Canada Revenue Agency's 2023–24 Departmental Results Report

On this page

- Message from the Minister

- Foreword from the Chair

- Message from the Commissioner

- Results – what we achieved

- Spending and human resources

- Corporate information

- Supplementary information tables

- Federal tax expenditures

- Public Service Commission and assessment of recourse reports

- Annex A: Strategic Priorities for 2023–24 and their commitments

- Definitions

Read a summary of the Departmental results report Print this page

Copyright information

© His Majesty the King in Right of Canada, as represented by the Minister of National Revenue, 2024

ISSN: 2560-9130

Rv1-32E-PDF

Message from the Minister

The 2023–24 Departmental Results Report of the Canada Revenue Agency (CRA) highlights the CRA’s results and significant achievements benefiting Canadians.

Throughout the year, the CRA played a vital role to support critical priorities, such as affordability, housing, health, environment, and our economy. It has adapted quickly to implement new legislative measures, and to foster the integration of government services to ensure that more taxpayers have access to the benefits to which they are entitled.

Faced with the challenge of reducing expenditure, the multiplication of benefits, and the increased risks related to data security, the CRA commits to putting new initiatives in place to provide high-quality services to Canadians in a timely manner.

Our efforts to modernize services and enhance digital capabilities were decisive in responding to the evolving needs of taxpayers and businesses alike. Web content optimization projects have facilitated access to key information. A new digital identity validation option was also introduced to facilitate the access to sign-in services such as My Account.

The CRA has also been working in collaboration with other departments, including Employment and Social Development Canada (ESDC) and Service Canada, to explore synergies in our service offerings.

Through enhanced collaboration with federal partners, and expanded education and outreach activities, the CRA has continued to reach diverse client groups, particularly hard-to-reach populations. For example, in 2024, 1.5 million low-income individuals were invited to use the “SimpleFile by Phone” service to automatically complete and submit their tax returns. By simplifying this process, we are helping Canadians access benefits like the Canada Child Benefit and the GST/HST credit, which help improve their quality of life.

In the last year, the CRA distributed over $12 billion in benefits, particularly through new financial support measures such as the one-time Grocery rebate and the Interim Canada dental benefit that helped lower-income families with children under 12 get the dental care they need.

The CRA also launched new credits and tools to support housing. The multigenerational home renovation tax credit allowed eligible individuals to claim a credit for certain renovations aiming to create a self-contained secondary unit, facilitating cohabitation between seniors or persons with disabilities and a relative. In April 2023, the Government of Canada introduced the tax-free First Home Savings Account empowered prospective first-time home buyers to save for their first home on a tax-free basis.

At the same time, the CRA assigns substantial resources to detect and process tax non-compliance cases. In the context of new and emerging economies, such as platform economy, short-term rentals, and cryptocurrencies, various awareness initiatives are undertaken to increase compliance regarding income tax reporting.

Combatting aggressive tax planning, tax avoidance, and the underground economy are top priorities where the CRA is investing more resources. Thanks to an optimized use of information technology, and its extensive collaboration with national and international partners, the CRA is able to more effectively target high-risk taxpayers.

I invite you to read this report to discover details about the CRA’s accomplishments over the past year, and understand how it is pursuing its vision to be a world-class tax and benefits administration that is trusted, fair and helpful, by putting people first.

Hon. Marie-Claude Bibeau, P.C., M.P.

Minister of National Revenue

Foreword from the Chair

On behalf of the Board of Management of the Canada Revenue Agency (CRA), I am pleased to recommend the 2023–24 Departmental Results Report to the Minister of National Revenue for tabling in Parliament.

This year, the CRA, like all government organizations, has been working to fulfill the Government's commitment to refocus government spending. I am proud the CRA, with the support of the Board, continues to provide more and improved services to Canadians and advance its ambitious service and digital transformation agendas, even in this fiscal environment.

Similar to previous years, the CRA continues to focus its efforts on service excellence. The Board challenged the CRA to promote innovation, adopt modern technologies, and embrace intelligent risk-taking. We encouraged the CRA to prioritize digital channels; streamline processes; and set tangible, achievable, and ambitious targets using new and improved performance measurement processes and data tools and analytics.

The Board was also pleased to have contributed to the work the CRA is doing to increase security and safeguard personal information through constant oversight of the CRA’s security posture. The Board also reviewed the CRA’s procurement practices to ensure they are efficient and robust. Furthermore, the Board continued to encourage the CRA to prepare its workforce for the challenges and opportunities of the future by developing new skills and promoting a culture of innovation.

Throughout 2023–24, the Board, like the CRA, was actively engaged in maintaining strong relationships with a wide variety of external stakeholders, including the Office of the Taxpayers’ Ombudsperson, Revenu Québec, Shared Services Canada, the Chief Privacy Officer of Canada, and tax practitioners. These engagements helped the Board better understand the perspectives of our partners and the community we serve.

We are proud of what the CRA has achieved, but this report provides the opportunity to reflect on lessons learned. The Board acknowledges that there is still work to be done to improve Canadians’ trust in the CRA and the CRA’s performance related to its external service standards. The Board and the CRA will work together to ensure that where we fell short this year will inform the development of the CRA’s future Corporate Business Plans.

It is important to note as well that much of the work done by CRA staff remains invisible to the public eye. System upgrades, data management improvements, strategic planning, risk analysis and mitigation, project management, and capacity building all take place behind the scenes and are integral to the CRA’s future. Many of our people’s successes fall beyond the scope of this report, but I would like to take this opportunity to acknowledge all the contributions, big and small, that we have witnessed over the past year.

I am continually impressed by the passion, enthusiasm, and commitment of CRA employees who take pride in serving Canadians. The CRA is a large and complex organization, but its results are driven by individuals working together to solve problems, achieve goals and prepare for the challenges and opportunities of the future.

The CRA’s work is vital to the well-being and prosperity of our country. The Board and the CRA share an unwavering commitment to provide Canadians with world-class service. As we navigate the challenges of the present, we will continue to work closely together, share our ideas, expertise, and passion to better serve Canada and Canadians.

Suzanne Gouin

Chair, Board of Management

Message from the Commissioner

Throughout 2023–24, the CRA continued to contribute to the economic and social well-being of Canadians as we pursued our vision to be a world-class tax and benefits administration that is trusted, fair, and helpful by putting people first.

Putting people first means that we work to understand their needs and expectations so that we may deliver better programs and services. We made considerable progress with our People First approach this year, providing Canadians the information they need to fulfill their tax obligations and access the benefits and credits designed to assist them, identifying, and removing barriers to accessibility in line with the Accessible Canada Act, and improving our digital services.

The population in Canada has grown by 1.3 million in the past year. For the CRA this represents an unprecedented increase in our overall program intake numbers. The rise in tax system participation includes not only newcomers but also a heightened awareness of taxes and benefits among vulnerable populations. This increase in volume has made it more challenging to meet some of our service standards. Despite this, we have delivered new income-tested benefits, credits and programs, leading to more applications, payments, and validations activities. We continue to expand on our tools to provide a more comprehensive and positive experience for taxpayers. For example, we have increased our portal capabilities, including online chat, world income submission, mail service, and the Progress Tracker. We will continue to engage with Canadians through consultations, and engagement activities, to support ongoing improvements to our services.

The CRA also responded to a number of natural disasters this year, including wildfires and floods across the country. When disasters occur, the CRA follows a defined disaster relief response process to provide quality service and consistent support to affected taxpayers. In 2023–24, the CRA implemented a range of measures, commensurate with the severity of the incidents, to provide relief.

The CRA provides high quality service to assist Canadians to meet their tax obligations voluntarily, but we also take action to ensure everyone pays the tax that they owe. This year, we continued combatting aggressive tax planning and tax evasion by refining processes to identify carousel and aggressive GST/HST schemes, increasing audits and penalties to discourage wilful non-compliance, as well as identifying and closing suspicious accounts before an unwarranted refund was paid.

I continued in my role as Chair of the Organisation for Economic Co-operation and Development’s (OECD) Forum on Tax Administration. The CRA’s collaboration with other tax administrations continued to advance tax reform to progress Pillar One and Pillar Two. Pillar One would ensure that the largest and most profitable global corporations, including large digital corporations, pay their fair share of tax in the jurisdictions where their users and customers are located. Pillar Two is a global minimum tax regime to ensure that large multinational corporations are subject to a minimum effective tax rate of 15 per cent on their profits wherever they do business.

