Part-time student with a scholarship

Pre-test question

Sorry, that is incorrect

The scholarship exemption for part-time students is equal to the tuition paid, plus the costs of program-related materials, plus the $500 basic scholarship exemption.

That is correct

The scholarship exemption for part-time students is equal to the tuition paid, plus the costs of program-related materials, plus the $500 basic scholarship exemption.

Instructions

- Open the tax software

- Review the Background information and Required slips (tax slips, receipts, etc.)

- Provide all required information for the appropriate sections of the tax software

- Once completed, compare your results with the solution provided

- Afterwards, refer to Key points of the tax software and the Takeaway points

Background information

Situation

Antoine is working full time and pursuing a part-time degree at the University of Canada which granted him a scholarship. Antoine received Form T2202, Tuition and Enrolment Certificate, from the school.

Antoine’s 2024 notice of assessment (NOA) indicates that his Canada training credit limit (CTCL) for 2025 is $1,500 and he wants to claim this amount. He does not have any unused tuition amounts from prior years. He also wishes to claim $300 for program-related materials he paid for during his studies.

| Category | Data |

|---|---|

| Name | Antoine Grey |

| Social insurance number (SIN) | 000 000 000 |

| Address | 123 Main Street City, Province X0X 0X0 |

| Date of birth | August 17, 1980 |

| Marital status | Single |

Required slips

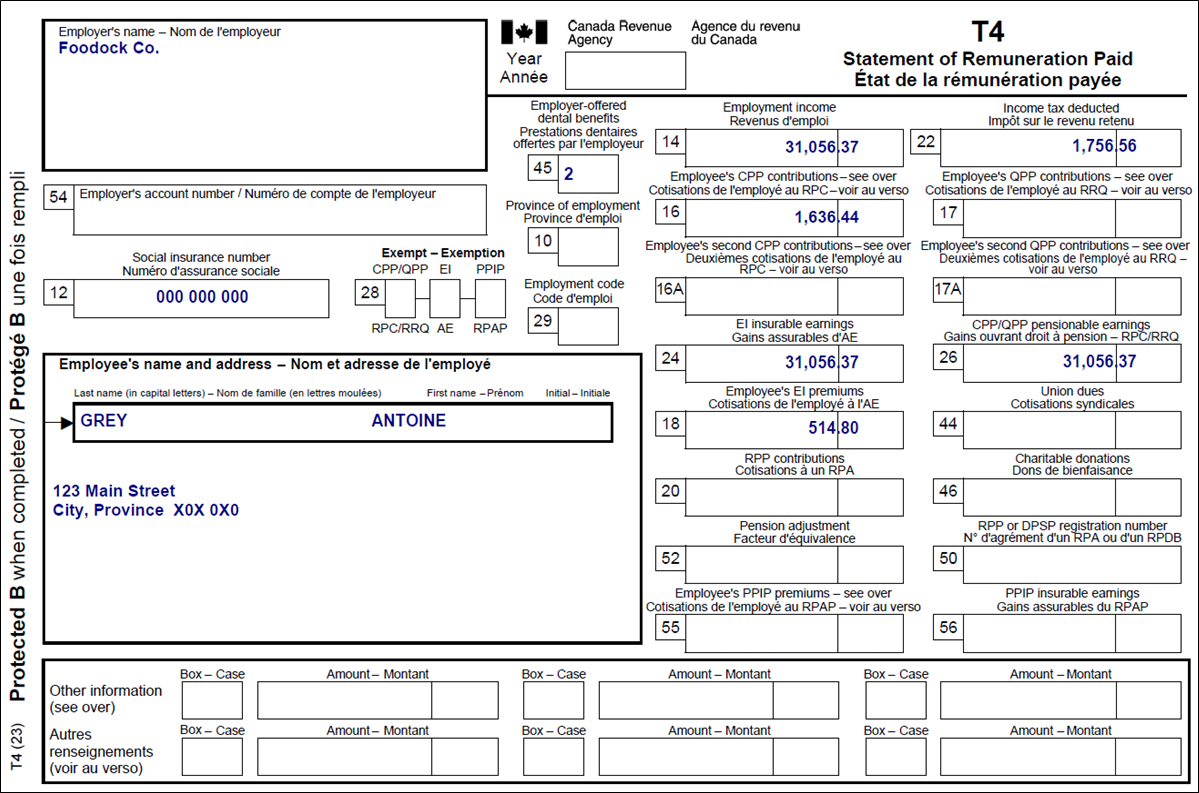

T4 – Statement of Remuneration Paid (Foodock Co.)

