Treasury Board of Canada Secretariat 2024–25 Departmental Results Report

At a glance

This departmental results report details the Treasury Board of Canada Secretariat’s (TBS’s) actual accomplishments against the plans, priorities and expected results outlined in its 2024–25 Departmental Plan.

Key priorities

TBS’s key priorities in 2024–25 were as follows:

- advancing responsible government spending

- improving digital government and the delivery of digital services

- strengthening management excellence across the public service

- improving people management practices and bargaining in good faith

- modernizing the federal regulatory system

Highlights for Treasury Board of Canada Secretariat in 2024–25

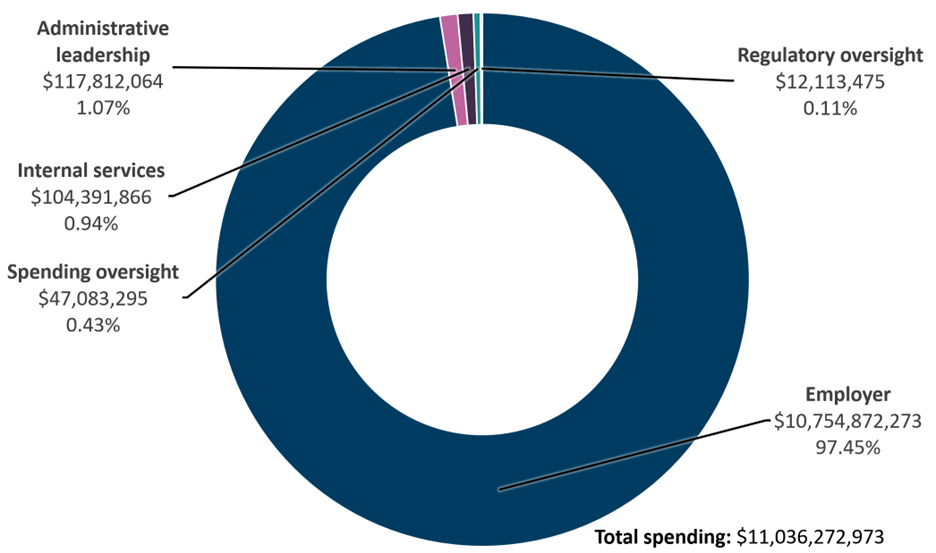

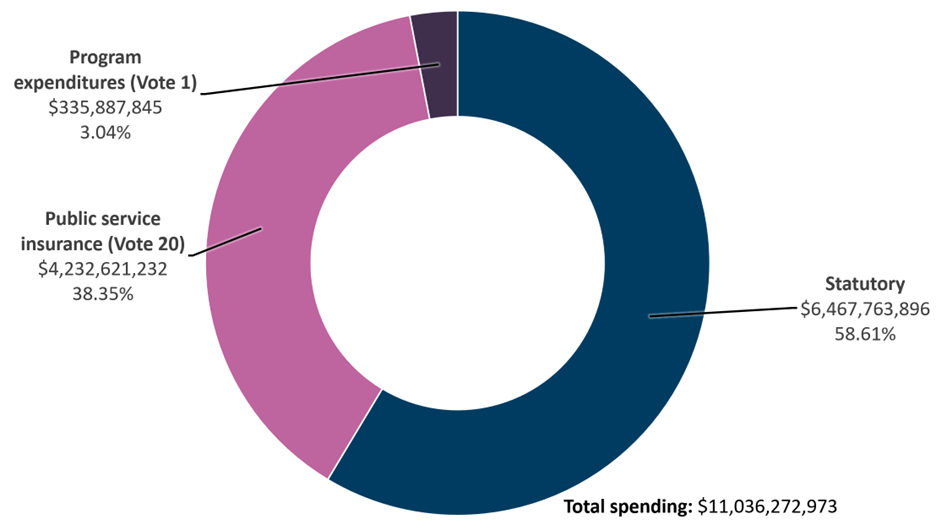

- Total actual spending (including internal services): $11,036,272,973

- Total full‑time equivalent staff (including internal services): 2,422

Complete information on the Treasury Board of Canada Secretariat’s total spending and human resources is available in the Spending and human resources section of its full departmental results report.

Summary of results

The following provides a summary of the results the department achieved in 2024–25 under its main areas of activity, called “core responsibilities.”

Core responsibility 1: Spending oversight

Actual spending: $47,083,295

Actual full‑time equivalent staff: 297

TBS oversaw government spending by:

- reviewing and challenging more than 450 Treasury Board submissions to make sure they aligned with government priorities and were fiscally responsible

- leading strategies to make sure federal organizations had the funds they needed to operate while Parliament was prorogued

- completing the review of the Policy on Results and starting updates to strengthen its effectiveness

- continuing to help departments improve the quality of reporting on the gender and diversity impacts of nearly 800 government programs

- continuing to integrate the Quality of Life Framework for Canada into government decision‑making processes to help make sure the government’s investments benefit Canadians

- collaborating with departments, professional associations and the Canada School of Public Service to strengthen capabilities in the evaluation and performance measurement communities, and among users of results information

More information on TBS’s spending oversight core responsibility is available in the “Results – what we achieved” section of its full departmental results report.

Core responsibility 2: Administrative leadership

Actual spending: $117,812,064

Actual full‑time equivalent staff: 739

TBS promoted the sound management in government by:

- establishing a working group to examine productivity in the federal public service

- developing a new risk and compliance process to help deputy heads meet their accountabilities

- working to make sure government service delivery is digitally enabled and meets the needs of Canadians through strategies such as the following:

- Canada’s first strategy on artificial intelligence (AI) for the public service

- the Government of Canada Enterprise Cyber Security Strategy

- the 2024 Application Hosting Strategy

- the Trust and Transparency Strategy

- the 2023–2026 Data Strategy for the Federal Public Service

- the Government of Canada Digital Talent Strategy

- taking steps to uphold and enforce the highest standards of procurement and ensure sound stewardship of funds, including by:

- introducing requirements for all managers across government to strengthen accountability in procurement management

- completing the Horizontal Internal Audit of Procurement Governance

- releasing the Guide to Mitigating Conflicts of Interest in Procurement

- posting more information on government contracts on the Open Government portal to promote transparency

- working with the Canada School of Public Service and with Public Services and Procurement Canada to strengthen procurement training and create a new professional development framework for procurement and materiel management professionals

- continuing to make sure the government’s financial statements were prepared according to generally accepted accounting principles, as recognized by the Office of the Auditor General for the 26th consecutive year

- continuing to support the Greening Government Strategy, which has succeeded in surpassing the government’s 40% emissions‑reduction target for greenhouse gas emissions from its facilities and conventional fleet, one year sooner than the initial target

More information on TBS’s administrative leadership core responsibility is available in the “Results – what we achieved” section of its full departmental results report.

Core responsibility 3: Employer

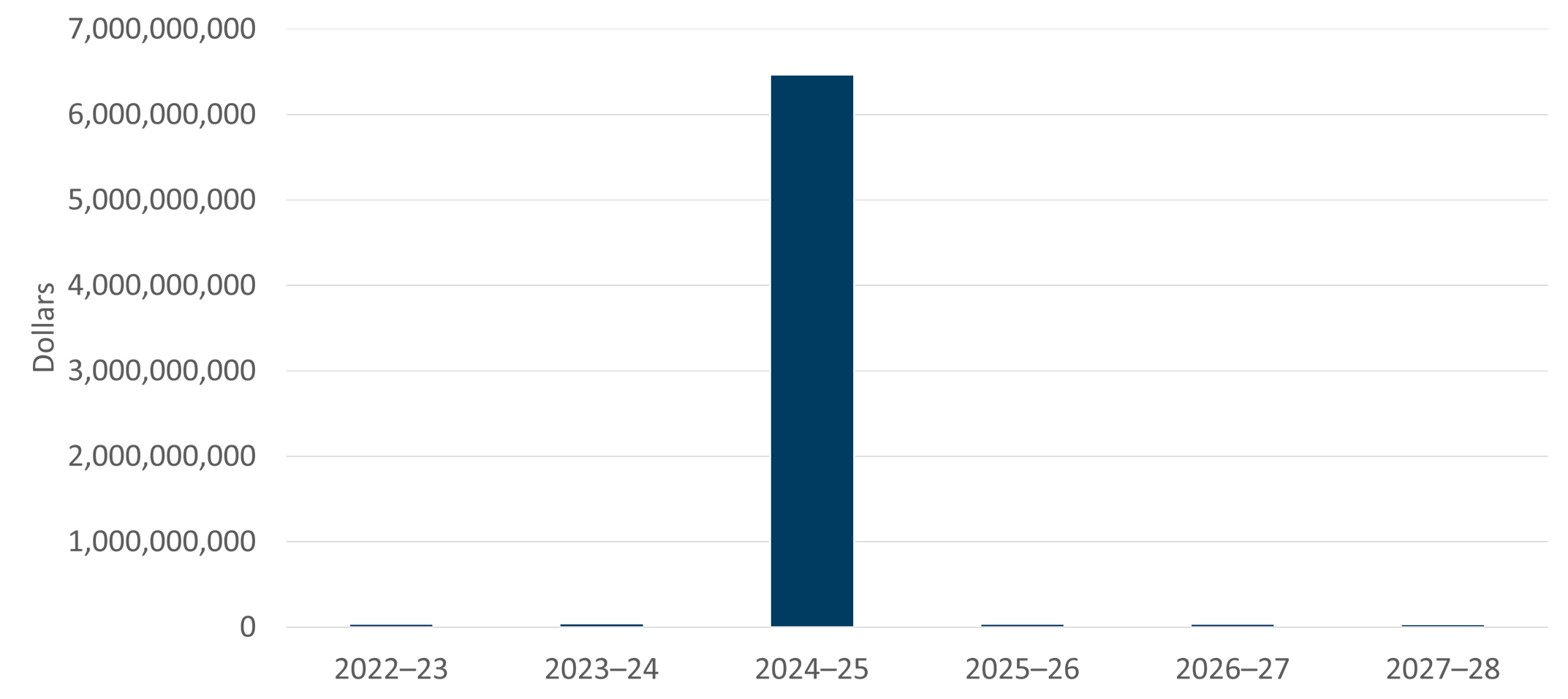

Actual spending: $10,754,872,273

Actual full‑time equivalent staff: 641

TBS did the following as part of making sure the public service has good people management practices:

- issued Guidance for Public Servants on their Personal Use of Social Media as part of continuing to foster a clear understanding of the Values and Ethic Code for the Public Sector

- continued to develop and implement the Action Plan for Black Public Servants, including introducing the Second Official Language Training Initiative to offer flexible training options to more than 500 Black public servants annually

- supported implementation of the Accessibility Strategy for the Public Service of Canada, which led to the government hiring nearly 7,000 persons with disabilities, surpassing the goal set in 2019 of hiring 5,000 new public servants with disabilities by 2025

- supported implementation of the modernized Official Languages Act by:

- establishing a new Official Languages Accountability and Reporting Framework to clarify roles and responsibilities in implementing the modernized act

- launching a new version of the online tool Burolis to help Canadians find out which federal offices offer services in English, in French or in both official languages

- launching a framework for second official language training to increase the bilingual capacity of the public service

TBS negotiated in good faith and reached agreements with 14 bargaining units representing 25% of represented employees in the core public administration. It also:

- drafted legislative changes to allow eligible federal and territorial public servants in critical frontline safety and security roles to retire after 25 years of service without pension reductions

- oversaw the smooth transition of administration of the Public Service Dental Care Plan from Sun Life to Canada Life and introduced improvements and changes to the plan

More information on TBS’s employer core responsibility is available in the “Results – what we achieved” section of its full departmental results report.

Core responsibility 4: Regulatory oversight

Actual spending: $12,113,475

Actual full‑time equivalent staff: 68

TBS worked to make sure the federal regulatory system protected and advanced the public interest, including sustainable economic growth, by:

- providing a dedicated challenge function on all Governor‑in‑Council regulatory submissions and orders‑in‑council in support of decision‑making by the Treasury Board, Part B

- accelerating negotiations among the provinces and territories on a framework on the mutual recognition of goods

- organizing a meeting of the Canada–United States Regulatory Cooperation Council, which promotes economic growth, job creation, and other benefits to consumers and businesses through increased regulatory transparency and coordination

- supporting the External Advisory Committee on Regulatory Competitiveness in providing its final advice to the Treasury Board to advance regulatory excellence

- continuing to advance regulatory modernization and work to remove red tape in the federal regulatory system, including through the TBS Red Tape Reduction Office

More information on TBS’s regulatory oversight core responsibility is available in the “Results – what we achieved” section of its full departmental results report.

From the President

President of the Treasury Board

I am pleased to present the Departmental Results Report for the Treasury Board of Canada Secretariat (TBS) for 2024–25. This report presents the progress TBS has made in its ongoing work for Canada and Canadians.

TBS has improved how government purchases are managed to ensure public funds are used responsibly. This includes setting new requirements for managers across government to strengthen accountability in procurement, completing the Horizontal Internal Audit of Procurement Governance, and releasing the Guide to Mitigating Conflicts of Interest in Procurement. TBS is also increasing transparency by sharing more details about government contracts on the Open Government portal.

During the year, TBS took significant strides in the digital leadership space. For instance, the department launched Canada’s first AI Strategy for the Federal Public Service to help the government seize the opportunities of innovative technology while establishing guardrails to protect our systems. In addition, TBS developed the Government of Canada’s Enterprise Cyber Security Strategy to improve collaboration across departments and better equip government to anticipate, respond to and recover from cyber attacks.

Recognizing that red tape is a barrier to investment and growth, TBS established the Red Tape Reduction Office to make the regulatory system more efficient, reduce barriers to investment and economic growth and reduce regulatory costs for Canadians and businesses.

TBS continues to lead the government’s push towards operations that are net-zero emissions, climate-resilient, and green – all of which contribute to reduced operating costs over time. This past fiscal year, the government succeeded in surpassing its 40% reduction target for greenhouse gas emissions from its facilities and conventional fleet, one year ahead of schedule.

To foster a diverse, equitable, accessible and inclusive workforce and workplace, TBS continued to support the implementation of the Accessibility Strategy for the Public Service of Canada. This work led to the government hiring nearly 7,000 persons with disabilities, surpassing its goal by 2,000 new hires. TBS also introduced the Second Official Language Training Initiative to annually help provide more than 500 Black employees with the opportunity to succeed through flexible training options.

These are just a few examples of the work TBS undertook during 2024–25 to support a high-functioning public service. I invite you to read this report to see how TBS is helping the government move forward on its commitments to Canadians.

Original signed by

The Honourable Shafqat Ali, P.C., M.P.

President of the Treasury Board

Results – what we achieved

Core responsibilities and internal services

Core responsibility 1: Spending oversight

In this section

Description

TBS reviews spending proposals and authorities and existing and proposed government programs for efficiency, effectiveness and relevance; and provides information to Parliament and Canadians on government spending.

Quality of life impacts

TBS’s activities carrying out this core responsibility contribute to the “good governance” domain of the Quality of Life Framework for Canada and, more specifically, “confidence in institutions.”

Progress on results

This section details the department’s performance against its targets for its departmental result under Core responsibility 1: Spending oversight.

For spending oversight, 91% of a sample of government programs included suitable measures for tracking performance and informing decision‑making, which exceeds the target of 90% and is 2% higher than the previous year.

Table 1 shows the departmental result indicator, the target, the date to achieve the target, and the actual result for the departmental result “Government organizations measure, evaluate and report on their performance” for the last three fiscal years.

| Departmental result indicator | Target | Date to achieve target | Actual result |

|---|---|---|---|

| Percentage of government programs that have suitable measures for tracking performance and informing decision‑making | At least 90% | 2022–23: 87% 2023–24: 89% 2024–25: 91% |

The Results section of the infographic for the Treasury Board of Canada Secretariat on GC Infobase provides additional information on results and performance related to TBS’s program inventory for spending oversight.

Details on results

The following section describes the results achieved for spending oversight in 2024–25.

1. Reviewing proposals from departments for new and existing programs

In 2024–25, TBS led strategies to make sure federal organizations had the funds they needed to operate while Parliament was prorogued. In addition, it reviewed more than 550 Treasury Board submissions from departments for new and existing programs to make sure they:

- aligned with Treasury Board policies

- supported value for money

- clearly explained the results to be achieved and how they would be measured

- contained clear assessments of risks, including financial risks

This work supported government priorities including:

- new programs and initiatives

- defence procurement and shipbuilding projects, such as the River-class destroyers and polar icebreakers

- funding to support asylum claimants and new Canadians

- Indigenous claims and litigation settlements

- economic investments to support growth and development

2. Improving managing for results

To improve the government’s overall approach to managing for results, TBS completed the review of the Policy on Results and started working on renewing it. The policy, which came into force in 2016, sets out the fundamental requirements for departments in relation to their accountability for performance information and evaluation. It also emphasizes the importance of focussing on results in management and expenditure decisions, and in public reporting.

Working with departments, TBS improved data collection on gender and diversity to support the annual reporting required under the Canadian Gender Budgeting Act.

TBS also continued to integrate the Quality of Life Framework into government decision‑making processes to help make sure the government’s investments benefit Canadians. The framework measures what matters most to Canadians and supports evidence‑based budgeting and decision‑making at the federal level.

In collaboration with departments, professional associations and the Canada School of Public Service, TBS continued to strengthen capabilities in the evaluation and performance measurement communities, as well as among users of results information.

Resources required to achieve results

Table 2 provides a snapshot of the planned and actual spending and full‑time equivalents required to achieve results for spending oversight in 2024–25.

| Resource | Planned | Actual |

|---|---|---|

| Spending | $5,164,159,416 | $47,083,295 |

| Full‑time equivalents | 303 | 297 |

The Finances section of the infographic for the Treasury Board of Canada Secretariat on GC Infobase and the People section of the same infographic provide complete financial and human resources information related to TBS’s program inventory.

Related government priorities

This section highlights government priorities that are being addressed through this core responsibility.

Gender‑based analysis plus

In 2024–25, TBS continued to help departments report on the gender‑ and diversity‑related impacts of their programs, as part of fulfilling the requirements of the Canadian Gender Budgeting Act. It reviewed the information provided in the departmental results reports of 90 federal organizations to assess the impacts of programs on different groups of people based on gender and other identity factors. The results of the review are in the annual report on the Impacts of Gender Based Analysis page.

United Nations 2030 Agenda for Sustainable Development and the Sustainable Development Goals

Promote policy coherence

In 2024–25, TBS supported Canada’s Federal Implementation Plan for the 2030 Agenda by continuing to help integrate the economic, social, environmental and governance aspects of sustainable development into government decision‑making. For example, it applied the sustainability and resilience lens of the Quality of Life Framework to Treasury Board submissions. TBS also continued to engage with federal partners to strengthen the use of the Quality of Life Framework in departmental plans and reports.

More information on TBS’s contributions to Canada’s Federal Implementation Plan on the 2030 Agenda and the Federal Sustainable Development Strategy can be found in the Treasury Board of Canada Secretariat’s Departmental Sustainable Development Strategy for 2023 to 2027.

Program inventory

Spending oversight is supported by the following programs:

- Expenditure Data, Analysis, Results, and Reviews

- Oversight and Treasury Board Support

Additional information related to the program inventory for spending oversight is available on the Results tab of the infographic for the Treasury Board of Canada Secretariat on GC InfoBase.

Core responsibility 2: Administrative leadership

In this section

Description

TBS leads government‑wide initiatives, develops policies and sets the strategic direction for government administration related to service delivery and access to government information, as well as the management of assets, finances, information and technology.

Quality of life impacts

TBS’s activities in relation to this core responsibility contribute to the “good governance” domain of the Quality of Life Framework for Canada, more specifically, to “confidence in institutions.” Under this core responsibility, TBS also contributes to the “environment” domain, more specifically, to reducing greenhouse gas emissions, by leading the greening of government operations.

Progress on results

This section details the department’s performance against its targets for each departmental result under Core responsibility 2: Administrative leadership.

With respect to one of the performance indicators for the departmental result “Government service delivery is digitally enabled, accessible and meets the needs of Canadians,” 52% of high‑volume services met service standards in 2024–25. This result is below the target of at least 80% and lower than in the previous year (55%).

Under the Policy on Service and Digital, reporting shifted from priority services to high‑volume services, defined as those with 45,000 or more transactions a year across all channels. This change, together with limitations in the current methodology, contributed to the decline in the percentage of services that meet service standards. However, across all services, individual service standards were met 73% of the time.

The target of 80% reflects Canadians’ expectations of simple, secure and efficient delivery of services and benefits. TBS is helping the government work toward meeting these expectations through the effective use of modern technology and data by:

- using a risk‑informed lens for overseeing service design and service delivery in order to help better coordinate work between departments

- uncovering gaps, identifying solutions, and supporting better decision‑making

- offering quarterly workshops and facilitating access to experts

- implementing a comprehensive artificial intelligence (AI) strategy for the public service

- overseeing major government transformation and modernization initiatives led by departments

- implementing the Government of Canada Digital Talent Strategy, by attracting, developing and retaining digital and service talent

In addition, TBS assesses gaps in the areas of technology, data and digital talent to identify areas for improvement so that government can provide modern, user‑friendly services to Canadians.

In 2024–25, 38% of Government of Canada business applications were assessed as healthy. This result is below the target of at least 40% and higher than in the previous year (35%). To continue to improve on this result, TBS will encourage departments to adopt good business management practices for information technology (IT). These practices include improving data collection and use to identify outdated technology and related costs, as well as continuing to validate all aspects of the digital landscape and different business needs in it.

In 2024–25, 94% of key financial management processes had a system of internal controls that was at the continuous monitoring stage, up from 93% in 2023–24.

Although the 100% target has not yet been reached, departments continue to strengthen and expand their control frameworks. They will need additional time to reach the ongoing monitoring stage. TBS will continue to support and track their progress.

More information on the Government of Canada’s service performance is available in the Infographic for Government of Canada on GC InfoBase and in the GC Service Inventory on the Open Government Portal.

Table 3 shows the departmental result indicator, the target, the date to achieve the target, and the actual result for each departmental result indicator related to “Government service delivery is digitally enabled, accessible and meets the needs of Canadians” for the last three fiscal years.

| Departmental result indicator | Target | Date to achieve target | Actual result |

|---|---|---|---|

| Percentage of high‑volume Government of Canada services that meet service standards | At least 80% | 2022–23: 40% 2023–24: 55% 2024–25: 52% |

|

| Percentage of Government of Canada business applications assessed as healthy | At least 40% | 2022–23: 38% 2023–24: 35% 2024–25: 38% |

Table 4 shows the departmental result indicator, the target, the date to achieve the target, and the actual result for the departmental result “Government has good asset and financial management practices” for the last three fiscal years.

| Departmental result indicator | Target | Date to achieve target | Actual result |

|---|---|---|---|

| Percentage of key financial management processes for which a system of internal controls has been established and that have reached the continuous monitoring stage | 100% | 2022–23: 65% 2023–24: 93% 2024–25: 94% |

The Results section of the infographic for the Treasury Board of Canada Secretariat on GC Infobase provides additional information on results and performance related to TBS’s program inventory for administrative leadership.

Details on results

The following section describes the results achieved for administrative leadership in 2024–25.

1. Strengthening the management of risk and compliance

TBS is committed to strengthening management excellence across the federal public service and to helping deputy heads meet their accountabilities as articulated in legislation and in Treasury Board policy.

In 2024–25, TBS developed a risk and compliance process to replace the Management Accountability Framework. Through the new process, which launched in 2025–26, TBS will provide departments with a mechanism for verifying annually that they are effectively managing their organizations. The process will focus on compliance, performance and risk in core areas of administration. The process will also help TBS identify enterprise‑wide trends that might need attention.

2. Examining public service productivity

In , the President of the Treasury Board formed a working group to examine productivity in the federal public service. The members of the group represented several sectors, including labour, academia and technology. They also included former members of the public service.

The working group will present its findings and recommendations to the President in 2025–26.

3. Leading digital government transformation

TBS continued to help the government work to meet Canadians’ expectations of simple, secure and efficient delivery of services and benefits through the effective use of modern technology and data. This work was guided by the 2023–2026 Data Strategy for the Federal Public Service, which sets out the strategic approach to managing data as a valuable asset across its lifecycle.

In 2024–25, following extensive public consultations, TBS launched Canada’s first AI strategy for the public service. This strategy will strengthen Canada’s role as a leader, including by:

- establishing an AI Centre of Expertise to support and to help coordinate government‑wide AI efforts

- ensuring that AI systems are secure and used responsibly

- providing training and talent development pathways

- building trust through openness and transparency in how AI is used

TBS also oversaw major government transformation initiatives led by departments by:

- working with departments to develop their initiatives

- commissioning independent third‑party reviews of select initiatives to make sure risks are identified and properly mitigated

As part of responding to the 2023 report of the Auditor General of Canada on modernizing information technology systems, TBS took steps to improve the health of government applications and to remediate technological debt. These steps included working with Shared Services Canada and other federal institutions to define the goals of the 2024 Application Hosting Strategy, which are as follows:

- to provide robust governance and oversight of application hosting performance and costs

- to leverage competitive procurements that support long‑term operations

- to drive sustainable funding that is predictable and transparent, and that is supported by effective spending and cost controls

- to promote cohesive and consolidated application hosting services to reduce burdens on federal institutions

TBS supported departments by publishing the Government of Canada Enterprise Cyber Security Strategy. Developed by TBS, Communications Security Establishment Canada and Shared Services Canada, the strategy outlines a proactive, whole‑of‑government approach to make sure the government can quickly and effectively combat cyber threats and address vulnerabilities across its digital estate. The strategy aims to help safeguard government systems, protect Canadians’ information and strengthen the resilience of digital government to ensure the continued delivery of secure and reliable digital services.

In addition, TBS released the Government of Canada Trust and Transparency Strategy. The strategy aims to make the Government of Canada open by design in support of a transparent, accountable and participatory culture of governance that contributes to the equitable and inclusive economic and social well‑being of Canada and reinforces public trust in government and democratic institutions. As part of this strategy, TBS:

- worked with partners to implement the Access to Information Modernization Action Plan

- engaged with Indigenous partners early in 2024–25 to discuss improving to access to information for Indigenous people and protecting Indigenous data from disclosure

- continued to implement the 2022–24 National Action Plan on Open Government while consulting on the 2025–29 National Action Plan in collaboration with Canada’s Multi‑stakeholder Forum on Open Government

- continued to implement the 2023–2026 Data Strategy for the Federal Public Service

As part of leading digital government transformation, TBS continued to implement the Government of Canada Digital Talent Strategy. As part of this strategy, TBS focused on:

- attracting and recruiting a diverse cohort of digital talent by working to improve recruitment processes and tools on the GC Digital Talent platform to help the federal government meet its digital talent needs

- developing and retaining digital talent by establishing a training and development fund that is investing $4.725 million annually to support efforts to equip the government’s IT professionals with the latest digital skills and knowledge

- developing fit‑for‑purpose processes, policies and tools, guided by the Directive on Digital Talent

4. Developing policies and setting the strategic direction for the management of assets and finances

i. Asset management

In 2024–25, TBS continued its efforts to support departmental management and capacity in project management, procurement, and real property.

In relation to procurement, TBS took steps to strengthen the management and oversight of procurement processes to demonstrate sound stewardship of funds. For example, it:

- introduced requirements for all managers in government to make them more accountable in managing procurement

- completed the Horizontal Internal Audit of Procurement Governance, which identified and made recommendations to:

- examine the feasibility of integrating procurement authorities

- clarify responsibilities

- enhance government-wide direction and support

- strengthen data collection and government-wide analysis

- released the Guide to Mitigating Conflicts of Interest in Procurement

- made more information about government contracts available on the Open Government portal

- worked with the Canada School of Public Service and with Public Services and Procurement Canada to strengthen training on procurement and to create a new professional development framework for procurement and materiel management professionals

TBS also collaborated with:

- departments and agencies to develop a risk‑based authority model for real property transactions to better manage real property assets

- Public Services and Procurement Canada to integrate accessibility criteria into all assets and acquired services

- Indigenous Services Canada, Public Services and Procurement Canada, and Indigenous partners to help departments follow the Mandatory Procedures for Contracts Awarded to Indigenous Businesses

ii. Financial management

In 2024–25, to support sound financial management in a tightening fiscal context, TBS continued to provide assurance and improve its framework for sound stewardship of the financial management function, including financial management policies and guidance, costing, transfer payments, and government accounting and reporting.

For the 26th consecutive year, TBS received an unmodified audit opinion from the Auditor General of Canada on the government’s consolidated financial statements. An unmodified opinion means that the Auditor General found that the government presented its financial statements fairly and according to generally accepted accounting principles. This track record of unmodified audit opinions provides continued assurance to Canadians that they can trust the financial information the government publishes.

In addition, in 2024–25, TBS continued to support sound financial management in the government by:

- working with the Department of Finance Canada and other departments to improve the governance and oversight of departmental financial forecasting and how this forecasting informs the government’s fiscal decisions

- working with departments to continually improve and adapt their established systems of internal controls to evolving risks and trends

- leading the consolidation and reduction of financial management systems across government to support departments as they migrate from legacy technology to modern digital solutions, which will help strengthen internal controls and provide better information to decision‑makers faster

- continuing to strengthen the financial management community, including by:

- improving data‑literacy skill sets

- advancing diversity, inclusion and accessibility through training and development, inclusive staffing, and accessible program design

- collaborating with departments on recruitment processes

- continuing to refine financial controls and operational flexibility by amending:

- the Policy on Financial Management to update the authorities delegated from the Treasury Board

- the Directive on Payments to provide:

- new authorities to pay honorariums to First Nations

- more flexibility for making advance payments across fiscal years

- a requirement that suppliers be paid before the payment due date

- strengthened risk management

- continuing to engage with departments and key stakeholders on the renewal of the Policy on Transfer Payments

To ensure continued independent oversight of public resources and to assure Canadians of responsible stewardship of government activities, TBS provided direction and guidance to internal audit functions in departments on updating their audit practices based on the latest policy and standards. TBS also led internal audit, advisory and other assurance engagements for more than 40 small departments and 4 regional development agencies that do not have an internal audit function.

5. Leading the greening of government operations

The Government of Canada is committed to making its operations net‑zero, resilient and green, consistent with global efforts like the Paris Agreement. The Greening Government Strategy: A Government of Canada Directive outlines the government’s plan to meet or exceed national climate objectives in its operations and establishes targets for government operations.

In 2024–25, TBS and departments succeeded in surpassing the government’s 40% emissions‑reduction target for greenhouse gas (GHG) emissions from its facilities and conventional fleet, one year ahead of its initial target.

TBS continued to support the Greening Government Strategy by:

- updating the Standard on Embodied Carbon in Construction to address the use of steel and whole‑building design

- publishing the Standard on the Disclosure of Greenhouse Gas Emissions and the Setting of Reduction Targets in federal procurements

- supporting departmental initiatives aimed at greening real property, fleet, and procurement, and at promoting climate resilience

- supporting projects through the Greening Government Fund to reduce greenhouse gas emissions in federal operations

- supporting the decarbonization of federal air and marine fleet operations through the Low‑carbon Fuel Procurement Program, including expanding the program to include carbon dioxide removal services

In addition, TBS continued to lead the federal government’s efforts to increase the understanding of the risks posed to federal assets, services and operations by climate change and to encourage action to reduce them. For example, it provided departments with guidance on how to prioritize climate risk assessment for critical real property and engineering assets.

TBS continued to promote transparency in greening operations by supporting departments in their public reporting on the environmental performance of their operations on the TBS website, the Open Government Portal and in Departmental Sustainable Development Strategies.

6. Supporting effective communications

Results achieved

In 2024–25, TBS released the new Policy on Communications and Federal Identity and the Directive on the Management of Communications and Federal Identity. The changes included:

- increasing integration of communications into departmental planning and decision‑making processes such as crisis management and policy and program development

- strengthening requirements to help ensure non‑partisan government advertising

- strengthening accountabilities for heads of communications

Resources required to achieve results

Table 5 provides a snapshot of the planned and actual spending and full‑time equivalents required to achieve results for administrative leadership in 2024–25.

| Resource | Planned | Actual |

|---|---|---|

| Spending | $117,984,693 | $117,812,064 |

| Full‑time equivalents | 541 | 739 |

The Finances section of the infographic for the Treasury Board of Canada Secretariat on GC Infobase and the People section of the same infographic provide complete financial and human resources information related to TBS’s program inventory.

Related government‑wide priorities

This section highlights government priorities that are being addressed through this core responsibility.

Gender‑based analysis plus

In 2024–25, TBS continued to develop and deliver capacity‑building and talent management strategies and initiatives that align with gender-based analysis plus priorities. These strategies and initiatives will help create a skilled, inclusive, diverse, accessible and equitable workforce in the government’s various relevant communities of practice.

United Nations 2030 Agenda for Sustainable Development and the Sustainable Development Goals

In 2024–25, TBS supported Goal 12 (Ensure sustainable consumption and production patterns) and Goal 13 (Take urgent action to combat climate change and its impacts) as part of its work to green government operations. In particular, TBS continued to work with Environment and Climate Change Canada to implement the 2023–26 Federal Sustainable Development Strategy (FSDS). Given its mandate, TBS focused on the following areas of the FSDS:

- working with all departments on implementing the Greening Government Strategy to meet commitments to achieve net‑zero emissions in government operations by 2050 and to being climate resilient

- updating the Policy on Green Procurement to include requirements on disclosure of and reduction in the carbon footprint of structural materials

- providing advice and guidance to departments on drafting the parts of their 2023–27 Departmental Sustainable Development Strategies that relate to greening their operations

TBS also supported Goal 16 (Promote peaceful and inclusive societies for sustainable development, provide access to justice for all and build effective, accountable and inclusive institutions at all levels) by acting on the recommendations of the Access to Information Review Report to Parliament. Through this work, TBS took steps to reduce delays in responding to information requests and to advance Indigenous reconciliation through support for Indigenous‑led information and data strategies.

In addition, TBS continued to advance domestic and international open data through the Open Government Partnership. Releasing more open data and improving data quality will facilitate information‑sharing within government and with external partners, which will help advance citizen‑driven activities and collaboration, and increase transparency and accountability of government actions related to sustainable development.

Open data provides critical information for achieving the UN sustainable development goals and for measuring progress in meeting them.

More information on TBS’s contributions to Canada’s Federal Implementation Plan on the 2030 Agenda and the Federal Sustainable Development Strategy can be found in the following:

Program inventory

The following programs support administrative leadership:

- Communications and Federal Identity Policies and Initiatives

- Comptrollership Program

- Digital Government Program

- Public Service Accessibility

Additional information related to the program inventory for administrative leadership is available on the Results tab of the infographic for the Treasury Board of Canada Secretariat on GC Infobase.

Core responsibility 3: Employer

In this section

Description

TBS develops policies and sets the strategic direction for people management in the public service, manages total compensation (including pensions and benefits) and labour relations, and undertakes initiatives to improve performance in support of recruitment and retention objectives.

Quality of life impacts

TBS’s activities carrying out this core responsibility contribute to the “prosperity” domain of the Quality of Life Framework for Canada and, more specifically, “employment,” “wages,” and “job satisfaction.” These activities also contribute to the “good governance” domain and, more specifically, “confidence in institutions” and “representation in senior leadership positions.”

Progress on results

This section details the department’s performance against its targets for each departmental result under Core responsibility 3: Employer.

Although deputy heads are responsible for managing their own human resources, TBS monitors the progress against the policy objectives set by the Treasury Board, as employer, and strives to ensure an appropriate degree of consistency in people management practices across the public service.

The 2024–25 targets for the overall public service were achieved for the following indicator related to these policy objectives:

- 76% of employees agreed their department or agency implements activities and practices that support a diverse workforce (target: at least 75%)

The public service fell short of TBS’s targets related to two other policy objectives:

- 69% of employees indicated their organization respects individual differences such as culture, workstyles and ideas (target: at least 80%)

- 59% of employees believed their workplace is psychologically healthy (target: more than 68%)

The results for these indicators are measured through the Public Service Employee Survey, which is conducted every two years. The 2022 survey results for the two indicators were 75% and 68%, respectively. The 2024 survey results for the two indicators declined to 69% and 59%, respectively, indicating a downward shift in employee perceptions. This decline underscores the need for sustained efforts by departments to foster an inclusive culture that actively respects and values individual differences, as well as practices and behaviours that lead to and maintain psychologically healthy and safe work environments. TBS is developing enterprise-wide guidance on effective practices and behaviours associated with psychologically healthy and safe work environments, which it plans to publish in 2026.

In 2024–25, 87% of institutions (compared with a target of at least 90%) had communications in designated bilingual offices that were almost always conducted in the official language chosen by the public.

In accordance with the Official Languages Act, TBS conducts an annual Official Languages Review Exercise in which it gathers information from federal institutions to monitor their level of compliance with their official languages obligations. The review also provides a diagnosis that identifies strengths, challenges, trends, good practices, and effective support activities. To support a higher level of performance, TBS has coordinated information sessions with institutions that were required to submit a review of their official languages programs. These sessions took place early in the annual review exercise.

In addition to monitoring public service progress against policy objectives, TBS leads negotiations with bargaining agents and manages total compensation to ensure fair and sustainable terms for collective agreements, pensions and benefits. In 2024–25, TBS met its target in relation to negotiating in good faith. Specifically, 100% of Federal Public Sector Labour Relations and Employment Board outcomes confirm that the Government of Canada bargained in good faith.

Table 6 shows the departmental result indicator, the target, the date to achieve the target, and the actual result for each indicator related to the departmental result “The public service has good people management practices” for the last three fiscal years.

| Departmental result indicator | Target | Date to achieve target | Actual result |

|---|---|---|---|

| Percentage of employees who believe their workplace is psychologically healthy | More than 68% | 2022–23: 68% 2023–24: 68%table 6 note † 2024–25: 59% |

|

| Percentage of employees who responded positively to “my department or agency implements activities and practices that support a diverse workforce” | At least 75% | 2022–23: 79% 2023–24: 79%table 6 note † 2024–25: 76% |

|

| Percentage of employees who indicate that their organization respects individual differences (for example, culture, workstyles and ideas) | At least 80% | 2022–23: 75% 2023–24: 75%table 6 note † 2024–25: 69% |

|

| Percentage of institutions where communications in designated bilingual offices nearly always occur in the official language chosen by the public | At least 90% | 2022–23: 92% 2023–24: 87% 2024–25: 87% |

|

Table 6 Notes

|

|||

Table 7 shows the departmental result indicator, the target, the date to achieve the target, and the actual result for the departmental result “Terms and conditions of public service employment are negotiated in good faith” for the last three fiscal years.

| Departmental result indicator | Target | Date to achieve target | Actual result |

|---|---|---|---|

| Percentage of Federal Public Sector Labour Relations and Employment Board outcomes that confirm that the Government of Canada is bargaining in good faith | 100% | 2022–23: 0%table 7 note * 2023–24: 100% 2024–25: 100% |

|

Table 7 Notes

|

|||

The Results section of the infographic for the Treasury Board of Canada Secretariat on GC Infobase provides additional information on results and performance related to TBS’s program inventory for employer.

Details on results

The following section describes the results achieved for the employer core responsibility in 2024–25 compared with the planned results set out in TBS’s departmental plan for the year.

1. Bargaining in good faith

In 2024–25, TBS worked to maintain collaborative, professional and respectful relationships with Canada’s public service unions by negotiating on:

- modern, competitive and fiscally sustainable compensation packages

- harmonized and simplified language in collective agreements to improve their administration and the administration of certain employee benefits

TBS negotiated in good faith and reached agreements with 14 bargaining units representing 25% of represented employees in the core public administration.

TBS also continued to work through the five‑step process to develop pay equity plans for:

- the Royal Canadian Mounted Police (RCMP)

- the Canadian Armed Forces (CAF)

- the core public administration (CPA)

The Pay Equity Act required that the plans be posted by . However, given the complexity of the work, the Pay Equity Commissioner granted TBS the following extensions for posting final plans:

- 18 months for members of the RCMP (by )

- 2 years for members of the CAF (by )

- 3 years for employees of the CPA (by )

Table 8 shows the progress of the pay equity committees for the RCMP, the CAF and the CPA as of the end of 2024–25.

| Group | Step | Details |

|---|---|---|

| RCMP | Step 3 Step 4 |

The committee started discussions to determine the value of the work performed in each predominantly female and male job class (Step 3). It also continued to discuss compensation for each predominantly female and predominantly male job class (Step 4). |

| Canadian Armed Forces | Not applicable | The committee held its first meeting. |

| Core public administration | Step 2 Step 3 |

The committee continued to meet to determine whether the job classes agreed to in Step 1 are predominantly female or male (Step 2). It also continued working on determining the value of the work performed in each predominantly female and male job class (Step 3). |

Also in 2024–25, TBS oversaw the transition of the administration of the Public Service Dental Care Plan from Sun Life to Canada Life and also introduced improvements and changes to the plan.

In addition, TBS continued to oversee efforts to address the issues that public servants, retirees and their dependants experienced when the Public Service Health Care Plan transitioned to Canada Life as the new administrator in 2023. It collaborated with Public Services and Procurement Canada, the contract authority, to make sure Canada Life addressed plan members’ concerns, providing guidance where needed, and pressing for timely resolutions to problems. TBS also continued to communicate with plan members with the goal of increasing their awareness of the Public Service Health Care Plan.

2. Modernizing the public service pension plan

In 2024–25, TBS drafted amendments to the Public Service Superannuation Act to extend the operational service early retirement program to additional frontline employees in the public service, specifically, the following:

- firefighters

- paramedics

- border services officers

- parliamentary protection officers

- search and rescue workers

The amendments would allow these employees to retire at any age after 25 years of frontline service, with no pension reduction, an option already available to Correctional Service Canada employees working in federal correctional institutions. These amendments would provide consistency in treatment for eligible employees, allowing for greater career mobility in the public service.

3. Strengthening and modernizing the public service

TBS continued to analyze federal public service needs, keeping pace with changes in society and technology that affect its services, service delivery and employee management.

In 2024–25, TBS:

- updated the Directive on Telework to align with the hybrid work environment and to clarify roles and responsibilities for heads of human resources, employees, and managers; the updated directive took effect

- introduced the Directive on the Stewardship of Human Resources Management Systems that articulates how the authorities of the Chief Human Resources Officer apply to the management and oversight of human resources management systems

TBS also continued to work with Public Services and Procurement Canada to:

- provide strategic direction and operational leadership to stabilize the current pay system

- prepare for the next human resources and pay solution by:

- simplifying human resources and pay policies and processes

- reducing the number of human resources systems across the government

- improving pay results for employees

4. Reinforcing values and ethics

In 2024–25, TBS continued to work with the Privy Council Office and the Canada School of Public Service to support departments and employee networks in fostering a clear understanding of the Values and Ethics Code for the Public Sector and in equipping public servants to apply the code in their daily work. These efforts built on the Deputy Ministers’ Task Team on Values and Ethics Report to the Clerk of the Privy Council, published in 2023.

As part of these efforts, TBS:

- published Guidance for Public Servants on their Personal Use of Social Media to help public servants understand how their online activities can impact public trust, team cohesion, their professional credibility, and the confidence of the government

- continued to provide administrative support to the task force on the review of the Public Servants Disclosure Protection Act, which was set up to find ways to enhance the federal disclosure process and strengthen protections and supports for public servants who come forward to disclose wrongdoing

5. Creating a diverse, equitable, accessible and inclusive workforce

The government is committed to fostering a safe, healthy and inclusive environment where the workforce is representative of the Canadian population and where equity‑seeking employees are recognized equally for their contributions and are provided every opportunity to succeed.

To support this commitment, TBS continued to implement the Action Plan for Black Public Servants, including by introducing three initiatives:

- the Aspiring Directors Program, through the Canada School of Public Service (CSPS), to support 100 Black public servants in preparing to take on executive roles

- the Leadership Development Program, through the CSPS, to enhancing leadership skills for 300 Black supervisors and managers

- the Second Official Language Training Initiative to offer flexible language training options to over 500 Black public servants annually, including self‑directed online programs and part‑time online instructor‑led group sessions

TBS also developed an action plan with deputy heads of departments to address the findings of A Study on the Black Executive Community in the Federal Public. The study describes the lived experiences of Black executives, identifies the systemic barriers to their participation and inclusion, and recommends measures to improve their working conditions and increase their representation in the public service.

Some of TBS’s efforts in relation to Black employees also benefited other racialized employees and executives, as well as those who identify as Indigenous, as persons with a disability or as 2SLGBTQIA+.

In addition, TBS raised awareness about the barriers faced by racialized employees and employees in equity groups and took steps to address them by continuing to:

- support efforts led by Employment and Social Development Canada to modernize the Employment Equity Act in response to the report of the Employment Equity Act Review Task Force

- promote transparency and accountability by collecting and disseminating unprecedented levels of disaggregated data on the composition and experience of employment equity groups and subgroups in the public service as a whole

- modernize the self‑identification questionnaire and develop a centralized platform where departments can find comprehensive demographic data on the public service work force to improve measurement, reporting and programming

- respond to the recommendations of the Auditor General’s Report 5 — Inclusion in the Workplace for Racialized Employees by:

- supporting the audited organizations as they examine their complaint‑resolution processes

- providing organizations with information on harassment prevention and resolution to help them identify and address the root causes of disadvantage for racialized employees

- establishing new expected behaviours in existing competency frameworks in support of non‑racist and inclusive work environments

- manage enterprise‑wide initiatives to help increase diversity and inclusion, including:

- Executive Talent Management

- the Executive Leadership Development Program

- the Mosaic Leadership Development Program

- Mentorship Plus

- the Federal Speakers’ Forum on Lived Experience

As part of the Accessibility Strategy for the Public Service of Canada, the government committed to hiring 5,000 persons with disabilities by 2025. In 2024–25, the government exceeded this target, having hired nearly 7,000 persons with disabilities. However, persons with disabilities continues to be the only employment equity group with representation below the workforce availability rate.

To help remove barriers to working in the public service for employees with disabilities, in 2024–25, TBS:

- supported the ongoing adoption of the Government of Canada Workplace Accessibility Passport and developed a secure, accessible, user‑centric and bilingual digital application for it

- provided expert guidance, tools and integrated measurement frameworks to help departments measure their progress on accessibility

- led government‑wide initiatives to build disability confidence and to promote leadership opportunities for people with lived experience of disability

6. Promoting official languages

In 2024–25, TBS supported the implementation of the modernized Official Languages Act, by:

- establishing a new Official Languages Accountability and Reporting Framework which:

- specifies the roles and responsibilities of federal institutions subject to the act

- describes the mechanisms to support official languages governance at the federal level

- describes the administrative, parliamentary and court remedies available in the event of non‑compliance

- specifies expectations with respect to accountability for official languages

- launching a new version of Burolis website, where people can find out at which federal offices they can receive services in English, in French or in both official languages

- launching the second official language training framework (posted on the Language Training Hub on GCcollab), which includes tools to:

- help departments and managers plan and prioritize access to language training

- help managers and employees learn their second official language

- reviewing official languages policy instruments to align them with:

- the amendments to the Official Languages Act

- the commitments made as part of official languages reform

- drafting regulations to promote linguistic duality, advance the use of English and French equally, and enhance the vitality of English and French linguistic minority communities

TBS also continued to make sure Canadians have greater access to bilingual federal services by coordinating the Official Languages Regulations Reapplication Exercise as part of implementing the Official Languages (Communications With and Services to the Public) Regulations. Through the exercise, federal institutions confirm the linguistic designation of their offices. TBS expects the exercise to result in about 700 more federal offices and points of service being designated as bilingual by 2027.

7. Supporting health and safety

In 2024–25, to help achieve harassment‑ and violence‑free workplaces in the federal public service where all employees are treated with respect and dignity, TBS continued to develop resources and tools to help organizations follow the National Standard of Canada for Psychological Health and Safety in the Workplace. This work included:

- consulting with bargaining agents through the National Joint Council of the Public Service of Canada on resources and tools that help departments prevent and resolve workplace violence and harassment

- continuing to implement the Federal Public Service Workplace Mental Health Strategy

TBS also continued to:

- monitor departmental indicators of performance in the areas of health, safety, harassment and violence in the workplace

- make sure enough qualified resources are available to investigate harassment and violence when they occur

- take action to support psychologically healthy and safe workplaces, practices and behaviours by supporting human resources teams, providing training, and helping manage complex cases

- help organizations in streamline their occupational health and safety operations by integrating the Federal Public Service Workplace Mental Health Strategy into their overall health and safety program

Resources required to achieve results

Table 9 provides a snapshot of the planned and actual spending and full‑time equivalents required to achieve results for the employer core responsibility in 2024–25.

| Resource | Planned | Actual |

|---|---|---|

| Spending | $3,954,592,665 | $10,754,872,273 |

| Full‑time equivalents | 520 | 641 |

The Finances section of the infographic for the Treasury Board of Canada Secretariat on GC Infobase and the People section of the same infographic provide complete financial and human resources information related to TBS’s program inventory.

Related government priorities

This section highlights government priorities that are being addressed through this core responsibility.

Gender‑based analysis plus

In 2024–25, TBS continued to use data from a range of public service and other sources to monitor and report on program impacts based on gender and other identity factors to ensure inclusive outcomes related to the employer core responsibility. For example, TBS used information from the Labour Program related to harassment and occupational health and safety to report on this area. This information included the number of cases with allegations linked to the 13 prohibited grounds of the Canadian Human Rights Act.

In addition, TBS continued to work with departments to ensure that the proportion of visible minorities, Indigenous peoples, persons with disabilities, and women in the public service meets or exceeds their workforce availability, including in leadership positions.

TBS’s Gender‑based analysis plus supplementary information report contains more information.

United Nations 2030 Agenda for Sustainable Development and the Sustainable Development Goals

In 2024–25, TBS continued to support Goal 5 (Achieve gender equality and empower all women and girls) and Goal 10 (Advance reconciliation with Indigenous peoples and take action to reduce inequality). It did so by working with departments to address employment barriers and to improve diversity, equity, accessibility and inclusion in the public service. It also continued to advance the implementation of pay equity across the core public administration, the RCMP and the CAF. As well, TBS monitored the design and use of benefit plans with gender considerations in mind.

More information on TBS’s contributions to Canada’s Federal Implementation Plan on the 2030 Agenda and the Federal Sustainable Development Strategy can be found in the Treasury Board of Canada Secretariat’s Departmental Sustainable Development Strategy for 2023 to 2027.

Program inventory

Employer is supported by the following programs:

- Employer

- Public Service Employer Payments

Additional information related to the program inventory for employer is available on the Results page on GC InfoBase.

Core responsibility 4: Regulatory oversight

In this section

Description

TBS develops and oversees policies to promote good regulatory practices, reviews proposed regulations to ensure they adhere to the requirements of government policy, and advances regulatory cooperation across jurisdictions.

Quality of life impacts

TBS’s activities carrying out this core responsibility contribute to the “good governance” domain of the Quality of Life Framework for Canada and, more specifically, “confidence in institutions” and “Canada’s place in the world.”

Progress on results

This section details the department’s performance against its targets for each departmental result under Core responsibility 4: Regulatory oversight.

TBS continued to work toward meeting its target of Canada ranking in the top five in the world for stakeholder engagement, regulatory impact assessment and ex‑post evaluation, as assessed by the Organisation for Economic Co‑operation and Development (OECD) Indicators of Regulatory Governance survey. The survey ranks all 38 OECD member countries for performance in regulatory stakeholder engagement, regulatory impact assessment and ex‑post evaluation practices.

In 2024–25, TBS met the targets for two of the three indicators, with Canada ranking fourth for stakeholder engagement and fourth for regulatory impact assessment. Although Canada did not meet its target for ex‑post evaluation, ranking seventh, it stayed in the top ten. The Government of Canada is taking proactive steps to improve its ranking and meet the target result by reviewing outdated or unnecessary rules to make sure all federal regulations continue to meet their intended goals while supporting the economy.

Table 10 shows the departmental result indicator, the target, the date to achieve the target, and the actual result for each departmental result indicator related to “The federal regulatory system protects and advances the public interest, including sustainable economic growth” for the last three fiscal years.

| Departmental result indicator | Target | Date to achieve target | Actual result |

|---|---|---|---|

| Ranking of Canada’s regulatory system by the Organisation for Economic Co‑operation and Development (OECD) for stakeholder engagementtable 10 note * | Canada to rank in the top 5 for stakeholder engagement in the next issue of the report | 2022–23: 3rdtable 10 note * 2023–24: 3rdtable 10 note * 2024–25: 4th |

|

| Ranking of Canada’s regulatory system by the Organisation for Economic Co‑operation and Development (OECD) on Regulatory Impact Assessmenttable 10 note * | Canada to rank in the top 5 for regulator impact assessment in the next issue of the report | 2022–23: 5thtable 10 note * 2023–24: 5thtable 10 note * 2024–25: 4th |

|

| Ranking of Canada’s regulatory system by the Organisation for Economic Co‑operation and Development (OECD) for ex‑post evaluationtable 10 note * | Canada to rank in the top 5 for ex‑post evaluation in the next issue of the report | 2022–23: 6thtable 10 note * 2023–24: 6thtable 10 note * 2024–25: 7th |

|

Table 10 Notes

|

|||

The Results section of the infographic for the Treasury Board of Canada Secretariat on GC InfoBase provides additional information on results and performance related to TBS’s program inventory for regulatory oversight.

Details on results

The following section describes the results achieved for regulatory oversight in 2024–25.

1. Providing central oversight

In 2024–25, TBS continued to support the Treasury Board in focusing on high‑risk and high‑priority regulatory proposals. For the more than 280 regulations and 210 orders in council it reviewed, TBS performed a challenge function to make sure regulators conducted analysis that met the requirements of the Cabinet Directive on Regulation and its related policies and directives. This analysis includes examining potential positive and negative effects of a regulatory proposal on the health, safety, security, social and economic well‑being of Canadians, businesses, and on the environment.

TBS also continued to implement the one‑for‑one rule, which is set out in the Cabinet Directive on Regulation. Established in 2015 under the Red Tape Reduction Act and the Red Tape Reduction Regulations, this rule is designed to control the growth of administrative burden on businesses.

TBS also applied the small business lens to regulatory proposals that consider the direct administrative and compliance requirements on small businesses.

Finally, TBS continued working with government partners to make sure advanced tools were in place for consulting the public on federal regulations. Tools included the Comment on proposed regulations online tool and the Let’s Talk Federal Regulations platform. More than 22,000 comments were submitted on 215 regulations through the online commenting feature for proposed regulations in Canada Gazette, Part I.

2. Reducing regulatory burden

TBS continued to support Canada’s regulators in maintaining a modern, competitive regulatory system. Regulations are vital for safeguarding the health, safety and security of Canadians and the environment, but over time some requirements pile up or become outdated, creating “red tape.”

In 2024–25, TBS created the Red Tape Reduction Office to address red tape by:

- making the regulatory system more efficient

- reducing barriers to investment and economic growth

- reducing regulatory costs for Canadians and businesses

TBS also supported the third round of regulatory reviews. This round focused on the blue economy and supply chains.

The Blue Economy Regulatory Roadmap, led by Fisheries and Oceans Canada with support from TBS and other departments, was completed and posted online in . It outlines a suite of initiatives the government plans to pursue to modernize regulation and foster innovation and economic growth in the blue economy.

TBS also worked with federal partners on the supply chain regulatory review. This review aims at making supply chains more resilient by making regulatory improvements.

TBS also supported the External Advisory Committee on Regulatory Competitiveness in submitting its final advice letter to the President of the Treasury Board in . The committee’s advice has informed the government’s continued efforts to improve the regulatory system and reduce regulatory burden for Canadians and businesses.

3. Promoting regulatory experimentation

In 2024–25, TBS continued to promote whole‑of‑government approaches to regulatory experimentation, which fosters innovation and improves competitiveness. The Centre for Regulatory Innovation helps federal regulators identify and overcome barriers to regulatory innovation. It offers advice, funding and tools for innovation that reduces red tape and boosts economic growth.

In 2024–25, the centre funded five projects through its Regulatory Experimentation Expense Fund, committing over $1.7 million across five departments and agencies. These projects include:

- The Canada Energy Regulator is developing and testing new rules to protect Indigenous rights using a co‑creation approach

- Agriculture and Agri‑Food Canada and the Canadian Food Inspection Agency are testing a new approach to streamline the approval process for new fertilizers to reduce regulatory burden, support innovation, and maintain safety

- Agriculture and Agri‑Food Canada and the Canadian Food Inspection Agency are testing a new approach to developing guidance that will better meets industry’s needs and will create a predictable regulatory environment

- Transport Canada and the National Research Council are assessing how Maritime Autonomous Surface Ships can be safely integrated into Canadian waters

- Transport Canada is testing extended reality simulators in pilot training to determine whether they could help reduce the number of in‑aircraft hours required to get a pilot licence and, in turn, lower training costs and shorten timelines and continue to yield qualified pilots

4. Encouraging regulatory cooperation and harmonization

Regulatory cooperation and alignment is integral to making it easier for businesses to operate, both domestically and internationally, while maintaining the highest standards for health, safety, security and environmental protection.

Domestically, TBS supported the work of the Canadian Free Trade Agreement’s Committee on Internal Trade as it launched a pilot project in the trucking sector in to reduce internal barriers to trade and support the smoother movement of goods across Canada. Through the pilot, participating jurisdictions will recognize each other’s regulatory requirements, even in areas where there are differences (for example, signage requirements for oversized vehicles), so that trucks and the goods they carry can move across Canada more efficiently, without compromising safety and security measures.

Internationally, in 2024, the President of the Treasury Board hosted a series of round tables with Canadian and American business leaders, industry representatives, and associations to explore opportunities for regulatory cooperation between Canada and the United States that would address regulatory barriers to trade and support economic growth. Meetings were held in Moncton, Toronto, Ottawa, Windsor, Winnipeg, Montreal, as well as in Chicago and in Washington, DC. Overall, the President of the Treasury Board spoke with 83 Canadian and U.S. stakeholders, who noted over 250 bilateral irritants related to transportation, borders, health and food safety, agriculture, and more.

In , the Secretary of the Treasury Board and the Administrator of the U.S. Office of Information and Regulatory Affairs co-chaired a meeting of the Canada–United States Regulatory Cooperation Council. In a separate meeting, the co-chairs discussed the operation of the Council, a review of new, ongoing, and completed work plans, and shared expertise on regulatory projects.

In , as co‑lead of the Canada–European Union Regulatory Cooperation Forum, TBS co‑hosted a round table on regulatory cooperation in hydrogen. The forum brought together Canadian and European interested parties to share insights and expertise in the field. Participants raised issues related to topics including definitions, methodology, traceability requirements, and the mutual acceptance of the results of conformity assessments. Work is now underway to determine how best to address these issues.

Resources required to achieve results

Table 11 provides a snapshot of the planned and actual spending and full‑time equivalents required to achieve results in 2024–25.

| Resource | Planned | Actual |

|---|---|---|

| Spending | $13,178,032 | $12,113,475 |

| Full‑time equivalents | 74 | 68 |

The Finances section of the Infographic for Treasury Board of Canada Secretariat on GC Infobase and the People section of the same infographic provide complete financial and human resources information related to TBS’s program inventory.

Related government priorities

This section highlights government priorities that are being addressed through this core responsibility.

Gender‑based analysis plus

In 2024–25, TBS continued to perform a challenge function on regulatory proposals submitted for Governor‑in‑Council approval to make sure they align with the gender‑based analysis plus requirements and with guidance under the Cabinet Directive on Regulation. Details are available in TBS’s supplementary information table on gender‑based analysis plus.

United Nations 2030 Agenda for Sustainable Development and the Sustainable Development Goals

In 2024–25, TBS supported Canada’s Federal Implementation Plan for the 2030 Agenda by continuing to help departments integrate sustainable development impact analysis into regulatory development processes, as required by the Cabinet Directive on Regulation. This directive requires an integrated cost and benefit analysis of regulations on society, the economy and the environment.

More information on TBS’s contributions to Canada’s Federal Implementation Plan on the 2030 Agenda and the Federal Sustainable Development Strategy can be found in the Treasury Board of Canada Secretariat’s Departmental Sustainable Development Strategy for 2023 to 2027.

Program inventory

Regulatory oversight is supported by the following programs:

- Regulatory Policy, Oversight, and Cooperation

Additional information related to the program inventory for regulatory oversight is available on the Results page on GC InfoBase.

Internal services

In this section

Description

Internal services refer to the activities and resources that support a department in its work to meet its corporate obligations and deliver its programs. The 10 categories of internal services are:

- management and oversight services

- communications services

- legal services

- human resources management

- financial management

- information management

- information technology

- real property

- materiel

- acquisitions

Progress on results

This section presents details on how the department performed to achieve results and meet targets for internal services.

1. Fostering employee well‑being

In 2024–25, TBS continued to foster employees’ well‑being and to address their evolving needs in a modern workplace by:

- fostering a culture of psychological safety through wellness initiatives, mental health training, and accessible resources such as the Employee Assistance Program

- raising awareness about and understanding of psychological health and safety in the workplace, in accordance with the Federal Public Service Workplace Mental Health Strategy, the Canada Labour Code and the National Standard of Canada for Psychological Health and Safety in the Workplace, through the Not Myself Today campaign

- continuing to provide training on workplace safety, including on harassment and violence prevention

TBS also continues to give employees and managers the tools and resources they need to foster an organizational culture where everyone can take part in constructive discussions about the workplace.

2. Building a diverse, inclusive and accessible workplace

In 2024–25, TBS continued to recruit and promote Indigenous people, persons with disabilities, visible minorities, and women, with the aim of achieving a representative workforce. As a result, representation increased across all four employment equity groups.

TBS took concrete action to combat all forms of racism, discrimination and hate, and to foster a culture of accessibility and inclusion in the department. For example, TBS:

- supported the efforts of its Indigenous, Black employee, accessibility and 2SLGBTQIA+ networks

- continued to offer the Mentorship Plus program, an initiative that pairs executive sponsors with individuals from equity‑seeking groups who aspire to leadership and executive positions

- continued to make official languages training a priority, offering a wide variety of training options to all employees, including those in equity‑seeking groups

- supported the work of the TBS Women’s Network to address systemic barriers women may face at TBS, including by funding EmpowerHER, the network’s mentorship program, which is open to all TBS employees who identify as women

3. Maintaining a culture of integrity, accountability and excellence

In 2024–25, TBS worked with staff and managers to improve understanding of their responsibilities under the Values and Ethics Code for the Public Sector. It also:

- started updating the TBS Code of Conduct, including by consulting employees and employee networks

- improved implementation of the TBS Code of Conduct by launching an automated conflict of interest declaration and a new database to track and report conflict of interest, and by elevating decision‑making on conflict‑of‑interest measures to the deputy‑minister level

- promoted the ethical use of emerging technologies and digital tools by integrating principles of fairness, privacy protection and responsible practices into operations and training

4. Leveraging and securing TBS data