Canada Learning Bond: Community partner resources

On this page

Overview

This page is for community organizations promoting the benefits of early savings for the post-secondary education of a child in a Registered Education Savings Plan (RESP) and helping to raise awareness of the Canada Learning Bond (CLB) and Canada Education Savings Grant (CESG).

Community organizations play a key role empowering families and fostering equitable access to opportunities, in part, by:

- reaching Canadians where they are

- raising awareness of the Government of Canada programs, services and benefits

The Canada Education Savings Program (CESP) works closely with community organizations to give individuals the information, tools and support they need to plan and save for the cost of post-secondary education. By building strong partnerships, the CESP helps parents, young people and learners access the support they need to open an RESP and receive education savings benefits.

Note: Find out more information about opening an RESP and receiving education savings benefits.

CLB Champions Network

The CLB Champions Network assists families living with low income, learn about ways the Government of Canada can help them save for the future costs of their child's education after high school. Its goal is making sure every child in Canada has access to an affordable post-secondary education.

The CLB Champions Network is a group of not-for-profit and community-based organizations that includes schools, financial institutions, settlement service providers, charitable and philanthropic organizations, government institutions, and other groups that share information about:

- the CLB and other education savings benefits paid into an RESP

- the processes associated with opening an RESP and accessing the CLB, including obtaining a Social Insurance Number (SIN) and filing a tax returns

The CLB Champions also share best-practices and lessons-learned on efforts to improve access to the CLB for underserved and hard-to-reach groups, particularly among eligible children and youth in:

- Indigenous communities

- those living in rural and remote communities

Sign-up to become a CLB Champion: Join our distribution list to receive program information, support, and resources.

Support for community events

Hosting a community outreach event, such as a workshop, information fair, or family-friendly gathering is a powerful way to raise awareness of the CLB and help eligible families access education savings benefits for their children. Community organizations can provide guidance on eligibility and connect families with trusted financial institutions and government officials for information on Government of Canada programs and/or benefits. This not only supports children's future education but also strengthens community trust and engagement.

Please submit a request at esdc.lb.cesp-pcee.dga.edsc@hrsdc-rhdcc.gc.ca if you want to engage with a program expert on how the CESP can help you plan a successful education savings event.

Additional resources

Community Outreach and Liaison Service (COLS) - Service Canada

The organization builds relationships with community partners across the country to provide individuals who do not have easy access to the in-person offices with the information, tools and support they need.

The Canada Revenue Agency (CRA)

Outreach officers help Canadians learn about benefits and credit payments they can get by doing their taxes. Connect with local CRA regional service offices to discuss how the Agency can help meet the needs of your community.

Promotional resources

To help community partners promote the benefits of early planning and savings for post-secondary education and raise awareness of education savings benefits paid into RESPs, the CESP has developed an array of resources that can be shared with their clientele.

Posters

Canada Learning Bond - Promotional poster 1

Text version - Canada Learning Bond - Promotional poster 1

The visual includes the following text:

Canada Learning Bond: Wherever they decide to go, we can help you get them there. Find out about the Canada Learning Bond: canada.ca/education-savings.

Visual: Young boy dressed as an accountant beside a calculator, holding an arrow pointing up.

The visual ends with the Employment and Social Development Canada's signature and the Canada Wordmark.

Canada Learning Bond - Promotional poster 2

Text version - Canada Learning Bond - Promotional poster 2

The visual includes the following text:

Canada Learning Bond: Wherever they decide to go, we can help you get them there. Find out about the Canada Learning Bond: canada.ca/education-savings.

Visual: Young girl dressed as an architect wearing a hard hat and holding a ruler, on top of a general arrangement layout.

The visual ends with the Employment and Social Development Canada's signature and the Canada Wordmark.

Registered Education Savings Plan - Promotional poster

Text version - Registered Education Savings Plan - Promotional poster

The visual includes the following text:

Registered Education Savings Plans: Wherever they decide to go, we can help you get them there. Find out about Registered Education Savings Plans: canada.ca/education-savings.

Visual: Young child dressed as an astronaut, wearing a cardboard astronaut helmet.

The visual ends with the Employment and Social Development Canada's signature and the Canada Wordmark.

Canada Education Savings Grant - Promotional poster

Text version - Canada Education Savings Grant - Promotional poster

The visual includes the following text:

Canada Education Savings Grant: Wherever they decide to go, we can help you get them there. Find out about the Canada Education Savings Grant: canada.ca/education-savings.

Visual: Young girl dressed as a chemist wearing glasses and a lab coat, holding a flask and a test tube.

The visual ends with the Employment and Social Development Canada's signature and the Canada Wordmark.

Infographics

Canada Learning Bond - Promotional infographic - Adult beneficiaries

Text version - Canada Learning Bond - Promotional infographic - Adult beneficiaries

Employment and Social Development Canada

Canada Learning Bond

18 to 20 years old?

Not sure how to pay for your education after high school?

The Government of Canada can help

You could get up to $2,000 with the Canada Learning Bond for your education after high school

No contributions are necessary

You can apply for the Canada Learning Bond as soon as you turn 18

You have up until the day before you turn 21 to apply

If you are eligible for the Canada Learning Bond, you will receive $500 deposited into your Registered Education Savings Plan (RESP) + An additional $100 for every year you were eligible up to the age of 15 = You could receive up to $2,000

You could be eligible if:

- You were born on or after Jan. 1, 2004

- You are a resident of Canada

- You have a valid Social Insurance Number (SIN)

- Your family income met the eligibility criteria for at least one year

Heads-up!

Starting in April 2028, the age limit to retroactively claim the Canada Learning Bond will increase from 20 to 30. That's 10 more years to access support for your education.

Where to use this money

You can use the money to pay for a wide variety of expenses from your full- or part-time studies in:

- apprenticeship programs

- colleges/CEGEPs

- universities

- trade schools

How to access it:

- Find an RESP promoter that offers the Canada Learning Bond. Some offer options to open an RESP online, over the phone, or in person.

- Open an RESP and request the Canada Learning Bond. You will need your Social Insurance Number to apply. If you qualify, all eligible Canada Learning Bond funds will be deposited in your RESP.

- Take money out of the RESP for education-related expenses such as tuition, books, and transportation.

For more information consult canada.ca/education-savings

[The visual ends with the Canada wordmark.]

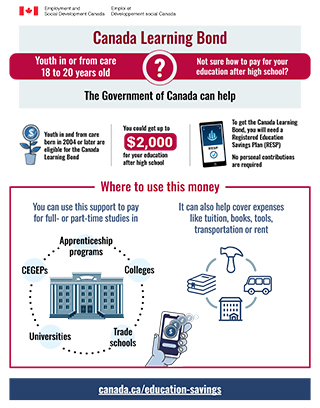

Canada Learning Bond - Promotional infographic - Youth-in-care

Text version - Canada Learning Bond - Promotional infographic - Youth-in-care

Employment and Social Development Canada

Canada Learning Bond

Youth in or from care 18 to 20 years old

Not sure how to pay for your education after high school?

The Government of Canada can help:

Youth in and from care born in 2004 or later are eligible for the Canada Learning Bond

You could get up to $2,000 for your education after high school

To get the Canada Learning Bond, you will need a Registered Education Savings Plan (RESP)

No personal contributions are required

Where to use this money

You can use this support to pay for full- or part-time studies in:

- apprenticeship programs

- colleges

- CEGEPs

- universities

- trade schools

It can also help cover expenses like tuition, books, tools, transportation or rent

Heads-up!

Starting in April 2028, the age limit to retroactively claim the Canada Learning Bond will increase from 20 to 30. That's 10 more years to access support for your education.

Did you know?

You can open an RESP and apply for the Canada Learning Bond when you turn 18 or 19 years old

[A map of Canada highlighting each province and territory based on the legal age of majority. The age of majority is shown as 19 years old in British Columbia, Yukon, Northwest Territories, Nunavut, Newfoundland and Labrador, New Brunswick and Nova Scotia. The age of majority is shown as 18 years old in Alberta, Saskatchewan, Manitoba, Ontario, Quebec and Prince Edward Island.]

The Government will automatically deposit the Canada Learning Bond in your RESP

Your RESP can stay open for up to 35 years after the plan is opened. You'll have time to think about your next step!

How to access it:

- Ask your Public Primary Caregiver if they have already opened an RESP for you. If not, take the next steps to open one for yourself.

- Find an RESP promoter that offers the Canada Learning Bond. Some offer options to open an RESP online, over the phone, or in person.

- Open an RESP and request the Canada Learning Bond. You will need your Social Insurance Number to apply. If you qualify, all eligible Canada Learning Bond funds will be deposited in your RESP.

- Take money out of the RESP for education-related expenses such as tuition, books, and transportation.

For more information consult canada.ca/education-savings

[The visual ends with the Canada wordmark.]

Videos

Education savings - Promotional video

Transcript - Education savings - Promotional video

[Upbeat music begins while a woman appears on screen, speaking directly to the camera.]

Narrator: Do you want to grow your money over time so that you can support your child's education after high school?

[Text on screen: "Registered Education Savings Plan"]

Narrator: Opening a Registered Education Savings Plan or RESP is the best way to get started!

[A sequence of videos appears as the woman continues speaking. The sequence includes: a parent and child hold hands while walking to school, the child gazes up at the parent; a close-up view of a group of graduates in caps and gowns, one of them turns to face the camera; two students write in notebooks seated in a classroom; a trades person works on a small aircraft inside an aircraft hanger.]

Narrator: When your child starts post-secondary education, the money in their RESP can be used for college, university, trades school or an apprenticeship program

[Text on screen: "tuition, books, tools, rent, transportation, internet, groceries"]

[The text appears side by side with a sequence of videos: a young person wears headphones around their neck, holds a cellphone in one hand, and writes in a notebook with the other hand; a young person sits on public transit with a laptop on their lap and earbuds in their ears; a young person browses food items on a grocery store shelf holding a grocery basket.]

Narrator: and can help cover tuition, books, tools, rent, transportation, internet, and even groceries.

[The woman reappears on screen and continues speaking.]

[Text on screen: "Canada Learning Bond up to $2,000"]

Narrator: Your child could receive up to $2,000 if they are eligible for the Canada Learning Bond with an RESP! And you don't need to make any contributions to benefit!

[The woman remains on screen and continues speaking.]

[Text on screen: "Canada Education Savings Grant"]

Narrator: The Canada Education Savings Grant is another great way to set your child up for success after high school.

[The woman remains on screen and continues speaking.]

[Text on screen: "up to $500 annually" appears below "Canada Education Savings Grant".]

Narrator: If you add money to an RESP, the Government of Canada will provide up to $500 annually on top of your annual contributions.

[The woman remains on screen and continues speaking.]

[Text on screen: "up to $500 annually" fades and the text "up to $7,200" appears below "Canada Education Savings Grant"]

Narrator: You could get up to a maximum of $7,200 for your child before they turn 18.

[A sequence of videos appears as the woman continues speaking. The sequence includes: two people sit at a table with a financial advisor, reviewing paperwork; parents with two children on their laps sit across from a financial advisor, who shows them a chart on a laptop. One parent signs a document; a person works on a laptop in a kitchen while another person sits next to them, holding a baby and looking at the screen.]

Narrator: Talk to your bank or financial service provider to find out if they offer these benefits and for help applying.

[The woman reappears on screen and continues speaking.]

Narrator: Don't wait! Start planning for your child's post-secondary education now and watch your savings grow!

[The woman continues speaking and fades out of view.]

[Text on screen: "For more information, visit: Canada.ca/education-savings"]

Narrator: For more information, visit: Canada.ca/education-savings

[The text on screen fades out and the Canada Wordmark appears on the screen. Music fades out.]

Submit a request at esdc.lb.cesp-pcee.dga.edsc@hrsdc-rhdcc.gc.ca to receive the Canada Education Savings Program toolkit as a zip file.