Tax data entry sections

On this page

- Interview setup

- Entering the tax slips

- Other income and information slips

- Other deductions and credits

- Provincial tax and credits

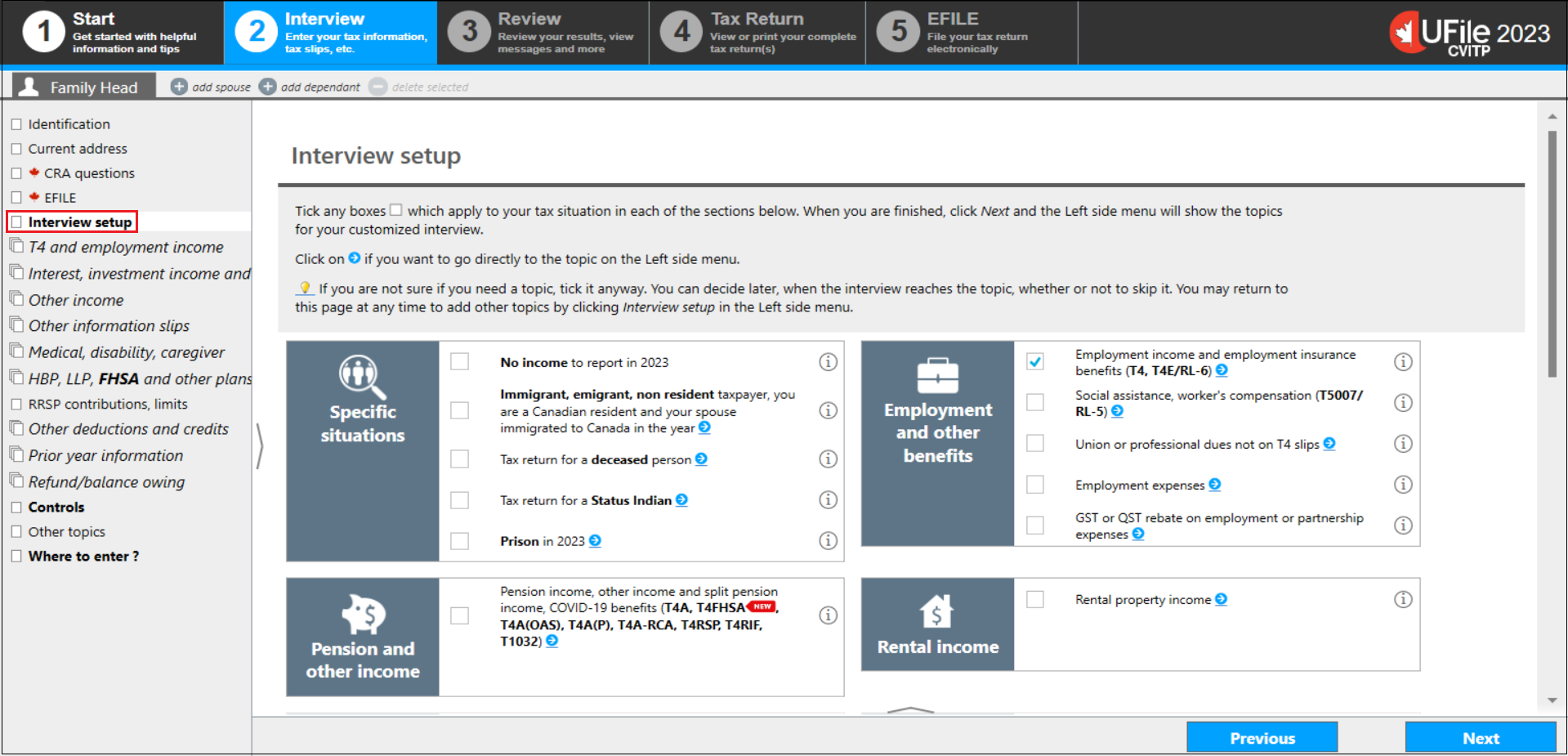

Interview setup

Text version of the above image

UFile screen

Under Interview tab

Family Head sub-tab

Interview setup topic is highlighted

Interview setup page

The Interview setup is where you indicate any Specific situations that may apply to the individual. It is also where you select the types of income, deductions or credits that you will be entering on their tax return. When you tick applicable boxes and click Next, the corresponding topics will be generated in the left-side menu, ready for you to complete.

UFile tip

If you forget to select a topic from this screen, you can always go back to the Interview setup to tick the appropriate box. Some boxes are ticked by default, but the tax return will not be impacted if any of these boxes do not apply to the individual’s situation.

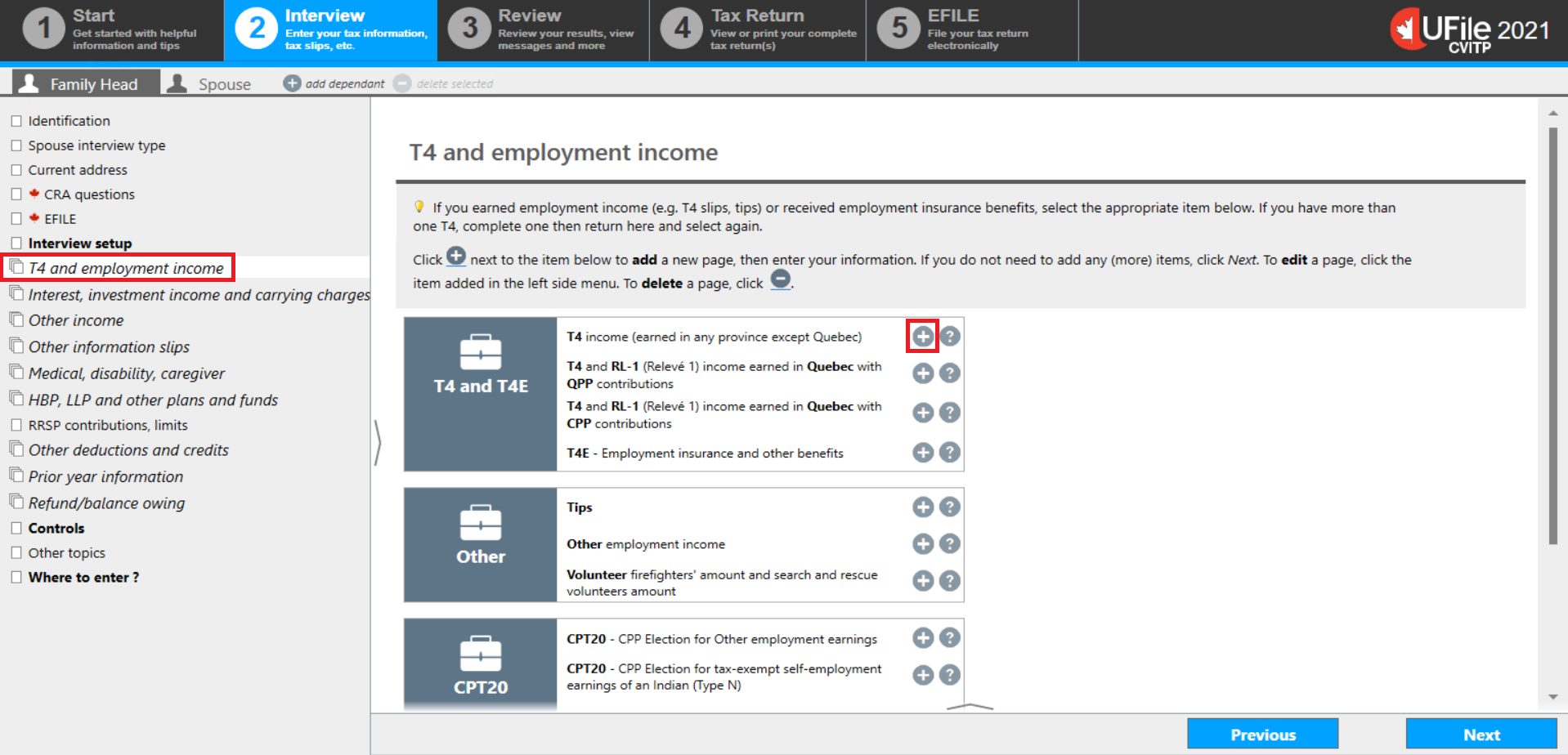

Entering the tax slips

Text version of the above image

UFile screen

Under Interview tab

Family Head sub-tab

T4 and employment income topic is highlighted

T4 and employment income page

+ sign beside T4 income (earned in any province except Quebec) is highlighted

Each topic can be accessed from the left-side menu.

Once you have clicked on a topic, applicable tax slips, deductions and credits can be added by clicking on the + sign next to each item. This will generate pages where income amounts, or other required information, are entered.

