management Policies Development and Monitoring |

Government Affairs |

Well-managed and efficient government operations |

70,832,094 |

Government-Wide Program Design and Delivery |

Government Affairs |

Well-managed and efficient government operations |

127,193,033 |

Government-Wide Funds and Public Service Employer Payments |

Government Affairs |

Well-managed and efficient government operations |

2,746,401,897 |

Spending area |

Total planned spending |

Total actual spending |

|---|---|---|

Economic affairs |

N/A | N/A |

Social affairs |

N/A | N/A |

International affairs |

N/A | N/A |

Government affairs |

6,505,181,133 |

2,990,853,512 |

Note: The figures above do not include Internal Services.

Financial statements and financial statements highlights

Financial statements

The Treasury Board of Canada Secretariat financial statements [unaudited] for the year ended March 31, 2017, are available on the Secretariat’s website.

Financial statements highlights

The highlights presented in this section are drawn from the Secretariat’s financial statements. The financial statements were prepared using Government of Canada accounting policies, which are based on Canadian public sector accounting standards.

The figures provided in other sections were prepared on an expenditure basis, while the figures in this section were prepared on an accrual basis. The difference relates to accrual entries such as the recognition of services without charge received from other government departments, acquisition of capital assets and related amortization expenses, and accrued liability adjustments.

Financial information |

2016–17 Planned results |

2016–17 Actual |

2015–16 Actual |

Difference (2016–17 actual minus 2016–17 planned) |

Difference (2016–17 actual minus 2015–16 actual) |

|---|---|---|---|---|---|

Total expenses |

3,046,425,303 |

3,077,669,086 |

4,152,291,564 |

31,243,783 |

(1,074,622,479) |

Total net revenues |

11,848,562 |

10,890,100 |

11,701,966 |

(958,462) |

(811,866) |

Net cost of operations before government funding and transfers |

3,034,576,741 |

3,066,778,986 |

4,140,589,598 |

32,202,245 |

(1,073,810,613) |

Note: Refer to the Secretariat’s 2016–17 Future-Oriented Statement of Operations for additional information on planned results.

The Secretariat’s total expenses of $3.1 billion in 2016–17 included approximately $2.7 billion related to public service employer payments for government-wide benefits programs, such as the employer’s share of the Public Service Health Care Plan (PSHCP), the Public Service Dental Care Plan (PSDCP) and other insurance and pension programs. The Secretariat’s total net revenues of $10.9 million in 2016–17 mainly resulted from revenues collected from internal support services that the Secretariat provided to other government departments and the recovery of Public Service Pension Plan administration costs.

The decrease of $1.1 billion in actual net cost of operations before government funding and transfers in 2016–17 is mostly due to a decrease in public service employer payments. This included a decrease of $822 million related to one-time actuarial adjustments to the Public Service Pension Plan made in 2015–16 in accordance with the Public Service Superannuation Act in order to align with the triennial valuation tabled in Parliament in January 2016, as well as a decrease of $290 million mostly related to a one-time payment made in 2015–16 to restore the financial health of the Service Income Security Insurance Plan.

The increase of $32 million to the net cost of operations before government funding and transfers between 2016–17 planned and actual results is mostly due to additional funding approved for the Enabling Functions Transformation Initiative, partially offset by the revised actuarial adjustments.

Financial information |

2016–17 |

2015–16 |

Difference (2016–17 minus 2015–16) |

|---|---|---|---|

Total liabilities |

714,404,674 |

459,800,454 |

254,604,220 |

Total net financial assets |

642,232,112 |

376,944,154 |

265,287,958 |

Departmental net debt |

72,172,562 |

82,856,300 |

(10,683,738) |

Total non-financial assets |

33,511,879 |

27,414,380 |

6,097,499 |

Departmental net financial position |

(38,660,683) |

(55,441,920) |

16,781,237 |

The Secretariat’s liabilities consist mainly of accounts payable to other government organizations related to employer contributions to employee benefit plans (EBP) and to accrued employee claims for health and dental benefits under the PSHCP and the PSDCP. The increase of $255 million in total liabilities is mostly due to an increase in accounts payable to other government organizations to adjust their share of employer contributions to EBP as well as an account payable to address a shortfall under the RCMP Disability Insurance Plan.

The Secretariat’s assets consist mainly of accounts receivable from other government departments and agencies to pay for their share of employer contributions to employee benefit plans, as well as amounts due from the Consolidated Revenue Fund (CRF) that may be disbursed from the CRF without further charges to the Secretariat’s authorities. The increase of $265 million in total net financial assets is mostly due to an increase in amounts due from the CRF.

The departmental net debt is mainly comprised of accrued liabilities to be paid from authorities in future years. The decrease of $11 million is mostly due to a reduction of $6 million to the accrued liability associated with a legal settlement and a decrease of $3 million in accrued severance benefits due to a change in the estimated future obligation.

The Secretariat’s non-financial assets consist mainly of tangible capital assets. The increase of $6 million is mostly due to the capitalization of software development costs.