I’m pleased that in 2023–24, new collective agreements were signed with both the Professional Institute of the Public Service of Canada Audit, Financial and Scientific Group and the Public Service Alliance of Canada Union of Taxation Employees. These agreements provide approximately 55,000 employees with stability and support in the work they do in delivering services to Canadians.

Great strides were also taken to support the hybrid model of work. The hybrid model allows us to harness the advantages of both remote and on-site work, while connecting with our direct teams and colleagues across different areas. We engaged employees to inform improvements and modernization efforts as the CRA adapts to the new model. I want to make sure our hybrid environment fosters cooperation, providing opportunities to connect from a mentoring, onboarding, and collaboration perspective.

The CRA is committed to fostering a workplace that reflects the diversity of Canada. In 2023–24, we created the CRA Black Employee Network, which joined the Indigenous Employee Network, Visible Minority Network, Women’s Collaborative Network, Persons with Disabilities Network, and the 2SLGBTQI+ Network to support and develop equity, diversity, and inclusion at the CRA. I recognize we have more to do to continue to make progress on creating a fully representative workforce in a truly inclusive workplace.

The CRA has experienced significant growth in recent years to deliver pandemic support benefits, as well as new benefits to support the lives of Canadians, such as the Canada dental benefit. In 2023–24, the CRA also reinforced efforts to ensure that our spending is focused on supporting priorities that matter most to Canadians. The CRA’s budgets for travel and professional services, and its operating budget were reduced. Branches and regions identified savings opportunities, which focused on programs and operations where there was duplication, lower value for money activities, or a misalignment with government priorities.

I am extremely proud with all that we have accomplished as an agency. This past year, we retained our ranking as a top employer in the National Capital Region, and we were recognized as one of Canada’s best diversity employers, as well as one of the top employers for young people. I'm struck wherever I go across the country by the passion and enthusiasm with which people approach their jobs. The CRA is fortunate to have a competent and skilled workforce, dedicated to the job they do. The CRA’s 2023–24 Departmental Results Report highlights the achievements resulting from this dedication.

Bob Hamilton

Commissioner of the Canada Revenue Agency

Results – what we achieved

Core responsibilities and internal services

Core responsibilities: tax and benefits

Description of tax core responsibility

The CRA’s core responsibility for tax is to ensure that Canada’s self-assessment tax system is sustained by providing taxpayers with the support and information they need to understand and fulfill their tax obligations, and by taking compliance and enforcement action when necessary to uphold the integrity of the system, offering avenues for redress whenever taxpayers may disagree with an assessment/decision.

Description of benefits core responsibility

The CRA’s core responsibility for benefits is to ensure that Canadians obtain the support and information they need, to know what benefits they may be eligible to receive, that they receive their benefit payments in a timely manner, and have avenues of redress when they disagree with a decision on their benefit eligibility.

Progress on results

In carrying out its two core responsibilities of administering taxes and benefits, the Canada Revenue Agency (CRA) measured its performance against 11 departmental result indicators (see tables 1 and 2). This section provides context for these results. The CRA also made specific commitments to Canadians for 2023–24, to advance its strategic priorities related to its core responsibilities. These results are presented in the “Details on the results” section below.

The CRA operates in a complex environment, which in 2023–24 was marked by a population increase, economic pressure and evolving client expectations. This year, as in the past few years, the CRA has invested resources to respond to this environment by delivering new programs, benefits, and credits. Since COVID-19, the size of the CRA’s workforce has increased, reflecting the growing volume and complexity of the returns processed and benefits delivered to Canadians. In fact, the amount of benefit payments has surged by more than 50% in recent years.

In 2023–24, the volume of transactions processed by the CRA increased, partly due to population growth and the CRA’s success in outreach efforts to promote participation in the tax and benefit system. Volumes also increased because of the CRA’s delivery of new income-tested benefits, credits, and programs in support of the economic and social well-being of Canadians, in light of economic pressures and a rising cost of living. As a result of these factors, the CRA received increased applications, information requests, payments and validation activities in 2023–24. For example, CRA contact centres answered approximately 19.6 million individual tax, business, and benefit enquiries calls using agents and automated services, compared to 18.8 million in 2022–23. This unprecedented demand for CRA services has led to a strain on resources and impacted the CRA’s service delivery.

In 2023–24, the CRA experienced an increase of over 60% in relief requests compared to pre-pandemic levels. Financial hardship continued to be the most common reason for taxpayer relief requests. The CRA processed an unprecedented amount of relief requests and provided proactive relief for those affected by the British Columbia and Northwest Territories Wildfires. No penalties or interest were applied for late filing of all T2, GST/HST, Special Elections and Returns and Other Levies returns and payments that would normally have been due between August 15, 2023, and October 16, 2023. The proactive relief eliminated the burden on taxpayers to seek and apply for relief.

Taxpayers comply with Canadian tax obligations, the right tax revenue is secured for Canadians, and Canadians have trust in the CRA

Canadians’ participation in the tax system remained strong at 94% in 2023–24. This is due in part to the CRA’s activities to foster trust and improve service, so the vast majority of Canadians voluntarily comply with their tax obligations.

Canadians’ trust in the CRA is crucial for maintaining a fair, efficient, and secure tax and benefit system that supports the economic and social well being of Canada. To maintain and increase the trust of Canadians, the CRA has:

- enhanced its transparency and provided clearer and more accessible information, educational resources and outreach programs to help taxpayers understand their rights and responsibilities;

- improved its services to make tax filing easier, including engaging stakeholders to understand their concerns and improve the tax system;

- worked to identify and combat tax evasion and aggressive tax planning, and publicized enforcement actions;

- invested in security to ensure taxpayer information is protected to the highest standards.

The Service Satisfaction Index (SSI) reflects the CRA’s commitment to providing client-centric services to Canadians and is an important indicator of the CRA’s focus on effectively meeting the needs and expectations of its clients and providing a positive service experience. In 2023–24, the SSI surpassed its target, which is an indication that the commitments that the CRA has delivered for Canadians are working. For example, the CRA disseminated simple and practical tax and financial literacy information to Canadian youth and newcomers to help ensure they understand taxes, file their taxes, and access benefits, increased outreach to remote indigenous communities, and on the digital front, the CRA enabled individual and business clients and their representatives to track the progress and expected completion date of the processing and actioning of a filed GST/HST return. A number of important services were delivered within their standard. The CRA, however, did not meet all its external service standards targets, in part due to the unprecedented service demand described above. The CRA remains committed to high quality service delivery in all its programs.

In addition, the CRA increased its outreach efforts to make it easier for Canadians to file their income tax and benefit returns. New and enhanced services continued to be introduced, such as Taxpayer Self-service–a new digital service allowing taxpayers and their authorized representatives, to complete some accounting transfers, in real time, and Simple File: Let us help you get your benefits!, a paper-based simplified filing option made available to all Indigenous communities.

The CRA also explored ways to foster compliance while maintaining its People First approach, including seeking to educate taxpayers on their tax compliance obligations in the hopes of influencing future behaviour and preventing non-compliance events. For example, with the increase in short-term residential rentals (like Airbnb), the CRA began sending education letters to taxpayers who report rental income over $30,000 on their T1 returns, providing information on GST/HST registration requirements and instructions on how to register. This initiative sent over 34,000 letters to taxpayers in 2023–24 and increased registrations in a sector that historically had low registration rates.

In 2023–24, the CRA also continued compliance activities related to COVID-19 Pandemic programs. The CRA’s compliance programs remained focused on post validation projects to safeguard the collection of unwarranted emergency benefits during the pandemic.

The CRA continued to explore new technologies, leveraging business intelligence, and developing solutions to support its compliance efforts. The Government of Canada has invested significantly in the CRA, to crack down on tax evasion and aggressive tax planning. The CRA continued to maximize the impact of these investments and deliver Federal Budget and Economic Statement commitments to increase the opportunity and capacity in its compliance activities.

Canadians receive their rightful benefits

The CRA administered 205 services and ongoing benefits as well as one-time payment programs to support the economic and social well-being of Canadians. In 2023–24, the CRA issued nearly $52.7 billion in benefits, compared to $46.4 billion in 2022–23.

The CRA continued to make it easy for taxpayers to file their returns so that they can receive the benefits and credits to which they are entitled through programs like the Community Volunteer Income Tax Program (CVITP) and the Non-Filer Benefit Letter.

The CRA’s CVITP helped 758,540 low-income and vulnerable individuals in 2023–24. Since 2019, the use of promotional products such as videos, articles, radio soundbites, printed materials, and marketing tactics via social media platforms, has raised awareness of the free CVITP tax clinics that help individuals access the benefits and credits to which they are entitled.

A Non-Filer Benefit Letter was also issued to 200,106 taxpayers to promote filing and receiving benefits and credits. As a result of these mailings, a total of 22,678 returns were filed resulting in over $29.6 million in tax refunds payments and $35.6 million in credits/benefits paid to Canadians.

In delivering tax and benefit programs, the CRA also sought to address unique – and sometimes complex – tax needs for newcomers and other populations that required particular education resources and support.

Benefit recipients shared their satisfaction levels regarding their overall benefits service experience by participating in surveys. For 2023–24, 72% of respondents reported being satisfied with their overall benefits experience. While this is slightly below the target, the results were impacted by a change in the way respondents were canvassed. The CRA will continue to monitor this indicator to ensure that the benefit recipients are satisfied with the service they receive.

The CRA remains committed to delivering a world-class tax and benefit administration that is trusted, fair and helpful by putting people first. Please see the “Details on results” section below for additional information on the CRA’s strategic priorities and related results.

Table 1: Targets and results for tax

Table 1 provides a summary of the target to be achieved by March 31, 2024, and actual results for each indicator associated with the results under tax.

Departmental Result Indicators

|

2023–24 target

|

2023–24 actual result

|

2022–23 actual result

|

2021–22 actual result

|

|---|---|---|---|---|

Percentage of individual tax returns filed on time

|

At least 90%

|

89%

|

89%

|

90.5%

|

Percentage of businesses registered for GST/HST

|

At least 90%

|

88%

|

89%

|

94.1%

|

Percentage of tax liabilities paid on time

|

At least 91%

|

92%

|

90.7%

|

89.9%

|

Percentage of Canadians who participate in the income tax systemFootnote 1

|

At least 93%Footnote 2

|

94%

|

93.3%

|

92.4%

|

Ratio of collectable tax debt to total net receipts (cash accounting)

|

At most 20%

|

25%Footnote 3

|

20.8%

|

18.9%

|

Percentage of external service standards targets that are met

|

At least 75%

|

55%

|

71%

|

74%

|

Service Satisfaction Index

|

At least 7.0

|

7.4

|

7.3

|

7.3

|

Public Perception Index: Trust

|

At least 7.0

|

6.6

|

6.6

|

6.8

|

Table 2: Targets and results for benefits

Table 2 provides a summary of the target to be achieved by March 31, 2024, and actual results for each indicator associated with the results under benefits.

Departmental Result Indicators

|

2023–24 target

|

2023–24 actual result

|

2022–23 actual result

|

2021–22 actual result

|

|---|---|---|---|---|

Percentage of Canada child benefit payments issued to recipients on time

|

100%

|

100%

|

100%

|

100%

|

Percentage of respondents satisfied with overall benefits experience

|

At least 75%

|

72%Footnote 4

|

75%Footnote 5

|

85%

|

Percentage of taxpayers (benefit recipients) who filed as a result of targeted CRA intervention

|

At least 10%

|

11.3%

|

11.4%

|

17.4%

|

Additional information on the detailed results and performance information for the CRA’s program inventory is available on GC InfoBase.

Details on results

The CRA presents its plans under four strategic priorities that align to its mandate, Departmental Results and Government of Canada priorities. The following section describes the results of the CRA’s commitments for each strategic priority related to tax and benefits in 2023–24 compared with the planned results set out in the CRA’s departmental plan for the year.

A. Deliver seamless client experiences and tailored interactions that are digital first

The CRA prioritizes delivering client experiences that incorporate digital solutions tailored to clients’ needs, and guided by a “People First” approach to providing its services and programs to Canadians. This priority has helped support the Minister of National Revenue’s mandate to modernize the CRA to provide a seamless, empathetic and client–centric experience.

Throughout 2023–24, the CRA continued to modernize and adapt the way it worked to improve its clients’ experiences. By prioritizing digital channels, streamlining processes, and ensuring client-centric services, the CRA has made it easier for individuals and businesses to access clear, timely, and accurate information.

"Given the complexity of Canada’s tax system, we must make things easier for Canadians. This is being done through education and outreach activities, language simplification, website content optimization, and better self-serve options. While there is more work in progress, the Board is pleased to see some success. For example, the CRA has been able to reach increasingly more people through the Community Volunteer Income Tax Program, communication campaigns, and improved digital options, helping Canadians get the benefits they are entitled to."

This priority contained 17 commitments in the CRA’s 2023–24 Departmental Plan. During this reporting period, the CRA met 16 of its 17 commitments. Refer to Annex A for a complete list of commitments and their results identified as having been met or not met.

A1. Targeted education and outreach

This past year, the CRA emphasized ensuring that Canadians accessed the benefits and credits to which they are entitled. The CRA collaborated with ESDC to align their prioritization, planning, and monitoring activities and to help hard-to-reach populations. Through these activities, the CRA aims to increase the trust and participation of Canadians in the tax and benefits system.

In 2023–24, CRA outreach programs and communication activities continued to evolve to meet the distinct needs of specific groups of clients, such as Indigenous peoples, seniors, new Canadians, youth, persons with disabilities, and small and new businesses. The CRA expanded its social media presence and outreach efforts, including campaigns targeting youth and newcomers, such as back-to-school initiatives, the learn about your taxes tool, and Financial Literacy Month. These activities showed significant engagement, with tax tips garnering thousands of views and high social media interaction rates. During the 2024 tax season, targeted campaigns, including multilingual resources for newcomers and educational materials for youth, reinforced the CRA’s commitment to enhancing taxpayer education.

The CRA met with national Indigenous educational and literacy partners to promote the Learn about your taxes initiative to Indigenous youth. It also collaborated with regional outreach teams to consult Indigenous school boards on integrating “Learn About Your Taxes” into their curriculum. The CRA enhanced the online learning tool to cover topics that reflect the diverse needs of youth in today’s modern workforce. Additional content on “Working for yourself” was also launched to address commonly encountered self-employment scenarios among young people. In 2023–24, the Learn About Your Taxes web pages received 291,964 clicks.

"The Board continued to work with the CRA on improving participation in the tax and benefit system by vulnerable populations. We believe in the importance of feedback from a wide range of clients and continue to encourage the CRA to engage with diverse groups to get a better understanding of their experience with and expectations for the CRA. While there has been significant progress, there is still work to be done to make the CRA’s services and benefits easier to access."

Performance outcomes and results for commitments under this objective for 2023–24:

- Continued to enhance outreach efforts and communication campaigns, guided by analyses of Indigenous population demographics and areas with low tax participation. The CRA used results from an examination of tax and census data as well as Public Opinion Research to direct the CRA’s Indigenous Strategy 2024–27. The strategy outlines initiatives that build long-lasting and meaningful relationships with Indigenous communities and tailors services for Indigenous clients.

- Increased the number of outreach activities within Indigenous communities from 427 activities in 2022–23 to 678 in 2023–24. The activities were held in 260 unique Indigenous communities in 2023–24.

- Expanded the CRA’s social media presence by increasing the number of posts issued by 32%. This, in turn increased visibility of the CRA’s messages and resulted in 33 million impressions. The CRA Instagram page accumulated over 19,000 followers – an increase of 94% within 1 year. Collaborations with other government entities led to innovative projects, such as the CRA’s new podcast, "Taxology". The podcast reached #1 on Apple Podcast Charts (in the Government genre), and as of March 31, 2024, has exceeded expectations by reaching 15,499 total plays, with 6,768 listeners and 1,763 subscribers across all platforms.

- Launched service visits to claimants of the Scientific Research and Experimental Development (SR&ED) tax incentives to provide information, tools, and support required to submit claims. The CRA completed 296 SR&ED service visits during the 2023–24 fiscal year.

- Helped 758,540 low-income and vulnerable individuals through the CVITP, an increase of 16.8% over 2022 (649,420 individuals helped). This improved benefit and credit uptake among hard-to-reach populations was in part due to enhancements made to the Benefits Outreach Program, and focusing primarily on young adults, newcomers, and Indigenous Peoples. The CRA also funded grant payments to qualified organizations to encourage their continued participation in the CVITP.

- Implemented new and improved performance measurement tools and processes to enhance outreach programs, which contributed to improving benefit and credit uptake among hard-to-reach populations.

- Implemented a feedback form to measure increases in tax literacy and awareness among participants following an outreach presentation. A soft launch took place March 1 to 31, 2024.

- Utilized the insights gathered through to CRA’s Linkage rate study to enable more efficient resource allocation and targeted outreach efforts, aiming to close the benefits access gap and improve the tax-filing rates and financial well-being for hard-to-reach populations, such as under-served Indigenous communities.

- Worked with business intelligence on a deeper analysis for specific aspects of the tax system, including demographics of individuals identifying as indigenous who apply for the Disability tax credit, to identify what related program enhancements could be made.

- Launched the new Client Assistance Referral and Enquiry Service (CARES) on February 19, 2024. The CARES line provides expanded services to clients requiring a high level of support to access benefits. This service includes address changes, direct deposit updates, mailing printouts such as Notice of Assessments, clarification of CRA correspondence, assistance in claiming uncashed cheques, and CVITP direct referrals.

- Completed 18 educational reviews for pre-pandemic files, to assist employers in self-correcting and to promote compliance with their filing and reporting obligations.

- Published the first progress report on its 2023–2025 Accessibility Plan on December 22, 2023. This plan aims to identify, eliminate, and prevent barriers to accessibility for employees and clients. The progress report offers insights learned from ongoing consultations with persons with disabilities, and other key accomplishments to strengthen accessibility across its programs and services.

- Launched the first phase of modernizing the appeals systems to automate workload distribution functionalities for redress programs. This enables efficiencies in the resolution of requests and disputes, improved digital services for Canadians and near real-time data, including improved data integrity and accessibility which allows the CRA to respond more quickly to trends.

- Engaged with 13 organizations that support newcomers to Canada. This resulted in 35 group seminars with over 550 participants that offered free tax help and educated them on their tax obligations in Canada. The CRA held sessions with numerous immigrant and refugee service centres, societies, and associations for new Canadians.

- Completed advertising and marketing campaigns, including five campaigns focusing on Benefits and Credits, Scams, CVITP Recruitment, Underused Housing, and Compliance. Also, the CRA innovated its experiential marketing and media partnerships. For instance, the CRA hosted an escape room that travelled to various locations across the country to help Canadians learn the signs of common scams so they can protect themselves from scammers.

Delivering new benefits for Canadians

In 2023–24, the Government of Canada proposed new financial support measures to make life more affordable for Canadians. The CRA undertook significant efforts to efficiently deliver these benefits as soon as they became available and to reach people to increase benefit uptake. Enhancing and delivering benefits for Canadians is crucial because these benefits directly support their well-being and financial stability.

Interim Canada dental benefit

The interim Canada dental benefit launched on December 1, 2022, and closed on June 30, 2024. The benefit helped lower-income families with children under 12 get the dental care they needed. The CRA, in collaboration with Health Canada, delivered an extensive communications campaign to raise awareness of the second period of the benefit from July 1, 2023, to June 30, 2024.

This high-profile campaign, which helped Canadians prepare and apply for the new dental benefit, used a variety of proactive tactics, including social media and engagement with partners.

During the 2023–24 fiscal year, the CRA delivered more than 244,000 Canada dental benefit payments totalling nearly $250 million. Since the program launch on December 1, 2022, until March 31, 2024, the benefit has helped provide dental care access to more than 443,000 children.

Canada Carbon Rebate

The Canada Carbon Rebate (CCR) (previously known as the climate action incentive payment) is a tax-free quarterly payment to help individuals and families offset the cost of the federal pollution pricing. It is available to residents of Alberta, Saskatchewan, Manitoba, New Brunswick, Newfoundland and Labrador, Nova Scotia, Ontario, and Prince Edward Island. It consists of a basic amount and a rural supplement for residents of small and rural communities.

From April 1, 2023, to March 31, 2024, the CRA delivered over 45 million payments and issued more than $8.79 billion in benefits.

Eligible residents of Canada don’t need to apply to receive the CCR. They automatically receive the CCR each year when filing their income tax and benefit return.

Grocery rebate

As announced in Budget 2023, the Government of Canada introduced a one-time grocery rebate to provide financial support to eligible Canadians. The CRA issued this rebate on July 5, 2023, alongside the July 2023 quarterly GST/HST credit payment. There were more than 10.4 million payments issued to individuals and families totalling over $2.36 billion.

Advanced Canada workers benefit

The Advanced Canada workers benefit provides advance payments equivalent to 50% of the Canada workers benefit across three equal payments for low-income individuals and families who are already in the workforce. From July 28, 2023, to March 31, 2024, the CRA delivered more than 6.1 million payments and issued $1.39 billion in benefits.

A2. More ways to interact digitally

The CRA leverages technology to meet clients’ and employees’ expectations. The CRA has continued to accelerate its use of digital tools and processes to improve service, offering clients convenient self-serve options to access information, apply for benefits, and meet their tax obligations. These investments in information technology are fully aligned with the Government of Canada’s strategic direction for the integrated management of service, information, data, information technology, and cyber security, as described in its Digital Ambition. Although its traditional service methods are still available, the CRA continued to pursue more ways to apply technology to its full range of services and enable its clients to self-serve, where appropriate.

The CRA continues to advance its Digital Learning Program to help employees gain the necessary skills, knowledge, and behaviours related to digital ways of working, by creating a space to connect CRA employees to the Canada School of Public Service courses and events that support digital transformation.

Performance outcomes and results for commitments under this objective for 2023–24:

- Completed 5 web content optimization projects, which made it easier for taxpayers to find and understand information on the Canada.ca website about the taxes and benefits administered by the CRA, including:

- SR&ED tax incentives

- Dental Benefit Period 2

- T1 Guides

- Service Feedback

- Payments and Collections

This work has delivered measurable results in service improvement for Canadians, with a 30%-point improvement in the ability of taxpayers to quickly find and understand answers on the website to their most frequently asked tax and benefit-related questions. Additional web content optimization projects supporting other critical priorities (Scams and Fraud as well as My Account / My Business Account) missed the completion target date of March 31, 2024, but are on track for completion in the first quarter of 2024–25.

- Included the GST/HST initial returns and adjustment requests to the Progress Tracker. This enables individuals, business clients, and their representatives to track the progress and expected completion date of files and enquiries they submitted to the CRA for its action.

- Provided GST/HST registrants with a more streamlined digital service within the secure online portal by allowing them, as of May 2023, to file their GST/HST return and their GST189 General Application for GST/HST Rebates at the same time.

- Implemented the Decisions and Reviews Tracking System (DARTS). DARTS was built with the functionality to receive rulings requests from ESDC as well as internal CRA partners. In addition, clients requesting rulings through My Business Account can now include more information with their requests including supporting documents.

- Completed a business case, a project management framework, and a transformation blueprint for furthering the implementation of an ePayroll solution for the Government of Canada. Budget 2024 re-confirmed the Government’s commitment to putting an ePayroll solution in place.

B. Combat aggressive tax planning and tax evasion

Protecting the integrity and fairness of Canada’s tax system by addressing tax evasion and avoidance on all levels has remained a priority. The CRA approaches its work with the underlying idea that most people will meet their tax obligations voluntarily. Recognizing that the tax system is complex, and that voluntary compliance is more cost-effective than enforcement, the CRA helps clients by using an education-first approach. The CRA seeks to address non compliance as early as possible, with the appropriate level of interventions or compliance activities. As a responsible administrator, the CRA strives to identify and actively enforce compliance in cases where taxpayers do not meet their tax obligations. Doing this ensures that all taxpayers pay the taxes they owe or only receive the refunds to which they are entitled.Footnote 6

Tax evasion and tax avoidance, including GST/HST schemes, are global problems that can prevent nations from generating the tax revenues they need to advance and prosper. In line with the Minister’s mandate to combat tax avoidance and tax evasion, the CRA has increased resources to identify and address non-compliance. This includes an increased number of audit resources, access to a greater number of data sources, and strengthened relations with domestic and international partners. In particular greater international cooperation helps the CRA enhance its ability to access accurate and timely tax and financial information from offshore tax jurisdictions.

Combatting carousel schemes and other aggressive GST/HST schemes aimed at obtaining unwarranted GST/HST refunds continued to be a priority in 2023–24. The enhancements to the CRA’s intelligence and risk assessment system have contributed to the CRA’s efforts in the detection and prevention of these aggressive GST/HST arrangements. Early intervention approaches have been effective in identifying scheme participants earlier in the cycle and in closing suspicious accounts before a return is filed and an unwarranted refund is paid.

