Report on the Canada Revenue Agency's 2019 Serving Canadians Better Consultations

Learn how the Canada Revenue Agency (CRA) is listening to Canadians, changing how we work, and improving services with the goal to be trusted, fair, and helpful by putting people first.

The Canada Revenue Agency (CRA) consulted with Canadians in spring 2019 to improve its service experience and support its vision of being trusted, fair, and helpful by putting people first.

What you told us:

- Provide personal and tailored services

- Make taxes easier to understand

- Provide accurate information consistently

- Make services accessible

- Modernize programs and services

Why we consulted:

- To proactively listen and learn from Canadians about their current service experience and their expectations for the future to inform the CRA's service transformation agenda over the next couple of years

How we consulted:

3,330+

online submissions

April 23 – June 18

140+

attended 7 sessions

May & June

- Online consultations were open to all Canadians from April 23 to June 18, 2019 in both official languages

- Over 3,300 submissions were received through CRA's online engagement platform

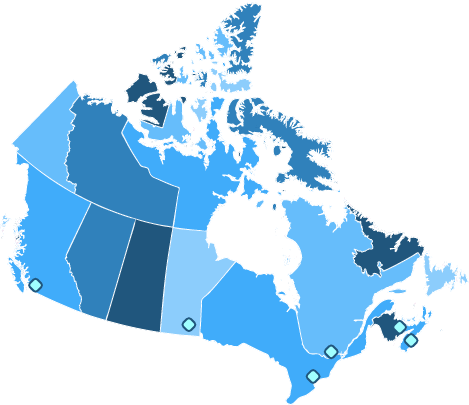

- To gather more in-depth information, 7 in-person consultations were conducted across Canada during May and June 2019

- Over 140 Canadians participated in these focused conversations

- On average, 20 participants attended each session and Canadians from various walks of life were recruited by a neutral, third-party

Who we consulted:

- General population

- Advocates for vulnerable populations, including seniors, newcomers, persons with disabilities, modest income Canadians, youth and students, refugees, and housing insecure individuals

2019 Serving Canadians Better Consultations

On October 29, 2018 the CRA announced the appointment of its first Chief Service Officer (CSO) to lead the CRA's transformation towards becoming more client-centric. With the goal of becoming an organization that is fair, trusted and helpful by putting people first, the CRA conducted the Serving Canadians Better (SCB) consultations with individuals between April and June 2019.

We focused on three key areas of our relationship with Canadians: service experiences, service improvements and the CRA's future direction. We learned that Canadians are noticing significant improvements with how the CRA serves them. However, there is still work to be done.

The feedback received during these consultations is in line with what we heard through existing feedback channels, such as public opinion research, mail, service complaints, call centres and social media. We will use the feedback gathered from all sources to transform how we serve Canadians over the next few years.

How we consulted

During the SCB consultations, we heard directly from Canadians coast to coast through online consultations and in-person sessions.

In-person

Over 140 members of the general population and advocates for vulnerable populations participated in seven face-to-face sessions across Canada during May and June 2019. Sessions with individuals took place in Halifax, Mississauga, Moncton, Montreal, and Winnipeg. Sessions with advocates took place in Vancouver and Montreal.

We heard from Canadians from many different socio-economic backgrounds in terms of age, gender and economic status. Participants in some sessions were recruited from organizations that help vulnerable members of the community with their taxes or help them qualify for social programs that rely on tax filings. This includes seniors, newcomers to Canada, persons with disabilities, youth and students, refugees, modest income Canadians, and housing insecure individuals, primarily those who have benefited from the CRA's Community Volunteer Income Tax Program (CVITP) clinics.

Online

Over 3,300 submissions were received from individuals through the online consultations via the CRA Engage tool from April 23 to June 18, 2019. Canadians were invited to participate in the online consultations through press releases, social media posts, and through reminder cards which were given to participants at the in-person sessions, as well as to CRA Outreach Officers during their visits across Canada. Invitations sent out through press releases were also spread through the media.

We heard from Canadians in many different tax situations. This includes but is not limited to individuals self-identifying as taxpayers, tax preparers, self-employed individuals, business owners, and others.