The increase of $17 million to the departmental net financial position, which is the difference between the total non-financial assets and the departmental net debt, is thus attributable to the increase in tangible capital assets and the reduction in accrued liabilities to be paid from future authorities.

Supplementary information

Corporate information

Organizational profile

Appropriate minister: The Honourable Scott Brison, President of the Treasury Board

Institutional head: Yaprak Baltacıoğlu, Secretary of the Treasury Board

Ministerial portfolio: The minister’s portfolio consists of the Treasury Board of Canada Secretariat and the Canada School of Public Service, as well as the following organizations, which operate at arm’s length and report to Parliament through the President of the Treasury Board: the Public Sector Pension Investment Board, the Office of the Commissioner of Lobbying of Canada and the Office of the Public Sector Integrity Commissioner of Canada.

Enabling instrument: The Financial Administration Act is the act that establishes the Treasury Board itself and gives it powers with respect to the financial, personnel and administrative management of the public service, and the financial requirements of Crown corporations.

Year of incorporation / commencement: 1966

Reporting framework

The Secretariat’s Strategic Outcome and Program Alignment Architecture of record for 2016–17 are shown below.

1. Strategic Outcome: Good governance and sound stewardship to enable efficient and effective service to Canadians.

- 1.1 Program: Decision-Making Support and Oversight

- 1.1.1 Sub-Program: Cabinet Decision Support

- 1.1.2 Sub-Program: Expenditure Analysis and Allocation Management

- 1.2 Program: Management Policies Development and Monitoring

- 1.2.1 Sub-Program: Financial Management Policy

- 1.2.2 Sub-Program: People Management Policy

- 1.2.3 Sub-Program: Information Management and Information Technology Policy

- 1.2.4 Sub-Program: Externally Facing Policy

- 1.2.5 Sub-Program: Organizational Management Policy

- 1.3 Program: Government-Wide Program Design and Delivery

- 1.3.1 Sub-Program: Pensions and Benefits

- 1.3.2 Sub-Program: Labour Relations

- 1.3.3 Sub-Program: Government-Wide Operations

- 1.3.4 Sub-Program: Transformation Leadership

- Program 1.4: Government-Wide Funds and Public Service Employer Payments

- Internal Services

Supporting information on lower-level programs

Supporting information on results, financial and human resources related to the Secretariat’s Program Inventory is available in the TBS InfoBase.

Supplementary information tables

The following supplementary information tables are available on the Secretariat’s website:

- Departmental Sustainable Development Strategy

- Details on transfer payment programs of $5 million or more (nil for TBS in 2016-17)

- Horizontal initiatives

- Internal audits and evaluations

- Response to parliamentary committees and external audits

Project name and project phase |

Original estimated total cost (dollars) |

Revised estimated total cost (dollars) |

Actual total cost (dollars) |

2016–17 Main Estimates (dollars) |

2016–17 Planned spending (dollars) |

2016–17 Total authorities (dollars) |

2016–17 Actual spending (dollars) |

Expected date of close-out |

|---|---|---|---|---|---|---|---|---|

Program: Internal Services; Sub-Program: Real Property Services |

||||||||

Workspace Renewal Initiative (Implementation Phase) |

54,000,000 |

54,000,000 |

28,726,466 |

4,494,774 |

4,494,774 |

4,494,774 |

2,168,302 |

2017–18 |

The Workspace Renewal Initiative (Implementation Phase) exceeded the Secretariat’s project approval limit at the time of approval, prompting the request for specific Treasury Board approval. This approval happened before the increased authorities afforded to the Secretariat as a result of the approval of its investment plan ().

Expenditures include salary (FTEs), contracts (services) and assets (goods), but do not include GST/HST.

Workspace Renewal Initiative (Implementation Phase): Estimated total cost (columns 1 and 2) includes funding for the Secretariat and for Shared Services Canada. Other columns (columns 3 to 7) reflect Secretariat figures only.

- Status report on transformational and major Crown projects (nil for TBS in 2016-17)

- Up-front multi-year funding (nil for TBS in 2016-17)

- User fees, regulatory charges and external fees

Federal tax expenditures

The tax system can be used to achieve public policy objectives through the application of special measures such as low tax rates, exemptions, deductions, deferrals and credits. The Department of Finance Canada publishes cost estimates and projections for these measures each year in the Report on Federal Tax Expenditures. This report also provides detailed background information on tax expenditures, including descriptions, objectives, historical information and references to related federal spending programs. The tax measures presented in this report are the responsibility of the Minister of Finance.

Organizational contact information

Treasury Board of Canada Secretariat

90 Elgin Street

Ottawa, Canada K1A 0R5

Toll-free: 1-877-636-0656

Teletypewriter (TTY): 613-369-9371

Email: questions@tbs-sct.gc.ca

Website: https://www.canada.ca/en/treasury-board-secretariat.html

Appendix: definitions

- appropriation (crédit)

- Any authority of Parliament to pay money out of the Consolidated Revenue Fund.

- budgetary expenditures (dépenses budgétaires)

- Operating and capital expenditures; transfer payments to other levels of government, organizations or individuals; and payments to Crown corporations.

