Scam prevention and the CRA

On this page

- What are scams

- Recognize various CRA-related scams

- What to do if you're a victim of a scam

- CRA scam alerts

- Posters to print and share

What are scams

As a taxpayer, you should be cautious if you receive any communication that claims to be from the Canada Revenue Agency (CRA) and requests personal information such as a social insurance number (SIN), credit card number, bank account number, or passport number.

Scams may insist that personal information is needed so that you can receive a refund or a benefit payment. Cases of fraudulent communication could also involve threatening or coercive language to scare you into paying a false debt to the CRA. Other communications could direct you to visit a fake CRA website where you are asked to verify your identity by entering personal information.

Unlike scams and fraud, tax schemes are plans or arrangements that go against the Canadian tax laws and are often advertised by promoters. Promoters are individuals or businesses who recruit taxpayers to their tax schemes by promising to reduce their taxes so that they receive large tax deductions or tax-free income. For more information on tax schemes, visit Beware of tax schemes that promise to reduce your taxes.

If you are unsure and want to confirm if the CRA contacted you, call:

In the provinces

Individuals:

1-800-959-8281

Businesses:

1-800-959-5525

In the territories

Individuals:

1-866-426-1527

Businesses:

1-866-841-1876

Recognize various CRA-related scams

Know what to expect when the CRA contacts you, what we may ask or what we will not, plus what are the most current CRA scams.

Scams by phone

The CRA will not

- demand immediate payment by:

- Interac e-transfer

- Cryptocurrency (Bitcoin)

- Prepaid credit cards

- Gift card from retailers such as iTunes, Amazon, or others

- ask for a fee to speak with a contact centre agent

- use aggressive language or threaten you with arrest or sending the police

- leave voicemails that are threatening or give personal or financial information

The CRA may

- verify your identity by asking for personal information such as your full name, date of birth, address, or SIN

- ask for details about your file in My Account or My Business Account

- call you to ask about a tax debt or to begin an audit process

- call you to offer free tax help for your small business or offer support in helping your clients access their benefits and credits

- send an automated telephone message to remind you of your filing or other tax obligations

When in doubt, ask yourself

- Why is the caller pressuring me to act immediately? Am I certain the caller is a CRA employee?

- Have I received written communication from the CRA by email or mail about the subject of the call?

- Does the CRA have my most recent contact information, such as my email and address?

- Is the caller asking for information I would not give in my tax return or that is not related to the money I owe the CRA?

- Did I recently send a request to change my business number information?

- Do I have an instalment payment due soon?

Not sure if it’s the CRA calling? Here’s how to find out!

Video example

Video: Spot the red flags

Know how to know the CRA is phoning you and how to spot the imposters.

Video: Spot the red flags

Current CRA phone fraud activities

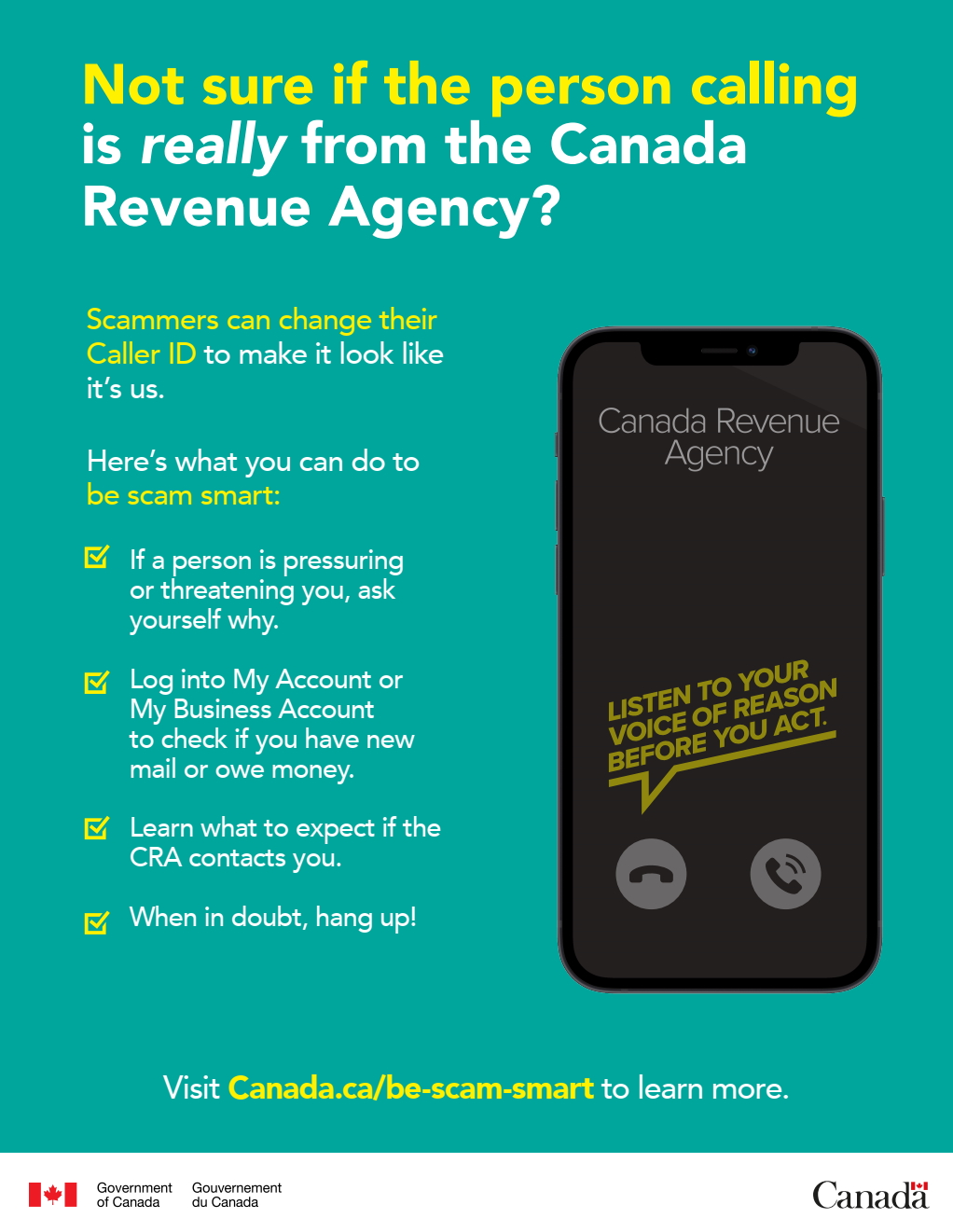

Caller ID Spoofing

Caller ID is a useful function. However, the information displayed can be altered by criminals. Never use only the displayed information to confirm the identity of the caller whether it be an individual, a company or a government entity.

Sample 1

The first example is a voice message that was received by a CRA employee based in Halifax and contains several red flags you should be aware of:

Transcript:

The reason behind this call is to notify you that we have registered a criminal case against your name concerning a tax evasion and tax fraud in the federal court house. So if you want any further information about this case, please make sure you give us a call back as quick as possible to our direct hotline number to the Canada Revenue Agency Headquarters. That is 613-927-9919, I will please repeat the number, it is 613-927-9919. If we don’t receive a call from your side, please be prepared to face the legal consequences, as the issue of tax is extremely serious and time-sensitive. So have a blessed time.

Extortion phone call demanding payment

What is it: Extortion phone calls from scammers demanding payment and claiming to be from the CRA.

How to recognize it: Scammers will call you from a fake number. They may use a local number or use numbers from local law enforcement agencies or governments.

They may ask you to confirm your SIN and then demand you pay them by Bitcoin or by gift cards.

What to do: The CRA will not use aggressive language or demand immediate payment over the phone.

The CRA does not accept:

- Cryptocurrency (Bitcoin)

- Prepaid credit cards

- Gift card

Scams by email

The CRA will not

- give or ask for personal or financial information by email and ask you to click on a link

- email you a link that demands you fill in an online form with personal or financial details

- send you an email with a link to your refund

- demand immediate payment by:

- Interac e-transfer

- Cryptocurrency (Bitcoin)

- Prepaid credit cards

- Gift card from retailers such as iTunes, Amazon, or others

- threaten you with arrest or a prison sentence

The CRA may

- notify you by email when a new message or a document, such as a notice of assessment or reassessment, is available for you to view in secure CRA portals such as My Account, My Business Account, or Represent a Client. To confirm if an email notification you received is legitimate, see email notifications you will receive

- email you a link to a CRA webpage, form, or publication that you ask for during a telephone call or a meeting with a CRA agent

- email you a consent form to meet with someone from the CRA via videoconference. You will only receive the form after you’ve agreed to provide your email address

- email you about Tax credits and benefits for individuals and the CRA’s online services, such as My Account

When in doubt, ask yourself

- Did I file my tax return on time? Have I received a notice of assessment or reassessment saying I owe tax?

- Does the CRA have my most recent contact information, such as my email and address?

- Do I have an instalment payment due soon?

Video example

Video: Protecting your personal information

Know what the CRA will email you and what we will not.

Video: Protecting your personal information

Current CRA email fraud activities

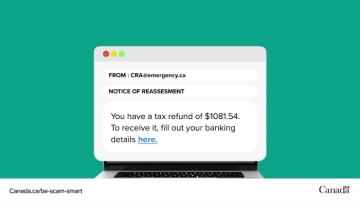

Email message offering a refund

What is it: An email message scam impersonating the CRA to offer fake refunds to Canadians. This is known as phishing.

How to recognize it: Scammers will send you an email message from a fake CRA email address, offering a refund. The email will state that the CRA owes you a refund, and ask you to click on the link provided. If you click on the link, you will be asked to provide:

- personal information such as your SIN, date of birth or your name

- online banking information to accept the refund by e-transfer

What to do: Do not reply to the email message or send them any personal information.

The CRA will not ask you by email for:

- personal information

- bank information

- payments by e-transfers or gift cards

Scams by mail

The CRA will not

- set up a meeting with you in a public place to take a payment

- demand immediate payment by:

- Interac e-transfer

- Cryptocurrency (Bitcoin)

- Prepaid credit cards

- Gift card from retailers such as iTunes, Amazon, or others

- threaten you with arrest or a prison sentence

The CRA may

- ask for financial information such as the name of your bank and its location

- send you a notice of assessment or reassessment

- ask you to pay an amount you owe through any of the CRA's payment options

- take legal action to recover the money you owe

- write to you to begin an audit process

- write to you to offer free tax help for your small business

When in doubt, ask yourself

- Did I file my tax return on time? Have I received a notice of assessment or reassessment saying I owe tax?

- Does the CRA have my most recent contact information, such as my email and address?

- Do I have an instalment payment due soon?

Current CRA mail fraud activities

Fraudulent tax returns - identity theft

What is it: Scammers acquire personal information (such as user ID and passwords), and file fake tax returns in your name. This is referred to as identity theft and target all Canadians.

How to recognize it: You may notice:

- a change on your account

- an email notification saying your account has been modified

- a delay in receiving credits or refunds

- difficulty filing your tax return online

What to do: If you notice a change on your account has been made, and you did not make it, contact the CRA as soon as possible.

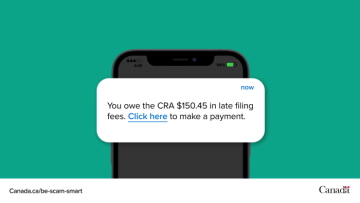

Scams by text messages / instant messaging

The CRA has introduced multi-factor authentication for all of its sign-in services. If you enrolled with the telephone option, you will receive a text message with a one-time passcode each time you sign in to your CRA account.

The CRA will not use text messages or instant messaging such as Facebook Messenger or WhatsApp to start a conversation with you about your taxes, benefits, or My Account under any circumstance.

When in doubt, ask yourself

- Does the CRA have my most recent contact information, such as my email and address?

- Do I have an instalment payment due soon?

Video example

Video: Is the CRA texting me

Video: Is the CRA texting me

Current CRA text messages / instant messaging fraud activities

Text or instant message offering a refund

What is it: A text message scam impersonating the CRA to offer fake refunds to Canadians. This is known as phishing.

How to recognize it: Scammers will send a message from a fake number to your phone or tablet. They will claim to be the CRA and offer a refund, encouraging you to click on a link provided in their message.

They may asked you to provide:

- personal information such as your SIN, date of birth or your name

- online banking information to accept the refund by e-transfer

What to do: Do not reply to the text message or send them any personal information.

The CRA will not use text messages or instant messages to start a conversation with you about your refund.

What to do if you're a victim of a scam

If you suspect that you may be the victim of a scam or fraud or have been tricked into giving personal or financial information, contact your local police service.

Contact Service Canada

For a lost or stolen social insurance number, call:

1-866-274-6627

When to report to the CRA

Contact the CRA using the options below if any of the following occur:

- you think your CRA account has been compromised

- you find changes you did not request to your banking, address, business, or personal information

- you find a benefit application made for you without your knowledge

- you want to disable online access to your information in CRA sign-in services

- you want to enable online access to your information in CRA sign-in services after it has been disabled

Option 2

Call the CRA

Automated phone system:

1-800-265-2577 (in Canada)

1-613-221-3176 (outside Canada)

Live call with an agent:

1-833-995-2336 (Individual accounts)

1-800-959-5525 (Business accounts)

1-800-959-8281 (Trust accounts)

Teletypewriter (TTY):

1-800-267-7622

If the CRA has confirmed that a taxpayer's information has been compromised, the agency will act to prevent the fraudulent use of the information involving systems and processes for which the CRA is responsible.

You can request the CRA to put enhanced security measures on your account. With enhanced security measures, our call centre agents will ask additional security questions to verify your identity.

In addition to contacting the CRA, all scams or fraud should be reported to the Canadian Anti-Fraud Centre to assist law enforcement with investigations.

CRA scam alerts

The CRA is regularly made aware of scams impersonating the CRA. Stay up-to-date with current CRA's scam alerts.

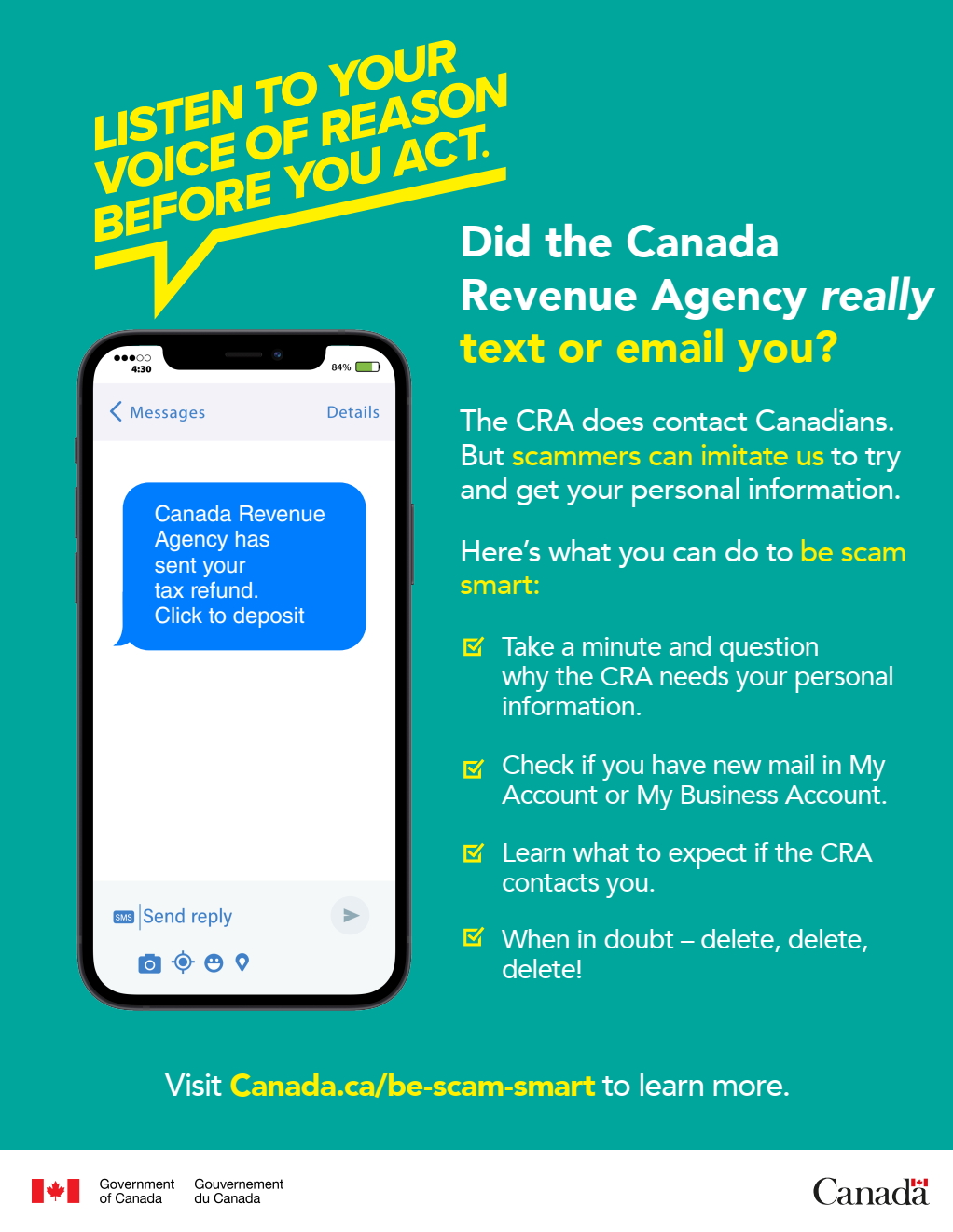

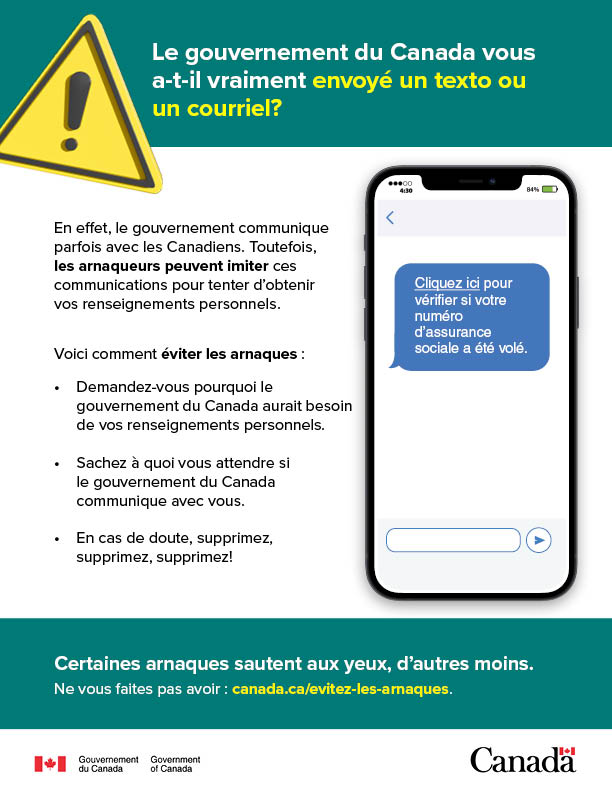

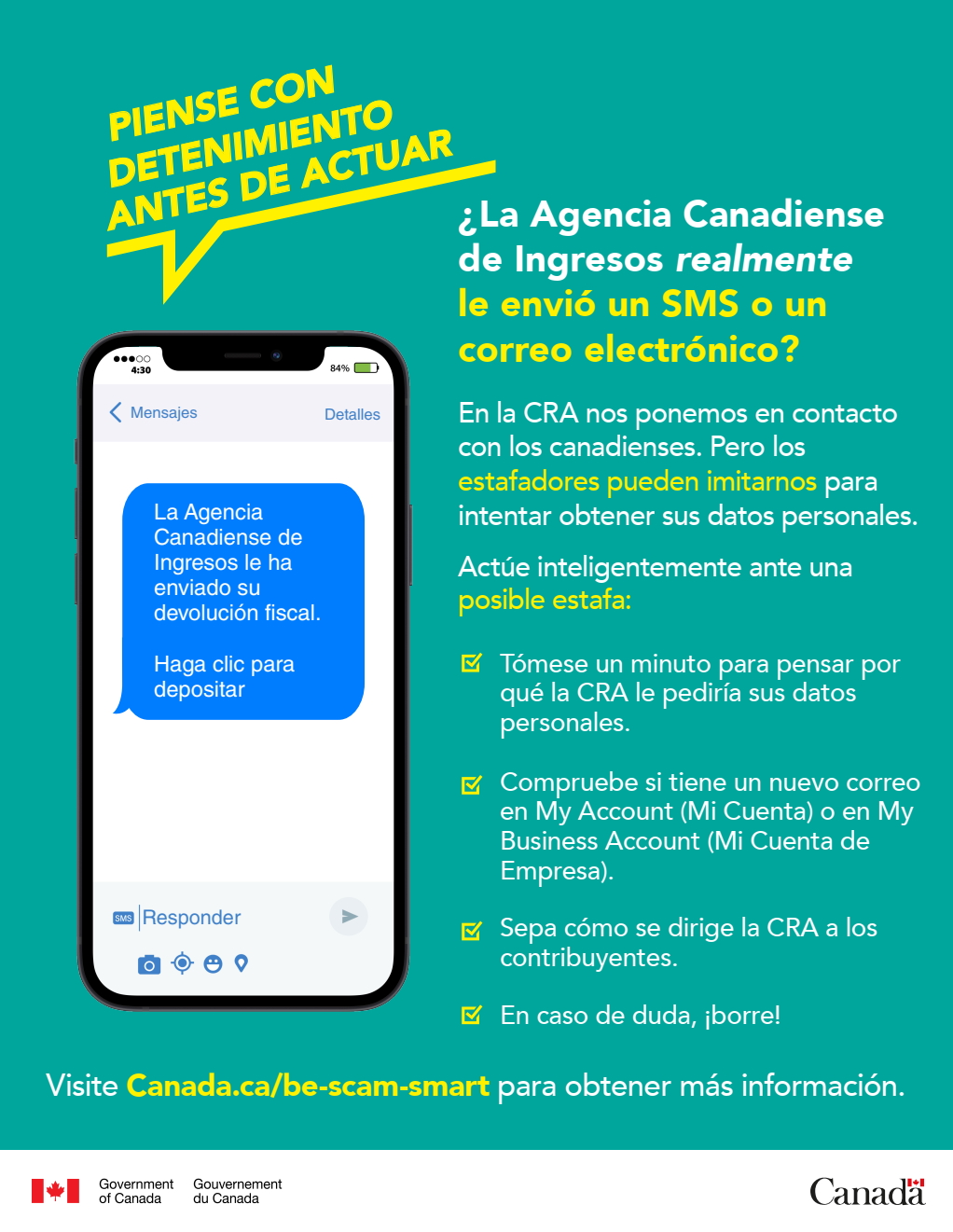

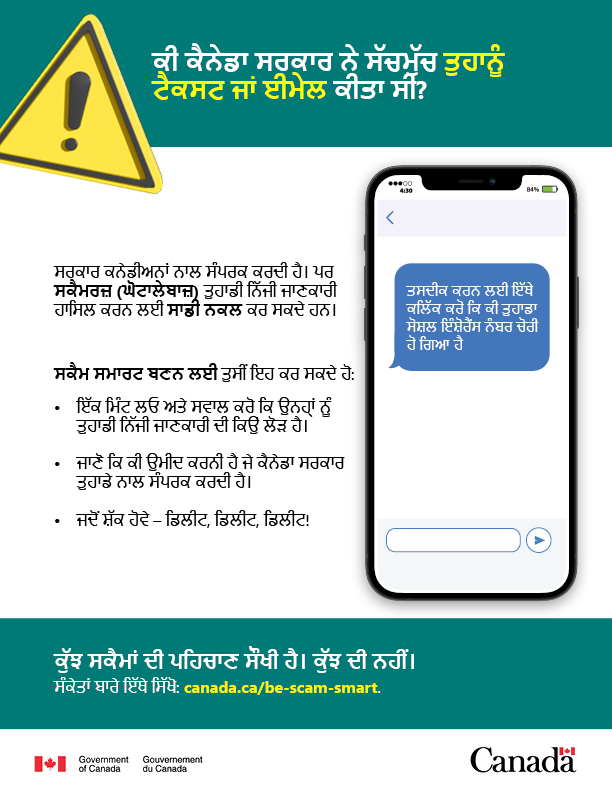

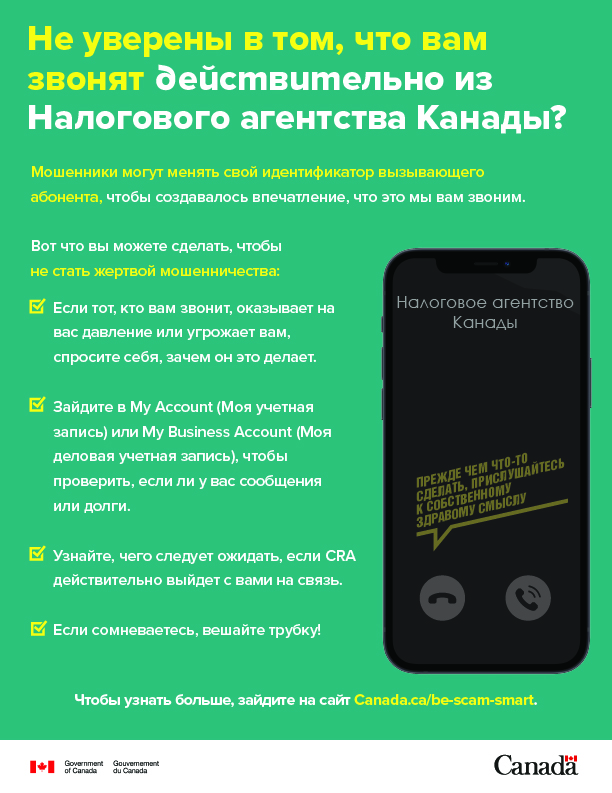

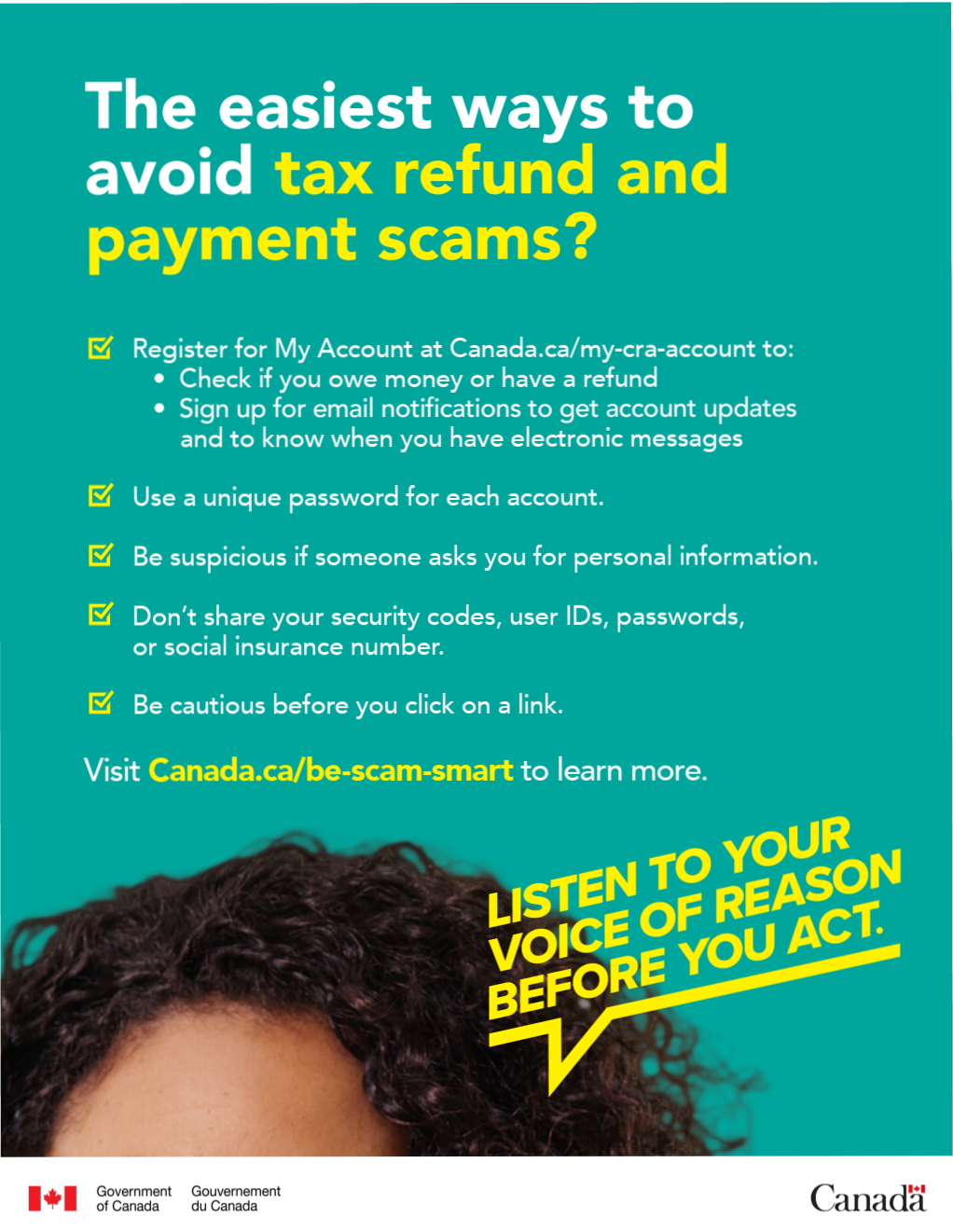

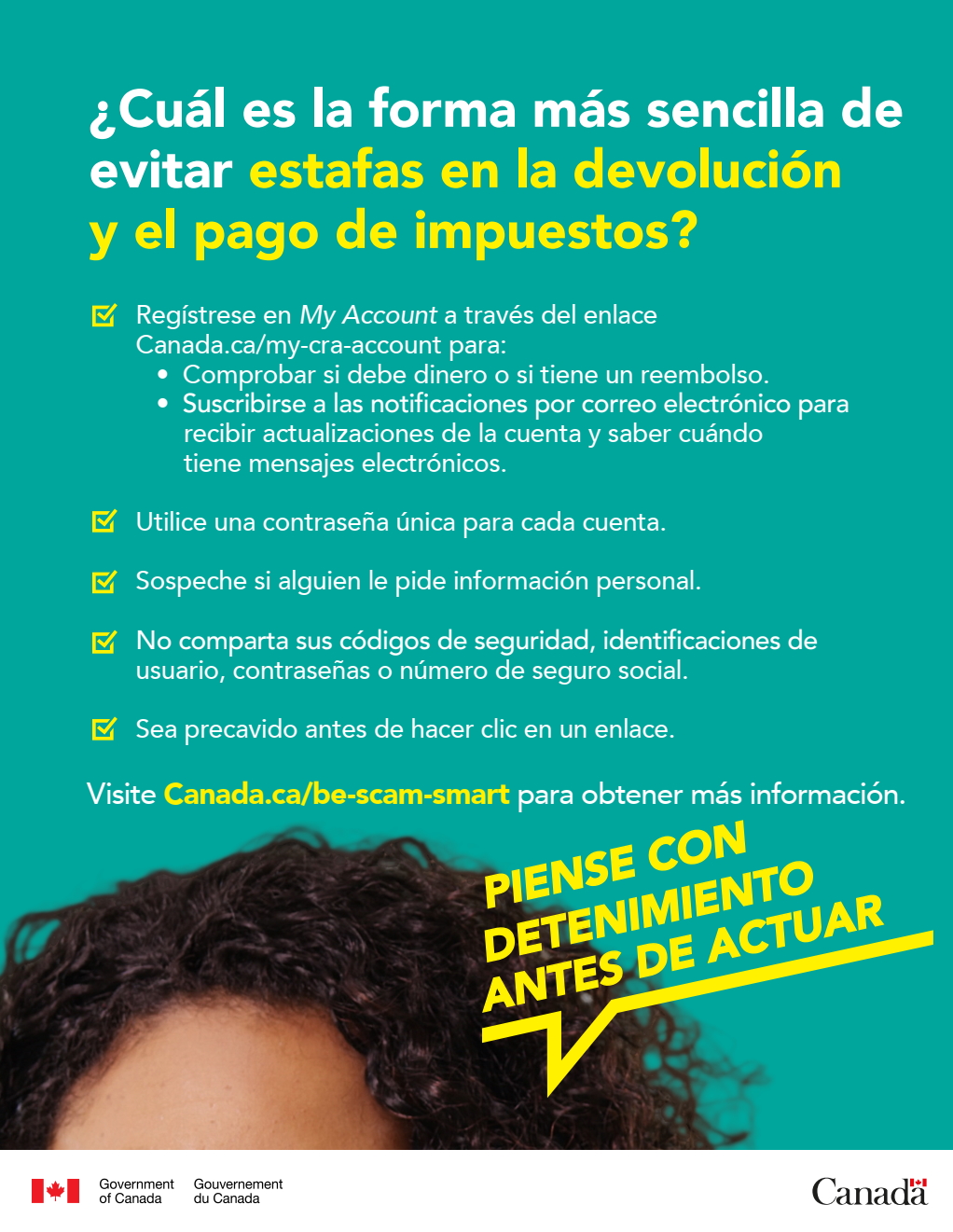

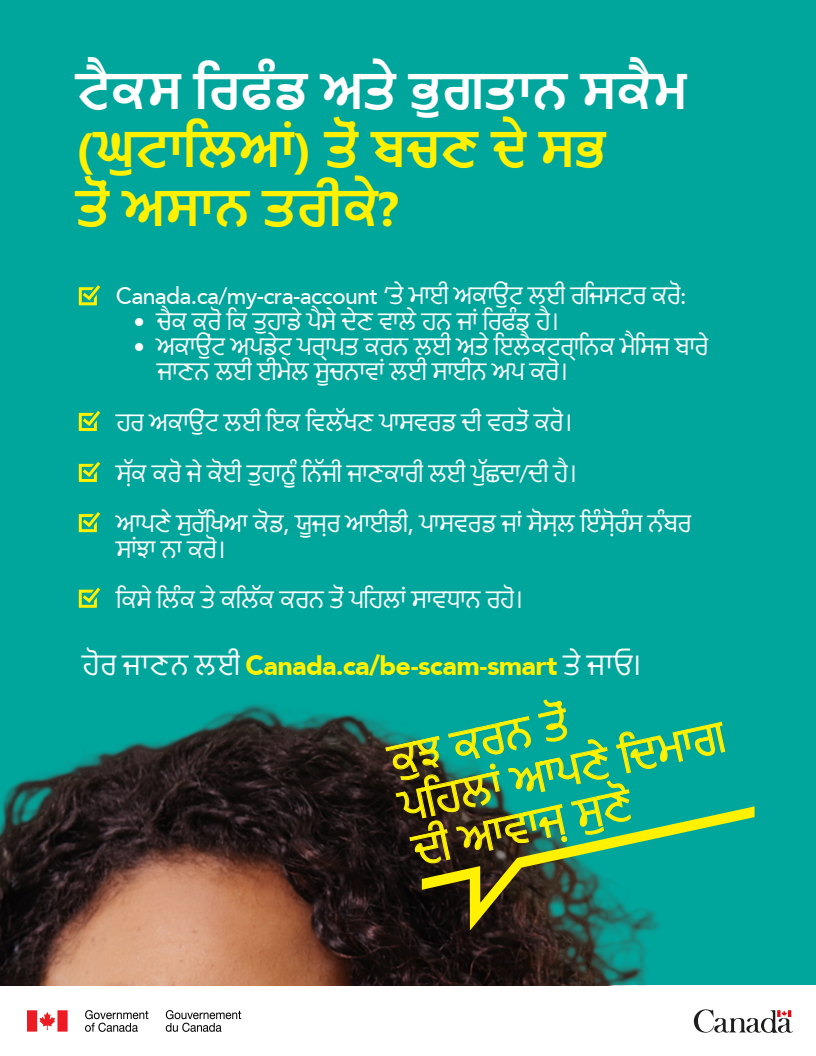

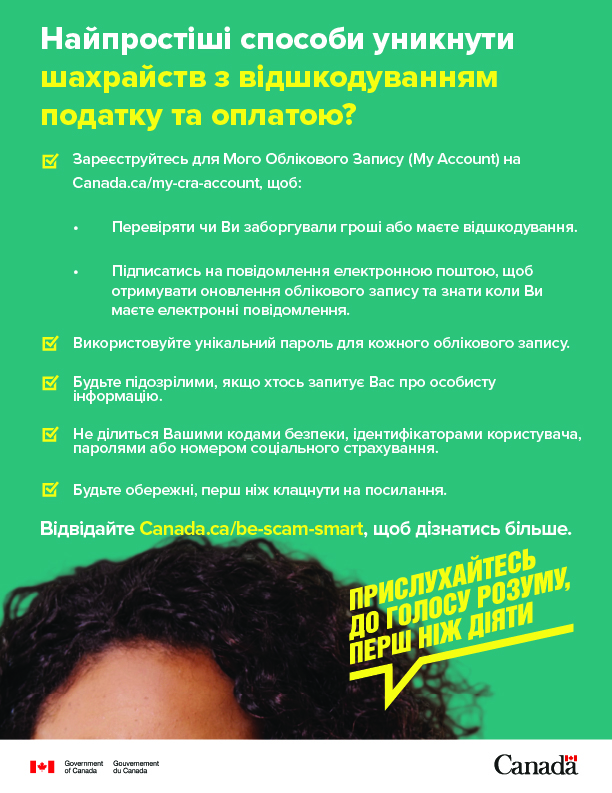

Posters to print and share

These print-ready posters give some tips on how to be scam smart and are available in 11 languages.

Published: 2023-03-09

Page details

- Date modified: