Employers: How to complete the record of employment (ROE) form

This guide contains general information for employers about how to complete the ROE.

If you’re an employee, you can access your ROE in My Service Canada Account (MSCA).

Alternate formats

Large print, braille, MP3 (audio), e-text and DAISY formats are available on demand by ordering online or calling 1 800 O-Canada (1-800-622-6232). If you use a teletypewriter (TTY), call 1-800-926-9105.

On this page

- Chapter 1: Understanding the ROE form

- Chapter 2: Block-by-block instructions for completing the ROE

- Chapter 3: Instructions for special groups of workers

- Chapter 4: Insurability, useful websites, order of paper ROEs and the Employer contact centre

- Annex 1: Summary chart – Type of earnings, insurable/non-insurable earnings and hours, and pay-period allocation

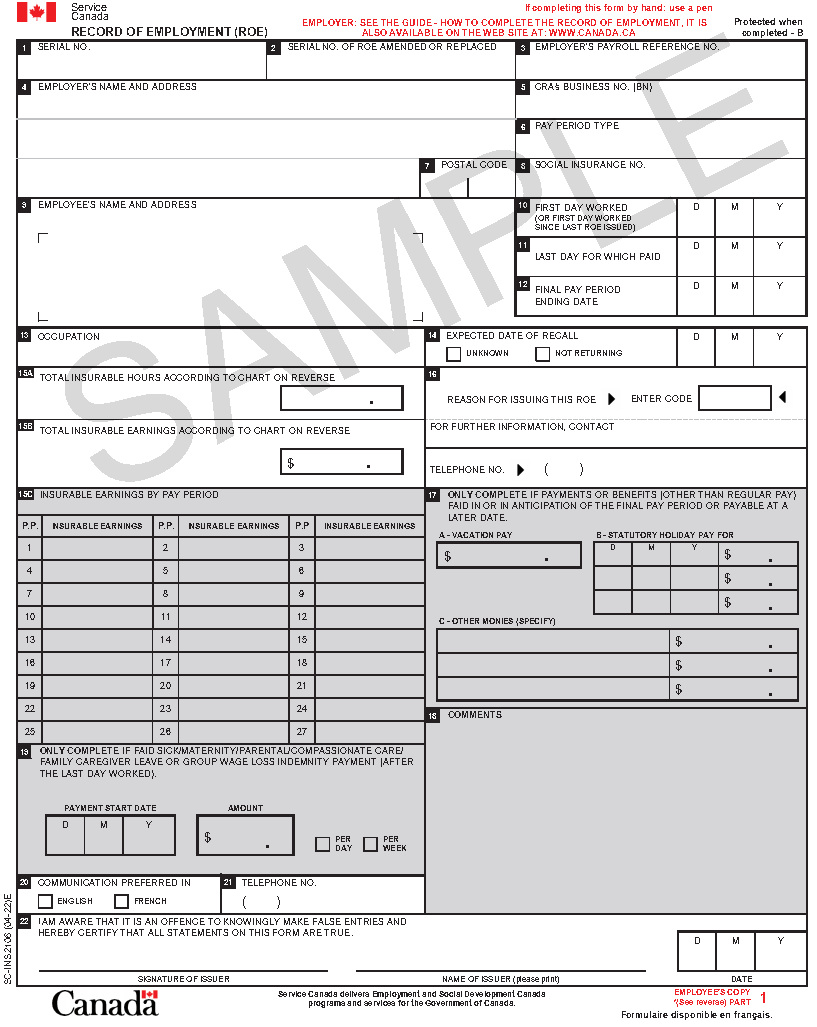

- Annex 2: Example of a blank paper ROE

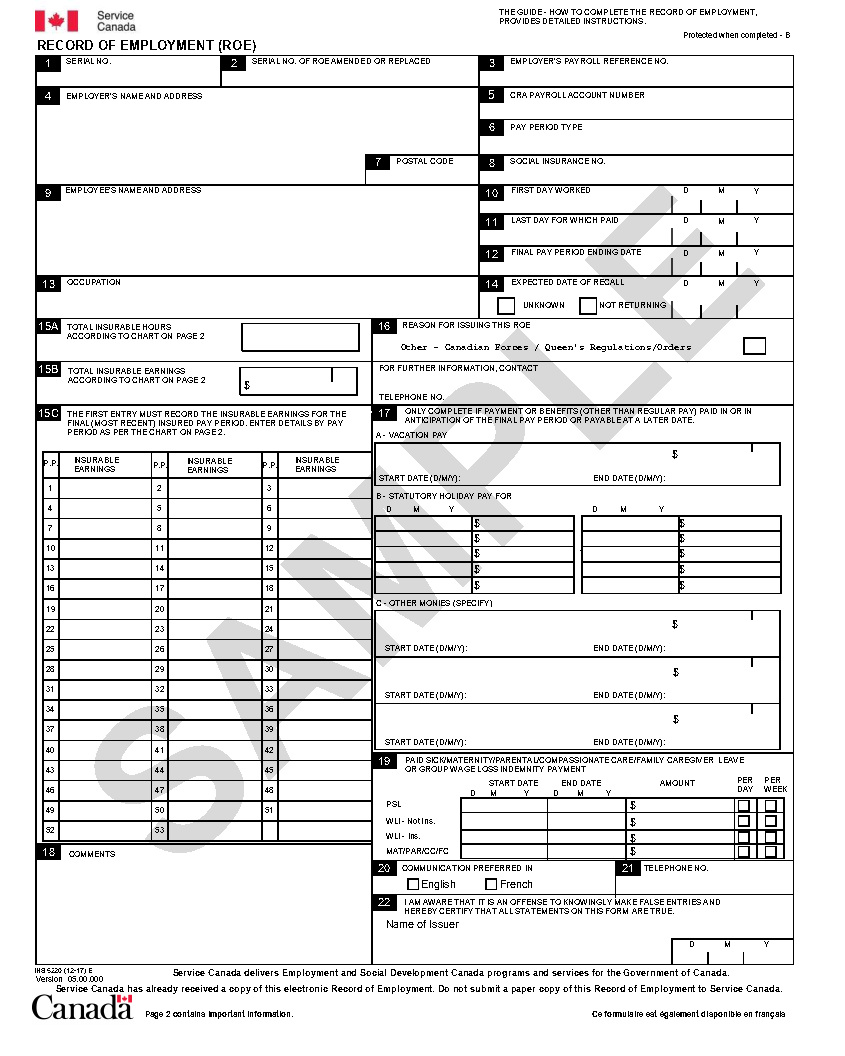

- Annex 3: Example of a blank electronic ROE

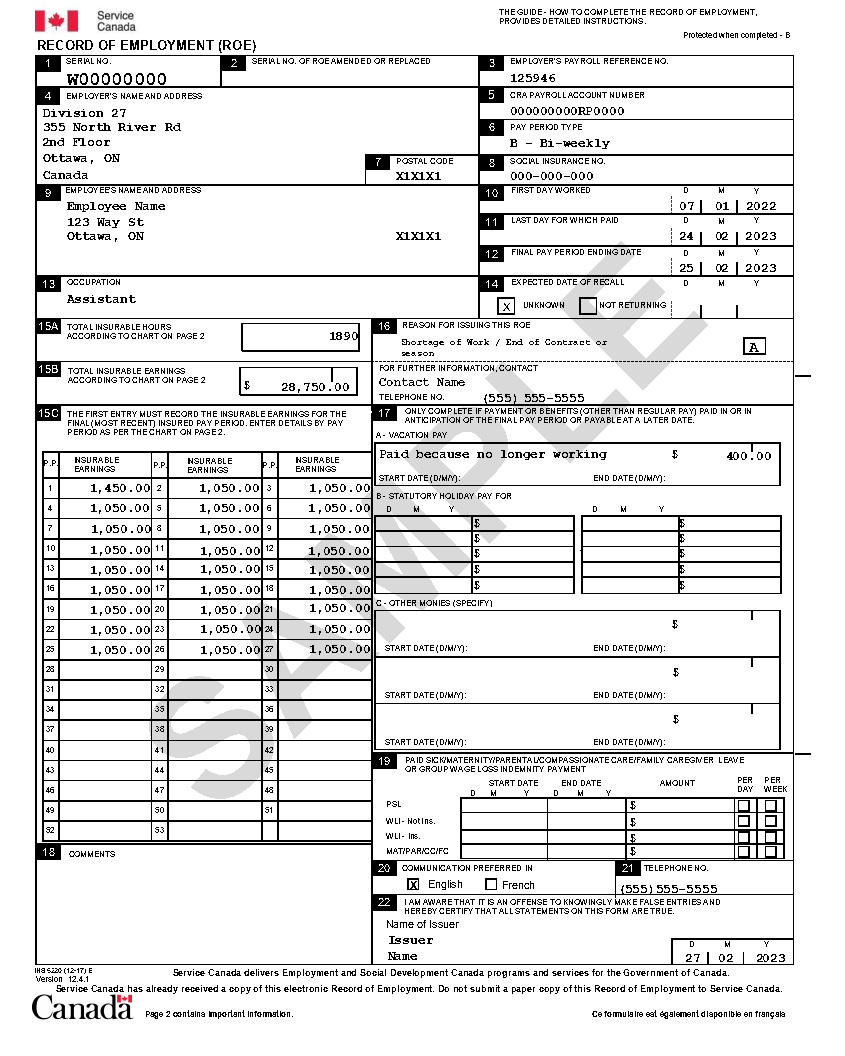

- Annex 4: Example of a completed electronic ROE

- Annex 5: Example of a blank paper ROE for self-employed fishers

- Annex 6: Example of a blank electronic ROE for self-employed fishers

Chapter 1: Understanding the ROE form

In this section

- Who should use this guide

- Definition of an ROE

- Information on the ROE used by Service Canada

- Information about the insurable earnings and insurable hours

- Cases when earnings and hours are not insurable

- Cases of an interruption of earnings

- When to issue an ROE

- Deadline for issuing an ROE

- Paper copy of electronic ROEs to employees is not required

- Keep payroll records related to ROEs

- Store paper copies of the ROE

- Location to send Part 2 of the paper ROE

- Location to send other ROE-related documents or correspondence

- Make changes to a paper ROE after you have completed it

- Cancel an ROE

- When to issue an amended ROE

- What to do with void or surplus paper ROEs

- Order paper ROE forms

Who should use this guide

Use this guide if you:

- are an employer who completes ROE forms for your employees

- work for a small, medium, or large business or organization and you complete ROEs on behalf of that business or organization, or

- are a professional, such as an accountant, bookkeeper, or payroll processor, who completes ROEs on behalf of your clients

If you need ROE Web technical information, consult the ROE Web user guide or contact the Employer Contact Centre.

Definition of an ROE

The ROE is the form—whether electronic or paper—that employers complete for employees receiving insurable earnings who stop working and experience an interruption of earnings. The ROE is the single most important document in the Employment Insurance (EI) program. Each year, more than 1 million Canadian employers fill out more than 9 million ROE forms for their employees.

You must complete the ROE even if the employee does not intend to apply for EI benefits. On the ROE, you enter details about the employee's work history with your organization, including insurable earnings and insurable hours.

There are 2 ROE formats available:

- you can transmit an ROE to us electronically, or

- you can complete a paper ROE form

Electronic ROE

An electronic ROE is submitted to Service Canada electronically.

There are 3 ways to submit ROEs electronically:

- you can submit ROEs through ROE Web by using compatible payroll software to upload ROEs from your payroll system

- you can submit ROEs through ROE Web by manually entering data online through Service Canada's website, and

- you can submit ROEs through Secure Automated Transfer (SAT), which is performed on your behalf by a payroll service provider using bulk transfer technology

There are different types of electronic ROEs, which are identified with serial numbers that start with the following letters:

- W or M – ROE Web

- S – ROE SAT

- Y – ROE Web for self-employed fishers

ROE Web is an efficient, reliable, secure, simple, and easy to use way of issuing an ROE electronically. Using ROE Web, you can create, submit, print, and amend ROEs using the Internet. ROE Web gives you the flexibility to issue ROEs according to your pay cycle.

For more information on ROE Web, visit the Service Canada website or call the Employer Contact Centre.

Paper ROE

The paper ROE is a one-page form in triplicate. Triplicate means there are 3 copies of the ROE—the first one is the original, and the second and third are carbon copies.

Once you complete it, you must distribute the 3 copies of the paper ROE as follows:

- give Part 1 to the employee (the employee will use this copy to apply for EI benefits)

- send Part 2 to Service Canada (see Location to send Part 2 of the paper ROE)

- keep Part 3 for your records

There are different types of paper ROEs, and each one is identified with serial numbers that start with the following letters:

- A – English or French ROE (all ROEs in this series have been distributed; although they can no longer be ordered, they are still valid)

- E – English ROE

- K – French ROE

- L – Laser ROE (this format is no longer used, it has been replaced by ROE Web)

- Z – ROE for fishers (the instructions on how to complete this version of the ROE are different from other ROEs. For details, see How to Complete the Record of Employment Form for Self-Employed Fishers)

Information on the ROE used by Service Canada

At Service Canada, we use the information on the ROE to determine whether a person who has experienced an interruption of earnings is eligible to receive EI benefits, what the benefit amount will be, and how long the person is eligible to receive those benefits. We also use the ROE to ensure that no one misuses EI funds or receives them in error.

In addition, for people living in Quebec, we share ROE information with the Government of Quebec, which administers maternity, paternity, parental, and adoption benefits to residents of that province through a program called the Quebec Parental Insurance Plan (QPIP).

For these reasons, it is very important that you make sure the information you provide on the ROE is accurate.

Information about the insurable earnings and insurable hours

Insurable earnings include most of the different types of compensation you provide to your employees on which EI premiums are paid. While Service Canada determines where insurable earnings are allocated on the ROE, the Canada Revenue Agency determines what types of earnings and hours are insurable. For details, see Annex 1 on types of earnings and insurable hours, or visit the Canada Revenue Agency.

Cases when earnings and hours are not insurable

In some cases, earnings and hours are not insurable. For example, when an employee does not deal at arm's length with the employer, or when an employee of a corporation controls more than 40% of the corporation's voting shares, the employment is not insurable.

You only need to issue ROEs for employees who receive insurable earnings and who work insurable hours. If you are not sure if an employee's earnings and hours are insurable, contact the Canada Revenue Agency for an insurability ruling. See the section called Enquiries about insurability for information on how to contact the Canada Revenue Agency.

Cases of an interruption of earnings

An interruption of earnings occurs in the following situations.

When an employee has had or is anticipated to have 7 consecutive calendar days with no work and no insurable earnings from the employer, an interruption of earnings occurs. This situation is called the 7-day rule. For example, the 7-day rule applies when employees quit their jobs or are laid off, or when their employment is terminated (see exceptions in the table below). When the 7-day rule applies, the first day of the interruption of earnings is considered the last day for which paid (see Block 11, Last day for which paid for details).

When an employee’s salary falls below 60% of regular weekly earnings and the separation of their employment is due to either: illness, injury or quarantine (sick leave), pregnancy/maternity leave, to care for 1 or more new-born children of the claimant or 1 or more children placed with the claimant for the purpose of adoption (parental leave), to provide care or support to a critically ill or injured family member (compassionate care or family caregiver leaves). In this case, the first day of the interruption of earnings is the Sunday of the week in which the salary falls below 60% of the regular weekly earnings.

Example

Julio usually works 40 hours per week in insurable employment, with gross earnings of $1,000. Because he is ill, Julio is only able to work 16 hours per week, and is now making $400 per week (40% of his regular weekly earnings). In this instance, the first week he earns $400 is the week Julio experiences an interruption of earnings. The Sunday of that week is the first day of Julio's interruption of earnings.

Whenever an employee starts receiving wage loss insurance (WLI) payments, an interruption of earnings occurs. For more information, see the What to report on Block 19 chart.

Exceptions to the 7-day rule – Interruption of earnings

The 7-day rule for an interruption of earnings does not apply in the following cases.

Real estate agents: An interruption of earnings occurs only when a real estate agent's licence is surrendered, suspended, or revoked, unless the agent ceases to work in that employment due to either: illness, injury or quarantine (sick leave), pregnancy/maternity leave, to care for 1 or more new-born children of the claimant or 1 or more children placed with the claimant for the purpose of adoption (parental leave), to provide care or support to a critically ill or injured family member (compassionate care or family caregiver leaves). In other words, if employees stop working for any other reason, such as a leave of absence or a vacation, they do not experience an interruption of earnings as long as the contract continues. For more information on how to complete ROEs for real estate agents, see Real estate agents in Chapter 3.

Employees who have non-standard work schedules (also referred to as lay days): Some employers have agreements with their employees for schedules that allow for alternating periods of work and leave. Some employees, like firefighters, health-care workers, and factory workers, have non-standard work schedules. Even though these types of employees do not have scheduled work for 7 consecutive days or more, they do not experience an interruption of earnings.

If the employee has been terminated and is entitled to a period of leave under an employment agreement to compensate for extra hours (time) worked within an established work pattern, explain in Block 18 of the ROE the period of leave they are entitled to and their work pattern.

Examples

A firefighter works for 4 consecutive 24-hour days (96 hours of insurable work) and then has 10 consecutive days off. In this situation, even though the firefighter has no work for more than 7 consecutive days, it is considered that he continues to be employed during the 10-day leave period. Therefore, there is no interruption of earnings.

A miner works for 14 consecutive 12-hour days (168 hours of insurable work) and then has 7 consecutive days off. In this situation, even though the miner has no work for 7 consecutive days, it is considered that he continues to be employed during the 7 day period. Therefore, there is no interruption of earnings.

Commission sales people: For employees whose earnings consist mainly of commissions, an interruption of earnings occurs only when the employment contract is terminated, unless the employee ceases to work due to either: illness, injury or quarantine (sick leave), pregnancy/maternity leave, to care for 1 or more new-born children of the claimant or 1 or more children placed with the claimant for the purpose of adoption (parental leave), to provide care or support to a critically ill or injured family member (compassionate care or family caregiver leaves). In other words, if the employee stops working for any other reason, such as a leave of absence or a vacation, they do not experience an interruption of earnings as long as the contract continues. For more information on how to complete ROEs for commission salespeople, see Commission salespeople in Chapter 3.

When to issue an ROE

Regardless of whether the employee intends to file a claim for EI benefits, you have to issue an ROE:

- each time an employee experiences an interruption of earnings, or

- when Service Canada requests one

Notes

- You should only issue ROEs according to the instructions provided by Service Canada

- In a situation where an employer has to lay off a large number of employees, such as when a plant is closing, Service Canada is available to provide you with advice on issuing ROEs. For more information, call the Employer Contact Centre

Special situations involving when to issue ROEs

When Service Canada requests an ROE: The most common situation in which we would ask you to issue an ROE occurs when an employee is working 2 jobs and experiences an interruption of earnings in one of them. If this happens and the employee submits an application for EI benefits, we need an ROE from the current employer, even though the employee is still working there. We use the information on both ROEs to calculate the benefit amount and the number of weeks of EI benefits the claimant should receive.

When the pay period type changes: When your business or organization changes its pay period type, you must issue ROEs for all employees, even though the employees are not experiencing an interruption of earnings. For details, see the note under Block 6, Pay period type.

When an employee stays with the employer but is transferred to another Canada Revenue Agency Payroll Account Number: If you have more than one Payroll Account Number (see Block 5, CRA business Number for details) and an employee's payroll file is transferred to a different Payroll Account Number within the organization, an ROE is not required if:

- there has been no actual break in the employee receiving earnings during the transfer, and

- you agree to issue a single ROE that covers both periods of employment if the need arises

Note: If the change in CRA Payroll Account Number involves a change in pay period type, you must issue an ROE for the employee.

When there is a change in ownership: When a business changes ownership, the former employer usually has to issue ROEs to all employees. However, if the following 2 conditions apply, you do not have to issue ROEs:

- there has been no actual break in the employee receiving earnings during the change-over, and

- the former employer's payroll records are available to the new employer, and the new employer agrees to issue a single ROE that covers both periods of employment, if the need arises

Note: If the change in ownership involves a change in pay period type, you must issue ROEs for all employees.

When an employer declares bankruptcy: When an employer declares bankruptcy and a receiver takes over the operation of the business, the employer usually has to issue ROEs to all employees. However, if the following 2 conditions apply, you do not have to issue ROEs:

- there has been no actual break in the employee receiving earnings during the change-over, and

- the employer's payroll records are available to the receiver, and the receiver agrees to issue a single ROE that covers both periods of employment, if the need arises

Note: If employees continue to work for an employer after the bankruptcy, the interruption of earnings does not occur until the employees actually stop working, even if they do not receive any earnings.

For part-time, on-call, or casual workers: You do not have to issue an ROE every time a part-time, on-call, or casual worker experiences an interruption of earnings of 7 days or more. However, you must issue one when:

- an employee requests an ROE and an interruption of earnings has occurred

- an employee is no longer on the employer's active employment list

- Service Canada requests an ROE, or

- an employee has not done any work or earned any insurable earnings for 30 days

For wage-loss insurance (WLI) plan payments: When you offer your employees a wage-loss insurance (WLI) plan:

- if the plan payments are not insurable, issue an ROE when the interruption of earnings occurs, or

- if the plan payments are insurable, issue an ROE when the interruption of earnings occurs, and issue a second ROE for the period of the insurable WLI payments, after they stop

During self-funded leave: In some workplaces, employees can make agreements with their employer to take self-funded leave. Under these agreements, employees work and defer a portion of their salary for a certain period of time to finance a later period of leave. For example, an employee may work for 4 years, deferring 20% of his or her salary during those 4 years to finance leave during the fifth year. During self-funded leave, an interruption of earnings does not occur, so you do not have to complete an ROE unless either party breaks the agreement. If the agreement is broken by either party during the self-funded leave and the employee will not be returning to work, you must then issue an ROE. In Block 11, Last day for which paid, enter the date of the last day the employee worked before leaving on self-funded leave.

Notes

- Contact the Canada Revenue Agency for instructions on how to deduct EI premiums on earnings during both the deferral and self-funded leave periods

- If you use a Payroll Service Providers (PSP): While it is not a requirement to issue ROEs if you change PSPs, if the new PSP is not be able to issue ROEs for the period of employment covered by your previous PSP, the previous PSP can issue them up to the time that the new PSP takes over

Deadline for issuing an ROE

If you issue ROEs on paper

If you issue ROEs on paper, you must issue an ROE within 5 calendar days of:

- the first day of an interruption of earnings, or

- the day the employer becomes aware of an interruption of earnings

Note: If you issue paper ROEs, you must give Part 1 (the original) to your employees. Please let your employees know that they must submit the paper ROE to Service Canada if they are applying for EI benefits. They must either upload their original copy when they submit their online application for EI benefits, mail it to us or drop it off in person at a Service Canada Centre. The mailing address will be provided to them on the Information and Confirmation page once they submit their online application for EI benefits.

If you issue ROEs electronically

If you issue ROEs electronically and your pay period is weekly, biweekly (every 2 weeks), or semi-monthly (twice a month, usually the 15th and last day of the month), you have up to 5 calendar days after the end of the pay period in which an employee's interruption of earnings occurs to issue an electronic ROE.

If you have a monthly pay period or 13 pay periods per year (every 4 weeks), you must issue electronic ROEs by whichever date is earlier:

- 5 calendar days after the end of the pay period in which an employee experiences an interruption of earnings, or

- 15 calendar days after the first day of an interruption of earnings

Note: If you issue electronic ROEs, you no longer need to provide a paper copy to your employees (see the section, Paper copy of electronic ROEs to employees is not required, for details).

The deadline for submitting an electronic ROE is based on the pay period type and the day on which the interruption of earnings occurred.

| Pay period type | Deadline | Example |

|---|---|---|

| Weekly | If you have a weekly pay period cycle, you must submit the electronic ROE to Service Canada no later than 5 calendar days after the end of the pay period in which the interruption of earnings occurs. | Martin stops working on March 1, 2022, which is the first day of the interruption of earnings. You have a weekly pay period that runs from February 26, 2022, to March 4, 2022. Since the pay period that contains the interruption of earnings will end on March 4, 2022, you must issue Martin's ROE no later than March 9, 2022. |

| Biweekly | If you have a biweekly pay period cycle, you must submit the electronic ROE to Service Canada no later than 5 calendar days after the end of the pay period in which the interruption of earnings occurs. | Ginette stops working on March 1, 2022, which is the first day of the interruption of earnings. You have a biweekly pay period that runs from February 26, 2022, to March 11, 2022. Since the pay period that contains the interruption of earnings will end on March 11, 2022, you must issue Ginette's ROE no later than March 16, 2022. |

| Semi-monthly | If you have a semi-monthly pay period cycle, you must submit the electronic ROE to Service Canada no later than 5 calendar days after the end of the pay period in which the interruption of earnings occurs. | Safina stops working on March 1, 2022, which is the first day of the interruption of earnings. You have a semi-monthly pay period that runs from March 1, 2022, to March 15, 2022. Since the pay period that contains the interruption of earnings will end on March 15, 2022, you must issue Safina's ROE no later than March 20, 2022. |

| Monthly | If you have a monthly pay period cycle, you must submit the electronic ROE to Service Canada by whichever date is earlier:

|

Example 1 Peter stops working on March 1, 2022, which is the first day of the interruption of earnings. You have a monthly pay period that runs from March 1, 2022, to March 31, 2022. For a monthly pay period, the ROE must be issued by whichever date is earlier:

Example 2 Martha stops working on March 30, 2022, which is the first day of the interruption of earnings. You have a monthly pay period that runs from March 1, 2022, to March 31, 2022. For a monthly pay period, the ROE must be issued by whichever date is earlier:

|

| 13 pay-periods (every 4 weeks) | If you have a 13 pay period cycle (you pay employees every 4 weeks), you must submit the electronic ROE to Service Canada by whichever date is earlier:

|

Example 1 Roberto stops working on March 1, 2022, which is the first day of the interruption of earnings. You have a 13 pay period cycle, which ends every fourth Sunday. The pay period that contains the interruption of earnings runs from February 28, 2022, to March 27, 2022. For this type of pay period cycle, you must issue the ROE by whichever date is earlier:

Example 2 Juliette stops working on March 23, 2022, which is the first day of the interruption of earnings. You have a pay period that runs from February 28, 2022, to March 27, 2022. For this type of pay period cycle, you must issue the ROE by whichever date is earlier:

|

Paper copy of electronic ROEs to employees is not required

If you submit ROEs electronically, you no longer need to print a paper copy for your employees. When you submit ROEs electronically, the data is transmitted directly to Service Canada's database, where it is used to process EI claims.

Notes

- Make sure your employees are aware that you will be submitting their ROEs to Service Canada electronically, so therefore they should not submit copies to Service Canada

- Employees who have registered with the My Service Canada Account online service can view and print copies of their electronic ROEs. Learn more about My Service Canada Account

- Although you are no longer required to print paper copies of ROEs if you submit them electronically, we recommend that, if they request them, you provide your employees with copies as a courtesy. However, be sure to remind employees that they should not deliver these paper copies to a Service Canada office

- Inform your employees that, if they plan to apply for EI benefits, they should submit their EI applications as soon as they experience an interruption of earnings even if they have not received all their ROEs (specifically those ROEs issued on paper)

If you need more information about submitting ROEs electronically, visit Record of Employment on the Web or call the Employer Contact Centre.

Keep payroll records related to ROEs

Regardless of whether you issue ROEs electronically or on paper, you have to store all related payroll records in electronic or paper format for 6 years after the year to which the information relates.

Store paper copies of the ROE

If you issue paper ROEs, you must store Part 3 of all completed paper ROEs for 6 years after the year to which the information relates. Be sure to store them in a secure place. Once you complete the ROE, the information it contains is considered confidential.

If you issue ROEs electronically, you do not have to store paper copies of them, but you must ensure you save the data for 6 years after the year to which the information relates.

Location to send Part 2 of the paper ROE

Send Part 2 of all completed paper ROEs to Service Canada's ROE centre in Bathurst, New Brunswick. The address of the centre is:

Service Canada

P.O. Box 9000

Bathurst NB E2A 4T3

The Bathurst ROE centre does not handle any other ROE or EI-related business. For this reason, you should only use the above address to send Part 2 of the ROE. You must send all other ROE-related documents and all ROE-related correspondence to your local Service Canada Centre.

Note: If you issue ROEs electronically, you do not have to send paper copies to Service Canada.

Location to send other ROE-related documents or correspondence

If you have ROE-related documents or correspondence, send them to your local Service Canada Centre. The only document you should send to the ROE centre in Bathurst, New Brunswick, is Part 2 of the paper ROE.

Make changes to a paper ROE after you have completed it

You can make changes to a completed paper ROE, as long as you still have all 3 copies. If you still have all 3 copies of a paper ROE, make changes by:

- striking out the incorrect information by drawing a line through it

- inserting the correct information, and

- initialing the change

Note: Never use white-out.

If you have already distributed copies of the paper ROE, you cannot change it. In this case, you have to issue an amended ROE to make changes. See When to issue an amended ROE for details.

Cancel an ROE

You cannot cancel an ROE that you have already issued. If you issued an ROE in error, you have to issue an amended ROE. See the next section for details.

When to issue an amended ROE

You must issue an amended ROE in the following situations:

- issue an amended ROE when you need to change, correct, or update the information you entered on an ROE you issued previously

Example

- After you issue the original ROE, your employee's departure changes from not final to final and the employee has not worked since you issued the original ROE. Because the departure is now final, you have to pay additional money to the employee on separation because you owe the employee for vacation pay. In this case, you would issue an amended ROE of the original to include this information. If there is no new information to report, you do not need to issue an amended ROE.

- issue an amended ROE if you submitted one to Service Canada in error. When you complete the amended ROE, enter "Previous ROE issued in error" in Block 18 – Comments

- issue an amended ROE when Service Canada asks you to do so

Notes

- When amending an ROE, complete all of the blocks on the amended ROE, not just the blocks where information has changed from the original ROE

- If you have an employee on leave that has been issued an ROE, and prior to coming back to work they inform you that they are not returning, you are not required to amend the original ROE provided you are not making any additional payments to the employee because of the permanent separation. That said, if you are paying additional money to the employee, then you must file an amended ROE

Issue an amended ROE electronically

For information on how to issue an amended ROE electronically:

- if you are using ROE Web, consult the online help instructions within the ROE Web application or call the Employer Contact Centre, or

- if you are using ROE SAT, contact your payroll service provider

Note: If you are amending a paper ROE electronically, enter "Amending a paper ROE" in Block 18 Comments, and include the serial number of the original paper ROE.

Issue an amended ROE using a paper form

Follow these instructions to issue an amended ROE using a paper form:

- use a blank paper ROE form

- in Block 2, enter the serial number of the original ROE you are correcting

- be sure to complete all the blocks, even if the information is the same as what you entered on the original ROE

- correct any information that was wrong on the original ROE

Note: When amending an ROE using a paper form, it is not necessary to enter a comment in Block 18 indicating that it is an amended ROE.

What to do with void or surplus paper ROEs

If you have void paper ROEs (for example, you may void a form if you have made errors on it), you can destroy the forms. If you do so, before you destroy them, be sure to write down the serial numbers and keep them with your payroll records.

If you have surplus paper ROEs, please call the Employer Contact Centre for instructions on how to return them.

Order paper ROE forms

To order paper ROE forms, call the Employer Contact Centre. When placing your order, please have your Canada Revenue Agency Payroll Account Number ready for identification purposes.

Chapter 2: Block-by-block instructions for completing the ROE

In this section

- Order to complete the blocks of the ROE

- Block 1 – Serial number

- Block 2 – Serial number of ROE amended or replaced

- Block 3 – Employer's payroll reference number (optional)

- Block 4 – Employer's name and address

- Block 5 – CRA Business Number (Payroll Account Number)

- Block 6 – Pay period type

- Block 7 – Employer's postal code

- Block 8 – Employee's Social Insurance Number

- Block 9 – Employee's name and address

- Block 10 – First day worked

- Block 11 – Last day for which paid

- Block 12 – Final pay period ending date

- Block 13 – Occupation (optional)

- Block 14 – Expected date of recall (optional)

- Block 15A – Total insurable hours

- Block 15B – Total insurable earnings

- Block 15C – Insurable earnings by pay period

- Block 16 – Reason for issuing this ROE

- Block 17 – Separation payments

- Block 18 – Comments

- Block 19 – Paid sick/maternity/parental/compassionate care/family caregiver leave or group wage loss indemnity payment

- Block 20 – Language

- Block 21 – Telephone number of issuer

- Block 22 – Certification

In this chapter, we provide detailed instructions on how to complete the ROE. If you have any questions, call the Employer Contact Centre.

Order to complete the blocks of the ROE

You can complete the administrative information (Blocks 1 through 9, and Blocks 13 and 14) in any order you like. However, it is often easier to complete the rest of the form in the following order.

Step 1: Complete the period of employment information in Blocks 10, 11, and 12. This information provides you with the timeframe for which you need to report the employee's insurable hours and earnings.

Step 2: Enter any separation payments paid or payable to the employee in Blocks 17A, 17B, and 17C (see more information on Block 17 – Separation payments).

Step 3: Calculate the insurable hours to enter in Block 15A.

Step 4: If you need to complete Block 15C, do it next. Then, enter the total insurable earnings in Block 15B. Remember to include the insurable separation payments you entered in Block 17 in the total amount you enter for the final pay period (P.P. 1) in Block 15C, and in the total insurable earnings you enter in Block 15B.

Notes

- For paper ROEs, you only need to complete Block 15C if the employee received no insurable earnings in 1 or more pay periods, or if you opt to do so in order to provide us with the necessary information for the variable best weeks calculation (for more information, see Block 15C – Insurable earnings by pay period)

- For electronic ROEs, you must always complete Block 15C

Block 1 – Serial number

Each paper ROE is numbered with a pre-printed serial number. If you are using paper ROEs, the serial number already appears in this block. It is important for the employer to keep records of the serial numbers of all completed or destroyed ROEs for 6 years.

When you use an electronic ROE, the program automatically assigns a serial number to each ROE form as soon as it is successfully submitted to Service Canada. There is no need to keep a record of these serial numbers, although it might be helpful if you need to amend an electronic ROE later.

Block 2 – Serial number of ROE amended or replaced

Complete this block if you are issuing an amended ROE to change or correct information you provided on an original ROE. In this block, enter the serial number of the original ROE.

Note: When you issue an amended ROE, make sure to complete the entire form and re-enter all the correct information from the original ROE, not just the changed information.

Block 3 – Employer's payroll reference number (optional)

In this block, enter the number you are using to identify the employee in your payroll records.

Block 4 – Employer's name and address

In this block, enter the employer's name and address. Use the same name and address that appear on the Canada Revenue Agency remittance form you use to report your payroll source deductions.

Note: You have to enter the employer's postal code in Block 7.

Block 5 – CRA Business Number (Payroll Account Number)

Enter the Canada Revenue Agency Payroll Account Number (formerly called the Business Number) you use to report the employee's payroll deductions to the Canada Revenue Agency. The Payroll Account Number consists of 9 numbers, followed by 2 letters, followed by 4 numbers. You must enter all 15 characters.

Notes

- If you have several Payroll Account Numbers, enter the Payroll Account Number you used to report the payroll deductions for the employee who is receiving the ROE

- If you have an employee who is working in 2 or more positions at the same time, you may have assigned different Payroll Account Numbers to those positions. If the employee experiences an interruption of earnings in all positions, you can issue 1 ROE combining all the payroll info. If you cannot combine all the information, you can issue separate ROEs for each Payroll Account Number

Block 6 – Pay period type

In this block, enter the pay period type for the employee. There are 5 standard types of pay period:

- weekly

- biweekly

- semi-monthly

- monthly, or

- 13 pay periods a year

If your semi-monthly or monthly pay periods are non-standard (that is, they do not end on the 15th or the last day of the month), please enter "non-standard semi-monthly" or "non-standard monthly" in this block.

Special situations

For employees who are paid solely on commission or on salary plus irregularly paid commission: Use a weekly pay period and average the earnings over the period of employment covered by the ROE. For more information, see How to use the weekly averaging formula.

For contract workers who are not paid on a regular basis: Use a weekly pay period and average the earnings over the period of employment covered by the ROE. For more information, see How to use the weekly averaging formula.

For employees who work irregular pay periods: For employees who work irregular pay periods—for example, if your pay cycles vary in length, where 1 period may cover 29 days and the next may cover 32 days—use a weekly pay period type and average the earnings over the period of employment covered by the ROE. For more information, see How to use the weekly averaging formula.

Example

Lea works for an employer that has irregular pay periods: 1 pay period covers 25 days, the next covers 29 days, and another covers 35 days. In this case, enter weekly as the pay period type in Block 6 and average the earnings over the period of employment using the weekly averaging formula.

Note: An ROE should only reflect 1 pay period type. If you change your pay period type during an employee's period of employment, you should issue an ROE for the period of employment up to the change in pay period type. If there is an interruption of earnings later, you should issue a second ROE for the rest of the employee's period of employment until the interruption of earnings. On the second ROE, in Block 10, enter the date of the first day after the pay period change, and in Block 11, enter the last day for which paid.

Block 7 – Employer's postal code

In this block, enter the employer's postal code.

Block 8 – Employee's Social Insurance Number

In this block, enter the employee's 9-digit Social Insurance Number (SIN). It is very important to enter the correct SIN on an ROE, since we cannot process a claim for EI benefits without it.

Note: Social Insurance Numbers that begin with a 9 are temporary numbers. Check with your employee to see if they have since received a permanent number. If they have, enter the permanent number here.

Block 9 – Employee's name and address

In this block, enter the employee's name (first name and initials, followed by the family name) and the employee's address, including the postal code.

Block 10 – First day worked

In Block 10, you usually enter the employee's first day of work for which he or she received insurable earnings. However, if you have previously issued an ROE for that employee, the date you enter in Block 10 will be the first day the employee worked after the last interruption of earnings (that is, since the last ROE was issued).

Example

Anne started working for you in March 2021 as a landscaper. In November 2021, you completed an ROE for Anne, since your business closes each year over the winter months. On March 15, 2022, Anne returned to work for your company. Now in November 2022, you are ready to complete the latest ROE for Anne. In Block 10, you enter "15/03/2022" as Anne's first day worked.

Notes

- The date you enter in Block 10 is not necessarily the day the employee was hired, unless the employee worked on that day. The first day worked must be a day when the employee worked and received insurable earnings

- If you are planning to pay your employee for a statutory holiday that occurs before the employee's first day of work, call the Employer Contact Centre for more information on how to report it

Block 11 – Last day for which paid

In Block 11, enter the last day for which the employee received insurable earnings. This date usually coincides with the last day of work; however, in some cases, employees continue to receive insurable earnings after their last day of work. This occurs with paid leave, such as vacation or sick leave, earned days off, or salary continuance (see Salary continuance below). In these cases, enter the date of the last day of paid leave in Block 11, making sure that date is not a statutory holiday (see Block 17B, Statutory holiday pay for details on how to report statutory holidays).

Example of last day paid while on sick leave

Your employee Nader has become ill and has to stop working for a while. His last day of work was May 7, 2021, at which time he began receiving sick leave payments, which are considered insurable earnings. He received 10 paid sick days, until May 21, 2021. In Block 11 of Nader's ROE, you enter "21/05/2021."

Note: When unpaid wages (not including amounts for overtime or termination pay) are owing to an employee on separation because of the employer's bankruptcy, receivership, or impending receivership, you must enter the last day for which these wages are owed.

Example of last day paid and bankruptcy of the employer

Several employees of a construction company are told they will be laid off on November 30. Their pay period is monthly, and because of their employer's bankruptcy they do not receive their last pay cheque on November 30. Even though the employees have not been paid for their last month of work, you would enter "November 30" as the last day for which paid in Block 11.

Salary continuance

As part of a severance package, instead of receiving a lump-sum payment on separation, an employee may receive a salary continuance. Under a salary continuance, the employee continues to receive a regular pay cheque and continues to be entitled to employee benefits for a certain time period. There is no interruption of earnings between the last day worked and the beginning of the salary continuance—in fact, there is no interruption of earnings until the salary continuance stops. For this reason, do not issue an ROE until the end of the salary continuance period. In Block 11, enter the last day of the salary continuance period, not the last day worked.

Note: For questions on what constitutes a salary continuance, contact the Canada Revenue Agency.

Block 12 – Final pay period ending date

In Block 12, you enter the end date of the final pay period that includes the date you entered in Block 11. The date in Block 11 and the date in Block 12 will usually be different dates, except when the employee's last day paid corresponds to the last day of the pay period. Please note that the date in Block 12 can never be earlier than the date in Block 11.

Example

Your pay period is monthly, with an end date of the last day of each month. Saffi started working for you on March 15, 2012, and her last day of work was March 19, 2021. There were no interruptions of earnings during those 9 years, and you did not complete a previous ROE for Saffi. In Block 10, you enter "15/03/2012," and in Block 11, you enter "19/03/2021." In Block 12, you enter "31/03/2021," since that is the end date of the final pay period that includes the last day paid.

Note: When using the weekly averaging formula, use the Saturday of the week that contains the last day for which paid as the date to enter in Block 12.

Block 13 – Occupation (optional)

In this block, enter an accurate description of the employee's main occupation. For example:

- sales clerk

- graphic designer

- construction labourer

- legal assistant

Block 14 – Expected date of recall (optional)

If the employee will be returning to work and you know the expected return date, enter it in Block 14. If you do not know the return date, check the "Unknown" box. If the employee will not be returning to work, check the "Not returning" box.

Important:

When completing an ROE in the French version of ROE Web, it is not possible to use commas as decimal punctuation in numbers. Therefore, you must use the period, as in English. For example, you would enter "345.75", not "345,75". If you try to include a comma, it will automatically disappear. However, they will reappear in the PDF version.

Block 15A – Total insurable hours

To determine if hours are insurable, see Annex 1 on types of earnings and insurable hours of this guide.

There are 3 steps to calculating the number of hours to enter in Block 15A:

- determine the number of consecutive pay periods to use

- determine which hours are insurable, and

- calculate the employee's total insurable hours

Step 1 - Determine the number of consecutive pay periods to use

In Block 6, you identified your pay period type. Now, you must determine the number of consecutive pay periods that occurred during the period of employment—the amount of time between the date in Block 10 and the date in Block 11. Specifically, starting with the most recent pay period, you have to add up how many full, partial, and nil pay periods (any pay periods during which the employee did not work and did not receive any insurable earnings) occurred during the period of employment, up to a predetermined maximum number (see the chart below).

| Pay period type | Maximum number* of most recent consecutive pay periods you use to calculate the employee's total insurable hours |

|---|---|

| Weekly | 53 |

| Biweekly | 27 |

| Semimonthly(including non-standard) | 25 |

| Monthly(including non-standard) | 13 |

| 13 pay periods a year | 14 |

*The number of pay periods you use to determine the number of hours to enter in Block 15A is different from the number of pay periods you use for Block 15B.

Example of the determination of the number of pay periods that apply when the pay period is semi-monthly

Since your pay periods end on the 15th and the last day of each month, your pay period is semi-monthly. Paula started working for you on April 19, 2021, and her last day of work was December 10, 2021. In Block 10 you enter "19/04/2021," in Block 11 you enter "10/12/2021," and in Block 12 you enter "15/12/2021." To determine how many pay periods apply, you have to count the number of pay periods between the dates in Block 10 and Block 11. In this case, there are 16 pay periods between April 19 and December 10—fewer than the maximum number of 25 semi-monthly pay periods according to the "Calculating total insurable hours" chart above. Therefore, all insurable hours are included. For this reason, you report all of Paula's insurable hours in Block 15A.

Example of the determination of the number of pay periods that apply when the pay period is weekly

Your pay period is weekly, ending on Friday. Roman started working for you on February 14, 2004, and his last day of work was September 28, 2021. There have been no interruptions of earnings during those 17 years, so you have not issued any previous ROEs. In Block 10 you enter "14/02/2004," in Block 11 you enter "28/09/2021," and in Block 12 you enter "01/10/2021." To determine how many pay periods apply, you check the "Calculating total insurable hours" chart. Since your pay period is weekly, and because Roman worked for more than the maximum number of pay periods, you only report insurable hours for the most recent consecutive 53 pay periods on Roman's ROE.

Step 2 - Determine which hours are insurable

The total number of hours employees work each week for which they receive insurable earnings are considered insurable hours. The different types of insurable earnings are described in Annex 1, and include vacation pay, overtime pay, and statutory holiday pay.

If the employee received statutory holiday pay, include the statutory holiday hours in the total insurable hours, unless the statutory holiday occurred after the date in Block 11 (see Block 17B - Statutory holiday pay for details). If this is the case, you may or may not have to include the statutory holiday hours in the total insurable hours—it all depends on whether the employee's departure is final or not final.

If the employee's departure is final

We consider an employee's departure as final when the employer–employee relationship is not expected to continue in the future. For example, the departure is final when an employee is dismissed, when a job disappears because of restructuring, when a business closes, or when an employee voluntarily leaves. When the departure is final, do not include the hours for a paid statutory holiday that occurs after the date in Block 11 in the employee's total insurable hours (Block 15A).

Example

Mario started working for you on February 15, 2021, and his last day of work was December 17, 2021. His position within your company is no longer required, so his departure is final. You pay employees for any statutory holidays that occur during the month of departure. For this reason, you will pay Mario for the December 25 statutory holiday.

When completing Mario's ROE, you enter "15/02/2021" in Block 10 and "17/12/2021" in Block 11. To determine the Block 15A amount, you use the last 44 pay periods to calculate Mario's total insurable hours (since you pay your employees weekly and because there are 44 full, partial, and nil pay periods that fall during the period of employment). Although you paid Mario for the December 25 statutory holiday, you do not include the hours for this statutory holiday day in his total insurable hours, since his departure is final.

If the employee's departure is not final

We consider an employee's departure as not final when the employer–employee relationship is expected to continue in the future. For example, the departure is not final if the employee will be returning to work after a period of leave, or if you intend to rehire the employee after a temporary layoff (even if you do not know the return date).

When the departure is not final, if you pay for a statutory holiday, the hours are insurable. For this reason, include these hours in the employee's total insurable hours in Block 15A.

Example

You pay your employees biweekly, ending every other Friday. Mai has worked at your factory since May 15, 2005, without any work interruptions. You have not issued any previous ROEs for Mai. Starting on December 31, 2020, you have to temporarily shut the factory down for 2 months to perform required maintenance. Mai's last day of work is December 30, 2020, but she plans to return to work once the maintenance is done. For this reason, because you pay your employees for statutory holidays, you pay Mai for the January 1, 2021, statutory holiday.

When completing Mai's ROE, you enter "15/05/2005" in Block 10, "30/12/2020" in Block 11, and "01/01/2021" in Block 12, since that is the ending date of the last pay period. Since Mai worked for more than the maximum number of 27 biweekly pay periods, you use the last 27 pay periods to determine Mai's total insurable hours. Because Mai's departure is not final, you include the statutory holiday hours in the total insurable hours you enter in Block 15A. Also, the statutory holiday pay is included in P.P. 1 (the final pay period field) of Block 15C. Enter "01/01/2021" in Block 17B and the amount.

Step 3 - Calculate the employee's total insurable hours

Once you have determined the number of insurable hours the employee worked for each pay period (including statutory holiday hours), add all the insurable hours together. This number is the employee's total insurable hours. Enter it in Block 15A.

Block 15B – Total insurable earnings

Helpful hint for completing Block 15B

Before you complete Block 15B, you may want to take the time to complete Block 15C, even though it may not be required, and Block 17.

By doing so, it may be easier for you to calculate the correct amount to enter in Block 15B. It may also reduce the number of calls you receive from Service Canada requesting more information. See instructions on how to complete Block 15C.

There are 3 steps to calculating the total insurable earnings to enter in Block 15B:

- determine the number of consecutive pay periods to use

- determine which earnings are insurable, and

- calculate the employee's total insurable earnings

Notes

- When an employee is paid in foreign currency, it is the employer's responsibility to convert the foreign currency to Canadian dollars for the purpose of completing the ROE

- When an employee's earnings consist of commissions only or salary and irregularly paid commissions (for example, real estate agents or commission salespeople) or when an employee has irregular pay periods (for example, some contract workers) you must calculate a weekly average amount for the employee's earnings over the period of employment reported on the ROE. For details, see How to use the weekly averaging formula

- When unpaid wages (not including amounts for overtime or termination pay) are owing to an employee on separation because of the employer's bankruptcy, receivership, or impending receivership, you must still include the hours and earnings on the ROE

- The amounts you include in Blocks 15B and 15C should reflect the actual amounts the employee earned. If you paid any amounts in error, do not include them on the ROE. If you later determine that you will not be able to recover the money you paid in error to the employee, the money will become a taxable benefit. You must then include the amount on the ROE in the pay period during which you determine that you will not be able to recover it

Step 1 - Determine the number of consecutive pay periods to use

In Block 6, you identified your pay period type. Now, you must determine the number of consecutive pay periods that occurred during the period of employment—the amount of time between the date in Block 10 and the date in Block 11.

Specifically, starting with the most recent pay period, you have to add up how many full, partial, and nil pay periods (any pay periods during which the employee did not work and did not receive any insurable earnings) occurred during the period of employment, up to a predetermined maximum number (see the chart below).

| Pay period type | Maximum number* of most recent consecutive pay periods you use to calculate the employee's total insurable earnings |

|---|---|

| Weekly | 27 |

| Biweekly | 14 |

| Semimonthly(including non-standard) | 13 |

| Monthly(including non-standard) | 7 |

| 13 pay periods a year | 7 |

*The number of pay periods you use to determine the amount to enter in Block 15B is different from the number of pay periods you use for Block 15A.

Example of the determination of the number of pay periods that apply when the pay period is biweekly

Your pay period is biweekly, ending every other Friday. Sandeep started working for you on May 10, 2021, and his last day of work was October 15, 2021. The first pay period he worked was a partial one, since it ended on May 14, 2021.

In addition, Sandeep did not work for 1 full pay period during the summer, and did not receive any earnings for that 2-week period.

In Block 10 you enter "10/05/2021," in Block 11 you enter "15/10/2021," and in Block 12 you enter "15/10/2021." To determine how many pay periods apply, count the number of full, partial, and nil pay periods that fall during the period of employment. In this case, between May 10 and October 15, there were 12 full, partial, and nil pay periods. To calculate Sandeep's total insurable earnings, you will add up all the insurable earnings he received during these 12 pay periods.

Example of the determination of the number of pay periods that apply when the pay period is monthly

Your pay period is monthly, ending on the last day of the month. Mélanie started working for you on January 4, 2011, and her last day of work was June 18, 2021. There have been no work interruptions during those 10 years, and you have not issued any previous ROEs for her.

In Block 10 you enter "04/01/2011," in Block 11 you enter "18/06/2021," and in Block 12 you enter "30/06/2021." To determine how many pay periods apply, you check the "Calculating total insurable earnings" chart above. According to the chart, the maximum number of monthly pay periods that apply is 7. Since your pay period is monthly, and because Mélanie worked for more than the maximum number of pay periods, you will only report insurable earnings for the most recent 7 consecutive pay periods on Mélanie's ROE.

Step 2 - Determine which earnings are insurable

Once you have determined the number of pay periods you need to use, you must then determine the employee's insurable earnings for each pay period, including statutory holiday pay. To determine which earnings are insurable, see Annex 1 on types of earnings and insurable hours. In all cases, statutory holiday pay is included in insurable earnings—you only need to figure out in which pay period you should include it.

If the statutory holiday occurred during the period of employment (that is, before the date you enter in Block 11), you should report the statutory holiday pay in the pay period during which the statutory holiday occurred.

If the statutory holiday occurred after the period of employment (that is, after the date you enter in Block 11), you should include the earnings for the statutory holiday in the final pay period.

Example

Your pay period is monthly, with an end date of the last day of the month. Terry has worked for you since May 21, 2015, and his last day of work is December 30, 2020. In Block 10 you enter "21/05/2015," in Block 11 you enter "30/12/2020," and in Block 12 you enter "31/12/2020."

You paid Terry for the January 1 statutory holiday, which occurs after the date you enter in Block 11. You include the statutory holiday pay for January 1 in the final pay period. In this case, you also need to enter "01/01/2021" and the corresponding in Block 17B Statutory holiday pay.

Step 3 - Calculate the employee's total insurable earnings

Once you have determined the insurable earnings the employee received for each pay period, add all the insurable earnings together. This amount is the employee's total insurable earnings. Enter it in Block 15B.

Note: You must report all insurable earnings the employee received—not just the EI maximum insurable earnings amount.

Block 15C – Insurable earnings by pay period

There is a difference between the paper ROE and the electronic ROE in terms of the number of pay periods of information we ask you to provide in Block 15C.

Completing Block 15C on the paper ROE (27 fields)

If you use a paper ROE, you only have to complete Block 15C if the employee did not earn any insurable earnings in 1 or more pay periods. In Block 15C on the paper ROE, there are 27 fields in which to report insurable earnings, which allows for a maximum of 27 weekly pay periods.

Note: On April 7, 2013, a new way of calculating a claimant's Employment insurance benefit rate came into effect. This new way of calculating the benefit rate takes into account the employee's best weeks in the last year. Because of this, you are encouraged to complete Block 15C (according to the instructions for the electronic 53 field ROE) even if there are not any pay periods where the employee did not earn any insurable earnings.

In Block 15C, you must provide the payroll data for the required number of pay periods as indicated in the chart below, or fewer if the period of employment is shorter. Enter the insurable earnings the employee received for each full, partial, or nil pay period. To do so, complete Block 15C, making sure to enter the insurable earnings for the final pay period in the first pay-period field (the one marked "1" in the pay period (P.P.) column), the second-last pay period in the second pay-period field (P.P. 2), and so on.

For any nil pay periods with no insurable earnings, enter "0.00."

Include both dollars and cents. Do not round off the totals. Do not use the dollar sign.

In P.P. 1, remember to include any insurable amounts you reported in Block 17 - Separation payments.

To determine the number of consecutive pay periods to enter in this block, see the chart below.

| Pay period type | Maximum number* of most recent consecutive pay periods you use to calculate the employee's total insurable earnings |

|---|---|

| Weekly | 27 |

| Biweekly | 14 |

| Semimonthly(including non-standard) | 13 |

| Monthly(including non-standard) | 7 |

| 13 pay periods a year | 7 |

*The number of pay periods you use to determine the amount to enter in Block 15C on a paper ROE is different from the number of pay periods you use for Block 15A.

Example

Your pay period is bi-weekly, ending on every second Friday. Hassan started working for you on April 5, 2021, and his last day of work was September 17, 2021. He took part of July off in unpaid leave.

In Block 10 you enter "05/04/2021," in Block 11 you enter "17/09/2021," and in Block 12 you enter "17/09/2021." In Block 15C you enter the following details for the 12 consecutive pay periods that apply:

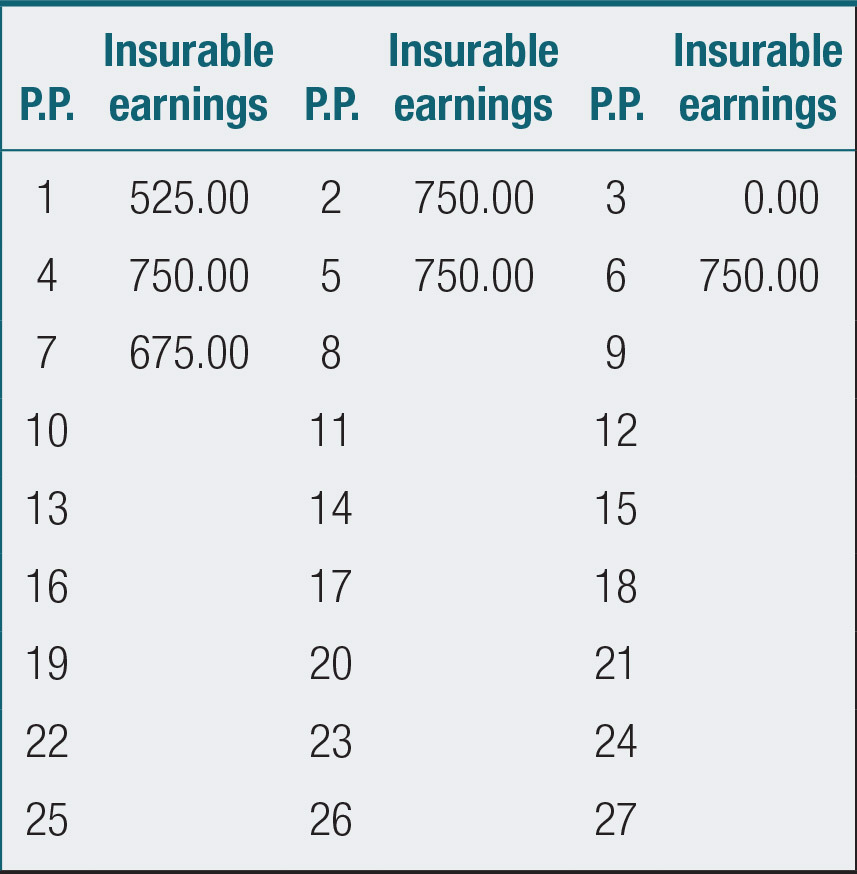

Representation of Block 15C of an ROE

- Pay Period 1: Final pay period (contains last day for which paid) insurable earnings of $1800.00

- Pay periods 2 and 3: Full pay periods insurable earning of $1800.00 for each period

- Pay Period. 4: Partial pay period insurable earnings of $750.00

- Pay Period 5: Nil pay period no insurable earnings

- Pay Period 6: Partial pay period insurable earnings of $450.00

- Pay Periods 7, 8, 9, 10 and 11: Full pay periods insurable earnings of $1800.00 for each period

- P.P. 12: First pay period (contains first day worked) insurable earnings of $1100.00

Completing Block 15C on the electronic ROE (53 fields)

If you use electronic ROEs, you must complete Block 15C and provide the equivalent of 53 weeks of payroll data (or less, if the period of employment is shorter than 53 weeks). Make sure to enter the insurable earnings for the final pay period in the first pay period field (the one marked "1" in the "P.P." column), the second-last pay period in the second pay-period field (P.P. 2), and so on. For any nil pay periods with no insurable earnings, enter "0.00."

To determine the number of consecutive pay periods to enter in this block, see the chart below.

| Pay period type | Maximum number of most recent consecutive pay periods you use to calculate the employee's total insurable earnings |

|---|---|

| Weekly | 53 |

| Biweekly | 27 |

| Semimonthly(including non-standard) | 25 |

| Monthly(including non-standard) | 13 |

| 13 pay periods a year | 14 |

Variable Best Weeks

Variable Best Weeks is the national approach to calculating EI weekly benefit rates. It aligns the calculation of benefits with the local labour market conditions in each region. Specifically, EI benefit rates are calculated using the best (highest) weeks of earnings during the qualifying period, which will range from 14 to 22, depending on the unemployment rate in the client's region.

Under the Variable Best Weeks approach, employers are encouraged to provide the equivalent of 53 weeks of pay period information in Block 15C of the ROE form. Currently, the paper ROE only has enough space to enter information for 27 weekly pay periods.

For this reason, if you have a weekly pay period and you are using paper ROEs, you can provide the data for pay periods 28 to 53 by attaching a separate sheet to each copy of the ROE. If you prefer, you can use the weekly pay-period worksheet to provide the additional pay period information.

Note: If you use the 53-field electronic ROE, or provide the equivalent information in block 15C of the paper ROE, you will usually receive fewer phone calls and requests for payroll information from Service Canada.

Block 16 – Reason for issuing this ROE

We have assigned codes to the most common reasons for issuing an ROE. In Block 16, enter the code that best corresponds to the reason you are issuing the ROE. For details about what each code means and when you should use it, review the information below.

Notes

- Even if an employee is casual or part-time, we still need to know why the employee is no longer working. For this reason, regardless of whether an employee is full-time, part-time, or casual, you must enter a code in Block 16

- If you are issuing an ROE for 2 or more reasons, enter the code that applies first in Block 16

- It is a serious offence to misrepresent the reason for issuing an ROE. If you knowingly enter a false or misleading reason for issuing an ROE, you may be subject to fines or prosecution. Knowingly means fully aware, "with full knowledge of the facts"

- Service Canada has automated the way we process ROEs. In this technological environment, when you include a comment in Block 18, the ROE is removed from the automated processing system and a Service Canada officer has to review it manually. This review slows the process down, and sometimes requires the officer to call you for clarification. For this reason, you should only enter comments in Block 18 in exceptional circumstances. Do not include comments that only confirm information you have already entered on the form

Code A - Shortage of work (layoff)

Code A is the most commonly used code. Use this code when the employee is laid off, since a "shortage of work" occurs when an employer has to lay off staff. For example, if you are issuing an ROE because a contract is ending, a season is over, or you are temporarily shutting down operations, use Code A.

For example (this list is not exhaustive):

- end of contract or season

- end of casual/part-time work

- end of school year

- temporary shutdown of operations

- permanent shutdown of operations

- position eliminated/redundant

- company restructuring

- employer bankruptcy or receivership

Code B - Strike or lockout

Use Code B when an employee is on strike or has been locked out of the workplace.

Code C - Return to school

Service Canada is phasing out the use of this code. Instead of Code C, please use 1 of the following codes:

- if the employee is leaving to return to school, use Code E – Quit. Be sure to enter "Return to school" in Block 18 if you are using a paper ROE. If you are using ROE Web online, choose the "Return to school" option from the drop-down menu

- if the employee is leaving to participate in a government-approved apprenticeship training program, use Code J – Apprentice training

Note: If you hire a student on either a summer term, co-op term or on any other basis where the term is fixed, if they fulfill their term code A – Shortage of work can be used.

Code D - Illness or injury

Use Code D when the employee is leaving work temporarily because he or she is ill or injured.

Code E - Quit

Use Code E when the employee initiates the separation from employment. For example, an employee may quit to take another job, to accompany a spouse who must move for his or her work to another location, to return to school, or to voluntarily retire, or the employee may decide to quit the position permanently because of health reasons.

If you are using a paper ROE, include a comment in Block 18, Comments. For example, you could enter "Take another job," "Follow spouse," "Return to school," "Voluntary retirement," or "Health reasons." If you are using ROE Web online, choose the appropriate option from the drop-down menu.

For example (this list is not exhaustive):

- take another job

- relocate with spouse

- return to school

- voluntarily retire

- health reasons

Note: If the employee is leaving the workplace because of mandatory retirement, see Code G - Retirement.

Code F - Maternity

Use Code F only when a person who is pregnant or has recently given birth is leaving the workplace to take maternity leave. It does not apply to adoptive parents or a parent who is not pregnant or has not recently given birth.

Notes

- If the employee is pregnant and is experiencing an interruption of earnings first because of illness and then because of maternity leave, use Code D - Illness or injury, since you should use the code that applies first. In this case, there is no need to amend the ROE once the employee begins their maternity leave

- If the employee is an adoptive parent or a parent to a newborn who has not recently given birth, see Code P- Parental

Code G - Retirement

(mandatory/approved under the Work Force Reduction program)

Use Code G when the employee is leaving the workplace because of mandatory retirement or through a Work Force Reduction approved by Service Canada. If you are using a paper ROE and the employee is retiring under an approved Work Force Reduction, enter "Approved work-force reduction" in Block 18. If you are using ROE Web online, choose the "Approved work-force reduction" option from the drop-down menu. See the Work Force Reduction program for details.

Note: If the employee is voluntarily retiring, see Code E - Quit.

Code H - Work-Sharing

Use Code H when the employee is participating in the Service Canada Work-Sharing Program.

Code J - Apprentice training

Use Code J if the employee is leaving the workplace temporarily to participate in a government-approved apprenticeship training program.

Code M – Dismissal or suspension

Use Code M when the employer initiates the separation from employment for any reason other than layoff or mandatory retirement (that is, the employee is leaving the workplace because he or she has been dismissed by the employer). Also use this code when the employee is suspended from their employment.

This code is also used when the employment is terminated within a probationary period because the employee was not well suited for the position (that is, the employee was not able to satisfactorily perform the duties of the position). If you are using a paper ROE and the employment was terminated within the probationary period, enter "Terminated within probationary period" in Block 18 - Comments. If you are using ROE Web online, choose the "Terminated within probationary period" option from the drop-down menu.

Code N - Leave of absence

Use Code N when the employee is leaving the workplace temporarily to take a leave of absence. For example, if the employee is taking any period of unpaid leave, use Code N.

Note: A leave of absence does not include illness or injury, maternity leave, parental leave, compassionate care leave, or leave for a caregiver providing care to a critically ill or injured person —instead, use Code D – Illness or injury, Code F – Maternity, Code P – Parental, or Code Z – Compassionate care/family caregiver respectively.

Code P - Parental

Use Code P if the employee is leaving the workplace temporarily to take parental or adoption leave.

Note: If the employee is a person who is pregnant or has recently given birth, see Code F - Maternity.

Code Z - Compassionate care/family caregiver

Use Code Z if the employee is leaving the workplace temporarily to claim compassionate care benefits, or family caregiver benefits.

Code K - Other

The vast majority of reasons for issuing an ROE are covered by the above codes. Use Code K only in exceptional circumstances (see examples below). If none of the above reasons apply to the situation, use Code K, and provide an explanation in Block 18 - Comments.

For example (this list is not exhaustive):

- change in payroll/ownership or company name

- change in pay period type

- death of an employee

- Service Canada has requested the ROE

Contact name and telephone number

Also in Block 16, you must enter the full name and telephone number of the person in your organization who is readily available to provide more information or clarification about the reason for issuing the ROE, if Service Canada needs it.

Block 17 – Separation payments

In Block 17 (A, B, and C), report all payments or benefits other than regular pay that the employer has paid or will pay to the employee because of the separation. The term separation refers to the period during which an employee experiences an interruption of earnings. The separation can be either final or not final.

It does not matter when the employer makes these separation payments to the employee. For example, the employee can receive these payments or benefits:

- in the final pay period

- any time after the employee is notified of the interruption of earnings, or

- at a later date during the interruption of earnings (regardless of whether the interruption of earnings is final or not final)

Include all separation payments in Block 17, regardless of whether these payments or benefits are considered as insurable earnings. You must also include any insurable amounts in Blocks 15B and 15C, if necessary. For details on what payments or benefits are considered insurable, see Annex 1 on types of earnings and insurable hours.

Note: Do not include in Block 17 any separation payments that have not been paid because of bankruptcy.

Block 17A – Vacation pay

In this block, enter any vacation pay the employer has paid or will pay to the employee because of the separation. The following chart explains the different ways you can pay vacation pay, and whether or not you need to report it in Block 17A.

| Type of vacation pay | Description | Fields required |

|---|---|---|

| Included with each pay | Usually paid as a percentage of the employee's earnings for a pay period. | Do not report the amount in Block 17A. Do not include any comments in Block 18, such as "Included with each pay" or "Paid with every pay." |

| Paid because no longer working | Any vacation pay that is payable to the employee because of layoff or termination of employment. | Include the amount in Block 17A. Do not include any comments in Block 18, such as "17A $$ is included in 15C P.P. 1." |

| Paid for a vacation leave period after the last day for which paid (Example: a paid vacation period during a plant shutdown that will occur while the employee is on leave) | Any vacation pay paid by the employer for a specific period of leave after the date in Block 11, when the employee plans to take vacation leave during the interruption of earnings and the employer granted the leave. | In Block 17A, include the amount. If you are using a paper ROE, include the dates of the vacation leave in Block 18. If you are using ROE Web online, include the dates in the appropriate field. Note: If you will be paying an employee for a vacation leave period immediately after the last day of work, it should not be reported here. In this case, the last day for which paid would be the last day of the period of leave, and the period of leave would not be reported in Block 17A. |

| Anniversary vacation pay payment made for a date that falls after the interruption of earnings | Any vacation pay paid on a specific date (or dates) each year. | In Block 17A, include the amount. If you are using a paper ROE, include the date of the anniversary in Block 18. If you are using ROE Web online, include the date in the appropriate field. |

If there are hours attached to the vacation pay, report them in Block 15A. If you are not sure if there should be hours attached or you do not know the number of hours to report, contact the Canada Revenue Agency for a ruling on your individual situation.

Vacation taken before it is earned

Employers sometimes advance vacation leave to their employees before they earn it. In a situation where employees have taken vacation leave and are later laid off before they earned all the leave, do not show any amount in Block 17A. In this case, employees would actually have an overpayment with the employer. Like all overpayments, you should not report these hours and earnings on the ROE. To ensure amounts on the ROE are correct, you should amend the amount the employee was paid for the pay period in which the employee took the leave to reflect the amount the employee should have been paid. Do not include any comments in Block 18.

Note: If you later determine that you will not be able to recover the money you paid in error to the employee, the money will become a taxable benefit. You must include the amount on the ROE in the pay period during which you determine that you will not be able to recover it. Do not include any insurable hours for this amount in Block 15A.

Block 17B – Statutory holiday pay

The term statutory holiday covers the following days:

- the actual day of the statutory holiday

- any other day off with pay that replaces a statutory holiday (for example, if Christmas Day falls on a Sunday, an employer may give the following Monday as a day off with pay to replace the statutory holiday), or

- any designated floater days—additional days off with pay that are taken at a time agreed to by both the employee and the employer

In Block 17B, you will report the amount you paid or will pay for each statutory holiday that falls after the date in Block 11, as well as the date of each statutory holiday. Do not include any statutory holidays that occurred before this date. Remember to include any amounts you report in Block 17B in the totals you enter in Block 15B and in the "P.P. 1" field of Block 15C, if necessary.

Note: If you are using a paper ROE and you have more than 3 statutory holidays to report in Block 17B, enter the additional information in Block 18. If you are using an electronic ROE, there are 10 fields available.

Example

Your pay periods are biweekly, ending every other Friday. Hugo's first day of work at your company was September 22, 2020, and his last day was December 18, 2020. He had a 2-week break with no work or earnings from November 15 to 28, 2020. He received a daily salary of $75 (each day represents 7 hours worked). You pay him for each of the 2 statutory holidays occurring after his last day: December 25, 2020, and January 1, 2021 ($75 for each statutory holiday – 7 hours per day). Hugo's departure is not final, since he will be returning to work on January 6, 2021.

In Block 10, you enter "22/09/2020."

In Block 11, you enter "18/12/2020." This is the actual last day worked, and not a statutory holiday date.

In Block 12, you enter "25/12/2020," since it is the end date for the last pay period.

In Block 15A, you enter "392" as the total insurable hours (56 days x 7 hours per day = 392 hours). Since the departure is not final, this number includes 14 insurable hours for the 2 statutory holiday days that occurred after the date in Block 11.

In Block 15B, you enter "$4,200" (56 days x $75 per day = $4,200). This amount includes $150 for the 2 statutory holidays that occurred after the date in Block 11.