Annual Report 2023

ISSN 1495 – 0561

Cat. no.: H78E-PDF

PDF version (581 KB)

Table of Contents

- Statistical Highlights 2023

- Letter to the Minister

- Chairperson’s Message

- About the Patented Medicine Prices Review Board

- Price Review Activities

- Pharmaceutical Pricing Trends

- Research And Development Expenditures

- National Prescription Drug Utilization Information System Research Initiative

- Glossary of Terms

Statistical Highlights 2023

Price Review Mandate

- In 2023, 1,146 patented medicines for human use were reported to the PMPRB, including 86 new medicines.

- Five undertakings to voluntarily lower the price of a medicine and/or pay potential excess revenues to the Government of Canada were accepted in 2023.

- Undertakings for potential excess revenues resulted in payments to the Government of Canada totaling more than $2.1 million.

Reporting Mandate

Price Trends:

- The national list price for patented medicines increased by 0.7% in 2023, while the Consumer Price Index rose by 3.9%.

- Canadian list price ratios were higher than all PMPRB11 countries and fourth highest among the 31 Organisation for Economic Co-operation and Development (OECD) countries.

Sales Trends:

- Sales of patented medicines in Canada were $19.9 billion in 2023, an increase of 8.2% over the previous year.

- Patented medicines accounted for 47% of the sales for all medicines in Canada in 2023.

Research and DevelopmentFootnote 1 (R&D):

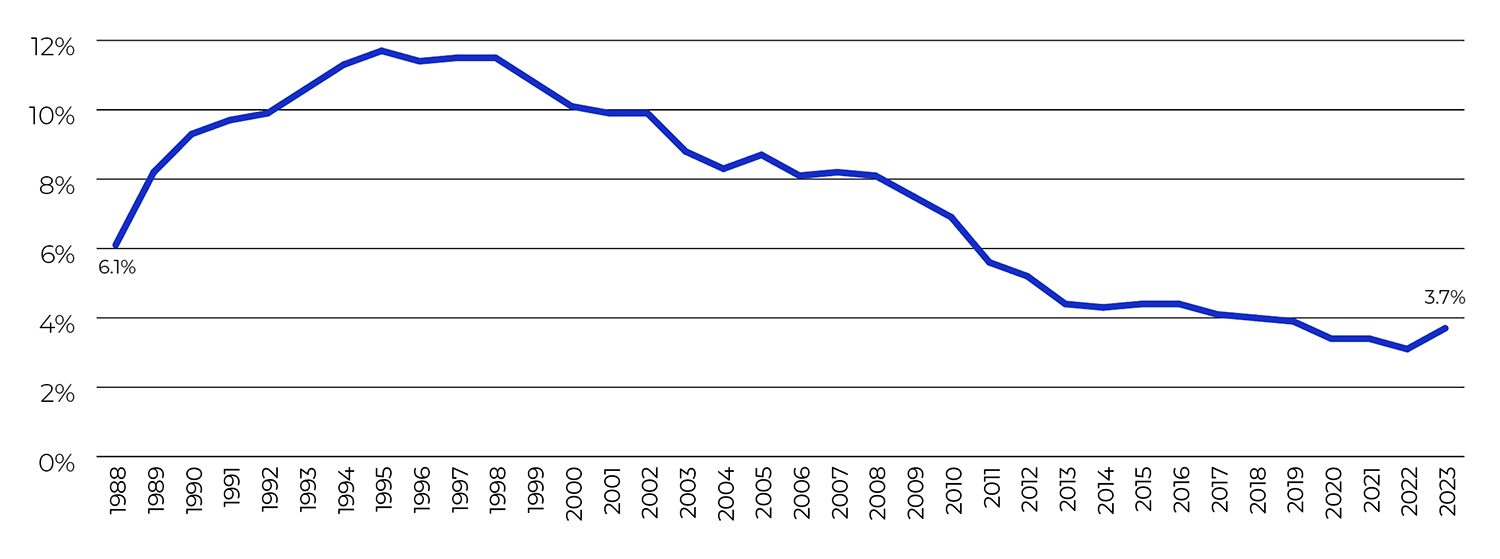

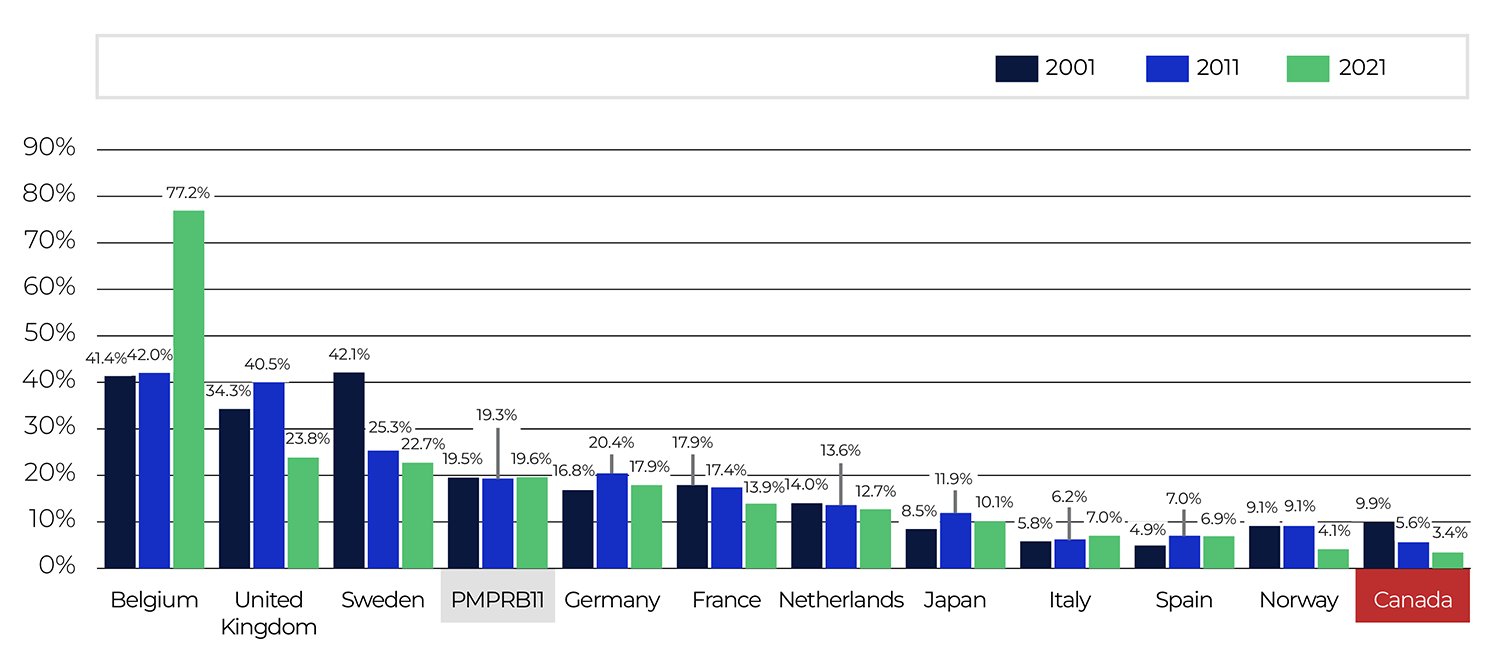

- The R&D-to-sales ratio for all Rights Holders in Canada was 3.7% in 2023, an increase from 3.1% in 2022.

- Rights Holders reported $1,069.3 million in total R&D expenditures, an increase of 17.0% over 2022.

Letter to the Minister

21 October 2024

The Honourable Mark Holland, P.C., M.P.

Minister of Health

House of Commons

Ottawa, Ontario

K1A 0A6

Dear Minister:

I have the pleasure to present to you, in accordance with sections 89 and 100 of the Patent Act, the Annual Report of the Patented Medicine Prices Review Board for the year ended December 31, 2023.

Yours very truly,

Thomas J. Digby

Chairperson

Chairperson’s Message

The Patented Medicine Prices Review Board (PMPRB) is an independent quasi-judicial body established by Parliament in 1987 under the Patent Act (the Act). The PMPRB’s mandate is to protect and inform Canadians by ensuring that the prices of patented medicines sold in Canada are not excessive and by reporting on trends in pharmaceutical pricing.

This Annual Report marks the first year under a newly appointed PMPRB Board and reflects a period of realignment at the PMPRB. In 2023, the Board launched the first phase of a three-phase approach to developing new Guidelines, which will address the amended Patented Medicines Regulations brought into force in July 2022. This first phase opened public consultations on the Guidelines development with a Scoping Paper designed to encourage a productive conversation with interested groups. A two-day Policy Roundtable followed, where these groups were invited to present their feedback in person. These discussions laid the groundwork for the next two phases of development in 2024 and 2025. In the meantime, the PMPRB is operating under Interim Guidance issued September 2023.

If you are a return reader to the PMPRB’s Annual Report, you will find this year’s edition different from the last, both in what analysis you see and where you find it in the document. These changes were made with the aim of delivering an Annual Report that is concise and relevant to its readers and that reaches to the core of its mandate. As you read through the report, I encourage you to make use of the links and methodology notes leading you to additional information and other PMPRB reporting that may be of interest.

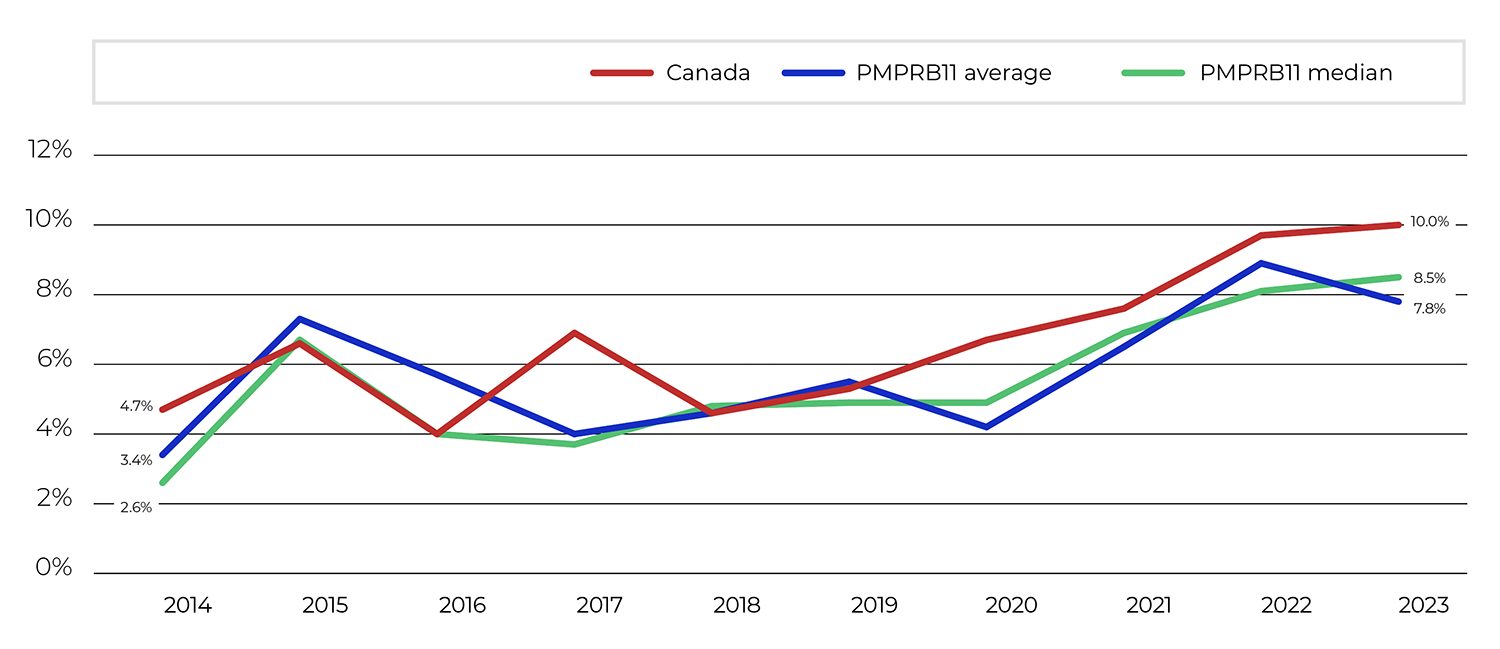

Amid these changes, we continue to see consistent trends in the pharmaceutical market. The entry of new, higher-priced patented medicines was the main driver behind a nearly $50 increase in patented medicine sales per person this year, from $465 to $514. Canadian list prices for patented medicines in 2023 were higher than all 11 of the PMPRB schedule countries (the “PMPRB11”), or fourth highest in the OECD. Approximately 84% of patented medicine sales in Canada were for medicines with a list price higher than the PMPRB11 median, while 25% were for medicines with a list price that topped the highest price in the PMPRB11. Rights Holders spent more on research and development (R&D) in 2023 compared to 2022, though the ratio of R&D to sales for patented medicines in Canada remains substantially below that of the PMPRB11.

The PMPRB forms an integral piece of a sustainable pharmaceutical ecosystem in Canada, and we recognize the importance of this role as we move through the next phases towards releasing new Guidelines in the coming year. Throughout this process, we are prioritizing a clear and consistent alignment with our mandate and responsive engagement with those affected by the price review process, with the aim of presenting final Guidelines that deliver on our responsibility to Canadians.

Thomas J. Digby

Chairperson

About the Patented Medicine Prices Review Board

The Patented Medicine Prices Review Board (PMPRB) is an independent, quasi-judicial body established by Parliament in 1987 under the Patent Act (Act).

The PMPRB is a quasi-judicial administrative body with a dual mandate. Through its price review mandate, the PMPRB ensures that the prices of patented medicines sold in Canada are not excessive. Through its reporting mandate, the PMPRB issues an Annual Report with information on trends in pharmaceutical sales and pricing and on research and development (R&D) spending by Rights Holders.

In addition, at the request of the Minister of Health under section 90 of the Act, the PMPRB conducts analysis of price, utilization, and cost trends for patented and non-patented medicines under the National Drug Utilization Information System (NPDUIS) research initiative. The reports prepared through this initiative provide pharmaceutical payers and policy makers with information to support evidence-based reimbursement and pricing decisions.

The PMPRB is part of the Health Portfolio, which includes Health Canada, the Public Health Agency of Canada, the Canadian Institutes of Health Research, and the Canadian Food Inspection Agency. The Health Portfolio supports the Minister of Health in maintaining and improving the health of Canadians. Because of its quasi-judicial responsibilities, the PMPRB carries out its mandate at arm’s length from the Minister, who is responsible for the sections of the Act pertaining to the PMPRB.

The PMPRB contributes to sustainable spending on pharmaceuticals in Canada by:

- Acting as an effective check on the prices of patented medicines and intervening where the Board determines a price to be excessive; and

- Providing price, cost, and utilization information to support timely and knowledgeable pricing, purchasing, and reimbursement decisions.

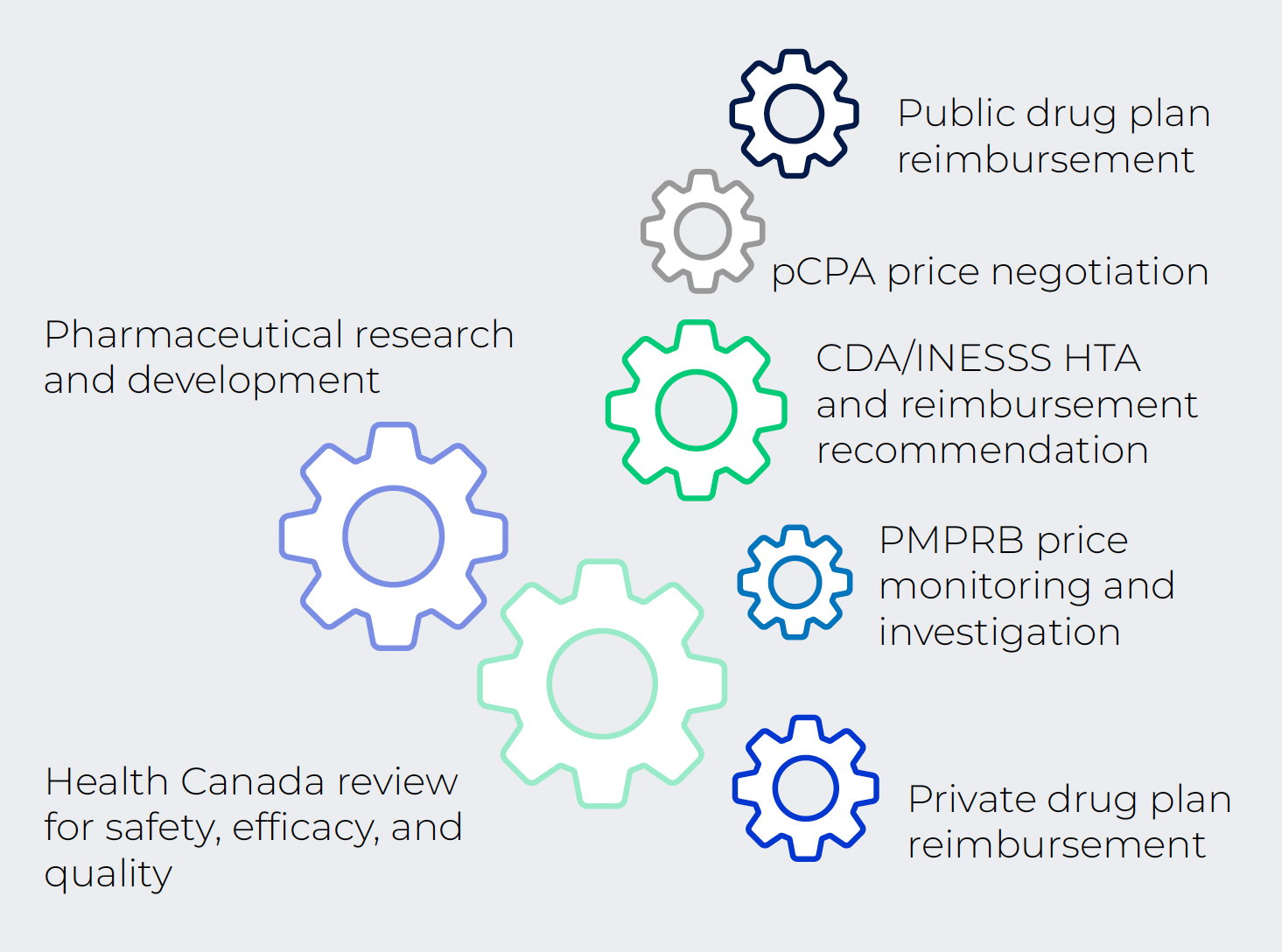

Where does the PMPRB fit in Canada’s healthcare ecosystem?

The PMPRB’s mandate is an independent piece of a complex ecosystem that manages the medicines approved in Canada.

This includes healthcare-related bodies, such as:

- Health Canada, which approves medicines for marketing in Canada based on their safety, efficacy, and quality;

- Canada’s Drug Agency (CDA, formerly the Canadian Agency for Drugs and Technologies in Health), which performs health technology assessment and assembles expert committees to make recommendations on which medicines should qualify for reimbursement under publicly funded drug programs, as well as the Institute national d’excellence en santé et en services sociaux (INESSS), which evaluates medicines to make recommendations on reimbursement by public plans in Quebec;

- The pan-Canadian Pharmaceutical Alliance (pCPA), which negotiates the list prices on behalf of the publicly funded drug programs across Canada (both federal and provincial, including Quebec); and

- Federal, provincial, and territorial (F/P/T) public drug plans, which approve the listing of medicines on their respective formularies for reimbursement purposes.

Figure description

This chart illustrates the multiple actors in the Canadian prescription medicine ecosystem, represented as gears:

- Pharmaceutical research and development;

- Health Canada review for safety, efficacy, and quality;

- PMPRB price monitoring and investigation;

- Private drug plan reimbursement;

- Canada Drug Agency (CDA) and Institut national d'excellence en santé et en services sociaux (INESSS) health technology assessment (HTA) and reimbursement recommendation;

- Pan-Canadian Pharmaceutical Alliance (pCPA) price negotiation;

- Public drug plan reimbursement.

CDA: Canada’s Drug Agency (formerly the Canadian Agency for Drugs and Technologies in Health); INESSS: Institut national d'excellence en santé et en services sociaux; HTA: health technology assessment; pCPA: pan- Canadian Pharmaceutical Alliance.

Did You Know?

Since 1987, pharmaceutical costs in Canada have grown at an average annual rate of 6.6%, outpacing most other health care costs and rising at approximately three times the rate of inflation. Pharmaceutical expenditures make up 13.9 % of total health care spending.i

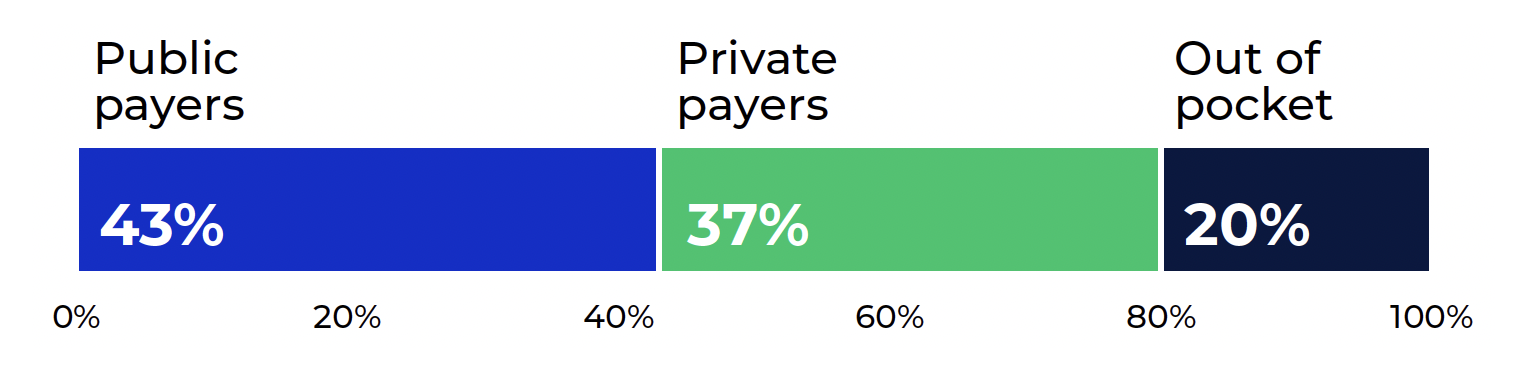

Spending on all prescriptions drugs in Canada in 2023 was estimated to be just over $41 billion. Of this, 43% was paid for by the public sector, 37% by private insurers, and 20% out of pocket by Canadians.i

Figure description

This chart shows the distribution of prescription medicine sales in 2023 by payer. Public payers accounted for 43% of sales, private payers accounted for 37% of sales, and the remaining 20% were paid out of pocket.

Data source: Canadian Institute for Health Expenditures (CIHI), National health expenditure trends, 2023

Notes

i Canadian Institute for Health Information (CIHI), National Health Expenditures Trends, 2023 (November 2023)

ii Conference Board of Canada, Understanding the Gap 2.0 (May 2022)

iii Statistics Canada, Pharmaceutical access and use during the pandemic (November 2022)

iv Morgan SG, Lee A. 2017. Cost-related non-adherence to prescribed medicines among older adults: a crosssectional analysis of a survey in 11 developed countries. BMJ Open 2017;7:e014287. DOI: 10.1136/bmjopen-2016- 014287

In 2022, the Conference Board of Canada estimated that 2.8% of Canadians (approximately 1.1 million people) are not insured for prescription drug coverage.ii This gap has narrowed in the last five years, owing largely to the introduction of OHIP+ in Ontario, but it does not take into account the millions of Canadians who are underinsured for their prescribed medications. Two thirds (67%) of Canadians took or were prescribed medication in 2021, yet one fifth (21%) of the total population reported not having insurance to cover any of the cost of their prescription medications.iii This percentage fluctuated across the provinces and was higher among racialized groups (29%).

As a result, nearly one fifth (18%) of the Canadian population spent $500 or more out of pocket on prescription medications in 2021, and close to 1 in 10 Canadians (9%) reported skipping doses, delaying filling, or otherwise not adhering to their prescriptions because of cost.iii Looking specifically at seniors, Canada has one of the highest rates of cost-related non-adherence among comparator countries.iv

Jurisdiction

Price Review

1,146 patented medicines were reported to the PMPRB in 2023.

The PMPRB reviews the price at which Rights Holders (companies) sell their products to wholesalers, hospitals, pharmacies, and other large distributors to ensure that this price is not excessive. This price is sometimes also known as the factory gate (or ex-factory) price.

The PMPRB only reviews the prices of patented medicines, which means that non-patented medicines are not under the PMPRB’s jurisdiction. Patents are a form of intellectual property that protect inventions by allowing the patent holder the right to stop others from making, using, or selling their invention during the life of the patent. Patented medicines, in the PMPRB context, are those that have an “invention pertaining to a medicine,” namely where the invention “is intended or capable of being used for medicine or for the preparation or production of medicine.”

The Act requires Rights Holders to inform the PMPRB of their intention to sell a new patented medicine. Rights Holders include any parties who are “entitled to the benefit of a patent” regardless of whether they are owners or licensees under those patents and regardless of whether they operate in the “brand” or “generic” sector of the market. Rights Holders are required to file price and sales information when a new patented medicine is first sold and regularly thereafter, until all relevant patents have expired. Rights Holders are not required to get approval of the price to be able to market their medicines. However, the Act requires the PMPRB to ensure that the prices of patented medicines sold in Canada are not excessive.

Staff review the prices that Rights Holders charge for each individual strength and form of a patented medicine. If the price of a patented medicine appears to be potentially excessive, the Rights Holder may volunteer to lower the price and/or make a payment to the Government of Canada through a voluntary undertaking. If this is unsuccessful, the Chairperson may consider whether a hearing on the matter is in the public interest. At the hearing, a panel composed of Board members acts as a neutral arbiter between Staff and the Rights Holder. If, after hearing all of the evidence in light of the factors set out in section 85 of the Act, the Hearing Panel concludes that the price of a patented medicine is/was excessive in any market in Canada, it can order the maximum ceiling price to be reduced to a non-excessive level. It can also order a Rights Holder to make a payment to the Government of Canada to offset the excess revenues earned and can double the amount of this payment if there has been a policy of excessive pricing.

Reporting

As required by the Act, the PMPRB reports annually to Parliament through the Minister of Health on its activities for the previous year, pricing trends of all medicines, and R&D expenditures reported to the PMPRB by pharmaceutical Rights Holders.

In addition, as a result of a request from the federal Minister of Health under section 90 of the Act, the PMPRB prepares reports for the Minister which contain critical analyses of price, utilization, and cost trends for patented and non-patented medicines. These reports are prepared by the NPDUIS research initiative group of the PMPRB and are also published online.

Communications and Outreach

The PMPRB takes a proactive and plain-language approach to its external communication activities. This includes targeted social media campaigns and more conventional (e.g., email) engagement with domestic, international, and specialized news media. The PMPRB is actively pursuing additional opportunities to leverage new and emerging media to communicate with the Canadian public.

The PMPRB recognizes the importance of openness and transparency as we continue to work on modernizing the way we carry out our mandate. Regular communication through various channels about our progress, including projected timelines and key milestones, helps ensure we remain focused on delivering results. Engagement with interested groups remains a central part of this multi-faceted communications approach.

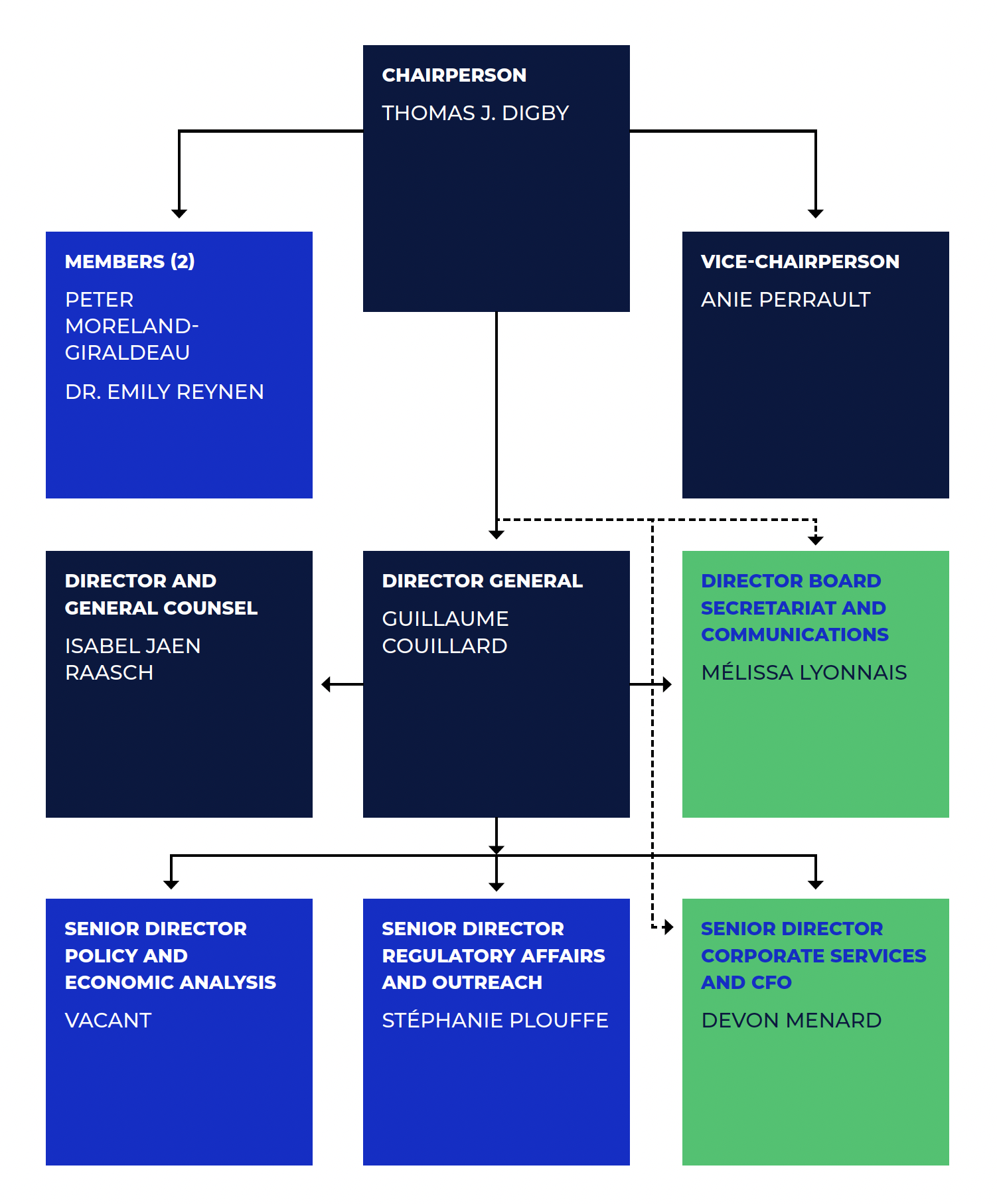

Governance

The PMPRB is composed of no more than five Board members who serve on a part-time basis and who are assisted in their work by public servants (Staff). Board members, including a Chairperson and a Vice- Chairperson, are appointed by the Governor in Council. The Chairperson, designated under the Act as the Chief Executive Officer of the PMPRB, has the authority and responsibility to supervise and direct its work. By law, the Vice-Chairperson exercises all the powers and functions of the Chairperson when the Chairperson is absent or incapacitated, or when the office of the Chairperson is vacant.

The members of the Board, including the Chairperson, are collectively responsible for implementing the applicable provisions of the Act. Together, they establish the guidelines, general rules, and by-laws of the PMPRB provided for by the Act (section 96) and consult, as necessary, with the federal and provincial ministers responsible for health, representatives of consumer groups, the pharmaceutical industry, and others.

Members of the Board

For more information, see the Organizational Structure page of the PMPRB website.

Chairperson

Thomas J. Digby

Thomas Digby was appointed Chairperson of the Board on January 27, 2023.

Thomas Digby is a lawyer with more than 25 years’ experience in Canadian and US intellectual property (IP) law, in the field of pharmaceuticals. He has worked closely with diverse biotech start-ups, their venture investors, and, for 10 years, with the global pharmaceutical leader, Novartis.

Vice-Chairperson

Anie Perrault

Anie Perrault was appointed Vice-Chairperson of the Board on August 10, 2023.

Ms. Anie Perrault is a lawyer by training with more than 30 years of professional experience in the public and private sectors. Her career has focused on communications and public affairs related to genomic research and biotechnology and she has held several strategic positions at a national level in this field. She was Director General of BIOQuébec from 2013 to 2022 and Vice President, Communications of Genome Canada from 2001 to 2006.

Members

Peter Moreland-Giraldeau

Peter Moreland-Giraldeau was appointed to the Board on October 6, 2023.

Peter Moreland-Giraldeau is an administrative law lawyer currently working as Legal Counsel for the Appeals Commission for Alberta Workers’ Compensation. Peter obtained his LLB from the University of Leicester and his LLM from the University of British Columbia.

Dr. Emily Reynen

Dr. Emily Reynen was appointed to the Board on October 20, 2023.

Dr. Emily Reynen completed both undergraduate and doctorate degrees in Pharmacy at the University of Toronto Leslie Dan Faculty of Pharmacy, and obtained her medical degree from the McGill University Faculty of Medicine. Dr. Reynen currently practices as a staff intensivist at Quinte Health Care Belleville General Hospital site and is an Adjunct Assistant Professor at Queen’s University.

Organizational Structure and Staff

PMPRB Organizational Chart (August 2024)

Figure description

This organizational chart illustrates the high-level reporting structure within the PMPRB and lists the current Board and Senior Staff members, as of August 2024. Board: Chairperson— Thomas J. Digby; Vice-Chairperson— Anie Perrault; Members— Peter Moreland-Giraldeau, Dr. Emily Reynen. Senior Staff: Director General — Guillaume Couillard; Director and General Counsel— Isabel Jaen Raasch; Director Board Secretariat and Communications— Mélissa Lyonnais; Senior Director Policy and Economic Analysis— Vacant; Senior Director Regulatory Affairs and Outreach— Stéphanie Plouffe; Senior Director Corporate Services and CFO— Devon Menard.

Director General

The Director General (formerly “Executive Director”) is responsible for advising the Board and for the leadership and management of Staff.

Regulatory Affairs and Outreach

The Regulatory Affairs and Outreach Branch reviews the prices of patented medicines sold in Canada, ensures that Rights Holders are fulfilling their filing obligations, encourages Rights Holders to comply voluntarily with the PMPRB’s Guidelines, implements related policies, and investigates complaints on the prices of patented medicines.

Policy and Economic Analysis

The Policy and Economic Analysis Branch develops policy and strategic advice; leads consultations and makes recommendations on possible amendments to the PMPRB’s Guidelines; conducts research and analysis on the prices of medicines, pharmaceutical market developments, and R&D trends; and submits reports to the Minister of Health with centralized, objective, and credible information in support of evidence-based policy.

Corporate Services

The Corporate Services Branch provides advice and services in relation to human resources management; facilities; procurement; health, safety, and security; information technology; and information management. It coordinates activities pursuant to the Access to Information Act and the Privacy Act, and is responsible for strategic planning and reporting. It is also responsible for financial planning and reporting, accounting operations, audit and evaluation, and liaising with federal central agencies on these topics.

Board Secretariat

The Board Secretariat manages the Board’s meeting and hearing processes, including the official record of proceedings.

General Counsel

The General Counsel advises the PMPRB on legal matters, leads the legal team representing Staff in proceedings before the Board, and liaises with counsel for the Attorney General in PMPRB-related proceedings before federal and provincial courts.

Budget

In 2023-24, the PMPRB had a Main Estimates budget of $17.1 million and an approved staff level of 81 full-time equivalent employees.

Table 1. Budget and Staffing

| 2022-23 | 2023-24 | 2024-25 | |

|---|---|---|---|

| Budget* | $17,003,213 |

$17,093,674 |

$17,746,047 |

| Salaries and employee benefits | $10,164,617 |

$10,257,961 |

$10,910,335 |

| Operating | $2,375,235 |

$2,372,352 |

$2,372,352 |

| Special Purpose Allotment† | $4,463,361 |

$4,463,361 |

$4,463,361 |

| Full Time Employees (FTEs) | 85 |

84 |

81 |

Notes

* Budget amounts are based on the Main Estimates.

† The Special Purpose Allotment is reserved strictly for external costs of public hearings (legal counsel, expert witnesses, etc.). Unspent funds are returned to the Consolidated Revenue Fund.

Price Review Activities

The PMPRB works in the interest of Canadians to ensure that the prices of patented medicines sold in Canada are not excessive. It does this by reviewing the prices that Rights Holders charge for individual patented medicines and by ensuring that Rights Holders reduce their prices and pay back excess revenues, where appropriate. This section provides a summary of the reporting requirements for Rights Holders, as well as price reviews, undertakings, hearings, and matters before the courts in 2023.

Reporting Requirements

By law, Rights Holders must file information about the sale of their medicines in Canada.Footnote 2 The Act and the Patented Medicines Regulations (Regulations) set out the information required and Staff review pricing information on an ongoing basis until all relevant patents have expired.

Amending Regulations to the Act that came into force on July 1, 2022, implemented a new basket of schedule countries for which Rights Holders must provide comparative price information and reduced reporting requirements for medicines at the lowest risk of excessive pricing. A broader group of 11 reference countries (PMPRB11) are now used in place of the previous seven (PMPRB7), removing the United States and Switzerland and adding Australia, Belgium, Japan, the Netherlands, Norway, and Spain.

The Compendium of Policies, Guidelines and Procedures (Guidelines) details price tests and triage mechanisms used by Staff in its review and investigation of the prices of patented medicines up to July 1, 2022. The Board is in the process of developing new Guidelines, and until new Guidelines are implemented, the amended Interim Guidance issued by the Board on September 27, 2023, is in operation. The amended Interim Guidance provides an expedited assessment for prices of New Medicines, which include any Medicine without a MAPP (Maximum Average Potential Price) or NEAP (Non-Excessive Average Price) as of July 1, 2022. New Medicines are considered reviewed if their list price is below the median international price of the PMPRB11 countries. New Medicines that do not meet this criterion continue to be under review until new Guidelines are in place.

The amended Interim Guidance constitutes measures that apply during a temporary period and does not constitute full “Guidelines”. It is instead designed as a simple and temporary process that allows Rights Holders to have some ability to predict how their international price filings based on the PMPRB11 would affect the level of scrutiny applied during internal administrative price reviews at the PMPRB, in the absence of full Guidelines.

Guidelines are not binding and are developed in consultation with stakeholders, including the federal and provincial ministers responsible for Health, consumer groups, health care professionals, and the pharmaceutical industry.

Failure to File Price and Sales Data

Failure to file occurs when a Rights Holder fails, either completely or partially, to report required information including sales and pricing information and/or investment in Canadian research and development information, to the PMPRB, as mandated by the Act and the Regulations. There were no Board Orders issued for failure to file in 2023.Footnote 3

Price Review

The PMPRB reviews the Canadian prices of each strength of each individual dosage form of each patented medicine reported by Rights Holders pursuant to the Regulations. In most cases, this unit is consistent with the Drug Identification Number(s) (DINs) assigned by Health Canada at the time the medicine is approved for sale in Canada.

New Patented Medicines Reported to the PMPRB in 2023

For the purpose of this report, a new patented medicine in 2023 is defined as any patented medicine or new dosage form or strength of a patented medicine first sold in Canada, or previously sold but first patented, between December 1, 2022, and December 1, 2023.

There were 86 new patented medicines for human use reported as sold in 2023. Some are one or more strengths of a new medicinal ingredient, and others are new presentations of existing medicines. Of these 86 new patented medicines, four were sold in Canada prior to the issuance of the Canadian patent that brought it under the PMPRB’s jurisdiction.

Price Review of Existing Patented Medicines for Human Use in 2023

For the purpose of this report, existing patented medicines include all patented medicines first sold and reported to the PMPRB prior to December 1, 2022.

At the time of this report, there were 1,060 existing patented medicines:

- 553 were not the subject of investigations;

- 389 were the subject of investigations (including investigations commenced prior to July 1, 2022);

- 111 were Medicines with no MAPP under the Guidelines that applied prior to July 1, 2022;

- 6 were the subject of an undertaking;Footnote 4 and

- 1 was subject to a Settlement Agreement and Order.

Status Updates in 2023

Over the course of 2023, two of the new medicines reported as under review and 97 of the existing medicines reported as the subject of investigations in the 2022 Annual Report resulted in one of the following:

- the closure of the investigation;

- an undertaking by the Rights Holder to reduce the price and/or pay potential excess revenues to the Government of Canada (see “Undertakings”); or

- a public hearing to determine whether the price was excessive, including any remedial Order determined by the Board (see “Hearings”).

Complaints Regarding Patented Over-the-Counter Medicines, Patented Generic Medicines, and Patented Medicines for Veterinary Use

Reduced reporting obligations for certain generic medicines (previously, reduced reporting obligations only applied to over-the-counter and veterinary medicines) came into force on July 1, 2022, as provided for in the Amending Regulations. Staff only review the prices of patented over-the counter medicines, patented generic medicines, and patented veterinary medicines when a complaint of excessive pricing has been received. No complaints related to these kinds of medicines were received in 2023.

Complaints Regarding Patented Medicines

The PMPRB investigates complaints from Canadians who are concerned that they are being charged too much for their medication. Once the complaint is received, Staff determine whether the medicine is patented and if it falls under the PMPRB’s jurisdiction. If the medicine is not patented, the matter is closed. If the medicine is patented, the price information that Rights Holders are required by law to file with the PMPRB is re-examined in light of the complaint. A total of 15 complaints were received by the PMPRB in 2023. As Interim Guidance is currently in place, no complaints-based investigations were opened.

Certificates of Supplemental Protection

Amendments made to the patented medicines section of the Act that came into force on June 30, 2021, extended the PMPRB’s jurisdiction to medicines that are protected by a Certificate of Supplementary Protection (CSP). A CSP gives the certificate holder the same legal rights given by the patent for a maximum period of two years after the patent expiry date. There were 21 CSPs reported to the PMPRB in 2023, with expiration dates ranging from 2024 to 2037, bringing the total of active CSPs reported to the PMPRB to 181. Each patent that had its duration extended through a CSP can be linked to multiple patented medicines. In total, there are 37 patented medicines linked to the 21 CSPs reported in 2023.

Undertakings and Hearings

Undertakings

An undertaking is a promise by a Rights Holder to adjust its price(s) and/or pay potential excess revenues to the Government of Canada.Footnote 5 The consideration of an undertaking is an administrative procedure and does not constitute an admission or determination by the PMPRB that the price submitted by the Rights Holder, or used to calculate potential excess revenues, is not excessive. However, the receipt of an undertaking can be taken into consideration by the Chairperson when deciding whether an investigation should be closed.

In 2023, the Chairperson approved the closure of investigations based on the receipt of five undertakings. In addition to price reductions for certain medicines, undertakings for potential excess revenues resulted in payments to the Receiver General totaling $2,155,258.53.

Table 2. Undertakings Approved by the PMPRB Chairperson in 2023

| Patented medicine (Trade name)* | Rights Holder | Date signed by Rights Holder | Price reduction | Payment to the government |

|---|---|---|---|---|

| Undertakings approved in 2023 | ||||

Amikacin liposome inhalation suspension (sold under trade name Arikayce) |

Insmed Inc. |

Oct. 2022† |

Yes |

- |

Tucatinib (sold under trade name Tukysa) |

Seagen Canada Inc. |

Nov. 2022† |

Yes |

- |

Buprenorphine/naloxone (sold under trade name Suboxone Film) and buprenorphine (sold under trade name Sublocade) |

Indivior UK Ltd |

Nov. 2022† |

- |

$948,354.84 |

Gilteritinib (sold under trade name Xospata) |

Astellas Pharma Canada Inc. |

Mar. 2023† |

- |

$635,774.92 |

Clindamycin/benzoyl peroxide (sold under trade name Clindoxyl Gel) |

GlaxoSmithKline Inc. |

Aug. 2023† |

Yes |

$571,128.77 |

Total for undertakings approved as of December 31, 2023 |

$2,155,258.53 |

|||

Notes

* Drug Identification Number (DIN).

† These undertakings were submitted by the respective Rights Holder in 2022 but were approved by the PMPRB Chairperson in 2023. For this reason, they did not meet the criteria for inclusion in the 2022 Annual Report.

Hearings

The PMPRB holds hearings into two types of matters: excessive pricing and failure to file.

Excessive Pricing

The PMPRB can hold public hearings to determine whether the price of a medicine is excessive. During a hearing, submissions and evidence from the parties are heard by a Hearing Panel of at least two Board members. The Hearing Panel determines whether a patented medicine is being, or has been, sold at an excessive price in any market in Canada by taking into consideration the available information relating to the factors set out in section 85 of the Act. If the Hearing Panel finds the price is excessive, it can issue an order to reduce the maximum price of the patented medicine in question (or of another patented medicine of the Rights Holder) and/or to offset revenues received as a result of the excessive price. Judicial review of Board decisions can be sought in the Federal Court of Canada. No excessive pricing hearings were commenced in 2023 or between January 1 and March 31, 2024.

Failure to File

The PMPRB can hold public hearings to determine whether a Rights Holder has failed to file information as per the filing requirements set out in the Act and Regulations. If the Hearing Panel finds that the Rights Holder has failed to file, they can order the Rights Holder to report the required pricing and sales information.

No failure to file hearings were commenced in 2023 or between January 1 and March 31, 2024.

Summary

Undertakings for potential excess revenues in 2023 resulted in payments to the Government of Canada totaling $2,155,258.53.

Since 1993, 175 undertakings have led to investigation closures. In addition, 31 notices of hearing have been issued, 14 of which were resolved through settlements prior to the hearing on the merits and 17 of which were subject to a full public hearing on the merits (10 related to allegations of excessive pricing and 7 related to allegations of failure to file). These measures resulted in price reductions and/or payments to the Government of Canada. Over $243 million has been collected through undertakings, settlements, and Board Orders through payments to the Government of Canada.

Matters Before the Federal Court, Federal Court of Appeal, and Supreme Court of Canada or Other Courts

T-906-20: on January 18, 2017, Galderma Canada Inc. filed an application for judicial review of the Board’s decision dated December 19, 2016. In that decision the Board found that Canadian Patent No. 2,478,237 pertains to the patented medicine adapalene sold under the trade name Differin and ordered Galderma to file the required information for the period between January 1, 2010, and March 14, 2016. The Federal Court granted Galderma’s judicial review application on November 9, 2017, and quashed the Board’s decision. On November 21, 2017, the Attorney General appealed the Federal Court’s grant of the judicial review application. On June 28, 2019, the Federal Court of Appeal granted the appeal and issued its decision sending the matter back to the Board for redetermination. The Board’s decision on redetermination, issued on May 7, 2020, again ordered Galderma to file the required information for the period between January 1, 2010, and March 14, 2016. On August 11, 2020, Galderma Canada Inc. filed an application for judicial review of the Board’s May 7, 2020, decision on redetermination (T-906-20), which was dismissed by the Federal Court on January 11, 2024. On February 9, 2024, Galderma Canada Inc. filed a notice of appeal against the Federal Court’s January 11, 2024, decision (A-61-24). The appeal is pending.

A-61-24: On February 9, 2024, Galderma Canada Inc. filed a notice of appeal against the Federal Court’s January 11, 2024, decision (see T-906-20 above). The appeal is pending.

Table 3. Status of Board Proceedings in 2023 up to May 31, 2024

| Medicine | Indication/use | Rights holder | Issuance of notice of hearing | Status |

|---|---|---|---|---|

- |

- |

- |

- |

- |

| Medicine | Indication/use | Rights Holder | Issuance of notice of hearing | Status |

|---|---|---|---|---|

Adapalene (sold under trade names Differin and Differin XP) |

Acne |

Galderma Canada Inc. |

(redetermination) |

Board Order: May 7, 2020. Galderma to file the required information for the requested period. * Application for Judicial Review and prior litigation: see below. |

| Medicine | Indication/use | Applicant | Issue | Date of notice of hearing/status |

|---|---|---|---|---|

Adapalene (sold under trade names Differin and Differin XP) |

Acne |

Galderma Canada Inc. |

Failure to file (jurisdiction) |

Application for Judicial Review. Court File T-83-17 (Re. Board Panel’s decision of December 19, 2016): Decision issued November 9, 2017, quashing in part Board Panel’s decision. Notice of Appeal (Federal Court of Appeal) filed on November 21, 2017. Court File A-385-17. Decision issued on June 28, 2019. Matter sent for redetermination by the Board. Redetermination decision issued on May 7, 2020. Application for Judicial Review. Court File T-906-20 (Re. Board Panel’s Decision of May 7, 2020) filed on August 11, 2020. Application for Judicial Review dismissed on January 11, 2024. Notice of Appeal (Federal Court of Appeal) filed on February 9, 2024. Appeal pending. |

Pharmaceutical Pricing Trends

The PMPRB fulfills its annual reporting mandate by providing information on trends in pharmaceutical pricing in Canada, based on information submitted by Rights Holders on their sales of patented medicines, including quantities sold, list and net prices, and net revenues. This section includes analysis on the price, use, and salesFootnote 6 of patented medicines in Canada and international markets, as well as the factors that contribute to these trends.Footnote 7

In this edition of the Annual Report, Canadian list prices are used for many analyses that were based on average transaction prices in past years. List prices are publicly available gross prices for a medicine, whereas average transaction prices (ATP) are an estimate of the net price calculated by dividing sales for a medicine by the number of units sold.Footnote 8 Average transaction prices may include certain discounts and rebates given at the ex-factory level (from the manufacturer to the first purchaser), but do not include discounts or rebates provided at other points in the supply chain or through reimbursement or other agreements with insurers. Therefore, it is important to note that neither the list price nor the net price (ATP) is the true price paid by insured Canadians or by public or private insurers, who often negotiate discounts with the companies selling the medicine, its distributors, and pharmacies.

There are a number of reasons for the change to list price reporting. First and foremost, the PMPRB’s jurisdiction is limited to the ex-factory price of a medicine, as underlined in recent court decisions. Data collected by the PMPRB from Rights Holders does not include the confidential prices negotiated by payers in Canada.

Second, list prices are directly related to the pharmaceutical ecosystem in Canada and are relevant to all Canadians. They are the prices that non-insured Canadians pay at the pharmacy (before applicable pharmacy mark-ups), and the base prices on which insured Canadians calculate their co-pays, even if the insurer has negotiated a better deal behind the scenes.

List prices are also the common ground for:

- price negotiations between insurers and industry;

- product listing agreements by drug plans;

- wholesale distributor prices; and

- pharmacy reimbursement by drug plans.

Finally, the international price information filed by Rights Holders with the PMPRB consists of list prices. Comparisons of Canadian to foreign prices are most accurate if all prices are in the same category.

By switching to list price for this analysis, the information presented below is now more consistent from figure to figure, more comparable from country to country, and more compatible with other public sources of pharmaceutical analysis.

Disclaimer

Although select statistics reported in the Pharmaceutical Pricing Trends section are based in part on data obtained under license from the MIDAS® database proprietary to IQVIA Solutions Canada Inc. and/or its affiliates (“IQVIA”), the statements, findings, conclusions, views, and opinions expressed in this Annual Report are exclusively those of the PMPRB and are not attributable to IQVIA.

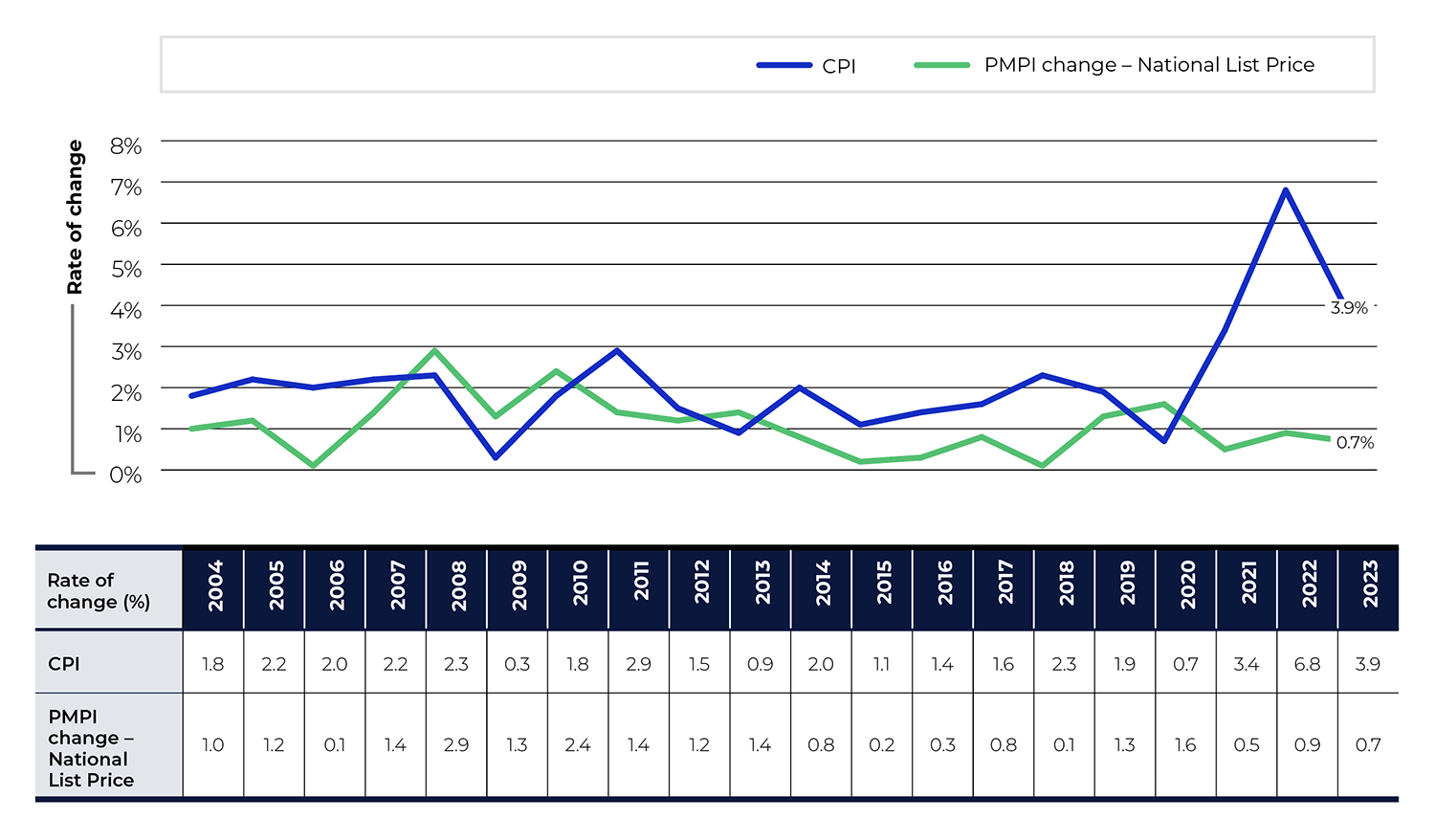

Price Trends

List prices for patented medicines in Canada may increase or decrease from one year to the next, depending on several factors in the pharmaceutical market. To chart this trend, the PMPRB uses the Patented Medicines Price Index (PMPI). The PMPI measures the average year-over-year change in the list prices of patented medicines sold in Canada. The average is weighted by the sales of each individual medicine and is based on list price and sales information submitted by Rights Holders for a six-month period.Footnote 9 This is similar to the approach Statistics Canada uses for the Consumer Price Index (CPI).

Figure 1 shows the year-over-year changes in the PMPI and the CPI side by side over two decades, from 2004 to 2023. General price inflation, as measured by the CPI, has exceeded the average increase in the prices of patented medicines almost every year since 2004. In 2023, the CPI rose by 3.9%, while the PMPI increased by 0.7%.

The PMPI only measures the sales growth that is directly tied to changes in the prices of patented medicines. It does not measure changes in the use of these medicines, changes in prescribing patterns, or the introduction of new medicines, which are explored later in this section.

Figure description

This line graph depicts the year-over-year percent changes in the PMPI and CPI for the years 2004 to 2023. The PMPI is based on the national list price in Canada.

| Year | CPI change | PMPI change (National List Price) |

|---|---|---|

2004 |

1.80% |

1.00% |

2005 |

2.20% |

1.20% |

2006 |

2.00% |

0.10% |

2007 |

2.20% |

1.40% |

2008 |

2.30% |

2.90% |

2009 |

0.30% |

1.30% |

2010 |

1.80% |

2.40% |

2011 |

2.90% |

1.40% |

2012 |

1.50% |

1.20% |

2013 |

0.90% |

1.40% |

2014 |

2.00% |

0.80% |

2015 |

1.10% |

0.20% |

2016 |

1.40% |

0.30% |

2017 |

1.60% |

0.80% |

2018 |

2.30% |

0.10% |

2019 |

1.90% |

1.30% |

2020 |

0.70% |

1.60% |

2021 |

3.40% |

0.50% |

2022 |

6.80% |

0.90% |

2023 |

3.90% |

0.70% |

Notes

Note: To account for revised submissions from Rights Holders, price and quantity indices are recalculated for the five years preceding the current Annual Report year.

Data source: PMPRB; Statistics Canada

Comparison of Canadian Prices to Foreign Prices

In addition to reporting Canadian prices, Rights Holders are also required to report publicly available pricesFootnote 10 of patented medicines in 11 comparator countries (PMPRB11): Australia, Belgium, France, Germany, Italy, Japan, Spain, Sweden, Norway, the Netherlands, and the United Kingdom (UK).

The PMPRB uses this information in its price reviews to conduct international price comparison tests and in its reporting to measure Canadian prices of patented medicines relative to those in other countries.

Price Change by Country

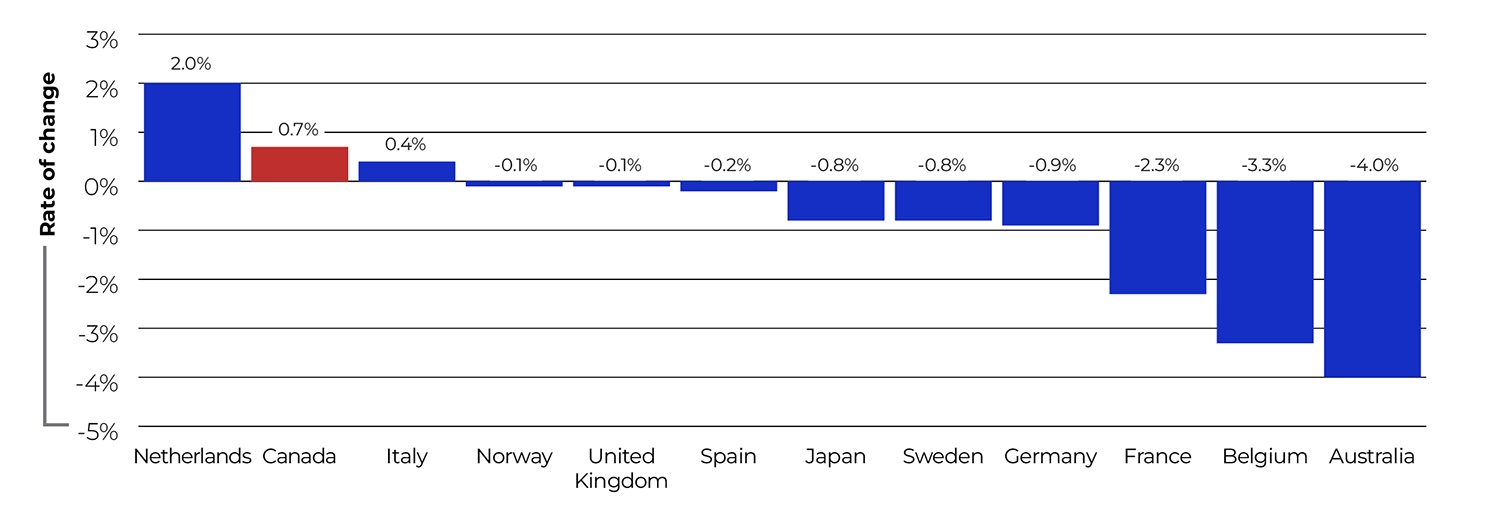

Figure 2 gives the annual change in list prices for Canada and each of the PMPRB11 countries. This analysis applies the PMPI methodology, with weights based on Canadian sales, to the international price data that Rights Holders submitted to the PMPRB.

In 2023, Canadian list prices saw a slight increase of 0.7%. While prices in Italy and the Netherlands also increased, prices in all other PMPRB11 countries decreased, most notably in Australia (-4.0%) and Belgium (-3.3%). These results are consistent with a long-term trend for patented medicine prices to rise over time in Canada and slowly fall over time in most comparator countries within the PMPRB11.

Figure description

This bar graph depicts the average annual rates of change in list prices of patented medicines for Canada and each of the PMPRB11 comparator countries.

| Country | Annual average rate of price change, 2023 |

|---|---|

Netherlands |

2.0% |

Canada |

0.7% |

Italy |

0.4% |

Norway |

-0.1% |

United Kingdom |

-0.1% |

Spain |

-0.2% |

Japan |

-0.8% |

Sweden |

-0.8% |

Germany |

-0.9% |

France |

-2.3% |

Belgium |

-3.3% |

Australia |

-4.0% |

Notes

Data source: PMPRB

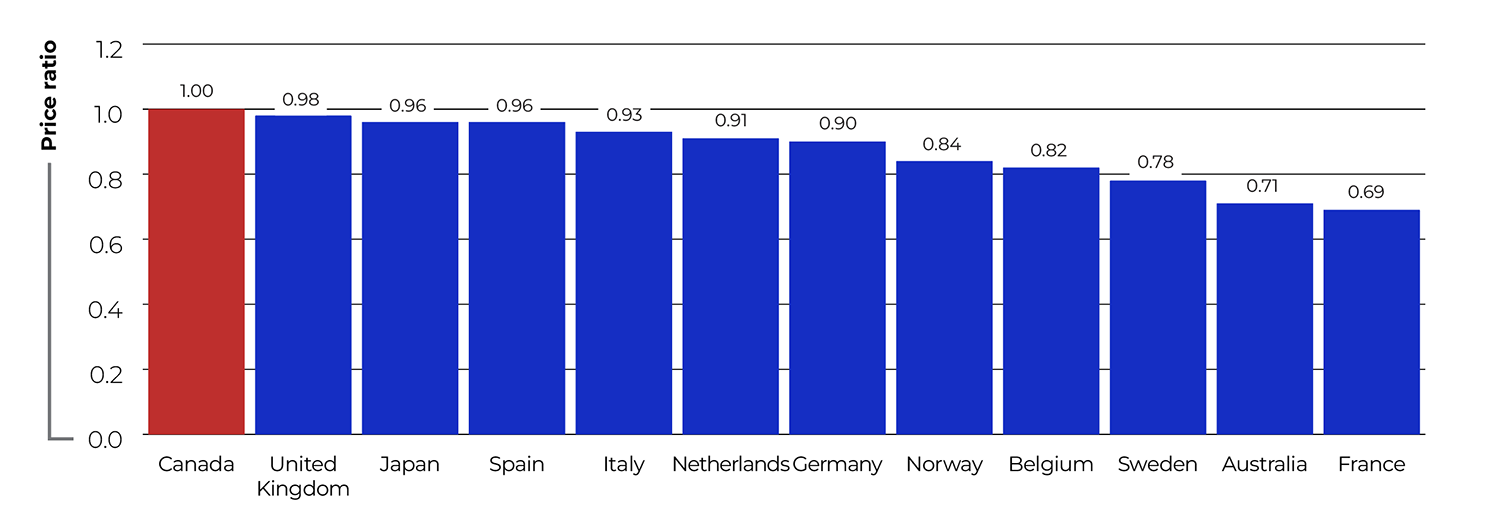

Bilateral Price Comparisons

Figure 3 and Table 4 provide bilateral comparisons of list prices in each of the PMPRB11 countries to list prices in Canada. Foreign-to-Canadian price ratios are expressed as an index with the Canadian price set to a value of 1.00 and the international price reported relative to this value. A value lower than 1.00 indicates that the average international price was lower than the price in Canada. Changes in these ratios from year to year may indicate a change in the Canadian price, a change in the international price, or fluctuations in the exchange rate between the two countries’ currencies.

As shown in Figure 3, Canadian list prices in 2023 were higher than those in all PMPRB11 countries.

Figure description

This bar graph depicts the average foreign-to-Canadian price ratios in 2023 for Canada and the PMPRB11 comparator countries, using list prices.

| Country | Average foreign-to-Canadian list price ratio, 2023 |

|---|---|

Canada |

1.00 |

United Kingdom |

0.98 |

Japan |

0.96 |

Spain |

0.96 |

Italy |

0.93 |

Netherlands |

0.91 |

Germany |

0.90 |

Norway |

0.84 |

Belgium |

0.82 |

Sweden |

0.78 |

Australia |

0.71 |

France |

0.69 |

Notes

Note: This analysis uses list prices (gross prices) in Canada and international markets. Results may not be directly comparable to previous Annual Reports, which used average transaction prices (net prices) for this figure.

Data source: PMPRB; MIDAS® database, 2023, IQVIA (all rights reserved)

When international differences in the cost of living are considered using purchasing power parity (PPP), Canadians still incurred a larger consumption cost for the patented medicines they purchased in 2023 than residents of Australia, Belgium, France, Norway, and Sweden, but a lower consumption cost for patented medicines than residents of Germany, Italy, Japan, the Netherlands, Spain, and the UK (Table 4).

It is important to note that it is not always possible to find a matching foreign price for every strength and dosage form of a patented medicine sold in Canada. For example, of the 1,116 DINs that reported a patent to the PMPRB in 2023 and had Canadian sales available at the time of analysis, 40% had a publicly available ex-factory price for Japan while 65% had a price for Germany. Table 4 indicates how often an international price comparison was available for each of the comparator countries.Footnote 11

Methodology Note: Comparing Prices at Market Exchange Rates and Purchasing Power Parities

Tables 4 and 5 compare the foreign prices of patented medicines to their Canadian prices using two sets of price ratios, depending on the method by which foreign prices were converted to their Canadian dollar equivalents.

The price ratios are sales-weighted arithmetic means of price ratios for individual DINs, with weights based on Canadian sales patterns. They can help answers to questions such as:

How much more/less would Canadians have paid for the patented medicines they purchased in 2023 had they paid Country X prices rather than Canadian prices?

For example, Table 4 states that the 2023 France-to-Canada price ratio for medicines available in both countries was 0.69. This means Canadians would have paid 31% less for the patented medicines they purchased in 2023 if they had paid French prices.

Foreign-to-Canadian price ratios are reported with foreign prices converted to their Canadian dollar equivalents by means of market exchange rates (more exactly, the 36-month moving averages of market rates the PMPRB normally uses in applying its Guidelines). Year-to-year changes in these ratios may be influenced by variations in international exchange rates. For Tables 4 and 5, price ratios are also reported with currency conversion at purchasing power parity (PPP). The PPP between any two countries measures their relative costs of living expressed in units of their own currencies. In practice, cost of living is determined by pricing out a standard basket of goods and services at the prices prevailing in each country.

When applied to the calculation of foreign-to-Canadian price ratios, PPPs produce statistics answering questions such as:

How much more/less of other goods and services would Canadians have sacrificed for the patented medicines they purchased in 2023 had they lived in Country X?

For example, the 2023 France-to-Canada price ratio at PPP was 0.82 (Table 4). This means that Canadians would have sacrificed 18% less of other goods and services for the patented medicines they purchased in 2023 had they lived in France.

Because PPPs are designed to represent relative costs of living, they offer a simplified way to account for differences in overall national price levels when comparing individual prices, incomes, and other monetary values across countries. PPPs are provided here as a point of context but as they are estimates, these results should not be understood as directly representative of the prices paid in either country.

Table 4 Foreign-to-Canadian List Price Ratios, Bilateral Comparisons, Canada and the PMPRB11, 2023

| Canada | Australia | Belgium | France | Germany | Italy | Japan | Netherlands | Norway | Spain | Sweden | United Kingdom | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

At market exchange rates |

||||||||||||

Price ratio 2023 |

1.00 |

0.71 |

0.82 |

0.69 |

0.90 |

0.93 |

0.96 |

0.91 |

0.84 |

0.96 |

0.78 |

0.98 |

Price ratio 2022 |

1.00 |

0.73 |

0.83 |

0.70 |

0.91 |

0.92 |

1.06 |

0.92 |

0.85 |

0.95 |

0.80 |

0.97 |

At purchasing power parities |

||||||||||||

Price ratio 2023 |

1.00 |

0.66 |

0.98 |

0.82 |

1.06 |

1.28 |

1.13 |

1.07 |

0.87 |

1.32 |

0.82 |

1.00 |

Price ratio 2022 |

1.00 |

0.69 |

0.99 |

0.86 |

1.08 |

1.27 |

1.23 |

1.04 |

0.70 |

1.35 |

0.82 |

1.09 |

Number of patented medicines compared 2023 (DINs) |

1,116* |

498 |

567 |

497 |

721 |

619 |

441 |

680 |

689 |

660 |

547 |

707 |

Sales ($millions) |

$19,918.2 |

$15,776.0 |

$15,732.0 |

$12,135.7 |

$16,709.6 |

$15,889.1 |

$13,026.9 |

$16,762.2 |

$16,530.5 |

$15,606.6 |

$12,165.2 |

$16,732.6 |

Notes

Note: This analysis uses list prices (gross prices) in Canada and international markets. Results may not be directly comparable to previous Annual Reports, which used average transaction prices (net prices) for this table.

* Only medicines reported to the PMPRB in 2023 with available Canadian sales data at the time of the analysis are considered in this section. This is a subset of the total number of medicines reported to the PMPRB in 2023.

Data source: PMPRB; MIDAS® database, 2023, IQVIA (all rights reserved)

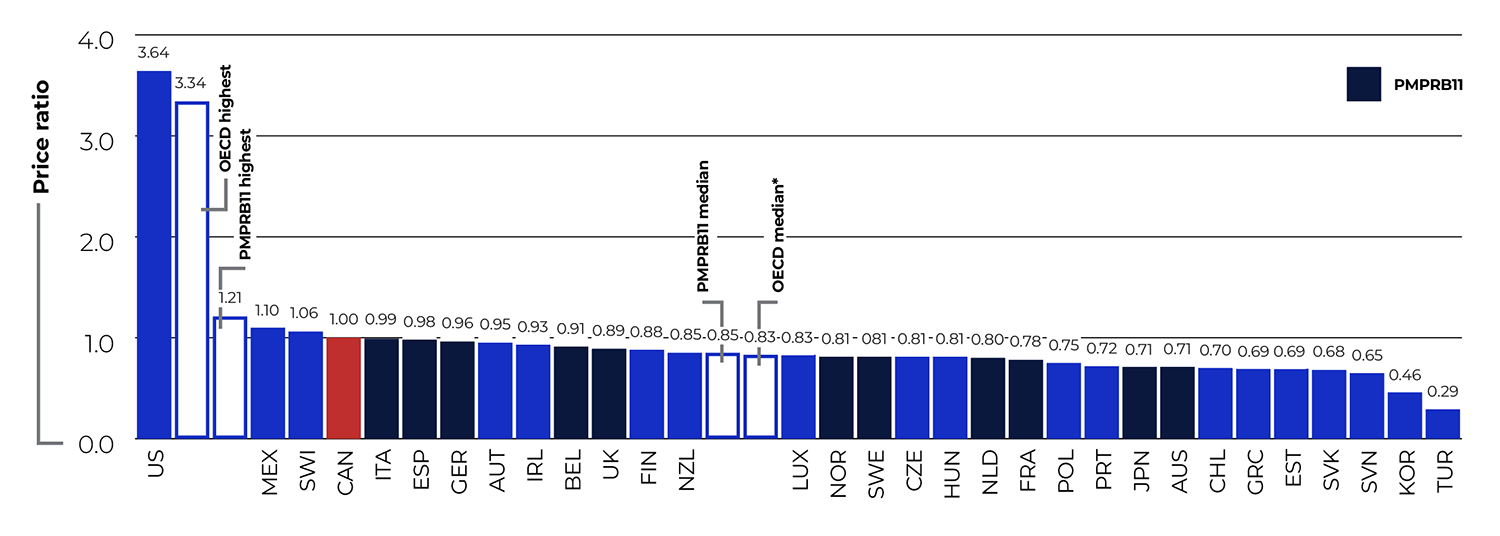

Rights Holders only report international sales data for PMPRB11 countries in which the patented medicine is sold. To assess how Canada compares to a basket of countries beyond the PMPRB11, Figure 4 uses Canadian and international prices reported in the IQVIA MIDAS® database for all countries in the Organisation for Economic Co-operation and Development (OECD) with available data. MIDAS data reflects ex-factory manufacturer prices and includes all sales in the pharmacy and hospital sectors.Footnote 12 This analysis shows that median OECD prices are, on average, approximately 17% lower than price levels in Canada, which are the fourth highest among the 31 countries.

The foreign-to-Canadian price ratios in Figure 4 are calculated using the same bilateral, sales-weighted methodology used to produce the ratios presented in Figure 3, but results will differ somewhat due to the use of different data sources.

Methodology Note: Comparing Prices with the OECD

The PMPRB's methodology focuses on the Canadian market, which may result in different price comparisons than those seen in US-centric studies, such as recent findings reported by RAND.Footnote 13

It is important to understand the methodology behind this analysis when comparing to other studies:

Medicine selection: For consistency, this analysis starts with the list of patented medicines in Canada, defined as those that reported sales to the PMPRB in the given year. From this list, only prescription medicines for human use available in both Canada and the comparison country are selected, with Canada as the base.

Price index weight: Ratios are calculated bilaterally and weighted based on Canadian sales patterns for individual medicines.

Studies with a different approach to medicine selection and weighting may result in variations in both the price ratios shown and the international ranking.

Figure description

This bar graph depicts the average foreign-to-Canadian price ratios for patented medicines in 2023 for the Organisation for Economic Cooperation and Development (OECD) countries using Canadian and international prices reported in the IQVIA MIDAS® database. The median for the OECD countries, which is calculated at the medicine level for medicines with prices available in at least three foreign markets, was 0.83. The median for the PMPRB11 comparator countries was 0.85. At the highest OECD price, the ratio was 3.34, and at the highest PMPRB11 price, the ratio was 1.21.

| Country | Average foreign-to-Canadian price ratio |

|---|---|

United States |

3.64 |

Mexico |

1.10 |

Switzerland |

1.06 |

Canada |

1.00 |

Italy |

0.99 |

Spain |

0.98 |

Germany |

0.96 |

Austria |

0.95 |

Ireland |

0.93 |

Belgium |

0.91 |

United Kingdom |

0.89 |

Finland |

0.88 |

New Zealand |

0.85 |

Luxembourg |

0.83 |

Norway |

0.81 |

Sweden |

0.81 |

Czech Republic |

0.81 |

Hungary |

0.81 |

Netherlands |

0.80 |

France |

0.78 |

Poland |

0.75 |

Portugal |

0.72 |

Japan |

0.71 |

Australia |

0.71 |

Chile |

0.70 |

Greece |

0.69 |

Estonia |

0.69 |

Slovakia |

0.68 |

Slovenia |

0.65 |

South Korea |

0.46 |

Turkey |

0.29 |

Notes

* Calculated at the medicine level for medicines with list prices available in at least three foreign markets.

Data source: PMPRB; MIDAS® database, 2023, IQVIA (all rights reserved)

Multilateral Price Comparisons

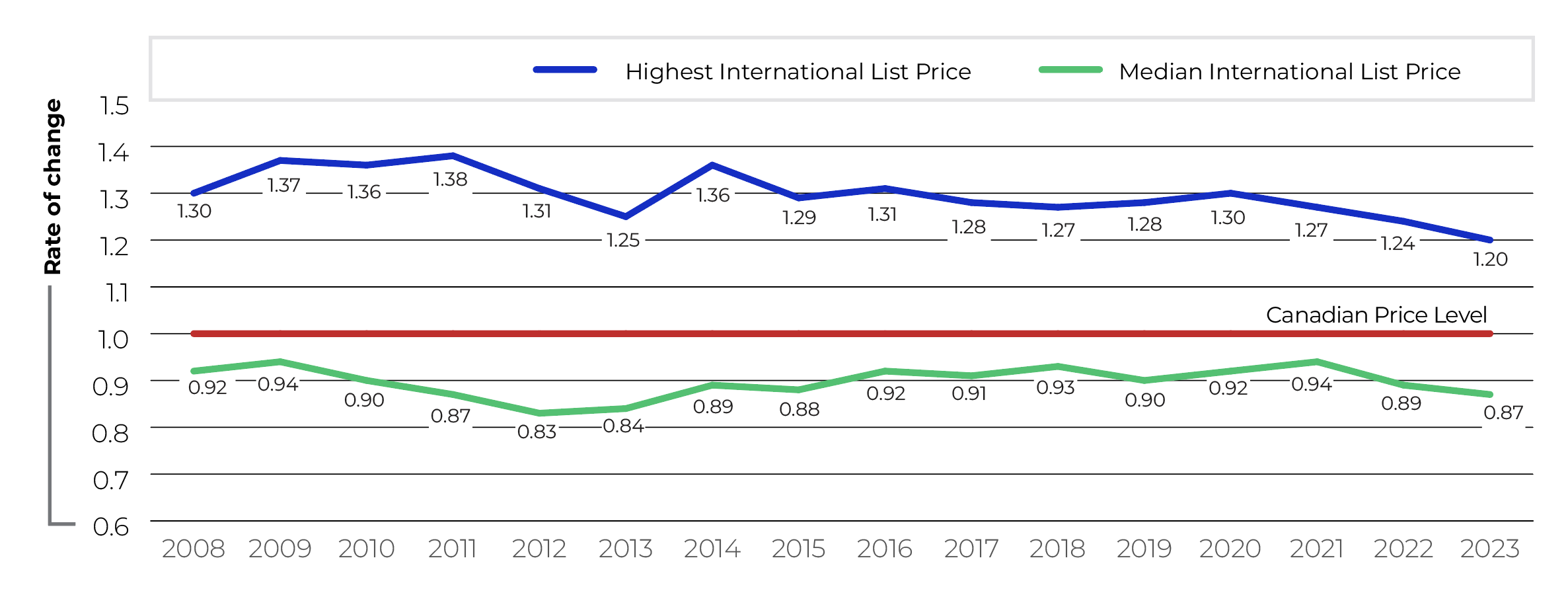

Table 5 provides foreign-to-Canadian price ratios using several multilateral measures of foreign prices. The median international price (MIP) is the median of list prices observed in the PMPRB11, while the highest international price (HIP) is the highest of the list prices for the same group. Other multilateral price ratios compare the lowest and simple mean of PMPRB11 foreign list prices to the Canadian list price.

Focusing on the results based on market exchange rates, the MIP-to-Canadian price ratio was 0.87 for the PMPRB11 in 2023, a slight decrease from 2022. The HIP-to-Canadian price ratio was 1.20 (Figure 5).

Table 5 Foreign-to-Canadian List Price Ratios, Multilateral Comparisons, 2023

| Median | Lowest | Highest | Mean | |

|---|---|---|---|---|

| Price ratio at market exchange rates | 0.87 | 0.62 | 1.20 | 0.87 |

| Price ratio at purchasing power parities | 0.99 | 0.64 | 1.50 | 1.01 |

| Number of patented medicines | 848 | 848 | 848 | 848 |

| Sales ($millions) | $18,909.67 | $18,909.67 | $18,909.67 | $18,909.67 |

Notes

Note: This analysis uses list prices (gross prices) in Canada and international markets. Results may not be directly comparable to previous Annual Reports, which used average transaction prices (net prices) for this table.

Data source: PMPRB

Figure description

This line graph depicts the trend in the average foreign-to-Canadian price ratios from 2008 to 2023 with the list price in Canada set to a value of 1.00. Two trend lines are given for the Highest International List Price (HIP) and the Median International List Price (MIP) in the PMPRB11.

| Year | Median International List Price | Highest International List Price |

|---|---|---|

2008 |

0.92 |

1.30 |

2009 |

0.94 |

1.37 |

2010 |

0.90 |

1.36 |

2011 |

0.87 |

1.38 |

2012 |

0.83 |

1.31 |

2013 |

0.84 |

1.25 |

2014 |

0.89 |

1.36 |

2015 |

0.88 |

1.29 |

2016 |

0.92 |

1.31 |

2017 |

0.91 |

1.28 |

2018 |

0.93 |

1.27 |

2019 |

0.90 |

1.28 |

2020 |

0.92 |

1.30 |

2021 |

0.94 |

1.27 |

2022 |

0.89 |

1.24 |

2023 |

0.87 |

1.20 |

Notes

Note: This analysis uses list prices (gross prices) in Canada and international markets. Results may not be directly comparable to previous Annual Reports, which used average transaction prices (net prices) for this figure.

PMPRB11 is Australia, Belgium, France, Germany, Italy, Japan, Netherlands, Norway, Spain, Sweden, and the UK.

Data source: PMPRB; MIDAS® database, 2008–2023, IQVIA (all rights reserved)

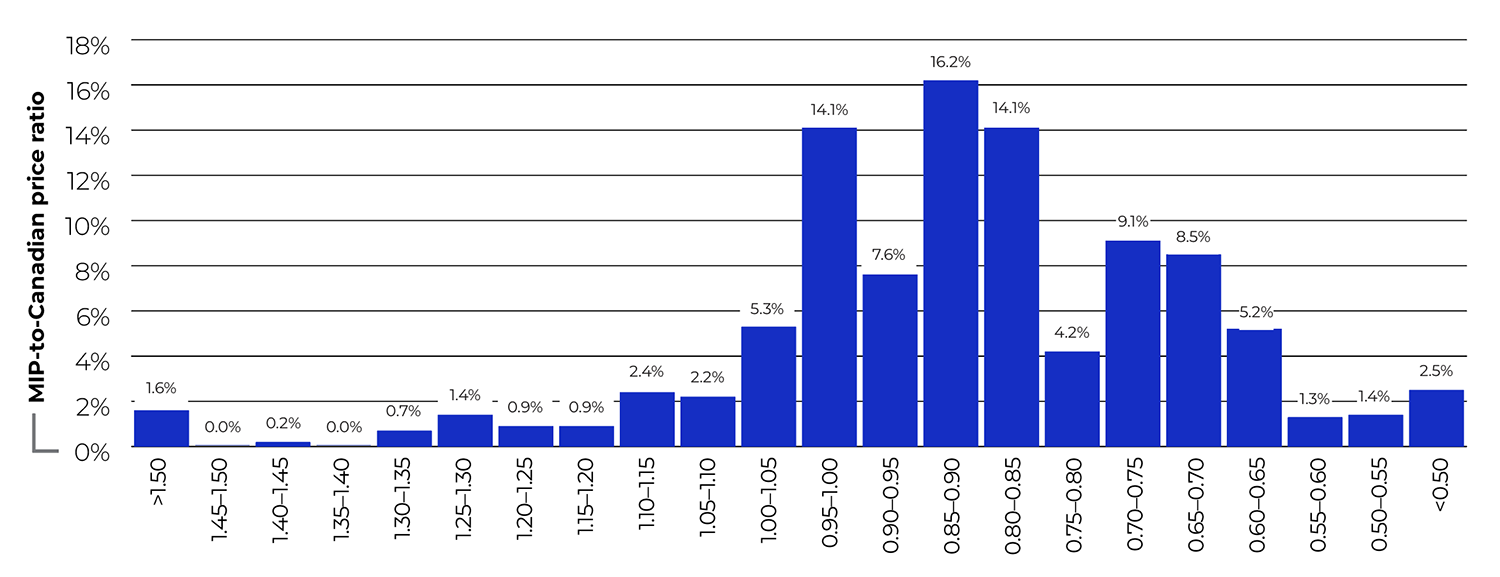

Figure 6 offers more detail on the medicine-level MIP-to-Canadian ratios underlying the ratios reported in Table 5. Figure 6(a) distributes the 2023 sales of each patented medicine according to the value of its MIP-to-Canadian price ratio (more exactly, according to the range into which the ratio fell).Footnote 14 Patented medicines with international prices similar to those in Canada (MIP-to-Canadian price ratios between 0.90 and 1.10) accounted for 29.2% of sales. Those with international prices at least 10% lower than the Canadian price (ratios less than 0.90) accounted for 62.5% of sales.

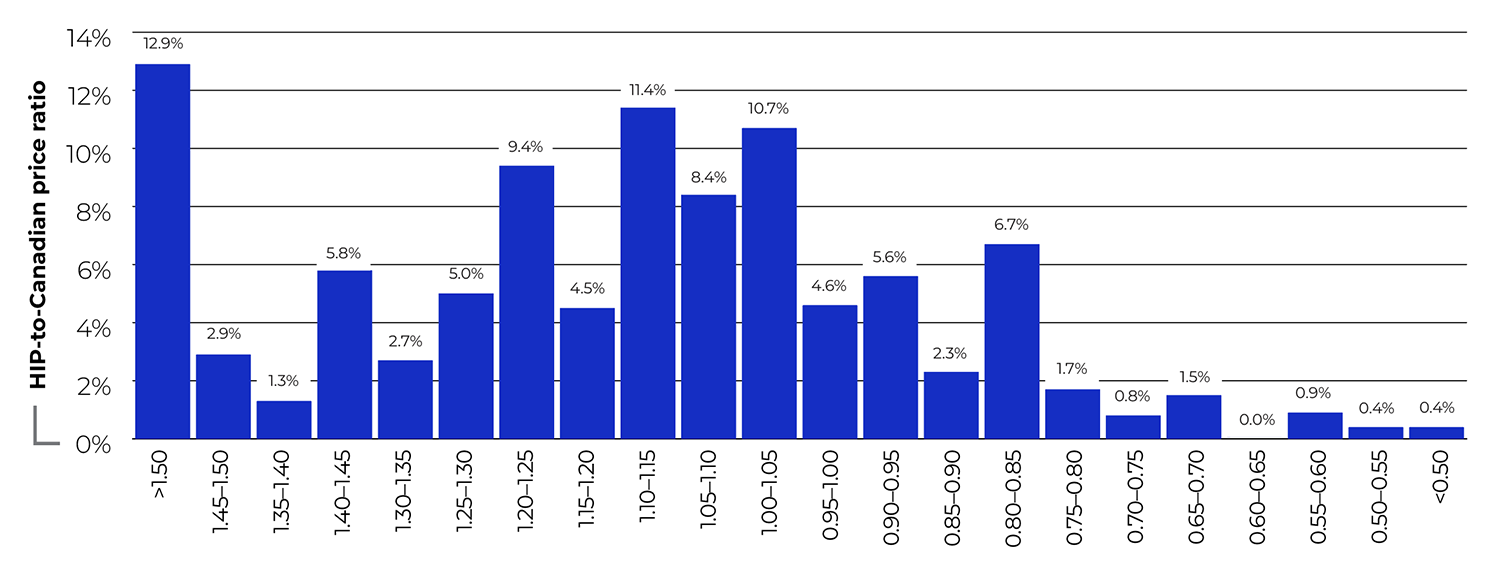

Figure 6(b) conducts the same analysis using the highest international price (HIP). In this case, medicines with ratios over 1.10 accounted for 55.9% of sales.

Figure 6 Range Distribution, Share of Sales by List Price Ratio, 2023

Figure description

This bar graph depicts the distribution of 2023 sales of patented medicines by their range of median international list price (MIP)-to-Canadian price ratio. Ratios between less than 0.50 and greater than 1.50 are given in increments of 0.05. For example, medicines with a MIP-to-Canadian price ratio less than 0.50 accounted for 2.5% of total patented medicine sales.

| MIP-to-Canadian price ratio | Share of sales |

|---|---|

>1.50 |

1.6% |

1.45–1.50 |

0.0% |

1.40–1.45 |

0.2% |

1.35–1.40 |

0.0% |

1.30–1.35 |

0.7% |

1.25–1.30 |

1.4% |

1.20–1.25 |

0.9% |

1.15–1.20 |

0.9% |

1.10–1.15 |

2.4% |

1.05–1.10 |

2.2% |

1.00–1.05 |

5.3% |

0.95–1.00 |

14.1% |

0.90–0.95 |

7.6% |

0.85–0.90 |

16.2% |

0.80–0.85 |

14.1% |

0.75–0.80 |

4.2% |

0.70–0.75 |

9.1% |

0.65–0.70 |

8.5% |

0.60–0.65 |

5.2% |

0.55–0.60 |

1.3% |

0.50–0.55 |

1.4% |

<0.50 |

2.5% |

Notes

Note: This analysis uses list prices (gross prices) in Canada and international markets. Results may not be directly comparable to previous Annual Reports, which used average transaction prices (net prices) for this figure.

Data source: PMPRB

Figure description

This bar graph depicts the distribution of 2023 sales of patented medicines by their range of highest international list price (HIP)-to-Canadian price ratio. Ratios between less than 0.50 and greater than 1.50 are given in increments of 0.05. For example, medicines with a HIP-to-Canadian price ratio less than 0.50 accounted for 0.4% of total patented medicine sales.

| HIP (highest international price)-to-Canadian price ratio | Share of sales |

|---|---|

>1.50 |

12.9% |

1.45–1.50 |

2.9% |

1.40–1.45 |

1.3% |

1.35–1.40 |

5.8% |

1.30–1.35 |

2.7% |

1.25–1.30 |

5.0% |

1.20–1.25 |

9.4% |

1.15–1.20 |

4.5% |

1.10–1.15 |

11.4% |

1.05–1.10 |

8.4% |

1.00–1.05 |

10.7% |

0.95–1.00 |

4.6% |

0.90–0.95 |

5.6% |

0.85–0.90 |

2.3% |

0.80–0.85 |

6.7% |

0.75–0.80 |

1.7% |

0.70–0.75 |

0.8% |

0.65–0.70 |

1.5% |

0.60–0.65 |

0.0% |

0.55–0.60 |

0.9% |

0.50–0.55 |

0.4% |

<0.50 |

0.4% |

Notes

Data source: PMPRB

Utilization of Patented Medicines

The price and sales data used to calculate the PMPI also allow the PMPRB to examine trends in the quantities of patented medicines sold in Canada. The PMPRB maintains the Patented Medicines Quantity Index (PMQI) for this purpose.

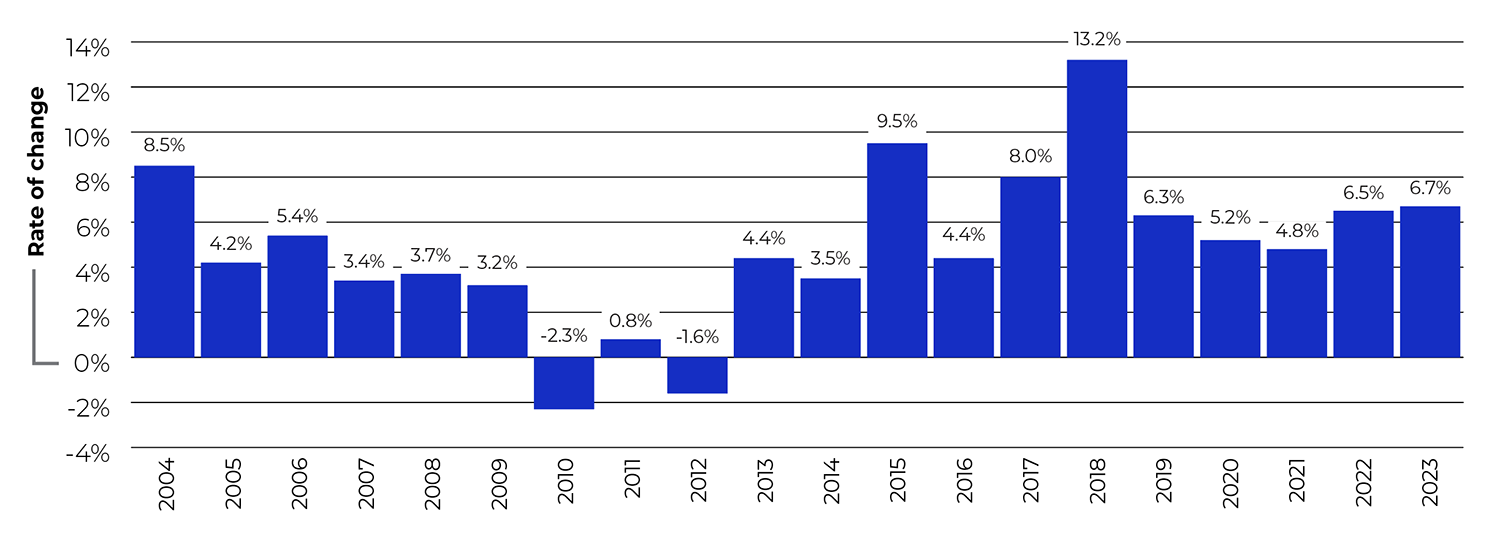

Figure 7 provides rates of utilization growth, as measured by the PMQI, from 2004 through 2023. The results show that the quantity of patented medicines sold increased by 6.7% in 2023, a slightly higher rate than the year before.

Figure description

This bar graph depicts the average annual rates of growth in utilization, as measured by the Patented Medicines Quantity Index (PMQI), from 2004 to 2023.

| Year | Rate of change |

|---|---|

2004 |

8.5% |

2005 |

4.2% |

2006 |

5.4% |

2007 |

3.4% |

2008 |

3.7% |

2009 |

3.2% |

2010 |

-2.3% |

2011 |

0.8% |

2012 |

-1.6% |

2013 |

4.4% |

2014 |

3.5% |

2015 |

9.5% |

2016 |

4.4% |

2017 |

8.0% |

2018 |

13.2% |

2019 |

6.3% |

2020 |

5.2% |

2021 |

4.8% |

2022 |

6.5% |

2023 |

6.7% |

Notes

Data source: PMPRB

Trends in Sales of Patented Medicines

Price and utilization are just two of the many factors that shape spending on patented medicines in Canada. A broader look at sales trends can provide context on which factors drove the change in sales revenues over the past year, how they compare to trends in previous years, and where Canada stands relative to international markets.

Trends in Sales

Canadians spent an additional $1,510 million on patented medicines in 2023 compared to the year before, bringing total annual spending to $19.9 billion. This represented an annual increase of 8.2%, compared to a five-year growth rate of 3.7% (Table 6).

Table 6 Sales of Patented Medicines, 2019 to 2023

Year |

Patented medicine |

5-year compound annual growth rate |

Sales of patented medicines as a share of all medicine sales* |

Patented medicine sales per capita |

Change in patented medicine sales per capita |

Patented medicine sales as a share of GDP |

|

|---|---|---|---|---|---|---|---|

Sales ($billions) |

Change in sales |

||||||

2023 |

$19.9 |

8.2% |

3.7% |

47.3% |

$513.60 |

10.4% |

0.670% |

2022 |

$18.4 |

5.7% |

1.8% |

49.0% |

$465.12 |

2.0% |

0.666% |

2021 |

$17.4 |

-1.7% |

2.2% |

51.0% |

$456.14 |

-3.3% |

0.758% |

2020 |

$17.7 |

3.0% |

3.2% |

55.4% |

$472.00 |

2.9% |

0.801% |

2019 |

$17.2 |

3.5% |

4.5% |

57.5% |

$458.60 |

2.7% |

0.748% |

Notes

* The denominator in this ratio comprises sales of patented and non-patented brand medicines and patented and non-patented generic medicines. This value is derived from data contained in IQVIA’s MIDAS® database.

Data source: PMPRB; MIDAS® database, 2019−2023, IQVIA (all rights reserved)

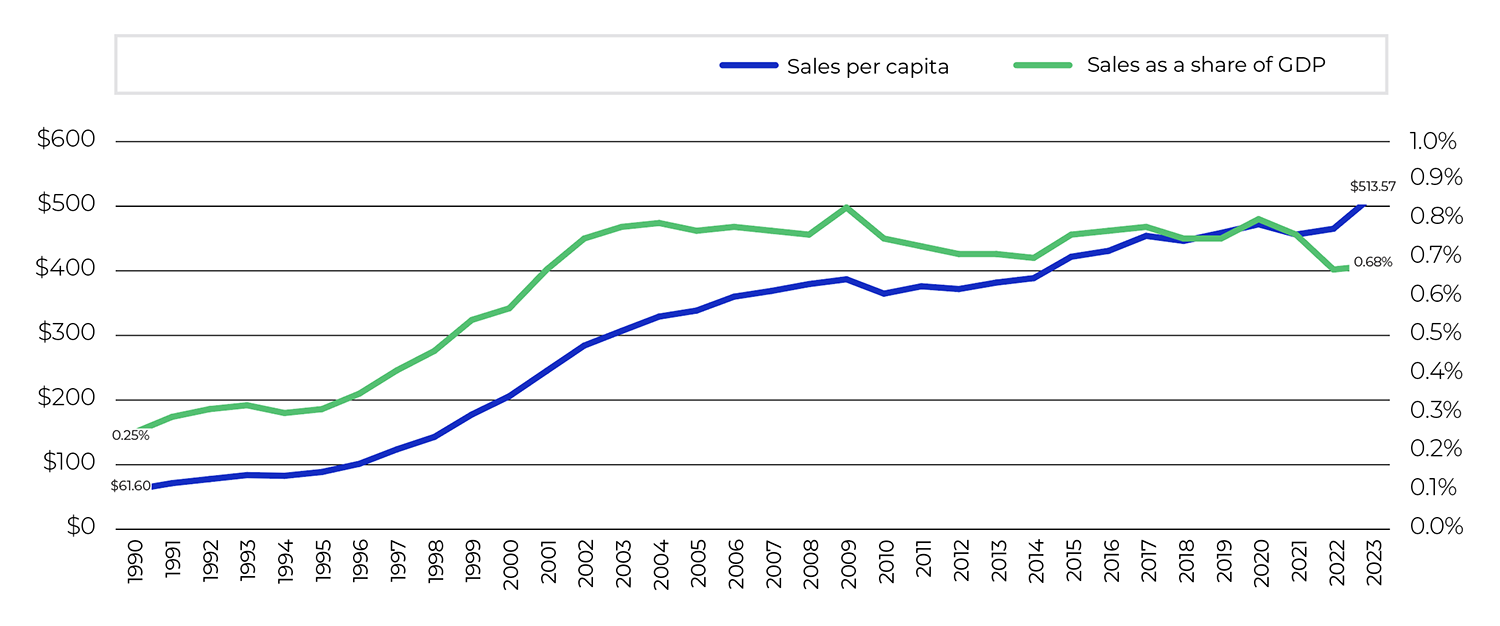

Figure 8 reports on trends in the sales of patented medicines from 1990 to 2023. Patented medicines accounted for 47.3% of the sales of all medicines in Canada in 2023, down from a peak of 72.7% in 2003 and a slight decrease from 49.0% in 2022. As shown in Figure 8(a), this percentage has generally declined since 2019, even as overall spending on patented medicines continues to trend upwards. This indicates that sales of non-patented brand and generic medicines have grown at a faster rate than sales of patented medicines in recent years.

The trends in sales per capita and sales as a percentage of the gross domestic product (GDP) displayed in Figure 8(b) show the ongoing importance of patented medicines in the Canadian economy. Since 1990, per capita sales of patented medicines have risen from $61.60 to $513.57, while sales as a percentage of GDP have risen from 0.25% to 0.68%.

Figure 8 Trends in Patented Medicine Sales, 1990 to 2023

Figure description

This line and bar graphic depicts the annual sales of patented medicines and the patented medicine share of all medicine sales from 1990 to 2023.

| Year | Sales of patented medicines ($billions) | Share of sales for patented medicines |

|---|---|---|

1990 |

$1.7 |

43% |

1991 |

$2.0 |

43% |

1992 |

$2.2 |

44% |

1993 |

$2.4 |

44% |

1994 |

$2.4 |

44% |

1995 |

$2.6 |

44% |

1996 |

$3.0 |

45% |

1997 |

$3.7 |

52% |

1998 |

$4.3 |

55% |

1999 |

$5.4 |

61% |

2000 |

$6.3 |

63% |

2001 |

$7.6 |

65% |

2002 |

$8.9 |

67% |

2003 |

$9.7 |

73% |

2004 |

$10.5 |

72% |

2005 |

$10.9 |

71% |

2006 |

$11.7 |

68% |

2007 |

$12.1 |

63% |

2008 |

$12.6 |

62% |

2009 |

$13.0 |

60% |

2010 |

$12.4 |

56% |

2011 |

$12.9 |

58% |

2012 |

$12.9 |

59% |

2013 |

$13.4 |

61% |

2014 |

$13.8 |

60% |

2015 |

$15.1 |

62% |

2016 |

$15.6 |

61% |

2017 |

$16.8 |

62% |

2018 |

$16.7 |

59% |

2019 |

$17.2 |

58% |

2020 |

$17.7 |

55% |

2021 |

$17.4 |

51% |

2022 |

$18.4 |

49% |

2023 |

$19.9 |

47% |

Notes

Note: To account for revised submissions from Rights Holders, sales are recalculated for the five years preceding the current Annual Report year.

The patented medicine share of all medicine sales is based on a denominator of sales of patented and non-patented brand medicines and patented and non-patented generic medicines. This value is derived from data in IQVIA’s MIDAS® database.

Data source: PMPRB; MIDAS® database, 1990–2023, IQVIA (all rights reserved)

Figure description

This line graphic depicts patented medicine sales per capita and as a share of GDP in Canada from 1990 to 2023.

| Year | Sales per capita | Share as a share of GDP |

|---|---|---|

1990 |

$61.60 |

0.25% |

1991 |

$71.40 |

0.29% |

1992 |

$77.70 |

0.31% |

1993 |

$83.90 |

0.32% |

1994 |

$82.80 |

0.30% |

1995 |

$88.70 |

0.31% |

1996 |

$101.40 |

0.35% |

1997 |

$123.70 |

0.41% |

1998 |

$142.90 |

0.46% |

1999 |

$177.60 |

0.54% |

2000 |

$205.90 |

0.57% |

2001 |

$245.20 |

0.67% |

2002 |

$284.30 |

0.75% |

2003 |

$307.00 |

0.78% |

2004 |

$329.20 |

0.79% |

2005 |

$338.50 |

0.77% |

2006 |

$360.00 |

0.78% |

2007 |

$368.90 |

0.77% |

2008 |

$379.50 |

0.76% |

2009 |

$386.90 |

0.83% |

2010 |

$364.70 |

0.75% |

2011 |

$376.10 |

0.73% |

2012 |

$371.80 |

0.71% |

2013 |

$381.80 |

0.71% |

2014 |

$388.70 |

0.70% |

2015 |

$421.80 |

0.76% |

2016 |

$430.94 |

0.77% |

2017 |

$454.09 |

0.78% |

2018 |

$446.30 |

0.75% |

2019 |

$458.60 |

0.75% |

2020 |

$472.00 |

0.80% |

2021 |

$456.14 |

0.76% |

2022 |

$465.12 |

0.67% |

2023 |

$513.57 |

0.68% |

Notes

Data source: PMPRB; Statistics Canada; OECD

Drivers of the Growth in Sales

Changes in patented medicine prices have played a minor role in year-over-year sales growth since 2018, suggesting that on average, the prices of existing patented medicines are fairly stable. However, this does not reflect the overall increases in treatment costs due to the entry of newer, higher-priced patented medicines.

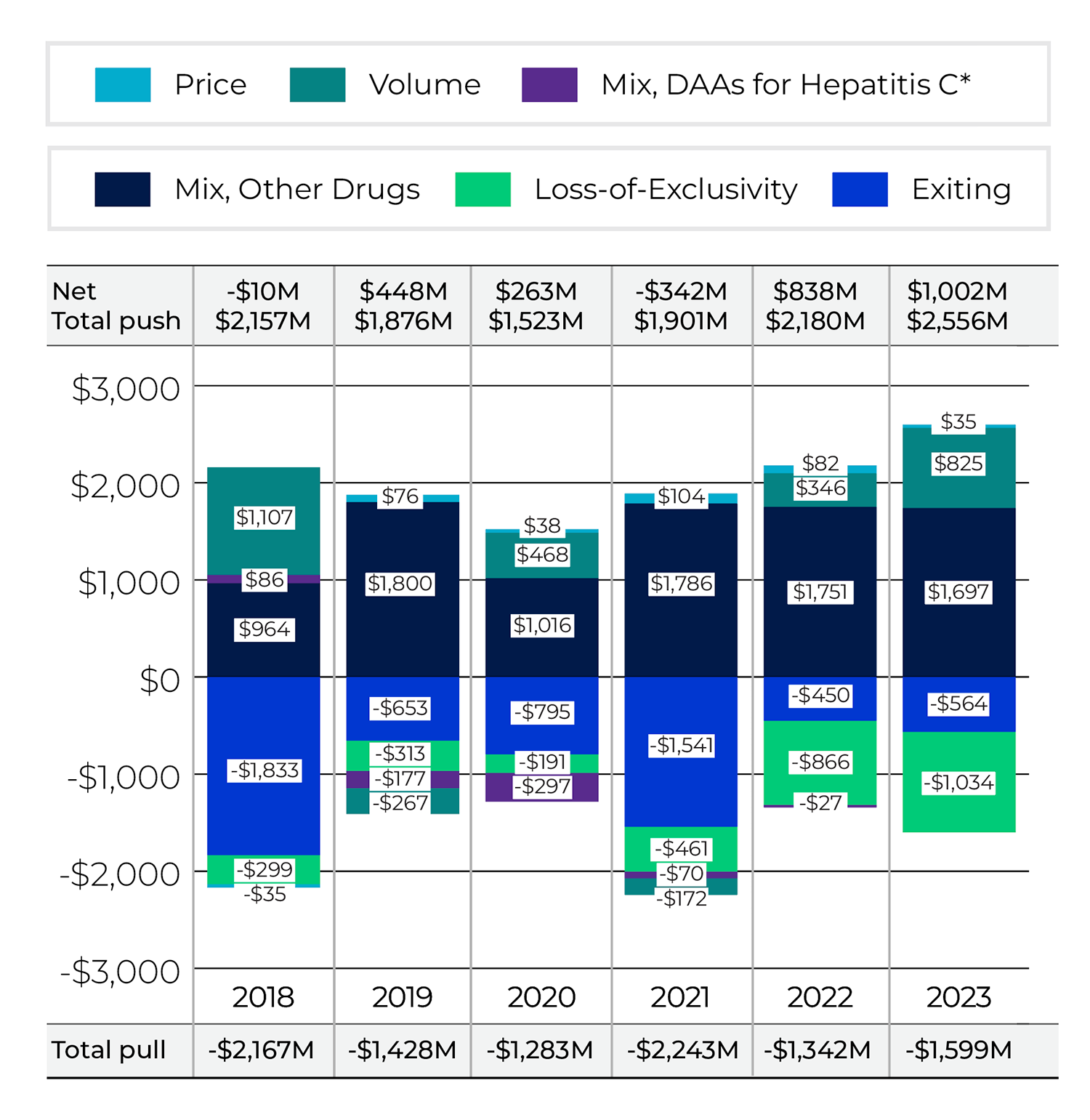

Figure 9 summarizes the major factors that drove the annual change in patented medicine sales between 2018 and 2023. This analysis shows that the shift to new higher-cost patented medicines has been a major driver of sales growth in recent years. In 2023, the use of higher-cost patented medicines (mix effect) put an upward pressure on expenditures of $1.7 billion (9.2%), while increases in the quantity of medicines sold (volume effect) contributed an additional $825 million (4.5%) push.

Counterbalancing these upward pressures, there was a moderate market segment shift as some high-selling medicines stopped reporting their sales to the PMPRB. The loss-of-exclusivity effect accounted for a pull of $1.03 billion (-5.6%) on sales in 2023.

Methodology Note: Drivers of Sales Growth

The growth in the sales of patented medicines is influenced by changes in several key factors:

- Volume effect: changes in the quantity or amount of patented medicines sold. This effect focuses on established medicines that were on the market for the period analyzed. Increases in the population, changes in demographic composition (e.g., shifts in the age distribution), increases in the incidence of disease, and changes in prescribing practices are among the factors that may contribute to this effect.

- Mix effect: shifts in use between lower- and higher-cost patented medicines. This effect applies to both new medicines and those that were already on the market. The switch to new higher-priced medicines, the use of new medicines that treat conditions for which no effective treatment previously existed, and changes in prescribing practices are among the factors that may contribute to this change.

- Exiting effect: previously patented medicines that have stopped reporting sales revenues to the PMPRB or are no longer sold in Canada.

- Loss-of-exclusivity effect: medicines that have lost market exclusivity and are open to some level of generic competition but are still patented.

- Price effect: changes in the prices of existing patented medicines. This effect applies to both increases and decreases in the prices of patented medicines over the time period analyzed.

Some factors, such as the mix effect, will generally put an upward pressure on sales, while others, such as the loss-of-exclusivity effect, have the opposite effect.

The cost driver analysis used here follows the approach detailed in the PMPRB report The Drivers of Prescription Drug Expenditures: A Methodological Report, 2013.

Figure 9 Key Drivers of Change in the Sales of Patented Medicines, 2018 to 2023

Figure description

This bar graph describes the factors that impacted the annual rates of change in the sales of patented medicines from 2018 to 2023 in absolute dollar amounts, along with the total push up (positive) and pull down (negative) effects. Direct-acting antiviral (DAA) medicines for hepatitis C are presented separately from the rest of the drug-mix effect up to 2022 because of their high impact but have been combined with the drug-mix effect for 2023.

Exiting |

Loss-of-exclusivity |

Mix, other drugs |

Mix, DAAs for hepatitis C |

Volume |

Price |

Total pull effects |

Total push effects |

Net change |

|

|---|---|---|---|---|---|---|---|---|---|

2018 |

-$1,833 |

-$299 |

$964 |

$86 |

$1,107 |

-$35 |

-$2,167 |

$2,157 |

-$10 |

2019 |

-$653 |

-$313 |

$1,800 |

-$177 |

-$267 |

$76 |

-$1,428 |

$1,876 |

$448 |

2020 |

-$795 |

-$191 |

$1,016 |

-$297 |

$468 |

$38 |

-$1,283 |

$1,523 |

$263 |

2021 |

-$1,541 |

-$461 |

$1,786 |

-$70 |

-$172 |

$104 |

-$2,243 |

$1,901 |

-$342 |

2022 |

-$450 |

-$866 |

$1,751 |

-$27 |

$346 |

$82 |

-$1,342 |

$2,180 |

$838 |

2023 |

-$564 |

-$1,034 |

$1,697 |

– |

$825 |

$35 |

-$1,599 |

$2,556 |

$1,002 |

Notes

Note: When multiple factors change simultaneously, they create a residual or cross effect, which is not reported separately in this analysis, but is accounted for in the total cost change.

Values may not add to the net change due to rounding and the cross effect.

As this model uses various measures to isolate the factors contributing to growth, the net change reported here may differ slightly from the reported overall change in the patented medicines market reported in Table 6.

* DAA: Direct-acting antivirals for the treatment for hepatitis C. Mix, DAAs for Hepatitis C is included in Mix, Other Drugs starting in 2023.

Data source: PMPRB

Figure description

This bar graph describes the factors that impacted the annual rates of change in the sales of patented medicines from 2018 to 2023 in percent rate of growth for each contributing factor, along with the total push up (positive) and pull down (negative) effects. Direct-acting antiviral (DAA) medicines for hepatitis C are presented separately from the rest of the drug-mix effect up to 2022 because of their high impact but have been combined with the drug-mix effect for 2023.

Exiting |

Loss-of-exclusivity |

Mix, other drugs |

Mix, DAAs for hepatitis C |

Volume |

Price |

Total pull effects |

Total push effects |

Net change |

|

|---|---|---|---|---|---|---|---|---|---|

2018 |

-10.9% |

-1.8% |

5.7% |

0.5% |

6.6% |

-0.2% |

-12.9% |

12.8% |

-0.1% |

2019 |

-3.9% |

-1.9% |

10.7% |

-1.0% |

-1.6% |

0.5% |

-8.5% |

11.2% |

2.7% |

2020 |

-4.6% |

-1.1% |

5.9% |

-1.7% |

2.7% |

0.2% |

-7.4% |

8.8% |

1.5% |

2021 |

-8.6% |

-2.6% |

10.0% |

-0.4% |

-1.0% |

0.6% |

-12.6% |

10.7% |

-1.9% |

2022 |

-2.6% |

-5.0% |

10.0% |

-0.2% |

2.0% |

0.5% |

-7.8% |

12.5% |

4.7% |

2023 |

-3.1% |

-5.6% |

9.2% |

– |

4.5% |

0.2% |

-8.7% |

13.9% |

5.4% |

Notes

Note: When multiple factors change simultaneously, they create a residual or cross effect, which is not reported separately in this analysis, but is accounted for in the total cost change.

Values may not add to the net change due to rounding and the cross effect.

As this model uses various measures to isolate the factors contributing to growth, the net change reported here may differ slightly from the reported overall change in the patented medicines market reported in Table 6.

* DAA: Direct-acting antivirals for the treatment for hepatitis C. Mix, DAAs for Hepatitis C is included in Mix, Other Drugs starting in 2023.

Data source: PMPRB

Global Sales

To compare Canadian sales trends to those in international markets, the following figures and tables make use of global sales data for all prescription medicines from IQVIA.Footnote 15

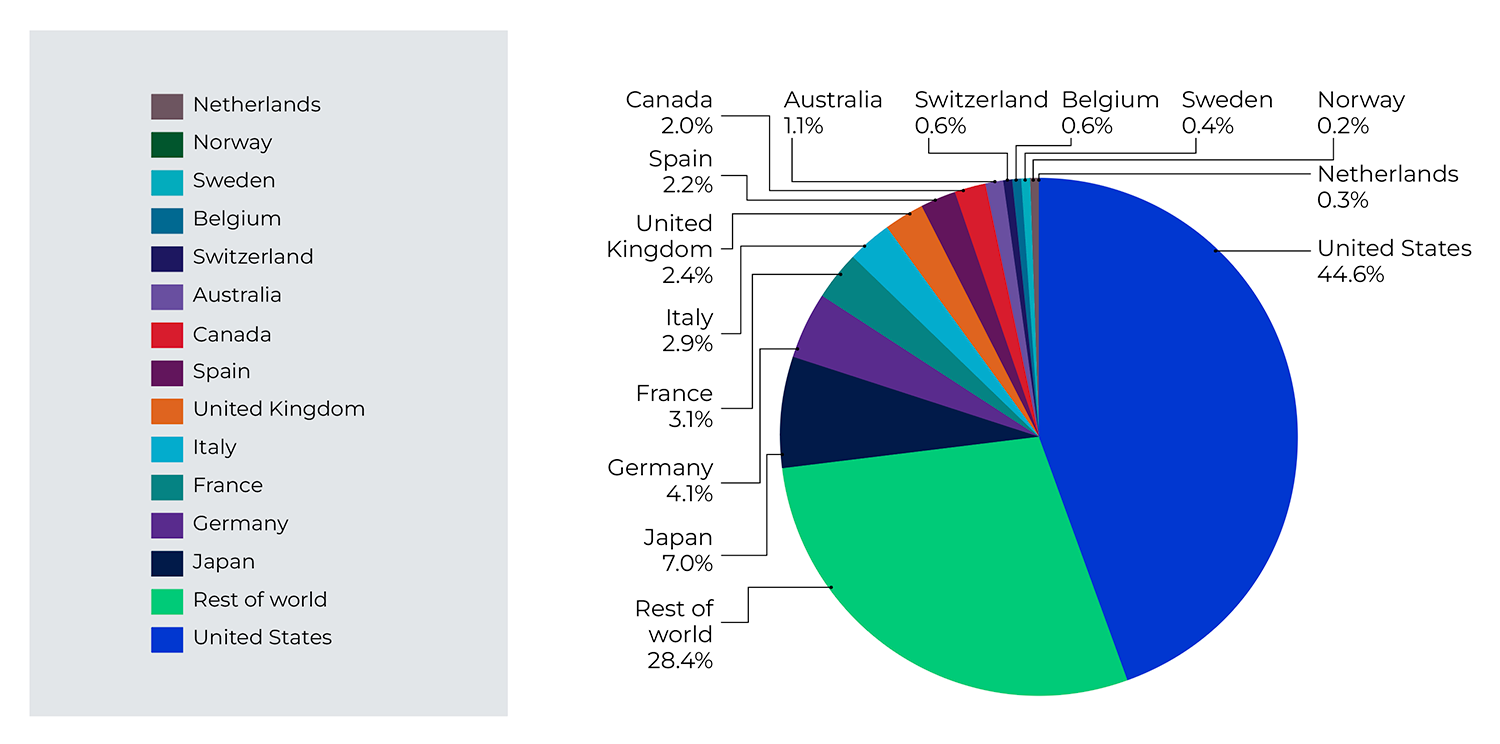

Figure 10 shows the shares of global sales held by Canada and other major national markets, including the PMPRB11 countries.Footnote 16 Canadian sales accounted for 2.0% of the global market in 2023, making Canada the ninth largest national market for pharmaceuticals. Canada has consistently been within the 2.0%–2.5% range over the last decade.

Figure description