T4 slip – Information for employers

You may be looking for: T4 slip – Information for employees

On this page

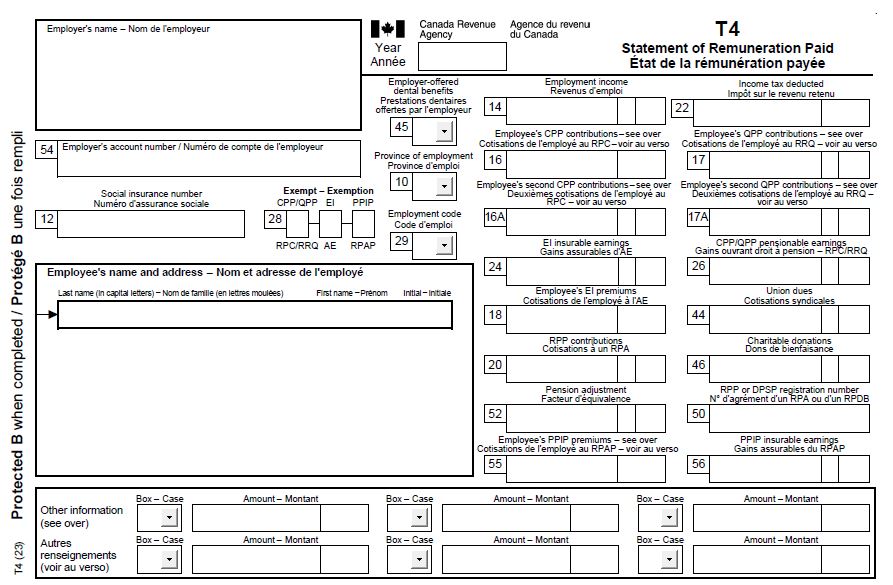

What is a T4 slip

A T4 slip identifies all of the remuneration paid by an employer to an employee during a calendar year.

You can get a Form T4 slip in a PDF or PDF fillable/saveable format to file on paper.

When to issue

If you are an employer (resident or non-resident) and you paid your employees employment income, commissions, taxable allowances and benefits, fishing income, or any other remuneration, you must issue a T4 slip if any of the following apply:

- You deducted CPP/QPP, EI, PPIP, or income tax from remuneration paid to your employee

- If the remuneration paid to your employee is not included on the exception list , the total of all remuneration paid in the calendar year was more than $500 (under the CRA administrative policy)

Exception list

- Group term life insurance benefits

If you provide current or former employees with taxable group term life insurance benefits, you always have to issue a T4 slip, even if the total of all remuneration paid in the calendar year is $500 or less.

What to report

What to report and not report on a T4

Report

- Salary or wages

- Tips or gratuities

- Bonuses

- Vacation pay

- Employment commissions

- Gross and insurable earnings of self-employed fishers

- Taxable benefits or allowances

- Retiring allowances

- Deductions withheld during the year

- Pension adjustment (PA) amounts for employees who accrued a benefit for the year under your registered pension plan (RPP) or deferred profit sharing plan (DPSP)

- Security options benefits provided to an employee, former employee or non-resident employee

Do not report

- If you paid pensions, lump-sum payments, annuities, or other income (including amounts paid to a proprietor or partner of an unincorporated business) use: T4A slips – Information for payers

- If you paid amounts from a retirement compensation agreement use: T4A-RCA slips – Retirement Compensation Arrangement (RCA) trust

- If you paid fees (except for director fees), commissions, or other amounts to a non-resident for services rendered in Canada, other than employment situations: use T4A-NR slips – Payments to non-residents for services provided in Canada

- If you are an employer with construction as your primary source of business income use: T1204 – Government services contract payments or T5018 – Statement of contract payments

What are the guidelines for filling out slips

Do

- If you have multiple payroll accounts, file a T4 return for each payroll account

- Income is reported on a T4 slip for the year in which it is paid, regardless of when it was earned

- If your employee worked in more than one province or territory during the year, fill out a T4 slip for each province or territory

- Report, in dollars and cents, all amounts you paid during the year (except pension adjustment amounts, which are reported in dollars only)

- A maximum of 10 digits, including cents, can be reported using box 14

- Report all amounts in Canadian dollars, even if they were paid in another currency. Learn more about the average exchange rates: Exchange rates

Do not

- Do not show negative dollar amounts on slips, to make changes to previous years. Learn more: Make corrections after filing

- If a box does not have a value, do not enter "nil" or "N/A", leave the box blank

- Do not change the headings of any of the boxes

- Do not enter hyphens or dashes between numbers

- Do not enter the dollar sign ($)

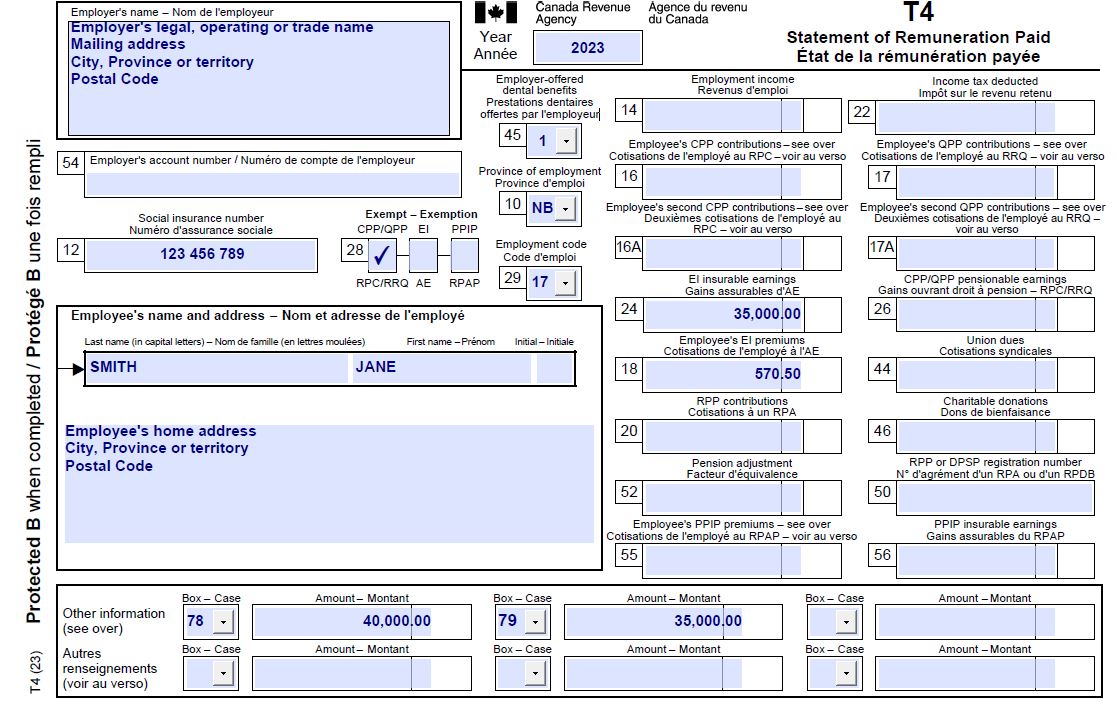

How to fill out the "Other information" section

The "Other information" area at the bottom of the T4 slip has boxes for you to enter codes and amounts that relate to employment commissions, taxable allowances and benefits, deductible amounts, fishers' income, and other entries if they apply.

The boxes are not pre-numbered. Enter the codes and amounts that apply to the employee.

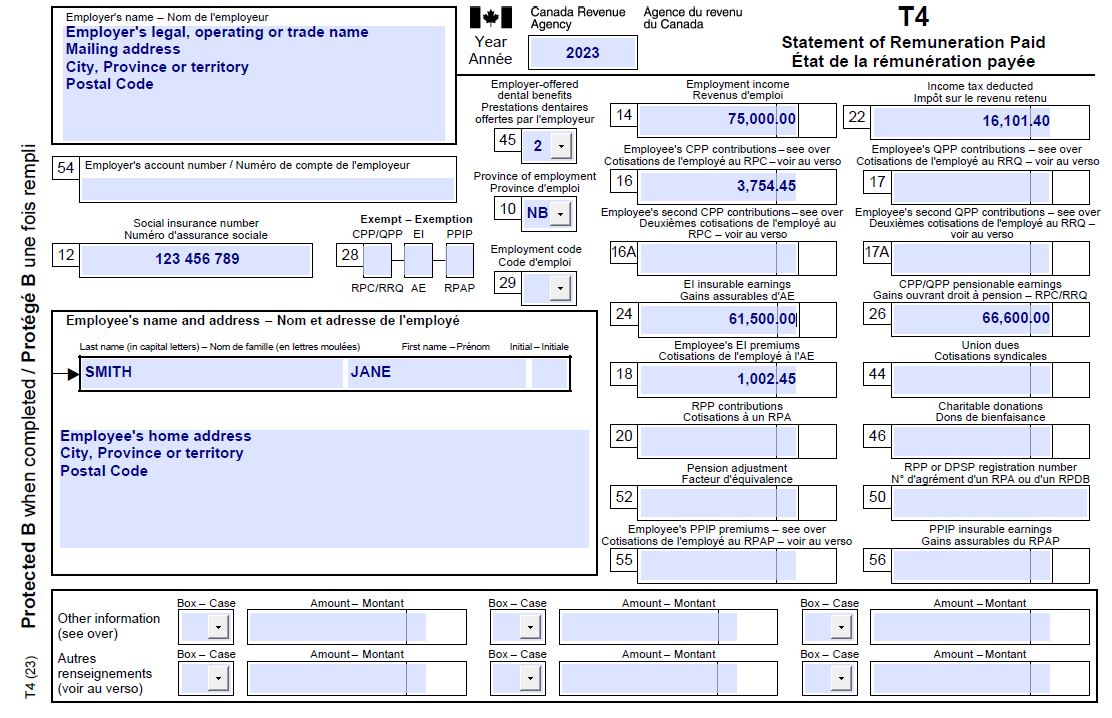

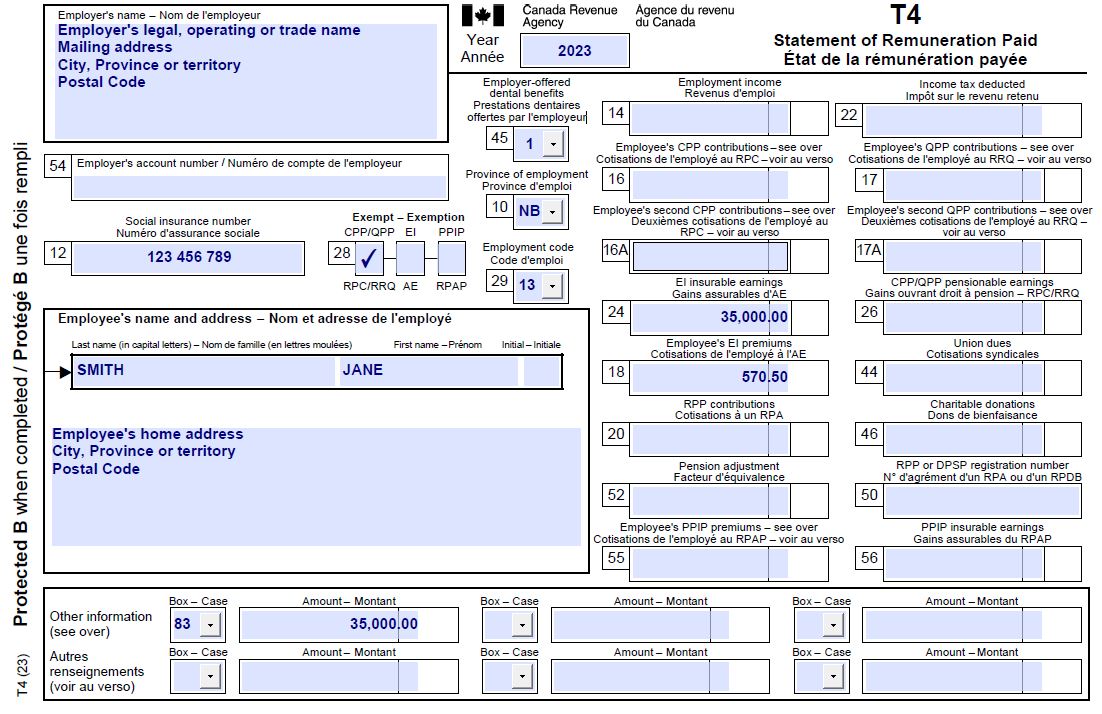

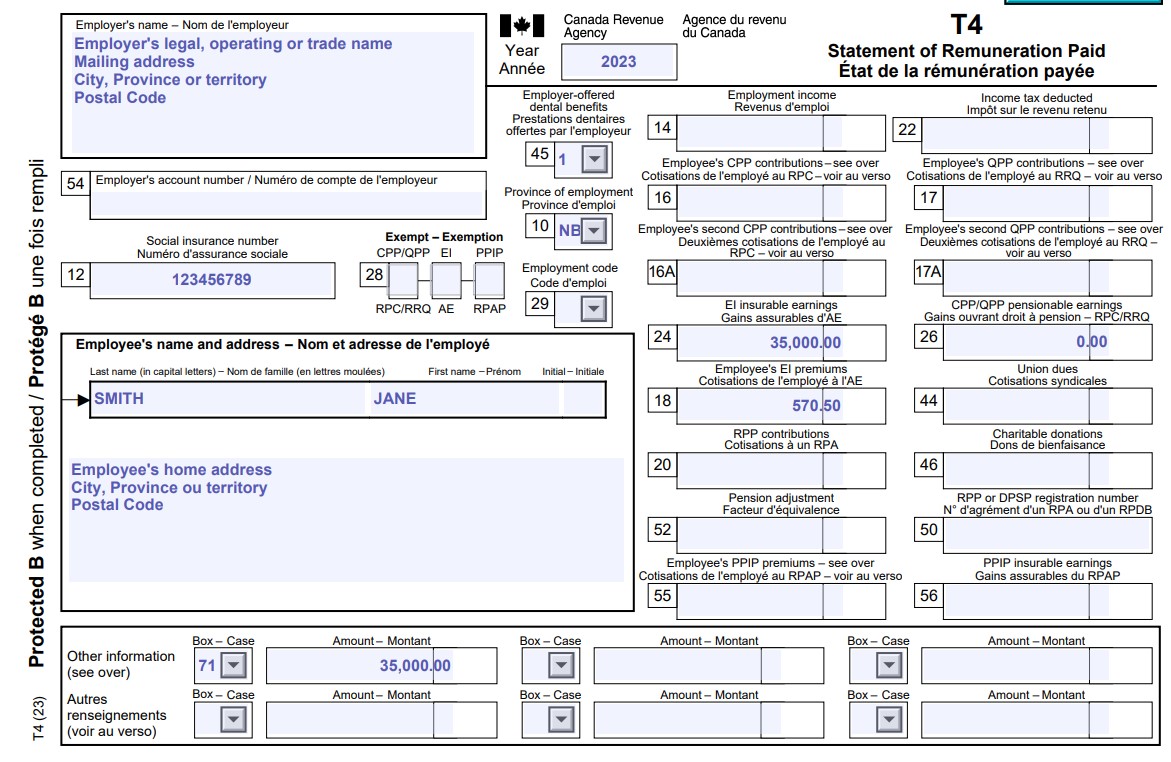

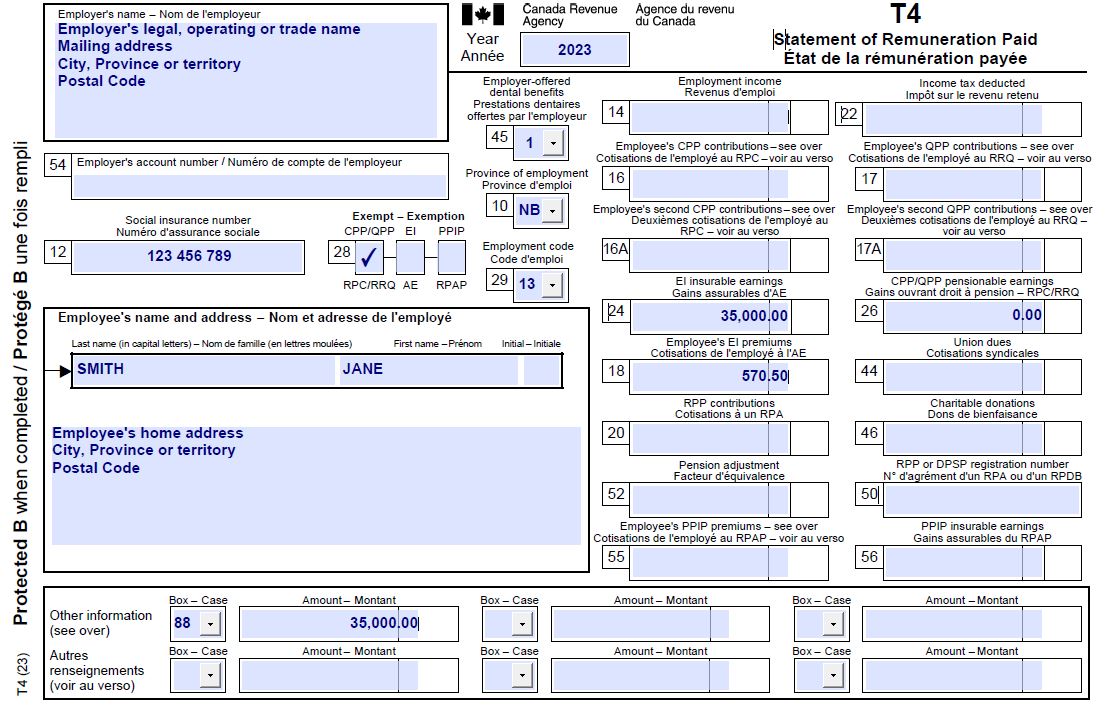

Example:

What if you have more than 6 codes in "Other information"

If more than 6 codes apply to the same employee (overflow T4 slips):

- Use an additional T4 slip

- Enter only the employer's name and address, the employee's SIN and name, province code, applicable CPP/QPP and/or EI exempt status, pensionable and insurable earnings of zero and fill out the required boxes in the "Other information" area

- Report each code and amount only once

- Do not repeat all the data on the additional slip

How to fill out

Before you fill out the T4 slip, make sure to review the list of special situations . You can filter by key words to find information specific to your situation.

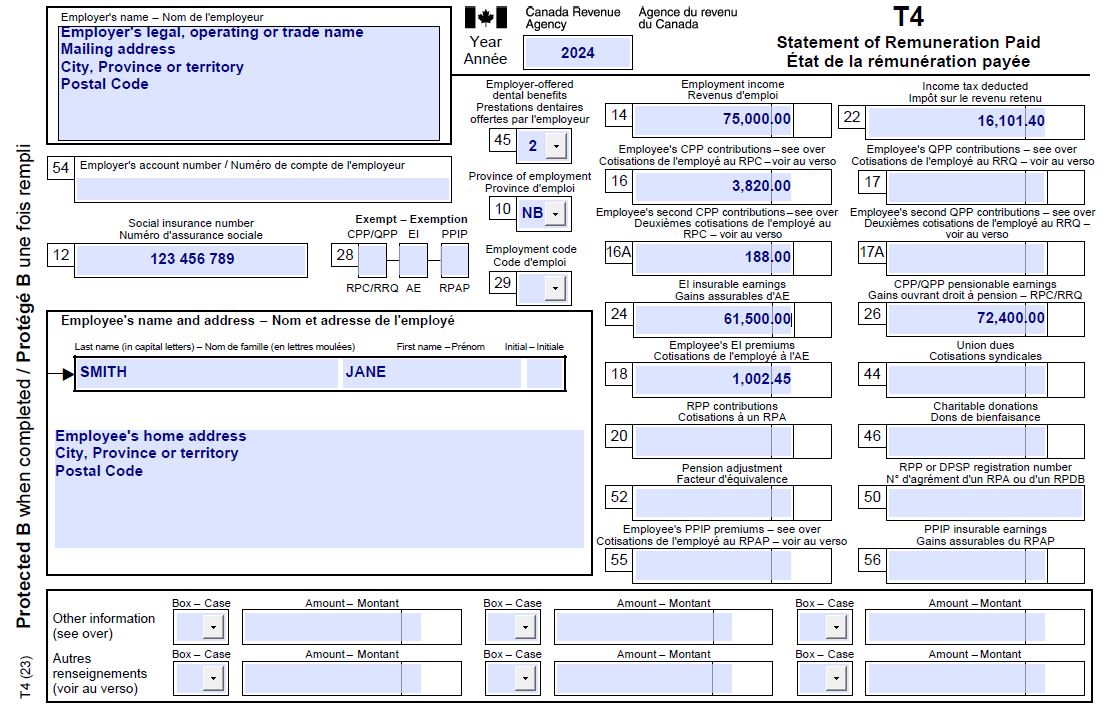

View examples of completed T4 slips in regular and special situations

Identification

Year

Enter the 4 digits of the calendar year in which you made the payment to the employee.

Employer's name

Enter your legal name, your operating or trading name (if it differs from your legal name) and address.

Employee's name and address

Enter all in capital letters the employee's last name followed by the employee's first name and initials.

If the employee has more than one initial, enter the employee’s first name followed by the initials in the "First name" field.

Do not enter titles, such as Director, Mr, or Mrs.

Enter the employee's home address, including the province or territory, the postal code and the country.

Box 10 – Province of employment

Enter the provincial or territorial abbreviation for the province or territory of employment. This is not always the province where the employer is located.

List of provinces and territories and their abbreviations

Province or territory Abbreviation Alberta AB British Columbia BC Manitoba MB New Brunswick NB Newfoundland and Labrador NL Northwest Territories NT Nova Scotia NS Nunavut NU Ontario ON Prince Edward Island PE Quebec QC Saskatchewan SK Yukon YT United States US Keywords: Province of employment outside Canada Enter ZZ if an employee worked in a country other than Canada or the United States, or if the employee worked in Canada beyond the limits of a province or territory (for example, on an offshore oil rig).

ZZ

Specific situation

- More than one province or territory

- Fill out separate T4 slips for each province or territory if your employee worked in more than one province or territory in the year.

Learn more: Determine the province of employment (POE).

Box 12 – Social insurance number

Enter the social insurance number (SIN) provided by the employee.

Specific situations

- No SIN

- Enter 9 zeros if you do not have the employee's SIN. You still have to file their T4 slip before the due date even if you cannot get a SIN from your employee.

- SIN beginning with a 9 and received a permanent SIN

Enter the permanent SIN if the employee had a SIN beginning with a 9 and later in the year received a permanent SIN.

Do not prepare 2 T4 slips.

Learn more: Get the social insurance number (SIN).

Box 28 – Exempt (CPP/QPP, EI, and PPIP)

Specific situations

- CPP/QPP

Do not use box 28 if you report any of the following:

- pensionable earnings using box 26

- retiring allowances and no other type of income is paid, reported using code 66, code 67 or code 69

- an amount greater than "0" using boxes 16, 16A, 17, 17A or 26

- an amount of "0" in box 26 and the employee gave you a copy of a filled out Form CPT30, Election to Stop Contributing to the Canada Pension Plan, or Revocation of a Prior Election

Enter an "X" or a checkmark under CPP/QPP if one of the following applies:

- you do not have to report any amount because you did not have to deduct CPP or QPP contributions for the full reporting period

- you enter an employment code using box 29

- EI

Do not use box 28 if you report EI premiums deducted using box 18 or EI insurable earnings using box 24.

Enter an "X" or a checkmark under EI if you do not have to report any amount because you did not have to deduct EI premiums for the full reporting period.

- PPIP

Do not use box 28 if you report PPIP premiums using box 55 or PPIP insurable earnings using box 56.

Enter an "X" or a checkmark under PPIP if you do not have to report any amount because you did not have to deduct PPIP premiums for the full reporting period.

Learn more: Get ready to make deductions and CPP/EI explained.

Box 29 – Employment code

Enter the appropriate employment code in box 29 if one of the following situations applies. Otherwise, leave it blank.

11 – Placement or employment agency workers

Use code 11 if the following apply:

You are an agency's client and:

- The agency placed a worker under your direction and control

- You pay the worker

- The worker is not the agency's employee

You are a placement or employment agency and:

- You placed the worker under the direction and control of one of your clients

- You pay the worker

Do not use code 11 if you are an agency or the agency's client and the worker is paid self-employment income, use the T4A slip – Information for payers.

Learn more: Payments to employee of an employment agency (temporary-help) and Placement/employment agencies – CPP/EI explained.

12 – Self-employed taxi drivers and drivers of other passenger-carrying vehicles

Use code 12 if the worker you paid is a taxi driver or a driver of other passenger-carrying vehicle and is not your employee. This also applies if the person you paid is registered, or entitled to be registered under the Indian Act.

Learn more: Payments to taxi and other passenger-carrying drivers.

13 – Self-employed barbers and hairdressers

Use code 13 if the worker you paid is all of the following:

- Barber or a hairdresser providing their services in an establishment that offers barbering and hairdressing services

- Not the owner or operator of the establishment

- Not your employee

This also applies if the person you paid is registered or entitled to be registered under the Indian Act.

Learn more: Payments to barbers and hairdressers and Barbers and hairdressers – CPP/EI explained.

14 – Withdrawal from a prescribed salary deferral arrangement plan

Use code 14 if the payment involves a prescribed salary deferral plan or arrangement. This includes when you are paying both of the following:

- Salary to the participant and part of the salary are deferred

- Paying out the deferred salary to the participant

Do not use code 14 if the salary deferral arrangement is not a prescribed plan.

Learn more: Payments related to salary deferral arrangements.

15 – Seasonal Agricultural Workers Program

Use code 15 if the worker meets all conditions to be a foreign worker employed in Canada under the Seasonal Agricultural Workers Program.

Learn more: Payments to agriculture and horticulture workers and Seasonal Agricultural Workers Program.

16 – Detached employee – Social security agreement

Use code 16 if your employee is considered detached and you entered in box 10 that your employee worked in a country other than Canada using abbreviations US or ZZ, for all or part of the year.

A detachment is when an employee is temporarily assigned, posted, or seconded to another country for a specific period of time. A worker is not considered detached if they have been permanently transferred or appointed to a position in another country

Learn more: Employee who is working outside Canada for a Canadian company or the Canadian government and Employment outside Canada – CPP/EI explained.

17 – Self-employed fishing income

Use code 17 if the worker meets all conditions to be a self-employed fisher. This also applies if the person you paid is registered or entitled to be registered under the Indian Act.

Learn more: Payments to fishers and Fishers – CPP/EI explained.

Box 45 – Employer-offered dental benefits Slips filed for calendar year 2023 and after

For calendar year 2023 and after, it is mandatory to indicate whether the employee or any of their family members were eligible, on December 31 of that year, to access any dental care insurance, or coverage of dental services of any kind, that you offered.

Recipient code and type of recipient table Code Access 1 Not eligible to access any dental care insurance, or coverage of dental services of any kind 2 Payee only 3 Payee, spouse and dependent children 4 Payee and their spouse 5 Payee and their dependent children Do not use box 45 before January 2024 if you are filing electronically.

Specific situation

- Use of code 1 – T4 slips filed for calendar year 2023 only

- Health Canada administrative policy

To reduce the burden on employers, for calendar year 2023 only, it is not mandatory to fill out box 45 when and only when code 1 is applicable.

This administrative policy applies only if all reasonable efforts have been made to comply with the reporting requirements.

- T4 slips filed before January 2024

- Health Canada administrative policy

To reduce the burden on employers, if you filed your T4 slips for calendar year 2023 before January 2024, you do not have to file amended T4 slips to report this code.

- Third party filing T4 slips

- Any third party organizations that complete T4 slips annually on behalf of their clients are required to complete this box. They are required to get the information from their clients and report it accurately on the T4 slip issued.

- Union-offered dental coverage

- If a union offers dental benefits to its members, the union would not be considered as their employer and will not be required to issue a T4 slip to report this benefit for their members or provide this information to the member's employer. A union will have to report this benefit for its own employees or former employees.

- Multiple T4 slips

If you file multiple T4 slips for an employee on various RP accounts of your single business number, you need to consistently report on all slips what coverage was offered on December 31 of that year.

Alternatively, you may choose to report according to each RP account separately.

- More than 6 codes in "Other information"

- If more than 6 codes in "Other information" apply to the same employee and you have to use an additional T4 slip (overflow slip), the same code should be used for all overflow slips for the same employee.

- Employee declines dental coverage

- Update - Clarification

An employer must report whether the employee is eligible to access dental benefits provided by the employer, not whether the employee has chosen to use it, opted out, or refused coverage. If dental benefits were offered, you must report that they were offered and to whom according to the codes provided.

- Employee leaves employment before December 31 of the taxation year

- Update - Clarification

If, on December 31 of the taxation year, the employee was no longer eligible for dental insurance offered by you (because they no longer worked for your company or for any other reason), fill out box 45 using code 1 “Not eligible to access any dental care insurance, or coverage of dental services of any kind.”

Learn more on the Canadian Dental Care Plan (CDCP): Dental coverage.

Box 54 – Employer's account number

Enter your 15-character payroll account number (for example, 123456789RP0001) on your copy and the copy you send to the CRA only.

Do not enter your account number on the copies you give to the employees.

Income and source deductions

Box 14 – Employment income

Report your employee's total income before deductions using box 14.

A maximum of 10 digits, including cents, can be reported using box 14.

Depending on the type of payment you made, you may also need to report these amounts in "Other information" using specific codes.

Type of payments included in employment income

Generally, you have to report payments from the following using box 14:

- Salary, wages, commissions or other remuneration including taxable benefits

- Honorariums from employment or office, director's fees, management fees, fees paid to board or committee members and executor's, liquidator's, or administrator's fees earned to administer an estate (as long as the executor, liquidator, or administrator does not act in this capacity in the regular course of business)

- Bonuses or retroactive pay increases and vacation pay

- Wages in lieu of termination notice

- Remuneration paid while the employee is on vacation, furlough, sabbatical, or sick leave, or for lost-time pay from a union, vacation pay, benefits paid under a supplementary unemployment benefit plan to a trustee for payment of periodic amounts to employees who are laid off for any temporary or indefinite period (such as employer paid maternity and parental top-up amounts) and payments for sick leave credits and accrued vacation

- Wage-loss replacement plans benefits

- Tips and gratuities that are controlled by you and received from the performance of services are considered income from employment

- Additional amounts that you pay while participating in a job creation project that Employment and Social Development Canada (ESDC) has approved

- Remuneration paid to a member of a religious order who has taken a vow of perpetual poverty, unless you pay the remuneration to the order or the employee gives you a letter of authority

Specific situations

- SUBP payments

Report payments you made under a supplementary unemployment benefit plan (SUBP), such as maternity, parental and compassionate care top ups that do not qualify as a SUBP under the Income Tax Act, whether they are registered with Services Canada or not using box 14.

Do not report any top-up amounts paid under a SUBP that qualifies as a SUBP under the Income Tax Act using box 14, use the T4A slip.

Learn more: Payments from supplementary unemployment benefit plan (SUBP).

- Payments out of a EBP

- Report payments you made out of an employee benefit plan (EBP) and amounts that a trustee allocated under an employee trust using box 14.

- First Nations (exempt income) Keywords: Indians indigenous first nations

- Do not report tax-exempt employment income you paid to your employee who is registered, or entitled to be registered under the Indian Act using box 14, use code 71 or for a self-employed worker use code 88.

- Box 29 – Employment codes

Do not report income you paid using box 14 if you are using box 29 with the following employment codes:

- 11 – Placement or employment agency worker, use code 81

- 12 – Taxi drivers and drivers of other passenger-carrying vehicles, use code 82

- 13 – Barber or hairdresser, use code 83

- 16 – Detached employee – Social security agreement, and no other type of income is reported on the T4 slip

- 17 – Self-employed fishing income, use code 78, code 79 or code 80

- 12, 13 or 17 – Tax-exempt income paid to a worker who is registered, or entitled to be registered under the Indian Act, use code 88

- Retiring allowances

Do not report retiring allowances using box 14:

- Board and lodging

Report the total amount of the board and lodging benefit paid to your employee using box 14 and code 30.

Do not report using box 14 if you paid lodging and housing benefit at special work sites, use code 31 for the tax-exempt board, lodging and housing at the special work sites.

- Travel in a prescribed zone

Report the total amount of the travel benefit paid to your employees using box 14 and code 32.

- Personal use of employer’s automobile or motor vehicle

Report the value of the automobile benefit for the personal use of the automobiles or motor vehicles you provided to your employee (as a result of their current, previous or intended office or employment) using box 14 and code 34.

- Interest-free and low-interest loans

Report the value of the taxable benefit from an interest-free or low-interest loan you provided to your employee using box 14 and code 36.

- Security options benefits

Report the total value of the security options taxable benefit you provided to your employee using box 14 and code 38.

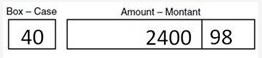

- Taxable benefits

Report the value of the taxable benefits you provided to your employee using box 14 and code 40 unless the benefit is reported in other codes of the T4 slip.

- Employment commissions

Report the employment income from employment commissions you paid to your employee who sold property or negotiated contracts for you using code box 14 and code 42.

Do not include GST/HST or PST in the amount reported in box 14.

- Canadian Forces personnel and police officers

Report the employment income using box 14 and code 43. Only report the employment income up to the maximum rate of pay earned by a lieutenant-colonel of the Canadian Armed Forces using code 43.

- Emergency volunteers

Report the taxable employment income you as a government, municipality, or public authority paid to your employee who is an emergency volunteer (such as a firefighter, ambulance technician, or search and rescue volunteer) using box 14

Do not report the tax-exempt amount (up to $1,000) you paid to your employee who is an emergency volunteer using box 14, use code 87.

You must report the total amount using box 14 if you paid the individual other than as a volunteer for performing the same or similar duties.

- Employees with power saws or tree trimmers

Report the rental payments you made to employees for the use of their own power saws or tree trimmers using box 14.

Do not reduce the amount reported in box 14 by the cost or value of saws, trimmers, parts, gasoline, or any other materials the employee supplies.

- Detached employee – Social security agreement

- Do not report any amount using box 14 if you use employment code 16 – Detached employee – Social security agreement and no other type of income is reported on the T4 slip.

- Employee salary overpayments

Report the salary overpayment you made to your employee using box 14 if your employee:

- Does not repay you

- Repaid you, but they did not perform their duties

Do not report any amount using box 14 if the employee repaid you but the repayment was because of a clerical, administrative or system error.

Learn more when on how to make corrections when the employee repays you: Make corrections after filing.

Learn more:

Box 16 – Employee's CPP contributions

Report amounts you deducted for your employee's share of the Canada Pension Plan (CPP) contributions using box 16 if you enter in box 10 that your employee had a province of employment other than Quebec. If you report an amount in box 16, you have to report pensionable earnings using box 26.

Do not report the employer's share of CPP contributions on the T4 slip.

Specific situations

- No deductions

Do not report any amount using box 16 if you did not deduct CPP.

- Province of employment is Quebec

Do not report any amount using box 16 if box 10 shows the employee's province of employment is Quebec, use box 17.

- CPP2 contributions

Do not report CPP2 contributions using box 16, use box 16A.

- Over deductions (overpayment)

Report the total CPP deductions using box 16 and the correct pensionable earnings using box 26 if you over deducted CPP contributions (overpayment) from your employee and did not reimburse them.

Learn more if you over deducted CPP contributions:

- Make corrections before filing if you reimbursed them

- Make corrections after filing

- Under deductions (recovering)

Do not report any recovered amount using box 16 if you under deducted CPP contributions.

Learn more if you under deducted CPP contributions:

- First Nations (exempt income) Keywords: Indians indigenous first nations

Report amounts you deducted for your employee's share of the CPP contributions using box 16. If you report an amount in box 16, you have to report pensionable earnings using box 26.

Tax-exempt employment income you paid to an employee who is registered or entitled to be registered under the Indian Act is not pensionable, unless you elected to provide CPP coverage to all of your First Nations employees on their tax-exempt employment income.

- Detached employee – Social security agreement

Report the amount you are paying for your employee CPP contributions using box 16 if you use employment code 16 – Detached employee – Social security agreement . You, as the employer, are paying CPP on behalf of the detached employee.

- Contribution to CPP and QPP during the same year

Report the amounts your employee contributed to CPP and QPP during the same year using 2 separate T4 slips as follows:

- 1 slip showing the applicable province or territory of employment (other than Quebec) for the CPP contributions you deducted using box 16 and the employee's CPP/QPP pensionable earnings using box 26

- 1 slip showing the province of employment as Quebec for the QPP contributions you deducted using box 17 and the employee's CPP/QPP pensionable earnings using box 26

Learn more: About the deduction of Canada Pension Plan (CPP) contributions.

Box 16A – Employee's second CPP contributions (CPP2) Slips filed for calendar year 2024 and after

For T4 slips filed for calendar year 2024 and after, report the amount of CPP2 contributions you deducted from your employee in box 16A if you enter in box 10 that your employee had a province of employment other than Quebec.

Specific situations

- No deductions

Do not report any amount using box 16A if you did not deduct CPP2.

- Province of employment is Quebec

Do not report any amount using box 16A if box 10 shows the employee's province of employment is Quebec, use box 17A.

- CPP contributions

Do not report any amount using box 16A if your employee has not reached the first maximum earnings ceiling, use box 16.

- Over deductions (overpayment)

Report the total CPP2 deductions using box 16A and the correct pensionable earnings using box 26 if you over deducted CPP2 contributions (overpayment) from your employee and did not reimburse them.

Learn more if you over deducted CPP2 contributions:

- Make corrections before filing if you reimbursed them

- Make corrections after filing

- Under deductions (recovering)

Do not report any recovered amount using box 16A if you under deducted CPP2 contributions.

Learn more if you under deducted CPP2 contributions:

If required, the CRA may need to update the instructions during 2023.

Learn more: About the deduction of Canada Pension Plan (CPP) contributions.

Box 17 – Employee's QPP contributions

Report amounts you deducted for your employee's share of the Quebec Pension Plan (QPP) contributions using box 17 if you enter in box 10 that your employee had a province of employment in Quebec. If you report an amount in box 17, you have to report pensionable earnings using box 26.

Do not report the employer's share of QPP contributions on the T4 slip.

Specific situations

- No deductions

Do not report any amount using box 17 if you did not deduct QPP.

- Province of employment is not Quebec

Do not report any amount using box 17 if box 10 shows the employee's province of employment is other than Quebec, use box 16.

- QPP2 contributions

Do not report QPP2 contributions using box 17, use box 17A.

- First Nations (exempt income) Keywords: Indians indigenous first nations

Report amounts you deducted for your employee's share of the QPP contributions using box 17. If you report an amount in box 17, you have to report pensionable earnings using box 26.

Tax-exempt employment income you paid to an employee who is registered, or entitled to be registered under the Indian Act is not pensionable and you must deduct QPP contributions.

- Contribution to CPP and QPP during the same year

Report the amounts your employee contributed to CPP and QPP during the same year using 2 separate T4 slips as follows:

- 1 slip showing the applicable province or territory of employment (other than Quebec) for the CPP contributions you deducted using box 16 and the employee's CPP/QPP pensionable earnings using box 26

- 1 slip showing the province of employment as Quebec for the QPP contributions you deducted using box 17 and the employee's CPP/QPP pensionable earnings using box 26

Learn more: Québec Pension Plan Contributions | Revenu Québec.

Box 17A – Employee's second QPP contributions (QPP2) Slips filed for calendar year 2024 and after

For T4 slips filed for calendar year 2024 and after, report the amount of QPP2 contributions you deducted from your employee in box 17A if you enter in box 10 that your employee worked in the province of Quebec.

Specific situations

- No deductions

Do not report any amount using box 17A if you did not deduct QPP2.

- Province of employment is not Quebec

Do not report any amount using box 17A if box 10 shows the employee's province of employment is other than Quebec, use box 16A.

- QPP contributions

Do not report any amount using box 17A if your employee has not reached the first maximum earnings ceiling, use box 17.

If required, the CRA may need to update the instructions during 2023.

Learn more: Québec Pension Plan Contributions | Revenu Québec.

Box 18 – Employee's EI premiums

Report amounts you deducted for your employee's share of the employment insurance (EI) premiums using box 18. If you report an amount in box 18, you have to report insurable earnings using box 24.

Do not report the employer's share of EI premiums on the T4 slip.

Specific situations

- No deductions

Do not report any amount using box 18 if you did not deduct EI.

- Over deductions (overpayment)

Report the total EI deductions using box 18 and the correct insurable earnings using box 24 if you over deducted EI premiums (overpayment) from your employee and did not reimburse them.

Learn more if you over deducted EI premiums:

- Make corrections before filing if you reimbursed them

- Make corrections after filing

- Under deductions (recovering)

Do not report any recovered amount using box 18 if you under deducted EI premiums.

Learn more if you under deducted EI premiums:

- First Nations (exempt income) Keywords: Indians indigenous first nations

Report amounts you deducted for your employee's share of the EI premiums using box 18. If you report an amount in box 18, you have to report insurable earnings using box 24.

Tax-exempt employment income you paid to an employee who is registered or entitled to be registered under the Indian Act is insurable and you must deduct EI premiums.

- Self-employed fishers, barbers and hairdressers, taxi drivers and drivers of other passenger‑carrying vehicles

Report amounts you remitted for the self-employed worker's share of EI premiums using box 18. If you report an amount in box 18, you have to report insurable earnings using box 24.

- Province of employment is Quebec

Report amounts you deducted for your employee's share of EI premiums calculated using the Quebec EI rate using box 18. If you report an amount in box 18, you have to report insurable earnings using box 24.

Learn more: Quebec EI premium rates and maximums.

- Detached employee - Social security agreement

- Do not report any amount using box 18 if you use employment code 16 – Detached employee – Social security agreement and no other type of income is reported on the T4 slip.

Learn more: About the deduction of Employment Insurance (EI) premiums.

Box 22 – Income tax deducted

Report the amount of income tax you deducted from your employee using box 22. This includes the federal, provincial (except Quebec), and territorial taxes that apply.

Specific situations

- No deductions

Do not report any amount using box 22 if you did not deduct income tax.

- Authority of a garnishee or a requirement to pay

Do not report any amount using box 22 if you withheld under the authority of a garnishee or a requirement to pay that applies to the employee's previously assessed tax arrears.

Learn more: About the deduction of income tax.

Box 24 – EI insurable earnings

Report the total amount of insurable earnings using box 24. This is the amount you used to calculate your employee's EI premiums that you reported using box 18, up to the maximum insurable earnings for the year.

Report "0" if the employee or the self-employed worker had no insurable earnings and you did not report an amount in box 18.

In many situations, boxes 14 and 24 will be the same amount.

Specific situations

- No EI premiums deductions required

Do not report in box 24 amounts paid to your employee for employment, benefits, or other payments that should not have EI premiums deducted.

The unpaid portion of any earnings from insurable employment that you did not pay because of your bankruptcy, receivership, or non-payment of remuneration for which the employee has filed a complaint with the federal, provincial, or territorial labour authorities.

Learn more:

- More than 1 slip

Report the insurable earnings amount for each period of employment in box 24 of each T4 slip if you give the same employee more than one T4 slip for the year.

Example

An employee earned $30,000 working in Ontario from January 2023 to June 2023 and earned $40,000 working in Quebec for the remainder of the year with the same employer. In addition to any other boxes that need to be filled out, report amounts in boxes 14 and 24 as follows:

- Ontario T4 slip – box 14 = $30,000 and box 24 = $30,000

- Quebec T4 slip – box 14 = $40,000 and box 24 = $31,500 (calculated as the maximum insurable earnings for 2023 of $61,500 – $30,000 already reported on T4 slip with Ontario as province of employment = $31,500)

- Correct deduction errors

Report the correct EI insurable earnings in box 24. This will reduce unnecessary pensionable and insurable earnings review (PIER) reports for EI deficiency calculations . For example, if the employee worked both inside and outside of Quebec.

Learn more:

Box 26 – CPP/QPP pensionable earnings

Report the total amount of pensionable earnings using box 26. This is the amount you used to calculate your employee's CPP/QPP contributions that you reported using box 16 and box 17, up to the maximum pensionable earnings for the year.

Slips filed for calendar year 2024 and after Report the total amount of pensionable earnings using box 26. This is the amount you used to calculate your employee's CPP/QPP contributions that you reported using box 16, box 16A, box 17 and box 17A, up to the maximum pensionable earnings and additional maximum pensionable earnings for the year.

Report "0" if the employee had no pensionable earnings and you did not report an amount in boxes 16, 16A, 17 or 17A.

In many situations, boxes 14 and 26 will be the same amount.

Specific situations

- No CPP/QPP contributions deductions required

Do not report amounts paid to your employee for employment, benefits, or other payments that should not have CPP/QPP contributions deducted using box 26.

Learn more:

- Non-cash taxable benefits, including security option benefits

Report the value of pensionable non-cash taxable benefits using box 26, even if the employee received no other remuneration.

For example, if your employee is on an unpaid leave of absence and you continue to provide benefits during the leave period, report the benefit using box 26.

- Amounts not to be included in box 26

Do not report using box 26 amounts paid to your employee:

- before and during the month the employee turned 18

- after the month the employee turned 70

- during the months the employee was considered to be disabled under the CPP or QPP

- after an eligible employee, who is 65 to 70 years of age and receiving CPP benefits, gave you a signed copy of Form CPT30, Election to Stop Contributing to the Canada Pension Plan, or Revocation of a Prior Election, with parts A, B, and C completed

- before an eligible employee who is 65 to 70 years of age, gave you a signed copy of Form CPT30 with parts A, B, and D completed

Report these amounts using box 14 even if you do not report them using box 26.

Learn more: Employee's life events: Start, stop or restart CPP deductions.

- Benefits and earnings taxable only in the Quebec

Certain taxable benefits and earnings are considered by Revenu Québec to be pensionable earnings for employees working in Quebec.

Generally, the amount you report using box 26 will be more than the amount you report using box 14 in this situation. The CRA will process the T4 slip even if box 26 is more than box 14.

Example 1 – Benefit taxable in Quebec – Unpaid leave

Marion works for her employer in Quebec and is on an unpaid leave of absence. Her employer pays $750 in premiums to an employer-paid private health benefit plan on her behalf. Since the benefit is not taxable outside of Quebec, it is not income. When preparing Marion's Quebec T4 slip, her employer will leave box 14 blank. Since the premiums are QPP pensionable, her employer will report $750 in box 26, the QPP contributions withheld on the benefit in box 17, and fill in any other boxes on her T4 slip as applicable.

Example 2 – Benefit taxable in Quebec – Other earnings

During 2023, Julien received wages of $25,000 plus an $875 benefit that is only taxable in Quebec. When preparing Julien's Quebec T4 slip, his employer will report $25,000 in box 14, $25,875 in box 26, and fill in any other boxes on his T4 slip as applicable.

Example 3 – Benefit taxable in Quebec and federally

Stephane works for his employer in Quebec and did not receive any cash earnings. However, his employer gave him a non-cash housing benefit valued at $1,100. When preparing Stephane's Quebec T4 slip, his employer will report $1,100 in boxes 14 and 26, and fill in any other boxes on his T4 slip as applicable.

Learn more: Source Deductions and Employer Contributions | Revenu Québec.

- More than 1 slip

Report the pensionable earnings amount for each period of employment in box 26 of each T4 slip if you give the same employee more than one T4 slip for the year.

Example

An employee earned $35,000 working in Ontario from January 2023 to June 2023 and earned $40,000 working in Quebec for the remainder of the year with the same employer. In addition to any other boxes that need to be filled out, report amounts in boxes 14 and 26 as follows:

- Ontario T4 slip – box 14 = $35,000 and box 26 = $35,000

- Quebec T4 slip – box 14 = $40,000 and box 26 = $31,600 (calculated as the maximum pensionable earnings for 2023 of $66,600 - $35,000 already reported on T4 slip with Ontario as province of employment = $31,600)

- Correct deduction errors

Report the correct CPP pensionable earnings in box 26. This will reduce unnecessary pensionable and insurable earnings review (PIER) reports for CPP deficiency calculations. For example, if the employee worked both inside and outside of Quebec.

Learn more:

Box 55 – Employee's PPIP premiums

Report amounts you deducted for your employee's share of the provincial parental insurance plan (PPIP) premiums using box 55 if you enter in box 10 that your employee worked in the province of Quebec. If you report an amount in box 55, you have to report insurable earnings using box 56.

Do not report the employer's share of PPIP premiums on the T4 slip.

Specific situation

- No deductions

Do not report any amount using box 55 if you did not deduct PPIP .

Learn more: Québec Parental Insurance Plan (QPIP) Premiums | Revenu Québec.

Box 56 – PPIP insurable earnings

Report the total amount of insurable earnings using box 56. This is the amount you used to calculate your employee's PPIP premiums that you reported using box 55, up to the maximum PPIP insurable earnings for the year.

Report "0" if the employee or the self-employed worker had no insurable earnings and you did not report an amount in box 55.

Specific situations

- No PPIP premiums deductions required

Do not report in box 56 amounts paid to your employee for employment, benefits, or other payments that should not have PPIP premiums deducted.

- PPIP insurable earnings are the same as employment income

Do not report an amount using box 56 if the amount for the PPIP insurable earnings is over the maximum for the year.

RPP or DPSP

Box 20 – RPP contributions

Report the amount, including instalment interest (for example, interest charged to buy back pensionable service), your employee contributed to a registered pension plan (RPP) using box 20.

Specific situations

- Employee did not contribute

- Do not report an amount if the employee did not contribute to a plan using box 20.

- Direct transfers

Do not report direct transfers to an RPP from an employee's RRSP.

- First Nations (exempt income) Keywords: Indians indigenous first nations

Do not report in box 20 an amount for RPP contributions relating to tax-exempt income you paid to an employee who is registered or entitled to be registered under the Indian Act.

If you pay taxable or partly tax-exempt employment income, you must prorate the RPP contribution and report the amount related to their taxable income using code box 20.

Give your employee proof of the amounts of RPP contributions for all tax-exempt income. Your employee will use this amount to fill out Form T90, Income Exempt From Tax Under the Indian Act.

Slips filed for calendar year 2024 and after For T4 slips filed for calendar year 2024 and after, you will need to report RPP contributions relating to tax-exempt income using a new code.

- RRSP

Do not report an amount if you made contributions to your employee's RRSP using box 20, use code 40 to report the total value of the benefit.

- RCA

Report the amount if the employee contributed to an RCA using box 20.

Do not report amounts that are not deductible.

You have to attach a letter informing the employee of the amounts you reported if the amount in box 20 includes RPP and RCA contributions.

- RPP past-service contributions

Report the amount your employee contributed to an RPP if the contributions included current and past-service contributions for:

Learn more: Contributions to savings and pension plans.

Box 50 – RPP or DPSP registration number

Enter the 7-digit registration number that the CRA gave you for your RPP or DPSP using box 50 if you reported an amount for a pension adjustment (PA) using box 52.

You have to report the plan number even if your plan requires only employer contributions. If you make contributions to union pension funds, enter the union's plan number.

If you made contributions to more than one plan for the employee, enter only the number of the plan under which the employee has the largest PA.

Box 52 – Pension adjustment

Report in box 52 the amount (in dollars only) of a pension adjustment (PA) an employee has under a registered pension plan (RPP) or a deferred profit sharing plan (DPSP). If you report an amount in box 52, you have to enter the plan registration number using box 50.

Specific situations

Do not report any amount using box 52 if the employee participated in your RPP or DPSP and one of the following situations applies:

- The calculated PA is a negative amount or "0"

- The employee died during the year

- The employee, even if they are still a member of the plan, no longer accrues new pension credits in the year (for example, the employee has accrued the maximum number of years of service in respect of the plan)

- Periods of leave or reduced services under a MEP

- Do not report the amount of a PA for periods of leave or reduced services if you are the plan administrator for a MEP using box 52, use the T4A slip.

- More than 1 slip

- Report the PA proportionately on each T4 slip if you have to fill out more than one T4 slip because they worked in more than one province or territory. If you cannot apportion the PA, report the total amount on one slip.

- More than one RPP or DPSP

- Report in box 52 the amount of the employee's PA you calculated using the total amount of all pension credits accumulated by the employee under all these plans for the year if the employee participates in one or more RPP or DPSP.

Learn more: Pension Adjustment (PA).

Union dues or charitable donations

Box 44 – Union dues

Report the amount you deducted from your employee for tax deductible union dues using box 44, only if you and the union agree that the union will not issue receipts for these dues. This includes amounts you paid to a parity or advisory committee that qualify for a deduction.

Specific situations

- Union issuing receipts

Do not report union dues deductions using box 44 if you and the union do not have an agreement that the union will not issue receipts. The union will have to issue receipts for the employee to claim the income tax deduction.

- Initiation fees

Do not report initiation fees using box 44.

- Strike pay

Do not report strike pay the union paid to union members using box 44.

- First Nations (exempt income) Keywords: Indians indigenous first nations

Do not report in box 44 an amount for union dues relating to tax-exempt income you paid to an employee who is registered, or entitled to be registered under the Indian Act.

If you pay taxable or partly tax-exempt employment income, you must prorate the amount for union dues and report the amount related to their taxable income using box 44.

Give your employee proof of the amounts of union dues for all tax-exempt income. Your employee will use this amount to fill out Form T90, Income Exempt From Tax Under the Indian Act.

Slips filed for calendar year 2024 and after For T4 slips filed for calendar year 2024 and after, you will need to report union dues relating to tax-exempt income using a new code.

Box 46 – Charitable donations

Report in box 46 amounts you deducted from your employee's earnings for donations to a registered charity in Canada.

Learn more: List of Charities.

Codes - Other information

Code 30 – Board and lodging

Report the total value of the board and lodging benefit you provided to your employee using code 30 and box 14.

Specific situation

- Member of the clergy or of a religious order

Report the total value of the housing benefit you provided to your employee who is a member of the clergy, including the part of your cost for the utilities that is eligible (electricity, heat, water and sewer) using code 30 and box 14.

Report all other utilities benefits that are not eligible that you provided to the employee using code 40.

Learn more: Housing and utilities expenses – Provided to a member of the clergy or of a religious order.

Learn more: Board, lodging, housing and utilities expenses.

Code 31 – Special work site

Report the value of the tax-exempt board, lodging and housing benefit provided to your employee working at special work site in a prescribed zone using code 31.

Do not report this amount in box 14.

Specific situation

- Partly provided in a prescribed zone

- Report the part of the benefit provided in a prescribed zone using code 31 and the value of the board and lodging benefit that is not considered provided in a prescribed zone using code 30.

Code 32 – Travel in a prescribed zone

Report the total value of the travel benefit you provided to your employee living in a prescribed zone using code 32 and box 14.

Specific situation

- Medical travel assistance

- Report the total amount of the medical travel benefit using code 32 and code 33 for the medical portion only.

Code 33 – Medical travel assistance

Report the value of the medical travel portion only if you provided travel assistance to your employee living in a prescribed zone using code 33 and the total value of the travel benefit using code 32.

Do not report this amount in box 14.

Code 34 – Personal use of employer's automobile or motor vehicle

Report the value of the automobile benefit for the personal use of the automobiles or motor vehicles you provided to your employee (as a result of their current, previous or intended office or employment) using code 34 and box 14.

Specific situation

- Employee's use of their own vehicle

- Do not report using code 34 if you provided an allowance or a reimbursement to your employee to compensate for use of their automobile or motor vehicle, use code 40.

Learn more:

Code 36 – Interest-free and low-interest loans

Report the value of the taxable benefit from an interest-free and low interest loan you provided to your employee using code 36 and box 14.

Learn more: Loans and employee debt.

Code 38 – Security options benefits

Report the total value of the security options taxable benefit you provided to your employee using code 38 and box 14.

Option benefit deductions

- Security options deduction under 110(1)(d)

- If your employee is eligible for the option benefit deduction under 110(1)(d), report 50% of the value of the taxable benefit received from qualified securities using code 39.

- Security options deduction under 110(1)(d.1)

- If your employee is eligible for the option benefit deduction under 110(1)(d.1), report 50% of the value of the taxable benefit received from qualified securities using code 41.

- Employer makes election under 110(1.1)

- If your employee is eligible for the option benefit deduction under 110(1)(d) and you made an election under 110(1.1) to not claim the cash-out as an expense, also report the value of the taxable benefit using code 86.

Learn more: Security (stock) options.

Code 39 – Security options deduction – 110(1)(d)

Report 50% of the value of the taxable benefit received from qualified securities if your employee is eligible for the option benefit deduction under 110(1)(d) using code 39. If you report an amount in code 39, you have to report the total value of the security options benefit using code 38.

Do not report this amount in box 14.

Specific situation

- Security options reported on Form T2-SCH 59

- Do not report taxable benefits realized from security options you reported on Form T2-SCH 59, Information Return for Non-Qualified Securities (2021 and later tax years).

Learn more: Security (stock) options.

Code 40 – Other taxable allowances and benefits

Report the value of the taxable benefits and allowances you provided to your employee using code 40 and box 14 unless the benefit is reported in other codes of the T4 slip.

Learn more: Determine if a benefit is taxable.

Code 41 – Security options deduction – 110(1)(d.1)

Report 50% of the value of the taxable benefit received from qualified securities if your employee is eligible for the option benefit deduction under 110(1)(d.1) using code 41. If you report an amount in code 41, you have to report the total value of the security options benefit using code 38.

Do not report this amount in box 14.

Learn more: Security (stock) options.

Code 42 – Employment commissions

Report amounts of commissions you paid to your employee who sold property or negotiated contracts for you using code 42 and box 14.

Learn more: Commission payments.

Code 43 – Canadian Armed Forces personnel and police deduction

Report employment income, up to the maximum rate of pay earned by a lieutenant-colonel of the Canadian Armed Forces, using code 43 and box 14.

For 2017 and subsequent taxation years, Canadian Armed Forces personnel and police officers deployed outside Canada can claim a deduction from net income for the amount of employment earnings they receive while serving on international operational missions as determined by the Minister of National Defence or by a person designated by that Minister. This is the case regardless of the risk associated with the mission.

Learn more: Canadian Armed Forces personnel and police deduction.

Code 66 – Eligible retiring allowances

Report using 66 eligible retiring allowances that you paid in the year to your employee that are eligible for transfer to an RPP, RRSP, or a PRPP, even if it was not transferred.

Do not report this amount in box 14.

Specific situations

- First Nations (exempt income) Keywords: Indians indigenous first nations

- Do not report non-eligible retiring allowances paid to your employee who is registered, or entitled to be registered under the Indian Act using code 66, use code 69.

- Non-eligible retiring allowances

- Do not report non-eligible retiring allowances using code 66, use code 67.

Learn more: Payments of retiring allowances.

Code 67 – Non-eligible retiring allowances

Report non-eligible retiring allowances you paid in the year to your employee that were not eligible for transfer to an RPP, RRSP or a PRPP using code 67.

Do not report this amount in box 14.

Specific situations

- First Nations (exempt income) Keywords: Indians indigenous first nations

- Do not report non-eligible retiring allowances paid to your employee who is registered, or entitled to be registered under the Indian Act using code 67, use code 69.

- Eligible retiring allowances

- Do not report eligible retiring allowances using code 67, use code 66.

Learn more: Payments of retiring allowances.

Code 69 – Indian (exempt income) – Non-eligible retiring allowances Keywords: Indians indigenous first nations

Report using 69 only tax-exempt non-eligible retiring allowances you paid to your employee who is registered or entitled to be registered under the Indian Act that were not eligible for transfer to an RPP, RRSP or a PRPP.

Do not report this amount in box 14.

Specific situations

- Partly tax-exempt non-eligible for transfer to an RPP, RRSP or a PRPP Keywords: Indians indigenous first nations Keywords: Indians indigenous first nations

Report using code 69 the tax-exempt part of the retiring allowances you paid that are not eligible to be transferred and the taxable part of the non-eligible retiring allowance using code 67.

- Eligible for transfer to an RPP, RRSP or a PRPP

- Do not report eligible retiring allowances using code 69, use code 66.

Learn more: Payments to First Nations workers.

Code 71 – Indian (tax-exempt income) – Employment Keywords: Indians indigenous first nations

Report only tax-exempt employment income you paid to your employee who is registered or entitled to be registered under the Indian Act using code 71.

Do not report this amount in box 14.

Specific situations

- Partly tax-exempt

- Report the tax-exempt part of the employee's employment income using code 71 and the taxable part of their income using box 14.

- Fully taxable

- Do not report fully taxable income using code 71, use box 14.

Learn more: Payments to First Nations workers.

Code 74 – Past service contributions for 1989 or earlier years while a contributor

Report amounts for past service contributions to an RPP for 1989 or earlier years while the employee was a contributor using code 74 and box 20.

Code 75 – Past service contributions for 1989 or earlier years while not a contributor

Report amounts for past service contributions to an RPP for 1989 or earlier years while the employee was not a contributor using code 75 and box 20.

Code 77 – Workers' compensation benefits repaid to the employer

Report the amount of workers' compensation benefits repaid to the employer using code 77 where:

- You previously paid your employee the workers' compensation benefit amount and you reported it as employment income on their T4 slip

- You were reimbursed by the workers' compensation board for the worker's compensation benefit amount you paid to your employee

This allows your employees to claim a deduction as other employment expenses on their income tax and benefit returns.

Do not report this amount in box 14.

Learn more: Payments related to workers' compensation claims.

Code 78 – Fishers – Gross income

Report the gross income you paid to a self-employed fisher using code 78. If you report an amount in code 78, you have to enter the employment code 17 using box 29. Also report:

- The net partnership amount if the fisher is a type 1 using code 79

- The shareperson amount if the fisher is a type 2 using code 80

Do not report this amount in box 14.

Code 79 – Fishers – Net partnership amount

Report the net partnership amount if you paid a type 1 fisher using code 79. If you report an amount in code 79, you have to report the gross income using code 78. Also report the same amount using :

- box 24 if you enter in box 10 that the fisher worked in a province other than Quebec

- box 56 if you enter in box 10 that the fisher worked in the province of Quebec

Do not report this amount in box 14.

Code 80 – Fishers – Shareperson amount

Report the shareperson amount if you paid a type 2 fisher using code 80. If you report an amount in code 80, you have to report the gross income using code 78. Also report the same amount using :

- box 24 if you enter in box 10 that the fisher worked in a province other than Quebec

- box 56 if you enter in box 10 that the fisher worked in the province of Quebec

Do not report this amount in box 14.

Code 81 – Placement or employment agency worker – Gross income

Report the gross income you paid to a self-employed placement or employment agency worker using code 81. If you report an amount in code 81, you have to enter the employment code 11 using box 29.

Do not report this amount in box 14.

Code 82 – Taxi drivers and drivers of other passenger-carrying vehicles – Gross income

Report the gross income you paid to a self-employed taxi driver and driver of other passenger-carrying vehicles using code 82. If you report an amount in code 82, you have to enter the employment code 12 using box 29.

Do not report this amount in box 14.

Code 83 – Barbers or hairdressers – Gross income

Report the gross income you paid to a self-employed barbers or hairdressers using code 83. If you report an amount in code 83, you have to enter the employment code 13 using box 29.

Do not report this amount in box 14.

Code 85 – Employee-paid premiums for private health services plans

Report the premiums that your employee paid to a private health services plans using code 85.

The use of code 85 is optional. If you do not use this code, the CRA may ask the recipient to provide supporting documents.

Do not report this amount in box 14.

This is considered a qualifying medical expense which the recipient may claim as a medical expense tax credit on their income tax and benefit return.

Learn more: Insurance plans.

Code 86 – Security options election

Report the value of the taxable benefit received from qualified securities if your employee is eligible for the option benefit deduction under 110(1)(d) and you made an election under 110(1.1) to not claim the cash-out as an expense using code 86. If you report an amount in code 86, you have to report the total value of the security options benefit using code 38.

Do not report this amount in box 14.

Code 87 – Emergency services volunteer exempt amount

Report only tax-exempt employment income (up to $1,000) you paid as a government, a municipality, or a public authority to a person who performed firefighter or search and rescue duties as a volunteer using code 87.

Do not report this amount in box 14.

Specific situations

- Employment income of $1,000 or more

- Report only the tax-exempt amount (up to $1,000) using code 87 and the remaining taxable employment income using box 14.

- Person does not qualify for the exemption

- Do not report an amount using code 87 if you employed the volunteer for the same or similar duties, use box 14 to report the total amount.

Learn more: Payments to emergency services volunteers.

Code 88 – Indian (exempt income) – Self-employment Keywords: Self-employment income Indians indigenous first nations

Report the tax-exempt part of the self-employment income you paid to a person who is registered, or entitled to be registered under the Indian Act who is a self-employed fisher , a self-employed barber or hairdresser , or a self-employed taxi driver or driver of other passenger-carrying vehicles using code 88. If you report an amount in code 88, you have to enter the appropriate employment code using box 29.

Do not report this amount in box 14.

Specific situations

- Partly tax-exempt

Report the tax-exempt part of the self-employment income using code 88 and the taxable self-employment income using:

- Fully taxable

Do not report fully taxable self-employment income using code 88, use:

Learn more: Payments to First Nations workers.

Code 94 – Indian (exempt employment income) - RPP contributions Slips filed for calendar year 2024 and after Keywords: Indians indigenous first nations

For T4 slips filed for calendar year 2024 and after, report only RPP contributions relating to tax-exempt employment income you paid to your employee who is registered, or entitled to be registered under the Indian Act using code 94. The amount of the tax-exempt employment income you paid is the amount reported using code 71.

Specific situations

- Partly tax-exempt

- Report the RPP contributions relating to tax-exempt employment income using code 94 and the RPP contributions relating to the taxable part of their employment income using box 20.

- Fully taxable

Do not report RPP contributions relating to fully taxable income using code 94, use box 20.

Learn more: Contributions to savings and pension plans

Code 95 – Indian (exempt employment income) - Union dues Slips filed for calendar year 2024 and after Keywords: Indians indigenous first nations

For T4 slips filed for calendar year 2024 and after, report only union dues relating to tax-exempt employment income you paid to your employee who is registered, or entitled to be registered under the Indian Act using code 95. The amount of the tax-exempt employment income you paid is the amount reported using code 71.

Specific situations

Page details

- Date modified: