Compensation for severe impacts

Claim compensation for severe impacts

On this page

Who can submit a claim

Compensation for severe impacts is available if you are a:

- current or former indeterminate employee, or

- current or former term employee of more than three months, or

- representative of the estate of a deceased employee (indeterminate or term of more than three months)

To be eligible to submit a claim, you must have:

- worked in an organization of the core public administration or a separate agency between April 1, 2016 and March 31, 2020, and

- incurred damages as a result of the Phoenix pay system between April 1, 2016 and March 31, 2020

Certain employees are not eligible for these claims:

- members of the class action as certified in Bouchard c. Procureur Général du Canada (200-06-000214-174), and

- any other member of the class that could be added by the courts, including:

- students

- casual employees

- workers working no more than one third of regular hours

- employees with terms of less than three months

What you can claim

There are various types of claims you can make in this process. You can make one or several claims for severe impacts at the same time. Severe impacts related to Phoenix could include:

- financial costs or lost investment income due to delays in pay

- leave taken because of health issues

- severe damages and personal hardship

If you have already filed a claim for financial costs and lost investment income, you do not need to reapply; however, you can make additional claims for other hardships in this process.

Applying the threshold

A combined threshold of $1,500 applies to some of these claims, meaning the total amount of damages to be paid for severe impacts caused by the Phoenix pay system must exceed $1,500. This threshold applies only once for severe damages claims. You can combine several types of claims in this process to ensure the one-time threshold is met.

A threshold will be applied once your claim is assessed and resulting damages are calculated. If your claim does not meet the threshold, the calculation will be explained to you.

Please make sure you have all the required documentation listed in the claims descriptions on hand when making your claim.

Types of claims

Financial costs or lost investment income

Type of claim

You incurred costs or lost investment income as a result of issues attributed to the Phoenix pay system for which you have not already submitted a claim.

What you can claim

You can claim lost investment income during the period in which you were unpaid. The amount you can claim cannot be greater than the amount of your missed net pay. In other words, if your net missing pay was for $2,000 but you cashed in a Guaranteed Investment Certificate that was for $5,000, we would refund the lost interest only on $2,000.

We realize that you may not be in a position to figure out the exact amount that you can claim. We can assist you and provide the breakdown to you.

You may claim interest if your pay, severance pay or pension payment was delayed beyond what would be normal established processing times:

- Severance payments should be processed within thirty (30) days of receipt of the severance pay annex by the Public Service Pay Centre

- Pension payments should be processed within one hundred and twenty (120) days of the date the application is approved by the Government of Canada Pension Centre, or within forty-five (45) days of receipt of all required documents by the Pension Centre, whichever is later

The interest will be calculated at the average Bank of Canada discount rate from the previous month plus 3% from the date the payment should have been made to the date the payment was issued. You may want to consult the interest rate table to estimate how much you could claim. Since 2016, the interest rate has varied between 3.75% and 5.00%.

Note that there is also an out-of-pocket claims process for all employees who incurred additional expenses because of Phoenix pay problems.

The threshold of $1,500 applies to these claims.

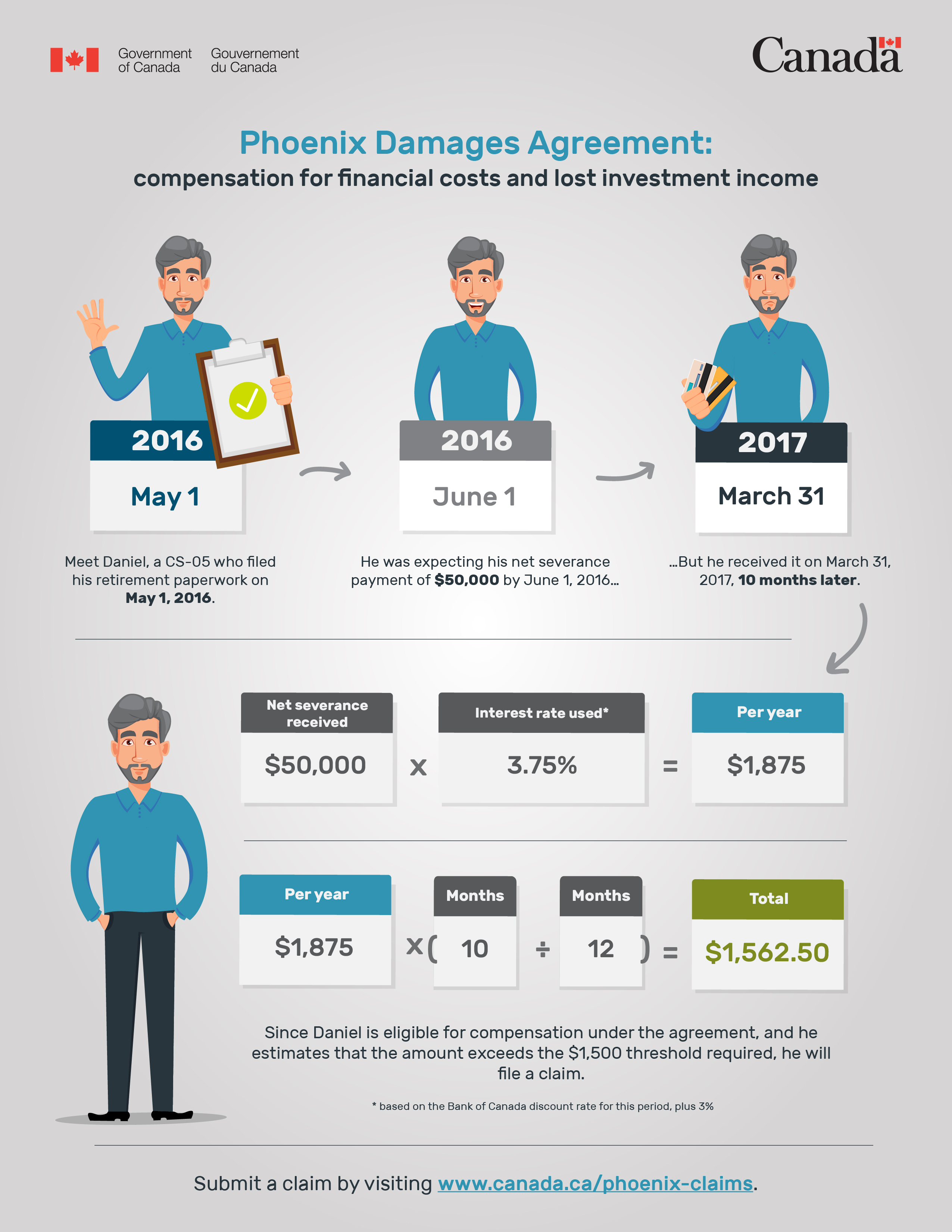

Example 1: interest on late payment

Daniel, a CS-05, filed his retirement paperwork on , and expected his net severance payment (after source deductions) of about $50,000 by .

Because the severance pay was paid only on , ten months later, Daniel may be entitled to compensation: he can file a claim for interest on the late payment.

The amount of compensation Daniel is entitled to is calculated using the average Bank of Canada discount rate from the previous month plus 3% and is based on ten months where the time to issue the payment exceeded the normal established processing timelines. The eligible compensation is $1,562.50.

Is Daniel eligible to file this type of claims? Yes!

- As a CS-05, he was a member of PIPSC.

- His severance was paid much later than the normal 30-day processing time.

- His compensation for financial loss is greater than the $1,500- threshold required for this type of claim.

Example 2: early withdrawal from a registered retirement savings plan (RRSP)

Sam a PM-06, was underpaid between April and October 2018. In order to pay his living expenses, he withdrew $15,000 from his RRSP in January 2019. He received payment for the missing net pay of $15,000 in February 2019.

The amount of compensation Sam could be entitled to is based on a comparison of his actual income tax liabilities in 2018 and 2019 versus the tax liability he would have incurred had he not withdrawn the funds from his RRSP in 2019 but had left them there to be withdrawn as a RRIF payment in future years. The eligible compensation is $4,000.

Since he was underpaid for 15 pay periods (between April and October 2018), Sam is also eligible to receive compensation for interest on his missing pay. Using the average Bank of Canada discount rate from the previous month plus 3% from the date his pay should have been made to the date it was issued, this interest compensation is $400.

Sam’s total compensation is $4,400.

Is Sam eligible to file this type of claim? Yes!

- As an PM-06, he was a member of PSAC.

- His regular pay was not fully paid on time.

- His compensation for financial loss is over the $1,500 threshold required for this type of claim.

Note that if Sam had not made an early withdrawal from his RRSP, the compensation would have only been for the interest on missing pay ($400). In this situation, he would not have been eligible for compensation under the terms of the agreement since the amount does not exceed the $1,500-threshold.

Example 3: lost investment opportunity

Caroline, a FI-03, did not receive her regular pay for 8 pay periods between June and September 2016. She finally received a payment on January 12, 2018. The net amount of her missing pay was $21,000.

In order to pay her living expenses, she had sold 260 shares of ABC stock on September 30, 2016, at a price of $81.26 per share. She incurred a selling fee of $35. The price of these shares on , was $105.16 per share.

The amount of the compensation Caroline is entitled to is the increase in the value of the shares between the date she sold them and the date she received her missing pay. Including the selling fee, the eligible compensation is $6,249.

Caroline is also eligible to receive compensation for interest on her missing pay. Using the average Bank of Canada discount rate from the previous month plus 3% from the date the payment should have been made to the date the payment was issued, this interest compensation is $164.

Caroline’s total compensation is $6,413.

Is Caroline eligible to file this type of claims? Yes!

- As an FI-03, she was a member of ACFO.

- Her regular pay was not paid on time.

- Her compensation for financial loss is over the $1,500- threshold required for this type of claim.

Note that if Caroline had not cashed in her shares, the compensation would have only been for the interest on missing pay ($164). In this situation, Caroline would not have been compensated because the amount does not exceed the $1,500-threshold set out in the agreement.

What you’ll need to provide

You will need to submit Annex A of the claims form, and provide documented evidence of (as applicable):

- lost investment income, which could include:

- price of the investment instrument (that is, stock) on the day you received your missing pay

- interest rate of the interest-earning financial instrument that was disposed of

- dividends that would have been earned on the dividend-earning financial instrument that was disposed of

- costs claimed, which could include:

- financial statements (bank, line of credit, credit card)

- loan agreements

- invoices from financial or other service providers

- disrupted pay (for example, pay stubs)

Additional documentation (as applicable):

- account statements or trade summaries

- your latest income tax Notice of Assessment or Reassessment for the year in which you withdrew early from your RRSP

- pay stub showing receipt of missing amount if full or partial payment has been received

- if retired, documented evidence of retirement date

If you are claiming financial cost or lost investment income only you may choose to submit your claim directly to your departmental claims officer, or to the officer in the last organization where you worked. If you choose this option, you must

- gather all required supporting documentation

- download and complete the Claim Form for Compensation for Financial Damages Caused by the Phoenix Pay System (PDF)

- submit your claim to the appropriate departmental claims officer

Compensation for leave taken

Type of claim

You used paid or unpaid leave due to illness* stemming from issues with your pay attributed to the Phoenix pay system.

* If you received compensation for damages through another settlement, such as through a grievance or complaint stemming from a claim for workplace injury benefits your reimbursement may be reduced by the amount of compensation you already received.

What you can claim

- For current employees: claims for re-credit of paid leave or compensation for unpaid leave taken due to an illness stemming from issues with the employee’s pay attributed to the Phoenix pay system

- For former employees: claims for compensation for paid (except sick leave) or unpaid leave taken due to an illness stemming from issues with the employee's pay issues attributed to the Phoenix pay system

- The threshold of $1,500 does not apply to these claims.

What you’ll need to provide:

You will need to submit Annex B of the claims form, and provide documented evidence (as applicable) that:

- demonstrates that you were on leave specifically due to Phoenix pay issues and the dates of the leave (that is, medical certificate, manager’s attestation or personal attestation* if neither a medical certificate nor manager’s attestation can be obtained)

- supports the dates and category of the leave taken (pay file, pay action requests, emails)

*subject to additional verification

Compensation for individuals on maternity, parental or disability leave

Type of claim

You began disability, maternity or parental leave between February 1, 2016 and March 31, 2020, experienced pay issues, and did not have access to or were denied an emergency salary advance or priority payment.

What you can claim

- Claims for employees who went on maternity, parental, or disability leave

- between February 1, 2016 and March 31, 2020

- who experienced pay issues related to their leave, and

- who did not have access to or were denied an emergency salary advance or priority payment

- You can claim monetary compensation and reimbursement of related expenses.

- The threshold of $1,500 does not apply to these claims.

Example: Delay in employment insurance benefits and top-up allowance

Emily is an AS-03 who went on maternity leave in July 2017. Her pay stopped soon afterwards, but her record of employment was not issued until September 2017. This resulted in a delay to her application for employment insurance maternity benefits and, subsequently, the maternity top-up allowance. She contacted her manager asking for priority payment to cover the period between the date her pay ceased and the date she received employment insurance, but her request was denied.

Emily could be entitled to monetary compensation. The amount of compensation would be determined by the level of impact of the pay issues and the duration of time she was without income.

Is Emily eligible to file this type of claim? Yes.

- As an AS-03, she was a member of PSAC.

- When applying for employment insurance for maternity leave, she experienced issues for which the employer was responsible (delay in issuing her record of employment).

- She requested and was denied a priority payment for the period between the cessation of her pay and the receipt of her benefits.

Note that the provisions on priority payments were amended in the Terms and Conditions of Employment on June 6, 2017. That amendment enabled individuals who experienced delays in receiving employment insurance maternity benefits prior to June 6, 2017, and who did not request or were denied a priority payment, to request it if the employment insurance maternity benefits they received at a later date did not cover the full period.

What you’ll need to provide

You will need to submit Annex C of the claims form, and provide, as applicable:

- pay stubs and documents (forms, letters etc.) related to the application process for employment insurance and disability insurance

- documented evidence of your request for emergency salary advance or priority payment

- documented evidence of being denied emergency salary advance or priority payment

Discriminatory practice

Type of claim

You believe you were discriminated against based on grounds protected from discrimination under the Canadian Human Rights Act as a result of your Phoenix pay issues.

What you can claim

- Claims alleging a discriminatory practice as defined under the Canadian Human Rights Act (CHRA) due to Phoenix pay issues, including but not limited to issues related to maternity, parental or disability leave.

- You can claim monetary compensation and reimbursement of related expenses.

- The threshold of $1,500 applies to these claims.

What you’ll need to provide

You will need to submit Annex D of the claims form, and provide (as applicable):

- documented evidence to establish a case of discrimination—this can include pay file, pay action requests, emails, records of discussions or any other applicable documents

- evidence of pain and suffering to help in measuring the impact of the discrimination. This can include:

- medical certificates

- emails to manager

- a personal attestation

- sick leave records

- any other applicable documents

- You must demonstrate that:

- you have a characteristic protected from discrimination under the CHRA, for example, sex, disability, or family status

- you experienced an adverse impact due to an issue with your pay stemming from the Phoenix pay system

- the protected characteristic was a factor in the adverse impact

Lost occupational capacity (Impacts to your career)

Type of claim

You suffered consequences related to lost occupational capacity (impacts to your career) as a result of issues directly attributable, in whole or in part, to your Phoenix pay issues. You:

- temporarily or permanently vacated your substantive position, or

- temporarily or permanently vacated your substantive position and were placed in an alternate position

Lost occupational capacity is defined as the loss of a person’s position or profession due to events directly attributable in whole or in part to the Phoenix pay system, and the employee can no longer meet the requirements of their position.

What you can claim

- Claims with respect to consequences for employees who temporarily or permanently vacated their substantive position or who temporarily or permanently vacated their substantive position and were placed in an alternate position, as a result of issues directly attributable, in whole or in part, to the Phoenix pay system.

- You can claim compensation for any difference in base salary between your original position and the alternate position.

- You can also claim for the reimbursement of related expenses.

- The threshold of $1,500 applies to these claims.

Example: Placed in an alternate position

Jim is a helicopter pilot (AO). He received incorrect or no pay for several weeks and went on sick leave for several months due to the resulting stress. He is returning to work but has been advised by his physician not to return to his position as a helicopter pilot until further notice.

As per the collective agreement, the employer will find him a suitable position outside the helicopter pilot group.

Is Jim eligible to file this type of claim? Yes.

- As a helicopter pilot, he was a member of the Canadian Federal Pilots Association.

- His pay issues caused him to vacate his substantive position and be placed in another position outside his occupational group.

If Jim were to move out of his former substantive position to a position where he earns less than he was earning previously, he could be entitled to the difference between his new rate of pay and his former rate of pay for the period covered by the Phoenix damages agreement. Furthermore, he could also be entitled to any of the allowances associated with his former substantive position for the period covered by the Phoenix damages agreement.

Note that the total amount of his claim for severe damages must be over the $1500-threshold required for this type of claim. For former employees, monetary compensation would be calculated based on base salary on the date of termination as reflected in the pay system at the time the claim is processed.

Example: Temporarily placed in an alternate position

Mélanie is a qualified employee working as a Ships’ Crews (SC) officer and is required to perform diving duties and maintain diving equipment on vessels. She has received incorrect or no pay for several weeks and left work on sick leave for several months due to the resulting stress. She returned to work in June 2016 but was advised by her physician not to perform any diving for a temporary period.

As a result, the employer temporarily assigned her to perform the duties of another position without diving duties. The doctor confirmed in June 2018 that she could return to her substantive position.

Is Mélanie eligible to file a claim for damages? Yes.

- As an SC employee, she is a member of PSAC.

- Due to her pay issues, she temporarily vacated her substantive position for two years and was placed in a different SC position that did not require her to dive.

While Mélanie maintained the same substantive salary, she was no longer entitled to receive the diving duty allowance and was therefore earning less than she was earning previously. In accordance with the PSAC damages agreement, she is entitled to any of the allowances associated with her former substantive position for the period covered by the MOA or until she returned to her former duties, which in her case was in June 2018.

Note: The total amount of her claim for severe damages under this annex must be over the $1500-threshold required as per the MOA. However, if the claim is less than the threshold, it can be lumped with any other claim (annex) for which the same $1500-threshold applies to ensure that the threshold is met.

What you’ll need to provide

You will need to submit Annex E of the claims form, and provide documented evidence (as applicable) showing that:

- pay issues resulted in the change in position, which can include:

- emails

- medical certificates

- records of discussions from human resources or a manager and with any other stakeholder from the date(s) of the pay issues attributed to the Phoenix pay system to the date of vacating the substantive position and date of placement in alternate position

Lost security clearance

Type of claim

You suffered consequences related to the loss of your security clearance as a result of issues that were directly attributable, in whole or in part, to your Phoenix pay issues

What you can claim

- Claims with respect to the consequences of a loss of security clearance as a result of pay issues directly attributable, in whole or in part, to the employee's Phoenix pay issues.

- You can claim for reimbursement of relevant expenses.

- The threshold of $1,500 applies to these claims.

What you’ll need to provide

You will need to submit Annex F of the claims form, and provide documented evidence of:

- loss of security clearance due to Phoenix pay issues, which can include

- security screening documents

- briefing documents

Documentation to demonstrate:

- the consequences of the loss of security clearance, which can include emails and records of discussions from:

- managers

- human resources

- security officers conducting the security clearance evaluation

- any other stakeholder

These records should be from the date(s) of pay issues to the date of loss of security clearance.

Bankruptcy

Type of claim

You suffered consequences related to a bankruptcy as a result of issues directly attributable, in whole or in part, to your Phoenix pay issues

What you can claim

- Claims with respect to the consequences of a bankruptcy as a result of issues directly attributable, in whole or in part, to the employee’s Phoenix pay issues. The employee must clearly demonstrate how their Phoenix pay issues directly resulted in their bankruptcy.

- You can claim for reimbursement of relevant expenses.

- The threshold of $1,500 applies to these claims.

What you’ll need to provide

You will need to submit Annex G of the claims form, and provide (as applicable):

- documented evidence that pay issues caused the bankruptcy

- the maximum number of monthly credit rating history your financial institution can provide

- bankruptcy records from your bankruptcy trustee

- documents related to the bankruptcy fees you incurred

- a record of communication as to what protections were provided by your financial institution relating to your bankruptcy

Significant credit rating impact

Type of claim

You suffered consequences of a significant credit rating impact as a result of issues directly attributable, in whole or in part, to your Phoenix pay issues

What you can claim

- Claims with respect to the consequences of a significant credit rating impact as a result of issues directly attributable, in whole or in part, to the employee’s Phoenix pay issues.

- You can claim for reimbursement of relevant expenses.

- The threshold of $1,500 applies to these claims.

Example: Significant change to credit rating

Zak, an FI-02, did not receive his regular pay for 2 pay periods and received only a portion of his pay for the following 10 pay periods between April and September 2016. In order to manage his expenses, he deferred mortgage and car payments, exhausted his credit card limits, and made late payments on many of his household bills. As a result, there was a significant change to his credit rating, which continues to impact his borrowing rate of interest.

Is Zak eligible to file this type of claim? Yes.

- As an FI-02, he was a member of ACFO.

- His regular pay was not paid on time.

- His pay issues resulted in a significant impact to his credit rating.

Zak could be entitled to reimbursement of relevant incurred expenses. Note that the total amount of his claim for severe damages must be over the $1,500-threshold required for this type of claim.

What you’ll need to provide

You will need to submit Annex H of the claims form, and provide (as applicable):

- documented evidence that pay issues caused the change to your credit rating

- documents from a financial institution showing your monthly credit rating for the 24 months prior to your pay issue(s) and for the 24 months following

- record(s) of communication as to what, if any, protection was provided by your financial institution relating your credit rating

- documents showing this credit rating impact on your borrowing rate of interest (chronology of events, dates, interest rate(s))

- documents providing evidence as to the financial impact of this change

Note: if you were charged fees for the preparation of your credit rating analysis, please include evidence of payment in your claim documentation. If the institution imposes a charge to prepare the rating analysis and your claim is accepted, the charge imposed by the institution to prepare the analysis will be reimbursed.

Resignation from the public service

Type of claim

You resigned from the public service because of financial hardship resulting from a loss of income due to issues attributable to the Phoenix pay system

What you can claim

- Claims for lost income and out of pocket expenses incurred by employees who resigned from the public service after having been appointed to a term of more than three months or indeterminate position.

- The resignation must be as a consequence of a loss of income leading to financial hardship* caused by the Phoenix pay issues.

- * Financial hardship refers to financial suffering or lack of what is needed for basic living requirements, such as food, clothing, shelter, medical expenses, and other essentials.

- The threshold of $1,500 applies to these claims.

Additional eligibility

To be eligible to submit a claim, employees must have been:

- actively looking for employment and available to work after their resignation or

- re-employed in a position with a lower salary rate in an organization not subject to the Phoenix pay system (private or public sector)

What you’ll need to provide

You will need to submit Annex I of the claims form and provide documentation (as applicable) that demonstrates that the resignation was directly attributable to loss of income leading to financial hardship

Documentation can include:

- emails

- records of discussions from

- managers

- human resources

- any other stakeholder from the date(s) of your pay issues to the date of your resignation

Documentation must include:

- an explanation of pay issues

- proof of hire with date in public service

- proof of resignation with date

- proof of request for Employment Insurance and payment received from Employment Insurance (if applicable)

- proof of hire in an organization not subject to the Phoenix pay system

- proof of salary rate on date of hire and duration of employment

- proof of financial hardship - documents demonstrating financial hardship could include, but are not limited to:

- mortgage statement

- lease or rental agreement

- property tax assessment and/or condo fees

- loan statements

- utility statements

- bank statements (most recent three months)

- investment statements

- credit card statements

- insurance (for example, auto, home, life) statements

Mental anguish

Protect your mental health

We recognize that recounting your Phoenix experiences and the impact it has had on you during this claims process can be difficult and could trigger mental anguish or trauma. A number of resources are available to support you through this process. They include:

- Employee Assistance Program

- eMentalHealth.ca

- Mental health support: get help

- Mental health for public servants: Protect your mental health

Type of claim

You suffered mental anguish or trauma caused in whole or in part by pay issues attributed to the Phoenix pay system, which interfered with your ability, to a profound degree, to lead a normal life.

Examples of mental anguish or trauma:

- You developed a severe and lasting mental illness, such as depression

- You attempted suicide

- You were hospitalized for an extended period

- You took medical retirement

- You became homeless

What you can claim

- Claims in respect of mental anguish or trauma*, which interfered with the ability of the employee, to a profound degree, to lead a normal life, caused in whole or in part by the Phoenix pay system.

- *To demonstrate mental anguish or trauma the employee must show that they suffered a prolonged and serious disturbance that goes beyond the normal distress, annoyance, and anxiety suffered in the circumstances.

- You can claim monetary compensation and reimbursement of relevant expenses.

- The threshold of $1,500 applies to these claims. The threshold will be applied once the claim is assessed and resulting damages are calculated. If the claim does not meet the threshold, the calculation will be explained to the claimant.

Example: Suffered from depression

Gilles, an EX-01, did not receive his regular pay for 8 pay periods between July and October 2016, and received only a portion of his pay between October 2016 and March 2017. The stress of the financial hardship he experienced caused him to develop severe depression, for which he was hospitalized for several weeks. His relationship with his family was impacted, resulting in his marriage ending in divorce. Gilles continues to take medication and receive counselling for his depression. Gilles’s depression rendered him unable to work for a period of six months. He had enough sick leave to cover the full period.

Gilles could be entitled to reimbursement of his sick leave for a period of six months and monetary compensation for the mental distress he has suffered. The amount of compensation would be determined by the level and duration of impact the pay issues have had on his ability to lead a normal life.

Is Gilles eligible to file this type of claim? Yes.

- As an EX-01, he is part of the identified unrepresented groups that are also able to make claims under a Phoenix Damages Agreement.

- His regular pay was inaccurate and not paid on time.

- His pay issues interfered to a profound degree with his ability to lead a normal life.

Note that his compensation for financial loss must be over the $1,500-threshold required for this type of claim.

What you’ll need to provide

You will need to submit Annex J of the claims form, and provide documentation (as applicable):

- showing a chronology of events, with dates, that led to your mental anguish or trauma which demonstrate how your pay issues related to the Phoenix Pay System interfered to a profound degree with your ability to lead a normal life

- evidence of your mental anguish, for example:

- A diagnostic from a health care professional is required for a mental illness or mental health disorder, medical certificates

- Documentation may also include emails to manager, personal attestation, sick leave records and any other applicable documents

Other personal or financial hardship

Type of claim

You experienced personal and financial hardships similar to, but other than, those previously listed, which

- resulted in comparable personal hardship or impact as a result of issues directly attributable to the Phoenix pay system, and

- are not covered under the types of claims already listed.

What you can claim

- Claims with respect to other damages similar to but other than those previously listed which resulted in comparable personal hardship or impact caused by Phoenix pay issues.

- The threshold of $1,500 applies to these claims.

What you’ll need to provide

You will need to submit Annex K of the claims form, and provide documentation that shows:

- a chronology of events (emails, records of discussions with human resources or managers and any other stakeholder, financial documents, medical evidence) from the date(s) of pay issues and the date of the damage encountered

- a correlation between your Phoenix pay issues and “other damage” that is fully supported by timelines, amounts and documents

Important – For all types of claims

- Outstanding pay issues related to the Phoenix pay system cannot be addressed through a claims process. If you have issues with your pay, follow the existing process to report a problem.

- Processing times may take longer given the complex nature of these types of claims.

- Filing a claim will not impact your pay or your pension payment since compensation for the claim will not be processed through the Phoenix pay system.

- You are encouraged to bundle your items as much as possible into one submission to ensure you reach the $1,500-threshold and to avoid unnecessary delays or increased paperwork.

- Ensure all supporting documentation is submitted with your claim form. If information is unclear or missing, we will contact you.

- Personal attestations will be subject to further verification as required.

Where damage compensation is based on salary, claim payments will be calculated using the last rate of pay shown in the Phoenix pay system at the time your claim is processed. If the rate of pay used to determine your claim amount is incorrect, please contact the Claims Office with supporting documentation (for example, a letter of offer) to confirm your rate of pay. The Claims Office will reassess your claim and advise you of your new claim amount. If you have any outstanding pay increases that are owed to you, you can submit a claim now, or you have the option to wait until the increases have been processed in Phoenix and paid out before submitting your claim.

How to submit a claim

There is no deadline for submitting a claim.

Before you begin

- Familiarize yourself with the appropriate Phoenix Damages Agreement

- Make sure you are eligible.

- Determine the correct type(s) of Claim(s) to submit.

- Consider whether the total damages payment you are seeking will meet the required threshold of $1500.

- Ensure you have all required documentation specific to each claim ready to submit.

If you need support

- Should you have questions concerning the claims process, you can contact the Claims Office.

Pay issues

Do not submit a claim if you are seeking clarification or follow-up on a pay issue. If you have issues with your pay, follow existing processes to report a problem. The claims process is to seek damages for personal or financial hardship incurred due to issues to your pay caused by the Phoenix Pay system.

Submit your claim

Privacy notice statement

The personal information requested in this form is collected under the authority of the Financial Administration Act. The information submitted via this form will be combined with pay information in a database of pay information held within the Treasury Board of Canada Secretariat (TBS) in order to:

- determine eligibility

- assess your payment amount in accordance with the Damages Agreement

Refusal to provide the requested personal information will result in TBS not being able to process the claim. The information you provide will be validated against a database of pay information held within TBS in order to:

- confirm eligibility

- calculate recommended payments based on claim information

If your claim is accepted and a payment is issued to you, your Social Insurance Number (SIN) will be obtained from the Public Services and Procurement Canada (PSPC) database of pay information in order to issue you a T4 and/or RL-1 tax slip and will be shared with Canada Revenue Agency and/or Revenu Québec for income tax purposes. The Personal information you provide is being collected by the TBS Claims Office and may be shared with PSPC and the last federal organization of employment for that organization to issue payment. Personal information will be protected, used and disclosed in accordance with the Privacy Act and as described in Personal Information Bank TBS PCE 742 (Claims and Compensation for damages related to the Phoenix Pay System) and in Personal Information Bank PSU 931 (Accounts Payable). Your information may also be used or disclosed for financial reporting and program evaluation. Under the Privacy Act, individuals have a right to access and correct their personal information. If you wish to avail yourself of these rights or require clarification about this privacy notice statement, please contact the TBS Access to Information and Privacy Coordinator by email at atip.aiprp@tbs-sct.gc.ca. If you are not satisfied with the response to your privacy concern, you may wish to communicate with the Office of the Privacy Commissioner by telephone at 1-800-282-1376.

Claims for compensation for severe impacts can be submitted two ways:

- online, or

- by mail, by completing the applicable claims form(s) (PDF)

Submit Online

Submit by mail

To submit a new claim:

- Download the mandatory Claim Form (PDF) and complete Sections 1 and 2 (Claimant Information and Type of Claim).

- Download and complete the Annex for each area of compensation (type of claim) you have selected in Section 2 of the mandatory Claim Form.

To update an existing claim:

- Download the mandatory Claim Form (PDF) and complete Sections 1 and 2 (Claimant Information and Type of Claim). In Section 2, select only the new area(s) of compensation (Type of Claim) you wish to add to your existing claim.

- Download and complete only the Annex(es) for the new area(s) of compensation you have selected in Section 2 of the mandatory Claim Form.

Please make copies of your claim documents as they will not be returned to you.

You may submit your claim by mail or courier. Registered mail or courier services are recommended as they provide confirmation your information arrived safely.

Send your completed claim form, the relevant annexes and supporting documents to the following address:

Treasury Board of Canada Secretariat

Attention: TBS Claims Office

90 Elgin St., Ottawa ON

K1A 0R5

After you submit a claim

Check the status of your claim.

We will review each claim carefully against the criteria that have been established between the signatories of the Memorandum of Agreement (MOA) to determine the appropriate entitlement.

After your claim has been processed, you will be contacted and provided with a decision letter related to your claim. Should your claim be approved, in full or in part, you will receive information about:

- the amount of the payment

- the calculation of the payment

- any source deductions that apply

- details regarding any leave entitlements to be recredited to you, if applicable

The decision letter will also ask you to sign and return a release form, which is required to process the payment and/or leave. Payment is then issued by your organization.

Please note that some claims for severe impacts are taxable. If you receive a taxable payment, the Treasury Board of Canada Secretariat (address: 90 Elgin, Ottawa, Ontario) will send you tax slips in February of the following year to submit with your income tax return.

If you would like more information about the decision letter we encourage you to contact us.

Accelerated Adjudication process

Should your claim be denied (in full or in part), you may also contact your bargaining agent about the options available to you, including referring the decision to the Federal Public Service Labour Relations and Employment Board.

Unrepresented and excluded employees may be eligible to file an application for judicial review in the Federal Court.

Learn more about the accelerated adjudication processes.