Public service pension at a glance

This document presents a brief description of the main features of the pension plan governed by the Public Service Superannuation Act (PSSA). Federal public service employees are covered by the pension benefit provisions offered by the government, commonly referred to as the “public service pension plan.”

The public service pension plan is designed to provide you with a lifetime income after retirement. In the event of your death, the plan also provides benefits to your eligible survivor and children.

If there is a discrepancy between the information in this document and that contained in the Act and the Public Service Superannuation Regulations or other applicable laws, the latter shall prevail at all times.

Table of contents

- Eligibility to participate in the public service pension plan

- Age at which you can receive an unreduced pension benefit

- Contributions

- Pensionable service (current and buyback)

- Retirement income from the public service pension plan

- At age 65

- Types of pension benefits

- Protection from inflation

- Survivor benefits

- Life Events for Plan Members

- Further Information

Eligibility to participate in the public service pension plan

As a full-time or part-time employee (minimum 12 hours per week), you are covered by the pension benefit provisions under the plan:

- from your first day at work, if you are appointed on an indeterminate basis;

- from your first day at work, if you are hired for a period of more than six months; or

- after six months of continuous employment, if you were originally hired for a period of six months or less.

Age at which you can receive an unreduced pension benefit

The date when you become a participant of the public service pension plan determines when you will be eligible to receive an unreduced pension benefit:

- If you were participating in the plan on or before , you are eligible to draw an unreduced pension benefit at age 60 with at least two years of pensionable service (or age 55 with 30 years of pensionable service); or,

- If you begin to participate in the plan on or after , you are eligible to draw an unreduced pension benefit at age 65 with at least two years of pensionable service (or age 60 with 30 years of pensionable service).

Contributions

You and your employer both contribute to the plan.

As a public service pension plan member, a portion of your salary goes toward your pension through payroll deductions. The portion of your salary that goes toward your pension depends on when you began paying into the pension plan.

If you started paying into the pension plan after December 31, 2012, you’re eligible for an unreduced pension at age 65, or age 60 with 30 years of service. You pay lower contribution rates because you work 5 years longer in general before you can retire with an unreduced pension, compared to those who started paying into the plan before January 1, 2013, who are eligible to receive an unreduced pension at age 60, or age 55 with 30 years of service.

Current contribution rates and the year’s maximum pensionable earnings (YMPE) amount can be found on the Contribution rates for the 3 major public sector pension plans page.

Coordination of contributions

Your public service pension plan contributions are coordinated with those of the Canada Pension Plan (CPP) or the Quebec Pension Plan (QPP), which results in two-tiered contribution rates.

- You pay at a lower rate up to the YMPE on which you contribute to the CPP or QPP.

- You pay at a higher rate above the YMPE.

For more information, consult the Canada Pension Plan / Quebec Pension Plan coordination section of the Retirement Income Sources page.

Pensionable service (current and buyback)

Pensionable service means the complete or partial years credited to you at retirement. The period during which you contribute to the pension plan is called current service.

You can also add eligible prior service in order to increase your pension. To do so, you can do one of the following:

- buy back service for eligible periods of prior employment. See the Service Buyback Package for more information; or

- transfer the actuarial value of accumulated pension benefits from another employer’s plan through a Pension Transfer Agreement.

You can accumulate up to 35 years of pensionable service in total.

A Pension Transfer Agreement is an agreement negotiated between the Government of Canada and an eligible employer to provide for the transfer of pension benefits from one pension plan to the other.

For more information on Pension Transfer Agreements, the types of service eligible for buy back, or to learn what you need to do to transfer the value of pension benefits or to buy back service, contact the Pension Centre for federal employees or refer to Increasing Your Pension as soon as you join the public service.

Retirement income from the public service pension plan

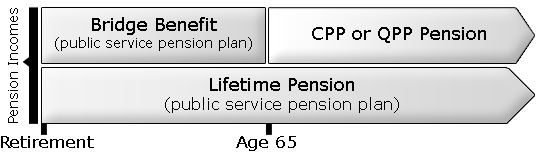

The public service pension plan provides for the payment of a lifetime pension payable until your death and a temporary bridge benefit payable until age 65.

