Treasury Board of Canada Secretariat 2025–26 Departmental Plan

On this page

- From the President

- Plans to deliver on core responsibilities and internal services

- Planned spending and human resources

- Corporate information

- Supplementary information tables

- Federal tax expenditures

- Definitions

From the President

Shafqat Ali, P.C., M.P.

President of the Treasury Board

I am pleased to present the 2025-26 Departmental Plan for the Treasury Board of Canada Secretariat (TBS).

TBS plays a pivotal role in overseeing the careful use of public funds and promoting public service excellence so that Canadians are well served by their government.

The 2025-26 Departmental Plan provides details about how the department will help the federal government in delivering on its priorities.

In the year ahead, TBS will support a comprehensive review of government spending to cut down waste, end duplicative programs, and deploy technology to boost public sector productivity and improve service delivery.

These priorities will be complemented by our ongoing work to advance the public service’s Digital Ambition to meet the needs and expectations of a digitally connected Canadian population, while protecting the security of government information and assets.

We will also continue to lead the federal government’s push towards low-carbon, climate-resilient and green operations. We have made important progress in this area and our actions are helping to drive the country forward in the fight against climate change. We will continue to press on.

And to boost economic growth, TBS will take further concrete actions to build a modern regulatory system that is responsive, easier to navigate, and promotes trade and innovation while protecting Canadians’ health, safety, security, and the environment.

TBS’s work is central to the government’s ability to face some of the most complex problems in our recent history. I’m honoured to take on and lead this important work as the new President of the Treasury Board.

I invite you to read this report and I look forward to reporting back to Canadians on how we’re delivering on our commitments.

Original signed by

The Honourable Shafqat Ali, P.C., M.P.

President of the Treasury Board

Plans to deliver on core responsibilities and internal services

Core responsibilities and internal services

- Core responsibility 1: Spending oversight

- Core responsibility 2: Administrative leadership

- Core responsibility 3: Employer

- Core responsibility 4: Regulatory oversight

- Internal services

Core responsibility 1: Spending oversight

In this section

Description

The Treasury Board of Canada Secretariat (TBS) reviews spending proposals and authorities and existing and proposed government programs for efficiency, effectiveness and relevance and provides information to Parliament and Canadians on government spending.

Quality of life impacts

The activities of this core responsibility contribute to the “good governance” domain of the Quality of Life Framework for Canada and, more specifically, “confidence in institutions.”

Indicators, results and targets

This section presents details on the department’s indicators, the actual results from the three most recently reported fiscal years, the targets and target dates approved in 2025–26 for spending oversight. Details are presented by departmental result.

Table 1 provides a summary of the target and actual results for each indicator associated with the results under spending oversight.

| Departmental result indicators | Actual results | Target | Date to achieve target |

|---|---|---|---|

| Percentage of government programs that have suitable measures for tracking performance and informing decision‑making | 2021–22: 89% 2022–23: 87% 2023–24: 89% |

At least 90% | March 2026 |

Additional information on the detailed results and performance information for TBS’s program inventory is available on GC InfoBase.

Plans to achieve results

The following section describes the planned results for spending oversight in 2025–26.

Reviewing new and existing programs

In 2025–26, TBS will pave the way for a comprehensive review of government spending to increase the federal government’s productivity and identify opportunities to respond to evolving priorities and challenges facing the country.

TBS will also continue to support the Treasury Board in reviewing and approving submissions from departments. It will work with departments to ensure that their Treasury Board submissions:

- support value for money and comply with rules and policies

- are designed to achieve and measure their expected outcomes

- contain clear risk assessments and risk management strategies so that initiatives succeed

Improving results‑based management

In 2025–26, TBS will continue to help departments link spending to outcomes. To help make sure departments have suitable information for tracking performance and for informing decision making, TBS will continue to provide them with guidance to achieve better outcomes for Canadians by:

- addressing the findings and recommendations of the review of the Policy on Results, including:

- proposing updates to the policy

- mitigating challenges faced by departments when implementing the policy

- working with partners to continue to build capacity in the evaluation and performance measurement communities, as well as among people who use information on results

- working with departments to collect better data on gender and diversity for the annual reporting required by the Canadian Gender Budgeting Act

- consolidating data and improving impact assessment methods to more accurately analyze the economic effects of business innovation and growth to support programs across government

- making data posted on GC InfoBase and on the Open Government Portal on federal government spending and results is easier for Canadians to access and use

TBS will also continue to integrate the Quality of Life Framework into government decision‑making processes to help ensure that investments benefit Canadians’ quality of life.

Planned resources to achieve results

Table 2 provides a summary of the planned spending and full‑time equivalents required to achieve results.

| Resource | Planned |

|---|---|

| Spending | $5,417,698,599 |

| Full‑time equivalents | 300 |

Complete financial and human resources information for TBS’s program inventory is available on GC InfoBase.

Related government priorities

Gender‑based analysis plus

In 2025–26, TBS will continue to ensure that Treasury Board submissions identify the impact on different groups based on gender and other identity factors and include a plan to collect and report gender‑based analysis plus data.

TBS will make sure submissions contain:

- sufficient information for decision makers on the potential impact of programs in terms of gender and diversity

- a plan to track the impact of programs in terms of gender and other intersecting identity factors

TBS will also continue to require departments to update Parliament and Canadians on their progress on gender‑based analysis plus in departmental plans and departmental results reports.

See TBS’s Gender‑based analysis plus supplementary information table for more information.

United Nations 2030 Agenda for Sustainable Development and the UN Sustainable Development Goals

In 2025–26, TBS will ensure that Treasury Board submissions consider sustainable development, where appropriate.

In consultation with federal partners, TBS will continue to ensure that departmental plans and departmental results reports inform readers about efforts to advance sustainable development across government.

More information on TBS’s contributions to the Federal Implementation Plan on the 2030 Agenda and the Federal Sustainable Development Strategy can be found in the TBS Departmental Sustainable Development Strategy for 2023 to 2027.

Program inventory

Spending oversight is supported by the following programs in the program inventory:

- Expenditure Data, Analysis, Results and Reviews

- Oversight and Treasury Board Support

Additional information related to the program inventory for spending oversight is available on the Results page on GC InfoBase.

Summary of changes to reporting framework since last year

There are no changes to the reporting framework associated with this core responsibility since last year.

Core responsibility 2: Administrative leadership

In this section

Description

TBS leads government‑wide initiatives, develops policies and sets the strategic direction for government administration related to service delivery and access to government information, as well as the management of assets, finances, information and technology.

Quality of life impacts

The activities of this core responsibility contribute to the “good governance” domain of the Quality of Life Framework for Canada and, more specifically, “confidence in institutions.” Under this core responsibility, TBS also contributes to the “environment” domain and, more specifically, to reducing “greenhouse gas emissions”, by leading the greening of government operations.

Indicators, results and targets

This section presents details on the department’s indicators, the actual results from the three most recently reported fiscal years, the targets and target dates approved in 2025–26 for administrative leadership. Details are presented by departmental result.

Tables 3 and 4 provide a summary of the target and actual results for each indicator associated with the results under administrative leadership.

| Departmental result indicators | Actual results | Target | Date to achieve target |

|---|---|---|---|

| Percentage of high‑volumeFootnote * Government of Canada services that meet service standards | 2021–22: 46% 2022–23: 40% 2023–24: 55% |

80% | March 2026 |

| Percentage of Government of Canada business applications assessed as healthy | 2021–22: 37% 2022–23: 38% 2023–24: 35% |

37% | March 2027 |

| Departmental result indicators | Actual results | Target | Date to achieve target |

|---|---|---|---|

| Percentage of key financial management processes for which a system of internal controls is at the continuous monitoring stage | 2021–22: 46% 2022–23: 65% 2023–24: 93% |

100% | March 2026 |

Additional information on the detailed results and performance information for TBS’s program inventory is available on GC InfoBase.

Plans to achieve results

The following section describes the planned results for administrative leadership in 2025–26.

Examining public service productivity

The public service plays a fundamental role in delivering programs and services to Canadians. Government operations and the delivery of services and programs must be agile and effective.

To that end, in December 2024, the President of the Treasury Board formed a working group to examine productivity in the federal public service and inform the government’s economic plan. The members of the group represent several sectors, including labour, academia and technology. They also include former members of the public service. The working group will identify opportunities to advance the public service’s ability to be innovative, flexible and efficient in delivering programs and services for Canadians and in supporting businesses and will make recommendations to the President.

Strengthening the management of risk and compliance

TBS is committed to strengthening management excellence across the federal public service and to helping deputy heads meet their accountabilities under the Financial Administration Act.

In 2025–26, TBS will introduce a risk and compliance process to replace the Management Accountability Framework. Through the new process, TBS will:

- review departments’ self-assessments of performance and risk in core areas of administration

- identify enterprise‑wide trends

Through this process, TBS will support a stronger culture of evidence‑based accountability in the public service and will strengthen departments’ ability to deliver on their mandates.

Leading digital government transformation

TBS is helping the government work to meet Canadians’ expectations of simple, secure and efficient delivery of services and benefits through the effective use of modern technology and data.

As noted in the 2024 Fall Economic Statement, Canada’s public service needs a transformative strategy to leverage new technologies like artificial intelligence (AI) to improve the efficiency and quality of program and service delivery for Canadians, and to reduce the costs of running government. In March 2025, following extensive public consultations, TBS launched Canada’s first AI strategy for the public service. This strategy will strengthen Canada’s role as a leader in AI by advancing four key priority areas:

- establishing an AI Centre of Expertise to support and to help coordinate government-wide AI efforts

- ensuring that AI systems are secure and used responsibly

- providing training and talent development pathways

- building trust through openness and transparency in how AI is used

In 2025–26, TBS will engage departments on the actions laid out in the AI strategy to confirm action leads and to develop a detailed implementation plan that includes resources, responsibilities, timelines and milestones. It will also continue to engage all departments on action implementation to ensure horizontal alignment.

TBS will also oversee major government transformation initiatives led by departments by:

- working with departments on the initiatives from the start

- commissioning independent third‑party reviews of select initiatives to make sure risks are identified and properly mitigated

As part of responding to the 2023 report of the Auditor General of Canada on modernizing information technology systems, TBS will take steps to improve the health of government applications and to remediate technological debt. These steps will include working with Shared Services Canada and other federal institutions to achieve the goals set out in the 2024 Application Hosting Strategy:

- to provide robust governance and oversight of application hosting performance and costs

- to leverage competitive procurements that support long‑term operations

- to drive sustainable funding that is predictable and transparent

- to promote cohesive and consolidated application hosting services to reduce burdens on federal institutions

TBS will also lead the implementation of the Government of Canada Enterprise Cyber Security Strategy. Developed by TBS, Communications Security Establishment Canada and Shared Services Canada, the strategy is a risk‑based, whole‑of‑government approach that will improve collaboration among departments and improve cyber security as a whole. The strategy will improve how the government prepares for, responds to and recovers from cyber attacks, while fostering a diverse workforce with the right skills, knowledge and culture to support cyber security.

In addition, TBS will continue to implement the Government of Canada Trust and Transparency Strategy. The strategy aims at making the Government of Canada open by design in support of a transparent, accountable and participatory culture of governance that contributes to the equitable and inclusive economic and social well‑being of Canada and reinforces public trust in government and democratic institutions. As part of this strategy, TBS will work with partners to:

- implement the Access to Information Modernization Action Plan, including leading the 2025 review of the Access to Information Act and the 2023–2026 Data Strategy for the Federal Public Service

- finish drafting and then start implementing the next iteration of the National Action Plan on Open Government

As part of leading digital government transformation, TBS will continue to implement the Government of Canada Digital Talent Strategy. This strategy includes measures to help the government attract, develop and retain digital and service talent.

TBS will also manage, with the Professional Institute of the Public Service of Canada, the IT Community Training and Development Fund, which invests $4.725 million annually to support efforts to equip the government’s information technology professionals with the latest digital skills and knowledge.

Providing strategic direction for managing assets and finances

i. Asset management

In 2025–26, TBS will continue to strengthen the management of assets and acquired services, as well as departmental capacity in project management, procurement, real property, materiel and investment management through policies, guidance and professional development.

As part of these efforts, TBS will:

- address the findings of the horizontal internal audit of procurement governance by taking the actions indicated in the joint management response of TBS and Public Services and Procurement Canada

- continue to oversee the implementation of measures announced in Budget 2024 that enforce and uphold the highest standards of procurement to ensure sound stewardship of funds

- support the implementation of the Government of Canada’s procurement priorities

- work with the Canada School of Public Service to strengthen training for public servants on managing assets and acquired services

- work with departments to pilot a risk‑based authority model for real property transactions to improve management of real property assets

ii. Financial management

In 2025–26, to support sound financial management in a tightening fiscal context, TBS will continue to provide assurance and improve its framework for sound stewardship of the financial management function, including financial management policies and guidance, costing, transfer payments, and government accounting and reporting.

TBS will require departments to demonstrate continuous improvement and adapt their established systems of internal controls to evolving risks and trends. TBS will also work with departments to improve their level of maturity related to financial management governance and strengthen in‑year and year‑end cash and accrual forecasting and accounting practices. For example, TBS will encourage departments to monitor their risks and financial positions, and to proactively communicate with key partners, including central agencies, on key risks and financial issues.

TBS will also continue to coordinate and provide oversight for the preparation of the Government of Canada’s consolidated financial statements and the audit of these statements by the Office of the Auditor General of Canada. The goal is to achieve an unmodified audit opinion for the 27th consecutive year, with a focus on ensuring that the consolidated financial statements are timely, accurate and complete. An unmodified opinion means that the Office of the Auditor General of Canada found that the government presented its financial statements fairly and according to generally accepted accounting principles.

In 2025–26, TBS will continue to support sound financial management in the government by:

- strengthening the financial management community, including by improving the community’s data literacy skills sets, as well as by identifying and addressing barriers to diversity, inclusion and accessibility in the community

- leading the consolidation and reduction of financial management systems across government to support the migration of departments from legacy technology to modern digital solutions, which will help strengthen internal controls and provide better information to decision makers faster

- building on consultations with key partners to continue the process to renew the Policy on Transfer Payments and to strengthen the transfer payment community by, for example:

- sharing best practices

- promoting innovation

- supporting departments that are looking to become more efficient by standardizing processes, leveraging emerging technologies and piloting innovative approaches

In addition, TBS will continue to modernize internal audit across the government, particularly with respect to its role in the following:

- supporting transformation programs

- providing value by using an agile suite of services

- enabling innovation

In leading horizontal internal audits, as well as internal audits in small departments and regional development agencies, TBS will continue to help strengthen public sector stewardship, accountability, risk management and internal control across government.

Leading the greening of government operations

The Government of Canada is committed to making its operations net-‑zero, resilient and green, consistent with global efforts like the Paris Agreement. The Greening Government Strategy: A Government of Canada Directive outlines the government’s plan to meet or exceed national climate objectives in its operations and establishes targets for government operations.

In 2025–26, TBS will continue to support the strategy by:

- leading and coordinating federal initiatives to reduce emissions from government operations and to make operations more climate‑resilient and green

- integrating knowledge from other leading organizations and sharing best practices broadly

- tracking and disclosing information on the government’s environmental performance centrally

- driving results to meet greening government environmental objectives

TBS will also continue to:

- manage the Greening Government Fund, which supports departmental projects to develop innovative approaches that can be reproduced within or across departments or to find solutions in areas or situations where reducing greenhouse gas emissions can be difficult

- roll out the Low‑carbon Fuel Procurement Program, through which the government plans to purchase up to 200 million liters of neat low‑carbon fuel by the end of 2030–31 cumulatively

Supporting effective communications

In 2025–26, TBS will complete its review of the Policy on Communications and Federal Identity and the Directive on the Management of Communications to address potential systemic barriers, constraints or gaps. It will then roll out changes to help ensure that communications policies remain up to date and accessible. It will also provide policy guidance where needed.

As part of making sure government advertising is non‑partisan, TBS will continue to monitor the effectiveness of the mandatory external review process. This process looks at all government advertising campaigns with budgets of more than $250,000, as well as at campaigns with budgets of less than $250,000 that departments submit voluntarily for review. The process ensures that ads meet non‑partisan communications criteria before they are published or aired.

Planned resources to achieve results

Table 5 provides a summary of the planned spending and full‑time equivalents required to achieve results.

| Resource | Planned |

|---|---|

| Spending | $142,017,011 |

| Full‑time equivalents | 584 |

Complete financial and human resources information for TBS’s program inventory is available on GC InfoBase.

Related government priorities

Gender‑based analysis plus

TBS will continue to develop and deliver capacity‑building and talent management strategies and initiatives that align with gender-based analysis plus priorities. These strategies and initiatives will help create a skilled, inclusive, diverse, accessible and equitable workforce in the government’s relevant communities of practice, including Departmental Audit Committees.

United Nations 2030 Agenda for Sustainable Development and the UN Sustainable Development Goals

Goal 12 (Ensure sustainable consumption and production patterns) and Goal 13 (Take urgent action to combat climate change and its impacts)

TBS will continue to work with Environment and Climate Change Canada on implementing the 2023–26 Federal Sustainable Development Strategy and on meeting commitments related to greening government in Goals 12 and 13.

TBS will also continue to work with all departments on implementing the Greening Government Strategy, the Policy on Green Procurement and the parts of their 2023–27 Departmental Sustainable Development Strategies that relate to greening their operations.

More information on TBS’s contributions to the Federal Implementation Plan on the 2030 Agenda and the Federal Sustainable Development Strategy can be found in the TBS Departmental Sustainable Development Strategy for 2023 to 2027.

Program inventory

Administrative leadership is supported by the following programs:

- Comptrollership

- Digital Government

- Communications and Federal Identity Policies and Initiatives

- Public Service Accessibility

Additional information related to the program inventory for administrative leadership is available on the Results page on GC InfoBase.

Summary of changes to reporting framework since last year

There are no changes to the reporting framework associated with this core responsibility since last year.

Core responsibility 3: Employer

In this section

Description

TBS develops policies and sets the strategic direction for people management in the public service, manages total compensation (including pensions and benefits) and labour relations, and undertakes initiatives to improve performance in support of recruitment and retention objectives.

Quality of life impacts

This core responsibility contributes to the “prosperity” domain of the Quality of Life Framework for Canada and, more specifically, “employment”, “wages”, and “job satisfaction,” through the activities done under this core responsibility. These activities also contribute to the “good governance” domain and, more specifically, “confidence in institutions” and “representation in senior leadership positions”.

Indicators, results and targets

This section presents details on the department’s indicators, the actual results from the three most recently reported fiscal years, the targets and target dates approved in 2025–26 for the employer core responsibility. Details are presented by departmental result.

Tables 6 and 7 provide a summary of the target and actual results for each indicator associated with the results under the employer core responsibility.

| Departmental result indicators | Actual results | Target | Date to achieve target |

|---|---|---|---|

| Percentage of Public Service Labour Relations and Employment Board outcomes that confirm that the Government of Canada is bargaining in good faith | 2021–22: 100% 2022–23: 0%Footnote * 2023–24: 100% |

100% | March 2026 |

| Departmental result indicators | Actual results | Target | Date to achieve target |

|---|---|---|---|

| Percentage of employees who believe their workplace is psychologically healthy | 2021–22: 68% 2022–23: 68% 2023–24: 68%Footnote ** |

More than 68% | March 2027 |

| Percentage of employees who responded positively to “my department or agency implements activities and practices that support a diverse workplace” | 2021–22: 78% 2022–23: 79% 2023–24: 79%Footnote ** |

At least 75% | March 2027 |

| Percentage of employees who indicate that their organization respects individual differences (e.g. culture, workstyles and ideas) | 2021–22: 77% 2022–23: 75% 2023–24: 75%Footnote ** |

At least 80% | March 2027 |

| Percentage of institutions where communications in designated bilingual offices “nearly always” occur in the official language chosen by the public | 2021–22: 91.6% 2022–23: 91.6% 2023–24: 87.2% |

At least 90% | March 2026 |

Additional information on the detailed results and performance information for TBS’s program inventory is available on GC InfoBase.

Plans to achieve results

The following section describes the planned results for the employer core responsibility in 2025–26.

Bargaining in good faith

In 2025–26, TBS will work to maintain collaborative, professional and respectful relationships with Canada’s public service unions by negotiating on:

- modern, competitive and fiscally responsible compensation packages

- harmonized and simplified language in collective agreements to improve the administration of certain terms and conditions of employment

In addition, TBS will continue to:

- develop pay equity plans for the core public administration, the RCMP and the Canadian Forces through committees that include employee and employer representatives

- engage with bargaining agents and others to modernize terms and conditions of employment

Modernizing the public service pension plan

TBS will support amendments to the Public Service Superannuation Act that expand the operational service program to provide earlier pension eligibility to certain additional occupational groups who promote and protect the safety and security of Canadians. This retirement benefit will allow firefighters, border services officers, parliamentary protection officers and other similar frontline employees to retire earlier, similar to Correctional Service Canada employees working in a federal correctional institution. These amendments will better align this benefit with the Income Tax Regulations and will help ensure consistency in treatment for frontline employees, allowing for greater career mobility in the public service.

Strengthening and modernizing people management in the public service

TBS reviews and adapts workplace policies and processes to help the public service fulfill its mandate.

In 2025–26, TBS will:

- launch a review of the Policy on People Management and its supporting instruments

- support departments as they implement the updated Directive on Telework

- continue to provide guidance and support to departments on implementing the Direction on Prescribed Presence in the Workplace

Working with Public Services and Procurement Canada, TBS will:

- provide strategic direction and operational leadership to stabilize the current pay system

- prepare for the next human resources and pay solution by:

- simplifying human resources and pay policies and processes

- reducing the number of human resources systems across the government

- improving pay results for employees

Reinforcing the values and ethics of the public service

TBS will continue to work with the Privy Council Office and the Canada School of Public Service to support departments in fostering a clear understanding of the Values and Ethics Code for the Public Sector and in equipping public servants to apply it in their daily work.

TBS will also:

- review the Directive on Conflict of Interest to ensure that the requirements are clear and effective

- support the government in addressing the results of the Review of the Public Servants Disclosure Protection Act, which will recommend possible amendments to the act to further support and protect federal employees who come forward to disclose wrongdoing

- communicate, raise awareness of and provide additional support on guidance for public servants on the personal use of social media

- continue to enhance guidance and supports that foster dialogue on values and ethics, including by updating the courses offered by the Canada School of Public Service on values and ethics

Creating a diverse, equitable, accessible and inclusive workforce and workplace

The government is committed to fostering a safe, healthy and inclusive environment where the workforce is representative of the Canadian population and where equity‑seeking employees are recognized equally for their contributions and are provided every opportunity to succeed.

To support this commitment, TBS will continue to develop and implement the Action Plan for Black Public Servants. As part of implementing the action plan, it will create career development programs and mental health supports for Black public servants by investing nearly $50 million over three years, as announced in Budget 2023.

Current programming includes the following:

- the Executive Leadership Program, which supports the career advancement of Black executives at the EX-01 to EX-03 levels

- the Career Counselling and Coaching Program for Black Public Servants, which offers personalized assessment, counselling and coaching for Black public servants

- a mental health fund that has supported Black-centric improvements to the Employee Assistance Program

Planning for future programming is underway.

TBS will also work with deputy heads of departments to respond to the Study on the Black Executive Community in the Federal Public Service. The study describes the lived experiences of Black executives, identifies the systemic barriers to their participation and inclusion, and recommends measures to improve their working conditions and increase their representation in the public service.

Working with the Black Executives Network, deputy heads and other leaders across the public service, TBS will accelerate efforts to:

- improve the representation of Black executives at all levels

- address barriers to participation and inclusion

- improve supports and working conditions

- address the recommendations in the study

Some of these efforts will also benefit other racialized employees and executives, as well as those who identify as Indigenous, as persons with a disability or as 2SLGBTQIA+.

TBS will also work to address and raise awareness about the barriers faced by racialized employees and employees in equity groups by:

- supporting efforts led by Employment and Social Development Canada to modernize the Employment Equity Act in response to the report of the Employment Equity Act Review Task Force

- continuing to modernize the self‑identification questionnaire and develop a centralized platform that will provide departments with more comprehensive employee demographic data to improve measurement, reporting and programming

- continuing to respond to the recommendations of the Auditor General’s October 2023 Report 5 — Inclusion in the Workplace for Racialized Employees by:

- supporting the audited organizations as they examine their complaint resolution processes

- providing organizations with information on harassment prevention and resolution to help them identify and address the root causes of disadvantage for racialized employees

- working to establish new expected behaviours in existing competency frameworks in support of non‑racist and inclusive work environments

- adjusting business processes, data, forms and digital tools that may pose barriers to equity, diversity, accessibility and inclusion

- providing guidance on inclusive design and on best practices

- managing enterprise‑wide initiatives to help increase diversity and inclusion, including:

- Executive Talent Management

- the Executive Leadership Development Program

- the Mosaic Leadership Development Program

- Mentorship Plus

- the Federal Speakers’ Forum on Lived Experience

As part of the Accessibility Strategy for the Public Service of Canada, the government committed to hiring 5,000 persons with disabilities by 2025. It has reached this target. However, persons with disabilities continues to be the only employment equity group with representation below the workforce availability rate. Therefore, in 2025–26, TBS will continue to support departments in increasing the representation of persons with disabilities.

In addition, TBS will work to increase accessibility in the public service by:

- advising federal departments on how to meet or exceed the requirements of the Accessible Canada Act, with a view to creating a barrier‑free public service by 2040

- continuing to develop and implement the digital GC Workplace Accessibility Passport to help employees get the tools, supports and measures they need to perform at their best and succeed in the workplace

- continuing to advance the goals of the Accessibility Strategy for the Public Service of Canada to help the federal public service lead by example in accessibility in Canada and abroad

Promoting official languages

TBS will continue to make sure Canadians have greater access to bilingual federal services by coordinating the Official Languages Regulations Reapplication Exercise as part of implementing the Official Languages (Communications With and Services to the Public) Regulations. Through the exercise, federal institutions confirm the linguistic designation of their offices using the language data from the most recent 10‑year census. TBS expects the exercise will result in about 700 more federal offices and points of service being designated as bilingual by 2027.

TBS will also continue to develop regulations to promote linguistic duality, advance the use of English and French equally, and enhance the vitality of linguistic minority communities.

TBS will continue to:

- review and update official languages policy instruments to ensure that they are in line with the amendments to the Official Languages Act and with the commitments made as part of official languages reform

- update policy instruments in response to needs expressed by partners in relation to government priorities such as reconciliation, diversity and inclusion

- participate in the cyclical review of the National Joint Council Bilingual Bonus Directive

In addition, TBS will continue to support the implementation of the modernized Official Languages Act and measures outlined in English and French: Towards a Substantive Equality of Official Languages in Canada, including through:

- the Official Languages Accountability and Reporting Framework, which:

- specifies the roles and responsibilities of federal institutions subject to the act

- describes the mechanisms to support official languages governance at the federal level

- describes the administrative, parliamentary and court remedies available in the event of non‑compliance

- specifies expectations with respect to accountability for official languages

- the second official language training framework (posted on the Language Training Hub on GCcollab), which includes tools to help departments and managers plan and prioritize access to language training and to support managers and employees learn their second official language

- additional tools and resources that help institutions to maintain and increase their bilingual capacity

Supporting occupational health and safety

- In 2025–26, in support of the government’s work to achieve harassment‑ and violence‑free workplaces that treat all employees with respect and dignity, TBS will continue to:

- monitor departmental indicators of performance in the areas of occupational health and safety and workplace violence and harassment

- co‑develop, with bargaining agents through the National Joint Council, tools to continually improve occupational health and safety

- provide resources, tools and guidance to help departments prevent and address workplace harassment and violence

- ensure that enough qualified resources are available to investigate harassment and violence when they occur

- take action to support psychologically healthy and safe workplaces, practices and behaviours by supporting human resources teams, providing training, and helping manage complex cases

- develop resources and tools to help organizations comply with the Canada Labour Code and the National Standard of Canada for Psychological Health and Safety in the Workplace

- help organizations in streamline their occupational health and safety operations by integrating the Federal Public Service Workplace Mental Health Strategy into their overall health and safety program

Planned resources to achieve results

Table 8 provides a summary of the planned spending and full‑time equivalents required to achieve results.

| Resource | Planned |

|---|---|

| Spending | $4,133,525,789 |

| Full‑time equivalents | 600 |

Complete financial and human resources information for TBS’s program inventory is available on GC InfoBase.

Related government priorities

Gender‑based analysis plus

TBS uses data from a range of public service and other sources to monitor and report on program impacts based on gender and other identity factors. Of note, TBS prepares an annual report on employment equity in the public service, which identifies trends and gaps in representation in the core public administration. The report also outlines enterprise‑wide initiatives and activities to identify, eliminate and prevent barriers to the full participation of members of employment equity groups in the public service.

In addition, TBS uses information from Labour Canada related to harassment and occupational health and safety to report on this area. This includes the number of cases with allegations linked to the 13 prohibited grounds of the Canadian Human Rights Act.

TBS also continues to work with departments to ensure that the proportion of racialized people, Indigenous people, persons with disabilities, and women in the public service meets or exceeds their workforce availability, including in leadership positions.

United Nations 2030 Agenda for Sustainable Development and the UN Sustainable Development Goals

Goal 5 (Achieve gender equality and empower all women and girls)

TBS will continue to help achieve gender equality by leading the implementation of the Pay Equity Act in the core public administration, the RCMP and the Canadian Forces. TBS will also monitor the design and use of pension and benefit plans with gender considerations in mind.

Goal 10 (Advance reconciliation with Indigenous peoples and take action to reduce inequality)

TBS helps advance reconciliation and reduce inequalities through its work to address employment barriers and to advance diversity, equity, accessibility and inclusion in the public service.

TBS also contributes to this goal through its other, employer related initiatives. For example, as part of the procurement process for new health care and dental care plans for public servants and pensioners, TBS ensured that providers must contribute $4.5 million in direct or indirect benefits annually to Indigenous communities.

Direct benefits will include Indigenous development and buying from Indigenous firms, while indirect benefits will include career development, community outreach and grants that help Indigenous communities meet their economic development needs.

Goal 13 (Take urgent action to combat climate change and its impacts)

As the contractor for the public service health care and dental care plans, Canada Life must document its greenhouse gas emission reduction targets in a corporate green strategy document and share it with TBS.

More information on TBS’s contributions to the Federal Implementation Plan on the 2030 Agenda and the Federal Sustainable Development Strategy can be found in the TBS Departmental Sustainable Development Strategy for 2023 to 2027.

Program inventory

Employer is supported by the following programs:

- Employer

- Public Service Employer Payments

Additional information related to the program inventory for the employer core responsibility is available on the Results page on GC InfoBase.

Summary of changes to reporting framework since last year

There are no changes to the reporting framework associated with this core responsibility since last year.

Core responsibility 4: Regulatory oversight

In this section

Description

TBS develops and oversees policies to promote good regulatory practices, reviews proposed regulations to ensure that they adhere to the requirements of government policy; and advances regulatory cooperation across jurisdictions.

Quality of life impacts

The activities of this core responsibility contribute to the “good governance” domain of the Quality of Life Framework for Canada and, more specifically, “confidence in institutions” and “Canada’s place in the world.”

Indicators, results and targets

This section presents details on the department’s indicators, the actual results from the three most recently reported fiscal years, the targets and target dates approved in 2025–26 for regulatory oversight. Details are presented by departmental result.

Table 9 provides a summary of the target and actual results for each indicator associated with the results under regulatory oversight.

| Departmental Result Indicators | Actual Results | Target | Date to achieve target |

|---|---|---|---|

| Ranking of Canada’s regulatory system by the Organisation for Economic Co‑operation and Development for stakeholder engagement | 2021–22: 5th 2022–23: 5thFootnote * 2023–24: 5thFootnote * |

At least 5th | March 2028 |

| Ranking of Canada’s regulatory system by the Organisation for Economic Co‑operation and Development on Regulatory Impact Assessment | 2021–22: 5th 2022–23: 5thFootnote * 2023–24: 5thFootnote * |

At least 5th | March 2028 |

| Ranking of Canada’s regulatory system by the Organisation for Economic Co‑operation and Development for ex‑post evaluation | 2021–22: 6th 2022–23: 6thFootnote * 2023–24: 6thFootnote * |

At least 5th | March 2028 |

Additional information on the detailed results and performance information for TBS’s program inventory is available on GC InfoBase.

Plans to achieve results

The following section describes the planned results for regulatory oversight in 2025–26.

Reviewing regulations

In 2025–26, TBS will continue to support the Treasury Board, serving as the Governor in Council, and focusing strategically on high‑risk and high‑priority regulatory proposals. For all proposals, TBS will perform a challenge function to ensure that regulators conduct impact assessments that meet the requirements of the Cabinet Directive on Regulation and its related policies and directives.

In addition, TBS will provide expert advice and leadership to support the regulatory development process. For example, through the Centre for Regulatory Innovation, TBS will help regulators:

- identify new opportunities to innovate and support them in the innovation process

- explore or develop innovative regulatory approaches through new resources and knowledge‑sharing

- explore innovation concepts and share knowledge through webinars and workshops

Encouraging regulatory cooperation and harmonization

Regulatory cooperation is key to making it easier for businesses to operate, both domestically and across jurisdictions, while maintaining the highest standards for health, safety and environmental protection.

In 2025–26, TBS will continue to advance regulatory cooperation initiatives in various domestic and international forums.

Domestically, TBS will:

- work with provinces and territories to improve regulatory alignment through the Regulatory Reconciliation and Cooperation Table

- work with the Privy Council Office and participating provinces and territories to develop a mutual recognition framework and to run a pilot project to mutually recognize regulatory requirements in the trucking sector

TBS will also engage with diverse groups, including Canadians, on regulatory issues through the Let’s Talk Federal Regulations platform.

In addition, TBS will continue to address and implement recommendations of the External Advisory Committee on Regulatory Competitiveness on ways to advance regulatory excellence and support the modernization of Canada’s regulatory system.

Reducing regulatory red tape

As announced in the 2024 Fall Economic Statement, in 2025–26, TBS will set up a Red Tape Reduction Office to reduce unnecessary barriers to innovation, productivity and economic growth, and to lower regulatory costs for Canadians and Canadian businesses.

To achieve this goal, the Red Tape Reduction Office will:

- accelerate the cutting of red tape from the regulatory system, including by strengthening efforts to address overly burdensome or outdated requirements in existing regulations, and by promoting regulatory cooperation

- establish measures to track, assess and communicate results of regulatory action to ensure a stronger, evidence‑based regulatory framework

- improve accountability, oversight and transparency, including through stronger engagement with Canadians and Canadian businesses and a dedicated channel for feedback on regulatory red tape

These efforts to address regulatory red tape are in addition to the continued implementation of measures set out in the Cabinet Directive on Regulation, which includes the one‑for‑one rule. Established under the Red Tape Reduction Act and the Red Tape Reduction Regulations, this rule is designed to control the growth of administrative burden on businesses, particularly small businesses.

Planned resources to achieve results

Table 10 provides a summary of the planned spending and full‑time equivalents required to achieve results.

| Resource | Planned |

|---|---|

| Spending | $10,525,457 |

| Full‑time equivalents | 59 |

Complete financial and human resources information for TBS’s program inventory is available on GC InfoBase.

Related government priorities

Gender‑based analysis plus

TBS will continue to review regulatory proposals prepared for Governor in Council approval to ensure that information on gender‑based analysis plus complies with the Cabinet Directive on Regulation and its associated policy instruments.

United Nations 2030 Agenda for Sustainable Development and the UN Sustainable Development Goals TBS will continue to support departments in integrating sustainable development impact analysis into their regulatory development processes under the Cabinet Directive on Regulation. This directive requires an integrated cost and benefit analysis of regulations on society, the economy and the environment.

More information on TBS’s contributions to the Federal Implementation Plan on the 2030 Agenda and the Federal Sustainable Development Strategy can be found in the TBS Departmental Sustainable Development Strategy for 2023 to 2027.

Program inventory

Regulatory oversight is supported by the following program:

- Regulatory Policy, Oversight and Cooperation

Additional information related to the program inventory for regulatory oversight is available on the Results page on GC InfoBase.

Summary of changes to reporting framework since last year

There are no changes to the reporting framework associated with this core responsibility since last year.

Internal services

In this section

Description

Internal services are the services that are provided within a department so that it can meet its corporate obligations and deliver its programs. There are 10 categories of internal services:

- management and oversight services

- communications services

- legal services

- human resources management services

- financial management services

- information management services

- information technology services

- real property management services

- materiel management services

- acquisition management services

Plans to achieve results

TBS’s internal services support the department’s four core responsibilities, including by:

- creating a diverse, equitable, inclusive and accessible workforce and workplace

- maintaining a culture of integrity, accountability and excellence

- fostering employee well‑being

- preparing for the futurewith data and artificial intelligence (AI)

Creating a diverse, equitable, inclusive and accessible workforce and workplace

In 2025–26, TBS will continue to foster a diverse, equitable, inclusive and accessible workplace for its employees by:

- taking action to address the Call to Action forward direction message to deputies, including setting and monitoring multi‑year targets for recruitment, promotion and inclusion and holding executives accountable for achieving them

- addressing harassment and discrimination experienced by Black executives as outlined in the recent Study on the Black Executive Community in the Federal Public Service

- continuing to implement TBS’s first departmental accessibility plan by removing physical barriers, analyzing hiring practices to identify barriers and biases, and focusing on professional development

- advancing reconciliation with Indigenous people and fostering cultural understanding through targeted learning activities and collaborative exchanges

- implementing practices to ensure that employees who use either official language feel respected, supported and fully included

- fostering a culture of belonging by supporting TBS’s employee networks and by integrating their priorities into departmental activities and programs

Maintaining a culture of integrity, accountability and excellence

In 2025–26, TBS will continue to build employee trust, enhance organizational resilience to ethical challenges, and align its operations with government‑wide values to ensure excellence in service delivery by:

- building a culture of continuous learning by promoting opportunities to learn about values, ethics and emerging public sector trends through events, activities and development programs

- empowering employees to act with integrity by encouraging them to talk about values and ethics and by recognizing behaviours that exemplify integrity, accountability and collaboration

- continuing to proactively manage ethical risks by regularly assessing risks and developing mitigation strategies

- ensuring that departmental policies and practices reflect evolving ethical standards

- continuing to promote the ethical use of emerging technologies and digital tools by integrating principles of fairness, privacy protection and responsible practices into operations and training

Fostering employee well‑being

In 2025–26, TBS will continue to foster a healthy, inclusive and productive workforce while addressing the evolving needs of employees in a modern workplace by:

- fostering a culture of mental health and resilience by continuing to support employees’ and managers’ mental health, physical and social well‑being through wellness initiatives, mental health training, and accessible resources such as the Employee Assistance Program

- increasing awareness and understanding of psychological health and safety in the workplace in accordance with the Federal Public Service Workplace Mental Health Strategy, the Canada Labour Code and the National Standard of Canada for Psychological Health and Safety in the Workplace

- continuing to provide training on workplace safety, including harassment and violence prevention

In addition, TBS will continue to give employees and managers the tools and resources they need to foster an organizational culture where everyone can take part in constructive discussions about workplace issues. It will also run promotional campaigns to prevent and mitigate workplace harassment and violence.

Preparing for the future with data and artificial intelligence

TBS will develop a three‑year strategy and plan to improve how its data is governed and managed. This work will include finding ways to improve how TBS operates in an increasingly digital environment, such as by making greater use of AI. The strategy will also include working with departmental managers and employees to ensure that they are supported by efficient, technology‑enabled and user‑centric internal processes, policies and tools.

Planned resources to achieve results

Table 11 provides a summary of the planned spending and full‑time equivalents required to achieve results.

| Resource | Planned |

|---|---|

| Spending | $97,772,538 |

| Full‑time equivalents | 658 |

Complete financial and human resources information for TBS’s program inventory is available on GC InfoBase.

Planning for contracts awarded to Indigenous businesses

Government of Canada departments are to meet a target of awarding at least 5% of the total value of contracts to Indigenous businesses each year.

In 2023–24, TBS exceeded this target by awarding 7% of the total value of all its contracts to Indigenous businesses.

In 2025–26, TBS will continue to:

- make sure that contracting and procurement are part of TBS’s integrated business planning and financial forecasting processes and that the target for Indigenous procurement is kept in mind for all planned procurements

- reinforce with business owners that they need to consider Indigenous vendors and have procurement officers play a challenge function where an opportunity exists

- require all contracting requests to include a mandatory justification when an Indigenous vendor is not considered, and putting a hold on requests where these justifications did not meet a minimum threshold, or where internal capacity existed

- raise awareness in the department about Indigenous vendors, especially about those that work in TBS’s top commodity and contracting areas

TBS will also continue to make sure its procurement officers have taken the mandatory training on Indigenous considerations in procurement.

Table 12 presents the current, actual results with forecasted and planned results for the total percentage of contracts the department awarded to Indigenous businesses.

| 5% reporting field | 2023–24 actual result | 2024–25 forecast result | 2025–26 planned result |

|---|---|---|---|

| Total percentage of contracts with Indigenous businesses | 7% | 5% | 5% |

Planned spending and human resources

This section provides an overview of TBS’s planned spending and human resources for the next three fiscal years and compares planned spending for 2025–26 with actual spending from previous years.

Spending

This section presents an overview of the department’s planned expenditures from 2022–23 to 2027–28.

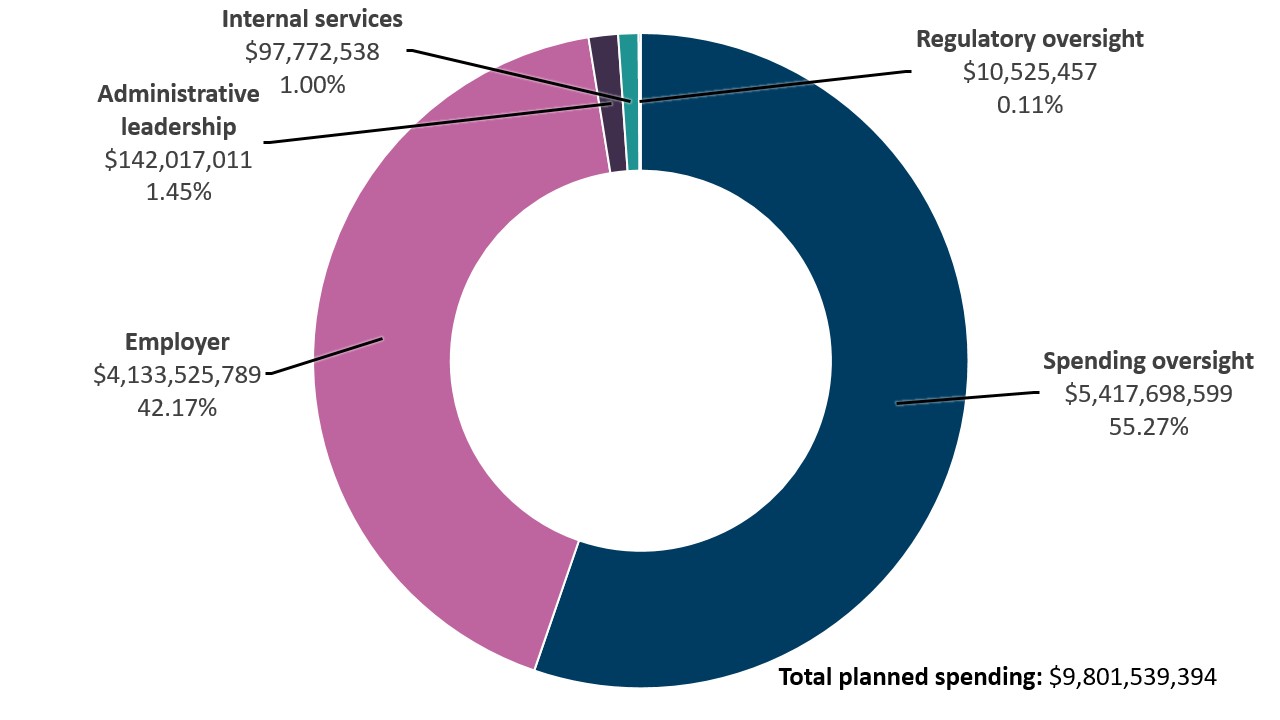

Figure 1 presents how much the department plans to spend in 2025–26 to carry out its core responsibilities and to provide internal services.

Text description of figure 1

| Core responsibility | Amount ($) | % |

|---|---|---|

| Spending oversight | 5,417,698,599 | 55.27% |

| Employer | 4,133,525,789 | 42.17% |

| Administrative leadership | 142,017,011 | 1.45% |

| Internal services | 97,772,538 | 1.00% |

| Regulatory oversight | 10,525,457 | 0.11% |

| Total planned spending | 9,801,539,394 | 100% |

Analysis of planned spending by core responsibility

TBS’s planned spending for 2025–26 consists of the following allocations:

- $5,417.7 million for the core responsibility of spending oversight, mainly to top up central vote funding held in TBS’s reference levels

- $4,133.5 million for the core responsibility of employer, for public service insurance payments related to TBS’s role as the employer of the core public administration

- $250.3 million for the administrative leadership and regulatory oversight core responsibilities, and for internal services, to run TBS and to fulfill the President’s other mandate letter commitments

TBS manages both central votes and departmental votes. It transfers funds in central votes to individual departments once specific criteria are met. TBS’s departmental spending comes from Vote 1, Program expenditures, and Vote 20, Public Service Insurance.

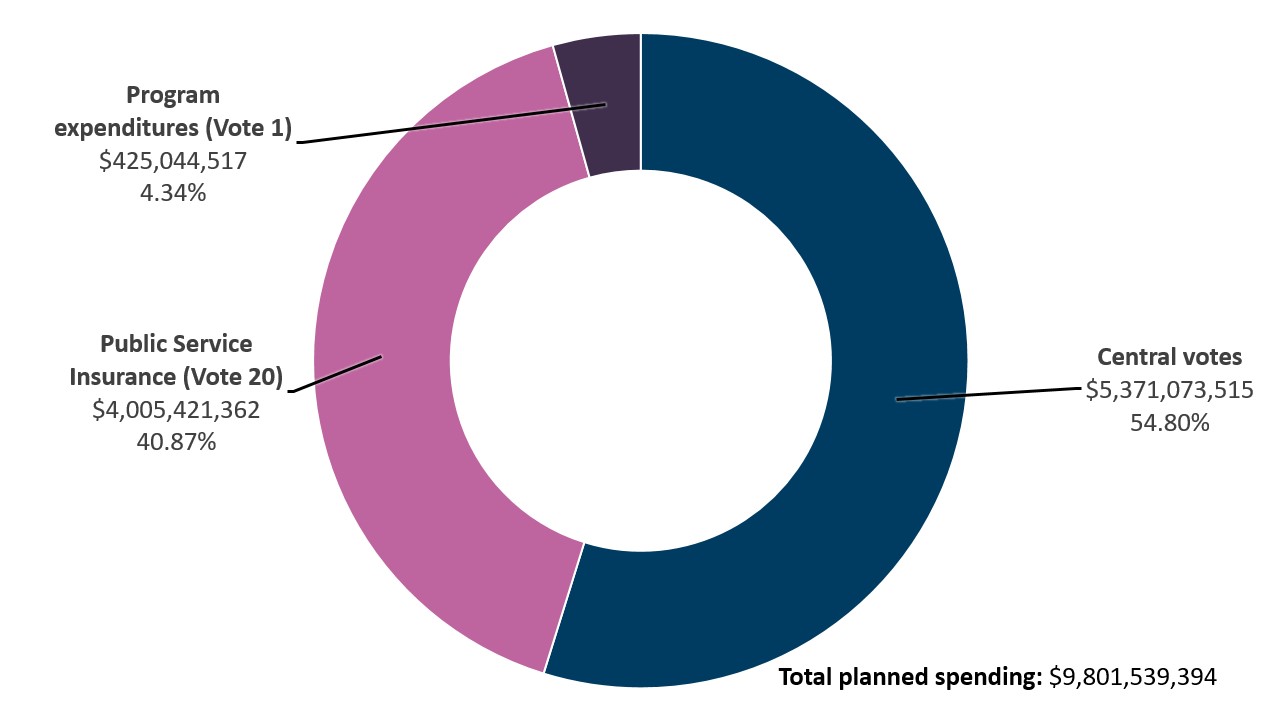

Figure 2 presents how much the department plans to spend in 2025–26, by vote.

Text description of figure 2

| Vote | Amount ($) | % |

|---|---|---|

| Central votes | 5,371,073,515 | 54.80% |

| Public Service Insurance (Vote 20) | 4,005,421,362 | 40.87% |

| Program Expenditures (Vote 1) | 425,044,517 | 4.34% |

| Total planned spending | 9,801,539,394 | 100% |

Analysis of planned spending by vote

Salary and operating expenditures to fulfill TBS’s mandate are managed under Vote 1, Program Expenditures.

As employer for the entire core public administration, TBS manages the employer’s share of pensioner and employee insurance and benefits plans, and provincial and federal legislated taxes under Vote 20, Public Service Insurance.

Under the spending oversight core responsibility, TBS manages six central votes.

Table 13 presents the central votes related to TBS’s spending oversight core responsibility.

| Vote | Name | Description |

|---|---|---|

| 5 | Government Contingencies | Provides departments with temporary advances for urgent or unforeseen expenditures between Parliamentary supply periods |

| 10 | Government‑Wide Initiatives | Supports the implementation of strategic management initiatives across the federal public service |

| 15 | Compensation Adjustments | Provides funding for adjustments made to terms and conditions of service or employment in the federal public administration as a result of collective bargaining |

| 25 | Operating Budget Carry‑Forward | Allows departments to carry forward unused funds from the previous fiscal year (up to 5% of Main Estimates gross operating vote) |

| 30 | Paylist Requirements | Covers the cost of meeting the government’s legal requirements as employer for items such as parental benefits and severance payments |

| 35 | Capital Budget Carry‑Forward | Allows departments to carry forward unused funds from the previous fiscal year (up to 20% of capital vote) |

Budgetary performance summary

Table 14 presents how much money TBS spent over the past three years to carry out its core responsibilities and to provide internal services. Amounts for the current fiscal year are forecast based on spending to date.

| Core responsibilities and internal services | 2022–23 actual expenditures | 2023–24 actual expenditures | 2024–25 forecast spending |

|---|---|---|---|

| Spending oversight | 44,076,954 | 49,449,330 | 45,659,416 |

| Administrative leadership | 135,056,295 | 117,125,327 | 130,534,860 |

| Employer | 3,871,345,553 | 3,955,557,909 | 11,024,724,217 |

| Regulatory oversight | 11,961,210 | 12,660,553 | 13,450,886 |

| Subtotal | 4,062,440,012 | 4,134,793,119 | 11,214,369,379 |

| Internal services | 99,750,988 | 115,540,766 | 109,140,922 |

| Total | 4,162,191,000 | 4,250,333,885 | 11,323,510,301 |

Analysis of the past three years of spending

Actual spending increased by $88.1 million from 2022–23 to 2023–24. The increase is primarily due to an increase in spending on TBS’s core responsibility as the employer for the public service, specifically, spending on insurance payments (Vote 20) related to the Public Service Health Care Plan and provincial payroll taxes.

Total forecast spending for 2024–25 is $7.073 billion more than actual expenditures in 2023–24. The increase is mainly attributable to a $6.425 billionFootnote 1 actuarial shortfall in 2024–25 in the public service superannuation account and is in accordance with the Actuarial Report (20th) on the Pension Plan for the Public Service of Canada as at 31 March 2023.

More financial information from previous years is available on the Finances section of GC Infobase.

Table 15 presents how much money TBS plans to spend over the next three years to carry out its core responsibilities and to provide internal services.

| Core responsibilities and internal services | 2025–26 planned spending | 2026–27 planned spending | 2027–28 planned spending |

|---|---|---|---|

| Spending oversight | 5,417,698,599 | 5,396,529,906 | 5,396,529,906 |

| Administrative leadership | 142,017,011 | 142,568,711 | 147,622,826 |

| Employer | 4,133,525,789 | 4,289,741,671 | 4,467,927,647 |

| Regulatory oversight | 10,525,457 | 10,953,095 | 10,953,095 |

| Subtotal | 9,703,766,856 | 9,839,793,383 | 10,023,033,474 |

| Internal services | 97,772,538 | 94,265,602 | 90,867,632 |

| Total | 9,801,539,394 | 9,934,058,985 | 10,113,901,106 |

Analysis of the next three years of spending

Planned spending for 2026–27 is $132.5 million more than planned spending for 2025–26 mainly due to increased funding requirements for the public service insurance plans and programs under the employer core responsibility. The increase is partially offset by decreases in:

- currently approved funding for the implementation of proactive pay equity in the federal public service

- currently approved funding for the Action Plan for Black Public Servants

- funding for a Phoenix-related settlement

Planned spending for 2027–28 is $179.8 million more than planned spending for 2026–27 mainly due to increased funding requirements for the public service insurance plans and programs under the employer core responsibility. The increase is partially offset by the sunsetting of funding for administering human resources and pay for the federal public service and by a decrease in currently approved funding for the Action Plan for Black Public Servants. This funding is subject to review and renewal.

More detailed financial information on planned spending is available on the Finances section of GC Infobase.

Funding

This section provides an overview of the department’s voted and statutory funding for its core responsibilities and for internal services. For further information on funding authorities, consult the Government of Canada budgets and expenditures.

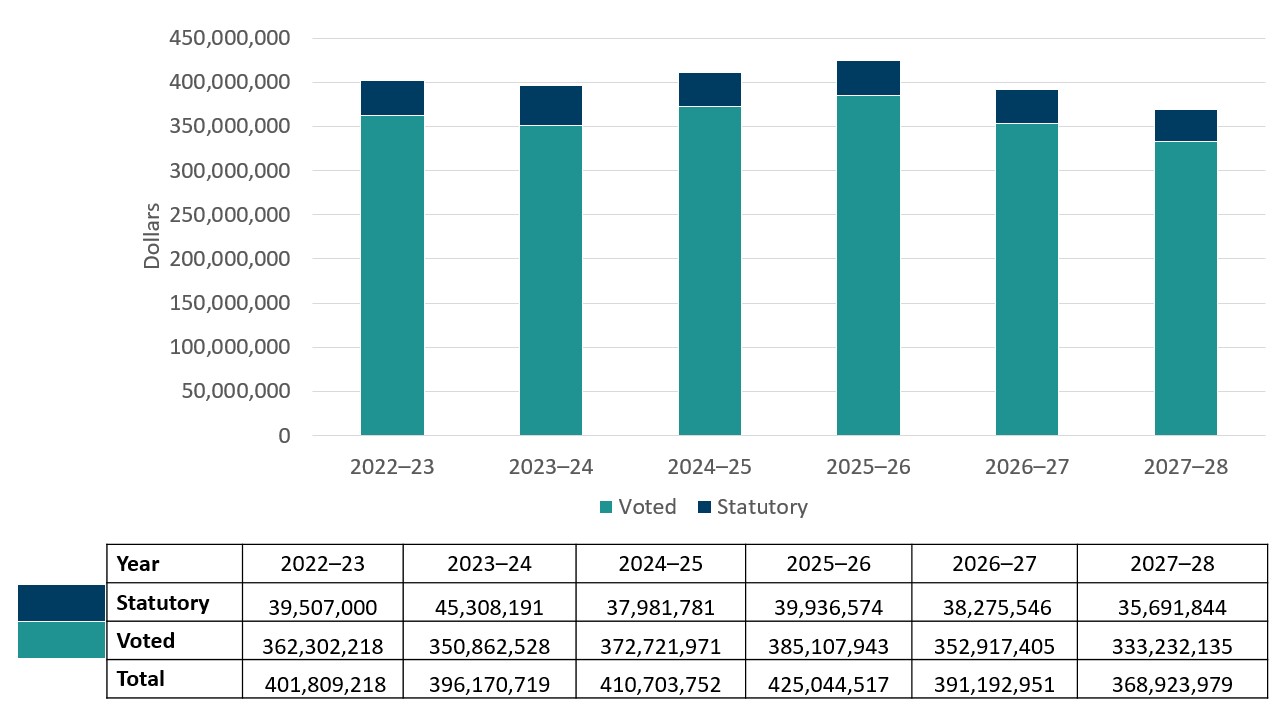

Figure 3 presents the department’s approved statutory expenditures and voted expenditures for Vote 1 (Program expenditures) for the six‑year period from 2022–23 to 2027–28.

Text description of figure 3

| Fiscal year | Statutory | Voted | Total |

|---|---|---|---|

| 2022–23 | 39,507,000 | 362,302,218 | 401,809,218 |

| 2023–24 | 45,308,191 | 350,862,528 | 396,170,719 |

| 2024–25 | 37,981,781 | 372,721,971 | 410,703,752 |

| 2025–26 | 39,936,574 | 385,107,934 | 425,044,517 |

| 2026–27 | 38,275,546 | 352,917,405 | 391,192,951 |

| 2027–28 | 35,691,844 | 333,232,135 | 368,923,979 |

Analysis of Program Expenditures (Vote 1) and statutory expenditures from 2022–23 to 2027–28

TBS’s program expenditures include salaries, non‑salary costs to deliver programs, and statutory items related to the employer’s contributions to TBS’s employee benefit plans.

Program expenditures in 2023–24 were $5.6 million less than in 2022–23 mainly due to:

- the sunsetting of funding for out-of‑court settlements

- the transfer of the Canadian Digital Service program to Employment and Social Development Canada (Order‑in‑Council 2023‑0784)

- Phase 1 of the Refocusing Government Spending initiative

Forecast spending for 2024–25 is $14.5 million more than actual expenditures in 2023–24 mainly due to:

- funding to advance clean fuels markets and carbon capture, use and storage technologies in Canada

- funding for the implementation of proactive pay equity in the federal public service

- funding for administering human resources and pay for the federal public service

- funding for the Action Plan for Black Public Servants

Planned spending for 2025–26 is $14.3 million more than forecast spending in 2024–25 mainly due to:

- funding for the implementation of proactive pay equity in the federal public service

- funding for the Action Plan for Black Public Servants

Planned spending for 2026–27 is $33.9 million less than planned spending in 2025–26 mainly due to:

- currently approved funding for administering human resources and pay for the federal public service

- currently approved funding for the Action Plan for Black Public Servants

Planned spending for 2027–28 is $22.3 million less than planned spending in 2026–27 mainly due to the sunsetting of funding for administering human resources and pay for the federal public service and the currently approved funding for the Action Plan for Black Public Servants, which are subject to review and renewal.

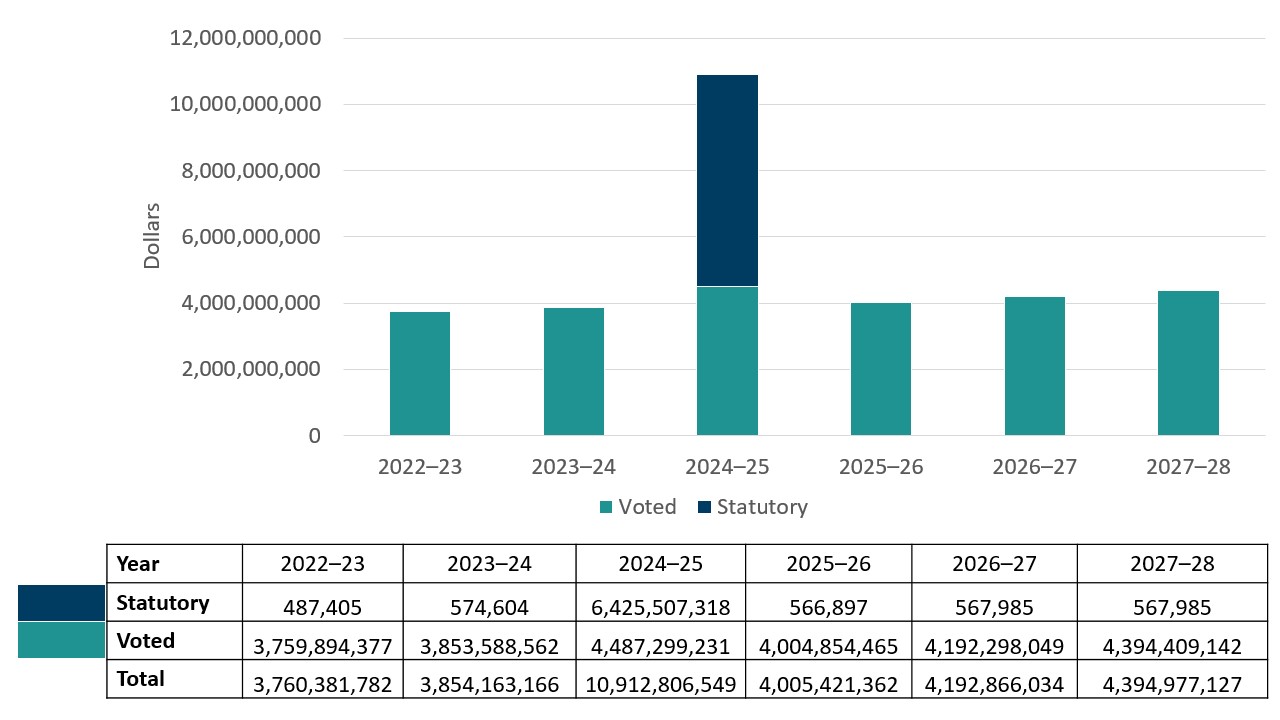

Figure 4 presents the department’s approved statutory expenditures and voted expenditures for Vote 20 (Public Service Insurance) for the six‑year period from 2022–23 to 2027–28.

Text description of figure 4

| Fiscal year | Statutory | Voted | Total |

|---|---|---|---|

| 2022–23 | 487,405 | 3,759,894,377 | 3,760,381,782 |

| 2023–24 | 574,604 | 3,853,588,562 | 3,854,163,166 |

| 2024–25 | 6,425,507,318 | 4,487,299,231 | 10,912,806,549 |

| 2025–26 | 566,897 | 4,004,854,465 | 4,005,421,362 |

| 2026–27 | 567,985 | 4,192,298,049 | 4,192,866,034 |

| 2027–28 | 567,985 | 4,394,409,142 | 4,394,977,127 |

Analysis of Public Service Insurance (Vote 20) and statutory expenditures 2022–23 to 2027–28

TBS’s public service insurance expenditures (expenditures from Vote 20) include the employer’s share of group benefit coverage to employees of the core public service under the various plans, plus salaries and non-‑salary costs to deliver the program.

The increase in planned spending in 2024–25 is mainly attributable to a $6.425 million actuarial shortfall in the public service superannuation account and is in accordance with the Actuarial Report (20th) on the Pension Plan for the Public Service of Canada as at 31 March 2023.

Excluding the 2024–25 actuarial shortfall, the other year-to-year changes in actual expenditures and planned spending between 2022–23 to 2027–28 are mainly attributable to funding requirements for the public service insurance plans and programs.

For further information on TBS’s departmental appropriations, consult the 2025–26 Main Estimates.

Future-oriented condensed statement of operations

The future-oriented condensed statement of operations provides an overview of TBS’s operations for 2024–25 to 2025–26.

Table 16 summarizes the expenses and revenues that net to the cost of operations before government funding and transfers for 2024–25 to 2025–26. The forecast and planned amounts in this statement of operations were prepared on an accrual basis. The forecast and planned amounts presented in other sections of the Departmental Plan were prepared on an expenditure basis. Amounts may therefore differ.

| Financial information | 2024–25 forecast results | 2025–26 planned results | Difference (2025–26 planned results minus 2024–25 forecast results) |

|---|---|---|---|

| Total expenses | 11,472,849,129 | 4,553,968,582 | (6,918,880,547) |

| Total revenues | 128,991,859 | 112,861,833 | (16,130,026) |

| Net cost of operations before government funding and transfers | 11,343,857,270 | 4,441,106,749 | (6,902,750,521) |

Analysis of forecast and planned results

Total expenses comprise public service employer payments ($10.918 billion in 2024–25 and $3.994 billion in 2025–26) and TBS program expenses ($554 million in 2024–25 and $560 million in 2025–26). Public service employer payments are used to fund the employer’s share of the Public Service Health Care Plan, the Public Service Dental Care Plan and other insurance and benefit programs provided to federal public service employees.

Planned public service employer payments for 2025–26 are $6.924 billion (63.4%) less than forecast results for 2024–25 mainly due to a one-time $6.425 billion contribution to the Public Service Pension Plan in 2024–25 to address an actuarial shortfall reported in the Actuarial Report (20th) on the Pension Plan for the Public Service of Canada as at 31 March 2023Footnote 2. The remaining variance is due to the sunsetting of funding received in 2024–25 that will be subject to the renewal process, as planned results for 2025–26 are based on approved funding to date.

TBS’s planned program expenses for 2025–26 are $5.6 million (1.0%) more than forecast results for 2024–25, mainly because of reductions in 2024–25 related to phase 1 of the refocusing of government spending initiative and increased funding in 2025-26 for proactive pay equity in the federal public service, for the Action Plan for Black Public Servants, as well as compensation adjustments due to collective bargaining and economic increases for executives. This is partially offset by the 2023–24 operating budget carry‑forward to 2024–25 and by lower anticipated SAP contractual obligations in 2025–26.

Total revenues include services provided to other government departments and Crown corporations associated with the administration of government-wide contracts for software licences, as well as the provision of internal support services related to shared financial and human resources management systems, accounting and mail services. Revenues also include the recovery of costs incurred by TBS for the administration of the Public Service Pension Plan.

The decrease of $16.1 million (12.5%) between 2025–26 planned revenues and 2024–25 forecast revenues is mainly due to a planned decrease in 2025–26 SAP contract cost recoveries.

A more detailed future-oriented statement of operations and associated notes, including a reconciliation of the net cost of operations with the requested authorities, are available on TBS’s website.

Human resources

This section presents an overview of the department’s actual and planned human resources from 2022–23 to 2027–28.

Table 17 shows a summary of human resources, in full-time equivalents, for TBS’s core responsibilities and for its internal services for the previous three fiscal years. Human resources for the current fiscal year are forecast based on year to date.

| Core responsibilities and internal services | 2022–23 actual full-time equivalents | 2023–24 actual full-time equivalents | 2024–25 forecast full‑time equivalents |

|---|---|---|---|

| Spending oversight | 289 | 298 | 303 |

| Administrative leadership | 913 | 827 | 581 |

| Employer | 654 | 674 | 625 |

| Regulatory oversight | 73 | 70 | 75 |

| Subtotal | 1,929 | 1,869 | 1,584 |

| Internal services | 669 | 696 | 660 |

| Total | 2,598 | 2,565 | 2,244 |

Analysis of human resources over the last three years

The variances in full-time equivalents by year can be partially linked to those found in the section on actual spending summary for core responsibilities and internal services.

Table 18 shows information on human resources, in full-time equivalents, for each of TBS’s core responsibilities and for its internal services planned for the next three years.

| Core responsibilities and internal services | 2025–26 planned full‑time equivalents | 2026–27 planned full-time equivalents | 2027–28 planned full-time equivalents |

|---|---|---|---|

| Spending oversight | 300 | 300 | 300 |

| Administrative leadership | 584 | 554 | 543 |

| Employer | 600 | 544 | 424 |

| Regulatory oversight | 59 | 59 | 59 |

| Subtotal | 1,543 | 1,457 | 1,326 |

| Internal services | 658 | 658 | 658 |

| Total | 2,201 | 2,115 | 1,984 |

Analysis of human resources for the next three years

The variances in full-time equivalents by year can be partially linked to those found in the section on budgetary planning summary for core responsibilities and internal services.

Corporate information

Departmental profile

Appropriate minister(s): The Honourable Shafqat Ali, President of the Treasury Board

Institutional head: Bill Matthews, Secretary of the Treasury Board

Ministerial portfolio:

The Treasury Board portfolio consists of the Treasury Board of Canada Secretariat and the Canada School of Public Service, as well as the following organizations, which operate at arm’s length and report to Parliament through the President of the Treasury Board:

- the Public Sector Pension Investment Board

- the Office of the Commissioner of Lobbying of Canada

- the Office of the Public Sector Integrity Commissioner of Canada.

Enabling instrument(s):

The Financial Administration Act established the Treasury Board and gave it powers related to the financial, personnel and administrative management of the public service, and the financial requirements of Crown corporations.

Year of incorporation / commencement: 1966

Departmental contact information

Mailing address:

Treasury Board of Canada Secretariat

90 Elgin Street

Ottawa, Canada K1A 0R5

Telephone: 613 369 3200

Email: questions@tbs‑sct.gc.ca

Website: https://www.canada.ca/en/treasury‑board‑secretariat.html

Supplementary information tables

The following supplementary information tables are available on TBS’s website:

Information on TBS’s departmental sustainable development strategy can be found on TBS’s website.

Federal tax expenditures

TBS’s Departmental Plan does not include information on tax expenditures.

The tax system can be used to achieve public policy objectives through the application of special measures such as low tax rates, exemptions, deductions, deferrals and credits. The Department of Finance Canada publishes cost estimates and projections for these measures each year in the Report on Federal Tax Expenditures.

This report also provides detailed background information on tax expenditures, including descriptions, objectives, historical information and references to related federal spending programs, as well as evaluations and GBA Plus of tax expenditures.

Definitions

- appropriation (crédit)

Any authority of Parliament to pay money out of the Consolidated Revenue Fund.

- budgetary expenditures (dépenses budgétaires)

Operating and capital expenditures; transfer payments to other levels of government, departments, or individuals; and payments to Crown corporations.

- core responsibility (responsabilité essentielle)