Employment and Social Development Canada’s 2024-25 Departmental results report

On this page

- At a glance

- From the Minister

- Service excellence highlights

- Results - what we achieved

- Core responsibility 1: Social development

- Core responsibility 2: Pensions and benefits

- Core responsibility 3: Learning, skills development and employment

- Core responsibility 4: Working conditions and workplace relations

- Core responsibility 5: Information delivery and services for other government departments

- Internal services

- Overall risks and mitigation strategies

- Spending and human resources

- Supplementary information tables

- Federal tax expenditures

- Corporate information

- Definitions

Alternate formats

Large print, braille, MP3 (audio), e-text and DAISY formats are available on demand by ordering online or calling 1 800 O-Canada (1-800-622-6232). If you use a teletypewriter (TTY), call 1-800-926-9105.

List of tables

- Table 1.1

- Table 1.2

- Table 1.3

- Table 1.4

- Table 1.5

- Table 2.1

- Table 2.2

- Table 2.3

- Table 2.4

- Table 3.1

- Table 3.2

- Table 3.3

- Table 3.4

- Table 3.5

- Table 3.6

- Table 3.7

- Table 4.1

- Table 4.2

- Table 4.3

- Table 4.4

- Table 4.5

- Table 5.1

- Table 5.2

- Table 5.3

- Table 6.1

- Table 6.2

- Table 7.1

- Table 7.2

- Table 7.3

- Table 7.4

- Table 7.5

- Table 7.6

- Table 7.7

- Table 7.8

- Table 7.9

- Table 7.10

- Table 7.11

At a glance

This departmental results report details Employment and Social Development Canada's actual accomplishments against the plans, priorities and expected results outlined in its 2024-25 Departmental Plan.

Key priorities

Employment and Social Development Canada is focused on making life more affordable for Canadians, growing a resilient and green economy, and making Canada more inclusive. We're also focused on service delivery excellence as we continue to meet the needs of Canadians in both official languages. We identified these key priorities for 2024-25:

- Making child care more affordable by reducing fees for regulated child care to an average of $10-a-day and creating 250,000 new regulated child care spaces by March 2026.

- Ensuring Indigenous children have access to a culturally appropriate Indigenous Early Learning and Child Care system that meets the needs of Indigenous families wherever they live by collaborating with First Nations, Inuit and Métis Nation governments and organizations.

- Fighting anti-Black racism and improving social and economic outcomes for Black communities in Canada by supporting initiatives that help organizations with these aims.

- Supporting the development of green jobs which will contribute to Canada's path to a net-zero emissions and climate resilient future. This will be done by launching a new sustainable jobs training funding stream that will fund projects led by unions to provide green skills training for trades workers.

- Assisting Canadian employers facing labour shortages through the Temporary Foreign Worker Program, allowing temporary hiring when Canadians and permanent residents are not available

- Introducing a new 15-week shareable Employment Insurance adoption benefit as announced in the 2023 Fall Economic Statement. The benefit is expected to provide Canadian families with additional time and flexibility as they welcome a new child in their home through adoption or surrogacy.

- Continuing to provide dispute resolution and dispute prevention assistance to unions and employers under the jurisdiction of the Canada Labour Code.

- Continuing to meet with representatives from provinces and territories to discuss issues of mutual interest including occupational health and safety as well as labour standards

- Continuing to address employee misclassification in the federally regulated road transportation sector by actively engaging with industry, conducting education sessions and undertaking enforcement actions under the Canada Labour Code.

- Continuing to explore ways to amend the Canada Labour Code to improve job protections for federally regulated gig workers by strengthening prohibitions against employee misclassification.

- Amended regulations to support the Pay Equity Commissioner's ability to address non-compliance with the Pay Equity Act and Pay Equity Regulations.

- Working to advance the Disability Inclusion Action Plan to reduce poverty and support the financial security of working-age persons with disabilities. This will include the development of the Canada Disability Benefit to provide direct monthly payments to eligible individuals.

- Placing Canadians at the core of how we design and deliver services, with emphasis on delivering services where and when Canadians need them. We will do this while making continuous improvements to service delivery. This will include the migration of Old Age Security (OAS) to the new common benefits platform as part of the Benefits Delivery Modernization (BDM), one of the largest IT modernization initiatives in the GC.

- Benefits Delivery Modernization (BDM) is the largest IT transformation initiative ever undertaken by the Government of Canada with the goal of modernizing the technology that administers Old Age Security (OAS), Employment Insurance (EI) and Canada Pension Plan (CPP).

- BDM is being implemented through three overlapping tranches that will see the Old Age Security, Employment Insurance and the Canada Pension Plan Programs onboarded to a common benefits delivery platform.

- The Benefits Delivery Modernization (BDM) Programme is introducing modern applications and incorporating leading-edge technologies to enable the delivery of Old Age Security (OAS) benefits initially, followed by Employment Insurance (EI) and then Canada Pension Plan (CPP). BDM is on track to modernize OAS, EI, and CPP over three phases, with an expected completion date of 2030-31.

- Based on other transformational initiatives in the public sector, it is estimated that BDM could potentially support improvement in ESDC efficiencies in the range of 20-30%.

To achieve our goals, we continued to improve our service delivery technology so Canadians can access our benefits and programs in an easy and secure manner. We also continued to develop products to improve user experience so Canadians can have reliable access to our services for life events, regardless of where they live.

Highlights for Employment and Social Development Canada in 2024-25

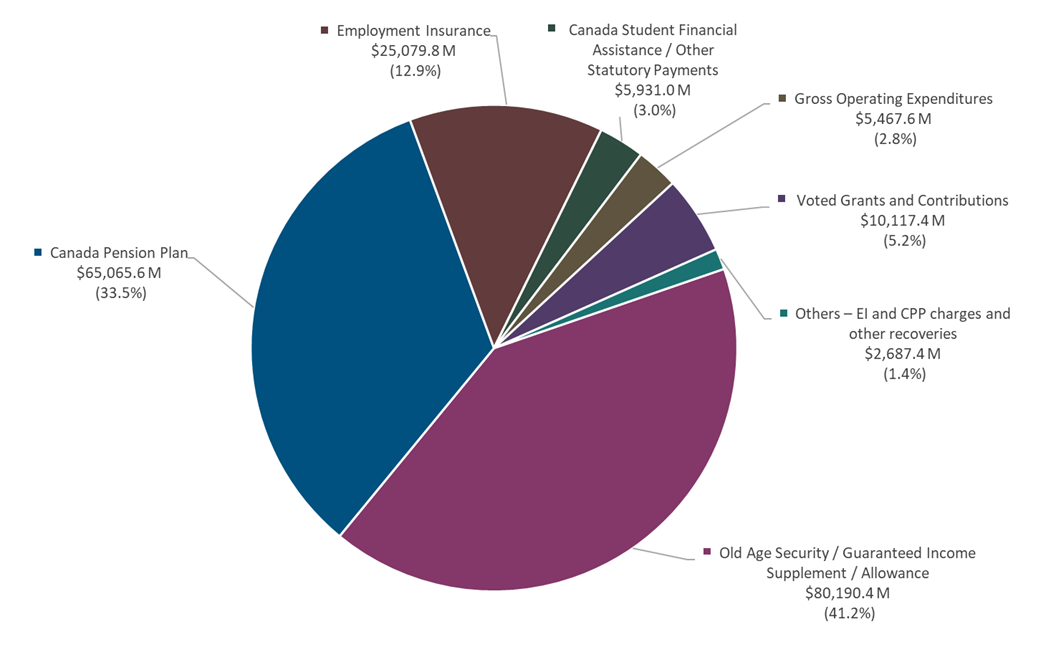

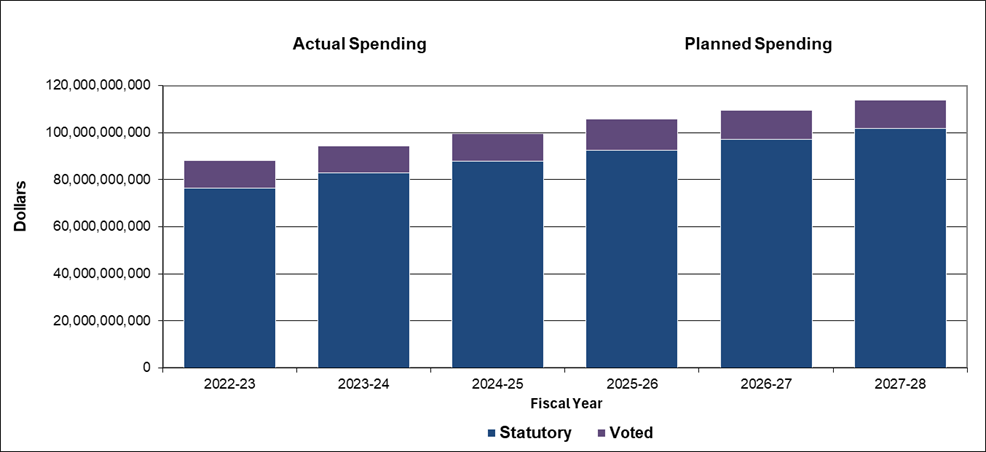

- Total gross actual spending (including internal services): $194.5 billion

- Total full-time equivalent staff (including internal services): 38,219

For complete information on Employment and Social Development Canada's total spending and human resources, read the Spending and human resources section of its full departmental results report.

Summary of results

The following provides a summary of the results the department achieved in 2024-25 under its main areas of activity, called "core responsibilities."

Core responsibility 1: Social development

Actual gross spending: $8,018,859,343

Actual net spending: $8,018,859,343

Actual full-time equivalent staff: 658

We continued working with provinces and territories to expand access to affordable, high-quality, flexible, and inclusive early learning and child care. This will help to reduce fees for regulated child care towards an average of $10-a-day and to create 250,000 new regulated child care spaces by March 2026.

The government completed the regulatory process for the Canada Disability Benefit, a new monthly benefit for low-income working-age persons with disabilities. This benefit is a commitment and cornerstone of Canada's Disability Inclusion Action Plan (DIAP), which is a blueprint for change to make Canada more inclusive for persons with disabilities.

We worked closely with provinces, territories, and Indigenous partners to begin implementing the National School Food Program and outlines a set of guiding principles, clear objectives, and a long-term vision. This is supported by a federal investment of $1 billion over five years.

The Supporting Black Canadian Communities Initiative (SBCCI) continued to help increase social inclusion, reduce systemic barriers, and strengthen social cohesion within Canada by advancing targeted measures for Black communities. Through its Capacity Building stream, the SBCCI has partnered with four Black-led organizations across the country to build foundational capacity in smaller Black-led and Black-serving, Black-focused (B3) community-based not-for-profit organizations.

For more information on Employment and Social Development Canada's Social development read the 'Results - what we achieved" section of its departmental results report.

Core responsibility 2: Pensions and benefits

Actual gross spending: $147,165,165,946

Actual net spending: $81,688,146,091

Actual full-time equivalent staff: 8,446

The Canada Pension Plan (CPP) enhancement was completed in January 2025. The changes will boost the maximum CPP retirement pension by more than 50% for today's youngest workers, and raise the amounts provided by the CPP's disability pension and survivor's pension.

We improved the Canada Pension Plan - Disability program by expanding our quality assurance efforts to include studies on applications related to terminal illnesses and grave medical conditions, as well as annual reviews of both initial and reconsideration decisions. We also launched a pilot project to test improvements to return-to-work supports for its beneficiaries who attempt to work.

We also successfully migrated the Old Age Security legacy system to the new Benefits Delivery Modernization platform. The new system provides a better experience, streamlining how Canadians apply for benefits as well as update their personal information and life events.

For more information on Employment and Social Development Canada's Pensions and benefits read the 'Results - what we achieved" section of its departmental results report.

Core responsibility 3: Learning, skills development and employment

Actual gross spending: $34,552,944,563

Actual net spending: $7,905,833,330

Actual full-time equivalent staff: 16,457

In 2024-2025, we increased Canada Student Grants by 40%, providing up to $4,200 for full-time students and $2,520 for part-time students. We also increased the interest-free Canada Student Loan limit from $210 to $300 per week, supporting about 297,000 students.

We launched the Sustainable Jobs Training Fund to support workers in gaining the skills needed for employment in the low-carbon economy.

Through the bilateral Labour Market Development Agreements and the Workforce Development Agreements, we helped reduce employment inequalities by providing Canadians with much-needed skills training and employment assistance.

In summer and fall 2024, we implemented measures to address rising unemployment and decreasing job vacancies, aiming to reduce reliance on the Temporary Foreign Worker (TFW) Program. These changes led to a 50% reduction in LMIA application received and encouraged employers to seek more domestic workers.

The temporary one-year EI measure offering up to four additional weeks of regular benefits to eligible seasonal workers in 13 EI regions ended as scheduled on September 7, 2024. However, a separate temporary measure-providing up to five additional weeks of regular benefits for seasonal workers in the same regions-was extended through Budget 2024 and will remain in place until October 24, 2026.

For more information on Employment and Social Development Canada's Learning, skills development and employment read the Results - what we achieved section of its departmental results report.

Core responsibility 4: Working conditions and workplace relations

Actual gross spending: $206,974,970

Actual net spending: $205,888,660

Actual full-time equivalent staff: 822

In 2024, new legislation amending the Canada Labour Code was passed to improve leave for federally regulated private sector employees experiencing pregnancy loss.

We updated the Occupational Health and Safety Regulations to enhance worker protection and respond to societal changes. More specifically, initiatives allow employers to include all-gender toilets in their efforts to meet requirements for providing washroom facilities.

We took action against employers in the road transportation industry who are misclassifying employees by strengthening the rules on misclassification in the Canada Labour Code.

For more information on Employment and Social Development Canada's Working conditions and workplace relations read the Results - what we achieved section of its departmental results report.

Core responsibility 5: Information delivery and services for other government departments

Actual gross spending: $603,214,600

Actual net spending: $603,214,600

Actual full-time equivalent staff: 5,462

We reviewed the language designation of all Service Canada offices to better support the Official Language Minority Communities across Canada. This was done as part of the Official Languages Regulations Reapplication Exercise, which requires federal institutions to review the language designation of their offices every 10 years.

As part of our commitment to more effectively reach people facing linguistic barriers, we piloted international and Indigenous language interpretation services on 1 800 O-Canada. We learned there is a daily demand for interpretation for many languages. As a result, we will continue offering this service.

We also expanded our Community Outreach and Liaison Service (COLS), which helps us reach populations facing barriers to accessing services and benefits (e.g. geographical, cultural or other), by meeting them where they live or spend time. Last year, we reached 21,900 community organizations that supported vulnerable populations, including 737 organizations in Indigenous communities.

In collaboration with Immigration, Refugees and Citizenship Canada (IRCC), we completed the Passport Program Modernization Initiative (PPMI) in August 2024. This initiative introduced technology that helps with automatic passport renewals as well as streamlined processes.

On behalf of Health Canada, we led the design, build, and successful implementation of the Canadian Dental Care Plan (CDCP) service delivery model at Service Canada for application intake and eligibility verification.

For more information on Employment and Social Development Canada's Information delivery and services for other government departments read the Results - what we achieved section of its departmental results report.

From the Minister

Building a fairer, stronger Canada

The 2024-2025 Departmental Results Report for Employment and Social Development Canada (ESDC) highlights the Department's key role in supporting Canadians, strengthening communities, and helping people thrive - no matter where they are or where they come from.

Over the past year, ESDC has continued to play a central role in empowering Canadians' success in a rapidly changing economy. From helping young people as they plan their futures, to building more inclusive workplaces, to welcoming internationally trained professionals into the labour market - our work is about making sure nobody is left behind.

Investing in inclusion and opportunity

Everyone deserves a fair and equal chance to succeed. Through the Disability Inclusion Action Plan and the new Canada Disability Benefit, we are taking steps toward greater equity for persons with disabilities. Families across the country are benefiting from more affordable and inclusive child care, allowing parents to have a choice and saving families hundreds of dollars. Indigenous-led early learning, and national school food initiatives also ensure that every child gets the strong start they deserve. ESDC continues to strengthen Black communities and address systemic barriers to full participation. Because when all communities succeed, Canada also succeeds.

Driving progress

The progress made reflects the dedication and commitment of Canada's public service. Their contribution ensures that ESDC continues to deliver programs and services that support Canadians every day.

Together, we are building the strongest economy in the G7 - one where everyone can contribute, share in our collective success, and move forward with confidence and opportunity.

The Honourable Patty Hajdu

Minister of Jobs and Families and Minister responsible for the Federal Economic Development Agency for Northern Ontario

Service excellence highlights

The department was dedicated to providing Canadians with high quality, timely, and accessible services. We improved services for Canadians and other clients in 3 main areas:

1. Modernizing our information technology (IT)

Transition to Cúram

On March 17, 2025, we moved all 7.4 million Old Age Security (OAS) recipients to the new Common Benefit Delivery platform (Cúram). Since that move, payments have been made accurately and on-time. OAS clients can also now upload documents instead of mailing or hand delivering to a Service Canada office, as well as update their personal information and life events, and track application status.

The successful transition of OAS to the Cúram platform was a major benchmark in modernizing benefit delivery, and sets the stage for:

- Employment Insurance (EI) to begin transitioning cohort by cohort in 2025-2026

- Canada Pension Plan (CPP) to follow in 2026-2027

Once complete, Canadians will benefit from a single point of access for all three programs, resulting in more streamlined service delivery and an improved client experience.

AI integration and service enhancements

We established the technology and governance needed to test AI solutions to improve client services. These efforts are helping people to make applying and receiving benefits, faster, and more efficient-while ensuring the protection of personal information.

Specifically, we:

- Set up AI governance to ensure solutions are safe and reliable

- Launched internal AI tools to help employees deliver better service

- Assist-Me (ESDC's first generative AI-powered chatbot) tool in OAS on Curam, provides accurate, real-time answers to over 90% of staff enquiries, helping agents deliver services effectively and focus on meaningful support; and

- Tested a new system that allows clients to update their information, such as their address, just once for all their benefits

Last year, we also released an early version of the Employment Insurance Benefits Estimator. This digital tool allows clients to estimate their EI benefits before applying by answering a few questions anonymously. We continued to refine the estimator based on direct client feedback and system data.

Accessibility and contact centre improvements

To improve service quality, accessibility, and responsiveness for vulnerable clients, we enhanced accessibility and responsiveness across key service channels, by:

- Upgrading Employer Contact Centre (ECC), Employment Insurance (EI) and teletypewriter (TTY) services to improve client support;

- Introducing a modernized TTY solution in the Canadian Dental Care Plan (CDCP) call centre, enabling real-time responses for TTY users; and

- Launching dedicated toll-free numbers for Video Relay Service (VRS) providers, offering prioritized access for clients with speech and hearing impairments.

We also began work to replace the aging 1 800 O-Canada contact centre platform. The new system (expected to be implemented by 2027) will:

- Be fully supported and scalable; and

- Offer new capabilities options that can be leveraged without additional procurement to modernize and improve client service delivery in the future as required

Digital access and security

We continued to work with federal and provincial partners to help Canadians access federal services online using their provincial digital credentials, and to feel confident doing so.

We helped clients securely access their online accounts by maintaining two key tools: Simplified Digital Identity Validation (extending the contract) and Multifactor Authentication (enhancements).

Canada.ca Enhancements

We continued to improve accessibility on Canada.ca, ensuring it meets Web Content Accessibility Guidelines 2.1 standards. We focused on using plain language, optimizing search, and managing content to comply with accessibility guidelines and the Canada.ca Content Style Guide. We also introduced innovative solutions to automate wait times for Service Canada and Passport offices, making it easier for Canadians to use our services.

2. Improving services for Canadians

Client-Centered Service Design

Client experience remained central to how we design and deliver services. To make our content easier to understand and online navigation more efficient, we:

- Worked with users to co-design and improve services in line with Government of Canada Digital Standards;

- Launched two life event hubs using journey labs approaches, including "What to do when someone dies" and "Welcoming a child" to improve services for Canadians;

- Made testing with real clients a fundamental part of our service design process for initiatives like the Canada Disability Benefit and the Canadian Dental Care Benefit;

- Continued to incorporate client feedback to ensure products such as forms, letters, and web content were clear and easy to use; and

- Applied human-centered design to remove service barriers.

Last year, we began collaborating with community organizations, such as the March of Dimes, to gather feedback from persons with disabilities on the usability of our client-facing products. We engaged diverse audiences to ensure our products are user-friendly and accessible.

Feedback and Performance Monitoring

We strengthened feedback mechanisms to better understand client needs and service barriers:

- The Office for Client Satisfaction (OCS) received 5,959 submissions, offering insights into service challenges and emerging issues;

- The Client Experience (CX) Survey continued to measure ease, effectiveness, emotion, and satisfaction across programs;

- Feedback questionnaires were offered across multiple service channels, including Service Canada Centres, 1 800 O-Canada, MSCA, Canada.ca, and eServiceCanada. This feedback was used to identify insights such as the impact of specific barriers to vulnerable groups. Two such examples included the impact of Plexiglas for hard of hearing clients and the need to provide the digitally vulnerable with more Citizen Access Workstation Services (CAWS) support. Implementation is underway for both recommendations.

Digital Insights and Web Usability

Last year, 59 departments used our analytics tool to gather insights from 1.348 billion visits to Canada.ca, and over 600,000 visitors responded to our Canada.ca Task Success Survey. This data helped departments better understand visitors' use of the website and measure how well it is meeting client needs.

Digitizing death registration

We partnered with several provinces to digitize the death registration process making it faster to inform vital statistics organizations. These efforts help reduce overpayments and the need for recoveries and investigations. To date:

- Ontario and Saskatchewan have finished building their systems and are working with users to start sharing information electronically;

- Nova Scotia and New Brunswick plan to finish this work by the end of 2025; and

- Manitoba and PEI plan to complete this work by fall 2026.

3. Removing barriers

Outreach and Client Support

We worked with the Canada Revenue Agency (CRA) and Statistics Canada to help hard-to-reach clients access government benefit programs and services. This coordinated outreach promoted a smoother client service experience, especially for those who require a high level of support, through a warm transfer (directly transferring the request to the correct telephone service) partnership between the CRA's Client Assistance Referral and Enquiry Service (CARES) and Service Canada's Outreach Support Centre (OSC).

Through the Service Referral Initiative (SRI), we continued to work with community organizations to identify at-risk and vulnerable individuals who may be eligible for federal services and benefits and referred them directly to a Service Canada representative. In 2024-2025, Service Canada:

- Onboarded 392 organizations, bringing the total to 837 with access to SRI support;

- Received 1,830 referral requests; and

- Received 92 warm transfers from the United Way's 211-telephone service.

Grants and Contributions

The Grant and Contributions Notification Service continued to promote transparency and provide Canadians with funding updates. Last year, the service sent automated updates to over 24,000 subscribers to promote nine calls for proposals opportunities. We also launched a social media campaign across multiple platforms, including Facebook and Instagram, to encourage registration for this service.

We added new search filters to our Grants and Contribution funding webpage to help users find opportunities that match their needs. On average, 6,700 users visited this page each month.

We also made efforts to increase use of our Grants and Contributions Online Services (GCOS). These included:

- Doing client feedback surveys;

- Improving processes, web content and instructions for users;

- Promoting GCOS at regular calls for proposal information and engagement sessions; and

- Social media initiatives including "how to" and testimonial videos.

As a result, GCOS saw new users increase by over 30% and applications increase by 18% from the previous fiscal year. This increase in digital use led to faster processing times and a better user experience.

Removing Barriers to Program Access (RBPA)

As part of RBPA, we completed a multi-year research initiative to improve access for various groups, including seniors, persons with disabilities, and youth. The research indicated that organizations' ability to access funding is impacted by several factors, including:

- Organizational capacity - organizations with limited or unstable financial and human resources cannot devote a significant amount of time and resources into seeking funding;

- Communication challenges - meaning a lack of responses and poor back-and-forth communication between organizations and the program; and

- Complexity of programs / funding applications: increased complexity was a barrier to receiving funding.

As a result of this research, we simplified application guidelines and procedures, revised eligibility criteria, and improved communications, leading to better help for many organizations.

Youth Digital Gateway (YDG)

The Youth Digital Gateway (YDG) project concluded on March 31, 2025. It finished on time, on budget, and achieved planned objectives.

Co-designed with youth and stakeholders, the platform improves access to Government of Canada resources for employment, education, and skill development. It makes it easier to find programs and services, facilitates employer engagement, and fosters collaboration among youth-serving organizations (especially benefitting the most disadvantaged youth).

Features include:

- Geo-location of support services;

- Integration with 211.ca;

- Youth-friendly, standardized content; and,

- An Organization Platform to foster collaboration among funded groups.

The platform increased engagement, especially among organizations supporting youth facing employment barriers, by updating its content and design. This also promoted digital inclusion and improved the public's view of youth employment programs.

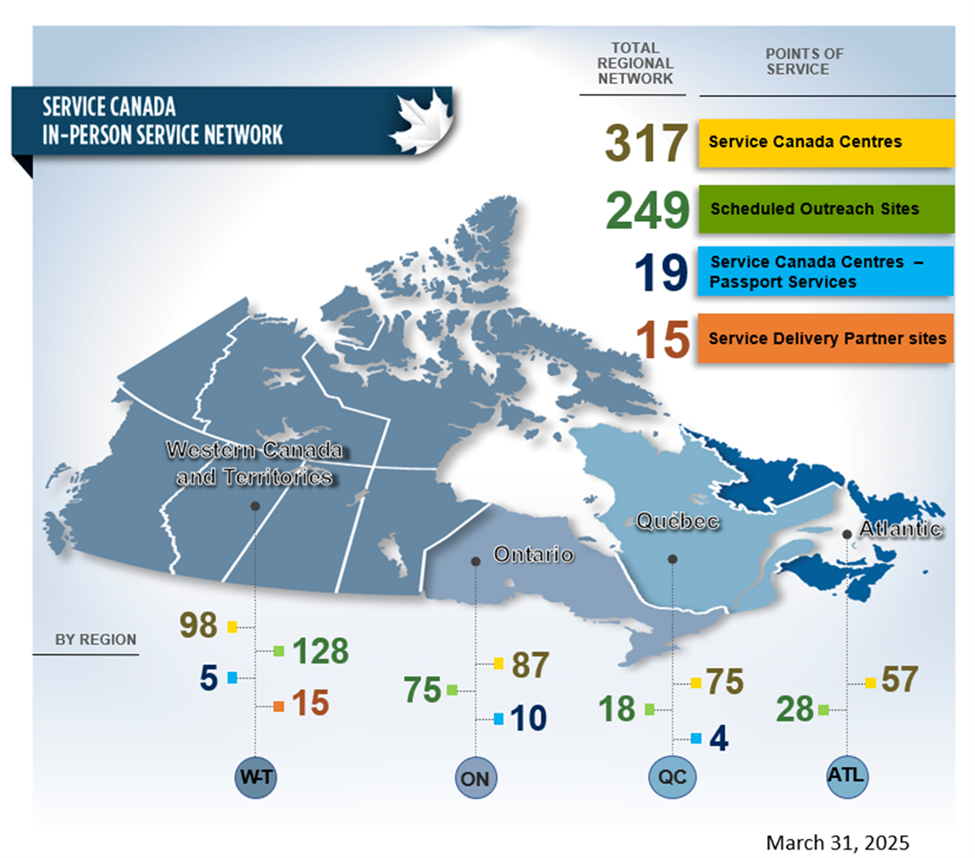

Service Canada Regional Service Delivery

Through partnerships with the provinces, territories, municipalities, and communities, our regional Service Canada offices delivered an array of essential services from hundreds of locations across the country. These offices continued reaching out and responding to clients' changing needs. Here are a few highlights from 2024-2025:

Western Canada and Territories Region

Improving passport production

A third Passport Production Centre opened in Surrey, BC, on October 30, 2024. This increased processing capacity, ensured service standards, and improved access for Canadians in remote and northern areas. Employees processed 262,995 passports and printed 345,531 passports, and employees in the call centre answered 33,166 calls by the end of the fiscal year.

Working with Indigenous partners

We participated in engagement sessions with Indigenous Skills and Employment Training (ISET) agreement holders, bringing together government, industry and Indigenous partners to collaborate on economic development and program delivery.

We supported forums, conferences, and network meetings, where we shared information on ISET program flexibilities, addressed emergency needs, supported client and daycare response plans, and identified strategic planning supports.

We also updated the ISET flexibilities guide-particularly regarding tariffs-and continue to support regular discussions to improve program delivery and emergency response.

Through these regular communications, we were able to:

- Enhance program holders' understanding of the terms and conditions of the ISET program;

- Increase capacity in case and data management through individualized training sessions; and,

- Provide a resource to support increased capacity in financial and results reporting.

These efforts improved employment outcomes for Indigenous peoples and communities.

Ontario Region

Providing outreach services

The Community Outreach and Liaison Team (COLS) helped asylum seekers by working with different government partners. These outreach services provided timely information about SIN services and the Job Bank.

Strengthened relationship with Indigenous Peoples

We made over 60 on-site visits to support and strengthen relationships and services with Indigenous clients and agreement holders. We met with Indigenous Service Delivery Partners through 55 visits to remote and urban First Nation, Inuit, and Metis communities across Ontario. Additionally, we joined 6 Indigenous conferences and events to build connections and understanding.

We supported reconciliation by hosting three engagement sessions with Indigenous Skills and Employment Training (ISET) Program Agreement Holders to address barriers to government services. We hosted two co-developed ISET Meetings and one Skills and Partnership Fund (SPF) Network Meeting to strengthen collaboration with Indigenous Peoples.

Support for employers

We worked with Ontario's Ministry of Labour, Immigration, Training and Skills Department (MLITSD) to support Canadian businesses affected by the U.S. tariff measures on Canadian goods. We coordinated joint outreach services to impacted employers, informed them about training options while receiving Employment Insurance Work-Sharing benefits, and coordinated support for affected workers.

We also explored ways to strengthen existing collaborative efforts to provide timely support to employers and employees affected by business closures and layoffs. Two key initiatives were:

- Joint Rapid Response Action Plan (JRRAP), which offers quick support to workers and employers affected by significant layoffs or closures, tailored to the specific labour market and socio-economic conditions. It involves coordination among federal and provincial governments, employers, unions, and community partners; and

- Rapid Re-employment and Training Service (RRTS) which is an initiative by the MLITSD to support workers who have been laid off, particularly large-scale layoffs.

Client focused

We upgraded six offices for accessibility and inclusivity based on the piloted enhancements introduced at the Toronto-North York Service Canada Centre (a flagship site where we test innovative, client-centric service design for potential expansion). These offices offer larger, more accessible spaces and a broader range of services. Features include:

- Accessible infrastructure: height-adjustable desks, fully accessible washrooms, door actuators, and mobility-friendly lunchrooms.

- Navigation and communication aids: tactile flooring, Bluetooth wayfinder beacons (select sites), and interpretation services (e.g., video remote sign language, telephone translation).

- Client support tools: accessible workstations, signature guides for vision impairments, and mobile workstations for queue assistance.

Improving bilingual service

In 2024-2025, we developed a targeted strategy for bilingual entry-level hiring. We engaged 162 external partners-including schools, language centres, and Francophone groups-to support bilingual recruitment and meet official language (OL) requirements.

We consulted with Official Languages (OL) Minority Communities as part of the OL Reapplication Exercise. Based on feedback, the Scarborough Passport office will be designated as bilingual to better serve the local community. This decision considered community size, office accessibility, and location, and supports the maintenance of bilingual services in Service Canada Centres.

Quebec Region

Access to services for homeless and Indigenous clients

In collaboration with the Commission de développement des ressources humaines des Premières Nations du Québec, we organized 14 mobile clinics in Montréal, Chicoutimi and Val-d'Or. These clinics brought together 13 departments and agencies to provide essential services to more than 860 Indigenous and homeless citizens, eliminating the need for travel and streamlining administrative processes.

Support for newcomers

We launched a targeted strategy to facilitate access to services for asylum seekers, focusing on two main areas:

- establishing partnerships with community organizations to expedite the issuance of Social Insurance Numbers (SIN); and

- strengthening coordination between public and community services to support rapid labour market integration.

SIN issuance for newcomers and asylum seekers is accelerated through partnerships with community organizations. We organized mobile clinics in these organizations to quickly issue the SIN as soon as newcomers arrive. We also offer information sessions on available services, including the Job Bank Plus, a platform where asylum seekers can find job offers, training and advice. Our team helps them register on this platform, which increases their visibility and employment opportunities.

Seniors' Transition to Old Age Security

We helped vulnerable seniors transition from provincial social assistance to Old Age Security benefits. This work facilitates access to the services and benefits to which they are entitled, improving their quality of life and social inclusion. In 2024-2025, the service was extended to all of Quebec. Using a personalized approach, Service Canada officers have helped more than 587 seniors, often facing language or literacy barriers, complete their Old Age Security application.

Atlantic Region

Regional Collaboration

In 2024-2025, we strengthened regional collaboration and shared resources within our organization to better support complex temporary foreign worker applications. This allowed us to handle more cases with active Labour Market Impact Assessment (LMIA) suspensions and health and safety concerns, resolve issues faster and improve worker protection.

Improving client service

Over the past year, specially trained Pensions Call Centre officers completed over 12,000 work items and significantly improving client service. This approach made better use of resources and solved more issues on the first try.

Text description of figure 1

- Service Canada Centres:

- Western Canada and Territories: 98

- Ontario: 87

- Québec: 75

- Atlantic: 57

- Total: 317

- Scheduled Outreach Sites:

- Western Canada and Territories: 128

- Ontario: 75

- Québec: 18

- Atlantic: 28

- Total: 249

- Service Canada Centres - Passport Services :

- Western Canada and Territories: 5

- Ontario: 10

- Québec: 4

- Total: 19

- Service Delivery Partner Sites:

- Western Canada and Territories: 15

- Total: 15

Results – what we achieved

Core responsibilities and internal services:

- Core responsibility 1: Social development

- Core responsibility 2: Pensions and benefits

- Core responsibility 3: Learning, skills development and employment

- Core responsibility 4: Working conditions and workplace relations

- Core responsibility 5: Information delivery and services for other government departments

- Internal services

Core responsibility 1: Social development

In this section

- Description

- Quality of life impacts

- Progress on results

- Details on results

- Resources required to achieve results

- Related government priorities

- Program inventory

Description

Increase inclusion and opportunities for Canadians to participate in their communities.

Quality of life impacts

Programs under this core responsibility contribute to several Quality of Life domains and indicators, including:

- Domain - Society (Indicators - Accessible environments, Indigenous languages, Positive perceptions of diversity, Sense of belonging to the local community, Volunteering) through activities that help remove barriers and provide racialized communities, people with disabilities, and other vulnerable groups, such as the elderly and families with children, opportunities to participate in their communities

- Domain - Prosperity (Indicators - Access to early learning and child care, Financial well-being, Protection from income shocks) through activities that increase the availability of affordable child care and support Indigenous groups to provide child care, and reduce poverty

- Domain - Good Governance (Indicator - Confidence in institutions), through activities that focus on the Sustainable Development framework, innovative projects and research that strengthen the programs of the department and the Government of Canada

Progress on results

This section details the department's performance against its targets for each departmental result under Core responsibility 1: Social development.

| Departmental Result Indicator | Target | Date to achieve target | Actual Result |

|---|---|---|---|

| Newly developed partnerships as a percentage of all partnerships developed by recipient organizations to address a range of social issues such as the social inclusion of persons with disabilities, children and families and other vulnerable populations | At least 45% | March 2025 | 2022-23: 61% 2023-24: 72.5% 2024-25: 89% |

| Departmental Result Indicator | Target | Date to achieve target | Actual Results |

|---|---|---|---|

| Number of community spaces and workplaces that are more accessible due to Enabling Accessibility Fund funding | At least 2871 | March 2025 | 2022-23: 1,048 2023-24: 437 2024-25: 425 |

| Departmental Result Indicator | Target | Date to achieve target | Actual Results |

|---|---|---|---|

| Average child care fees for regulated early learning and child care spaces | At most $10-a-day2 | March 2026 | 2022-23: As of March 31, 2023, seven provinces and territories were delivering regulated ELCC at an average of $10-a-day or less. 2023-24: As of March 31, 2023, seven provinces and territories were delivering regulated ELCC at an average of $10-a-day or less. 2024-25: As of March 31, 2023, eight provinces and territories were delivering regulated ELCC at an average of $10-a-day or less. |

| Departmental Result Indicator | Target | Date to achieve target | Actual Results |

|---|---|---|---|

| Number of targets that are being met for the published service standards of Social Development programs | 3 out of 3 | March 2025 | 2022-23: 3 out of 3 2023-24: 2 out of 34 2024-25: 2 out of 3 |

- Notes:

- The target has decreased due to Budget 2021 funding sunsetting in 2022-23. As such, the program only has its base funding of $20.65 million (grants and contributions), which limits the number of projects the program is able to fund.

- As part of the Canada-wide ELCC system, all provinces and territories signed agreements and committed to reduce fees for regulated child care to an average of $10-a-day by March 2026. The governments of Canada and Quebec signed an asymmetrical agreement given Quebec’s well established and preexisting child care system.

- Service standards are published on Transparency - Canada.ca.

- Service Standards were met in most Grants and Contributions programs. Two exceptions were the New Horizons for Seniors (NHSP) and the Social Development Partnerships Program (SDPP) programs where flexibility for clients in some administrative procedures meant the Notification of Funding Decisions Service Standard target was not met.

The Results section of the Infographic for Employment and Social Development Canada on GC Infobase page provides additional information on results and performance related to its program inventory.

Details on results

The following section describes the results for Social development in 2024-25 compared with the planned results set out in Employment and Social Development Canada's departmental plan for the year.

Affordability of early learning and child care (ELCC) is increased

Results achieved

By March 31, 2025, eight provinces and territories (Quebec, Yukon, Nunavut, Newfoundland and Labrador, PEI, Manitoba, Saskatchewan, and the Northwest Territories) offered regulated child care at an average of $10-a-day or less. All others had reduced parent fees by at least 50%. We continued working with provinces and territories to expand access to affordable, high-quality, flexible, and inclusive early learning and child care.

Workforce

In November 2024, federal, provincial and territorial ministers reviewed a draft strategy to strengthen the early learning and child care (ELCC) workforce. They discussed a path forward for working together on common goals to stabilize and support the early learning and child care workforce. By March 31, 2025, eleven provinces and territories had wage grids, top-ups or scales in place for Early Childhood Educators (ECEs). Across Canada, employment among ECEs and Assistants grew by about 2% in the past fiscal year, reaching 263,800 workers.

The National Advisory Council on Early Learning and Child Care continued to convene regularly to provide expert advice to the Government of Canada. The Council engaged with representatives from organizations who provide direct assistance to families from underserved communities, and submitted a What We Heard Report summarizing the main themes from these discussions. The Council also prepared a discussion paper on Expansion of ELCC Spaces in Canada, which highlighted challenges and proposed solutions.

ELCC Innovation Program

Fifteen innovations projects were completed in 2024-25, with the 3 remaining projects expected for completion by March 31, 2026. These projects test new approaches to improve quality, accessibility, affordability, inclusivity, and flexibility-especially for families with unique needs, including Indigenous, low-income, and families from Francophone and Anglophone minority communities.

Official Languages Action Plan

The Training and Capacity Building Initiative for ECEs in Francophone Official Language Minority Communities (OLMCs), led by the Association des collèges et universités de la francophonie canadienne (ACUFC) and funded through the 2018-2023 Action Plan for Official Languages, concluded on July 10, 2024. This initiative increased access to training and professional development by supporting 43 projects delivered by 27 organizations across all provinces and territories, except for Quebec.

Under the 2023-2028 Action Plan for Official Languages, $64.2 million was allocated for two initiatives in Francophone minority communities:

- $14.2 million in renewed funding for ECE training, strengthening skills and promoting the profession while supporting access to quality and inclusive child care programs and services; and

- $50 million to establish a national network of early childhood stakeholders (NECS) that will support the coordination and implementation of specific initiatives for Francophone minority communities across Canada.

Solicited calls were launched for each initiative and funding agreements were put in place with ACUFC and Commission nationale des parents francophones.

ELCC Data and Research

We also continued to support data and research initiatives specific to ELCC, including:

- Collaborating with Statistics Canada on multiple national surveys of the ELCC landscape with data from the third edition of the Canadian Survey on the Provision of Child Care Services (CSPCCS) was released on March 19, 2025;

- 10 research reports on ELCC an IELCC commissioned from Statistics Canada;

- Publications of ELCC and IELCC data and research on the Information Hub;

- Providing grant funding to the United Nations Educational, Scientific and Cultural Organization (UNESCO) to advance work on its early childhood care and education (ECCE) agenda, including publishing the first Global Report on ECCE; and

- Collaborating with Québec and New Brunswick to support an Organization for Economic Co-operation and Development (OECD) survey of the ELCC workforce (Teaching and Learning International Survey - Starting Strong). Initial results are expected in December 2025.

Advancing First Nations ELCC Priorities

In partnership with Indigenous Services Canada (ISC), the Public Health Agency of Canada (PHAC), and Crown-Indigenous Relations and Northern Affairs Canada (CIRNAC), we strengthened over 65 relationships with Indigenous partners to advance ELCC priorities in governance, programs and services, and infrastructure. Highlights include:

- A September 2024 Tripartite Memorandum of Understanding between the First Nations Leadership Council, Canada, and BC committing to work together on initiatives as determined by First Nations; and

- Continued implementation of major infrastructure funding from Budget 2021 to build new Indigenous ELCC centres or replace sites that have outlived their useful life. Also continued to advance funding from Budget 2021 to support urgent repairs and renovations at existing Indigenous ELCC sites; and as of March 31, 2025, over 1,500 projects have received support.

Barriers to accessibility for persons with disabilities are removed

Results achieved

Over the past fiscal year, we made significant strides in implementing the Accessible Canada Act (ACA), focusing on removing barriers and promoting inclusion through data, regulations, and community engagement. We continued to embody the principle of "Nothing Without Us" through engagement with the disability community on key activities.

Standards and Regulations

In Fall 2024, we published proposed draft amendments to the Accessible Canada Regulations which set out potential requirements for digital accessibility (or information and communication technologies, a priority area under the Accessible Canada Act), for consultation in Canada Gazette Part I. Phase 1 would focus on designing digital content (new web pages, new mobile applications and new digital documents) to be accessible from the start and building robust digital accessibility capacity in Canada.

Engagement and Funding

In May 2024, we hosted the third Canadian Congress on Disability Inclusion (CCDI), which brought together over 3,600 participants from across Canada and beyond. Attendees included persons with disabilities, disability organizations, public and private sector representatives, academics, thought leaders, and innovators. The event fostered dialogue, collaboration, and knowledge-sharing on advancing disability inclusion nationwide.

We supported five organizations in producing accessible print materials to reduce barriers for Canadians with print disabilities, helping to ensure equitable access to reading and information.

Through the Disability Benefit Navigation Program, we provided $1 million in funding to eight organizations to deliver interim navigation services, helping persons with disabilities better understand and access the Canada Disability Benefit and related supports.

Enabling Accessibility Fund

We improved safety and accessibility in communities and workplaces by funding a range of projectsFootnote 1, including:

- 9 mid-sized projects (approx. $19.7 million);

- 159 youth-led projects (approx. $1.5 million); and

- 255 small projects (approx. $23 million).

These investments supported the construction and enhancement of accessible spaces and services across the country.

Data, Research, and Measurement

- We continued to implement the Federal Data and Measurement Strategy for Accessibility (2022-2027). We launched the Strategy in 2022 and it covers a 5-year period through 2026-2027;

- We completed and published the third cycle of Public Opinion Research on Accessibility in March 2025. This research focused on the general public's level of awareness of the ACA and explored their experiences with barriers to accessibility, across six of the seven priority areas, as well as related attitudinal barriers. It was done to understand the impact of the ACA and other Government of Canada initiatives have on persons with disabilities over time.

- We released Phase 2 of the Performance Indicator Framework for Accessibility Data (PIF) in January 2025. These indicators were developed with federal partners, the disability community and data and academic experts in accessibility;

- We partnered with Statistics Canada to align data sources with performance indicators and publish results on the Accessibility Statistics data hub;

- We also collaborated with Statistics Canada on the Survey Series on Accessibility, three short surveys that provided new data on barriers to accessibility in the priority areas of employment and information communication technologies, and transportation; and

- With Statistics Canada, we published these four reports on barriers to accessibility based on data derived from 2022 Canadian Survey on Disability:

Seniors Advisory Committee (SAC) and International Engagement

In Ontario, the Seniors Advisory Committee identified service delivery gaps affecting older adults and vulnerable clients. As a result of their input, four new ramp signs were installed at the Ontario Regional Headquarters to better serve clients with mobility impairments.

Canada led its delegation to Geneva to present updates to the UN Committee on the Rights of Persons with Disabilities, highlighting progress made since its last appearance in 2017 and the submission of its 2022 report.

ESDC played a key role in supporting engagement with the disability community and National Indigenous Organizations. Following the session, the Committee issued a set of recommendations, which are currently under review in collaboration with federal, provincial, and territorial partners.

Poverty is reduced

Results achieved

Over the past fiscal year, we advanced efforts to reduce poverty through data monitoring, policy development, and collaboration:

Monitoring Poverty Trends and Market Basket Measure (MBM) Review

We tracked a slight rise in poverty rates, largely driven by the rising cost of living. In response, we analyzed how programs like the Canada Child Benefit and the Canada Disability Benefit could help mitigate impacts.

We collaborated with Statistics Canada to consolidate stakeholder feedback and released the What We Heard Report: Engagement activities for the Third Comprehensive Review of the Market Basket Measure (MBM) on October 29, 2024. Together, we also analyzed proposals for updating the MBM methodology, and expect to finalize a new methodology by the end of 2025.

Indigenous Engagement and National Advisory Council on Poverty (NACP)

We hosted regular bilateral discussions with National Indigenous Organizations to advance the co-development of poverty and well-being indicators that reflect the distinct experiences of First Nations, Inuit, and Métis. A set of indicators was finalized and officially endorsed by the Assembly of First Nations in December 2024.

We supported the Council's operations and coordinated its engagement activities. At the same time, we contributed to the drafting, publishing, and tabling of the NACP's annual report in Parliament.

National School Food Policy

Over the past year, we made meaningful progress in advancing a national school meal program. We supported the release of the National School Food Policy, which outlines a set of guiding principles, clear objectives, and a long-term vision. In parallel, we worked closely with provinces, territories, and Indigenous partners to begin implementing the National School Food Program, supported by a federal investment of $1 billion over five years.

Canada Disability Benefit (CDB)

Over the past year, the Government completed the regulatory process for the Canada Disability Benefit, marking a major milestone in advancing income support for persons with disabilities.

Developments included:

- Consulting with provinces and territories to assess how the benefit may interact with existing income-tested programs. We strongly encouraged jurisdictions not to claw back the benefit from their own supports for persons with disabilities; and

- Engaging with Modern Treaty and Self-Government partners, National Indigenous Organizations, and Nunavut Tunngavik Incorporated (NTI), in alignment with the Nunavut Agreement, to ensure inclusive and culturally appropriate implementation.

Capacity to address social issues is enhanced

Results achieved

Social Finance Fund (SFF)

As of December 31, 2024, investments from the Social Finance Fund (SFF) began reaching Social Purpose Organizations (SPOs), helping them address social and environmental challenges.

SFF wholesalers have committed over $170 million through 40 investments in 34 different social finance intermediaries and one direct investment in a SPO. These intermediaries, in turn, supported over 80 SPOs and various social finance projects, expanding access to social finance opportunities across the country.

Early data suggests at least 32% of investments at the intermediary level contributed to advancing social equity, of which 16% specifically supported gender equality.

More complete impact data, including on investments advancing social equity and/or gender equality, will be available in 2026 because of these tools.

Supporting Black Communities

We continued to invest in and support Black-led, Black-focused, and Black-serving (B3) organizations. Of note, last year:

- the Foundation for Black Communities (FFBC) funded 161 organizations totalling $9.5M to improve social and economic outcomes for Black communities;

- in addition, the FFBC published a 2024 Annual Report highlighting key activities and accomplishments.

Supporting Black Canadian Communities Initiative (SBCCI)

Last year, the SBCCI, through its Capacity Building stream, partnered with four organizations across the country to build foundational capacity in smaller B3 community-based not-for-profit organizations. We provided $15M to support 424 projects that helped build organizations' capacity to serve their communities. Funding was used for learning, equipment, and to make minor renovations to work and community spaces.

Through its Emerging Priorities stream, the SBCCI allocated $1 million to support two projects reflecting Black voices in policy and programming. This included the 2025 National Black Canadians Summit (NBCS) which welcomed over 1,500 participants, including 500 youth delegates to discuss and develop solutions for improving the social and economic outcomes of Black Canadians.

In August 2024, the Government announced $7.25 million over three years under the SBCCI's Systems Change stream to support Caribbean African Canadian Social Services (CAFCAN) in establishing the Canadian Institute for People of Afrikan Ancestry (formerly the National Institute for People of African Descent). In 2024-2025, $3 million was provided to launch the institute, whose mission is to inform and influence policy and program development at all levels of government.

We continued to advance rights, wellbeing and social inclusion of Black communities in Canada as part of our commitment towards the United Nations International Decade for People of African Descent. In April 2024, we participated in the third session of the UN Permanent Forum on People of African Descent, co-sponsoring a resolution to launch the Second International Decade (2025-2034). This reflects a whole-of-government approach to addressing systemic barriers affecting Black communities.

Social Development Partnerships Program - Disability (SDPP-D)

Through a two-year investment announced in Budget 2023, the SDPP-D funded approximately $8.8M in grants and contributions to help address the unique needs and ongoing barriers faced by persons with disabilities by investing in capacity building and the community-level work of Canada's disability organizations.

Resources required to achieve results

Table 1.5 provides a summary of the planned and actual spending and full-time equivalents required to achieve results.

| Resource | Planned | Actual |

|---|---|---|

| Gross spending | $7,930,989,184 | $8,018,859,343 |

| Net spending | $7,930,989,184 | $8,018,859,343 |

| Full-time equivalents | 529 | 658 |

Please refer to ESDC's Financial Framework for a complete description of the departmental financial profile, including an explanation of gross planned spending.

The Finances section of the Infographic for Employment and Social Development Canada on GC Infobase and the People section of the Infographic for Employment and Social Development Canada on GC Infobase provide complete financial and human resources information related to its program inventory.

Related government priorities

This section highlights government priorities that are being addressed through this core responsibility.

Gender-based Analysis Plus (GBA Plus)

Last year, we continued to monitor poverty trends across different population groups, with a focus on age cohorts (children, working-age adults, and seniors), geographic regions, family structures, and key demographic characteristics. This analysis recognizes that social and economic outcomes are shaped by intersecting identity factors such as gender, race, disability, and Indigeneity.

For example, single-parent families led by women had a poverty rate of 26.5%, compared to 18% for those led by men. This disparity reflects the cumulative impacts of gender-based labour-market inequalities, such as wage gaps, occupational segregation and limited access to flexible and secure jobs. Additionally, women-led-one-parent families often have greater caregiving responsibilities and challenges in accessing affordable high-quality childcare - factors that constrain economic mobility and perpetuate cycles of poverty. This level of understanding helps ensure that our poverty reduction efforts are responsive to the realities of Canadians.

Work continued to establish a Canada-wide Early Learning and Child Care (ELCC) system with provinces and territories that will benefit all Canadians. In the long term, it is projected to boost Canada's gross domestic product through increased labor market participation, particularly among women with young children. ELCC enables growth in the labour force participation rate of core-aged women with children under the age of six (79.3% as of March 2025), and it benefits families of lower socio-economic status, single parents, and underrepresented groups. Labour force participation of core-aged women with children under the age of six was 75.9% in 2019.

With First Nations, Inuit, and Métis Nation partners, we worked on developing a distinctions-based results framework for Indigenous Early Learning and Child Care (IELCC). We also explored approaches to expanding GBA Plus data collection, which will help us better understand how different factors might impact access to, experience of, and outcomes of this program. Any resulting distinctions-based, disaggregated data will empower Indigenous leaders to collect, manage, and share data for informed decision-making and to advance Indigenous-led priorities in ELCC.

Through the Accessible Canada Fund, we supported 18 projects which raise awareness of accessibility and inclusion in communities and workplaces. They also build partnerships between the disability community and various sectors. These projects engaged persons with disabilities and diverse groups, including Official language minority communities, 2SLGBTQIA+ communities, Indigenous peoples, and other minority groups. The projects reached thousands of Canadians through various outreach efforts like:

- Webinars on accessibility and employment;

- Multi-sector conferences addressing accessibility barriers;

- Disability-led training to challenge ableism; and

- Social media campaigns to enhance awareness and knowledge about accessibility and inclusion.

Our Social Development Partnerships Program - disability component (SDPP-D) asks organizations receiving national operating funding to train their staff on GBA Plus and to apply it to their activities and plans. Organizations report annually on their implementation of GBA Plus policies, including changes to hiring practices, mentorship programs, and staff training.

The Supporting Black Canadian Communities Initiative, in cooperation with the National Funders, collected data from recipients of the third call for proposals. The data collected was analyzed and the findings are being used to better-serve diverse Black communities across Canada. Some takeaways:

- The top mandated group served was all Black communities in Canada, followed by all African people, then newcomers and people with low-income;

- 94% of funded organizations were in an urban centre, roughly matching up to the distribution of the Black population, which is 98% urban; and

- 30 out of the 944 funded organizations served populations in Northern Canada, which is higher than the actual representation in Northern populations.

United Nations 2030 Agenda for Sustainable Development and the Sustainable Development Goals

End poverty in all its forms everywhere (SDG 1) - The Department will be launching the new Canada Disability Benefit, which aims to improve financial security for working-age Canadians with disabilities starting in July 2025.

Quality Education (SDG 4) - As of March 2024, the latest reporting period, provinces and territories reported creating nearly 95,000 new, affordable, and high-quality early learning and child care spaces. Reporting for the 2024-25 fiscal year is due to ESDC in October 2025.

Federal investments in Indigenous early learning and child care (IELCC) continued to be informed by flexible, Indigenous-led approaches guided by the co-developed IELCC Framework which reflects the unique cultures and needs of First Nations, Inuit, and Métis children across Canada.

Decent work and economic growth (SDG 8) and Industry, innovation and infrastructure (SDG 9) - In Fall 2024, proposed amendments to the Accessible Canada Regulations, which outline digital accessibility requirements, were published in the Canada Gazette Part I. These proposed rules require organizations to make new web pages, new mobile applications and new digital documents accessible for persons with disabilities. We held eight technical briefings for stakeholders from both public and private sectors.

Moreover, we engaged with various stakeholders, including with persons with disabilities, between September 2024 and January 2025, on the draft Accessible Canada Roadmap, which outlines a national vision for a barrier-free Canada by 2040. These engagements provided our department with feedback that will help inform the final Roadmap.

Additionally, in collaboration with Statistics Canada, we published initial performance indicator data in the areas of employment, information, communication and technology (ICT). The initial data on barriers to accessibility are available on the Accessibility Statistics data hub.

Partnerships for the goals (SDG 17) - We continued to lead Canada's implementation of the 2030 Agenda and its SDGs. Our work led to Canada releasing the report: Taking Action Together - Canada's 2024 Annual Report on the 2030 Agenda and the Sustainable Development Goals and delivering a national statement at the United Nations' High-Level Political Forum (HLPF) in July 2024. The annual report featured a whole-of-government and whole-of-society perspective.

More information on Employment and Social Development Canada's contributions to Canada's Federal Implementation Plan on the 2030 Agenda and the Federal Sustainable Development Strategy can be found in our Departmental Sustainable Development Strategy.

Program inventory

Social development is supported by the following programs:

- Accessible Canada Initiative

- Black-led Philanthropic Endowment Fund

- Canadian Benefit for Parents of Young Victims of Crime

- Early Learning and Child Care

- Enabling Accessibility Fund

- Indigenous Early Learning Child Care Transformation Initiative

- New Horizons for Seniors Program

- Social Development Partnerships Program

- Social Innovation and Social Finance Strategy

- Strategic Engagement and Research Program

- Sustainable Development Goals Funding Program

Additional information related to the program inventory for Social development is available on the Results page on GC InfoBase.

Core responsibility 2: Pensions and benefits

In this section:

- Description

- Quality of life impacts

- Progress on results

- Details on results

- Resources required to achieve results

- Related government priorities

- Program inventory

Description

Assist Canadians in maintaining income for retirement, and provide financial benefits to survivors, people with disabilities and their families.

Quality of life impacts

Programs under this core responsibility contribute to the following Quality of Life domain and indicators:

- Domain - Prosperity (indicators - Poverty, Household Income, Financial Wellbeing) through activities that provide Canadians with income for retirement, and financial benefits to people with disabilities, survivors of pension contributors and their families

Progress on results

This section details the department's performance against its targets for each departmental result under Core responsibility 2: Pensions and benefits.

| Departmental Result Indicator | Target | Date to achieve target | Actual Result |

|---|---|---|---|

| Percentage of seniors living in poverty | At most 7.3%1 | December 2030 | 2022-23: 5.6% (2021)2 2023-24: 6.0% (2022) 2024-25: 5.0% (2023) |

| Percentage of seniors receiving the Old Age Security Pension at age 65 and over in relation to the estimated total number of eligible seniors aged 65 and over (OAS pension take-up rate) | At least 94% | March 2025 | 2022-23: 96.7% (2020)3 2023-24: 96.5% (2021) 2024-25: 95.8% (2022) |

| Percentage of seniors receiving the Old Age Security pension at age 70 and over in relation to the estimated total number of eligible seniors aged 70 and over (OAS pension take-up rate 70+) | At least 99% | March 2025 | 2022-23: 99.0% (2020) 2023-24: 99.0% (2021) 2024-25: 98.8% (2022)4 |

| Percentage of seniors receiving the Guaranteed Income Supplement in relation to the estimated total number of eligible seniors (GIS take-up rate) | At least 90% | March 2025 | 2022-23: 91.3% (2020)5 2023-24: 89.6% (2021)6 2024-25: 90.9% (2022) |

| Percentage of Canada Pension Plan contributors aged 70+ receiving retirement benefits | At least 99% | March 2025 | 2022-23: 99% (2021) 2023-24: 98% (2022) 2024-25: 99% (2023) |

| Departmental Result Indicator | Target | Date to achieve target | Actual Results |

|---|---|---|---|

| Percentage of Canada Pension Plan contributors who have contributory eligibility for Canada Pension Plan Disability benefits and therefore have access to financial support in the event of a severe and prolonged disability | At least 68% | March 2025 | 2022-23: 65% (2021) 2023-24: 65% (2022) 2024-25: 63% (2023) |

| Percentage of Canadians approved for the Disability Tax Credit who have a Registered Disability Savings Plan to encourage private savings7 | At least 36% | December 2024 | 2022-23: 36% (2022) 2023-24: 35% (2023) 2024-25: 34% (2024) |

| Percentage of Registered Disability Savings Plan beneficiaries that have been issued a grant and/or a bond to assist them and their families to save for their long-term financial security8 | At least 74% | December 2024 | 2022-23: 76% (2022) 2023-24: 75% (2023) 2024-25: 76% (2024) |

| Departmental Result Indicator | Target | Date to achieve target | Actual Results |

|---|---|---|---|

| Number of targets that are being met for the published service standards of Pensions and Benefits programs | 10 out of 10 | March 2025 | 2022-23: 4 out of 10 2023-24: 4 out of 10 2024-25: 4 out of 1010 |

| Percentage of Canada Pension Plan Retirement Benefits paid within the first month of entitlement | At least 90% | March 2025 | 2022-23: 94.3% 2023-24: 94.3% 2024-25: 96.8% |

| Percentage of decisions on applications for a Canada Pension Plan disability benefit within 120 calendar days | At least 80% | March 2025 | 2022-23: 78.7% 2023-24: 53.2%11 2024-25: 49.3%11 |

| Percentage of Old Age Security basic benefits paid within the first month of entitlement | At least 90% | March 2025 | 2022-23: 87.6% 2023-24: 86.6%12 2024-25: 87.5%12 |

- Notes:

- The target has been updated from 6.1% (in the 2023-24 Departmental Plan) to 7.3%, which reflects Canada's current official poverty line, as provided by Statistics Canada, following the update of the Market Basket Measure to 2018 data, from 2008.

- The year in parentheses is the most recent for which tax -data is available.

- Since 2013, seniors can delay receiving their OAS pension until age 70 for higher monthly benefits. This affects the OAS pension take-up rate. For this reason, the Department also measures OAS pension take-up among eligible seniors aged 70 and over.

- There is not sufficient information or data to identify the direct cause of the 0.2% reduction, however, we are exploring various factors (e.g. increase in pension deferral for seniors 65+, administrative delays, etc.) that could have contributed to the decrease as part of a deeper dive on take-up for pensions programs.

- For the three years of GIS take-up results presented in this table, the calculation of this indicator was updated to leverage additional data available in Statistics Canada's Longitudinal Administrative Databank. This update allows the calculation to more closely reflect income sources and credits used in the determination of GIS benefit entitlement.

- Results are impacted by COVID 19 pandemic-related disruptions in seniors' income. Also, since June 2020, the expanded GIS earnings exemption has made more low-income Canadian seniors who work eligible for the GIS. Through targeted outreach activities, the Department reaches out to seniors who could be eligible for the GIS and invites them to apply for the benefit.

- The target and results are reported by calendar year, as eligibility criteria and entitlements are based on the calendar year. Indicators refer to beneficiaries aged 0 to 49 years.

- The small decline in RDSP take up rate is attributable to a higher growth rate for DTC than RDSP over the reference period.

- Service standards are published on Transparency - Canada.ca.

- The indicator measures whether the service standards are met for the following 10 indicators: Canada Pension Plan (CPP) retirement benefits are paid within the first month of entitlement; CPP payments are accurate; CPP calls are answered by an agent within 10 minutes; Canada Pension Plan Disability (CPPD) benefit application decisions are made within 120 calendar days of receiving a complete application; A decision for CPPD benefit applicants with a terminal illness is made within 5 business days of receiving a complete terminal illness application; A decision for CPPD benefit applicants with a grave condition is made within 30 calendar days of receiving a complete application; A decision on a CPPD benefit reconsideration request is made within 120 calendar days of receiving the reconsideration request; Old Age Security (OAS) basic benefits are paid within the first month of entitlement; OAS payments are accurate; and OAS calls are answered by an agent within 10 minutes.

Service Canada strives to improve overall results where service standards are not met. The OAS and CPPD programs experienced increases in inventories caused by changing demographics and increased complexity, which impacted speed of service results. In response: We implemented strategies to reduce the volume of older work in the inventory in preparation for the transition to the new common benefit delivery platform (Cúram) and to improve service delivery results. The CPPD program implemented short-term measures to increase capacity, streamline processes, and enhance operational efficiency through process automations. To improve service levels, the Pensions Call Centre increased capacity to better meet call demand, anticipating improvement in performance throughout fiscal year 2024-25 as officers gain experience and proficiency. - Recent growth in CPPD inventories were caused by processing capacity challenges and an increase in complex cases. Applications due to mental health and cognitive disabilities are on an upward trend, now representing 34% of CPPD applications. The CPPD Action Plan has been implemented with the goal of increasing capacity, containing inventory and simplifying processes. Service Canada implemented workload and workforce strategies to begin addressing these inventory pressures.

- Last year, OAS application inventories were higher than our capacity to process in a timely manner. This was primarily due to: technological challenges, increased workload complexity due to changing demographics regarding clients' residence and working histories, and workforce capacity. Service delivery results improved in 2024-25 as compared to 2023-24.

The Results section of the Infographic for Employment and Social Development Canada on GC Infobase page provides additional information on results and performance related to its program inventory.

Details on results

The following section describes the results for Pensions and benefits in 2024-25 compared with the planned results set out in Employment and Social Development Canada's departmental plan for the year.

Seniors have income support for retirement

Results achieved

Old Age Security

The OAS program provides a minimum income to seniors and contributes to their income replacement in retirement. Last year, OAS provided $80 billion in benefits to 7.4 million people. This included:

- $60.6 billion in OAS pension benefits;

- $18.9 billion in Guaranteed Income Supplement (GIS) benefits paid to 2.5 million low-income seniors; and

- $632 million in Allowance benefits paid to 68,664 near-seniors.

On March 17, 2025, the OAS legacy system was successfully migrated to the new Cúram platform, which now supports 7.4M clients and over 6,600 staff. The new system makes it easier for Canadians to apply for and manage benefits. Prior to release, both system and business readiness were thoroughly evaluated to ensure a smooth transition. This work included:

- Conducting three Business Pilot cycles to validate operational capabilities, identify improvements, and increase confidence in the system;

- Testing the system which yielded 99.9% accuracy rate across data migration, payment accuracy, and data matching;

- Training over 5,300 employees; and

- Developing contingency plans to ensure business continuity in case of emergency.

The new platform improves service delivery, reduces wait times, and ensures faster, more accurate payments. Clients can now apply online, upload documents, update personal information, and track application status. In the 10 weeks following implementation, online applications reduced processing times and saved 2,907 staff hours. The first payment run from Cúram was issued on April 28, 2025.

Canada Pension Plan

January 2025 marked the end of the Canada Pension Plan's (CPP) 7-year enhancement phase-in. Together, the base and enhancement portions of the CPP retirement pension will replace one-third (33.33%) of the earnings of Canadian workers, up from one-quarter (25%). The level of earning covered by the Plan was also increased by 14%. Together, these changes will boost the maximum CPP retirement pension by more than 50% for today's youngest workers, in addition to raising the amounts provided by the CPP's disability pension and survivor's pension.

- As part of the 2022-2024 Triennial Review, amendments were made to the CPP that do not affect contribution rates: Creating new benefits for dependent children of disabled or deceased contributors attending school part-time. They consist of a monthly flat rate benefit of $150.89;