Generally, the formula for calculating your pension is as follows:

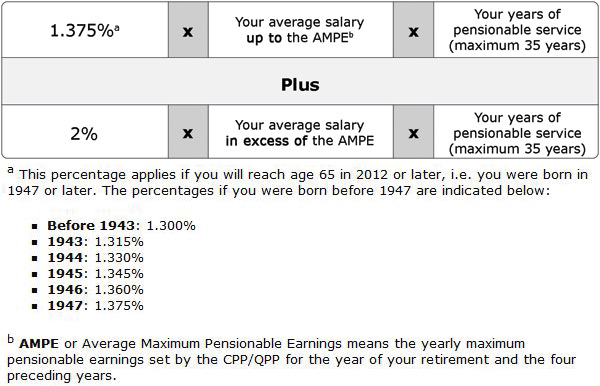

Lifetime pension

Your annual lifetime pension is based on your average salary of your five consecutive years of highest paid service and your years of pensionable service, as follows:

Figure 1 - Text version

1.375 percentFigure 1 - Note a multiplied by your average salary up to the Average Maximum Pensionable EarningsFigure 1 - Note b multiplied by your years of pensionable service (maximum 35 years)

plus

2 percent multiplied by your average salary in excess of the Average Maximum Pensionable Earnings multiplied by your years of pensionable service (maximum 35 years)

Figure 1 - Notes

- Figure 1 Note a

-

This percentage applies if you will reach age 65 in 2012 or later, i.e. you were born in 1947 or later. The percentages if you were born before 1947 are indicated below:

- Before 1943: 1.300%

- 1943: 1.315%

- 1944: 1.330%

- 1945: 1.345%

- 1946: 1.360%

- 1947: 1.375%

- Figure 1 Note b

-

AMPE or Average Maximum Pensionable Earnings means the yearly maximum pensionable earnings set by the CPP/QPP for the year of your retirement and the four preceding years.

If you retire before age 65, you will also receive a bridge benefit. This temporary benefit helps "bridge" your pension until age 65 when the CPP or QPP unreduced retirement benefit is expected to begin. However, the bridge benefit will stop immediately if you become entitled to CPP or QPP disability benefit.

If you retire after age 65, you will only receive the lifetime pension; the bridge benefit will not be paid.

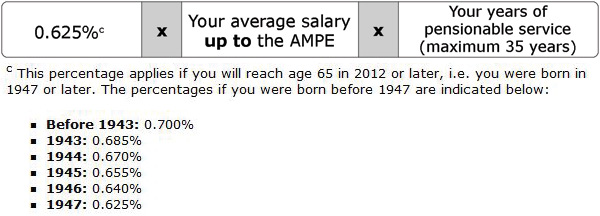

The bridge benefit is calculated as follows:

Bridge benefit

Figure 2 - Text version

0.625 percentFigure 2 - Note c multiplied by your average salary up to the Average Maximum Pensionable Earnings multiplied by your years of pensionable service (maximum 35 years)

Figure 2 - Notes

- Figure 9a Note c

-

This percentage applies if you will reach age 65 in 2012 or later, i.e. you were born in 1947 or later. The percentages if you were born before 1947 are indicated below:

- Before 1943: 0.700%

- 1943: 0.685%

- 1944: 0.670%

- 1945: 0.655%

- 1946: 0.640%

- 1947: 0.625%

At age 65

At age 65, you will continue to receive your lifetime pension. If you were in receipt of the bridge benefit, it will end on the first of the month following your 65th birthday as you would be eligible to apply for an unreduced CPP or QPP retirement benefit.

Your total pension income (your public service lifetime pension plus your CPP or QPP pension) at age 65 will be approximately the same as the amount you received from the lifetime pension and bridge benefit before age 65.

The following graph represents if you retire before age 65 and apply for CPP or QPP benefits at age 65 (age when unreduced CPP or QPP retirement benefits normally begins)

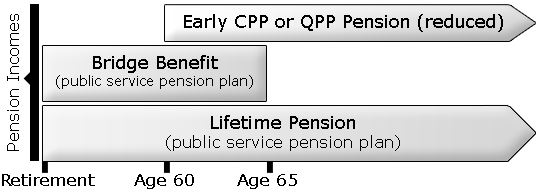

Choosing an early, reduced CPP or QPP benefit

If you retire before age 65 you can also choose to receive your CPP or QPP benefit before age 65; however, it is a reduced benefit that continues to be paid at the reduced rate after age 65. As a result, you will notice a decrease in your total pension income at age 65 because you are in receipt of an early CPP or QPP benefit.

The following graph represents if you retire before age 65 and apply for early CPP or QPP benefits (between 60–64 years of age)

Types of pension benefits

The benefits you will be entitled to when you leave the public service depend on your age and the number of years of pensionable service you have accumulated. The date when you became a member under the public service pension plan determines when you will be eligible to receive an unreduced pension benefit:

Types of pension benefits for plan members who were participating in the plan on or before

| If you are | And leave the public service with … of pensionable service | You will be entitled to |

|---|---|---|

| Age 60 or over | At least 2 years | An immediate annuity: your accrued pension calculated according to the pension formula, payable immediately. |

| Age 55 or over | At least 30 years | An immediate annuity |

| Age 50 up to 60 | At least 2 years | A deferred annuity: your accrued pension calculated according to the pension formula, payable at age 60 or An annual allowance: a permanently reduced pension, payable as early as age 50 and before age 60 |

| Under age 50 | At least 2 years | A deferred annuity payable at age 60 or An annual allowance payable as early as age 50 and before age 60 or A transfer value: the actuarial value of your pension benefits, payable in a lump sum. This amount must be transferred to another registered pension plan or to a locked-in retirement savings vehicle |

| Under age 60 | At least 2 years and retiring because of disability | An immediate annuity. The bridge benefit stop if you become entitled to CPP/QPP disability benefits or when you reach age 65 |

| Any age | Less than 2 years | The return of contributions with interest |

Type of pension benefits for plan members who began participating in the plan on or after

| If you are | And leave the public service with … of pensionable service | You will be entitled to |

|---|---|---|

| Age 65 or over | At least 2 years | An immediate annuity your accrued pension calculated according to the pension formula, payable immediately. Since you are age 65 or over, you will only receive the lifetime pension; the bridge benefit will not be paid |

| Age 60 or over | At least 30 years | An immediate annuity |

| Age 55 up to 65 | At least 2 years | A deferred annuity your accrued pension calculated according to the pension formula, payable at age 65 or An annual allowance a permanently reduced pension, payable as early as age 55 and before age 65 |

| Under age 55 | At least 2 years | A deferred annuity payable at age 65 or An annual allowance payable as early as age 55 and before age 65 or A transfer value the actuarial value of your pension benefits, payable in a lump sum. This amount must be transferred to another registered pension plan or to a locked-in retirement savings vehicle |

| Under age 65 | At least 2 years and retiring because of disability | An immediate annuity. The bridge benefit stops if you become entitled to CPP/QPP disability benefits or when you reach age 65 |

| Any age | Less than 2 years | The return of contributions with interest |

Note: For pension eligibility purposes, a year of part-time service counts as one year of pensionable service. Pension benefits are adjusted to reflect the assigned part-time hours of part-time work compared to the full-time hours of the position.

Protection from inflation

Once you have retired, your pension is increased on January 1 of each year to take into account the cost of living, based on increases in the Consumer Price Index (CPI).

Your first indexing increase will be implemented on January 1 of the year following your year of retirement. This amount will be pro-rated to reflect the number of full months remaining in the year of your retirement. In subsequent years, you will be entitled to the full increase.

Survivor benefits

If death occurs before you have completed two years of pensionable service, your contributions with interest will be refunded to your eligible survivor or children, or to your beneficiaries if you have no eligible survivors.

An eligible survivor means the person who was married to you before retirement or was cohabiting with you in a common law relationship before retirement and for at least one year before your death.

If you have at least two years of pensionable service, your eligible survivor and children will be entitled to the following:

- Survivor benefit: a monthly allowance equal to half of the pension you would have received before age 65 (calculated before any applicable reduction), payable immediately to your eligible survivor.

- Child allowance: one fifth of the survivor benefit (two fifths if you have no eligible survivor), payable until age 18 (age 25, if the child is a student); the maximum allowance for all children combined is the equivalent of four children’s benefits.

Supplementary Death Benefit

The Supplementary Death Benefit provides a lump-sum benefit equal to twice your annual salary, payable to your designated beneficiaries or to your estate. The coverage decreases by 10% each year starting at age 66 to a minimum of $10,000 by age 75. If you are still employed in the public service after age 65, the minimum coverage is the greater of $10,000 or one third of your annual salary.

Minimum Benefit

If you have no eligible survivor or children, or you have not named beneficiaries to receive the Supplementary Death Benefit or, if the beneficiaries you have named predecease you, your estate will receive an amount equal to the greater of the return of your contributions with interest or five years of pension payments, less any payments already received.

Life Events for Plan Members

In the event of

Leave without pay (maternity or parental leave and other approved leaves)

During a period of leave without pay, your membership in the plan continues as long as you make the required contributions and the leave is approved. You can accumulate up to five years of pensionable service for periods of leave without pay during your entire career (plus three more years for maternity or parental leave).

A marriage or common law relationship breakdown or marriage after retirement

In the event of a marriage or common law relationship breakdown, you can request the division of your accrued benefits according to the Pension Benefits Division Act.

If you marry after you retire, you have the option of requesting a survivor benefit for your new eligible spouse. Your pension will be reduced accordingly. Certain conditions apply.

Termination of employment

Depending on your age and your years of pensionable service when you terminate employment, you may be entitled to more than one type of pension benefit.

If you have more than two years of pensionable service, you may choose to receive one of the following pension benefits:

- an immediate annuity, deferred annuity, annual allowance or transfer value; or

- if you leave the public service for another employer, you may transfer your pension accumulated under the public service pension plan to your new employer’s pension plan under general portability rules or a Pension Transfer Agreement, provided that that employer has entered such an agreement with the Government of Canada.

If you have less than two years of pensionable service you will receive a return of your contributions with interest.

Re-employment after retirement

If you are re-employed in a position in the federal public service and you are not eligible to contribute to the pension plan, you can receive both your pension and the salary from your new position. However, if you choose to become re-employed in the public service and become eligible to contribute to the pension plan again, your monthly pension (including indexing) will cease, as you are unable to receive a public service pension and accumulate pensionable service simultaneously. The annual percentage increase received as a result of indexing will be based on your most recent date of retirement.

Generally, if you retire before and receive an immediate annuity, deferred annuity or an annual allowance and become re-employed in the federal public service after , you will continue to be covered under the pre-2013 pension plan terms (eligible to receive an unreduced pension at age 60, with at least two years of pensionable service, or at age 55 with 30 years of service).

However, you will not remain covered under the pre-2013 pension plan terms when re-employed in the federal public service on or after if you:

- left with less than two years of pensionable service with a return of contributions;

- opted for a transfer value; or

- opted to transfer the pension accumulated under the public service pension plan to a new employer’s pension plan under general portability rules or a Pension Transfer Agreement.

Part-time work

If you are working a minimum of 12 hours per week, you could be eligible to participate in the public service pension plan. Your pension contributions will be based on the actual salary you receive while working part-time. However, when calculating your pension, one year of part-time service will count as one year of pensionable service.

Further Information

Public Service Pension Plan

For detailed information about the public service pension plan, please visit Public Service Pension Plan.

Government of Canada Pension Centre

Toll free: 1-800-561-7930

Monday to Friday

a.m. to p.m. (Your Local Time)

Outside Canada and the United States: 506-533-5800

(collect calls accepted)

Monday to Friday

to p.m. (Atlantic Time)

Telephone Teletype (TTY): 506-533-5990

(collect calls accepted)

Monday to Friday

a.m. to p.m. (Atlantic Time)

- Canada Pension Plan (CPP) provides you with information concerning the CPP and the benefits it provides.

- Quebec Pension Plan (QPP) provides you with information concerning the QPP and the benefits it provides.

Visit Public service group insurance benefit plans for information on benefits.