For example, if you click the + sign next to T4 income (earned in any province except Quebec), T4 income will generate as a topic under T4 and employment income in the left-side menu.

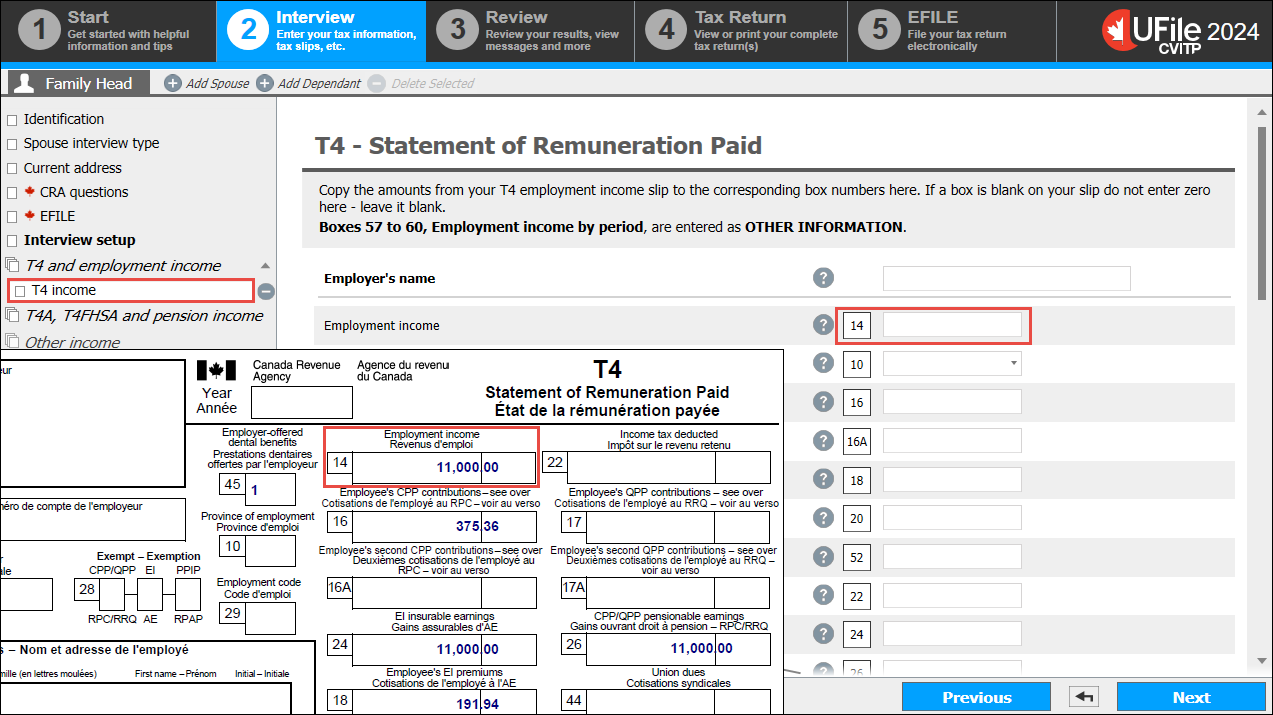

Example of entering information from a T4 slip on the T4-Statement of Remuneration Paid screen

Text version of the above image

UFile screen

Under Interview tab

Family Head sub-tab

T4 income topic is highlighted

T4 – Statement of Remuneration Paid page

Box 14 is highlighted

T4 – Statement of Remuneration Paid slip

Box 14: Employment income: 11,000.00 is highlighted

If you click the T4 income topic, the T4 – Statement of Remuneration Paid page will open, listing fields that match with the boxes found on the T4 slip. If an individual has multiple tax slips, you will need to enter each separately.

If the individual’s tax slip has a box that is not accounted for in UFile CVITP, scroll down to OTHER INFORMATION to select additional options.

As you add the issuer or employer’s names, they will populate in the left-side menu, making it easy to identify and review the information from a particular tax slip.

Enter any remaining tax slips that you may have and click Next to bring you to the next section.

If you need to correct any information for a particular tax slip, you can return to the page by clicking on the tax slip’s name in the left-side menu.

If you need to delete a tax slip, you can do this by clicking the minus - sign to the right of that specific tax slip.

If an individual has several of the same type of tax slip, such as multiple T4 slips, the software will add these up and report the total amount of employment income on the tax return.

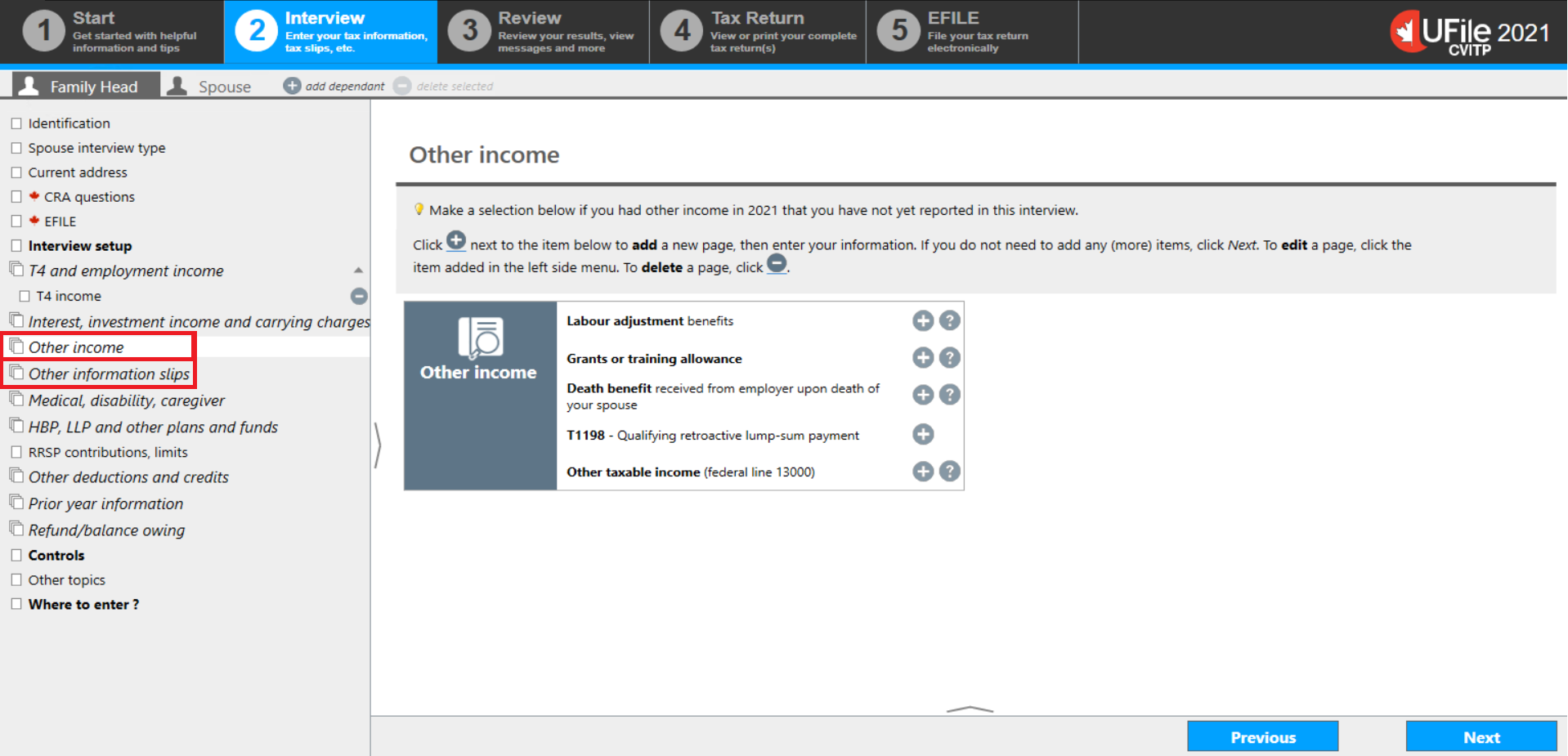

Other income and information slips

Text version of the above image

UFile screen

Under Interview tab

Family Head sub-tab

Other income topic is highlighted

Other information slips topic is highlighted

Other income page

Situations that are not found in the Interview setup may be found under Other income or Other information slips in the left-side menu.

Review these topics to see if any other situations apply to the individual.