1. Provide personal and tailored services

As valued clients of the CRA, we want to make sure our programs and services are tailored to your unique situations.

What you said

Participants told us that they want the CRA to show more understanding for individual situations. They want to feel that their time is valued. Canadians also told us that they would like a relationship with the CRA that feels more like a partnership.

All Canadians are different and need help in different ways.

Participants told us that having agents work as case managers to taxpayers was an idea worth looking into more. They said that building working relationships between agents and taxpayers goes hand-in-hand in providing service excellence that can be expanded across the CRA. For example, Canadians want employees to make suggestions that apply directly to their particular situation (e.g., new to Canada, senior citizen, self-employed). Other examples of personalized service included being addressed by name, for the CRA to avoid interactions that feel very “transactional”, and for agents to show more empathy and understanding for unique and complex situations. Canadians also mentioned that they want help navigating the various departments within the CRA to resolve their issues. They identified the service provided by banks as a good example of the personalized experiences they would like to see offered by the CRA. Canadians in all but one in-person session told us that in-person services, such as kiosks in malls or dedicated CRA service centres, could be an important part of tailoring our services to their needs and improve service to Canadians.

Advocates for vulnerable populations told us that the CVITP help line and the outreach program are valuable resources, but Canadians in higher income brackets would also benefit from additional information and help. Some participants suggested that the CRA have agents who are specialized in helping certain groups such as, seniors, first-time filers, those who have had a change in life situation such as a divorce, people with disabilities, and members of vulnerable populations.

Did you know…

Through CVITP, the CRA supports organizations who offer free tax clinics across Canada where volunteers file tax returns for eligible people.

2. Make taxes easier to understand

We have an important role in educating people about Canada's tax system. We want to make taxes easier to understand so you can meet your tax obligations.

What you said

Participants said that they are not always aware of new features the CRA offers, including information available online (e.g., videos on YouTube) and specific services (e.g., digital services). They would like to receive more information and updates throughout the year, rather than just during tax filing season. They also want to be able to access information easily and for it to make sense right away. Canadians want the CRA to communicate openly about what we do and how we are changing for the better.

I'm an accountant (not a tax accountant) and I still find understanding the filing process difficult at times, so I can only imagine how difficult it can be for others.

Canadians also believe that the CRA should have a more active role in providing education on financial literacy and how the tax system works. They would also like more information on how taxes are used to support society and want to hear about CRA programs and services though more communication channels. We heard from participants that the wording on CRA webpages can sometimes be too complex for some audiences, and that we should use less technical language to make sure that everyone can understand the information we provide on the web. Some participants told us that they would like more education on how to confirm they are truly dealing with the CRA, and how to report suspected scams.

Canadians told us that the CRA's digital services, such as My Account, are a good start to making taxes easier to understand. They felt that having all of their tax information in one place helped them find the information that they needed about their tax situation. Canadians also felt that these services could be expanded. They said that My Account could be more user friendly if the CRA gave notifications about important dates and service updates, and let Canadians track documents provided to the CRA and confirm progress on files.

3. Provide accurate information consistently

Canadians want to feel valued in their interactions with the CRA. We want to make sure you are receiving the right information no matter which service channel you find it through.

What you said

Participants said that they want to be given information that is right the first time. They told us that they want better access to tax information, both online and over the phone. Canadians want CRA agents to give the same answers when asked the same question and to know who to contact if they do not know the answer to a question themselves. Canadians want better explanations for how tax calculations are made, and want to be confident that these calculations are correct the first time.

[The CRA should] improve consistency [of] advice provided by agents over the phone.

Participants noted that there needs to be better communication within the CRA, across levels of government and between government departments. Canadians only want to confirm relevant information (e.g. social insurance number or date of birth) once each time they call the CRA, and want to be able to contact one department to change or update their personal information.

Though most participants found services such as the CRA's Auto-fill my return to help them, we also heard from some Canadians that these services could be expanded to become more useful. Some participants told us of challenges using Auto-fill my return, such as the need for Quebec residents to manually input provincial forms, that limit our ability to provide consistent service to all taxpayers.

Did you know…

Our new telephone platform is helping us improve our telephone inquiries service by activating skills-based routing which sends calls to the right agents, based on their skill set and training they received.

4. Makes services accessible

Canadians increasingly expect the Agency to offer services that are comparable to other service-oriented organizations they interact with. We want to make sure that all Canadians can access our services when and how they need them.

What you said

Canadians said that call centre agents are knowledgeable and professional in their interactions, however, call centre wait times and hours of operation need to improve. They told us that they want shorter wait times across all platforms. If there is a wait to receive information or speak with a CRA employee, whether over the phone, or during processing, reviews or objections, Canadians want to know how long it will be. Canadians also want to be able to interact with the CRA at times that are more convenient for them, and in more ways that meet their needs.

The call centre hours, which coincide with standard office hours, are overly limiting.

Participants said that the CRA webpages have answers to most of their questions, but they would like us to make information easier to find online. Canadians also want options for those who are unable to go online, such as being able to receive information in print or interact in-person with the CRA.

Canadians noted the need for the CRA to provide better access to services for Canada's increasingly diverse population. They identified barriers to interacting with the CRA faced by many different Canadians including seniors, newcomers, and clients without a fixed address. Barriers felt by Canadians include but are not limited to language, lack of education on the tax process, and having to call multiple departments to get answers. Canadians want the CRA to work more directly with them and their representatives to overcome these challenges.

Did you know…

Approximate wait times for the individual, benefits and business phone lines can be found online.

5. Modernize programs and services

The needs and expectations of Canadians are constantly evolving. We want to deliver programs and services the way Canadians expect us to.

What you said

Participants said they have noticed improvements to digital services that have made it easier to interact with the CRA. At the same time, Canadians want to see more upgrades and updates to technology. For example, Auto-fill my return has cut down on the time it takes Canadians to complete their tax returns, and My Account lets Canadians easily access information from previous tax years. However, there is still room for these services to become more useful tools with more features and information.

Online process to file documents in support of a review does not allow you to search the status of the case or ask questions.

Canadians want us to deliver service the way they are offered by others, and through more modern and integrated channels. They want us to continue improving our existing online services and make forms easier to fill out. Participants also told us that the CRA should make our services more flexible. They said that it is important to avoid “one size fits all” solutions and offer services in different ways. Examples of ways that participants would like to see services offered include online chats and being able to set times to meet with CRA employees over the telephone.

Overall, Canadians want to have more ongoing consultations with the CRA on how it can continue to evolve. Canadians want to be able to offer quick feedback after each interaction with the CRA to help find opportunities for growth and service improvement.

Did you know…

A redesign of My Account was launched in October 2018 that allows users to quickly view their tax and benefit information and easily update their personal information with the CRA.

Our future direction

The CRA has heard from Canadians. They told us that the CRA has improved its services, but they still expect a better experience when they interact with us.

The feedback received during the SCB consultations was in line with what we have heard through existing feedback channels. While what we have heard through those channels has led to several service improvements across the CRA, there is no substitute for consulting directly with Canadians about their needs.

As a result, through its commitment of being more client-centric, the CRA will consult with Canadians on regular basis through different means to ensure that we meet their needs and expectations. The information provided by Canadians will continue to influence the improvements we are making to our services.

Canadians want to see real change. As a result, we are committed to three main outcomes:

1. Making information more helpful and easier to understand

The tax system is complex, but we will make it easier to interact with. We are making it easier to file taxes, apply for benefits and generally interact with us. By providing clear, accurate, consistent, and timely information and support, it should be easier to meet your tax obligations.

2. Providing more convenient access to services and support

We are making the CRA more accessible to Canadians, wherever they are and however they choose to interact with us. We strive for service that is personal, tailored, and digital-first, without leaving anyone behind.

3. Ensure Canadians feel understood, respected, and valued

The CRA will better understand the people we serve. We need to show Canadians that we are listening and that our services and programs are fair and responsive to their needs and preferences

Stay connected

Did you know that CRA has many ways you can engage with us other than through traditional channels?

You can:

- Follow us on social media

- Sign up for updates with one of our electronic mailing lists

Learn more to stay connected and stay informed with the CRA.