Text version of the above image

T4 – Statement of Remuneration Paid

Protected B

Employer's name: Foodock Co.

Employee's name and address:

Last name: Grey

First name: Antoine

123 Main Street

City, Province X0X 0X0

Box 12: Social insurance number: 000 000 000

Box 14: Employment income: 31,056.37

Box 16: Employee's CPP contributions – see over: 1,636.44

Box 18: Employee's EI premiums: 514.80

Box 22: Income tax deducted: 1,756.56

Box 24: EI insurable earnings: 31,056.37

Box 26: CPP/QPP pensionable earnings: 31,056.37

Box 45: Employer-offered dental benefits: 2

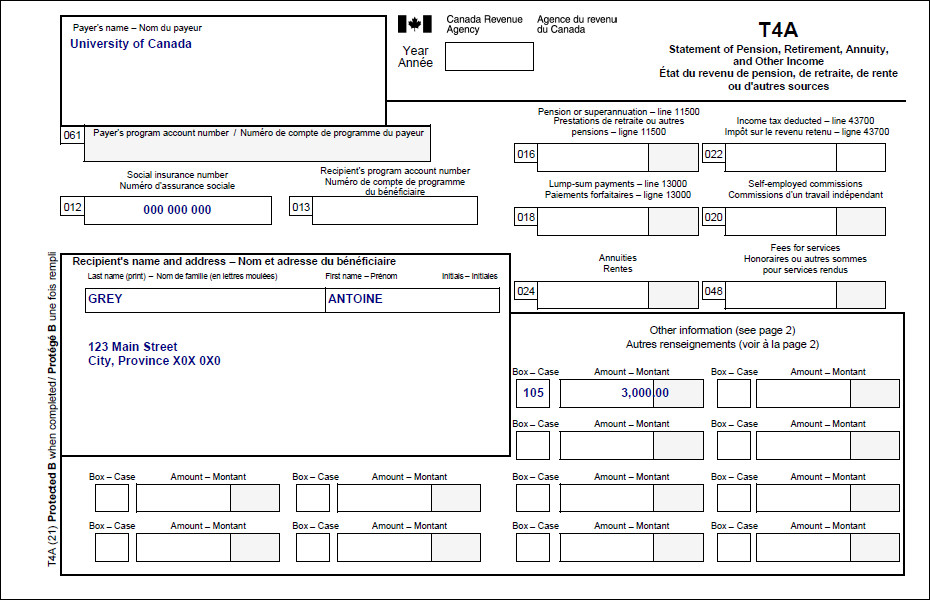

T4A – Statement of Pension, Retirement, Annuity, and Other Income (University of Canada)

Text version of the above image

T4A – Statement of Pension, Retirement, Annuity, and Other Income

Protected B

Payer's name: University of Canada

Recipient's name and address:

Last name: Grey

First name: Antoine

123 Main Street

City, Province X0X 0X0

Box 012: Social insurance number: 000 000 000

Box 105: 3,000.00

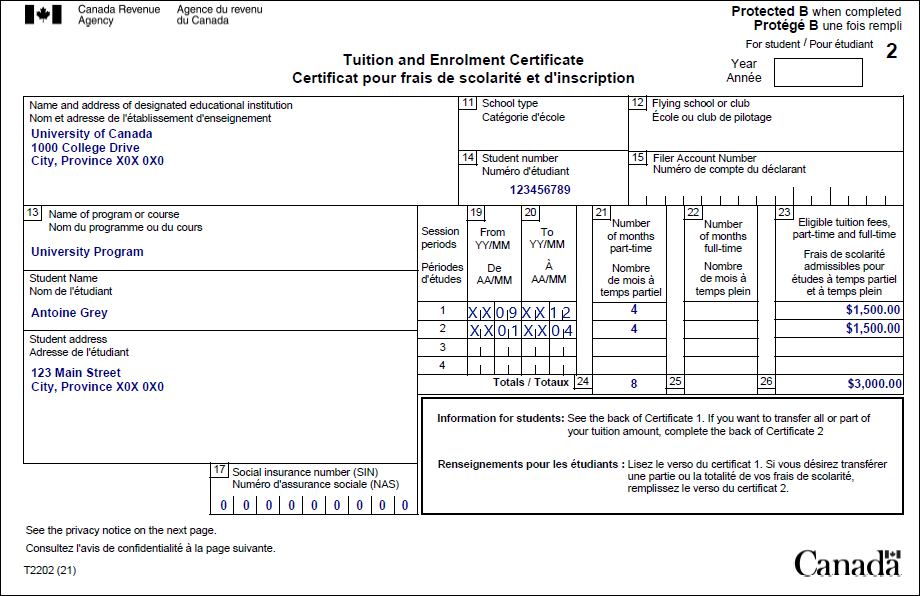

T2202 - Tuition and Enrolment Certificate (University of Canada)

Text version of the above image

Tuition and Enrolment Certificate - For student (slip 2)

Protected B

Name and address of designated educational institution:

University of Canada

1000 College Drive

City, Province X0X 0X0

Box 13: Name of program or course: University Program

Student Name: Antoine Grey

Student address:

123 Main Street

City, Province X0X 0X0

Box 14: Student number: 123456789

Box 17: Social insurance number (SIN): 000000000

Session periods

Session 1

Box 19: From YY/MM: XX/09

Box 20: To YY/MM : XX/12

Box 21: Number of months part-time: 4

Box 23: Eligible tuition fees, part-time and full-time: $1,500.00

Session 2

Box 19: From YY/MM: XX/01

Box 20: To YY/MM : XX/04

Box 21: Number of months part-time: 4

Box 23: Eligible tuition fees, part-time and full-time: $1,500.00

Totals

Box 24: 8

Box 26: $3,000.00

Review your results

Solution to Part-time student with a scholarship.

Key points of the tax software

Important note

To access complete instructions on the various steps of entering data into the software, click on the title of each section below.

Antoine's interview

- Click T4 and employment income in the left side menu

- Click the + sign next to T4 income (earned in any province except Quebec) in the T4 and T4E section

- Enter the information from Antoine’s T4 slip

- Click Interview setup in the left-side menu

- Tick the box next to Pension income, other income and split pension income, COVID-19 benefits (T4A, T4FHSA, T4A(OAS), T4A(P), T4A-RCA, T4RSP, T4RIF, T1032) in the Pension and other income section

- Click T4A, T4FHSA and pension income in the left side menu

- Click the + sign next to T4A – Pension, retirement, annuity, and other income (COVID-19 benefits)

- Select [105] Scholarships, bursaries, fellowship from the OTHER INFORMATION (COVID-19 benefits) drop-down menu

- Enter the amount from Antoine’s T4A slip into the field next to it

Tuition, education, and textbook amounts (T2202)

- Click Interview setup in the left-side menu

- Tick the box next to Tuition, education, textbooks, student loans, and Canada training credit in the Student section

- Click Tuition, education, student loans in the left-side menu

- Click the + sign next to T2202 Tuition and enrolment certificate* (TL11A/TL11C) (line 32300)

- In the Current year tuition amount section, enter the information from Antoine’s T2202, Tuition and Enrolment certificate in the corresponding fields

- Click Tuition, education, student loans in the left-side menu

- Click the + sign next to Part-time program details if you received scholarship, fellowship, and bursary income to be included at line 13010

- Enter the total amount paid for tuition found on the T2202 plus the cost of materials into the Tuition fees and costs of part-time education program-related material paid for current year field

- Click Tuition, education, student loans in the left-side menu

- Click the + sign next to Canada training credit (CTC)

- Enter the CTCL amount from Antoine’s 2024 NOA into the Canada training credit limit (CTCL) for 20XX field

- Select Yes from the Do you want to claim the Canada training credit in the current year? drop-down menu

- Leave the Enter the Canada training credit you are claiming. and Enter the Canada training credit claimed in the previous years. fields blank

Takeaway points

- Full-time and part-time students are allowed a scholarship exemption equal to the tuition fees paid, the cost of program-related materials and the $500 basic scholarship exemption

- The tax software automatically calculates the scholarship exemption with the information entered

- No amount is reported on line 13010 of the tax return because Antoine’s scholarship exemption amount is greater than the scholarship he received

Canada training credit and Tuition amount

- The Canada training credit limit and tuition amounts are found on the notice of assessment or reassessment of the prior year or using Auto-fill my return

- The tax software automatically calculates the tuition amount and the Canada training credit amount on Schedule 11 with the information entered

- Antoine’s Canada training credit amount is claimed on line 45350 of the tax return

- Antoine’s tuition fees are claimed on line 32300 of the tax return and are reduced by the Canada training credit amount he is claiming