Employment and Social Development Canada 2024 to 2025 Departmental plan

On this page

- From the Ministers

- Service excellence

- Plans to deliver on core responsibilities and internal services

- Planned spending and human resources

- Corporate information

- Supplementary information tables

- Federal tax expenditures

- Definitions

Large print, braille, MP3 (audio), e-text and DAISY formats are available on demand by ordering online or calling 1 800 O-Canada (1-800-622-6232). If you use a teletypewriter (TTY), call 1-800-926-9105.

From the Ministers

We are proud to present Employment and Social Development Canada's 2024 to 2025 Departmental Plan.

The Government of Canada's investments in our economy, communities and middle-class careers have delivered real economic opportunities for Canadians across the country. Yet we remain mindful that Canadians continue to face challenges-particularly the increased cost of living-which government action is addressing.

As part of this plan for families, we will work with provincial, territorial and Indigenous partners to deliver high-quality, accessible, and regulated early learning and child care for an average of $10 a day across Canada by March 2026. We will also invest significantly in the expansion of this system, which remains on track to deliver 250,000 new spaces.

Supporting Canadians during employment transitions remains a priority, such as continued Employment Insurance support for workers in seasonal employment. In addition, we will launch a Sustainable Jobs Training Fund to help workers upgrade or gain new skills for jobs in the low-carbon economy. We will also launch a new sustainable jobs training funding stream under the Canadian Apprenticeship Strategy's Union Training and Innovation Program. This stream will fund projects led by unions to provide green skills training for trades workers.

We will provide support to employers facing critical labour shortages through measures under the Temporary Foreign Worker Program. This program helps Canadian employers fill labour and skills shortages on a temporary basis when Canadians and permanent residents are not available. Temporary foreign workers play a vital role in many sectors of the economy, including agriculture and agri-food, and program policies are continuously reviewed to ensure they reflect the latest economic conditions and maintain program integrity. We will deliver on the Budget 2022 commitment to develop a new foreign labour program for agriculture and fish processing to ensure that Canada's food producers have access to a stable and reliable labour supply and to strengthen worker protections. Ensuring the health and safety of temporary foreign workers and ensuring that they are free from any form of abuse while in Canada are key priorities. Safe, healthy, fair and inclusive work conditions and cooperative workplace relations are priorities for all workers in Canada.

We are dedicated to enhancing services for Canadians, which will involve a multifaceted strategy aimed at addressing all aspects of services including efficiency, accessibility, responsiveness, technology innovation, and strengthening our partnership with other departments. As part of the Service Delivery Partnerships Program, we are adopting new client-centric approaches to service delivery while implementing new critical initiatives, such as helping deliver the Canadian Dental Care Plan to eligible uninsured Canadians. In late 2024, we will complete the deployment of the Passport Program Modernization Initiative, which contains a new intake tool to help address surges in passport applications. We also have expanded our 10-day passport service to 21 Service Canada Centres. Finally, as part of the Reaching All Canadians initiative, we will continue to ensure that all Canadians can access government services regardless of where they are or their circumstances, which includes understanding and reducing barriers faced by marginalized and underserved Canadians in receiving services. For example, we will test an interpretation service for both Indigenous and non-official languages on our telephone general enquiries program.

Canada's commitment to accessibility and inclusion is driven by a vision where every Canadian can thrive and participate fully in society. This year, we will develop options for modernizing the Employment Equity Act. This is an important step to advance equity, diversity and inclusion in federally regulated workplaces.

We will advance toward accessibility and inclusion by working with partners to implement the Canada Disability Benefit. Collaboration with persons with disabilities from various backgrounds will ensure that the new benefit's design and regulations are informed by the needs and lived experiences of the people who will receive it. We will also launch a pilot project to test improved employment supports for Canada Pension Plan disability clients who want to return to work while still receiving benefits.

We know that young Canadians continue to struggle with the rising cost of living. That's why we will continue to work with partners to help make higher education more affordable and accessible for Canadian students, particularly those facing barriers. In 2024 to 2025, as part of the Canada Student Financial Assistance Program, more than 700,000 post-secondary students are expected to receive financial assistance through non-repayable Canada Student Grants and interest-free Canada Student Loans. In addition, we will make it easier for youth who are ready to enter the workforce to find the opportunities and resources that will aid them in making that transition.

The Supporting Black Canadian Communities Initiative will continue to play a key role in the Department's efforts to increase social inclusion, reduce systemic barriers, and strengthen social cohesion within Canada by advancing targeted measures for Black communities. This includes addressing emerging priorities as identified by Black community stakeholders and strengthening the foundational capacity of Black-led and Black-serving community organizations in Canada.

We are also protecting the financial security of seniors through the Canada Pension Plan enhancement, which is being phased in through 2025. The limit of earnings protected by the plan will increase by 14% from the original limit. We will continue to move the Old Age Security (OAS) program to the new Benefits Delivery Modernization platform to offer faster payments, reduce wait times and improve online services. The next phases of the OAS migration, scheduled to be completed in December 2024, will see approximately 7 million new and existing OAS clients transition onto the new platform.

Finally, advancing progress on the Sustainable Development Goals both domestically and internationally remains a priority. This summer, Canada will release its 2024 annual report, highlighting progress made toward implementing the United Nations 2030 Agenda on Sustainable Development. We remain committed to advancing progress on the Sustainable Development Goals by reducing poverty, providing access to quality education, advancing gender equality and taking action on climate change and clean energy. Canada's poverty rate remains below the pre-pandemic rate, and the Government of Canada is continuing to make significant investments through targeted social programs and income supplements to reduce poverty, mitigate food insecurity and increase well-being.

We are determined to deliver programs and services to every Canadian, and to support them through every stage of their lives, now and in the future.

Minister of Employment, Workforce Development and Official Languages, Randy Boissonnault

Minister of Families, Children and Social Development, Jenna Sudds

Minister of Labour and Seniors, Seamus O'Regan Jr.

Minister of Diversity, Inclusion and Persons with Disabilities, Kamal Khera

Minister of Citizens' Services, Terry Beech

Minister for Women and Gender Equality and Youth, Marci Ien

Service Excellence

The department is dedicated to providing Canadians with high quality, timely, and accessible services. We will improve services for Canadians and other clients in 3 main areas:

1. Modernizing our Information Technology (IT)

In the post COVID-19 pandemic world, Canadians are accessing government services online more than ever before. They expect to receive a secure, high quality, and accessible digital service experience. We are using technology to improve how we deliver programs and services to Canadians. This year we will:

- continue to transform the service experience for Canadians receiving-or seeking to receive-Old Age Security, Employment Insurance, and Canada Pension Plan benefits. Between now and 2030, the Benefits Delivery Modernization Programme will help us simplify application processes, offer more convenient self-serve options and process files by routing work more efficiently. For clients who require help, there will be a smooth transition between self-service and assisted service, for example when an application moves from the online portal to the phone or in-person

- launch an EI Benefits Estimator, similar to the Old Age Security Benefits Estimator. This online tool will help citizens quickly estimate their allowable EI income based on information they provide

- improve services to speech and hearing-impaired clients. We will do this by refining and improving processes following our expanded use of a modern teletypewriter (TTY) solution which allows TTY calls to be answered in real time

- work with federal partners to establish agreements with provinces. This will allow individuals to use provincial digital credentials to access our online services. Individuals will be able to access online programs in a quick and secure manner. Programs include Employment Insurance, Canada Pension Plan and Old Age Security, and Canada Student Financial Assistance

- help clients securely access their online accounts. As stated in the 2023 Fall Economic Statement, we will maintain Simplified Digital Identity Validation (SDIV) and Multifactor Authentication (MFA) solutions associated with service delivery platforms, such as My Service Canada Account

- improve the experience for clients who are using the 1 800 O-Canada service. Replacement of the existing contact centre platform will span several years and the new platform will include improved capabilities and enhance the client experience in the long term

- make our digital platforms more accessible and user-friendly for clients by ensuring they meet the Web Content Accessibility Guidelines (WCAG) - version 2.1 Level AA Accessibility Standards. This is an international standard, adopted by the Government of Canada to support the goal of barrier-free access to Government of Canada information and services. On Canada.ca, accessibility is built into the platform, helping it meet WCAG version 2.1 standards

2. Improving Services for Canadians

Making services better for Canadians remains a top priority and will involve addressing various aspect of services, including efficiency, accessibility, responsiveness and technology innovation. Client service experience matters - it impacts whether we meet program objectives and helps to build trust in government. Canadians want services to be quick, safe, digital, and easy to access through many service channels. We will use feedback from clients to make services better and show clear results. Examples of this work will include:

- making it easier for clients to understand which benefits they are eligible for and reducing application errors by improving the usability of forms, letters, web content, guides, and web portals. Improvements will make the content easier to understand and online navigation more efficient. Changes will ensure that the language used for correspondance products is clear and concise, and the applications and forms are easy to complete

- improving our service to better fit client needs. We will gather feedback through our delivery channels (in-person, online, phone). This will help us know if our service delivery is working for clients, or if we need to make changes. Feedback will be used to inform data-driven enhancements by highlighting service delivery pain points experienced by service users

- focusing on client feedback, we will make sure we are meeting their needs. Some of the ways that feedback will be collected are:

- annual Service Canada Client Experience Survey questionnaires when clients access services on Canada.ca

- exit questionnaires when clients visit an in-person Service Canada Centre, call 1 800 O-Canada or use eServiceCanada

- providing other federal departments with digital tools so they can measure how well they are meeting client needs online. Through Canada.ca, we provide departments with access to a digital analytics tool to measure web traffic, and an in-page feedback tool to gather visitors' input. A survey tool is also available to collect feedback from users on a continuous basis. Survey data is shared with departments so they can identify where they need to make improvements within their content. For example, how it's presented, worded and how easy the information is to find

- making our new online portal, the Service Canada Client Hub, available to Canadians in 2024. The portal is a bilingual, accessible platform that provides clients and their circle of care with a personalized, easy-to-navigate dashboard of all Service Canada benefits and services. The hub represents the next generation of the My Service Canada Account interface and will mark the initial change that Service Canada clients will experience from our renewed digital channel

- partnering with Ontario, New Brunswick, Nova Scotia, Saskatchewan, Prince Edward Island and Manitoba to digitize the death registration process. This will allow medical informants and funeral directors to send death notifications to vital statistics organizations. This will be done in a timely, accurate and secure manner. Getting this information faster will help reduce benefit overpayments. There will be less need for payment recovery and investigations

3. Removing Barriers

Ensuring that all eligible Canadians can access government services remains a priority. We are committed to understanding and reducing barriers faced by marginalized and underserved Canadians. These most vulnerable clients, including children, low-income seniors, families, and Indigenous communities, have traditionally faced significant challenges in accessing government services. They might not know about the benefits they are entitled to. To reduce these barriers and increase the number of eligible Canadians receiving benefits, in 2024 to 2025 we will continue to:

- work with the Canada Revenue Agency and Statistics Canada to strengthen our understanding of the socio-economic and geographical characteristics of hard-to-reach populations, including barriers they face when accessing benefits. This information will help us tailor coordinated outreach measures to the needs of those requiring a higher level of support to access benefits

- provide hard-to-reach and at-risk individuals with additional support to access services and benefits. Our Service Referral Initiative will connect clients with a Service Canada representative who can help them apply for benefits

- collaborate with the United Way/Centraide's 211 community information service and the Canada Revenue Agency's income tax help lines to provide clients with seamless access to the department's programs and proactively seek to engage with other organizations who share a vision of providing clients with seamless access to core departmental programs

- work with community organizations to help vulnerable populations apply for departmental funding programs. We will do this by ensuring equitable access to grants and contributions through our Removing Barriers to Program Access initiative. Support may include an applicant guide and tools to help organizations complete and submit their applications

- increase awareness of funding opportunities so Canadians have all the necessary information to find and apply for departmental funding. We will do this by improving and updating the department's grants and contributions funding webpage content and simplifying language. In addition, we will promote this webpage through outreach packages, promotional campaigns and by offering information sessions to support the registration process

- continue the implementation of the Youth Digital Gateway project, project to provide youth with curated information, opportunities, resources, and other supports to help them find a job, build their skills, go to school, participate in training, and serve their communities. Through our work on the Youth Digital Gateway we will work with partners to integrate its services into a holistic single-window, user friendly Government of Canada digital channel for youth

Service Canada Regional Service Delivery

Through partnerships with the provinces, territories, municipalities, and communities, our regional Service Canada offices deliver a wide array of essential services at hundreds of Service Canada Centres across the country. Service Canada offices will continue reaching out and responding to the changing needs of clients. Each region works on various activities, some of which are shared across all regions while others are distinct and unique to each region. Here are a few highlights of the activities that regions will pursue this year:

Western Canada and Territories

- open a third Passport Delivery and Operations Centre in the west to expand passport processing and printing capacity across the nation

- collaborate with Indigenous Skills and Employment Training (ISET) agreement holders including, Indigenous service organizations, Nations, Tribal Councils and Self-Government/Modern Treaty Holders, to strengthen their understanding of the program and the built-in flexibilities that agreement holders can use to provide wrap around support services for clients and/or to establish emergency response plans that allow it to meet Indigenous communities' needs

- the region will also support these partners by working closely with them to make sure they are taking full advantage of ISET flexibilities and to increase capacity to meet the reporting requirements which will reduce administrative burdens, leading to improved employment outcomes for Indigenous peoples and communities

Ontario Region

- improve uptake and accessibility of programs and benefits, as well as service outcomes for vulnerable groups through ongoing partnerships and relationships with Indigenous communities, other government departments and community partners. These groups include Indigenous, persons with disabilities, seniors, newcomers, youth, racialized communities, and communities with low income, experiencing unemployment, or requiring assistance

- we will work with Immigration, Refugees, and Citizenship Canada, the Ontario Ministry of Labour, Immigration, Training and Skills Development (MLITSD), and municipalities to streamline the process for refugee claimants to obtain primary identification documents and accelerate their pathway to employment in Canada. We will also work with MLITSD to streamline and enhance the response times for the Joint Rapid Response Action Plan (JRRAP)

- expand on the use technology where available to create a more inclusive environment for clients. For example:

- accessible Point of Sale machines equipped with audible technology to enable clients with vision loss to hear the amount owed for payment

- high contrast displays to enable clients to input their PIN without assistance from an employee

- tactile Flooring and Tactile Maps to assist persons with disabilities to navigate

- geo-based technology such as Wayfinder Beacons to provide clients with cellular phone navigational information

- video Remote Interpretation between clients and employees to communicate using sign language and on-demand video remote interpretation

- resolve more client requests at first contact. We will do this by increasing automation for the review and processing of client requests. This includes creating a Pensions Virtual Registry to centralize digital information storage, to speed up processing and access to necessary information

- conduct Official Languages Minority Community consultations in major cities to ensure equal service quality in both Official Languages

Québec Region

- lead a single point of contact project to consolidate several services responding to the needs of homeless and Indigenous clients. The goal of the project is to enable these clients to benefit from the programs and services they are entitled to. Providing services in the same location will encourage these marginalized clients to come to our offices, which they do not do for many reasons and because of various obstacles

- expand the work of the Québec Region's Innovation Labs. This work, initially focused on Indigenous communities, and will now also benefit newcomers to Canada. The Labs bring clients, community organizations, and public servants together to identify the needs of clients and find solutions to provide them with better access to services

- facilitate the transition from Services Québec to Employment and Social Development Canada's Old Age Security for clients faced with language and/or literacy issues with a personalized service. Services Québec financially supports Québec seniors that are in a precarious situation until they reach the age of 65. At that point, this support ends, and these clients must seek support from Employment and Social Development Canada to obtain Old Age Security benefits. Québec Region Citizen Services officers will help those clients to organize the required documentation

Atlantic Region

- expand the parameters for intake of cases that contain allegations with heightened probability of serious concern to the health and safety of Temporary Foreign Workers who are working outside of the Atlantic region. The expansion will continue to support the National Workload initiative, assist other regions with heavy workload pressures, and improve timeliness across the network

- improve client service by having more employees in the Employment Insurance and Pensions processing and call centres cross-trained. This will allow employees to have broader knowledge to resolve issues at first contact with clients. This is being done as part of an expansion of the region's Integrated Service Management approach

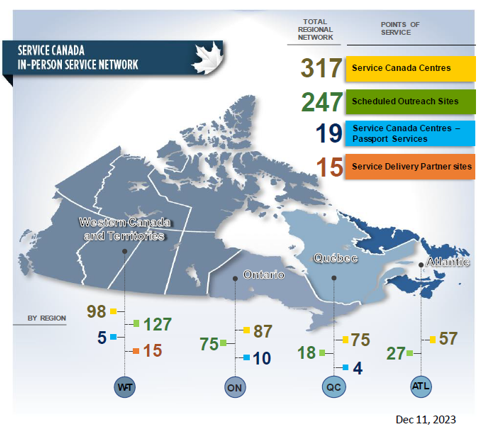

Text description of figure 1

This graphic shows the distribution of Service Canada's in-person service network by the type of office and regional distribution. Information in the graphic is valid as of December 11, 2023. The offices are distributed as follows:

Service Canada Centres

- Western Canada and Territories: 98

- Ontario: 87

- Québec: 75

- Atlantic: 57

- total: 317

Scheduled Outreach Sites

- Western Canada and Territories: 127

- Ontario: 75

- Québec: 18

- Atlantic: 27

- total: 247

Service Canada Centres - Passport Service Sites

- Western Canada and Territories: 5

- Ontario: 10

- Québec: 4

- Atlantic: 0

- total: 19

Service Delivery Partner Sites

- Western Canada and Territories: 15

- Ontario: 0

- Québec: 0

- Atlantic: 0

- total: 15

Plans to deliver on core responsibilities and internal services

Core responsibilities and internal services:

Social Development

In this section

- Description

- Quality of life impacts

- Results and targets

- Plans to achieve results

- Snapshot of planned resources in 2024 to 2025

- Related government priorities

- Program inventory

- Summary of changes to reporting framework since last year

Description

Increase inclusion and opportunities for Canadians to participate in their communities.

Quality of life impacts

Programs under this this core responsibility contribute to several Quality of Life domains and indicators, including:

- Domain - Society (Indicators - Accessible environments, Indigenous languages, Positive perceptions of diversity, Sense of belonging to the local community, Volunteering) through activities that help remove barriers and provide racialized communities, people with disabilities, and other vulnerable groups, such as the elderly and families with children, opportunities to participate in their communities

- Domain - Prosperity (Indicators - Access to early learning and child care, Financial well-being, Protection from income shocks) through activities that increase the availability of affordable child care and support Indigenous groups to provide child care, and reduce poverty

- Domain - Good Governance (Indicator - Confidence in institutions), through activities that focus on the Sustainable Development framework, innovative projects and research that strengthen the programs of the department and the Government of Canada

Results and targets

The following tables show, for each departmental result related to Social Development, the indicators, the results from the 3 most recently reported fiscal years, the targets and target dates approved in 2024 to 2025.

| Indicator | 2020 to 2021 result |

2021 to 2022 result |

2022 to 2023 result |

Target | Date to achieve |

|---|---|---|---|---|---|

| Newly developed partnerships as a percentage of all partnerships developed by recipient organizations to address a range of social issues such as the social inclusion of persons with disabilities, children and families and other vulnerable populations | Result to be achieved in the future | Result to be achieved in the future | 61% | At least 45% | March 2025 |

| Indicator | 2020 to 2021 result |

2021 to 2022 result |

2022 to 2023 result |

Target | Date to achieve |

|---|---|---|---|---|---|

| Number of community spaces and workplaces that are more accessible due to Enabling Accessibility Fund funding | 386 | 1,290 | 1,048 | At least 287 | March 2025 |

| Indicator | 2020 to 2021 result |

2021 to 2022 result |

2022 to 2023 result |

Target | Date to achieve |

|---|---|---|---|---|---|

| Average child care fees for regulated early learning and child care spaces | Not available | Not available | As of November 2023, 6 provinces and territories are delivering regulated child care for an average of $10-a-day or less. All remaining jurisdictions have reduced fees by at least 50% on average1 | At most $10-a-day | March 2026 |

| Indicator | 2020 to 2021 result |

2021 to 2022 result |

2022 to 2023 result |

Target | Date to achieve |

|---|---|---|---|---|---|

| Number of targets that are being met for the published service standards of Social Development programs2 | 1 out of 1 | 2 out of 33 | 3 out of 3 | 3 out of 3 | March 2025 |

- Notes:

- Québec and Yukon had already achieved $10-a-day prior to Budget 2021. While the Government of Québec supports the general principles of the Early Learning and Child Care Framework, it does not adhere to the Multilateral Framework as it intends to preserve its sole responsibility in this area. The Government of Canada has entered into an asymmetrical agreement with the province of Quebec that will allow for further improvements to their system.

- Service standards are published on Transparency - Canada.ca.

- Notification of funding is the only service standard not met.

The financial, human resources and performance information for Employment and Social Development Canada's program inventory is available on GC InfoBase.

Plans to achieve results

In fiscal year 2024 to 2025, the department will undertake the following activities to advance this core responsibility.

Affordability of early learning and child care is increased

We will continue to work with provinces and territories to increase access to high-quality, affordable, flexible and inclusive early learning and child care. This will help to reduce fees for regulated child care towards an average of $10-a-day and to create 250,000 new regulated child care spaces by March 2026.

We will support commitments from the provinces and territories to develop a highly qualified early learning and child care workforce. Specific measures to develop the workforce are outlined in the Canada-wide Agreements and include implementing wage grids where not already in place and initiatives to increase the percentage of certified early childhood educators providing regulated care to children. At the July 2023 Federal-Provincial-Territorial Meeting of Ministers Most Responsible for Early Learning and Child Care, all ministers (except Quebec, which participates as an observer only) agreed to develop a Canada-wide, multilateral workforce strategy for the early learning and child care workforce, recognizing that federal, provincial and territorial governments will have final authority on any implementation actions within their respective jurisdictions. The multilateral workforce strategy will centre on recruitment, retention and recognition.

The department will continue to support the work of the National Advisory Council on Early Learning and Child Care. This Council brings together academics, advocates, practitioners and caregivers and serves as a forum for consultations on issues and challenges facing the early learning and child care sector. It provides third-party expert advice to the Government of Canada.

The department will also continue to support communities and organizations exploring innovative practices to help improve the life outcomes of children through projects funded by the Early Learning and Child Care Innovation Program. These projects explore, test and develop new approaches that aim to improve the quality, accessibility, affordability, inclusivity and flexibility of early learning and child care programs and services. Data and research initiatives, including the development of a data and research strategy specific to early learning and child care, will also continue.

Finally, the department will continue to work with provinces and territories to support greater inclusion in the Canada-wide early learning and child care system through the Early Learning and Child Care Infrastructure Fund announced in Budget 2022.

Guided by the co-developed Indigenous Early Learning and Child Care Framework, we will continue to collaborate with First Nations, Inuit and Métis Nation governments and organizations in supporting Indigenous-led Early Learning and Child Care programs and services, delivered in communities across the country. Significant investments will continue to be made in Indigenous Early Learning and Child Care infrastructure. This funding aims to build new early learning and child care centres and upgrade older ones, ensuring that there are high quality facilities for Indigenous children. This investment will help grow the availability of Indigenous Early Learning and Child Care and improve access for Indigenous children and families. The goal is to provide them with access to high-quality, culturally-relevant, early learning programming and services across the nation.

Barriers to accessibility for persons with disabilities are removed

We will continue to track how well accessibility barriers are being identified and removed. We will use this data to measure progress in the removal of barriers which is part of our implementation of the Federal Data and Measurement Strategy for Accessibility. We will also publish the second half of the performance indicator framework for the Accessible Canada Act through this strategy. In addition, indicator data sources will be identified. A key data source will be the 2022 Canadian Survey on Disability. This survey collects data from Canadians with disabilities about the barriers they face and how these affect their full participation in society. Reports based on this data will help organizations working to advance accessibility across Canada.

Through the Enabling Accessibility Fund we will continue to remove barriers by supporting projects that improve safety and accessibility in communities and workplaces across Canada.

Poverty is reduced

Under the Poverty Reduction Strategy, we will continue to reduce poverty, by:

- leading and coordinating initiatives across the federal government which are helping to address the many dimensions of poverty and its impacts

- supporting the National Advisory Council on Poverty to develop their fifth annual report on the Government of Canada's progress toward the goal of a 50% reduction in poverty by 2030. We offer support to the Council in its provision of advice to the Minister of Families, Children and Social Development on poverty reduction, and in their engagement activities to continue a national dialogue with Canadians on poverty

- working with Statistics Canada to conduct the third comprehensive review of the Market Basket Measure. This will ensure that poverty in Canada is measured using the latest available data and methods, and that Canada's Official Poverty Line continues to accurately reflect a basic and modest standard of living. This work ensures that Canadians can be confident that poverty reduction results are reported using an approach that is up-to-date, transparent and informed by a diversity of stakeholder perspectives

- continuing to collaborate with First Nations, Inuit, and Métis to better understand poverty among Indigenous populations in Canada and determine specific indicators. Co-developed indicators of poverty and well-being would help track poverty over time and would provide insight on the interactions between programs and initiatives and their effectiveness for Indigenous persons in Canada. This is expected to improve transparency and accountability

We will continue to engage with provinces, territories, and Indigenous partners, and stakeholders on the development of a National School Food Policy and to work towards a national school meal program. We will seek to ensure that a National School Food Policy reflects regional and local needs by building on our partners' existing efforts on school food programming. This includes exploring how to expand and enhance existing efforts, and creating an environment for ongoing collaboration to increase the number of children who have access to nutritious food in school.

The Canada Disability Benefit (CDB), a key part of the Disability Inclusion Action Plan, will help to reduce poverty and support the financial security of working-age persons with disabilities by providing a direct monthly payment to eligible individuals. Working-age Canadians with disabilities experience poverty at twice the rate of working-age Canadians without disabilities. This year, we will continue the regulatory development process for this benefit which is essential to the delivery of the Disability Inclusion Action Plan.

Capacity to address social issues is enhanced

We will help charities and non-profits become more adaptable to changing community needs in Canada. Since the launch of the Community Services Recovery Fund in 2023, nearly 5,500 organizations will have received assistance to enhance staff and volunteer capabilities, improve systems and processes, and innovate program service.

This year, investments from the Social Innovation and Social Finance Strategy's Social Finance Fund will start reaching Social Purpose Organizations, helping them to address social and environmental issues. The fund's data will also be available for social finance wholesalers, social finance intermediaries, and Social Purpose Organizations to use as a guide for measuring the social and environmental impacts of investments.

The Black-led Philanthropic Endowment Fund will keep investing and supporting Black-led, Black-focused, and Black-serving charities and non-profits. These funds will help organizations run projects that fight anti-Black racism and improve social and economic outcomes for Black communities in Canada.

The Supporting Black Canadian Communities Initiative will continue to play a key role in the department’s efforts to increase social inclusion, reduce systemic barriers, and strengthen social cohesion within Canada by advancing targeted measures for Black communities. This includes addressing emerging priorities as identified by Black community stakeholders and strengthening the foundational capacity of Black-led and Black-serving community organizations in Canada.

Through a 2 year investment announced in Budget 2023 (beginning in 2023 to 2024), the Social Development Partnerships Program - Disability (SDPP-D) will continue to help address the unique needs and ongoing barriers faced by persons with disabilities by investing in capacity building and the community-level work of Canada's disability organizations.

We will continue to lead Canada's implementation of the United Nations 2030 Agenda for Sustainable Development (2030 Agenda) and its Sustainable Development Goals (SDGs). This includes developing Canada's 2024 Annual Report on the 2030 Agenda and the SDGs. The report will highlight actions taken by the whole-of-government and whole-of-society to achieve the SDGs at home and abroad. The report will be published in summer 2024 and we will be part of Canada's official delegation to the 2024 United Nations High-level Political Forum on Sustainable Development in July 2024.

Snapshot of planned resources in 2024 to 2025

- Gross planned spending: $7,930,989,184

- Net planned spending: $7,930,989,184

- Planned full-time resources: 529

Related government priorities

Gender-based analysis plus

Work underway with provinces and territories to establish a Canada-wide early learning and child care system will benefit all Canadians. In the long term, it is projected to boost Canada's gross domestic product through increased labor market participation, particularly among women with young children. The program aims to increase the labor force participation rate of core-aged women with children under age 6 (currently estimated at 79.2%), and it benefits families of lower socio-economic status, single parents, and underrepresented groups.

For the Indigenous Early Learning and Child Care Initiative, we will collaborate with Indigenous partners to identify specific Gender Based Analysis plus indicators that are useful and practical to collect. This will help us gain a clearer understanding of program results for Indigenous equity-diverse people.

We will collect Gender Based Analysis plus-related data from Social Development Partnerships Program - Disability projects. Data will include the number and types of groups served by projects, including groups that identify with more than 1 identity. For example, these groups can include persons with disabilities who also identify with Official Language minority communities, 2SLGBTQI+ communities, Indigenous and minority communities including Black and other visible minority groups.

The Supporting Black Canadian Communities Initiative will use Gender Based Analysis plus analysis to inform decisions on outreach and funding priorities. This will help ensure that organizations serving specific communities, or multiple marginalized groups, receive funding to enhance their capacity and ensure access to proper facilities and equipment. For example, analysis suggests a need for more outreach to Black Nova Scotian organizations, as well as ensuring access for northern organizations, due to the high number of Black people per capita in the North. This will help National Funders to do targeted outreach and provide support in their next call for proposals.

The Poverty Reduction Strategy was developed using a Gender Based Analysis plus analysis to understand the unique risk factors encountered by diverse groups. The strategy brings together significant investments that the government has made since 2015 to support the social and economic well-being of all Canadians, including funding for key poverty reduction initiatives. Gender Based Analysis plus analysis will continue to inform these investments to help maximize support to the many individuals experiencing poverty with identities that intersect with a diversity of groups including, but not limited to, Indigenous peoples, female-led lone parent families, persons with disabilities and visible minorities.

United Nations 2030 Agenda for Sustainable Development and the UN Sustainable Development Goals

In fiscal year 2024 to 2025, the department will continue to support the Sustainable Development Goals (SDGs) to ensure a coordinated whole-of-government and whole-of-society approach for advancing on the SDGs and the 2030 Agenda. This will be done in our department through the following programs:

End poverty in all its forms everywhere (SDG 1) - Through the Poverty Reduction Strategy, the department is aiming to reduce poverty by 50% by 2030, when compared to 2015. Through the Canada Child Benefit (CCB), a benefit provided as part of this strategy, the Government is providing more than $25 billion each year to more than 3.5 million families, including more than 6 million children. The CCB is indexed to keep pace with the cost of living.

Quality Education (SDG 4) - In its work with provincial, territorial and Indigenous partners to build and implement a Canada-wide early learning and child care system, the Government of Canada is supporting SDG 4. The goal of the Canada-wide system is that families have access to high-quality, affordable, flexible and inclusive early learning and child care no matter where they live in Canada through implementation of the Early Learning and Child Care and Indigenous Early Learning and Child Care programs.

Decent work and economic growth (SDG 8) and Industry, innovation and infrastructure (SDG 9) - The Accessible Canada Act will lead to the removal and prevention of barriers in transportation, the built environment, information, communication and technology (ICT), and employment. This will make infrastructure such as housing, public buildings, and public transportation systems more accessible for persons with disabilities. It will also improve access to information, products and services for individuals with disabilities. This year we will establish performance indicators to measure progress in removing barriers to accessibility in employment, transportation and ICT.

Partnerships for the goals (SDG 17) - Through the Sustainable Development Goals Funding Program, we will support implementation of the 2030 Agenda by strengthening partnerships and engagement with Canadians. As such, a new call for proposal of the program was launched in November 2023, with the aim to have projects in place in the summer 2024. These projects are expected to increase public awareness of the SDGs, share best practices or lessons learned that support Canada's progress on the 2030 Agenda within equity-deserving groups or groups of individuals in vulnerable situations. Projects are also expected to help support the integration of the SDGs in communities. We will also advance the core principle of the 2030 Agenda to leave no one behind by engaging with the whole-of-society and the whole-of-government in reporting on the SDGs. This will be accomplished through engagement activities led by civil society organizations such as the Together/Ensemble Conference and also by department-led engagement activities with stakeholders that serve different segments of the population.

More information on Employment and Social Development Canada's contributions to Canada's Federal Implementation Plan on the 2030 Agenda and the Federal Sustainable Development Strategy can be found in our Departmental Sustainable Development Strategy.

Program inventory

Social Development is supported by the following programs:

- Accessible Canada Initiative

- Black-led Philanthropic Endowment Fund

- Canadian Benefit for Parents of Young Victims of Crime

- Early Learning and Child Care

- Enabling Accessibility Fund

- Indigenous Early Learning Child Care Transformation Initiative

- New Horizons for Seniors Program

- Social Development Partnerships Program

- Social Innovation and Social Finance Strategy

- Strategic Engagement and Research Program

- Sustainable Development Goals Funding Program

Supporting information on planned expenditures, human resources, and results related to Employment and Social Development's program inventory is available on GC Infobase.

Summary of changes made to reporting framework since last year

- Indicator removed: Reduction in the estimated number of shelter users who are chronically homeless

Pensions and Benefits

In this section

- Description

- Quality of life impacts

- Results and targets

- Plans to achieve results

- Snapshot of planned resources in 2024 to 2025

- Related government priorities

- Program inventory

- Summary of changes to reporting framework since last year

Description

Assist Canadians in maintaining income for retirement, and provide financial benefits to survivors, people with disabilities and their families.

Quality of life impacts

Programs under this core responsibility contribute to the following Quality of Life domain and indicators:

- Domain - Prosperity (indicators - Poverty, Household Income, Financial Wellbeing) through activities that provide Canadians with income for retirement, and financial benefits to people with disabilities, survivors of pension contributors and their families

Results and targets

The following tables show, for each departmental result related to Pensions and Benefits, the indicators, the results from the 3 most recently reported fiscal years, the targets and target dates approved in 2024 to 2025.

| Indicator | 2020 to 2021 result | 2021 to 2022 result | 2022 to 2023 result | Target | Date to achieve |

|---|---|---|---|---|---|

| Percentage of seniors living in poverty | 5.7% (2019) | 3.1% (2020) | 5.6% (2021) | At most 7.3% | December 2030 |

| Percentage of seniors receiving the Old Age Security Pension at age 65 and over in relation to the estimated total number of eligible seniors aged 65 and over (OAS pension take-up rate) | 97.1% (2018) | 96.8% (2019) | 96.7% (2020) | At least 94%1 | March 2025 |

| Percentage of seniors receiving the Old Age Security pension at age 70 and over in relation to the estimated total number of eligible seniors aged 70 and over (OAS pension take-up rate 70+) | 99% (2018) | 99% (2019) | 99% (2020) | At least 99% | March 2025 |

| Percentage of seniors receiving the Guaranteed Income Supplement in relation to the estimated total number of eligible seniors | 91.2% (2018) | 92.2% (2019) |

91.9% (2020) | At least 90% | March 2025 |

| Percentage of Canada Pension Plan contributors aged 70+ receiving retirement benefits | 99% (2019) | 99% (2020) | 99% (2021) | At least 99% | March 2025 |

| Indicator | 2020 to 2021 result | 2021 to 2022 result | 2022 to 2023 result | Target | Date to achieve |

|---|---|---|---|---|---|

| Percentage of Canada Pension Plan contributors who have contributory eligibility for Canada Pension Plan Disability benefits and therefore have access to financial support in the event of a severe and prolonged disability | 65% (2019) | 65% (2020) | 65% (2021) | At least 68% | March 2025 |

| Percentage of Canadians approved for the Disability Tax Credit who have a Registered Disability Savings Plan to encourage private savings2 | 35% (2021) | 36% (2022) | Not yet available (2023) |

At least 36% | December 2024 |

| Percentage of Registered Disability Savings Plan beneficiaries that have been issued a grant and/or a bond to assist them and their families to save for their long term financial security | 78% (2021) | 76% (2022) |

76% (2023) |

At least 74% | December 2024 |

| Indicator | 2020 to 2021 result | 2021 to 2022 result | 2022 to 2023 result | Target | Date to achieve |

|---|---|---|---|---|---|

| Number of targets that are being met for the published service standards of Pensions and Benefits programs3 | 5 out of 10 | 5 out of 10 | 4 out of 10 | 10 out of 10 | March 2025 |

| Percentage of Canada Pension Plan Retirement Benefits paid within the first month of entitlement | 98% | 95.9% | 94.3% | At least 90% | March 2025 |

| Percentage of decisions on applications for a Canada Pension Plan disability benefit within 120 calendar days | 61% | 87.2% | 78.7%4 | At least 80% | March 2025 |

| Percentage of Old Age Security basic benefits paid within the first month of entitlement | 91% | 89.5% | 87.6% | At least 90% | March 2025 |

- Notes:

- This recognizes that not all people aged 65 years and older apply for Old Age Security (OAS) benefits when they first become eligible. Since 2013, seniors can choose to delay their OAS pension up to age 70, in exchange for a higher monthly benefit amount. As more people delay their applications for the OAS pension, there could be a decrease in the OAS take-up rate. This is why a new indicator has been added to measure take-up of the OAS pension by eligible seniors aged 70 and over. In addition, there is a 3-year time lag in the availably of data for this indicator.

- The target for this indicator looks at Canadian residents who have a disability and are aged 0 to 49 years. We adjusted the calculation in 2023 to reduce the lag time for reporting on results. Because of this adjustment, year over year comparisons should be done with caution.

- Service standards are published on Transparency - Canada.ca.

- Results are below the 80% target because the intake is back to pre-pandemic levels. In 2021 to 2022 intake was lower because clients were receiving the Canada Emergency Response Benefit, which resulted in the department exceeding its Speed of Service projections and target. In order to meet its service standard moving forward and improve service delivery results for Canadians, the department received a multi-year funding to address these workload challenges and hired additional resources.

The financial, human resources and performance information for Employment and Social Development's program inventory is available on GC InfoBase.

Plans to achieve results

In fiscal year 2024 to 2025, the department will undertake the following activities to advance this core responsibility.

Seniors have income support for retirement

Old Age Security

The department will ensure that seniors continue to have income support for retirement through the Old Age Security (OAS) program. The department will continue to provide the basic OAS pension, which is paid to all persons aged 65 or over who meet the residence requirements. The program will also provide eligible low-income OAS pensioners with the Guaranteed Income Supplement (GIS), and Allowances for low-income Canadians aged 60 to 64 who are the spouses or common-law partners of GIS recipients, or who are widows or widowers.

We will migrate Old Age Security (OAS) to the new Benefits Delivery Modernization platform. This will simplify the experiences of everyone who engages with the OAS program. This includes both the over 7 million seniors that receive benefits and the employees who administer them. The migration of the OAS to the new platform will be done through several releases. Based on lessons learned, a pilot will take place in summer 2024 to confirm that the solution works as planned and that the employees are ready for the change. The final release will follow in December 2024. Once the new system is in place, all OAS, Guaranteed Income Supplement (GIS) and Allowance benefits will be paid from the new system.

Canada Pension Plan

Enhancement to the Canada Pension Plan (CPP) that began in 2019 will, over time, increase the maximum Canada Pension Plan retirement pension by over 50%. January 2025 will mark the end of the enhancement's 7-year phase-in, when the range of earnings protected by the Plan will increase to 14% above the original limit. The Canada Revenue Agency will determine the 2025 basic and enhanced earnings limits in late 2024 based on wage growth.

Persons with disabilities and their families have financial support

We will make sure Canadians with severe and prolonged disabilities and their families have financial support from the Canada Pension Plan - Disability program. This year we will aim to improve the client experience by:

- expanding our quality assurance program to review more types of files, including grave medical conditions and terminal illness applications, in addition to initial and reconsideration decisions. Having more files undergo a quality assurance review will help to ensure medical decisions to determine eligibility are appropriate and consistent

- use experimental approaches to improve the program for Canadians with severe and prolonged disabilities. Specifically, we will launch a pilot project to test improved employment supports for Canada Pension Plan Disability clients who want to return to work while continuing to receive the benefit

We will continue to promote the Canada Disability Savings Grant and the Canada Disability Savings Bond to encourage people with disabilities, approved for the Disability Tax Credit (DTC) and who have opened a Registered Disability Savings Plan (RDSP), to save for the future. The bond is money the government contributes to the RDSPs of low-and-modest-income persons with disabilities, up to the lifetime maximum of $20,000. No personal contributions are required to receive the bond. The grant matches personal contributions up to 300%, to a lifetime maximum of $70,000. We will also raise awareness of the Canada Disability Savings Program to eligible individuals who have not yet opened an RDSP. We will undertake a range of activities including annual mass mail-outs, engagement with community-based stakeholders, and webinars conducted with the Canada Revenue Agency (CRA) to increase awareness of these initiatives.

Snapshot of planned resources in 2024 to 2025

- Gross planned spending: $148,006,897,563

- Net planned spending: $82,359,460,288

- Planned full-time resources: 7,522

Related government priorities

Gender-based analysis plus

There are gender differences in who receives Canada Pension Plan benefits. More women receive survivors' pension and disability pension compared to men. Men typically receive higher retirement pensions due to historically higher earnings. The Canada Pension Plan uses a Gender-based analysis plus approach in considering potential reforms to the Plan, which is currently taking place by means of the 2022 to 2024 Triennial Review. Items such as gender, household income level, work history, family status and widowhood are being considered to ensure that any potential changes to the Canada Pension Plan promote gender equality, diversity and inclusiveness. This focus will remain as potential options are presented to Canada's Finance Ministers and, should there be consensus on a reform package as a result of the Triennial Review, the department will work on implementing these reforms in 2025.

United Nations 2030 Agenda for Sustainable Development and the UN Sustainable Development Goals

In fiscal year 2024 to 2025, the department will continue to support the Sustainable Development Goals (SDGs) to ensure a coordinated whole-of-government and whole-of-society approach for advancing on the SDGs and the 2030 Agenda. This will be done in our department through the following programs:

End poverty in all its forms everywhere (SDG 1) - We are helping to reduce low income among seniors by updating the Old Age Security benefit amounts 4 times a year, in January, April, July, and October. This update makes sure benefits keep pace with the rising cost of living.

Achieve gender equality and empower all women and girls (SDG 5) - The Guaranteed Income Supplement is a monthly payment to low-income OAS pensioners and Allowances are benefits for low-income 60 to 64 year-old individuals who are either the spouse or common-law partner of a Guaranteed Income Supplement recipient, or who are a widow/widower. Both of these items assist more women than men. For example, in 2022 to 2023, 58% of Guaranteed Income Supplement beneficiaries were women and 42% were men. In the same year, 85% of Allowances beneficiaries were women and 15% were men.

More information on Employment and Social Development Canada's contributions to Canada's Federal Implementation Plan on the 2030 Agenda and the Federal Sustainable Development Strategy can be found in our Departmental Sustainable Development Strategy.

Program inventory

Pensions and Benefits is supported by the following programs:

- Canada Disability Savings Program

- Canada Pension Plan

- Old Age Security

Supporting information on planned expenditures, human resources, and results related to Employment and Social Development Canada's program inventory is available on GC Infobase.

Summary of changes made to reporting framework since last year

- Not applicable

Learning, Skills Development and Employment

In this section

- Description

- Quality of life impacts

- Results and targets

- Plans to achieve results

- Snapshot of planned resources in 2024 to 2025

- Related government priorities

- Program inventory

- Summary of changes to reporting framework since last year

Description

Help Canadians access post-secondary education, obtain the skills and training needed to participate in a changing labour market, and provide supports to those who are temporarily unemployed.

Quality of life impacts

Programs under this core responsibility contribute to several Quality of Life domains and indicators, including:

- Domain - Prosperity (Indicators - Postsecondary attainment, Youth not in employment, education or training [NEET], Child, student and adult skills, Protection from income shocks, Employment, Financial well-being, Labour underutilization) through programs that help Canadians access post-secondary education and assist Indigenous people, youth, and other groups obtain the training they need to participate in the labour market or return to school. In addition, programs provide support to individuals who are temporarily unemployed and to employers with labour needs

- Domain - Society (Indicators - Knowledge of official languages, Sense of belonging to local community and Volunteering), through programs that help Canadians in second-language minority communities obtain the skills and training they need to find employment in their communities

Results and targets

The following tables show, for each departmental result related to Learning, Skills Development and Employment, the indicators, the results from the 3 most recently reported fiscal years, the targets and target dates approved in 2024 to 2025.

| Indicator | 2020 to 2021 result | 2021 to 2022 result | 2022 to 2023 result | Target | Date to achieve |

|---|---|---|---|---|---|

| Employment or returns to school following provincially or territorially delivered skills training and/or employment services supported by Government of Canada funding transfers | 341,8692 (2019 to 2020)1 | 321,8032 (2020 to 2021)1 | 373,6542 (2021 to 2022)1 | Not available3 | March 2025 |

| Number of Canadians receiving provincially or territorially delivered skills training and/or employment services supported by Government of Canada funding transfers | 804,070 (2019 to 2020)1 |

607,149 (2020 to 2021)1 | 671,3494 (2021 to 2022)1 | Not available3 | March 2025 |

| Employment or returns to school following training/supports through federally administered programs | 96,699 | 196,498 | 132,975 | 139,0945 | March 2025 |

| Number of Canadians receiving training and/or employment supports through federally administered programs | 152,212 | 285,684 | 269,607 | 316,5516 | March 2025 |

| Percentage change in Canadians aged 25 to 64 enrolled in university or college | 1% decrease (2020) |

5.7% increase (2021) |

2.6% decrease (2022)7 |

Between a 1.5% decrease and a 1.5% increase (2024) | March 2025 |

| Percentage of Canadians between the ages of 18 and 24 that are enrolled in university or college | 44.6% (2020) |

45.2% (2021) |

44.5% (2022)7 |

At least 44.8% (2024) | March 2025 |

| Indicator | 2020 to 2021 result | 2021 to 2022 result | 2022 to 2023 result | Target | Date to achieve |

|---|---|---|---|---|---|

| Difference in the employment rate between Indigenous peoples (First Nations status and nonstatus, Inuit and Métis) and non-Indigenous peoples8 | 14.1 percentage points (Census 2021) | 14.1 percentage points (Census 2021) | 14.1 percentage points (Census 2021) | At most 12.4 percentage points | March 2027 |

| Difference in the employment rate between persons with disabilities and persons without disabilities8 | 16.0percentage points (2022 Canadian Survey of Disability)9 | 16.0 percentage points (2022 Canadian Survey of Disability)9 | 16.0 percentage points (2022 Canadian Survey of Disability)9 | At most 14.0 percentage points10 | March 2028 |

| Difference in the employment rate between women and men8 | 6.1 percentage points (Census 2021)11 | 6.1 percentage points (Census 2021)11 | 6.1 percentage points (Census 2021)11 | At most 5.6 percentage points | March 2027 |

| Difference in the employment rate between visible minority group members and the non-visible minority population8 | 4.6 percentage points (Census 2021) | 4.6 percentage points (Census 2021) | 4.6 percentage points (Census 2021) | At most 3.7 percentage points | March 2027 |

| Indicator | 2020 to 2021 result | 2021 to 2022 result | 2022 to 2023 result | Target | Date to achieve |

|---|---|---|---|---|---|

| Beneficiary to Unemployed Contributor ratio (B/UC ratio) | 64.4% (2019 to 2020)12 |

Not available13 | Not available13 | 64.3% | March 2025 |

| Indicator | 2020 to 2021 result | 2021 to 2022 result | 2022 to 2023 result | Target | Date to achieve |

|---|---|---|---|---|---|

| Percentage of low and middle-income Canadian young adults participating in Post-Secondary Education | 50.1% (2017) |

50.1% (2018) |

51.5% (2019) |

At least 52.0% (2021) |

March 2025 |

| Percentage of children under 18 who were eligible for the Canada Learning Bond and/or the additional amount of the Canada Education Savings Grant and were provided with any of those benefits in the current year | 28.5% (2017) |

31.2% (2018) | 32.3% (2019)14 |

At least 30% (2021) |

December 2024 |

| Indicator | 2020 to 2021 result | 2021 to 2022 result | 2022 to 2023 result | Target | Date to achieve |

|---|---|---|---|---|---|

| The percentage of loans in repayment that are paid each year. | 11.9% (2020 to 2021) | 15.8% (2021 to 2022) | 15.1% (2022 to 2023) | At least 12% (2024 to 2025) | March 2025 |

| Indicator | 2020 to 2021 result | 2021 to 2022 result | 2022 to 2023 result | Target | Date to achieve |

|---|---|---|---|---|---|

| Number of targets that are being met for the published service standards of Learning, Skills Development and Employment programs15 | 17 out of 23 | 19 out of 25 | 19 out of 25 | 25 out of 25 | March 2025 |

| Percentage of Employment Insurance benefit payments or non-benefit notifications issued within 28 days of filing | 88.8% | 85.4% | 76.2%16 | At least 80% | March 2025 |

| Percentage of Employment Insurance requests for reconsideration reviewed within 30 days of filing | 88.7% | 83.7% | 33.8% | At least 80% | March 2025 |

| Percentage of Social Insurance Numbers applied for through the Newborn Registration Service issued within 10 business days | 99% | 100% | 100% | 100% | March 2025 |

| Percentage of registrations to My Service Canada Account through Trusted Digital Identities in participating provinces/territories | 5.7% | 6.3% | 5% | At least 5% | March 2025 |

- Notes:

- These results are for both Labour Market Development Agreements (LMDAs) and Workforce Development Agreements (WDAs). Results shown are from the previous year because there is a 1-year lag in data availability.

- The results for this indicator have been slightly revised in view of program flexibilities for inclusion of uninsured participants who find employment or return to school. As such, actual results for fiscal year 2020 to 2021, 2021 to 2022, and 2022 to 2023 have been updated.

- Provincially and territorially (P/T) delivered programs set their own annual targets.

- Since the publication of the of the 2022 to 2023 Departmental Results Report, the actual result for this indicator in 2022 to 2023 was updated. As such, actual result was 671,349.

- This target includes the anticipated number of participants who find employment or return to school upon completion of 1 of the following federally funded programs: Community Workforce Development Program 250; Indigenous Skills and Employment Training Program (ISET) 20,000; Opportunities Fund for Persons with Disabilities (OF-PwD) 3,700; Student Work Placement Program (SWP) 40,000 opportunities (20,000 from SWP and 20,000 from Innovative Work-Integrated Learning Initiative); Youth Employment and Skills Strategy (YESS) 73,000, (which includes ESDC-delivered Youth Employment and Skills Strategy Program (YESSP) 3,000 and Canada Summer Jobs (CSJ) 70,000); and Skills for Success (SFS) 2,000. The Skills and Partnership Fund is not included in the target, but results will be provided for the performance indicator's actual results.

- This target includes the anticipated number of participants that will take training or receive employment supports through the following federally delivered programs: Canadian Apprenticeship Strategy (CAS) 81,795; Community Workforce Development Program (CWDP) 1,000; Future Skills (FS) 20,000; Indigenous Skills and Employment Training Program (ISET) 40,000; Opportunities Fund for Persons with Disabilities (OF-PwD) 6,200; Sectoral Workforce Solutions Programs (SWSP) 3,750; Student Work Placement Program (SWP) 40,000 opportunities (20,000 from SWP and 20,000 from Innovative Work-Integrated Learning Initiative) ; Youth Employment and Skills Strategy (YESS) 93,806, (which includes Youth Employment and Skills Strategy Program (YESSP) 23,806 and Canada Summer Jobs (CSJ) 70,000); Skills for Success (SFS) 30,000.

- Lower unemployment rates in 2022 had a significant impact on Post Secondary Education participation when compared to earlier in the COVID-19 pandemic.

- Many factors can affect employment rates within specific groups, and these factors may affect groups differently. Employment and Social Development Canada programming cannot be considered solely responsible for changes to the employment rate gaps.

- The result for this indicator may be skewed due to an increase in unemployment rates in 2020 and 2021 as the COVID-19 pandemic significantly impacted the labour market.

- The department is setting a new target of 14.0 percentage points (at most) which takes into consideration the goal of the Accessible Canada Act which aims for a barrier-free Canada by 2040 and the expected impact of federal, provincial, and territorial policies and programming.

- The COVID-19 pandemic had a bigger impact on women's employment compared with men in the labour market.

- This result comes from the 2019 to 2020 EI Monitoring and Assessment Report. There is a 1-year lag in reporting for this indicator due to data availability.

- Due to temporary changes made to the Employment Insurance Program in response to the COVID-19 pandemic, there are no results for fiscal years 2020 to 2021 and 2021 to 2022 and due to a 1-year lag in data availability, results for 2022 to 2023 will be made available in the 2023 to 2024 Departmental Results Report.

- As a result of a time lag in the availability of data from Statistics Canada, 2019 data is used for 2022 to 2023 actual results as it is the most recent available.

- Service standards are published on Transparency - Canada.ca.

- On average, eligible clients received their first payment within 24 days. Results are below the 80% target due in part to an unforeseen increase in claims related to the COVID-19 Omicron variant. In order to meet its service standard moving forward and reduce claim inventories to a sustainable level, Service Canada hired and trained 600 incremental resources in 2022 to 2023.

The financial, human resources and performance information for Employment and Social Development Canada's program inventory is available on GC InfoBase.

Plans to achieve results

In fiscal year 2024 to 2025, the department will undertake the following activities to advance this core responsibility.

Students, including those from low- and middle-income families, are provided with federally funded supports to help them participate in post-secondary education (PSE)

We will work with community organizations and government partners to raise awareness of, and access to, education savings benefits, including among students aged 18 to 20 with unclaimed amounts of the Canada Learning Bond. This funding helps youth from low-income households participate in post-secondary education.

We will fund the Supports for Student Learning Program to help youth who face barriers to education. Through the Student and Afterschool Supports stream of the program, we will work with youth-serving organizations to support over 40,000 youth this year. Projects will help youth complete high school and transition to post-secondary education so they can gain skills and experience needed in the labour market. Additionally, by the end of March 2025, at least 11,000 Canadian post-secondary students are expected to have received assistance to study or work abroad through the Global Skills Opportunity stream. These 2 streams aim to equip students with the skills and abilities needed to succeed in the labour market.

Student borrowers are able to repay their federal student debt

In the 2024 to 2025 academic year, we aim to provide financial assistance to 700,000 post-secondary students through non-repayable Canada Student Grants and interest-free Canada Student Loans as part of the Canada Student Financial Assistance (CSFA) Program.

By fall 2024, we expect to expand the reach of the Canada Student Loan (CSL) Forgiveness initiative, which is part of our commitment to improve access to health care and social services in rural communities. This benefit is currently available to family doctors and nurses who work in underserved rural and remote communities in Canada and will be expanded to include all communities with populations of 30,000 or fewer.

Canadians access education, training and lifelong learning supports to gain the skills and work experience they need

Success strategies and lessons learned for training and skills development will be shared by the Future Skills Centre through regular engagement activities with employers, industry, labour, training providers, Indigenous and not-for-profit organizations, and government. For example, what types of training and supports are most helpful for people in career transition versus people newly landed in Canada. Sharing this information will help to guide these groups in replicating and expanding effective practices based on reliable evidence. The Centre will also test a guide on how to pilot and scale promising skills interventions for Canadians.

We will invest in skills training and employment supports for Canadians with approximately $3 billion provided annually to provinces and territories through the bilateral Labour Market Development Agreements (LMDAs) and the Workforce Development Agreements (WDAs).

Additionally, we will create employment and career opportunities for persons with disabilities and support both employers and employees in the tourism and hospitality sector. We will do this by supporting 32 multi-year projects through the Sectoral Workforce Solutions Program. Ten of the projects will create employment and career opportunities for persons with disabilities, 20 will help employers, employees, and other industry stakeholder organizations in the tourism and hospitality sector to attract and retain skilled workers and 2 projects will focus on developing labour market information and tools. In addition, the program will launch a Sustainable Jobs Training Fund to help workers upgrade or gain new skills for jobs in the low-carbon economy.

In 2024 to 2025, we will support the transition of workers from declining industries to growth areas through the Community Workforce Development Program. This program aims to support workforce development while communities diversify their local economies, enhancing their long-term economic resiliency.

We will also work to remove barriers to internal labour mobility within Canada and encourage provinces and territories to cut the red tape that impedes the movement of workers, particularly in construction, health care and child care as announced in the 2023 Fall Economic Statement

Advice on supporting workers in a changing labour market will be provided in a final report from a Union-Led Advisory Table that was launched on December 5, 2023 by the Minister of Employment, Workforce Development and Official Languages and the Minister of Labour and Seniors. The report will outline actions to:

- help mid-career workers, particularly those in at-risk sectors and jobs, access training and transition to in-demand jobs

- address the needs of workers in industries facing changes and disruptions

- encourage ongoing skills development for workers throughout their working lives

- support diversity and inclusion in Canadian workplaces and remove barriers for equity-deserving groups to access jobs and advance in their careers

- help workers transition to retirement with dignity

Increase employment opportunities for youth

Our department leads the Youth Employment and Skills Strategy, delivered in partnership with 11 other federal departments, agencies and Crown corporations. This year, at least 23,648 youth, including 5,240 supported directly by our department, will take part in work experience opportunities offered by the Youth Employment and Skills Strategy Program. An additional 70,000 jobs for youth across Canada will be created through Canada Summer Jobs which is also part of the Youth Employment and Skills Strategy but delivered solely by our department.

In addition, a new series of youth-focused projects, as part of the Youth Employment and Skills Strategy Program, are anticipated to start as early as 2024. These projects will support youth facing multiple barriers develop the skills and experience they need to find and keep good jobs.

Starting this year, we will conduct a small-scale trial as part of the Youth Employment and Skills Strategy Program's Call for Proposals. This trial, through a randomized control test, will gauge the effectiveness of a small investment (up to $30,000) on improving organizations' capacity for data collection, analysis and reporting. For example, these activities could include staff development, use of digital tools, or data-driven testing. Approximately 30 to 35 projects will be selected to participate in the trial and the results will guide improvements in reporting and program design to better meet the diverse needs of Canadian youth.

We will increase Canada Service Corps (CSC) opportunities for Indigenous and under-served youth to be involved with their community, providing service placements and micro-grants to at least 11,000 youth in 2024 to 2025.

Finally, Job Bank will display Canada Summer Jobs opportunities on its Youth targeted page and on the Canada Summer Jobs page of its mobile app, during the 2024 campaign, to help youth find work.

Support apprenticeship training and access to skilled trades

This year we will support, through the Canadian Apprenticeship Strategy, approximately 81,795 individuals to participate and succeed in trades-focused training.

We will also launch a new sustainable jobs training funding stream under the Canadian Apprenticeship Strategy's Union Training and Innovation Program. This stream will fund projects led by unions to provide green skills training for trades workers. About 5,000 apprentices and certified tradespersons will benefit from this investment in 2024 to 2025.

We will support the development of standards and examination to help labour mobility, align apprenticeship training, and ensure uniform certification tools for the trades. We will do this by working with the provinces and territories as part of the Red Seal Program. This year, 7 interprovincial standards and 32 examinations for 8 trades will be finalised.

Canadians participate in an inclusive and efficient labour market

This year, through the Opportunities Fund for Persons with Disabilities, we will help approximately 6,000 persons gain skills and work experience for employment. In addition, about 2,000 employers will receive support to make workplaces more accessible and inclusive for persons with disabilities.

The Disability Inclusion Business Council launched the Canadian Business Disability Network in December 2023 and will continue to support the Network in its mission to assist businesses and employers in adopting best practices for disability inclusion. The Council will also offer advice and recommendations to the Minister of Diversity, Inclusion and Persons with Disabilities on disability inclusion in the workplace.