Treasury Board of Canada Secretariat 2023–24 Departmental Plan

On this page

- From the President

- Plans at a glance

- Core responsibilities: planned results and resources

- Planned spending and human resources

- Corporate information

- Supporting information on the program inventory

- Supplementary information tables

- Federal tax expenditures

- Organizational contact information

- Appendix: definitions

From the President

President of the Treasury Board

I am pleased to present the Departmental Plan for the Treasury Board of Canada Secretariat (TBS) for 2023–24. This Plan sets out TBS’s priorities for the ongoing improvement of government operations in the fiscal year ahead.

Over the past few years, the COVID-19 pandemic has accelerated our efforts to modernize government, and we will continue to make innovative changes to help departments deliver the programs and services that meet Canadians’ evolving expectations. This Plan outlines how we intend to do that in fiscal 2023-24.

The foundation for this ambitious agenda is TBS’s ongoing work to exercise rigorous oversight of government spending, improve the administration of government, foster a healthy, motivated and diverse public service workforce, and reduce regulatory burden — all while protecting the health, safety and security of Canadians and the environment.

I invite you to read the TBS Departmental Plan for more details on this important work, and I look forward to working with our dedicated public service to help Canadians succeed in the years ahead.

Original signed by:

The Honourable Mona Fortier, P.C., M.P.

President of the Treasury Board

Plans at a glance

The Treasury Board of Canada Secretariat (TBS) is a central agency that serves as the administrative arm of the Treasury Board. It provides oversight and leadership in relation to its four core responsibilities to help federal departments and agencies (departments) fulfill government priorities and achieve results for Canadians.

| Core responsibility | Key plans |

|---|---|

| Spending oversight TBS reviews spending proposals and authorities and existing and proposed government programs for efficiency, effectiveness and relevance and provides information to Parliament and Canadians on government spending. |

|

| Administrative leadership TBS leads government-wide initiatives, develops policies and sets the strategic direction for government administration related to service delivery and access to government information, as well as the management of assets, finances, information and technology. |

|

| Employer TBS develops policies and sets the strategic direction for people management in the public service, manages total compensation (including pensions and benefits) and labour relations, and undertakes initiatives to improve performance in support of recruitment and retention objectives. |

|

| Regulatory oversight TBS develops and oversees policies to promote good regulatory practices, reviews proposed regulations to ensure they adhere to the requirements of government policy; and advances regulatory cooperation across jurisdictions. |

|

For more information on the Treasury Board of Canada Secretariat’s plans, see the “Core responsibilities: planned results and resources” section of this plan.

Core responsibilities: planned results and resources

In this section

This section contains information on the department’s planned results and resources for each of its core responsibilities.

Specifically, for each core responsibility, it contains:

- a description of the core responsibility

- highlights of TBS’s plans for achieving the planned results in relation to the core responsibility in the coming year and beyond, organized by theme

- a description of TBS’s plans for:

- using gender‑based analysis plus

- contributing to the Government of Canada’s efforts to implement the United Nations 2030 Agenda for Sustainable Development and its efforts to achieve the UN Sustainable Development Goals

- taking innovative approaches to achieve its planned results

- the financial and human resources that TBS will allocate to achieve its planned results

Spending oversight

Description

TBS reviews spending proposals and authorities and existing and proposed government programs for efficiency, effectiveness and relevance and provides information to Parliament and Canadians on government spending.

Planning highlights

In 2023–24, TBS will continue to work with departments to ensure that their proposals:

- align with Treasury Board policies and government priorities

- support value for money

- clearly explain the results that will be achieved and how they will be measured

- contain clear assessments of risk, including financial risk

TBS will continue to study ways to incorporate the Quality of Life Framework into government decision‑making processes. In doing this, it will continue to work with a variety of experts and with the Organisation for Economic Co‑operation and Development. TBS will also help improve data collection to support coordinated, evidence‑based decisions so that investments benefit Canadians’ quality of life as much as possible.

It will work to improve results‑based management in the Government of Canada by:

- reviewing the Policy on Results

- streamlining Departmental Plans and Departmental Results Reports

- working with departments to build the capacity of their evaluation and performance measurement communities

- making sure users have timely access to data on federal government spending and results through GC InfoBase and Open Data

Gender-based analysis plus

As part of its spending oversight function, TBS reviews how departments:

- have considered gender and diversity in their proposals

- plan to track the impact of their proposals based on gender and other intersecting identity factors

In 2023–24, TBS will continue to explore ways to better monitor and report on the impact of programs on Canadians’ quality of life based on their gender and other identity factors.

United Nations (UN) 2030 Agenda for Sustainable Development and the UN Sustainable Development Goals

In 2023–24, TBS will help integrate the economic, social, environmental and governance aspects of sustainable development into government decision‑making by, for example:

- continuing to develop and promote the Quality of Life Framework requiring departments to report on their contributions to sustainable development

- making sure Treasury Board submissions take sustainable development into account, where appropriate

Innovation

TBS will work with Statistics Canada and other federal partners to explore different ways to assess the overall performance and impact of federal supports for innovation and economic growth.

Planned results for spending oversight

The following table shows, for spending oversight, the planned result, the result indicator, the target and the target date for 2023–24, and the actual results for the three most recent fiscal years for which actual results are available.

| Departmental result | Departmental result indicator | Target | Date to achieve target | 2019–20 actual result |

2020–21 actual result |

2021–22 actual result |

|---|---|---|---|---|---|---|

| Government organizations measure, evaluate, and report on their performance | Percentage of government programs that have suitable measures for tracking performance and informing decision making | At least 90% | March 2024 | 67% | 64% | 89% |

The financial, human resources and performance information for the Treasury Board of Canada Secretariat’s program inventory is available on GC InfoBase.

Planned budgetary spending for spending oversight

The following table shows, for spending oversight, budgetary spending for 2023–24, as well as planned spending for that year and for each of the next two fiscal years.

| 2023–24 budgetary spending (as indicated in Main Estimates) | 2023–24 planned spending | 2024–25 planned spending | 2025–26 planned spending |

|---|---|---|---|

| $5,214,275,497 | $5,214,275,497 | $5,164,635,991 | $5,151,267,421 |

Financial, human resources and performance information for the Treasury Board of Canada Secretariat’s program inventory is available on GC InfoBase.

Planned human resources for spending oversight

The following table shows, in full‑time equivalents, the human resources the department will need to fulfill this core responsibility for 2023–24 and for each of the next two fiscal years.

| 2023–24 planned full-time equivalents |

2024–25 planned full-time equivalents |

2025–26 planned full-time equivalents |

|---|---|---|

| 305 | 303 | 300 |

Financial, human resources and performance information for Treasury Board Secretariat of Canada’s program inventory is available on GC InfoBase.

Administrative leadership

Description

TBS leads government-wide initiatives, develops policies and sets the strategic direction for government administration related to service delivery and access to government information, as well as the management of assets, finances, information and technology.

Planning highlights

1. Leading digital government transformation

In August 2022, TBS launched Canada’s Digital Ambition, the government’s three‑year plan for service, information, data, information technology and cybersecurity. The plan lays out how the government will strive to meet Canadians’ expectations of simple, secure and efficient delivery of services and benefits through the effective use of modern technology and data.

In 2023–24, TBS will focus on the four strategic themes set out in the plan:

- excellence in technology and operations

- data-enabled digital services and programs

- action-ready digital strategy and policy

- structural evolution in funding, talent and culture

1) Excellence in technology and operations

TBS will continue to work with departments to modernize how the governments replaces, builds and manages its technology. For example, it will:

- develop a strategy to assess what technology needs updating or replacing

- implement an Application Portfolio Health Index which will give departments a more accurate picture of the overall health of their applications

- compile a government‑wide inventory of software assets that are at the end of their life to identify and mitigate any security issues

- provide a costing model and guidance to help departments decide whether to move their applications and databases to the cloud

- review planned investments in IT projects to make sure they are appropriate to the project phase

- work with departments to collect data on administrative services to see how the services are performing

Through the Canadian Digital Service, TBS will help departments improve their public‑facing services by:

- continuing to develop, test and scale products and services such as GC Notify

- helping departments make decisions about service design and technology, build in‑house capabilities, and adopt new ways of working

TBS will also help protect government information and services by:

- creating a vision and plan for the cybersecurity of government operations

- providing tools to improve how departments manage cybersecurity events

2) Data-enabled digital services and programs

TBS will work with departments to improve federal programs for Canadians and for public service employees by championing cross-government initiatives. It will, for example:

- enhance Sign‑In Canada, an authentication method that lets individuals and businesses log in just once when accessing multiple Government of Canada online services

- pilot the Government of Canada Task Success Survey to make government websites more usable

- update the government’s data strategy to include guidelines on the quality, sharing, accessibility and ethics of data

- implement the 2022–24 National Action Plan on Open Government

- address issues raised by the Access to Information Act review

3) Action-ready digital strategy and policy

TBS will continue to embed digital standards in its policy suite and to update the policy, legislation and governance that guide digital government. This includes advancing the delivery of services and the effectiveness of government operations though the Policy on Service and Digital.

TBS will also continue to help departments with digital transformation so that they can improve their services to Canadians.

To support this transformation, TBS will:

- develop and implement a framework for measuring the administrative burden of services on users and for measuring departments’ ability to develop and deliver services

- monitor and refresh security requirements for the services and functions essential to enterprise hybrid IT environments and continuously applying appropriate risk‑based measures

4) Structural evolution in funding, talent and culture

TBS will manage a government‑wide shift to fully digital service delivery by fostering a more entrepreneurial mindset that focuses on outcomes and enabling rather than on compliance and mitigating risk.

The government’s Digital Talent Strategy will play a key role in this shift by supporting initiatives that:

- eliminate barriers in staffing and speed up the hiring process, such as the GC Digital Talent platform

- recruit, retain and develop top digital talent, including in the senior leadership ranks

- strengthen partnerships with external stakeholders to help increase access to employment for underrepresented talent

- build on the success of the IT Apprenticeship Program for Indigenous People to help increase recruitment of other underrepresented groups

- create an onboarding and integration package for new employees in the digital community

TBS will also develop a Digital Skills Strategy to better equip the federal government’s IT community to serve Canadians.

2. Setting the strategic direction for the management of assets and finances

a. Asset management

In 2023–24, TBS will continue to strengthen the management of assets and acquired services.

It will enhance the effectiveness of policies and departmental capacity in project management, procurement, real property, materiel and investment management through training, tools, guidance and resources. It will also continue to provide departments with resources that will help them address socio‑economic and environmental priorities, as well as priorities relating to Indigenous peoples.

To increase flexibility and accountability in the management of investments, TBS will modernize approval structures by using a risk‑based model that can be tailored to an organization’s capacity to achieve its objectives.

It will also incorporate human rights, environmental, social, corporate governance, and supply chain transparency principles into the Directive on the Management of Procurement.

In addition, it will continue to work with Indigenous Services Canada, Public Services and Procurement Canada, and Indigenous partners to help departments implement the Mandatory Procedures for Contracts Awarded to Indigenous Businesses

Through the Centre of Expertise for Real Property, TBS will support departments in managing federal real property by helping them make evidence‑based decisions, improve data integrity, increase their capacity for data analytics, and implement the recommendations from the Horizontal Fixed Asset Review.

b. Financial management

In 2023–24, TBS will continue to strengthen the government’s financial management practices by providing guidance and support to departments on:

- financial policy development

- talent management

- costing

- financial reporting

- transfer payment policy

TBS will work with departments to strengthen internal controls over financial management to ensure that public resources are managed prudently. It will also help departments implement continuous monitoring of their systems of internal controls related to key financial management processes.

These efforts build on TBS’s success in strengthening the internal controls that ensure the accuracy of financial statements.

TBS will work with departments to transform financial management by standardizing data, automating processes and innovating analysis and reporting practices through the implementation of robust digital tools and system solutions. This will enable financial and program areas to provide better information to decision‑makers and to demonstrate the alignment of spending with government priorities.

In addition, TBS will continue to support and monitor the internal audit community, which provides deputy heads with assurance related to the design and operation of the governance, risk management and control processes in their organizations.

3. Supporting effective communications

To keep communication policies up‑to‑date and effective, TBS will continue to review the Policy on Communications and Federal Identity and the Directive on the Management of Communications to address potential systemic barriers, constraints, or gaps. This review will also help identify areas where additional policy guidance might be needed.

TBS will continue working to embed requirements for accessible communications in policy by building on the Guidelines on Making Communications Products and Activities Accessible, which it released in 2022.

Gender-based analysis plus

TBS will continue to review and develop administrative policies and initiatives to achieve more inclusive outcomes. For example, it will analyze disaggregated data involving Inuit firms to gain insight into the implementation of the Directive on Government Contracts, Including Real Property Leases, in the Nunavut Settlement Area.

As part of renewing the public service data strategy, TBS will look for ways to help departments increase their capacity to collect and use gender‑based analysis plus data in decision‑making and in designing and reviewing programs and services.

TBS will also continue to develop and deliver capacity‑building and talent management strategies and initiatives to help create a skilled, inclusive, diverse and equitable workforce in the government’s various relevant communities of practice.

United Nations (UN) 2030 Agenda for Sustainable Development and the UN Sustainable Development Goals

Goal 12 (Ensure sustainable consumption and production patterns) and Goal 13 (Take urgent action to combat climate change and its impacts)

TBS will continue to work with Environment and Climate Change Canada on implementing the 2023–26 Federal Sustainable Development Strategy. In 2023–24, it will focus on:

- working toward meeting commitments related to greening government in goals 12 and 13

- working with all departments on implementing the Greening Government Strategy and the Policy on Green Procurement

- providing advice and guidance to departments on drafting the parts of their 2023–27 Departmental Sustainable Development Strategies that relate to greening their operations

Goal 17 (Revitalize the global partnership for sustainable development)

Open data provides critical information for measuring progress toward meeting the sustainable development goals. In 2023–24, TBS will continue to adopt international best practices and publish new datasets on the Open Government Portal, including those that Canadians specifically request.

TBS will also continue to be an international leader in open data and open, inclusive government through the Open Government Partnership and the Digital Nations. TBS currently chairs an international Digital Nations working group that collaborates on existing standards, tools, methodologies and practices for sustainable information technology.

Innovation

TBS will innovate in areas such as recruitment processes, capacity‑building and training to identify how best to support the access to information and privacy communities. TBS expects that this will help Canadians access government information more quickly.

TBS will pilot tools for improving government websites, which will evaluate the effectiveness of Canada.ca as it works to improve this digital asset for Canadians. TBS and the Canada School of Public Service will pilot an innovative, interactive way of delivering a new course on project management for senior leaders. The course will focus on practical approaches and strategic leadership tools for complex projects.

In 2023–24, TBS will continue to administer the Greening Government Fund, which provides project funding to help departments reduce their operational greenhouse gas emissions. Projects test or implement innovative approaches that can be reproduced within or across departments or that pursue solutions in areas or situations where it is particularly difficult to reduce emissions.

Planned results for administrative leadership

The following table shows, for administrative leadership, the planned results, the result indicators, the targets and the target dates for 2023–24, and the actual results for the three most recent fiscal years for which actual results are available.

| Departmental result | Departmental result indicator | Target | Date to achieve target | 2019–20 actual result | 2020–21 actual result | 2021–22 actual result |

|---|---|---|---|---|---|---|

Table 4 Notes

|

||||||

| Government service delivery is digitally enabled and meets the needs of Canadians | Percentage of high-volume Government of Canada services that meet service standards | At least 80% | March 31, 2024 | Not available | Not available | 46% |

| Degree to which Canadians complete high‑volume tasks on Government of Canada websites | At least 80%table 4 note * | March 31, 2024 | Not available: new indicator | Not available: new indicator | 64.5% | |

| Percentage of Government of Canada business applications assessed as healthy | At least 40% | March 31, 2024 | 35% | 36% | 37% | |

| Government has good asset and financial management practices | Percentage of key financial management processes for which the system of internal controls is at the continuous monitoring stage | 100% | March 31, 2024 | Not available | 39% | 46% |

The financial, human resources and performance information for the Treasury Board of Canada Secretariat’s program inventory is available on GC InfoBase.

Planned budgetary spending for administrative leadership

The following table shows, for administrative leadership, budgetary spending for 2023–24, as well as planned spending for that year and for each of the next two fiscal years.

| 2023–24 budgetary spending (as indicated in Main Estimates) | 2023–24 planned spending | 2024–25 planned spending | 2025–26 planned spending |

|---|---|---|---|

| $130,464,276 | $130,464,276 | $144,952,275 | $141,664,710 |

Financial, human resources and performance information for the Treasury Board of Canada Secretariat’s program inventory is available on GC InfoBase.

Planned human resources for administrative leadership

The following table shows, in full‑time equivalents, the human resources the department will need to fulfill this core responsibility for 2023–24 and for each of the next two fiscal years.

| 2023–24 planned full-time equivalents | 2024–25 planned full-time equivalents | 2025–26 planned full-time equivalents |

|---|---|---|

| 627 | 582 | 579 |

Financial, human resources and performance information for the Treasury Board of Canada Secretariat’s program inventory is available on GC InfoBase.

Employer

Description

TBS develops policies and sets the strategic direction for people management in the public service, manages total compensation (including pensions and benefits) and labour relations, and undertakes initiatives to improve performance in support of recruitment and retention objectives.

Planning highlights

In 2023–24, TBS will focus on five core areas:

- Supporting health and safety

- Creating a diverse, equitable and inclusive workforce

- Strengthening and modernizing the public service

- Promoting official languages

- Bargaining in good faith

1. Supporting health and safety

TBS will support the health and safety of public servants by:

- leading the transition to the new contract for administering the Public Service Health Care Plan, which comes into effect on July 1, 2023

- establishing a mental health fund for Black public servants

- improving resources and tools to help departments comply with the National Standard of Canada for Psychological Health and Safety in the Workplace

- working with departments to prevent harassment and violence in their workplaces as outlined in a 2021 update to the occupational health and safety section of the Canada Labour Code

- working with Public Services and Procurement Canada on new contracts for the administration of the Public Service Dental Care Plan and the Pensioners’ Dental Services Plan, which take effect in 2024 and 2025, respectively

- leading the implementation of the new contracts in partnership with Public Services and Procurement Canada

- leading the legislative review of the Public Servants Disclosure Protection Act

2. Creating a diverse, equitable and inclusive workforce

In 2023–24, TBS will continue to work with the Privy Council Office to help departments implement their plans in response to the Call to Action on Anti-Racism, Equity and Inclusion in the Public Service.

TBS will work with diversity and inclusion communities of practice and with networks of equity‑seeking employees to bring about meaningful action to address the root causes of challenges employees face.

TBS will work with departments to ensure that they hire, retain and promote people with diverse talents. It will also help them foster inclusion in their organizations by:

- supporting career advancement, training, sponsorship and educational opportunities for Black public servants

- creating programs and fellowships for diverse groups of public servants and for students and new graduates

- supporting a review of the Employment Equity Act and making sure recommendations are implemented promptly

- monitoring the implementation of the updated self‑identification questionnaire, which is designed to increase the accuracy, depth and breadth of the data on the representation of employees from the four designated employment equity groups across the public service

- providing policy guidance and resources on employment equity, diversity and inclusion

- leading a Federal Speakers Forum on Diversity and Inclusion, a platform for public servants to share experiences about diversity, inclusion, accessibility and other related topics

- monitoring the implementation of the Maturity Model for Diversity and Inclusion, a tool that organizations can use to assess their progress toward their diversity and inclusion goals

- reviewing legislation and policy to make sure the directives and guidance under the Policy on People Management align with the objectives of the Canadian Human Rights Act and the Accessible Canada Act

3. Strengthening and modernizing the public service

TBS will continue to explore what the federal public service needs to do to keep up with changes in society and technology that are affecting the services it delivers, where and how it delivers them, and how it manages its employees.

As part of these efforts, TBS will continue to work with the Privy Council Office, in consultation with public sector unions, to strengthen and modernize the public service by developing:

- a coherent and coordinated plan for the future of work in the public service that includes flexible, equitable working arrangements

- a long‑term, government‑wide skills strategy to make sure the public service has the capacity to support Canadians’ needs in an increasingly changing world

- a comprehensive strategy for senior leaders that includes a new leadership profile to transform the leadership culture and meet Canadians’ needs

4. Promoting official languages

In 2023–24, TBS will promote official languages by:

- launching the first phase of the Official Languages Regulations Re‑Application Exercise, a multi‑year process to update the linguistic obligations of federal offices, which will continue into 2024–25

- staying abreast of legislative initiatives related to official languages and preparing to implement any changes

- developing a new language training framework to increase the use of both official languages in the public service

- encouraging departments to offer language training to help increase employees’ second‑language skills, while meeting the needs of all learners, including members of employment equity groups

5. Bargaining in good faith

In 2023–24, TBS will continue to bargain in good faith with Canada’s public sector unions, to negotiate modernized terms and conditions of employment, and to ensure fairness to employees and reasonableness for Canadians.

To help achieve and maintain pay stability, TBS will continue working with Public Services and Procurement Canada to process human resources transactions more quickly. This includes supporting Public Services and Procurement Canada as it works with organizations served by the Public Service Pay Centre to:

- implement best practices for pay

- make pay delivery more efficient

- improve pay results for employees

Gender-based analysis plus

TBS collects gender and diversity data through its administrative systems and surveys. It uses this data in developing, implementing and reviewing its policies, initiatives and systems.

In 2023–24, TBS will apply a whole‑of‑government approach to collecting, analyzing, sharing and publishing disaggregated data.

In addition, TBS will continue to apply an intersectional lens when developing and implementing human resources strategies to make sure talent management, succession planning and professional visibility initiatives reflect the diversity of the public service.

United Nations (UN) 2030 Agenda for Sustainable Development and the UN Sustainable Development Goals

Goal 5 (Achieve gender equality and empower all women and girls)

TBS will continue to work with departments to increase the representation of women and members of other equity‑seeking groups in positions of leadership in the federal public service. It will also advance the implementation of the Pay Equity Act across the public service.

Goal 10 (Advance reconciliation with Indigenous peoples and take action to reduce inequality)

TBS will continue to work with departments to ensure that the proportion of visible minorities, Indigenous peoples, persons with disabilities, and women in the public service meets or exceeds their workforce availability.

Innovation

TBS will continue to use the Centralized Enabling Workplace Fund to invest in innovative ideas, projects and initiatives aimed at improving workplace accommodation practices and removing systemic barriers that create the need for individual accommodations.

TBS expects to carry out the next two phases of a partnership with Employment and Social Development Canada that will explore the best application of behavioural insights to support a collaborative, digital workplace culture.

- Phase 2 will involve looking at how to use behavioural insights to prompt users to apply digital skills to bring about change

- Phase 3 will involve examining how to use behavioural insights to increase the use of digital tools across networks of collaborators, particularly executives

In 2023–24, TBS will start implementing a people‑centred leadership profile that includes new key leadership competencies and character attributes. This element of the Senior Leaders Strategy aims to improve well‑being among executives and foster an inclusive, psychologically healthy and high‑performing workforce.

Planned results for employer

The following table shows, for employer, the planned results, the result indicators, the targets and the target dates for 2023–24, and the actual results for the three most recent fiscal years for which actual results are available.

| Departmental result | Departmental result indicator | Target | Date to achieve target | 2019–20 actual result | 2020–21 actual result | 2021–22 actual result |

|---|---|---|---|---|---|---|

Table 1 Notes

|

||||||

| The public service has good people management practices | Percentage of employees who believe their workplace is psychologically healthy | At least 61% | March 2024 | 61% | 68% | 68%table 1 note * |

| Percentage of employees who responded positively to “my department or agency implements activities and practices that support a diverse workplace” | At least 75% | March 2024 | 79% | 78% | 78%table 1 note * | |

| Percentage of employees who indicate that their organization respects individual differences (for example, culture, workstyles and ideas) | At least 80% | March 2024 | 75% | 77% | 77%table 1 note * | |

| Percentage of institutions where communications in designated bilingual offices nearly always occur in the official language chosen by the public | At least 90% | March 2024 | 91% | 93.4% | 91.6%table 1 note † | |

| Terms and conditions of public service employment are negotiated in good faith | Percentage of Public Service Labour Relations and Employment Board outcomes that confirm that the Government of Canada is bargaining in good faith | 100% | March 2024 | 100% | 100% | 100%table 1 note ‡ |

The financial, human resources and performance information for the Treasury Board of Canada Secretariat’s program inventory is available on GC InfoBase.

Planned budgetary spending for employer

The following table shows, for administrative leadership, budgetary spending for 2023–24, as well as planned spending for that year and for each of the next two fiscal years.

| 2023–24 budgetary spending (as indicated in Main Estimates) | 2023–24 planned spending | 2024–25 planned spending | 2025–26 planned spending |

|---|---|---|---|

| $3,480,436,094 | $3,480,436,094 | $3,651,461,142 | $3,641,460,268 |

Financial, human resources and performance information for the Treasury Board of Canada Secretariat’s program inventory is available on GC InfoBase.

Planned human resources for employer

The following table shows, in full‑time equivalents, the human resources the department will need to fulfill this core responsibility for 2023–24 and for each of the next two fiscal years.

| 2023–24 planned full-time equivalents | 2024–25 planned full-time equivalents | 2025–26 planned full-time equivalents |

|---|---|---|

| 459 | 449 | 431 |

Financial, human resources and performance information for the Treasury Board of Canada Secretariat’s program inventory is available on GC InfoBase.

Regulatory oversight

Description

TBS develops and oversees policies to promote good regulatory practices, reviews proposed regulations to ensure they adhere to the requirements of government policy, and advances regulatory cooperation across jurisdictions.

Planning highlights

1. Encourage regulatory cooperation and harmonization

In 2023–24, TBS will:

- work with regulatory departments to identify and present regulatory cooperation and alignment issues that could be addressed through formal initiatives

- stay abreast of advances in internationally recognized regulatory practices by working with the Organisation for Economic Co‑operation and Development’s Regulatory Policy Committee

- represent the Government of Canada in formal regulatory cooperation initiatives such as:

- Canada‑U.S. Regulatory Cooperation Council

- Canada‑EU Regulatory Cooperation Forum

- Canada Free Trade Agreement Regulatory Reconciliation and Cooperation Table

- Agile Nations

TBS will also work with regulatory departments to finalize a tool for determining the potential impact of regulations on innovation, trade and competition, as well as on process efficiency.

2. Review regulations

TBS plans to lead examinations of existing frameworks and practices, including a third round of targeted regulatory reviews. These examinations will involve working with departments to find ways to build stronger supply chains through the regulatory framework with the goal of fostering innovation, competitiveness and economic growth.

TBS will work with departments to identify regulatory irritants and opportunities in specific sectors to inform targeted regulatory reviews and to develop tools that help regulators adopt best practices. It will, for example, use and promote tools that support best practices in stakeholder engagement, such as the online tool for commenting on proposed regulations and the Let’s Talk Federal Regulations platform.

TBS will provide advice and leadership on the development of regulatory impact assessments, cost‑benefit analysis, and other tools used in developing regulations. TBS will make sure regulators conduct an impact assessment that meets the requirements of the Cabinet Directive on Regulation and related policy instruments. TBS will also review and update the policies, guidance and program activities under the Cabinet Directive on Regulation that relate to stakeholder engagement and consultation during the regulatory process.

3. Reduce burden

TBS will continue to streamline the Canadian regulatory landscape by:

- coordinating the Annual Regulatory Modernization Bill, which is designed to remove non‑contentious, outdated and redundant legislative requirements

- examining ways to measure and address the cumulative regulatory burden and the impact of regulations on citizens

- proposing amendments to the Red Tape Reduction Regulations

To help understand stakeholder needs in areas such as regulatory excellence and modernization, TBS will continue to work with the External Advisory Committee on Regulatory Competitiveness. TBS will also foster engagement between this committee and a cross‑section of stakeholders to identify ways to make the regulatory system more competitive, innovative and effective.

Gender-based analysis plus

The Cabinet Directive on Regulation is supported by TBS gender‑based analysis plus policies, guidance and tools that federal regulators must follow during the regulatory life cycle.

For regulatory proposals prepared for Governor in Council approval, TBS will continue to review the information on gender‑based analysis plus to make sure they comply with the Cabinet Directive on Regulation and associated policy instruments.

Innovation

In 2023–24, TBS, through the Centre for Regulatory Innovation, will continue to support departments as they implement new approaches to regulation. For example, it will:

- disseminate a toolkit designed to facilitate novel regulatory approaches

- hold webinars and workshops to introduce regulators to regulatory innovation concepts

- launch a process to identify new opportunities for regulators to innovate

TBS will also work with regulators earlier in the innovation process to help more of them identify opportunities for developing new ideas and modernizing. TBS will also promote regulatory innovation by participating in departments’ efforts to engage with their stakeholders on regulatory modernization, such as Agriculture and Agri-food Canada’s Sector Engagement Table on Agile Regulations.

Planned results for regulatory oversight

The following table shows, for regulatory oversight, the planned results, the result indicators, the targets and the target dates for 2023–24, and the actual results for the three most recent fiscal years for which actual results are available.

| Departmental result | Departmental result indicator | Target | Date to achieve target | 2019–20 actual result | 2020–21 actual result | 2021–22 actual result |

|---|---|---|---|---|---|---|

| The federal regulatory system protects and advances the public interest, including sustainable economic growth | Ranking of Canada’s regulatory system by the Organisation for Economic Co-operation and Development for stakeholder engagement | Canada to rank in the top 5 in the next issue of the report | December 2024 | 3rd | 3rd | 3rd |

| Ranking of Canada’s regulatory system by the Organisation for Economic Co-operation and Development for regulatory impact assessment | Canada to rank in the top 5 in the next issue of the report | December 2024 | 4th | 4th | 5th | |

| Ranking of Canada’s regulatory system by the Organisation for Economic Co-operation and Development for ex-post evaluation | Canada to rank in the top 5 in the next issue of the report | December 2024 | 5th | 5th | 6th |

The financial, human resources and performance information for the Treasury Board of Canada Secretariat’s program inventory is available on GC InfoBase.

Planned budgetary spending for regulatory oversight

The following table shows, for regulatory oversight, budgetary spending for 2023–24, as well as planned spending for that year and for each of the next two fiscal years.

| 2023–24 budgetary spending (as indicated in Main Estimates) | 2023–24 planned spending | 2024–25 planned spending | 2025–26 planned spending |

|---|---|---|---|

| $12,551,889 | $12,551,889 | $12,562,280 | $10,049,956 |

Financial, human resources and performance information for the Treasury Board of Canada Secretariat’s program inventory is available on GC InfoBase.

Planned human resources for regulatory oversight

The following table shows, in full‑time equivalents, the human resources the department will need to fulfill this core responsibility for 2023–24 and for each of the next two fiscal years.

| 2023–24 planned full-time equivalents | 2024–25 planned full-time equivalents | 2025–26 planned full-time equivalents |

|---|---|---|

| 74 | 74 | 59 |

Financial, human resources and performance information for the Treasury Board of Canada Secretariat’s program inventory is available on GC InfoBase.

Internal services

Description

Internal services are the services that are provided within a department so that it can meet its corporate obligations and deliver its programs. There are 10 categories of internal services:

- management and oversight services

- communications services

- legal services

- human resources management services

- financial management services

- information management services

- information technology services

- real property management services

- materiel management services

- acquisition management services

Planning highlights

TBS allocates 26.8% of its planned operating spending and 31% of its planned full‑time equivalents to internal services, which support the department’s four core responsibilities.

TBS is a knowledge‑based organization committed to:

- fostering employee well‑being

- building a diverse, inclusive and accessible workplace

- preparing for the future

1. Fostering employee well‑being

In 2023–24, TBS will foster employee well‑being in a hybrid environment by providing TBS employees access to:

- mental and physical health and wellness tools, training and resources

- the Employee Assistance Program

- LifeSpeak, an online educational platform covering a range of topics related to well‑being, parenting and professional development

To foster dialogue, TBS will offer designated safe spaces for employees and managers to discuss workplace concerns, including how to prevent and address workplace harassment and violence.

2. Building a diverse, inclusive and accessible workplace

In 2023–24, TBS will work to build a diverse, inclusive and accessible workplace. For example, it will:

- focus recruitment and outreach activities on applicants in designated employment equity groups

- improve orientation programs and career development for employees

- work with employee networks to address systemic barriers and improve inclusion

- implement TBS’s accessibility plan and take specific actions to comply with the Accessible Canada Act

3. Preparing for the future

In 2023–24, TBS will prepare for the future by creating an Innovation Hub in its Human Resources Division. Hub staff will modernize internal processes and work with people throughout TBS to explore new ways to recruit, hire and retain employees.

TBS will continue to adapt its workplace policies and processes to make sure it fulfills its mandate and realizes the full potential of the hybrid approach.

TBS will work to leverage and secure data. It will, for example:

- expand data analytics capabilities to identify trends and inform decision‑making

- develop security and authentication tools for digital services and applications that build on the department’s cloud infrastructure

Planning for contracts awarded to Indigenous businesses

To support the Government of Canada’s commitment to award at least 5% of the total value of contracts to Indigenous businesses annually, TBS will work with Indigenous Services Canada to review its 2022–23 contracts and validate the identification and approval of any exceptions. In 2022–23, TBS’s leadership approved no exceptions on contracts.

To increase the likelihood of exceeding the 5% target in 2023–24, TBS will:

- restructure its procurement team focus more on the client and to allow more direct involvement in planning clients’ procurement

- make sure the procurement team gets involved earlier in procurement processes to make sure clients consider Indigenous vendors

- modify the integrated business planning process to include a new procurement template that requests a list of all planned contracts

- create tools for identifying verified vendors

In 2023–24, TBS will continue to strengthen its internal practices by, for example, requiring contract authorities to attest that they considered Indigenous vendors. When contract authorities do not consider an Indigenous vendor, they will be required to submit a justification to the procurement team before they award the contract. The procurement team will challenge any weak justifications and will propose Indigenous vendors when possible.

The following table shows the actual, forecast and planned percentages of contracts awarded to Indigenous businesses.

| 5% reporting field description | 2021–22 actual results | 2022–23 forecast target | 2023–24 planned target |

|---|---|---|---|

| Total percentage of contracts with Indigenous businesses | 0.5% | Phase 1: 5% Phase 2: Not applicable |

6% |

Planned budgetary spending for internal services

The following table shows, for internal services, budgetary spending for 2023–24, as well as planned spending for that year and for each of the next two fiscal years.

| 2023–24 budgetary spending (as indicated in Main Estimates) | 2023–24 planned spending | 2024–25 planned spending | 2025–26 planned spending |

|---|---|---|---|

| $93,135,241 | $93,135,241 | $92,014,192 | $90,859,648 |

Planned human resources for internal services

The following table shows, in full‑time equivalents, the human resources the department will need to carry out its internal services for 2023–24 and for each of the next two fiscal years.

| 2023–24 planned full-time equivalents | 2024–25 planned full-time equivalents | 2025–26 planned full-time equivalents |

|---|---|---|

| 658 | 659 | 658 |

Planned spending and human resources

In this section

This section provides an overview of the department’s planned spending and human resources for the next three fiscal years and compares planned spending for 2023–24 with actual spending for the current year and the previous year.

Planned spending for 2023–24

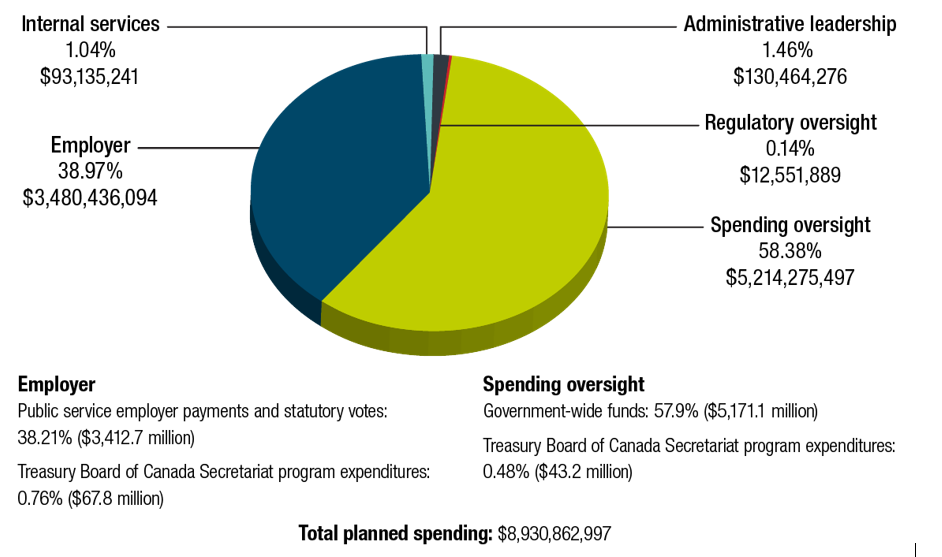

Figure 1 shows the breakdown of TBS’s planned spending of $8.9 billion for 2023–24, by core responsibility.

Figure 1 - Text version

| Core responsibility | Amount (in dollars) | Percentage |

|---|---|---|

| Spending oversight | 5,214,275,497 | 58.38 |

| Administrative leadership | 130,464,276 | 1.46 |

| Employer | 3,480,436,094 | 38.97 |

| Regulatory oversight | 12,551,889 | 0.14 |

| Internal services | 93,135,241 | 1.04 |

| Vote | Amount (in dollars) | Percentage |

|---|---|---|

| Public service employer payments and statutory votes | 3,412.7 million | 38.21 |

| Treasury Board of Canada Secretariat program expenditures | 67.8 million | 0.76 |

| Vote | Amount (in dollars) | Percentage |

|---|---|---|

| Government-wide funds | 5,171.1 million | 57.9 |

| Treasury Board of Canada Secretariat program expenditures | 43.2 million | 0.48 |

Total planned spending: $8,930,862,997

Overall, TBS’s total planned spending consists of its operating budget (3.9%) and government-wide funds and public service employer payments (96.1%).

TBS’s planned spending for 2023–24 consists of the following allocations:

- $5,214.3 million for the core responsibility of spending oversight, mainly to top up the government‑wide funds central vote funding held in TBS’s reference levels.

- $3,480.4 million for the core responsibility of employer, which relates to TBS’s role in supporting the Treasury Board as employer of the core public administration.

- $236.2 million for the administrative leadership and regulatory oversight core responsibilities and for internal services, to run TBS and to fulfill the President’s other mandate letter commitments.

The $5,214.3 million for spending oversight includes funding approved by Parliament in specific votes during the Main Estimates process. TBS transfers these funds to individual departments once specific criteria are met. Table 1 contains the number, name and description of the central votes associated with planned spending for 2023–24 for the spending oversight core responsibility.

| Vote | Name | Description |

|---|---|---|

| 5 | Government contingencies | Provides departments with temporary advances for urgent or unforeseen expenditures between Parliamentary supply periods |

| 10 | Government‑wide initiatives | Supports the implementation of strategic management initiatives across the federal public service |

| 15 | Compensation adjustments | Provides funding for adjustments made to terms and conditions of service or employment in the federal public administration as a result of collective bargaining |

| 25 | Operating budget carry‑forward | Allows departments to carry forward unused operating funds from the previous fiscal year of up to 5% of the gross operating budget in its Main Estimates |

| 30 | Paylist requirements | Covers the cost of meeting the government’s legal requirements as employer for items such as parental benefits and severance payments |

| 35 | Capital budget carry‑forward | Allows departments to carry forward unused capital funds from the previous fiscal year of up to 20% of their capital vote |

The $3,480.4 million for the core responsibility of employer will primarily be used for:

- payments under the public service pension, benefits and insurance plans, including payment of the employer’s share of health, income maintenance and life insurance premiums

- payments of provincial health insurance

- payments of provincial payroll taxes and Quebec sales tax on insurance premiums

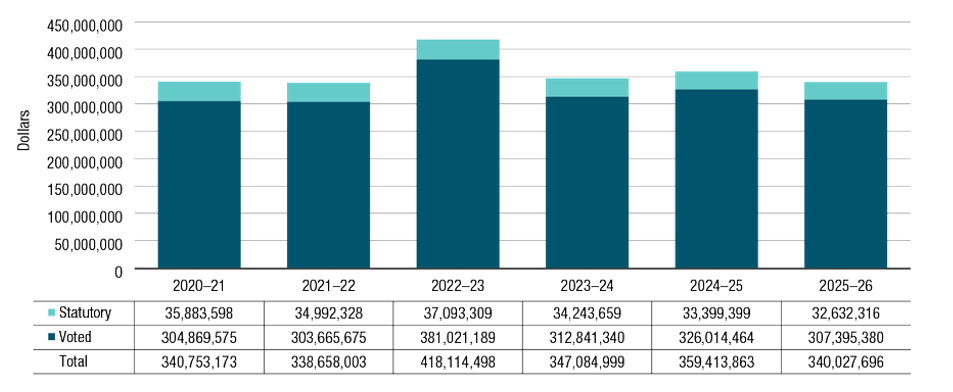

Departmental spending 2020–21 to 2025–26

The following graph presents planned spending (voted and statutory expenditures) over time.

Figure 2 - Text version

| Fiscal year | Total | Voted | Statutory |

|---|---|---|---|

| 2020–21 | 340,753,173 | 304,869,575 | 35,883,598 |

| 2021–22 | 338,658,003 | 303,665,675 | 34,992,328 |

| 2022–23 | 418,114,498 | 381,021,189 | 37,093,309 |

| 2023–24 | 347,084,999 | 312,841,340 | 34,243,659 |

| 2024-25 | 359,413,863 | 326,014,464 | 33,399,399 |

| 2025-26 | 340,027,696 | 307,395,380 | 32,632,316 |

TBS’s program expenditures include salaries, non‑salary costs to deliver programs, and statutory items related to the employer’s contributions to TBS’s employee benefit plans.

TBS’s program expenditures decreased by $2.1 million from 2020–21 to 2021–22.

Total forecast spending for TBS’s core responsibilities in 2022–23 is $79.5 million more than spending in 2021–22 mainly due to funding for:

- supporting governance and oversight of digital initiatives

- reviewing the Access to Information Act and implementing an action plan

- implementing proactive pay equity in the federal public service

- creating an accessible and inclusive workplace

- improving the oversight of the Benefits Delivery Modernization program

- developing a mental health fund for Black federal public servants

- developing an inclusive language training framework for the federal public service

- reviewing the Public Servants Disclosure Protection Act

- modernizing the Program and Administrative Services group

Total planned spending for TBS’s core responsibilities in 2023–24 is $71.0 million less than forecast spending in 2022–23 mainly due to:

- the sunsetting of the:

- Phoenix stabilization and HR‑to‑Pay initiatives

- Policy on COVID‑19 Vaccination for the Core Public Administration Including the Royal Canadian Mounted Police

- 2021–22 operating budget carry‑forward applicable to 2022–23

- a reprofiling of funds from 2021–22 to 2022–23 to meet the government’s obligations under a court‑ordered settlement related to the RCMP’s long‑term disability plan

- a transfer from Shared Services Canada for Government of Canada Enterprise Portfolio Management and for Financial Management Transformation to advance the development of the Government of Canada Digital Core Template

The decrease is partially offset by increases in planned spending for 2023–24 for the following initiatives:

- funding to advance clean fuels markets and carbon capture, utilization, and storage technologies in Canada

- Greening Government Fund

- implementing proactive pay equity in the federal public service

Total planned spending for TBS’s core responsibilities in 2024–25 is $12.3 million more than planned spending in 2023–24 mainly due to:

- funding to advance clean fuels markets and carbon capture, utilization, and storage technologies in Canada

- implementing proactive pay equity in the federal public service

- Greening Government Fund

Total planned spending for TBS’s core responsibilities in 2025–26 is $19.4 million less than planned spending in 2024–25 mainly due to:

- reduced funding for the Greening Government Fund

- sunsetting of the implementation of proactive pay equity in the federal public service

- sunsetting of the extension of targeted regulatory reviews and the External Advisory Committee on Regulatory Competitiveness

Budgetary planning summary for core responsibilities and internal services (dollars)

The following table shows information on spending for each of TBS’s core responsibilities and for its internal services for 2023–24 and other relevant fiscal years.

| Core responsibilities and internal services | 2020–21 actual expenditures | 2021–22 actual expenditures | 2022–23 forecast spending | 2023–24 budgetary spending (as indicated in Main Estimates) | 2023–24 planned spending | 2024–25 planned spending | 2025–26 planned spending |

|---|---|---|---|---|---|---|---|

| Spending oversight | 39,858,663 | 40,194,758 | 812,544,579 | 5,214,275,497 | 5,214,275,497 | 5,164,635,991 | 5,151,267,421 |

| Administrative leadership | 116,655,799 | 111,850,599 | 138,329,714 | 130,464,276 | 130,464,276 | 144,952,275 | 141,664,710 |

| Employer | 2,969,957,193 | 10,809,702,394 | 3,856,483,991 | 3,480,436,094 | 3,480,436,094 | 3,651,461,142 | 3,641,460,268 |

| Regulatory oversight | 10,022,274 | 10,218,687 | 12,165,969 | 12,551,889 | 12,551,889 | 12,562,280 | 10,049,956 |

| Subtotal | 3,136,493,929 | 10,971,966,438 | 4,819,524,253 | 8,837,727,756 | 8,837,727,756 | 8,973,611,688 | 8,944,442,355 |

| Internal services | 94,285,807 | 95,963,867 | 98,902,543 | 93,135,241 | 93,135,241 | 92,014,192 | 90,859,648 |

| Total | 3,230,779,736 | 11,067,930,305 | 4,918,426,796 | 8,930,862,997 | 8,930,862,997 | 9,065,625,880 | 9,035,302,003 |

Expenditures increased by $7,837.2 million from 2020–21 to 2021–22, mainly due to an increase in public service employer payments. This increase stemmed mainly from a $7,805 million contribution to the Public Service Pension Plan to address an actuarial shortfall under the Public Service Superannuation Account, in accordance with the triennial actuarial valuation of the plan as at March 31, 2020.

Forecast spending for 2022–23 is $6,149.5 million less than actual spending for 2021–22. Most of this variance relates to the employer core responsibility and stems from a one‑time contribution of $7,805 million to the Public Service Pension Plan to address an actuarial shortfall in 2021–22 that was offset by funding received for the Royal Canadian Mounted Police Life and Disability Insurance Plan in 2022–23.

Planned spending for 2023–24 is $4,012.4 million more than forecast spending for 2022–23. Most of the variance relates to the spending oversight core responsibility and funding for government‑wide central votes that is held in TBS’s reference levels. This funding is expected to be transferred to departments by year‑end. TBS expects that spending for spending oversight in 2023–24 will be similar to that in previous years. This increase is offset by reduced funding related to the Royal Canadian Mounted Police Life and Disability Insurance Plan.

The $104.4 million increase in planned spending from 2023–24 to 2025–26 is mainly attributable to an increase related to the funding requirements for the Public Service Insurance plans, which is offset by the sunsetting of the proactive pay equity and the Application Modernization initiatives.

Planned human resources

The following table shows information on human resources, in full‑time equivalents, for each of TBS’s core responsibilities and for its internal services for 2023–24 and the other relevant years.

| Core responsibilities and internal services | 2020–21 actual full-time equivalents | 2021–22 actual full-time equivalents | 2022–23 forecast full-time equivalents | 2023–24 planned full-time equivalents | 2024–25 planned full-time equivalents | 2025–26 planned full-time equivalents |

|---|---|---|---|---|---|---|

Table 3 Notes

|

||||||

| Spending oversight | 292 | 284 | 301 | 305 | 303 | 300 |

| Administrative leadership | 771 | 754 | 685 | 627 | 582 | 579 |

| Employer | 545 | 606 | 616 | 459 | 449 | 431 |

| Regulatory oversight | 61 | 66 | 73 | 74 | 74 | 59 |

| Subtotal | 1,669 | 1,710 | 1,675 | 1,465 | 1,408 | 1,369 |

| Internal services | 661 | 659 | 673 | 658 | 659 | 658 |

| Total | 2,330 | 2,369 | 2,348 | 2,123 | 2,067 | 2,027 |

Estimates by vote

Information on TBS’s organizational appropriations is available in the 2023–24 Main Estimates.

Future-oriented condensed statement of operations

The future‑oriented condensed statement of operations provides an overview of TBS’s operations for 2022–23 to 2023–24.

The forecast and planned amounts in this statement of operations were prepared on an accrual basis. The forecast and planned amounts presented in other sections of the Departmental Plan were prepared on an expenditure basis. Amounts may therefore differ.

A more detailed future-oriented statement of operations and associated notes, including a reconciliation of the net cost of operations to the requested authorities, are available on the TBS website.

| Financial information | 2022–23 forecast results | 2023–24 planned results | Difference (2023–24 planned results minus 2022–23 forecast results) |

|---|---|---|---|

| Total expenses | 4,279,958,721 | 3,864,377,570 | (415,581,151) |

| Total revenues | 101,501,296 | 92,150,868 | (9,350,428) |

| Net cost of operations before government funding and transfers | 4,178,457,425 | 3,772,226,702 | (406,230,723) |

Total expenses comprise public service employer payments ($3.7 billion in 2022–23 and $3.4 billion in 2023–24) and TBS program expenses ($0.6 billion in 2022–23 and $0.5 billion in 2023–24). Public service employer payments are used to fund the employer’s share of the Public Service Health Care Plan, the Public Service Dental Care Plan and other insurance and benefit programs provided to federal public service employees.

Planned public service employer payments for 2023–24 are $323 million (8.7%) less than forecast results for 2022–23. The variance is mainly due to a lump‑sum payment of $499 million under the Royal Canadian Mounted Police Life and Disability Insurance Plan in 2022–23, which was partially offset by projected increases in 2023–24 to benefit claims under the health and dental care plans, provincial payroll taxes, and disability insurance plan premiums.

Planned TBS program expenses for 2023–24 are $93 million (16.9%) less than forecast results for 2022–23, mainly because of the payment of out-of-court settlements in 2022–23, the sunsetting of funding received in 2022–23 for the Phoenix stabilization and HR-to-Pay initiatives, Policy on COVID‑19 Vaccination for the Core Public Administration Including the Royal Canadian Mounted Police, and the operating budget carry‑forward from 2021–22 to 2022–23, as well as retroactive compensation adjustments for executives in 2022–23.

Total revenues include recoveries from other government departments for costs associated with the administration of the government‑wide contract for SAP software, as well as the provision of internal support services related to shared financial and human resources management systems, accounting, and mail services. Revenues also include the recovery of costs incurred by TBS for the administration of the Public Service Pension Plan.

The decrease of $9 million (9.2%) between 2023–24 planned revenues and 2022–23 forecast revenues is mainly due to a planned reduction in 2023–24 SAP contract cost recoveries.

Corporate information

Organizational profile

Appropriate minister(s): The Honourable Mona Fortier, President of the Treasury Board

Institutional head: Graham Flack, Secretary of the Treasury Board

Ministerial portfolio: The Treasury Board portfolio consists of the Treasury Board of Canada Secretariat and the Canada School of Public Service, as well as the following organizations, which operate at arm’s length and report to Parliament through the President of the Treasury Board: the Public Sector Pension Investment Board, the Office of the Commissioner of Lobbying of Canada, and the Office of the Public Sector Integrity Commissioner of Canada.

Enabling instrument: The Financial Administration Act is the act that establishes the Treasury Board itself and gives it powers with respect to the financial, personnel and administrative management of the public service, and the financial requirements of Crown corporations.

Year of incorporation / commencement: 1966

Raison d’être, mandate and role: who we are and what we do

Information on TBS’s raison d’être, mandate and role is available on the TBS website .

Information on TBS’s mandate letter commitments is available in the mandate letter for the President of the Treasury Board.

Operating context

Information on the operating context is available on the TBS website.

Reporting framework

Treasury Board of Canada Secretariat’s approved departmental results framework and program inventory for 2023–24 are as follows.

| Departmental Results Framework | Departmental result: government organizations measure, evaluate, and report on their performance |

Indicator: percentage of government programs that have suitable measures for tracking performance and informing decision making |

|---|---|---|

| Program Inventory | Program: Expenditure Data, Analysis and Reviews |

|

Program: Oversight and Treasury Board Support |

||

| Departmental Results Framework | Departmental result: government service delivery is digitally enabled and meets the needs of Canadians |

Indicator: percentage of high-volume Government of Canada services that meet service standards |

|---|---|---|

Indicator: degree to which clients complete high-volume tasks on Government of Canada websites |

||

Indicator: percentage of Government of Canada business applications assessed as healthy |

||

Departmental result: government has good asset and financial management practices |

Indicator: percentage of key financial management processes for which the system of internal controls is at the continuous monitoring stage |

|

| Program Inventory | Program: Comptrollership Program |

|

Program: Digital Government Program |

||

Program: Canadian Digital Service |

||

Program: Communications and Federal Identity Policies and Initiatives |

||

Program: Public Service Accessibility |

||

| Departmental Results Framework | Departmental result: the public service has good people management practices |

Indicator: percentage of employees who believe their workplace is psychologically healthy |

|---|---|---|

Indicator: percentage of employees who responded positively to “my department or agency implements activities and practices that support a diverse workplace” |

||

Indicator: percentage of employees who indicate that their organization respects individual differences (for example, culture, workstyles and ideas) |

||

Indicator: percentage of institutions where communications in designated bilingual offices nearly always occur in the official language chosen by the public |

||

Departmental result: terms and conditions of public service employment are negotiated in good faith |

Indicator: percentage of Public Service Labour Relations and Employment Board outcomes that confirm that the Government of Canada is bargaining in good faith |

|

| Program Inventory | Program: Employer Program |

|

Program: Public Service Employer Payments |

||

| Departmental Results Framework | Departmental result: the federal regulatory system protects and advances the public interest, including sustainable economic growth |

Indicator: ranking of Canada’s regulatory system by the Organisation for Economic Co-operation and Development for stakeholder engagement |

|---|---|---|

Indicator: ranking of Canada’s regulatory system by the Organisation for Economic Co-operation and Development for regulatory impact assessment |

||

Indicator: ranking of Canada’s regulatory system by the Organisation for Economic Co-operation and Development for ex-post evaluation |

||

| Program Inventory | Program:Regulatory Policy, Oversight, and Cooperation |

|

Changes to the approved reporting framework since 2022–23

| Structure | 2022-23 | 2023-24 | Change | Reason for change |

|---|---|---|---|---|

| Core responsibility | Spending oversight | Spending oversight | No change | Not applicable |

| Program | Expenditure Data, Analysis, Results, and Reviews | Expenditure Data, Analysis, Results, and Reviews | No change | Not applicable |

| Program | Government-Wide Funds | Not applicable | Program ended | Flow-through fund program merged into the Expenditure Data, Analysis, Results, and Reviews program, which manages the funds |

| Program | Oversight and Treasury Board Support | Oversight and Treasury Board Support | No change | Not applicable |

| Core responsibility | Administrative leadership | Administrative leadership | No change | Not applicable |

| Program | Not applicable | Digital Government | New program | New unified program for the digital government activities under the Office of the Chief Information Officer of Canada |

| Program | Digital Policy | Not applicable | Program ended | Program merged into the new unified program for the digital government activities under the Office of the Chief Information Officer of Canada |

| Program | Digital Strategy, Planning, and Oversight | Not applicable | Program ended | Program merged into the new unified program for the digital government activities under the Office of the Chief Information Officer of Canada |

| Program | Canadian Digital Service | Canadian Digital Service | No change | Not applicable |

| Program | Not applicable | Comptrollership program | New program | New unified program for all activities related to comptrollership |

| Program | Acquired Services and Assets Policies and Initiatives | Not applicable | Program ended | Program merged into the new unified program for all activities related to comptrollership |

| Program | Financial Management Policies and Initiatives | Not applicable | Program ended | Program merged into the new unified program for all activities related to comptrollership |

| Program | Digital Comptrollership Program | Not applicable | Program ended | Program merged into the new unified program for all activities related to comptrollership |

| Program | Internal Audit Policies and Initiatives | Not applicable | Program ended | Program merged into the new unified program for all activities related to comptrollership activities |

| Program | Greening Government Operations | Not applicable | Program ended | Program merged into the new unified program for all activities related to comptrollership |

| Program | Communications and Federal Identity Policies and Initiatives | Communications and Federal Identity Policies and Initiatives | No change | Not applicable |

| Program | Public Service Accessibility | Public Service Accessibility | No change | Not applicable |

| Program | Management Accountability Framework | Not applicable | Program ended | Program merged into Management and Oversight under internal services |

| Core responsibility | Employer | Employer | No change | Not applicable |

| Program | Not applicable | Employer program | New program | New unified program for the employer activities under the Office of the Chief Human Resources Officer of Canada |

| Program | Employee Relations and Total Compensation | Not applicable | Program ended | Program merged into the new unified program for the comptrollership under the Office of the Chief Human Resources Officer of Canada |

| Program | Executive and Leadership Development | Not applicable | Program ended | Program merged into the new unified program for the comptrollership under the Office of the Chief Human Resources Officer of Canada |

| Program | People Management Systems and Processes | Not applicable | Program ended | Program merged into the new unified program for the comptrollership under the Office of the Chief Human Resources Officer of Canada |

| Program | Research, Planning and Renewal | Not applicable | Program ended | Program merged into the new unified program for the comptrollership under the Office of the Chief Human Resources Officer of Canada |

| Program | Workplace Policies and Services | Not applicable | Program ended | Program merged into the new unified program for the comptrollership under the Office of the Chief Human Resources Officer of Canada |

| Program | Public Service Employer Payments | Public Service Employer Payments | No change | Not applicable |

| Core responsibility | Regulatory oversight | Regulatory oversight | No change | Not applicable |

| Program | Regulatory Policy, Oversight, and Cooperation | Regulatory Policy, Oversight, and Cooperation | No change | Not applicable |

Supporting information on the program inventory

Supporting information on planned expenditures, human resources, and results related to Treasury Board of Canada Secretariat’s program inventory is available on GC InfoBase.

Supplementary information tables

The following supplementary information tables are available on the Treasury Board of Canada Secretariat’s website:

Federal tax expenditures

Treasury Board of Canada Secretariat’s Departmental Plan does not include information on tax expenditures.

Tax expenditures are the responsibility of the Minister of Finance. The Department of Finance Canada publishes cost estimates and projections for government‑wide tax expenditures each year in the Report on Federal Tax Expenditures. This report provides detailed information on tax expenditures, including objectives, historical background and references to related federal spending programs, as well as evaluations, research papers and gender-based analysis plus.

Organizational contact information

Mailing address

Treasury Board of Canada Secretariat

90 Elgin Street

Ottawa, Canada K1A 0R5

Telephone: 613‑369‑3200

Email: questions@tbs-sct.gc.ca

Appendix: definitions

- appropriation (crédit)

- Any authority of Parliament to pay money out of the Consolidated Revenue Fund.

- budgetary expenditures (dépenses budgétaires)

- Operating and capital expenditures; transfer payments to other levels of government, organizations or individuals; and payments to Crown corporations.

- core responsibility (responsabilité essentielle)

- An enduring function or role performed by a department. The intentions of the department with respect to a core responsibility are reflected in one or more related departmental results that the department seeks to contribute to or influence.

- Departmental Plan (plan ministériel)

- A document that sets out a department’s priorities, programs, expected results and associated resource requirements, covering a three‑year period beginning with the year indicated in the title of the report. Departmental Plans are tabled in Parliament each spring.

- departmental result (résultat ministériel)

- A change that a department seeks to influence. A departmental result is often outside departments’ immediate control, but it should be influenced by program-level outcomes.

- departmental result indicator (indicateur de résultat ministériel)

- A factor or variable that provides a valid and reliable means to measure or describe progress on a departmental result.

- departmental results framework (cadre ministériel des résultats)

- A framework that consists of the department’s core responsibilities, departmental results and departmental result indicators.

- Departmental Results Report (rapport sur les résultats ministériels)

- A report on a department’s actual performance in a fiscal year against its plans, priorities and expected results set out in its Departmental Plan for that year. Departmental Results Reports are usually tabled in Parliament each fall.

- full‑time equivalent (équivalent temps plein)

- A measure of the extent to which an employee represents a full person‑year charge against a departmental budget. Full‑time equivalents are calculated as a ratio of assigned hours of work to scheduled hours of work. Scheduled hours of work are set out in collective agreements.

- gender-based analysis plus (GBA Plus) (analyse comparative entre les sexes plus [ACS Plus])

- An analytical tool used to support the development of responsive and inclusive policies, programs and other initiatives. GBA Plus is a process for understanding who is impacted by the issue or opportunity being addressed by the initiative; identifying how the initiative could be tailored to meet diverse needs of the people most impacted; and anticipating and mitigating any barriers to accessing or benefitting from the initiative. GBA Plus is an intersectional analysis that goes beyond biological ( sex) and socio-cultural ( gender) differences to consider other factors, such as age, disability, education, ethnicity, economic status, geography, language, race, religion, and sexual orientation.

- government-wide priorities (priorités pangouvernementales)

- For the purpose of the 2023–24 Departmental Plan, government-wide priorities are the high-level themes outlining the Government’s agenda in the 2021 Speech from the Throne: building a healthier today and tomorrow; growing a more resilient economy; bolder climate action; fighter harder for safer communities; standing up for diversity and inclusion; moving faster on the path to reconciliation and fighting for a secure, just, and equitable world.

- high impact innovation (innovation à impact élevé)

- High impact innovation varies per organizational context. In some cases, it could mean trying something significantly new or different from the status quo. In other cases, it might mean making incremental improvements that relate to a high-spending area or addressing problems faced by a significant number of Canadians or public servants.

- horizontal initiative (initiative horizontale)

- An initiative in which two or more federal organizations are given funding to pursue a shared outcome, often linked to a government priority.

- non‑budgetary expenditures (dépenses non budgétaires)

- Net outlays and receipts related to loans, investments and advances, which change the composition of the financial assets of the Government of Canada.

- performance (rendement)

- What an organization did with its resources to achieve its results, how well those results compare to what the organization intended to achieve, and how well lessons learned have been identified.

- plan (plan)