MP Kit for CRA-related scams and fraud

What your constituents need to know about scams

Are you worried that your constituents could be scammed or be a victim of identity theft? So is the Canada Revenue Agency (CRA)!

There are many types of common scams out there that use the CRA name, with new ones being invented daily. Some of the common ones include the following:

- threatening or coercive language

- demanding immediate payment by gift cards or prepaid credit cards

- directing individuals to a fake CRA website

- sending an email or text message with a link that asks for personal or financial information

How can Canadians recognize CRA-related scams?

Taxpayers should be cautious if they receive a phone call, email, mail or text message claiming to be from the CRA.

Here are guidelines to help your constituents identify legitimate communications from the CRA.

By phone

The CRA will not

- ask for a fee to speak with a contact centre agent

- demand immediate payment by Interac e-transfer, cryptocurrency (Bitcoin), prepaid credit cards or gift cards from retailers such as iTunes, Amazon, or others

- use aggressive language or threaten you with arrest or sending the police

- leave voicemails that are threatening or give personal or financial information

The CRA may

- verify your identity by asking for personal information such as your full name, date of birth, address and account, or social insurance number (SIN)

- ask for details about your file in My Account or My Business Account

- call you to ask about a tax debt or begin an audit process

- call you to offer free tax help for your small business or offer support in helping your clients access their benefits and credits

By email

The CRA will not

- give or ask for personal or financial information by email and ask you to click on a link

- email you a link asking you to fill in an online form with personal or financial details

- send you an email with a link to your refund

- demand immediate payment by Interac e-transfer, cryptocurrency (Bitcoin), prepaid credit cards or gift cards from retailers such as iTunes, Amazon, or others

- threaten you with arrest or a prison sentence

The CRA may

- notify you by email when a new message or a document, such as a notice of assessment or reassessment, is available for you to view in secure CRA portals such as My Account, My Business Account, or Represent a Client. To confirm if an email notification you received is legitimate, see email notifications you will receive

- email you a link to a CRA webpage, form, or publication that you ask for during a telephone call or a meeting with an agent

- email you a consent form to meet with someone from the CRA via videoconference. You will only receive the form after you’ve agreed to provide your email address

- email you about Tax credits and benefits for individuals and the CRA’s online services, such as My Account

By mail

The CRA will not

- set up a meeting with you in a public place to take a payment

- demand immediate payment by Interac e-transfer, cryptocurrency (Bitcoin), prepaid credit cards or gift cards from retailers such as iTunes, Amazon, or others

- threaten you with arrest or a prison sentence

The CRA may

- ask for financial information such as the name of your bank and its location

- send you a notice of assessment or reassessment

- ask you to pay an amount you owe through any of the CRA's payment options

- take legal action to recover the money you owe

- write to you to begin an audit process

- write you to free tax help for your small business

By text messages/instant messaging

The CRA has introduced multi-factor authentication for all of its sign-in services. If you enrolled with the telephone option, you will receive a text message with a one-time passcode each time you sign in to your CRA account.

The CRA will not use text messages or instant messaging such as Facebook Messenger or WhatsApp to start a conversation with you about your taxes, benefits, or My Account under any circumstances.

If a taxpayer is unsure if the communication they received is from the CRA, they should always check their My Account or My Business Account or call the CRA at 1-800-959-8281 for individuals or 1-800-959-5525 for businesses.

How can Canadians protect themselves from fraud and identity theft?

To help lower the risk of being affected by fraud and identity theft, Canadians are encouraged to:

- Set up a Personal Identification Number (or PIN) for their account in order to identify themselves quickly and securely on the phone.

- Regularly change their user IDs and passwords, as well as security questions and answers.

- Avoid reusing passwords for different systems, services and applications. They should use unique passwords and change them regularly.

- Monitor their online CRA accounts by registering for My Account or My Business Account. Once registered, sign up for email notifications as an additional measure of security. This service notifies taxpayers by email if important information such as their address or direct deposit has been changed on CRA records.

Taxpayers can call the CRA to request that enhanced security measures be placed on their account. These measures will ensure that CRA call centre agents ask additional security questions to determine a caller’s identity.

What should Canadians do if they have been scammed?

If taxpayers suspect they may be the victim of a scam or fraud, or have been tricked into giving personal or financial information, the CRA strongly encourages them to contact their local police service.

Taxpayers can report scams to the Canadian Anti-Fraud Centre, or by calling 1‑888‑495‑8501.

If a taxpayer’s SIN has been lost or stolen, they should contact Service Canada a 1-866-274-6627.

Taxpayers should call the CRA if they:

- think their CRA user ID or password has been compromised

- find changes they did not request to their banking, address, business, or personal information

- find a benefit application made for them without their knowledge

- want to disable online access to their information in CRA sign-in services

- want to enable online access to their information in CRA sign-in services after it has been disabled

If the CRA confirms that a taxpayer’s information has been compromised, the CRA will act to prevent the fraudulent use of the information involving systems and processes for which the CRA is responsible.

Taxpayers can also ask the CRA to disable or re-enable online access to their information by contacting us.

If someone has had their account compromised and is unable to comply with their tax obligations, they may be eligible for taxpayer relief for any resulting interest or penalties. To submit requests for relief, individuals should complete Form RC4288, Request for Taxpayer Relief - Cancel or Waive Penalties or Interest.

How is the CRA informing Canadians about scams?

The CRA works to raise taxpayer awareness of scams and how they can protect their personal information.

The CRA’s scam alert page informs taxpayers about the latest scams pretending to be from the CRA and how to identify them. The CRA publishes these updates on, Facebook, Twitter, and LinkedIn when new scams are added to the page.

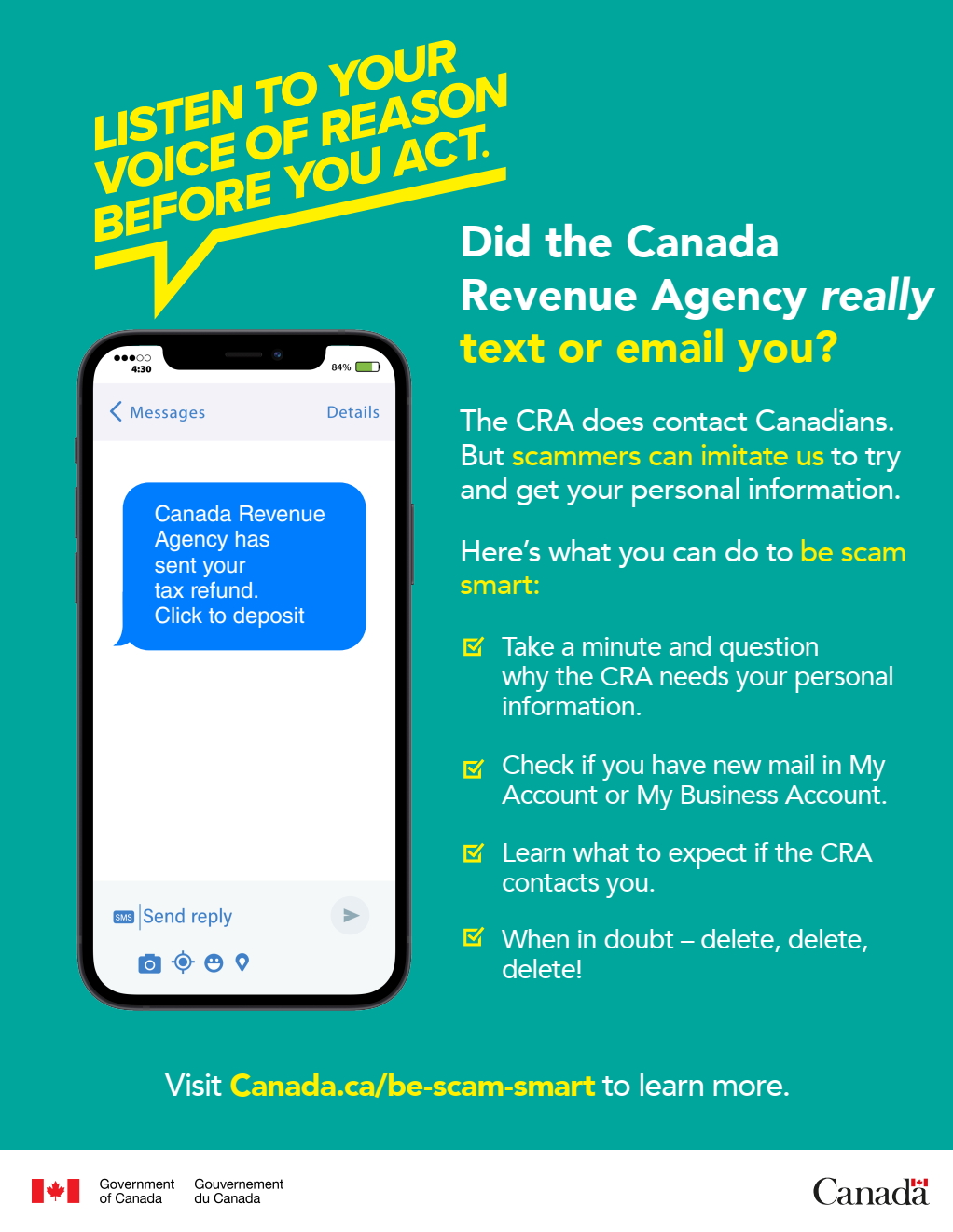

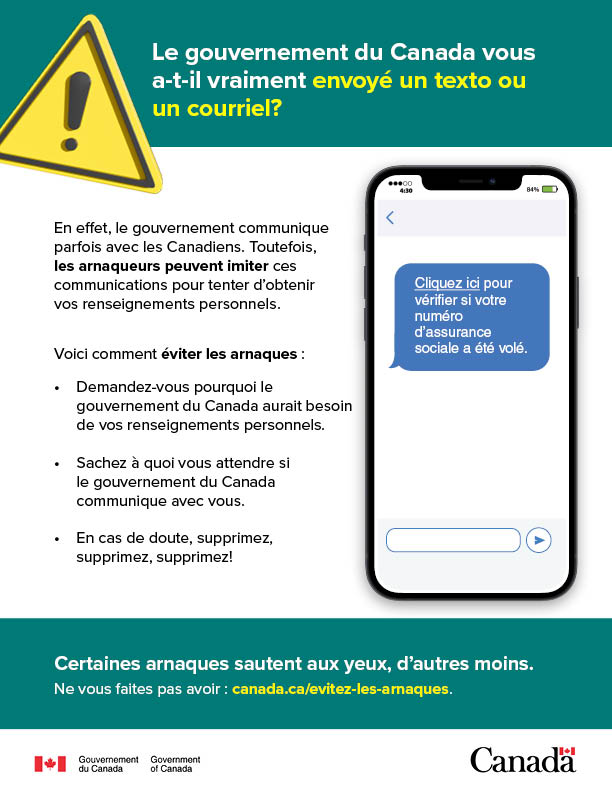

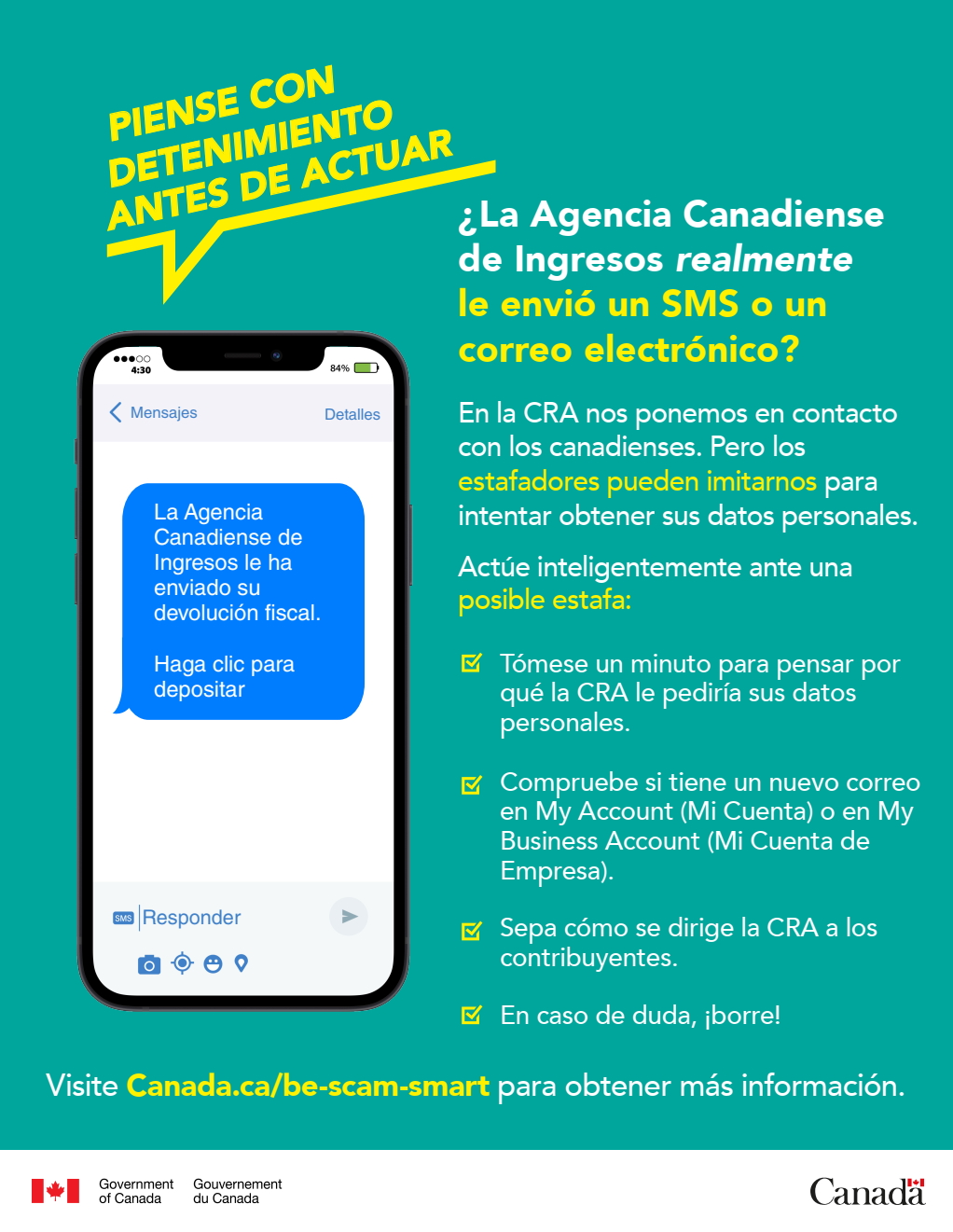

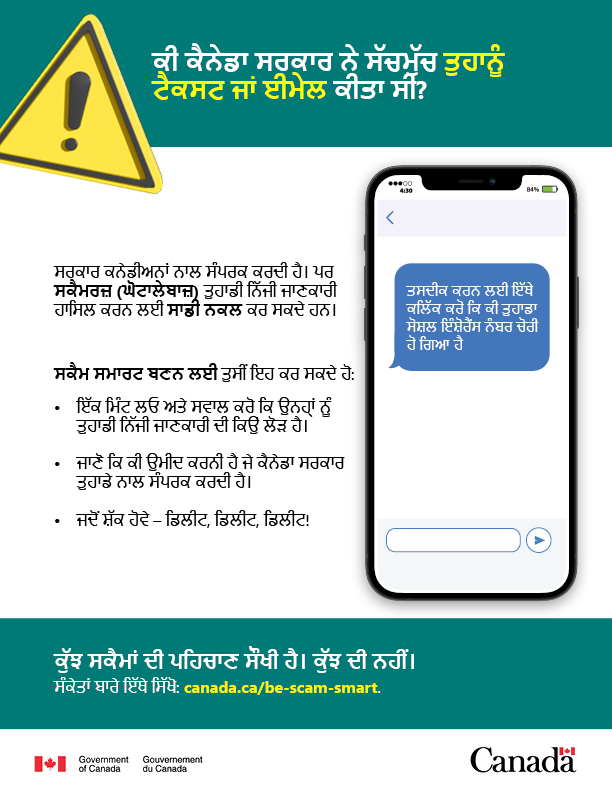

The CRA, in collaboration with other government departments, launched a national multimedia “Be Scam Smart” advertising campaign to increase awareness about common scams involving the Government of Canada name.

Additionally, the CRA’s scam prevention webpage, social media, news media, regular mail, and community outreach help increase taxpayer awareness of scams. The CRA partners with police forces, associations, and conducts print, radio and television interviews with media to widely distribute warnings about scams.

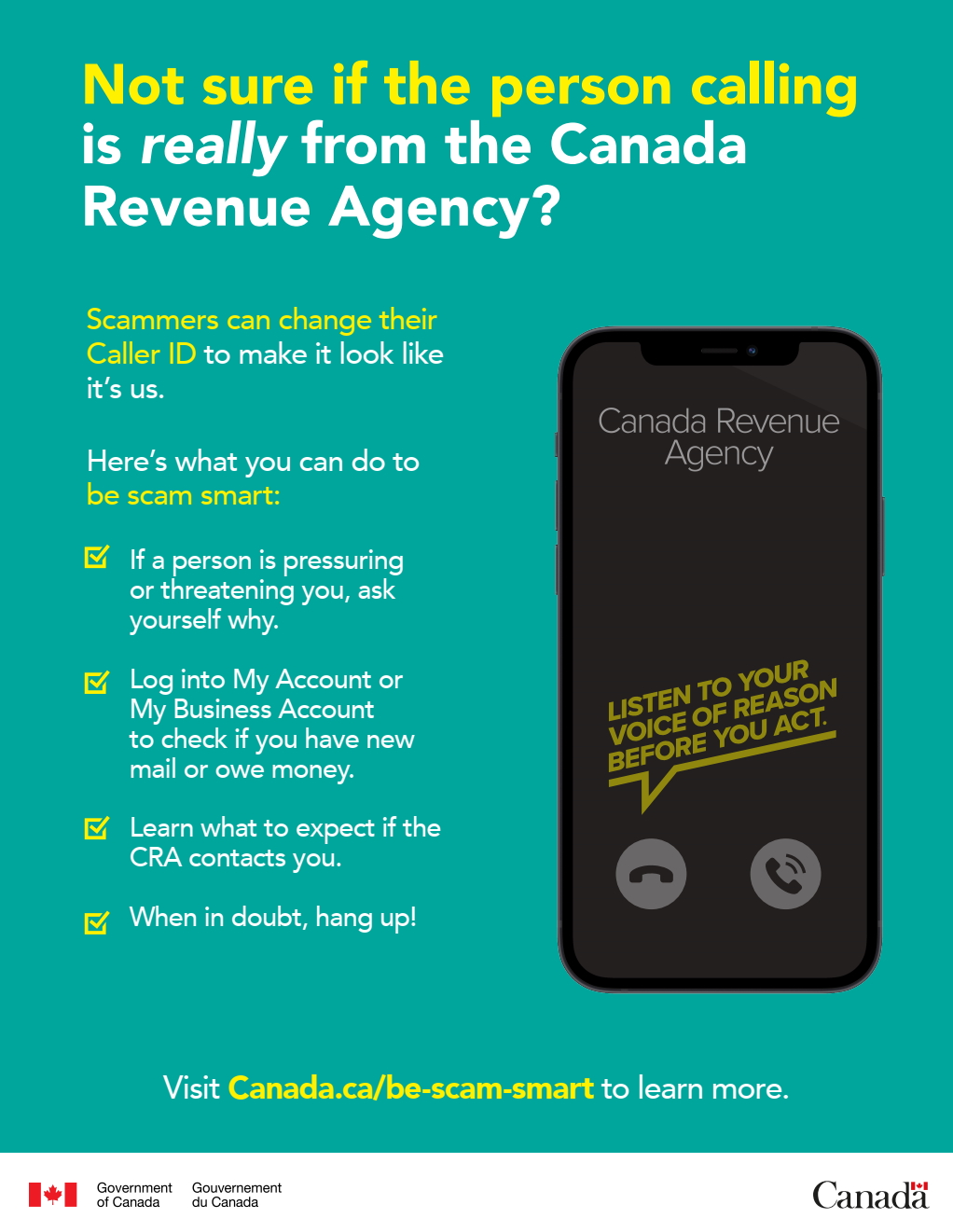

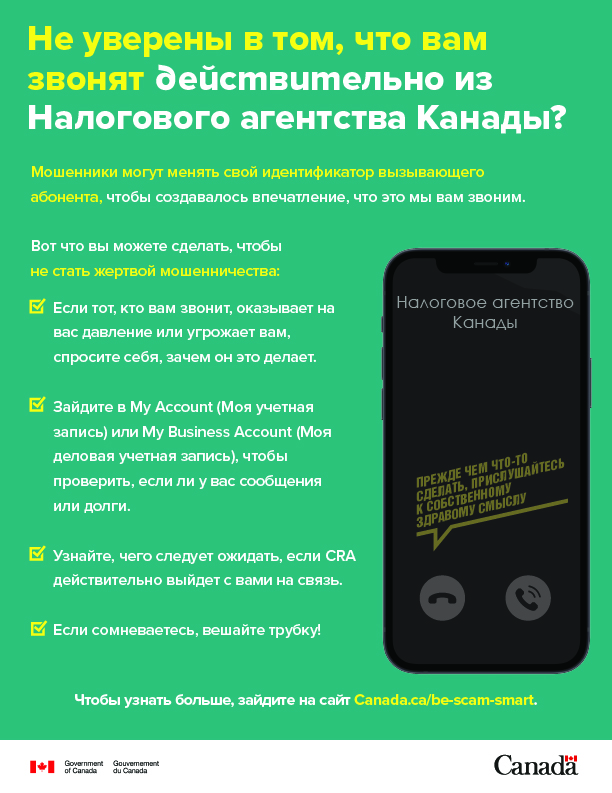

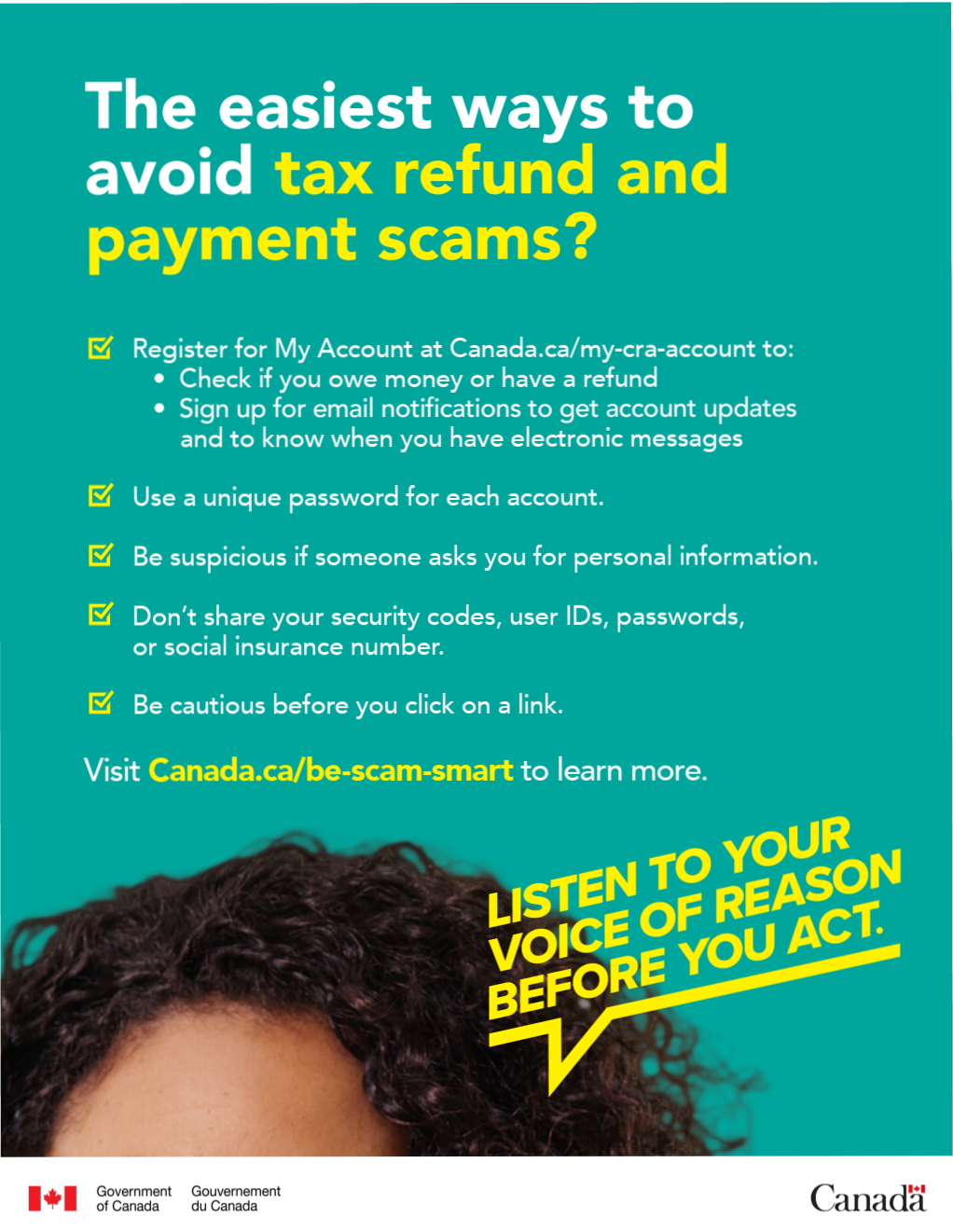

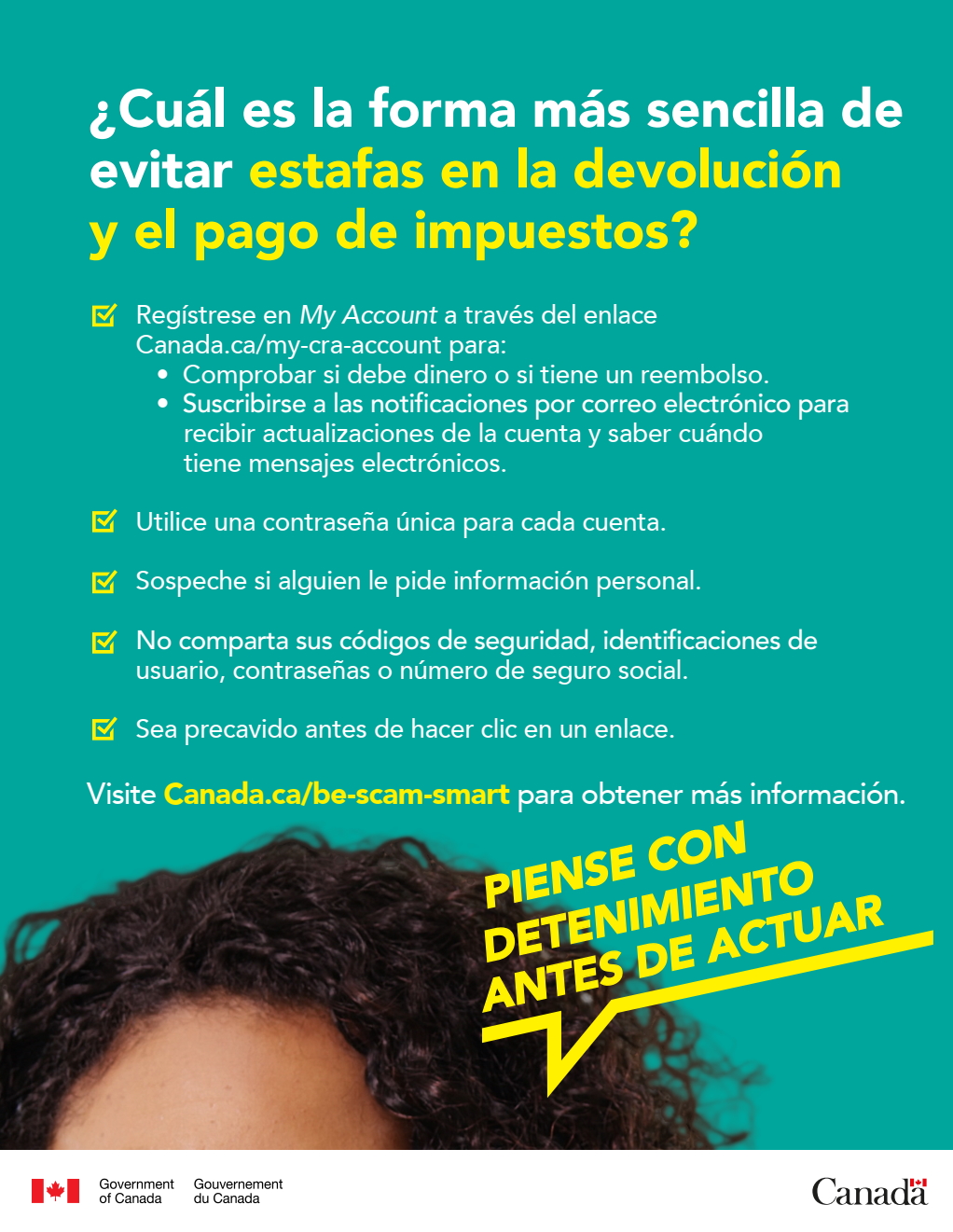

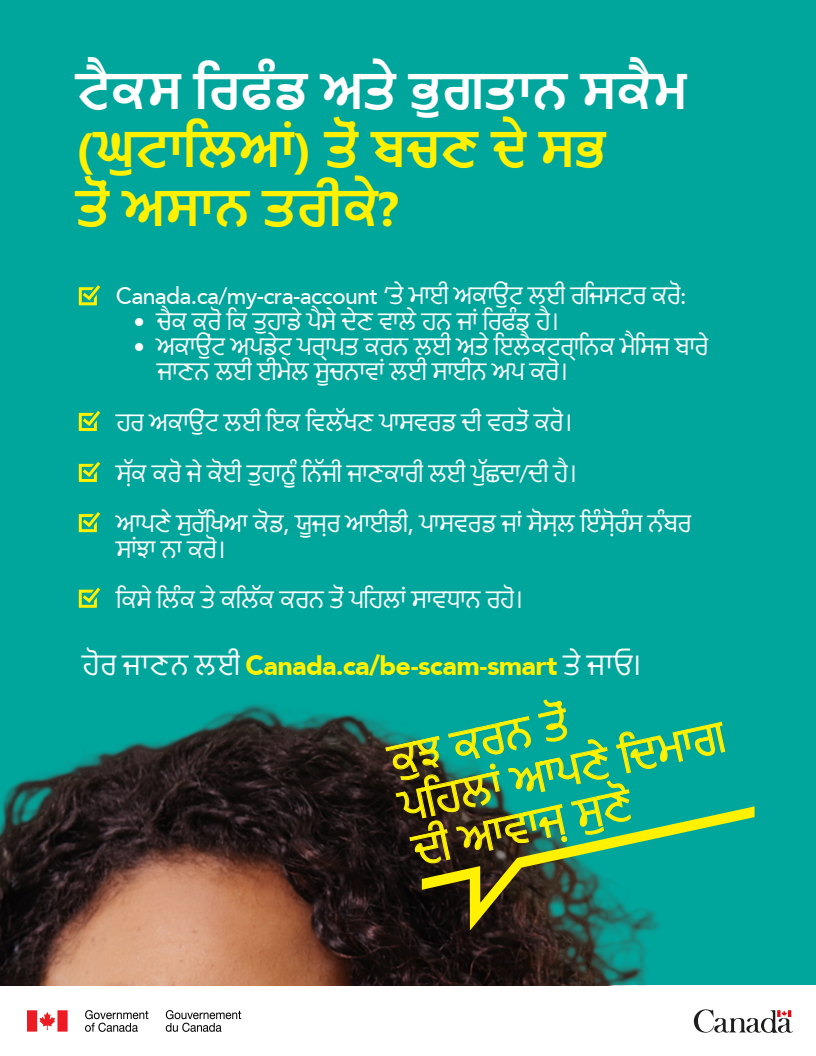

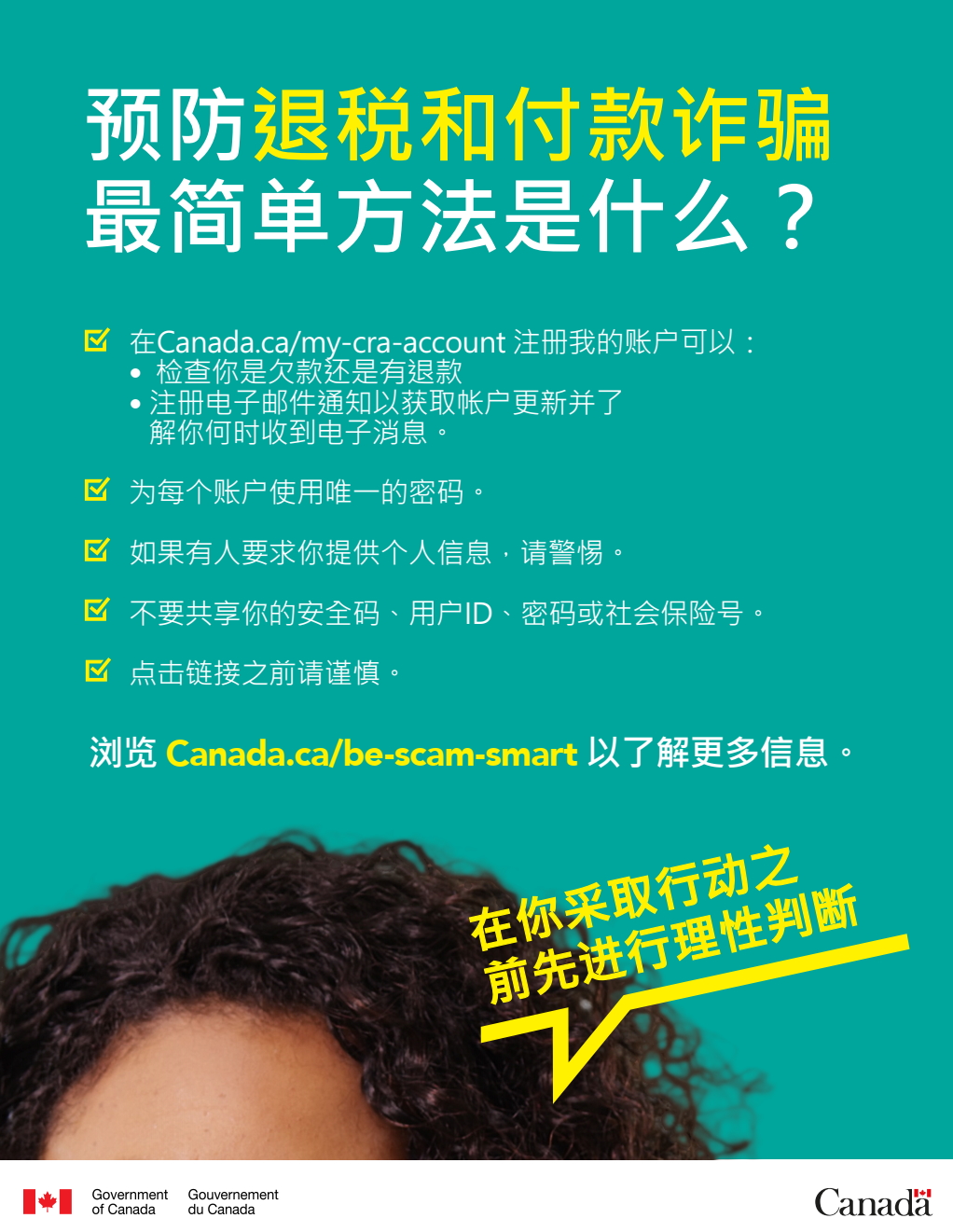

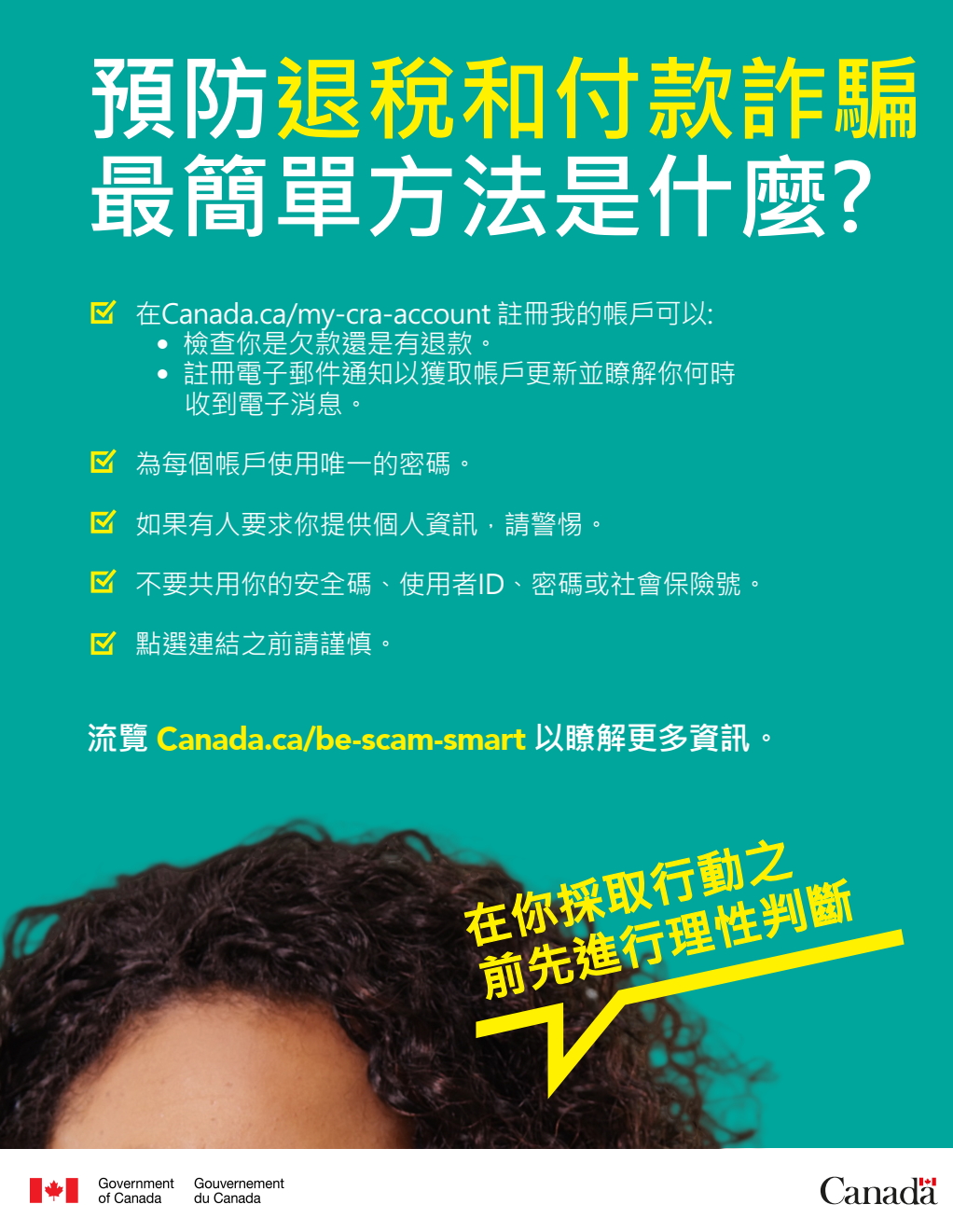

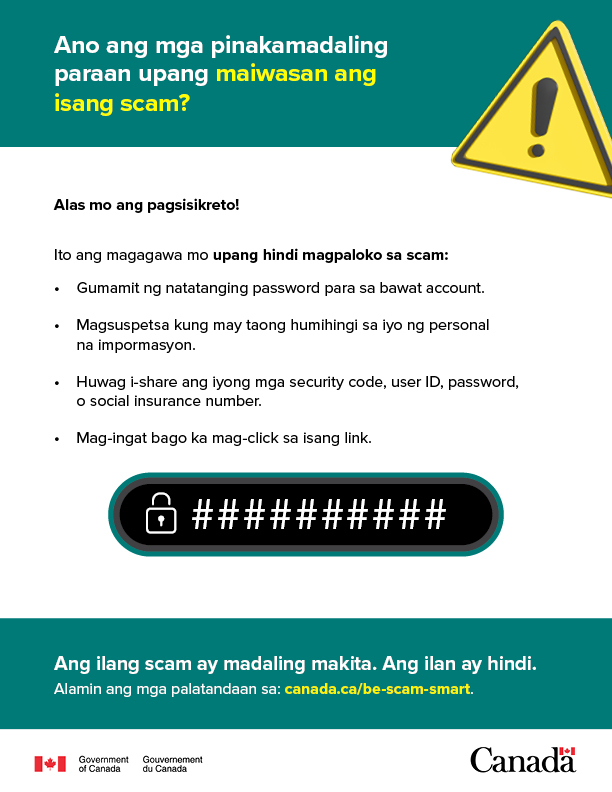

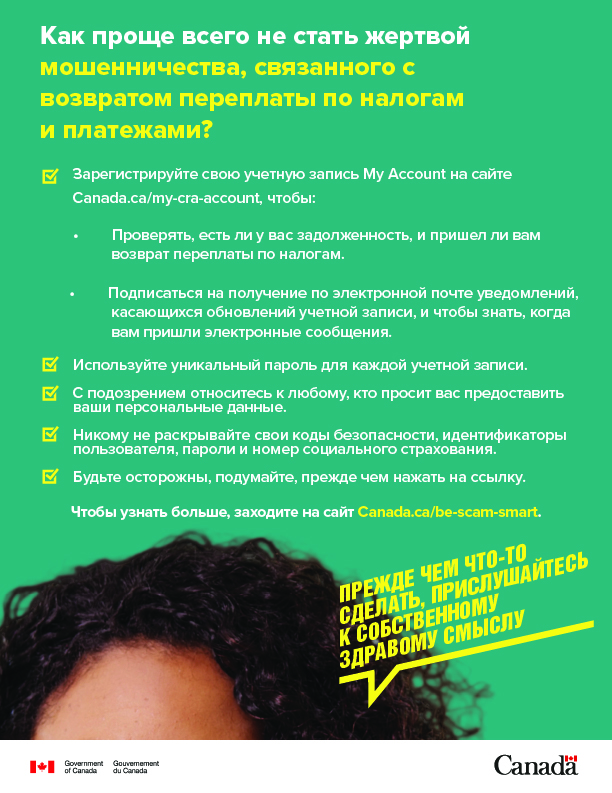

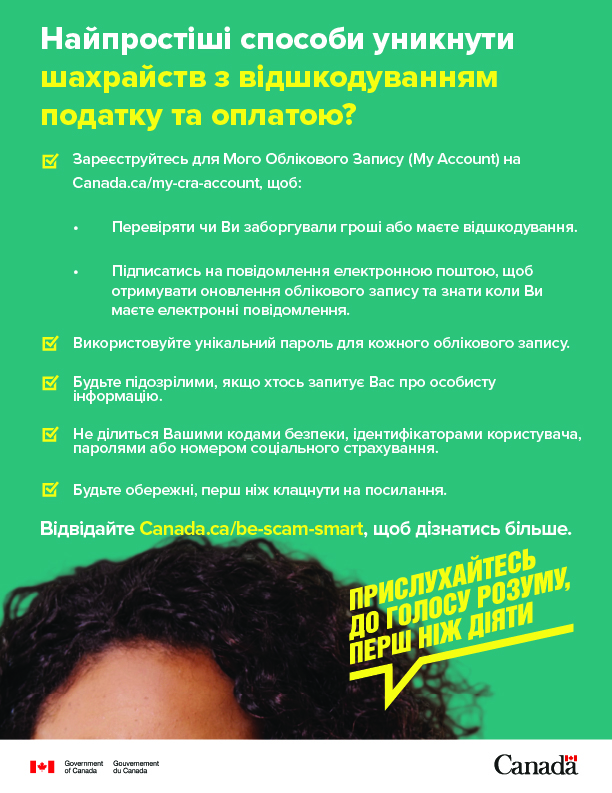

Posters to print and share

The CRA has print-ready posters with tips for taxpayers on how to be scam smart. The posters are available in 11 languages.

These print-ready posters give some tips on how to be scam smart and are available in 11 languages.

Published: 2022-11-08

Resources

- Scam prevention and the CRA

- CRA scam alerts

- Be Scam Smart

- Security and privacy of your information with the CRA

- Is the CRA texting me? - Video

- Protect your personal information - Video

- Spot the red flags - Video

- Rethink Your Password Habits to Protect Your Accounts from Hackers

- Best Practices for Passphrases and Passwords

- Posters to print and share

External websites

- Competition Bureau

- Canadian Anti-Fraud Centre

- Immigration and Citizenship

- Get Cyber Safe

- Office of Consumer Affairs

- Office of the Privacy Commissioner of Canada

- Royal Canadian Mounted Police

- Financial Consumer Agency of Canada

- Equifax and TransUnion Canada are two services that gather credit information on almost all individuals. At your request, they can flag your credit file to alert you of any changes that you did not make.