Other deductions and credits

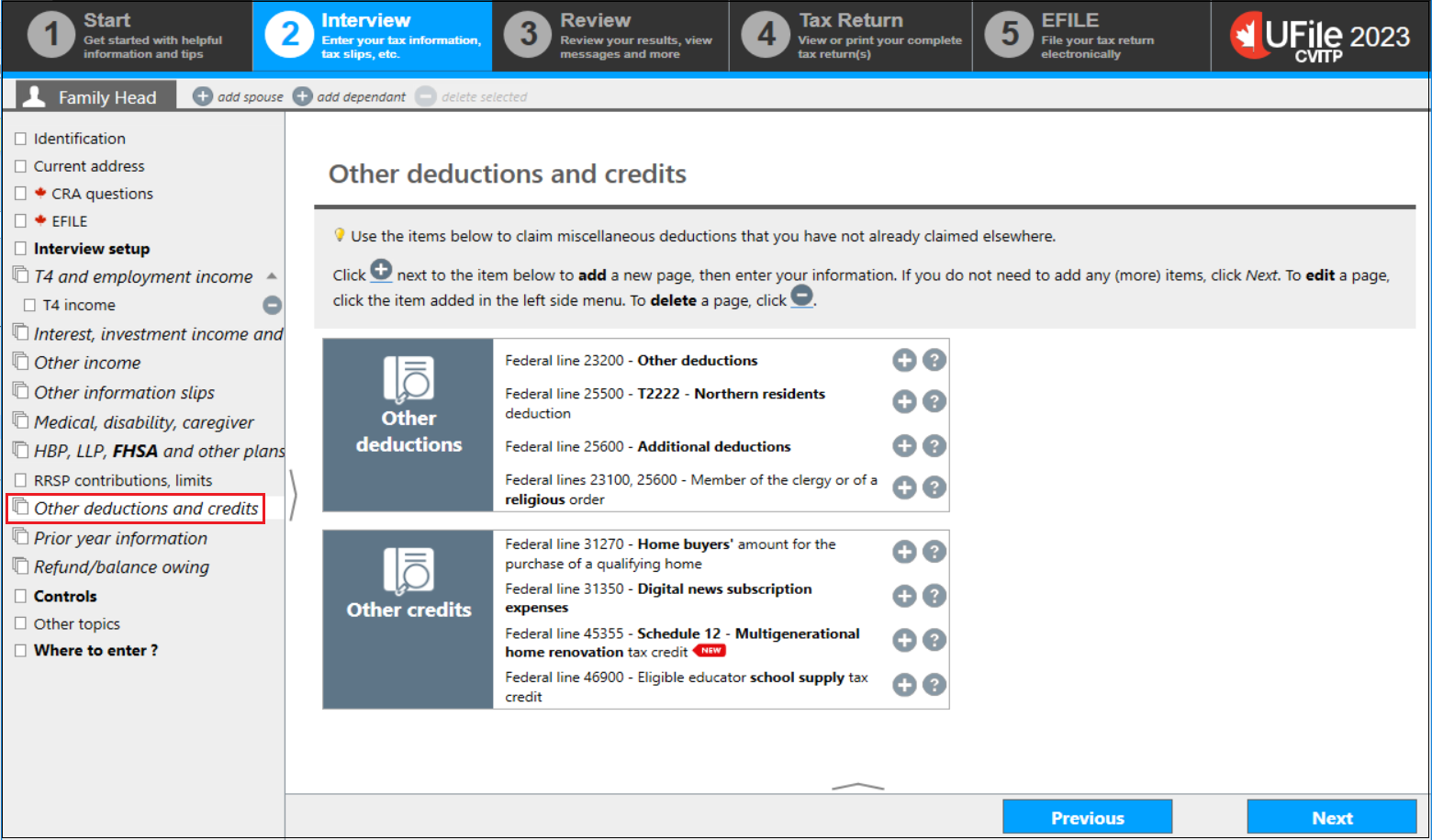

Text version of the above image

UFile screen

Under Interview tab

Family Head sub-tab

Other deductions and credits topic is highlighted

Other deducations and credits page

The Other deductions and credits topic will only be listed in the left-side menu if the box next to Other deductions and credits (including school supply, digital news subscription and home buyers amount) is ticked in Interview setup, in the Other topics section. This is where additional topics such as the Northern residents deduction are located.

For more information, refer to Types of deductions, Types of non-refundable tax credits and Types of refundable tax credits and other items in the Tax guide for volunteers along with the Tax considerations for Indigenous Peoples and newcomers section.

