T3010 charity return – Filing information

- Overview

- Before you file

- Filing information

- After you file

Two ways to file your charity return

Through MyBA

You can complete your return online using the new digital services for charities available on My Business Account (MyBA):

- If it is your first time accessing your charity’s account using MyBA, follow the instructions under the tab “Registered charity, RCAAA, RNASO” to log into MyBA.

- Once logged into MyBA, under your RR account, select the link “File a return”.

- You can now start completing your online return. For more information, see Advantages of filing using digital services.

If you have difficulty accessing the digital services, or have questions regarding the online return you can contact the Charities Directorate.

Any director registered with MyBA, or an authorized representative registered with Represent a Client, can complete your charity return entirely online.

On paper

Complete by hand or use the PDF fillable/saveable version of the following forms:

- Form T3010, Registered Charity Information Return

- Form T1235, Directors/Trustees and Like Officials Worksheet

- Form T1236, Qualified Donees Worksheet / Amounts Provided to Other Organizations (if applicable)

- Form T1441, Qualifying Disbursements: Grants to Non-Qualified Donees (if applicable)

- Form T2081, Excess Corporate Holdings Worksheet for Private Foundations (if applicable)

Mail the completed forms and your financial statements to:

Charities Directorate

Canada Revenue Agency

105 – 275 Pope Road

Summerside PE C1N 6E8

When your return is mailed, the postmarked date indicated on the envelope is used as the received date.

If you mail your return to an address other than the Charities Directorate (such as a tax services office), processing will be delayed.

Advantages of filing using digital services

- The form is broken down into sections that you complete at your leisure.

- You will only be asked for additional information on certain items depending on whether you say yes or no to previous questions, or check certain items on a list.

- Progress bars and status indicate which sections you’ve completed, started, or haven’t started yet.

- Start and stop the return at any time. Clicking “next” saves the information up to that point.

- Multiple individuals can work on it.

- Review and change a section at any time.

- You can print the return for your records once it’s been submitted.

- No more postmarks. The date you click submit is the date we officially receive it.

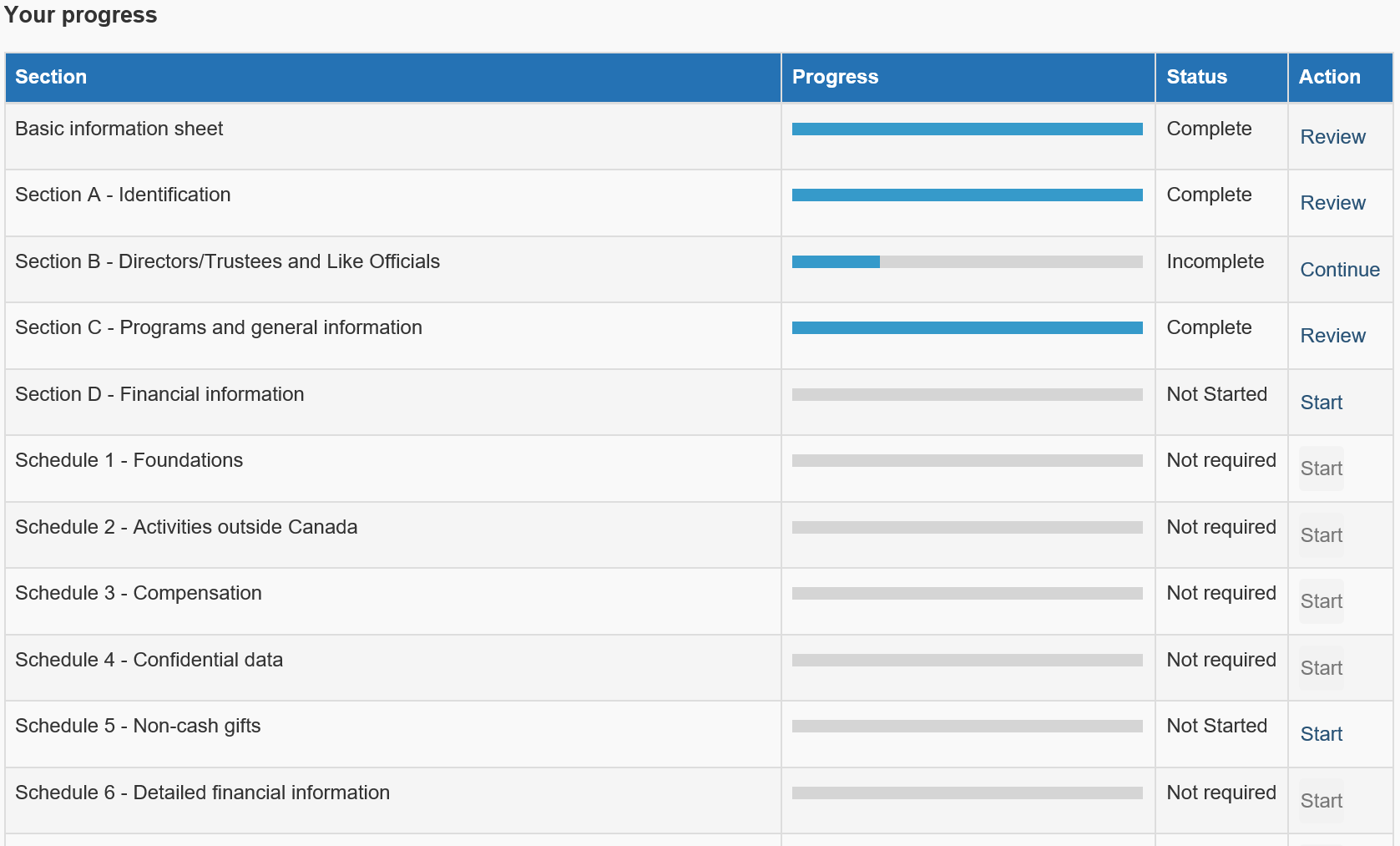

Image description

A screenshot from the T3010 Overview page on My Business Account showing the return’s progress table. This table lists all the sections, schedules and forms of the return that a charity needs to complete online. Each line of the table includes the title of the section, schedule or form, the progress bar, the status, and an action link.

Each progress bar fills up as you answer the questions in the section, schedule or form.

The status shows whether the section, schedule or form is Not started, Incomplete, Complete or Not required.

The action link is used to enter the section, schedule or form. It is clickable only for those sections, schedules or forms that the charity has to complete. The text of the link changes as you answer questions in the return. It says Start if you have not started the section yet, Continue if you have started but have not completed it, and Review once it is completed. You can still go back to make revisions when you click the Review link.

Guides and help

Related services and information

Page details

- Date modified: