Your Online Pension and Insurance Benefits Statement Guide (2015)

This guide applies to employees who were members of the public service pension plan on or before , who will continue to be able to retire with an unreduced pension at age 60 with at least two years of pensionable service (or at age 55 with at least 30 years of service).

Table of Contents

- Introduction

- Part I–Basic data for the calculation of your pension benefits

- Part II–Pension benefits under the Public Service Superannuation Act (PSSA)

- Part III–Group insurance benefit plans

- 1. Public Service Health Care Plan (PSHCP)

- 2. Public Service Dental Care Plan (PSDCP)

- 3. Disability Insurance (DI) Plan–for represented employees

- 4. Public Service Management Insurance Plan (PSMIP)–for unrepresented and excluded employees occupying confidential positions or in designated groups or executives

- Part IV–Post-retirement benefits

- Appendix–Useful Web Links

Part I–Introduction

This Guide is intended to explain the pension benefits and options described in Your Pension and Insurance Benefits Statement. It also provides you with information on your group insurance benefit plans.

Your pension plan is designed to provide you with income during your retirement. In the event of your death, the plan provides an income for your eligible survivors and children.

Your plan is referred to as a "defined benefit pension plan." A defined benefit plan is one in which the benefits payable upon retirement, termination of service, disability, and death are specified in the plan document-in this case, in the Public Service Superannuation Act (PSSA) and related regulations. The benefits are directly related to each employee's salary and pensionable service under the plan.

Disclaimer

This Guide to your statement is provided for information purposes only and is not a legal document outlining your rights and obligations. Should there be any discrepancy between the information in this document and that contained in the PSSA and related regulations or other applicable laws, the legislative provisions will apply. Similarly, should there be any discrepancy between the information in this document and that contained in the group benefit plan provisions or insurance contracts, the plan provisions or insurance contracts will apply.

The following corresponds to the sections found on Your Pension and Insurance Benefits Statement:

Graphic 1 - Page 1 of Your Pension and Benefits Statement

A. Your personal information–This section includes your name, date of birth, language preference, pension number, and Personal Record Identifier (PRI).

B. Calculation date–The information provided is based on your pay and pension records as of this date. These amounts will change with any additional service or salary increase after this date

C. Service and average salary–This section contains the information used to calculate your estimated pension benefits.

Graphic 2 - Page 2 of Your Pension and Benefits Statement

D. Retirement or departure from the public service–This section provides estimated pension benefit amounts for the various options you may be entitled to if you leave the public service, based on the pensionable service you have accrued as of the calculation date.

Graphic 3 – Page 3 of Your Pension and Benefits Statement

E. Retirement on grounds of disability–If you retire because of disability and you have more than two years of pensionable service, you may receive an immediate annuity. This section provides estimates for your immediate annuity and the reduction of your PSSA pension due to the coordination of benefits with the Canada Pension Plan/Quebec Pension Plan (CPP/QPP).

F. Protection for your survivors–In the event of your death, your eligible survivor(s) and children may be entitled to the listed amounts.

G. Public Service Health Care Plan (PSHCP)–This section identifies whether you are enrolled in the PSHCP, your plan number, and what levels of coverage you have.

Graphic 4– Page 4 of Your Pension and Benefits Statement

H. Public Service Dental Care Plan (PSDCP)–This section identifies whether you are enrolled in the PSDCP and your plan number.

I. Public Service Management Insurance Plan (PSMIP)–This section identifies whether you are enrolled in the PSMIP and what benefit amounts you and your survivors would be entitled to.

J. Disability Insurance (DI) Plan–This section identifies whether you are enrolled in the DI Plan and what benefit amounts you would be entitled to.

K. Post-retirement benefits–This section outlines the benefits and coverage you and your survivors have access to after retirement. See Part IV of this Guide for more information.

Part I–Basic data for the calculation of your pension benefits

1. Your estimated pension benefits are calculated as of the date indicated on your statement

The information in Your Pension and Insurance Benefits Statement was extracted from your pay and pension records as they stood on the date shown on your statement. The amounts shown on your statement are based only on your pensionable service and on your average salary for the five consecutive years of your highest paid service. It provides amounts only for those benefit options for which you have qualified as of the date of your statement.

These amounts will change with any additional service or salary increase after this date. If you have to make a decision in the near future concerning your pension options, please contact the Pension Centre in order to obtain the most up-to-date information.

2. Service and average salary for purposes of the pension plan

- Current service

-

Is the period of service during which you contribute daily to the pension plan to a maximum of 35 years. It includes previous periods of employment in the public service as a contributor under the public service pension plan for which no return of contributions was paid.

Note: You stop contributing to the pension plan on January 1 following the year you reach age 71. If you are turning 71, please contact the Pension Centre for further information.

- Transferred service

-

Means any period of service transferred from another employer's pension plan that has been added to your credit under the public service pension plan. This is generally done through a pension transfer agreement between the Government of Canada and eligible employers. The transferred service could also include periods of service with the Canadian Forces or the Royal Canadian Mounted Police or as a Member of Parliament.

- Service buyback (elective service)

-

Refers to any period of employment, either in the public service or with another employer that occurred before your most recent participation in the public service pension plan and has been purchased in order to count elective service toward your pension. It may include periods of leave without pay that you have elected to count under the public service pension plan as well as service as a member of the Canadian Forces or the Royal Canadian Mounted Police.

If your service buyback request has been confirmed, your statement will show the period of prior service that will be added to your pensionable service and the Request status field will show "Approved". When you fill out a request to purchase prior service, your payments will begin even though your service buyback has not yet been confirmed and your statement will show "Pending" in the Request status field.

A Service Buyback Estimator tool is available online; it enables you to estimate the cost of buying back prior service (elective service) and to compare your pension benefits with and without the service buyback.

- Total pensionable service

-

Means the years (complete or partial) to your credit as of the date of your statement. It includes periods of transferred service and any periods of elected service regardless of whether or not you have paid fully for that service. For purposes of determining your pensionable service, each year of part-time service counts as one year of pensionable service.

Note: The maximum period of pensionable service that may be used to calculate your pension is 35 years. Once you reach the maximum of 35 years of pensionable service, you are only required to contribute 1 per cent of your salary for indexing. Maximum service includes service to your credit under the Canadian Forces and the Royal Canadian Mounted Police pension plans.

- Average salary

-

Is based on your salary during the five consecutive years of your highest paid pensionable service. It includes any salary you earned after completing 35 years of service up to age 71, if that salary is the highest.

For the purposes of the public service pension plan salary is defined as the basic pay received by a person for the performance of the regular duties of a position. It does not include special remuneration or payment for overtime, although certain allowances may be considered as forming part of a person's basic pay. Contact the Pension Centre for further details.

If your salary exceeds $157,700 in 2015, then a portion of your pension contributions and eventual pension benefits will be subject to a Retirement Compensation Arrangement (RCA).

The Income Tax Act (ITA) limits tax-sheltered pension contributions and the payment of pension benefits for registered pension plans, like the public service pension plan. The Retirement Compensation Arrangements Regulations, No. 1 (RCA No. 1) were established to allow the accumulation and payment of benefits that are above the limits allowed under the ITA.

There is a maximum salary for which contributions can be made under the public service pension plan. It is referred to as the maximum contributory threshold and it increases annually. For the 2015 year, the maximum contributory threshold is $157,700. This means that employees whose annual salary is in excess of $157,700 will contribute to the public service pension plan for the portion of their salary that is below the limit and to the RCA No. 1 for the portion of their salary that is above the limit.

Part II-Pension benefits under the Public Service Superannuation Act (PSSA)

Please note that the pension benefit or options are calculated as of the date shown on your statement; however, the amounts shown may not necessarily reflect all salary adjustments at the time of printing.

1. Retirement or departure from the public service

Division of pension benefits

If your marriage or relationship of a conjugal nature breaks down, the pension benefits you have acquired during the course of that marriage or during the period of cohabitation in a relationship of a conjugal nature may, on application, be divided according to the terms of the Pension Benefits Division Act (PBDA). If you have had a pension benefits division under the PBDA, it is indicated on your statement and the annual pension amounts shown will have been adjusted accordingly.

Part-time service

If you have periods of part-time pensionable service, your benefits are adjusted to take into account your assigned hours of part-time work compared to the full-time hours of the position. Pensionable part-time service will be reflected in the amounts shown on your statement even if you are no longer in a part-time position.

Pension options

If you leave the public service, you may choose among a number of options, depending on your age and the years of pensionable service to your credit. These options are a return of contributions, an immediate annuity, a deferred annuity, an annual allowance, or a transfer value. You may also choose to transfer your service to a new employer's pension plan if your new employer has concluded a pension transfer agreement under the PSSA or if the new employer is interested in the possibility of entering into such an agreement.

More information on pension options is available online.

Return of contributions

If you have less than two years of pensionable service to your credit, generally you are only entitled to a return of contributions. A return of contributions is a reimbursement of all pension contributions that you have made to the public service pension plan plus quarterly interest.

Immediate annuity (annual amount)

An immediate annuity is a pension benefit that is immediately payable to contributors who retire at or after age 60 with at least two years of pensionable service or between age 55 and 60 with 30 or more years of pensionable service. Generally, the formula for calculating your pension is as follows:

Lifetime pension

Your annual lifetime pension payable from the public service pension plan is based on:

- Your average salary, that is, your salary during your five consecutive years of highest paid service. It includes any salary you earned after completing 35 years of service, if that salary is the highest. Your salary is converted to equivalent full-time salary for periods during which you worked less than full time; and

- Your years of pensionable service, that is, the complete or partial years of service credited to you at retirement–including the service buyback (whether or not it has been fully paid).

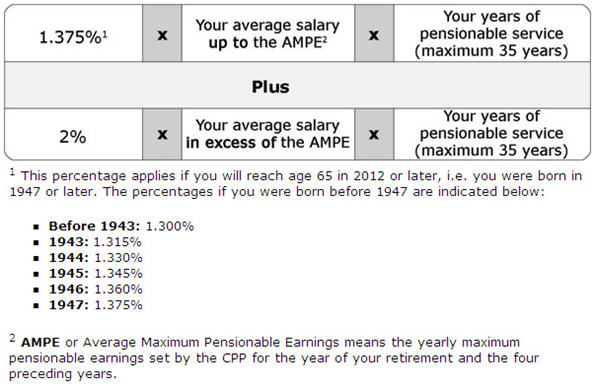

The following table illustrates how your annual lifetime pension is calculated.

Figure 1 - Text version

1.375 percentFootnote 1 multiplied by your average salary up to the Average Maximum Pensionable EarningsFootnote 2 multiplied by your years of pensionable service (maximum 35 years)

plus

2 percent multiplied by your average salary in excess of the Average Maximum Pensionable Earnings multiplied by your years of pensionable service (maximum 35 years)

Bridge benefit

If you retire before age 65, you will also receive a bridge benefit payable until age 65 or until you become entitled to CPP/QPP disability pension, whichever occurs first.

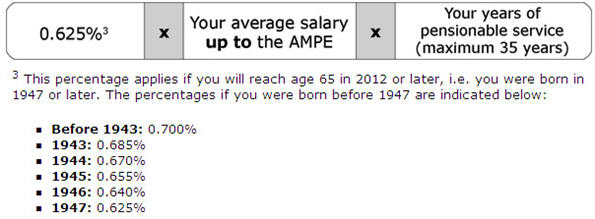

The following table illustrates how your bridge benefit is calculated.

Figure 2 - Text version

0.625 percentFootnote 3 multiplied by your average salary up to the Average Maximum Pensionable Earnings multiplied by your years of pensionable service (maximum 35 years)

Examples of how to calculate your pension are available online.

Deferred annuity (annual amount)

A deferred annuity is a pension benefit that is payable at age 60 to contributors who are not entitled to an immediate annuity at the time of their departure from the public service. A deferred annuity is calculated using the same formula as that described for an immediate annuity. If you choose this benefit, you may request an annual allowance (reduced pension) at any time after you reach age 50. If you become disabled before age 60, please see the section entitled "Retiring on grounds of disability."

Annual allowance (annual amount)

An annual allowance is a reduced pension payable as early as age 50 to contributors who are eligible for a deferred annuity. If you leave the public service and opt for an annual allowance, the deferred annuity that would be payable to you at age 60 is reduced to take into account the early payment of benefits. If you choose an annual allowance, the reduction is permanent.

The reduction applicable to your annual allowance is calculated using one of two formulas, depending on your age when you retire or when you opt for the annual allowance and on the years of service you have to your credit.

Reduction Formula 1

The amount of your deferred annuity is reduced by five per cent for every year, to the nearest one-tenth of a year, that you are under age 60 at the time the allowance is payable.

Reduction Formula 2

If you have 25 or more years of pensionable service and are at least 50 when you leave the public service, an annual allowance is calculated by determining the amount of your deferred annuity and reducing it by the greater of the following two amounts:

- five per cent for every year, to the nearest one-tenth of a year, that you are younger than 55 when you retire or when you opt for the annual allowance, whichever is later; or

- five per cent for every year, to the nearest one-tenth of a year, that your pensionable service is less than 30 years.

If Formula 1 results in a lesser reduction than Formula 2, your pension will automatically be calculated using Formula 1. In other words, your annual allowance would be determined using the more beneficial formula.

Examples of how to calculate your pension are available online.

Transfer value

If you leave the public service before you reach age 50 and have at least two years of pensionable service, you may take your earned pension benefits as a transfer value rather than as a future monthly pension. A pension transfer value is a lump sum equal to the present value of your future pension benefit (deferred pension). If you choose this option, you must do so within one year of leaving the public service.

In accordance with the limits specified in the Income Tax Act (ITA), a transfer value may have three components:

- 1. Amount within tax limits

-

This is the amount that will be transferred on a tax-sheltered basis to a retirement pension plan or vehicle that you choose. The limit is calculated as follows: multiply the annual pension payable at age 65 (plus applicable indexing) by nine. This portion of the transfer value is not paid to you directly. Instead, it must be transferred to one of the following:

- another registered pension plan; or

- a locked-in Registered Retirement Savings Plan (RRSP) that complies with the requirements of the Pension Benefits Standards Act, 1985 (PBSA) (Canada) and is administered in accordance with the requirements of those provisions; or

- a financial institution to buy an annuity.

- 2. Amount in excess of tax limits

-

Where a portion of the transfer value exceeds the tax limits, the payment will be made directly to you and that amount becomes part of your taxable income. However, if you have sufficient contribution room in your RRSP, no tax will be deducted on the amount that you transfer to your RRSP. A T4A will be issued to you and your financial institution will provide you with a receipt for tax-filing purposes.

- 3. Amount under the Retirement Compensation Arrangement ( RCA)

-

If your average salary exceeds the PSSA maximum contributory threshold, the transfer value calculation will include an additional amount to the two amounts described above–the amount that would be paid under the RCA established under the Special Retirement Arrangements Act. The RCA transfer value amount cannot be transferred to a tax-sheltered vehicle; it must be paid directly to you and taxed as required by the ITA. For a more detailed explanation of the RCA and how it may affect you, see "Average salary" in Part I of this Guide.

The amount of a transfer value can vary widely, depending on prevailing interest rates. When you know your termination date, you can obtain an estimate of the transfer value of your pension through the Pension Centre.

Transfer your service

If you leave the public service to work for another employer who has entered into a pension transfer agreement under the PSSA, it may be possible for you to transfer all or part of your public service pensionable service to your new employer's pension plan.

If your new employer does not have such an agreement but would be interested in discussing the possibility of entering into one, you should ask your new employer to contact the Pension Centre at the address below:

Government of Canada Pension Centre – Mail Facility

PTA and Insurance Team, Policy and Advisory Services Division

PO Box 8000

Matane QC G4W 4T6

Coordination of benefits with the Canada Pension Plan and the Quebec Pension Plan

When the Canada Pension Plan (CPP) and the Quebec Pension Plan (QPP) came into effect on , the federal government, like most Canadian employers offering a pension plan for their employees, decided to coordinate the new CPP/QPP with the public service pension plan. The government did this so that its employees would not have to set aside a greater proportion of their salary for retirement savings. It means that while you are employed in the public service, you and the federal government, like all Canadian workers and employers, must also contribute to the CPP (if you work outside Quebec) or the QPP (if you work in Quebec).

The coordination of the public service pension plan with the CPP/QPP affects not only your contributions but also your benefits. You contribute less to the pension plan under the public service pension plan on earnings up to the maximum covered by the CPP/QPP ($53,600 for 2015) and your public service pension is reduced to partially recognize benefits payable from CPP/QPP. This means that the public service pension benefits are reduced automatically by a standard formula once you reach age 65, which is the normal age of eligibility for CPP/QPP benefits, or immediately if you are entitled to a CPP/QPP disability pension.

Like other plans, the public service pension plan has begun to use the terms lifetime pension and bridge benefit to explain this coordination. Your statement shows the amount of public service pension reduction at age 65; however, the reduction amount can also be referred to as a bridge benefit amount.

The amount of reduction (or bridge benefit amount) shown on your statement is calculated as if you started receiving the CPP/QPP pension benefit on the date of your statement.

Information on the coordination of your pension plan with the CPP/QPP is available online.

2. Retiring on grounds of disability

Disability is defined under the public service pension plan as a physical or mental impairment that prevents a plan member from engaging in any employment for which he or she is reasonably suited by virtue of his or her education, training, or experience and that can reasonably be expected to last for the rest of that person's life.

For you to qualify for retirement on grounds of disability, Health Canada must certify that your situation corresponds to this definition.

If you retire because of disability and you have two years or more of pensionable service, you will receive an immediate annuity, regardless of your age. If you were entitled to an annual allowance, your immediate annuity would be adjusted to take into account any amount you had already received as an annual allowance.

If you are receiving a public service pension and you become entitled to a disability pension under the CPP/QPP before you reach age 65, your basic public service pension will be reduced immediately.

The amount of reduction shown on your statement is calculated as if you started receiving the CPP/QPP pension benefit on the date of your statement.

You may also be eligible for benefits under the Disability Insurance (DI) Plan or the long-term disability (LTD) portion of the Public Service Management Insurance Plan (PSMIP). Part III of your statement will indicate whether you have this coverage. More information about the disability insurance plan is available online.

3. Protection for your survivors

Survivor allowance (annual amount)

Generally, once you have two or more years of pensionable service to your credit, your eligible survivors and children become entitled to an immediate allowance in the event of your death.

The term "survivor" refers to (a) a person who was married to the contributor (plan member) at the time of the contributor's death or (b) a person who, in accordance with subsection 25(4) of the PSSA, "establishes that he or she was cohabiting in a relationship of a conjugal nature with the contributor for at least one year immediately before the death of the contributor."

The following basic benefit formula is used to calculate the survivor allowance:

1 per cent multiplied by the number of years of pensionable service (maximum 35 years) multiplied by the average salary of the plan member.

A survivor allowance can be apportioned if you are survived by both a legal spouse and another eligible survivor with whom you were living in a relationship of a conjugal nature at the time of your death.

More information about survivor benefits is available online.

Allowance for each child (annual amount)

The term "child" refers to your natural child, your stepchild, or a child that you have adopted either legally or is financially dependent on you or your survivor. To be eligible for an allowance, your child must normally be under age 18. Children between 18 and 25 may receive allowances if they are enrolled in a school or other educational institution on a full-time basis and have attended continuously since their 18th birthday or the date of your death, whichever is later.

Eligible children are entitled to allowances equal to one-fifth of the survivor benefit. The combined amount of children's allowances payable can be no more than four-fifths of the survivor benefit. If there are more than four eligible children, the maximum combined amount payable may be divided among them.

If there is no eligible survivor, orphan children receive double the amount of a regular child's allowance. Each orphan will receive two-fifths of the survivor benefit, up to a maximum of eight-fifths.

Five-year minimum benefit

The public service pension plan provides for a minimum benefit equal to the payment of your pension for a period of five years (five-year minimum benefit). If you and your eligible survivors have not received, in total, pension payments equal to five times the amount of your annual pension entitlement, the balance in the form of a lump sum becomes payable to your designated beneficiary or, if none, to your estate.

The minimum benefit is therefore payable only when there are no longer any eligible survivors or children to whom pension payments can be made.

Your designated beneficiary is the beneficiary you have named under the Supplementary Death Benefit Plan.

Supplementary Death Benefit Plan

The Supplementary Death Benefit Plan is a decreasing term life insurance designed to protect your family during the years you are building up your pension. It is provided pursuant to Part II of the PSSA.

Upon your death, the plan provides a benefit equal to twice your annual salary. If that amount is not a multiple of $1,000, the benefit amount is adjusted to the next highest multiple of $1,000. The amount of the benefit automatically goes up as your salary increases.

Beginning at age 66, your basic supplementary death benefit coverage will decline by 10 per cent of the initial amount each year until your coverage reaches the greater of 1/3 of your annual salary or $10,000 if still employed, or $10,000 if retired.

Note: Some employers who participate in the public service pension plan do not participate in the Supplementary Death Benefit Plan. Refer to Part II of your statement, under "Protection for your survivors," to see if you are a plan member.

Designated beneficiary

As a participant in the Supplementary Death Benefit Plan, you may change your designated beneficiary at any time. It is important to update the designation of your beneficiary to ensure that your selection still corresponds to your wishes. To help us serve you quickly and efficiently, please advise the Pension Centre of any changes to the address of your designated beneficiary. If you have not named a beneficiary, the benefit will be paid to your estate or succession.

For information about your beneficiary, you are asked to contact the Pension Centre by phone or email. For security reasons, a pension expert will ask you to provide additional personal information prior to disclosing the name of your beneficiary. All email inquiries will be followed up with a telephone call from a pension expert. Please do not include detailed personal information, such as your Personal Record Identifier or Social Insurance Number, in your email.

If you want to change your designated beneficiary, you must fill out a form entitled "Naming or Substitution of a Beneficiary" and forward it to:

Government of Canada Pension Centre – Mail Service

50 Dion Blvd

PO Box 8000

Matane QC G4W 4T6

Part III–Group insurance benefit plans

As a public service employee, you may be eligible for coverage under the following group insurance benefit plans:

- the Public Service Health Care Plan (PSHCP)

- the Public Service Dental Care Plan (PSDCP)

- the Disability Insurance (DI) Plan – for represented employees

- the Public Service Management Insurance Plan (PSMIP) – for unrepresented and excluded employees occupying confidential positions or in designated groups or executives

Note: Some employers subject to the PSSA participate in all the group insurance benefit plans offered to public service employees, some participate in one or more of the plans and some do not participate in any of the plans. If your employer does not participate in a plan, your statement will indicate that you do not have coverage. You may, however, have coverage under a similar plan offered by your employer.

1. Public Service Health Care Plan (PSHCP)

The PSHCP is an optional health care plan for you and your eligible family members. It is designed to supplement your provincial health insurance plan.

To participate, you must apply by completing an application form obtained from Compensation or on the Compensation Web Applications (CWA) and then complete the positive enrolment process.

The PSHCP provides two types of coverage to its members:

- Supplementary Coverage is intended for members who are also covered under a provincial/territorial health insurance plan. It provides participants with health coverage to 'supplement' the coverage provided under the provincial/territorial plan in the member's province/territory of residence.

- The Plan covers expenses for a range of health care services and supplies such as, prescription drugs, vision care and the services of various medical practitioners under its extended health care coverage.

- The Plan also includes three levels of hospital benefits that provide reimbursement up to a specific dollar amount in excess of standard ward charges. Level I pays a maximum of $60 per day towards the cost of your accommodation, Level II a maximum of $140 per day and Level III a maximum of $220 per day. If you join the PSHCP, you are automatically covered for Level I hospital benefits unless you elect for Level II or III.

- Comprehensive Coverage is intended for members and their eligible dependants who are residing with the member outside of Canada and who are not covered under a provincial/territorial health or hospital insurance plan. For more information on Comprehensive coverage, refer to the PSHCP.

Value to plan members

Your employer assumes the entire cost of the benefits provided under the Extended Health Provision as well as the cost of Level I hospital benefits. Employee contributions are not required unless you choose Level II or Level III hospital benefits coverage.

Under the Plan, you are reimbursed 80 per cent of your eligible expenses or of the stated maximums, if applicable. The exception being for emergency benefits while travelling and emergency travel assistance services, which are reimbursed at 100 per cent.

Hospital benefits are reimbursed at 100 per cent up to the specified limit.

If you and your spouse or common law partner are both members in your own right of the PSHCP and both elect family coverage, you may coordinate your benefits.

Further information is available at:

2. Public Service Dental Care Plan (PSDCP)

The PSDCP is a mandatory dental care plan for you and your eligible family members. It covers specific dental services and supplies not covered under your provincial or territorial health or dental care plan. The PSDCP covers only reasonable and customary dental treatment necessary to prevent or correct a dental disease or defect if the treatment is consistent with generally accepted dental practices.

Value to plan members

Your employer assumes the entire cost of the benefits provided under the PSDCP. Employee contributions are not required.

You are responsible for an annual deductible amount of $25 per person or $50 per family. After the deductible is satisfied, you are reimbursed for a percentage of the cost of the eligible expenses up to the amounts specified in the previous year dental association fee guides to a maximum of $1,700 per calendar year. Preventive (cleanings, examinations) and basic dental services (fillings, oral surgeries and scaling) are reimbursed at 90%. Major dental services such as crowns, dentures and bridges are reimbursed at 50%.

The PSDCP also reimburses eligible orthodontic services at 50% to a lifetime maximum of $2,500.

If you and your spouse or common law partner are both members in your own right of the PSDCP and both elect family coverage, you may coordinate benefits.

Further information is available at:

3. Disability Insurance (DI) Plan–for represented employees

The DI is a mandatory plan that protects against loss of income due to disability. It provides a monthly benefit if you are unable to work for long periods because of a totally disabling illness or injury.

Value to plan members

Your employer pays 85 per cent of your disability insurance premiums and you pay 15 per cent.

If you become disabled and the insurer approves your claim, your monthly benefit will equal 70 per cent of your insured annual salary. Benefits continue for as long as you meet the definition of total disability under the plan or until you reach age 65. Benefits are increased annually to reflect increases in the cost of living to an annual maximum of three per cent.

Your DI benefits will be reduced if you are eligible for certain other income. For example, your benefits will be reduced if you are entitled to a public service pension, a disability pension under the CPP/QPP, benefits paid for injuries incurred at the workplace, or disability benefits under another group insurance plan.

Disability benefits are taxable.

Further information is available at:

4. Public Service Management Insurance Plan (PSMIP)–for unrepresented and excluded employees occupying confidential positions or in designated groups or executives

The PSMIP provides employees in managerial or confidential positions and others who are members of certain designated groups with long-term disability insurance, which is compulsory. Certain other optional coverage is available, namely group life insurance, accidental death and dismemberment insurance, and dependants' insurance, as follows:

- Long-Term Disability ( LTD) Insurance

-

A program designed to protect against loss of income if you are unable to work for long periods because of a totally disabling illness or injury;

- Basic Life Insurance

-

A lump sum benefit roughly equal to your annual salary, payable to your named beneficiary in the event of your death;

- Supplementary Life Insurance

-

An optional additional layer of insurance equal to the amount of your basic life insurance;

- Accidental Death and Dismemberment Insurance

-

A lump sum benefit payable to your beneficiary if you are killed in an accident (on or off the job) or to you directly if you are maimed in an accident; and

- Dependants' Insurance

-

A lump sum benefit payable to you in the event of the death or accidental dismemberment of your spouse, common law partner, or child.

Coverage under the PSMIP is optional, except for the Long-Term Disability component.

Value to plan members

Long-Term Disability Insurance (LTD)

Your employer pays 85 per cent of your disability insurance premiums and you pay 15 per cent.

If you become disabled and the insurer approves your claim, your monthly benefits will equal 70 per cent of your insured annual salary. Benefits continue for as long as you meet the definition of total disability under the plan or until you reach age 65. Benefits are increased annually to reflect increases in the cost of living to an annual maximum of three per cent.

Your LTD benefits will be reduced if you are eligible for certain other income. For example, your benefits will be reduced if you are entitled to a public service pension benefit, a disability pension under CPP/QPP, benefits paid for injuries incurred at the workplace, or disability benefits under another group insurance plan.

Disability benefits are taxable.

Life Insurance

All other components of PSMIP are optional and entirely paid for by you. Premiums are based on your salary, age, sex, and the number of units of Accidental Death and Dismemberment Insurance selected. Compensation will advise you of the premiums for this insurance.

Under the PSMIP, you can designate a beneficiary by completing the forms designed for this purpose. You may at any time change your designated beneficiary, unless you have made an irrevocable designation. If you are a resident of the province of Quebec, the designation of a legal spouse is irrevocable unless you made it revocable. It is important to update the designation of your beneficiary(ies) to ensure that your selection still corresponds with your wishes. Under the PSMIP, more than one beneficiary can be designated. To help serve you better, please notify Compensation (if prior to retirement) or the Pension Centre (after retirement) of any changes to your designated beneficiary. If you have not named a beneficiary, the benefit will be paid to your estate or succession.

If you want to know the name of your beneficiary, please contact the Pension Centre.

If you want to change your designated beneficiary(ies), you must complete a "Change of Beneficiary" form and forward it either to Compensation or:

Government of Canada Pension Centre – Mail Facility

PO Box 5244

Shediac NB E4P 8T8

Further information is available at:

Part IV–Post-retirement benefits

1. Indexed public service pensions

Upon your retirement, your pension is indexed to take into account increases in the cost of living. Your pension will be adjusted each year, based on increases in the Consumer Price Index (CPI). The first increase, payable the year after you retire or leave the public service, will be pro-rated to reflect the number of full months since your retirement or departure date. If there is no change in the CPI or if it goes down, your pension will not be adjusted that year.

The indexing applies not only to your retirement benefits but also to your disability pension, survivor benefit, and child's allowance. If you retire with an entitlement to a deferred annuity, when it becomes payable at age 60, your basic pension will be increased by a percentage equal to the increases in the cost of living since you left the public service.

If you become re-employed in the public service and begin to make contributions under the public service pension plan, payment of your benefit, including indexing, will cease. When you again cease to be employed in the public service, indexing will be based on the amount of your basic pension at that time. Your retirement date for determining the annual percentage increase will be the most recent termination date.

More information about pension indexing is available online in the protection from inflation section.

2. Supplementary Death Benefit Plan (under the public service pension plan)

If you leave the public service with an entitlement to an immediate annuity or an annual allowance payable within 30 days of ceasing to be employed, you are deemed to have elected to continue your participation in the Supplementary Death Benefit Plan. In other words, you do not have to take any action. The required contributions will be deducted automatically from your monthly pension.

If you decide to retain this benefit, you will be covered for the exact amount for which you are covered at the time you leave the public service. Beginning at age 65, whether you are retired or employed, you will no longer be required to pay contributions for $10,000 of your coverage. This portion of your coverage is known as the paid-up benefit and will be provided to you for life at no cost.

Beginning at age 66, your basic supplementary death benefit coverage will decline by 10 per cent of the initial amount each year until your coverage reaches the greater of 1/3 your annual salary or $10,000 if still employed, or $10,000 if retired.

More information about the Supplementary Death Benefit Plan is available online.

3. Group insurance benefit plans

As a retired member under the public service pension plan, you or your survivors may be eligible to opt for coverage under the PSHCP and the Pensioners' Dental Services Plan (PDSP).

Public Service Health Care Plan

As a retired member, you and your eligible dependants may be eligible for coverage under the PSHCP for extended health care benefits and three levels of hospital benefits. To be eligible for coverage as a retired member under the PSHCP, you must be in receipt of an ongoing pension benefit under one of the Acts listed in Schedule IV of the PSHCP Directive and, effective , you must also have at least six years of pensionable service with the federal government. Some exceptions apply.

For coverage, you will pay contribution rates established for pensioners. Your rates will vary depending upon the level of coverage you choose (single or family). The government will continue to share in the costs of your benefits.

Once you indicate in writing to the Pension Centre that you wish to continue your coverage after retirement, contributions for PSHCP will be deducted from your pension.

Further information is available at:

Pensioners' Dental Services Plan

The PDSP is a voluntary and contributory plan that is separate from the Public Service Dental Care Plan (PSDCP) for employees. As an eligible retired member, you and your eligible family members can be covered for similar benefits to those provided under the PSDCP. However, you will contribute for your coverage at established rates. Your rates will vary depending upon the level of coverage you choose (Category I – Pensioner Only; Category II – Pensioner and One Eligible Dependant; Category III – Pensioner and More Than One Eligible Dependant). The government shares in the costs of the PDSP.

Retired members who meet specific criteria can apply for the PDSP. Your appropriate Pension Office will assist you with enrolment. Contributions for the PDSP are deducted from your pension.

An individual cannot be covered under the PDSP as both a member and a covered family member. Therefore, if you and your spouse or common law partner are both members in your own right of the PDSP there is no coordination of benefits between the two.

Further information is available at:

Appendix–Useful Web Links

This section provides access to all of your pension and benefits information and tools.

Acts and Regulations

The Department of Justice Canada provides up-to-date legislative material. The Public Service Superannuation Act governs your pension plan.

Compensation Sector Website—Pension Benefits Calculator and Service Buyback Estimator

This website provides tools for public service pension plan members to estimate the value of their future pension benefits (Pension Benefits Calculator) and the cost of buying back prior pensionable service (Service Buyback Estimator).

Old Age Security and Canada Pension Plan

Links to Old Age Security and the Canada Pension Plan can be found on the home page of Service Canada.

Public Sector Pension Investment Board

This site provides information on the Investment Board that is responsible for investing the employer and employee contributions in the financial markets.

Quebec Pension Plan

This site provides information on the Quebec Pension Plan and the benefits available to plan contributors.