Provincial tax and credits

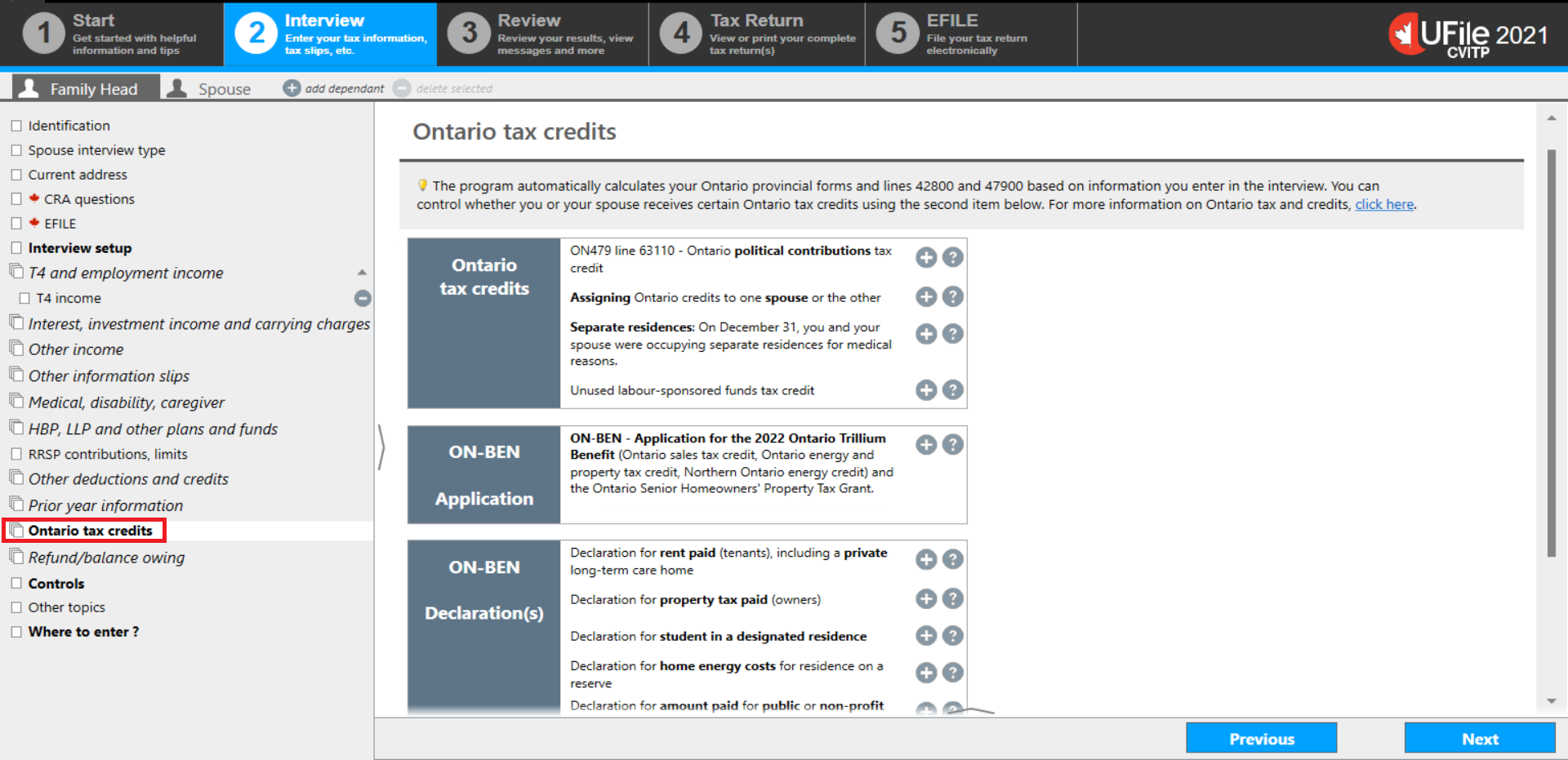

Text version of the above image

UFile screen

Under Interview tab

Family Head sub-tab

Ontario tax credits topic is highlighted

Ontario tax credits page

Additional topics, such as provincial or territorial tax and credits, populate in the left-side menu based on the information provided under the Identification topic. In this example, Ontario is the province of residence so the Ontario tax credits topic was generated.

For more information on Provincial and territorial benefits and credits, refer to Provincial and territorial benefits and credits.