As part of the CRA’s ongoing fight against criminal tax evasion in fiscal year 2023–24, 13 taxpayers were convicted for evading a total of $13.5 million in federal tax, and 9 new cases which included 14 taxpayers, were referred to the PPSC for possible criminal prosecution. In an effort to expand its work to ensure tax fairness and help law enforcement disrupt illegal activity, in 2023–24, the CRA and its partners uncovered over $95 million in unreported income from illicit enterprise, which resulted in $51 million in fiscal impact.Footnote 7

The CRA increased the number of audits for tax shelter promoters, advisors, and their clients to help discourage tax shelter promoters and advisors from selling offensive arrangements. As a result, taxpayers continued to be effectively deterred from becoming involved in aggressive tax planning arrangements. Third-party penalties (TPP), as enforced by the CRA, apply to promoters, advisors, or third-parties who intentionally file or prepare false statements or omit information on someone else’s tax returns. The penalties discourage behaviour that leads to non-compliance and vary based on the degree of involvement and the tax amount affected. In 2023–24, the CRA continued to streamline the TPP process, enhance the identification of schemes, and increase internal and external engagement activities including:

- training

- monitoring trends

- issuing tax alerts to warn Canadians about tax schemes and tax shelter promoter arrangements, and

- engaging the Joint International Taskforce on Shared Intelligence and Collaboration members to discuss common issues regarding tax advisors, tax shelter promoters and enablers

This priority contained 11 commitments in the CRA’s 2023–24 Departmental Plan. During this reporting period, the CRA met 10 of its 11 commitments. Refer to Annex A for a complete list of commitments and their results identified as having been met or not met.

B1. Combat aggressive tax planning and tax evasion

The CRA increased its resources to address tax avoidance within the high-net-worth (HNW) population. Audit programs continue to review program analytics, identify non-compliance, and focus audit efforts on the highest risk files.

Significant investments from the Government of Canada have helped the CRA to increase collaboration with both domestic and international partners, leverage improved technology, and enhance access to new data sources. These improvements give the CRA a better ability to target individuals and entities that engage in aggressive tax planning to either evade or avoid their tax obligations and reporting requirements.

During 2023–24, the CRA actively worked with its international and domestic partners to advance tax reform. This included participating in OECD meetings, working with the Department of Finance Canada, and supporting international partners through capacity building. These efforts focused on progressing the OECD's Pillar One and Pillar Two (PDF) reforms and will continue beyond 2023–24. Work also continued toward implementing the Digital Services Tax until Pillar One is brought into effect.

The Underused Housing Tax (UHT) is one of the many tools the Government of Canada is using to combat the housing crisis in Canada. A compliance pilot focusing on ensuring compliance, determining payable taxes, and educating property owners was launched in November 2023, and extended until October 2025. As of March 31, 2024, 432 compliance cases were initiated, with 48 completed. The CRA has contacted around 400 key partner associations and conducted 60 webinars with 2,713 participants.

To provide taxpayers and those who assist taxpayers with greater clarity and certainty regarding their tax obligations, the CRA published the mandatory disclosure rules (MDR) guidance and prescribed forms (including additional timely updates) and continued to work with partners by participating in various forums. Enhancements to these rules align with international best practices and aim to better equip the CRA with information to respond to tax risks.

Performance outcomes and results for commitments under this objective for 2023–24:

- Increased audit resources focused on the HNW population by expanding existing programs. The activities of these programs included the completion of over 700 audits, resulting in a total of $1.8 billion in fiscal impact.Footnote 8

- Continued to make progress toward reforming the international tax system as it applies to large multinational enterprises by engaging with the CRA’s international and domestic partners. The CRA is steadily moving toward putting in place the administrative system requirements to implement Pillar Two (as outlined within the Global Minimum Tax Act), while continuing to support ongoing discussions at OECD meetings.

- Developed and enhanced business intelligence (BI) tools for the HNW population. This includes leveraging various third-party data sources to enhance existing tools and solutions.

- Increased audits focused on tax promoters, advisors, and their clients. This has allowed the CRA to address promoter arrangements faster and more efficiently. Over 850 audits were completed in 2023–24, resulting in $101 million in fiscal impact.

- Successfully implemented the enhanced MDR, which received Royal Assent on June 22, 2023. The MDR guidance, as well as the RC312 (Reportable Transaction and Notifiable Transaction) and RC3133 (Reportable Uncertain Tax Treatments) information returns were finalized in time to allow taxpayers to meet their obligations. The MDR website was created, along with the Notifiable Transactions (NT) email notification feature, whereby subscribers are notified of updates to the guidance and any future NT designations. There are currently over 1,900 subscriptions to the notification feature. MDR presentations were delivered at various tax conferences to provide greater certainty and comfort to the tax community.

- Convened a multi-partner working group on reporting fees for services to get feedback and make sure it thoroughly understood the concerns of external partners. In March 2024, the CRA completed two engagements with key partners from the business community, including the Tax Executives Institute, the Canadian Federation of Independent Business, the National Payroll Institute, and the Chartered Professional Accountants of Canada. The discussions covered various topics, including options for reporting vehicles and thresholds.

- The CRA identified $822 million. in additional revenue as a result of various budget investments by the Government of Canada. An annual target is set and used to measure our progress towards the 5-year commitment. While the 2023–24 results fell approximately $94 million short of this year’s target, the CRA is confident it will meet its five-year commitment as it continues to implement new initiatives announced in Budget 2022 and it sees total fiscal impact from its compliance activities continuing to increase year-over-year.

- Continued to combat aggressive GST/HST schemes, and exceeded the Budget 2021 expectation for 2023–24 to identify $250 million in unwarranted GST/HST refunds by $42 million. The CRA's multifaceted strategy has continued to evolve with the advancement of risk assessment systems and more effective measures to address carousel schemes and emerging threats.

- As a result of a Government of Canada investment, resolved an additional $1.27 billion in debt during this reporting period, which exceeded the target of $1.2 billion.

B2. Emergency and recovery benefits compliance

Post-payment audits on the emergency business subsidies are ongoing to further examine the level of compliance of claimants who, based upon risk assessment, warrant further review.

Generally, compliance audits have largely found that most claimants have applied the rules correctly and have made every effort to comply. However, the CRA has identified a number of subsidy claimants that are suspected of willful and aggressive non-compliance in claims submitted as part of the Canada Emergency Rent Subsidy and the Canada Emergency Wage Subsidy. These claimants include certain third-party preparers of business subsidy claims who may have promoted and assisted in breaking or bending the rules, or knowingly facilitated the production of inaccurate or non-compliant claims. Throughout 2023–24, the CRA continued to identify and pursue subsidy claimants

Performance outcomes and results for commitments under this objective for 2023–24:

- Continued to conduct post-payment audits on the Canada Emergency Wage Subsidy (CEWS) and Canada Emergency Rent Subsidy (CERS) to make sure those who received emergency response benefits were in fact entitled to them.

- As of March 31, 2024, and since the start of CEWS post-payment audits, over 3,600 audits were completed representing $12.6 billion in CEWS claimed; over $590 million claim amounts were denied or reduced, and $7.7 million in penalties were assessed.

- As of March 31, 2024, and since the start of CERS post-payment audits, over 800 CERS audits were completed representing $52 million in CERS claimed; over $39.3 million claim amounts were denied or reduced and $7.3 million in penalties were assessed.

- Continued to identify and pursue subsidy claimants it suspected of willful and aggressive non-compliance, including certain third-party preparers of potentially ineligible business subsidy claims. As of March 31, 2024, over 1,700 audits were completed representing $110 million in CEWS/CERS claimed; over $97 million claim amounts were denied or reduced and $21.6 million in penalties were assessed.

C. Strengthen security and safeguard privacy

Canadians place their trust in the CRA to safeguard their information from unauthorized access or disclosure. That trust is crucial in promoting their compliance with their tax obligations. The CRA remains committed to continually enhancing its security technologies, processes, and controls to further protect the confidentiality and integrity of sensitive information from both internal and external threats. This is why the CRA has strict and ongoing measures in place to analyze, identify, and lessen potential threats; neutralize threats when they occur; prevent unauthorized changes to clients’ accounts; and protect sensitive data. In addition, CRA employees are provided with information and awareness sessions on various security subjects, such as unauthorized accesses, phishing and working in a hybrid environment. This is critical, as despite advanced technology, a portion of cyber breaches are caused by human error, emphasizing that vigilant, well-trained personnel are crucial in safeguarding against attacks.

The CRA has enhanced its ability to help businesses protect their accounts from fraudulent access through active identity protection measures and through monitoring using various tools, such as risk scoring. This has allowed the CRA to develop the Disbursement Report, which was implemented as a tool in 2023–24. The report serves to help identify and intercept pending payments to businesses that may be unauthorized.

By increasingly embedding privacy, accessibility, and security into the design of its programs and processes, as well as fostering a strong security culture among employees, the CRA has sought to build and maintain trust with Canadians.

This priority contained 7 commitments in the CRA’s 2023–24 Departmental Plan. During this reporting period, the CRA met 5 of its 7 commitments. Refer to Annex A for a complete list of commitments and their results identified as having been met or not met.

C1. Enhanced security and privacy

Being the holder of one of the largest repositories of personal and financial information in Canada, the CRA ensures that all information is protected through effective controls. A multi-layered approach to security, including system and business controls and safeguards, protects against potential internal and external threats and privacy breaches.

Artificial intelligence (AI) technologies offer promise for improving the efficiency of how the CRA provides digital services and delivers its programs. The rapid emergence of generative AI and its direct impact on the security of information, has made mitigating risks associated with these tools a priority for the CRA. It must do this to maintain confidentiality and integrity of personal and financial information. The CRA has implemented access controls for online generative AI tools and published guidance for employee use of online generative AI. These actions help ensure employees do not use sensitive CRA and taxpayer data in online generative AI systems. The CRA is also part of an OECD task force to develop a Framework on trustworthy AI (PDF) and is considered a leader in this field.

"The adoption of AI is a huge opportunity for the CRA to both improve service and save taxpayers’ money. It has been exciting to observe the evolution and implementation of AI at the CRA and to contribute to that process. The Board will encourage the CRA to do more with the technology, understanding it must be accompanied by solid governance practices and AI stewardship."

Performance outcomes and results for commitments under this objective for 2023–24:

- Continued to work with partners on the design of a privileged access management (PAM) solution to improve the CRA’s privileged administration process by using advanced security controls to prevent unauthorized access within its systems. Once implemented, a PAM solution will increase the CRA’s overall security posture and enhance compliance with CRA policies and industry best practices. This commitment was not met due to the project scope expanding to an enterprise-wide PAM solution. This delay does not pose a significant risk to the CRA.

- Remained committed to strengthening taxpayer information protection from insider activity risks, although it did not meet the original target date due to delays with the vendor providing the technological solution. The work to implement models to detect insider risks using a technological solution is ongoing and will contribute to a continuous assurance approach by identifying patterns that are known precursors of insider security risks. Missing this target does not pose a significant risk to the CRA.

- Created and communicated new awareness products and guidance related to employees’ security responsibilities. These products include updated training materials, news articles, posters, and digital screens for use in various CRA office buildings across the country. The topics of these products include promoting in office security tips, such as emergency response, piggybacking awareness, locking computer screens when not in use, and clean desk guidelines.

- Launched an automated confidentiality tool for business enquiries to reduce the risk of human error in correctly identifying those who are calling CRA contact centres. It improves the National Confidentiality handle time and Accuracy Results by streamlining the tasks an agent must do to answer an enquiry.

- Improved content on various pages on Canada.ca to better highlight new tools available for Canadians to report suspicions of identity theft on a 24/7 basis.

- The Interactive Voice Response system was successfully released in June 2023 and has received 5,383 calls.

- The CRA Identity Theft Webform was released in October 2023 and 348 forms were received by March 31, 2024 (individual accounts only).

C2. Timely responses to access to information and privacy (ATIP) requests

The Access to Information Act (ATIA) gives Canadians, permanent residents, and corporations or individuals present in Canada the right to ask for access to records under the Government of Canada’s control. The Privacy Act protects the privacy of individuals regarding the personal information a government institution has about them and gives them the right to ask for corrections to their information.

The CRA must respond to a formal request made under either of these acts within 30 calendar days of the date it receives the request or give notice that an extension of the deadline is required in accordance with the legislation. During 2023–24, the CRA continued to identify efficiencies through its Backlog Elimination Plan and provided more responses digitally. By increasing efficiency, the CRA was able to close all backlogged cases received before March 31, 2020. The CRA maintains its commitment to timelier responses to requests under the ATIA and the Privacy Act.

Performance outcomes and results for commitments under this objective for 2023–24:

- Closed all backlogged ATIA and Privacy Act requests received before March 31, 2020, by December 31, 2023. This is in line with the projected timeline of the Backlog Elimination Plan.

- Met its commitment and responded digitally to 90% of ATIA and Privacy Act requests.

Key risks

The CRA continually monitors its internal and external environments for events that could affect whether it achieves its strategic priorities and objectives. By identifying and managing risks properly, the CRA continues to be well positioned to deliver on its mandate and to maintain the trust and confidence of its clients.

Service experience and reputation management

To mitigate the risk of not meeting client expectations in delivering modern, digital options, the CRA has leveraged client research to further enhance its secure online portals, optimize content on Canada.ca, and understand challenges that clients face in end-to-end journeys through the following initiatives:

- Conducted user-experience research and improved the web content on Canada.ca to make it easier to find and understand.

- Introduced a new Progress Tracker within the secure portals, which accumulated 10 million visits during 2023–24, and made improvements to the look and feel of the portals for a more intuitive and consistent experience. Regular analysis of Portal Exit Survey results continues to inform the ongoing development and enhancement of digital services, secure portals, and related capabilities.

- Simplified the initial portal registration by enabling Canadians to use real-time identity validation when completing the login process for the first time.

- Consultations with sole proprietors identified challenges they face in meeting their tax obligations. These consultations will help the CRA design future solutions that effectively address their needs.

Tax debt and offshore and aggressive tax planning

In 2023–24, the CRA identified that there were risks of non-compliance from tax practitioners, tax shelter promoters, and advisors aiding aggressive tax planning schemes; the taxation of crypto-asset transactions; and HNW individuals avoiding or evading taxes using aggressive tax planning schemes.

To mitigate these risks, the CRA has been engaging with other tax administrations facing similar challenges. As a result, the CRA has been working on initiatives to bring a whole-of-agency approach to combatting carousel schemes, a heightened focus on early intervention, and continued advancements in data tools and analytics.

The CRA also engages with internal and external partners within the tax community to share best practices and enhance business intelligence mechanisms. As well, the CRA continues to disseminate communication products to raise awareness and help taxpayers understand how different crypto-asset events affect their tax obligations.

The CRA's increased resources dedicated to audit coverage focused on the HNW population has allowed it to address tax avoidance faster and more efficiently while targeting high risks of non-compliance.

The implementation of the mandatory disclosure rules has also given the CRA an additional avenue to deal with aggressive tax planning.

"As the economy evolves, taxing the digital economy and large multinational corporations remains a hot topic. Compliance falls outside of the Board’s mandate, but we are aware of the CRA’s efforts to use its resources effectively to make sure everyone participating in the economy complies with their obligations. The purpose of this important work is to give taxpayers the support and information they need to understand and fulfill their tax obligations and take compliance and enforcement actions when necessary. The Board will continue to support the CRA’s efforts to improve its ability to ensure tax compliance and combat tax evasion in any area of the economy."

Cyber security and protection of taxpayer information

The CRA continues to emphasize technological solutions, employee education, and proactive risk management to safeguard the information, assets, and systems it holds from cyber threats and external fraud risks.

The CRA limits potential cyber-attacks, decreases the likelihood of data breaches, and ensures employees are equipped to recognize and respond to cyber, account security, and external fraud threats by:

- Developing technological solutions as well as security and compliance products focused on encryption and authentication.

- Fostering a culture of security awareness.

- Regularly assessing security measures to proactively identify and address vulnerabilities.

- Establishing a training framework for developers that focuses on cyber security to help them find vulnerabilities sooner when developing applications.

- Piloting insider risk detection rules (for example, mass file deletion in the Microsoft 365 environment, and risky browser usage, risky file uploads) that are tied to events such as employees leaving the organization or employees recently joining.

- Exploring new technologies that will help the CRA better label its data, which will also help with data-loss prevention activities.

External dependencies

The CRA continues to manage its dependencies on external parties. These dependencies are mainly tied to its relationships with other government departments, including the Treasury Board of Canada Secretariat, Shared Services Canada, and the Department of Finance Canada. The CRA works closely with these partners to ensure that shared initiatives such as the Return to Office and the Refocusing of Government Spending (RGS), are completed effectively and efficiently.

Resources required to achieve results

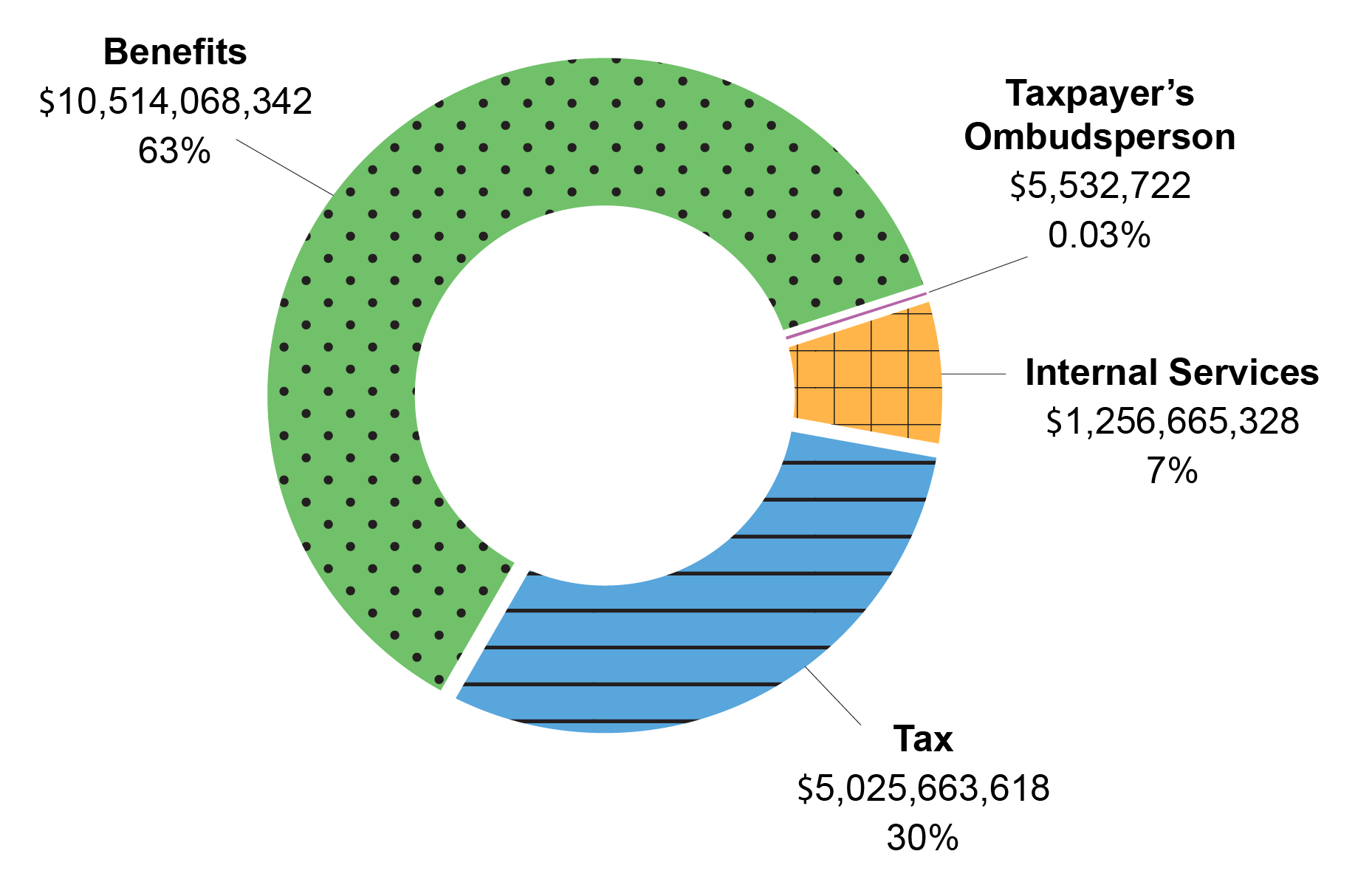

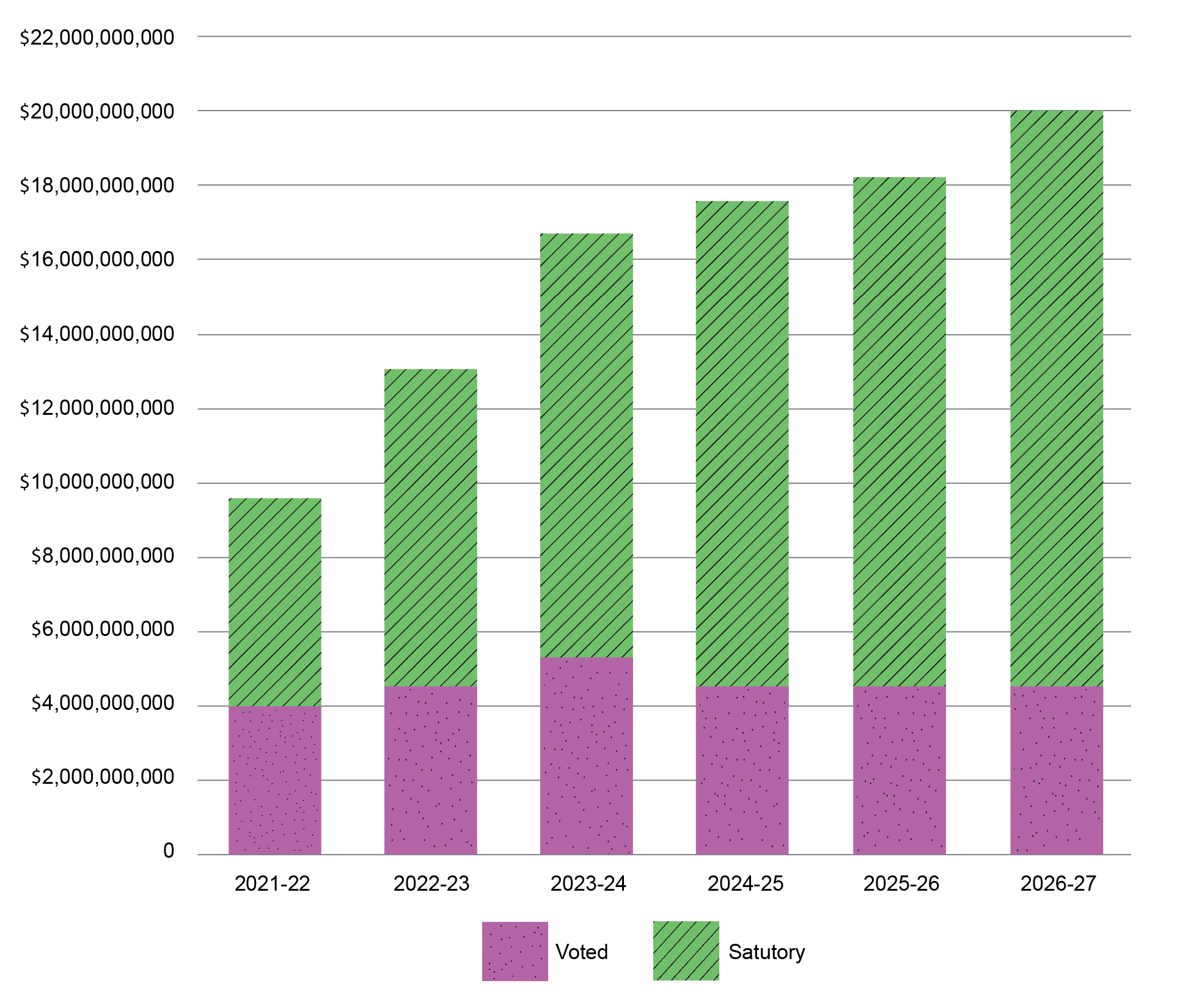

Table 3: Snapshot of resources required for tax

Table 3 provides a summary of the planned and actual spending and full-time equivalents (FTEs) required to achieve results.

Resource

|

Planned

|

ActualFootnote 9

|

|---|---|---|

Spending

|

$4,136,547,016

|

$5,025,663,618

|

Full-time equivalentsFootnote 10

|

39,907

|

43,866

|

Table 4: Snapshot of resources required for benefits

Table 4 provides a summary of the planned and actual spending and full-time equivalents (FTEs) required to achieve results.

Resource

|

Planned

|

ActualFootnote 11

|

|---|---|---|

SpendingFootnote 12

|

$9,683,526,641

|

$10,514,068,342

|

Full-time equivalents

|

2,389

|

2,658

|

Complete financial and human resources information for the CRA’s program inventory is available on GC InfoBase.

Related government-wide priorities

Gender-based analysis plus

The CRA is dedicated to administering its programs fairly, aligned with the Government of Canada’s commitments to Gender-based Analysis Plus (GBA Plus). To support its work, in 2023–24, the CRA developed a three-year action plan that builds on the activities and results of its previous action plan. The 2024–27 Action Plan aligns with the Government’s direction and requirements, as well as the CRA’s vision to be a world-class tax and benefits administration that is trusted, fair, and helpful by putting people first. The Plan also clearly states the CRA’s intent for GBA Plus and shares the outcomes and areas of focus the CRA will pursue. This will ensure that fairness is a central consideration in CRA decision-making and in delivering tax and benefits programs.

In addition to developing the three-year action plan, the CRA made significant progress in strengthening its engagements with its program areas to develop high-quality GBA Plus assessments. To complement this, the CRA increased the number of training sessions and workshops that promote the concept and applicability of GBA Plus across various CRA programs and services. It actively promoted GBA Plus tools and resources, including the Canada School of Public Service online training, and the CRA’s GBA Plus Awareness Week.

The CRA also focused on collaborating with external-facing programs to establish plans to collect disaggregated data. It also fostered collaborations with internal and external stakeholders to advance GBA Plus practices, drawing from best practices across government departments and from peer tax administrations internationally. Notably, the CRA’s participation in Women and Gender Equality Canada’s GBA Plus Implementation Survey 2022–23 provided valuable insights into how other federal government departments are putting these practices into place.

Additionally, leading and participating in the OECD’s Gender Balance Network (GBN) showed the CRA’s commitment to improving gender balance in leadership positions across tax administrations. The CRA used disaggregated data to take a fact-based approach to decision-making about tax and benefit administration. The CRA also piloted the GBN’s Gender Balance Maturity Model Self-Assessment which aimed to guide administrations in evaluating their current level of maturity and identifying potential reforms they can make over time to enhance gender balance within their tax organizations.

United Nations 2030 Agenda for Sustainable Development and the Sustainable Development Goals

The CRA has continued to work with its partners and stakeholders to advance the United Nations (UN) 2030 Agenda and the Sustainable Development Goals (SDGs). Internationally, the CRA upholds the SDGs through diverse and inclusive global engagements and partnerships with other countries to help them achieve the SDGs’ objectives. For example, the CRA provided assistance aimed at strengthening the tax capacity of recipient administrations. Through Tax Inspectors Without Borders, (a joint initiative of the OECD and the UN Development Program), the CRA provided expert assistance in risk assessment, audit techniques, and transfer pricing techniques related to taxation (for example, in the forestry and mining industries) in certain developing countries.

More information on the CRA’s contributions to Canada’s Federal Implementation Plan on the 2030 Agenda and the Federal Sustainable Development Strategy can be found in its Departmental Sustainable Development Strategy and the Departmental Sustainable Development Strategy Performance Reports.

"In 2023–24, the Board had an opportunity to give feedback on the CRA’s Departmental Sustainable Development Strategy, which supports the Government of Canada’s commitment to the United Nations sustainable development goals. The Board encouraged the CRA to demonstrate a serious commitment to the cause, specifically around climate action and waste and emissions reduction, by providing concrete and impactful metrics for tangible results."

Innovation

The CRA continues to foster a culture of innovation to improve its programs and services by encouraging experimentation and iterative approaches in process, design and implementation activities.

Automatic tax filing

Many lower income and vulnerable Canadians are missing out on valuable benefit and credit payments because they are not filing their income tax and benefit returns. Benefit and credit payments, such as the Canada child benefit and the goods and services tax/harmonized sales tax credit, help make life more affordable.

As announced in budget 2023, the CRA is ensuring more lower income Canadians have the ability to quickly and easily auto-file their tax returns. The CRA has expanded its SimpleFile by Phone (formerly called File My Return) service for 2023–24, inviting more than 1.5 million individuals to automatically complete and submit their tax returns in February 2024. The CRA is on track to increase this number to 2 million by 2025.

CVITP Direct Referral Process

In support of its commitment to increase the number of individuals helped through the CVITP, the CRA piloted a new way to connect eligible taxpayers to CVITP clinics. To do this, the CRA enabled CRA staff to directly refer consenting taxpayers to specific clinics.

Initial results showed that during the pilot period, 50% of taxpayers who chose the CVITP Direct Referral Process filed their income tax return at the clinic they were referred to. This is compared to 10% of individuals who filed at a CVITP clinic after they were provided only with a clinic's contact information.

Providing centralized service for conducting geospatial analysis to teams and programs across the CRA

The CRA is always looking for ways to proactively support taxpayers and deliver seamless client experiences and tailored approaches. In support of this, the CRA started using geospatial analysis, which provided key geographic information that helped identify taxpayers potentially affected by natural disasters. The data allowed certain CRA programs to make evidence-based decisions for establishing proactive relief efforts for Canadians in those zones. For example, the CRA used geospatial mapping to identify taxpayers affected by the Northwest Territories and British Columbia wildfires in August 2023. The mapping allowed the CRA to assess the implications from a tax perspective and identified a considerable amount of GST/HST and T2 filers in the affected regions.

The CRA also used its geospatial analysis to help decide on future locations for CVITP clinics.

Program inventory

The program inventory identifies all of the CRA’s programs that contribute to its core responsibilities and results.

Tax is supported by the following programs:

- Tax services and processing – The CRA helps businesses and individuals to comply with Canada’s tax laws by processing their information and payments, and providing related services.

- Returns compliance – The CRA ensures that individuals, businesses, and trusts are compliant with their withholding, remitting, reporting, and filing obligations.

- Collections – The CRA collects tax and non-tax debts on behalf of the federal, provincial, and territorial governments, as well as for other government departments and agencies.

- Reporting compliance – The CRA protects the integrity of Canada’s self-assessment tax system through education and proactive efforts that are aimed at promoting compliance.

- Objections and appeals – The CRA offers an impartial review process for taxpayers who wish to file a formal dispute.

- Taxpayer relief – The CRA administers the process under which relief of penalties and interest may be granted to taxpayers under certain circumstances.

- Service feedback – The CRA offers clients a process to provide feedback, including complaints, suggestions and compliments, and resolve problems about the service, quality, or timeliness of the CRA work.

- Charities – The CRA administers a national program for the regulation of charities, registered Canadian amateur athletic associations, and registered national arts service organizations and registered journalism organizations.

- Registered plans – The CRA is responsible for registering and monitoring deferred income and savings plans.

- Policy, rulings and interpretation – The CRA offers taxpayers, registrants, and tax intermediaries binding rulings and non-binding interpretations of the acts the CRA administers.

Benefits is supported by the following program:

- Benefits – The CRA ensures that Canadians obtain the support and information they need to know what benefits they may be eligible to receive, that they receive their benefit payments in a timely manner, and have avenues of redress when they disagree with a decision on their benefit eligibility.

Additional information related to the program inventories for tax and benefits is available on the Results page on GC InfoBase.

Internal services

Description

Internal services are the services that are provided within the CRA so that it can meet its corporate obligations and deliver its programs. There are 11 categories of internal services:

- management and oversight services

- communications services

- legal services

- human resources management services

- financial management services

- security services

- information management services

- information technology services

- real property management services

- materiel management services

- acquisition management services

Progress on results

The CRA presents its plans under four strategic priorities that align to its mandate, Departmental Results as well as Government priorities. The following section describes the results of the CRA’s commitments for the strategic priority related to internal services in 2023–24, compared with the planned results set out in CRA’s departmental plan for the year.

D. Nurture a high-performing, diverse, and inclusive workforce in a modern, flexible, and accessible workplace

The CRA maintains a high-performing, diverse, and inclusive workforce that drives a World-Class Tax and Benefit Administration. The CRA fosters a workplace where collaboration, professionalism, respect, and integrity thrive. In 2023–24, the CRA continued to support employee accessibility as well as compliance with official languages obligations. Valuing each employee’s contribution, the CRA aims to foster a work environment where employees have a sense of belonging and can achieve their full potential. This past year, the CRA took great strides to further modernize human resources programs and processes to support the hybrid model of work.