- Core Responsibility (responsabilité essentielle)

- An enduring function or role performed by a department. The intentions of the department with respect to a Core Responsibility are reflected in one or more related Departmental Results that the department seeks to contribute to or influence.

- Departmental Plan (Plan ministériel)

- Provides information on the plans and expected performance of appropriated departments over a 3-year period. Departmental Plans are tabled in Parliament each spring.

- Departmental Result (résultat ministériel)

- A Departmental Result represents the change or changes that the department seeks to influence. A Departmental Result is often outside departments’ immediate control, but it should be influenced by program-level outcomes.

- Departmental Result Indicator (indicateur de résultat ministériel)

- A factor or variable that provides a valid and reliable means to measure or describe progress on a Departmental Result.

- Departmental Results Framework (cadre ministériel des résultats)

- Consists of the department’s Core Responsibilities, Departmental Results and Departmental Result Indicators.

- Departmental Results Report (Rapport sur les résultats ministériels)

- Provides information on the actual accomplishments against the plans, priorities and expected results set out in the corresponding Departmental Plan.

- Evaluation (évaluation)

- In the Government of Canada, the systematic and neutral collection and analysis of evidence to judge merit, worth or value. Evaluation informs decision making, improvements, innovation and accountability. Evaluations typically focus on programs, policies and priorities and examine questions related to relevance, effectiveness and efficiency. Depending on user needs, however, evaluations can also examine other units, themes and issues, including alternatives to existing interventions. Evaluations generally employ social science research methods.

- full-time equivalent (équivalent temps plein)

- A measure of the extent to which an employee represents a full person-year charge against a departmental budget. Full-time equivalents are calculated as a ratio of assigned hours of work to scheduled hours of work. Scheduled hours of work are set out in collective agreements.

- government-wide priorities (priorités pangouvernementales)

- For the purpose of the 2016–17 Departmental Results Report, government-wide priorities refers to those high-level themes outlining the government’s agenda in the 2015 Speech from the Throne, namely: Growth for the Middle Class; Open and Transparent Government; A Clean Environment and a Strong Economy; Diversity is Canada’s Strength; and Security and Opportunity.

- Governor in Council (gouverneur en conseil)

- The Governor General of Canada acting by and with the advice and consent of the Queen’s Privy Council for Canada (in other words, Cabinet).

- horizontal initiatives (initiative horizontale)

- An initiative where 2 or more federal organizations, through an approved funding agreement, work toward achieving clearly defined shared outcomes, and which has been designated (for example, by Cabinet or a central agency) as a horizontal initiative for managing and reporting purposes.

- Management, Resources and Results Structure (Structure de la gestion, des ressources et des résultats)

- A comprehensive framework that consists of an organization’s inventory of programs, resources, results, performance indicators and governance information. Programs and results are depicted in their hierarchical relationship to each other and to the Strategic Outcome(s) to which they contribute. The Management, Resources and Results Structure is developed from the Program Alignment Architecture.

- non-budgetary expenditures (dépenses non budgétaires)

- Net outlays and receipts related to loans, investments and advances, which change the composition of the financial assets of the Government of Canada.

- performance (rendement)

- What an organization did with its resources to achieve its results, how well those results compare to what the organization intended to achieve, and how well lessons learned have been identified.

- performance indicator (indicateur de rendement)

- A qualitative or quantitative means of measuring an output or outcome, with the intention of gauging the performance of an organization, program, policy or initiative respecting expected results.

- performance reporting (production de rapports sur le rendement)

- The process of communicating evidence-based performance information. Performance reporting supports decision making, accountability and transparency.

- planned spending (dépenses prévues)

-

For Departmental Plans and Departmental Results Reports, planned spending refers to those amounts that receive Treasury Board approval by February 1. Therefore, planned spending may include amounts incremental to planned expenditures presented in the Main Estimates.

A department is expected to be aware of the authorities that it has sought and received. The determination of planned spending is a departmental responsibility, and departments must be able to defend the expenditure and accrual numbers presented in their Departmental Plans and Departmental Results Reports. - plans (plans)

- The articulation of strategic choices, which provides information on how an organization intends to achieve its priorities and associated results. Generally a plan will explain the logic behind the strategies chosen and tend to focus on actions that lead up to the expected result.

- priorities (priorité)

- Plans or projects that an organization has chosen to focus and report on during the planning period. Priorities represent the things that are most important or what must be done first to support the achievement of the desired Strategic Outcome(s).

- program (programme)

- A group of related resource inputs and activities that are managed to meet specific needs and to achieve intended results and that are treated as a budgetary unit.

- Program Alignment Architecture (architecture d’alignement des programmes)

- A structured inventory of an organization’s programs depicting the hierarchical relationship between programs and the Strategic Outcome(s) to which they contribute.

- results (résultat)

- An external consequence attributed, in part, to an organization, policy, program or initiative. Results are not within the control of a single organization, policy, program or initiative; instead they are within the area of the organization’s influence.